Molecular Diagnostic Market By Product Type (Instruments & Systems, Reagents & Kits, Software & Others), By Technology (Polymerase chain reaction (PCR), Transcription Mediated Amplification (TMA), Sequencing, Mass Spectrometry, Isothermal Nucleic Acid Amplification Technology (INAAT), In Situ Hybridization (ISH), Chips & Microarrays, Other Technologies), By Application (Infectious Disease, Oncology, Pharmacogenomics, Genetic Testing, Neurological Disease, Microbiology, Cardiovascular Disease, Others), By Test Location (Point of Care, Central Laboratories, Self-test or OTC), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 16242

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

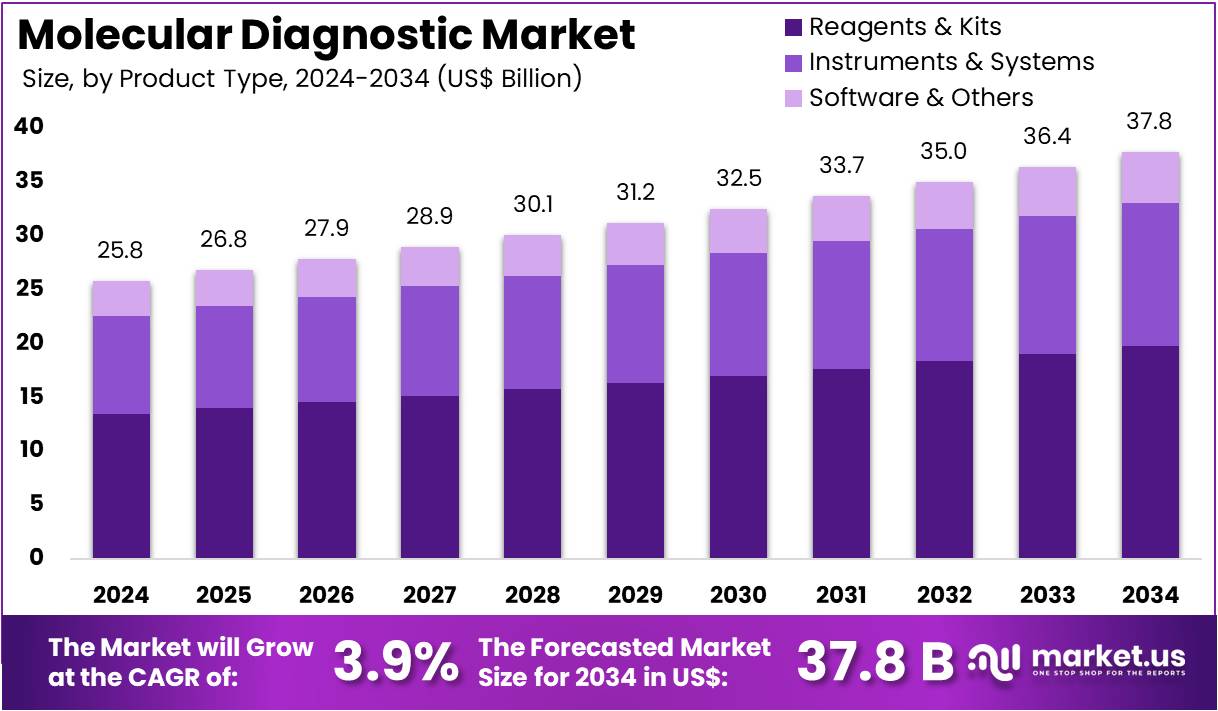

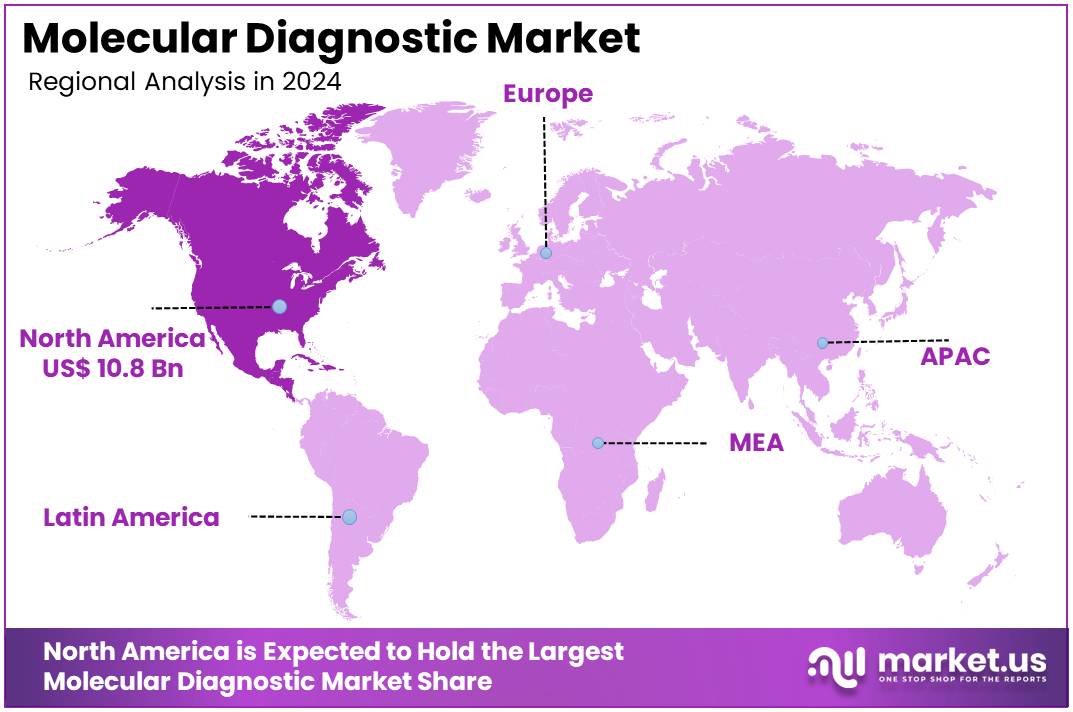

The Molecular Diagnostic Market Size is projected to be around US$ 37.8 Billion by 2034 from US$ 25.8 billion in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.9% share and holds US$ 10.8 Billion market value for the year.

The molecular diagnostics market is experiencing a period of significant expansion, driven by a convergence of technological innovation, demographic shifts, and a rising demand for precise and efficient diagnostic tools. The increasing global elderly population is a key factor, as this demographic is more susceptible to chronic and infectious diseases, creating a critical need for advanced diagnostic technologies.

Molecular diagnostics, with their unparalleled accuracy and ability to detect diseases at an early stage, are becoming essential for managing the healthcare needs of this demographic. This demand is further amplified by the growing popularity of Point-of-Care (POC) testing, which is fueled by a societal push for self-diagnostic tools and a greater patient awareness of the benefits of rapid results.

This trend is motivating companies to innovate and introduce new testing products, such as portable RT-PCR machines that can deliver highly accurate results for various viruses in a matter of minutes without the need for specialized training. This shift toward smaller, more accessible diagnostic devices aligns with a broader trend of healthcare decentralization, where advanced diagnostic capabilities are moving out of large central laboratories and into smaller clinics and even patient homes. The development of tailored, specialized designs for specific clinical departments also reflects a market that is becoming increasingly responsive to diverse diagnostic requirements.

