Global Mycoplasma Plate Antigens Market By Product Type (Plate Agglutination Test Products (Plate Antigens-Negative Control Serum, Mycoplasma Plate Antigens-Control Serum, and Mycoplasma Plate Antigens), and Confirmatory Testing Reagents (Negative Serum, Mycoplasma Whole Organism, and Mycoplasma Antiserum)), By Application (Drug Development, Veterinary Research, Infection Medicine, and Others), By End-user (Veterinary Hospitals, Poultry Veterinary Clinics, Pharma & Biotech Companies, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163284

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

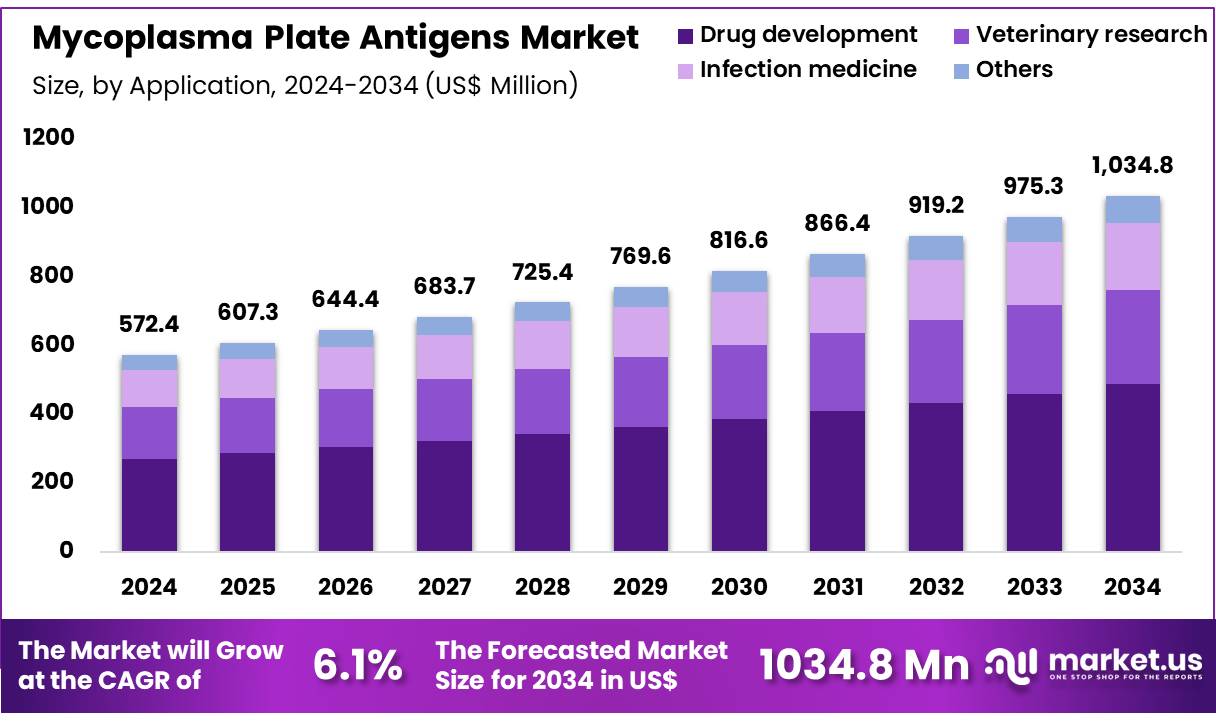

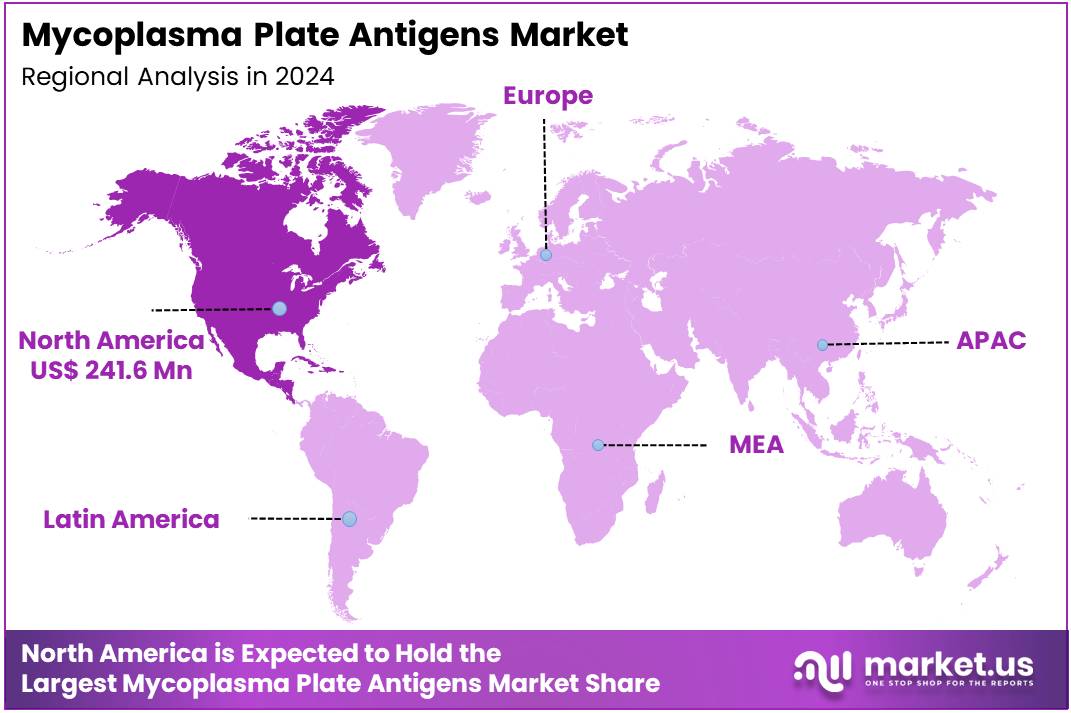

Global Mycoplasma Plate Antigens Market size is expected to be worth around US$ 1034.8 Million by 2034 from US$ 572.4 Million in 2024, growing at a CAGR of 6.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.2% share with a revenue of US$ 241.6 Million.

Increasing demand for biologics safety drives the Mycoplasma Plate Antigens Market, as manufacturers prioritize contamination-free production processes. Biopharmaceutical companies apply mycoplasma plate antigens in quality control to detect contamination in cell cultures, ensuring compliance with stringent regulatory standards. These antigens support vaccine development by verifying the purity of cell lines used in production.

Research laboratories utilize them to validate sterility in gene therapy products, safeguarding experimental integrity. In April 2023, Agathos Biologics expanded its testing portfolio with QIAGEN’s QIAcuity-based mycoplasma assays, enhancing precision in biologics and viral vector safety testing. This advancement fuels market growth by meeting the rising need for reliable detection in good manufacturing practice (GMP) environments.

Growing emphasis on infectious disease diagnostics creates opportunities in the Mycoplasma Plate Antigens Market, as clinical applications expand beyond biomanufacturing. Healthcare providers employ these antigens in diagnostic panels to identify Mycoplasma pneumoniae in respiratory infections, guiding targeted antibiotic therapy. These tests support epidemiological studies by detecting mycoplasma in community-acquired pneumonia outbreaks.

Multiplex assays integrate mycoplasma detection with other pathogens, streamlining workflows in clinical labs. In February 2023, Thermo Fisher Scientific, Inc. launched the TrueMark STI Select Panel, identifying Mycoplasma genitalium among other pathogens via PCR-based diagnostics. This innovation drives market expansion by broadening the scope of antigen-based testing in sexually transmitted infection diagnostics.

Rising adoption of rapid testing technologies propels the Mycoplasma Plate Antigens Market, as laboratories seek efficient contamination screening solutions. Biotechnology firms use these antigens in lateral flow assays to monitor mycoplasma in real-time during cell culture processes, minimizing production delays. These tests aid academic research by ensuring contamination-free cell lines in molecular biology studies.

Trends toward user-friendly diagnostics enhance accessibility for smaller labs with limited resources. In February 2023, SwiftDx introduced its rapid Mycoplasma Detection Kit, a lateral flow test simplifying contamination identification in biomanufacturing. This development positions the market for sustained growth by improving testing speed and accessibility across diverse laboratory settings.

Key Takeaways

- In 2024, the market generated a revenue of US$ 572.4 Million, with a CAGR of 6.1%, and is expected to reach US$ 1034.8 Million by the year 2034.

- The product type segment is divided into plate agglutination test products and confirmatory testing reagents, with plate agglutination test products taking the lead in 2023 with a market share of 53.6%.

- Considering application, the market is divided into drug development, veterinary research, infection medicine, and others. Among these, drug development held a significant share of 47.2%.

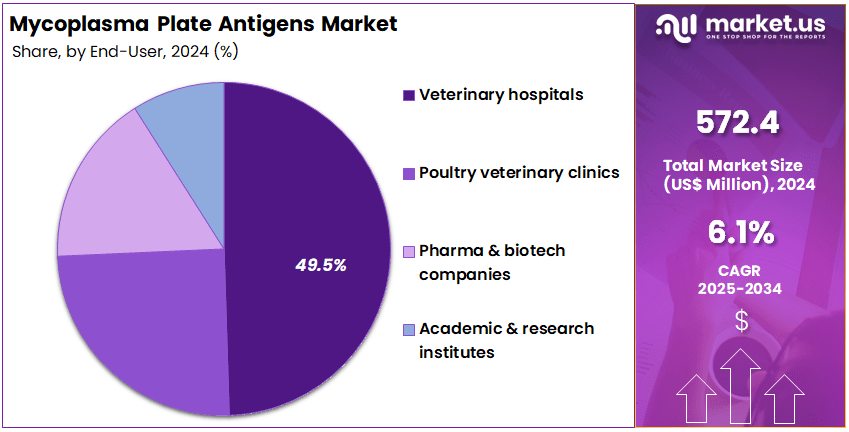

- Furthermore, concerning the end-user segment, the market is segregated into veterinary hospitals, poultry veterinary clinics, pharma & biotech companies, and academic & research institutes. The veterinary hospitals sector stands out as the dominant player, holding the largest revenue share of 49.5% in the market.

- North America led the market by securing a market share of 42.2% in 2023.

Product Type Analysis

Plate agglutination test products account for 53.6% of the Mycoplasma Plate Antigens market and are expected to dominate due to their accuracy, simplicity, and cost-effectiveness in pathogen detection. These tests are widely used to identify Mycoplasma infections in animal health diagnostics, particularly within poultry and livestock sectors. The growing emphasis on biosecurity and early detection of infectious agents in veterinary medicine is projected to drive the adoption of these products.

Veterinary hospitals and diagnostic centers prefer plate agglutination kits for their rapid results, minimal equipment requirements, and ease of interpretation. Technological advancements improving antigen stability, shelf life, and sensitivity are anticipated to strengthen their utility in both field and laboratory testing. Increased government focus on animal health surveillance and disease prevention programs supports consistent demand.

The rising need for routine screening and quality control in animal breeding and vaccine production further enhances adoption. The affordability and accessibility of plate agglutination kits make them particularly suitable for small-scale and rural veterinary facilities.

Collaborations between research institutions and diagnostic manufacturers are promoting the development of species-specific antigen kits. As livestock production expands globally, plate agglutination test products are likely to remain a cornerstone in Mycoplasma diagnostics.

By Application Analysis

Drug development represents 47.2% of the application segment and is projected to remain the leading area of application owing to the increasing need for novel antimicrobial and vaccine solutions against Mycoplasma species. The widespread prevalence of Mycoplasma gallisepticum and Mycoplasma bovis in poultry and cattle industries necessitates reliable diagnostic methods to validate therapeutic efficacy during R&D processes.

Pharmaceutical and biotech companies rely on Mycoplasma testing to ensure purity and biosafety in biological products, cell lines, and vaccine formulations. The expansion of preclinical and clinical research involving microbial contamination control is expected to drive testing demand. Regulatory bodies such as the USDA and EMA emphasize Mycoplasma screening during drug production, reinforcing its integration into R&D pipelines.

Increasing investment in veterinary vaccine research, particularly for respiratory diseases, further supports growth. Laboratories engaged in drug discovery and cell culture studies use plate antigens to evaluate immune responses and monitor contamination. Continuous development of customized testing reagents tailored for high-sensitivity detection enhances reliability.

Collaboration between veterinary pharmaceutical manufacturers and diagnostic providers accelerates innovation. As global focus intensifies on antimicrobial stewardship and biosafety, the demand for Mycoplasma testing in drug development is likely to expand significantly.

By End-User Analysis

Veterinary hospitals hold 49.5% of the end-user segment and are anticipated to remain the primary users of Mycoplasma plate antigen testing solutions due to their role in disease diagnosis, treatment, and preventive care. These facilities routinely conduct Mycoplasma testing to identify respiratory and reproductive tract infections in livestock and poultry. The rising incidence of zoonotic infections and increased awareness of animal health management are expected to drive adoption in veterinary hospitals.

Availability of trained veterinary professionals and well-equipped laboratories enhances diagnostic accuracy and efficiency. The integration of rapid plate agglutination assays enables veterinarians to make timely treatment decisions and implement biosecurity measures. Government-led animal health surveillance initiatives and vaccination programs contribute to higher testing volumes.

Hospitals increasingly collaborate with research institutions and diagnostic firms for validation and field testing of new diagnostic kits. The adoption of digital diagnostic tools and automated analyzers improves test consistency and reporting accuracy. Expansion of veterinary infrastructure, particularly in developing regions, supports the availability of advanced diagnostic services.

Continuous demand for routine disease screening and outbreak management reinforces the growth of Mycoplasma testing in hospitals. As livestock production systems modernize, veterinary hospitals are expected to remain central to diagnostic operations in this market.

Key Market Segments

Product Type

- Plate Agglutination Test Products

- Plate Antigens-Negative Control Serum

- Mycoplasma Plate Antigens- Control Serum

- Mycoplasma Plate Antigens

- Confirmatory Testing Reagents

- Negative Serum

- Mycoplasma Whole Organism

- Mycoplasma Antiserum

Application

- Drug Development

- Veterinary Research

- Infection Medicine

- Others

End-user

- Veterinary Hospitals

- Poultry Veterinary Clinics

- Pharma & Biotech Companies

- Academic & Research Institutes

Drivers

Surge in Mycoplasma pneumoniae Infections is Driving the Market

The resurgence of Mycoplasma pneumoniae infections has profoundly influenced the Mycoplasma plate antigens market, as these serological reagents are pivotal for detecting IgM and IgG antibodies in agglutination-based assays to confirm atypical pneumonia cases. Plate antigens, typically derived from whole-cell preparations of M. pneumoniae, facilitate rapid slide or tube agglutination tests that identify immune responses, essential for differentiating mycoplasma from viral etiologies in respiratory outbreaks.

This driver is particularly evident in pediatric populations, where outbreaks necessitate widespread serological screening to guide macrolide therapy and prevent complications like encephalitis. Healthcare facilities are augmenting inventories of these antigens to support high-throughput testing in sentinel laboratories during epidemic peaks.

The post-pandemic rebound has amplified its diagnostic indispensability, as prior non-pharmacologic interventions suppressed transmission, leading to a larger susceptible population. Public health directives now advocate its inclusion in syndromic panels for community-acquired pneumonia, enhancing its procedural integration.

The Centers for Disease Control and Prevention observed a rise in pneumonia-associated emergency department visits with Mycoplasma-related diagnoses from 1.0% to 7.2% among children aged 2–4 years between late March and early October 2024, underscoring the epidemiological pressure on serological diagnostics. This escalation correlates with increased reagent demands, as facilities prioritize its deployment for outbreak corroboration.

Innovations in stabilized antigen formulations mitigate denaturation risks, ensuring reliability in diverse climatic conditions. Economically, its utilization expedites discharge decisions, offsetting costs through reduced empirical antibiotic overuse.

International collaborations standardize interpretation thresholds, promoting its global dissemination. This infectious uptick not only elevates antigen consumption but also reinforces its foundational role in serological surveillance paradigms.

Restraints

Variability in Serological Test Sensitivity is Restraining the Market

Inconsistencies in the sensitivity of serological assays for mycoplasma detection continue to undermine confidence in plate antigen-based methods, particularly when early infections yield undetectable IgM responses. These tests, reliant on agglutination endpoints, may falter in immunocompromised individuals or those with prior exposures, where cross-reactivity with commensal flora confounds specificity. This restraint perpetuates a preference for molecular alternatives, relegating plate antigens to confirmatory roles despite their cost-effectiveness.

Laboratories encounter batch-to-batch variations in antigen potency, necessitating rigorous quality controls that inflate operational overheads. The delayed seroconversion window, often exceeding seven days, hinders acute-phase utility, prolonging diagnostic timelines in outbreak scenarios. Regulatory validations demand exhaustive cross-validation against PCR gold standards, prolonging market entry for refined formulations.

The Centers for Disease Control and Prevention highlights that serological tests for Mycoplasma pneumoniae may overestimate clinical significance due to nonquantitative PCR co-detection, with challenges in distinguishing colonization from infection persisting through 2024 surveillance efforts. Such limitations contribute to underutilization, as providers opt for integrated nucleic acid platforms.

Training disparities further exacerbate misinterpretations, favoring centralized reference testing over decentralized agglutination. Efforts to hybridize antigens with adjuvants advance sporadically, impeded by standardization gaps. These sensitivity variances not only curtail adoption rates but also impede the market’s prospective for frontline respiratory diagnostics.

Opportunities

Expansion of Respiratory Pathogen Surveillance Programs is Creating Growth Opportunities

The broadening of national respiratory surveillance frameworks has engendered considerable prospects for the Mycoplasma plate antigens market, embedding serological confirmation within multifaceted outbreak monitoring to trace seroprevalence trends. These programs, incorporating plate agglutination for retrospective cohort analyses, leverage antigens to delineate immunity gaps post-vaccination eras.

Opportunities emerge in subsidized reagent procurements for regional networks, fortifying capacities in under-resourced districts amid cyclical epidemics. Public-private synergies validate antigen panels for syndromic integration, subsidizing adaptations to encompass macrolide-resistant strains. This expansion mitigates diagnostic silos, positioning serological tools as adjuncts to genomic sequencing for comprehensive profiling. Fiscal allocations for enhanced biosurveillance catalyze inventory builds, diversifying toward multiplex-compatible formulations.

The Centers for Disease Control and Prevention’s National Syndromic Surveillance Program tracked a 9.0-fold increase in excess Mycoplasma pneumoniae cases starting late 2023 through 2024, fostering investments in serological infrastructure for sustained vigilance. This magnitude exemplifies scalable models, with analogous initiatives anticipating amplified antigen requisitions.

Innovations in lyophilized formats bolster logistical resilience, addressing supply frailties in remote deployments. As informatics platforms mature, serology-derived data unlock predictive modeling revenues. These programmatic enlargements not only heighten procedural scopes but also interweave the market into resilient epidemiological architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the Mycoplasma plate antigens market, leading them to delay refinements in confirmatory testing reagents while prioritizing essential agglutination strip production amid constrained biopharma funding. U.S.-China export restrictions and Caspian Sea shipping disruptions are limiting supplies of diagnostic proteins from Eurasian suppliers, extending specificity validation timelines and increasing certification costs for international contamination monitoring networks.

To address these hurdles, some developers are partnering with Arkansas-based protein cultivators, implementing quality benchmarks that expedite FDA approvals and attract vaccine research grants. Increasing biopharmaceutical production demands are channeling BARDA allocations into rapid antigen platforms, enhancing adoptions in contract manufacturing organizations.

U.S. tariffs of 25% on imported pharmaceuticals and medical devices are elevating costs for Asian-sourced substrates and conjugates, straining budgets for research labs and occasionally delaying global harmonization of detection protocols. In response, developers are leveraging IRA innovation credits to establish Arkansas synthesis facilities, introducing enzyme-boosted sensitivities and building expertise in stable antigen formulations.

Latest Trends

CDC’s Health Alert Network Bulletin on Mycoplasma Surge is a Recent Trend

The issuance of targeted epidemiological advisories has exemplified a salient progression in mycoplasma diagnostics during 2024, underscoring serological reinforcements to navigate resurgent pediatric infections. The Centers for Disease Control and Prevention’s bulletin disseminated guidance on Mycoplasma pneumoniae testing, advocating paired IgM/IgG assays amid a noted uptick in young children. This directive embodies a recalibration toward integrated serology in syndromic evaluations, accommodating its delayed kinetics with molecular complements for acute verifications.

Regulatory affirmations validate its deployment in surveillance tiers, hastening endorsements for outbreak-adapted protocols. This emphasis resonates with post-restriction dynamics, tethering antigen outputs to national repositories for spatiotemporal mapping. The alert addresses vulnerability amplifications, prioritizing reagents attuned to emergent demographics.

The Centers for Disease Control and Prevention released a Health Alert Network Bulletin in October 2024 on the increase in Mycoplasma pneumoniae infections among children, prompting enhanced serological utilization to support clinical management. Such promulgations underscore viability, as implementations affirm concordance with genomic benchmarks. Observers foresee doctrinal incorporations, elevating its eminence in pediatric guidelines.

Diachronic validations disclose discordance mitigations, refining stewardship evaluations. The vista anticipates algorithmic enhancements, forecasting therapeutic trajectories. This bulletin-driven evolution not only augments serological acuity but also aligns with adaptive infectious imperatives.

Regional Analysis

North America is leading the Mycoplasma Plate Antigens Market

In 2024, North America accounted for 42.2% of the global Mycoplasma plate antigens market, propelled by a marked resurgence of Mycoplasma pneumoniae infections post-pandemic, which heightened demand for serological reagents in diagnostic labs for antibody detection via agglutination assays, aiding in confirmation of atypical pneumonia in pediatric and adolescent cohorts.

Laboratories ramped up procurement of standardized plate antigens to support indirect hemagglutination tests, enabling accurate seroconversion monitoring for epidemiological surveillance, as infections peaked in summer months with enhanced testing in ambulatory clinics to guide macrolide alternatives amid rising resistance concerns.

The Centers for Disease Control and Prevention’s monitoring through the National Syndromic Surveillance Program revealed a rise in M. pneumoniae-related pneumonia emergency department visits, from 1.0% to 7.2% among children aged 2–4 years between March 31 and October 5, 2024, underscoring the urgency for robust antigen-based tools in outbreak response.

Institutional protocols expanded reagent use for cohort studies, correlating with federal grants for respiratory pathogen profiling in underserved regions, where at-home serology kits mitigated delays in rural diagnostics. Demographic surges in school-aged children, vulnerable to transmission in enclosed settings, amplified reagent volumes, backed by professional society endorsements for integrated testing in flu-like illness evaluations.

These developments exemplified the region’s strategic emphasis on serological diagnostics for atypical bacterial infections. The Centers for Disease Control and Prevention identified a 7.2-fold increase in M. pneumoniae-associated emergency department visits for children aged 2–4 years from March to October 2024, rising from 1.0% to 7.2% of pneumonia cases.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Regional authorities in Asia Pacific project the Mycoplasma plate antigens sector to proliferate during the forecast period, as post-restriction resurgences amplify serological needs for profiling macrolide-resistant strains in densely populated urban centers. Officials in China and South Korea direct funding toward agglutination reagent kits, equipping sentinel labs to track antibody responses in school outbreaks affecting adolescents.

Diagnostic consortia partner with state institutes to refine hemagglutination antigens, anticipating precise serodiagnosis of non-macrolide-responsive infections in immigrant clusters. Oversight bodies in Japan and Taiwan subsidize standardized plates, enabling community hospitals to monitor seroconversion without advanced PCR infrastructure. National programs anticipate linking antigen test data to digital registries, facilitating targeted azithromycin avoidance in resistant pediatric cases.

Local immunologists advance stabilized formulations, coordinating with regional networks to delineate epidemic clones in coastal migrant pools. These integrations foster a comprehensive arsenal for atypical pneumonia serology. China’s National Health Commission observed a median 93.02% macrolide-resistant Mycoplasma pneumoniae rate across 29 provinces by May 2024, up from 80.00% in July 2023.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent firms in the mycoplasma detection reagents sector propel growth by developing enhanced agglutination kits that boost sensitivity for detecting contaminants in cell cultures, supporting accelerated biopharma R&D timelines. They secure joint ventures with research consortia to co-engineer confirmatory panels, incorporating molecular cross-verification to meet stringent regulatory validations.

Enterprises allocate resources to scalable production lines for cost-optimized formulations, targeting veterinary and pharmaceutical applications amid rising infection outbreaks. Leaders execute selective buyouts of regional biotech entities to integrate diverse serotype antigens, diversifying offerings for global labs.

They penetrate high-potential areas in Latin America and the Middle East, negotiating with health ministries to embed solutions in surveillance protocols. Additionally, they introduce performance-linked service packages with training modules, cultivating lab dependencies and ensuring predictable revenue through renewals.

Vircell S.L., founded in 1991 and headquartered in Granada, Spain, specializes in biotechnology reagents for diagnosing human infectious diseases through techniques from cell culture to molecular biology. The company produces ready-to-use kits like its Mycoplasma pneumoniae ELISA, enabling accurate antibody detection in serum via automated immunoassays.

Vircell maintains in-house antigen production for quality independence, exporting to over 90 countries on five continents. CEO and founder Juan José Cubero leads a team committed to ISO 13485 compliance and GMP standards for reliable outputs. The firm partners with clinical labs to customize panels, advancing early pathogen identification. Vircell reinforces its global stature by prioritizing flexible, innovative diagnostics that address evolving epidemiological threats.

Top Key Players

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Prospec-Tany Technogene Ltd.

- MyBioSource, Inc.

- Merck KGaA

- Lonza Group Ltd.

- Eurofins Scientific S.E.

- Charles River Laboratories International, Inc.

- Bio-Rad Laboratories, Inc.

- Abnova Corporation

Recent Developments

- In October 2024, Merck KGaA established a state-of-the-art biosafety testing facility with an investment exceeding US$ 300 million to address the growing global demand for biologics quality assurance. This expansion strengthens the Mycoplasma Plate Antigens Market by scaling up regulatory-compliant testing capacity, particularly for biologics and vaccines that mandate Mycoplasma detection through antigen-based assays. It also promotes innovation in antigen development and supports faster lot-release testing in GMP environments.

- In February 2024, Thermo Fisher Scientific expanded its biosafety and Mycoplasma testing capabilities at its Wisconsin GMP laboratory. This strategic enhancement supports the increasing trend of outsourcing biosafety and quality control testing by biopharmaceutical manufacturers. By incorporating advanced Mycoplasma plate antigen methodologies into its biosafety portfolio, Thermo Fisher is driving market growth through enhanced accuracy, regulatory alignment, and scalable testing solutions that meet the needs of an expanding cell and gene therapy pipeline.

Report Scope

Report Features Description Market Value (2024) US$ 572.4 Million Forecast Revenue (2034) US$ 1034.8 Million CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plate Agglutination Test Products (Plate Antigens-Negative Control Serum, Mycoplasma Plate Antigens-Control Serum, and Mycoplasma Plate Antigens), and Confirmatory Testing Reagents (Negative Serum, Mycoplasma Whole Organism, and Mycoplasma Antiserum)), By Application (Drug Development, Veterinary Research, Infection Medicine, and Others), By End-user (Veterinary Hospitals, Poultry Veterinary Clinics, Pharma & Biotech Companies, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., QIAGEN N.V., Prospec-Tany Technogene Ltd., MyBioSource, Inc., Merck KGaA, Lonza Group Ltd., Eurofins Scientific S.E., Charles River Laboratories International, Inc., Bio-Rad Laboratories, Inc., Abnova Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mycoplasma Plate Antigens MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Mycoplasma Plate Antigens MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Prospec-Tany Technogene Ltd.

- MyBioSource, Inc.

- Merck KGaA

- Lonza Group Ltd.

- Eurofins Scientific S.E.

- Charles River Laboratories International, Inc.

- Bio-Rad Laboratories, Inc.

- Abnova Corporation