The market is also being propelled by the need to address significant public health challenges. For instance, the World Health Organization (WHO) has noted that noncommunicable diseases, such as cardiovascular diseases and cancers, are the leading causes of death globally, with a significant proportion of these deaths occurring in low- and middle-income countries. This highlights the immense potential for molecular diagnostics to improve health outcomes through early detection and personalized treatment. The Centers for Disease Control and Prevention (CDC) provides further evidence of this need, reporting that nearly 42 million adults in the US were living with diagnosed diabetes in 2021, and this number continues to rise, underscoring the demand for accurate, rapid diagnostic tools to manage chronic conditions.

Government agencies are actively promoting the adoption of advanced diagnostic technologies. In November 2024, Texas launched a pilot program for self-collected HPV screening. The initiative aims to improve access to cervical cancer screening in underserved communities. It demonstrates the feasibility and effectiveness of self-collection testing in real-world healthcare settings. This program highlights the role of public-private partnerships in expanding point-of-care (POC) testing. Such collaborations are addressing critical public health challenges while accelerating the integration of innovative solutions into clinical practice.

The National Institutes of Health (NIH) remains a major funder of molecular diagnostics research. Its focus includes infectious disease surveillance and personalized medicine applications. Investments target innovations that can enhance disease detection, monitoring, and treatment strategies. These initiatives represent a coordinated effort to improve health outcomes globally. Public and private sector engagement is strengthening the adoption of molecular diagnostic tools. As funding and pilot programs expand, their impact on healthcare accessibility and quality is expected to grow significantly.

Key Takeaways

- In 2024, the market for molecular diagnostic generated a revenue of US$ 25.8 billion, with a CAGR of 3.9%, and is expected to reach US$ 37.8 Billion by the year 2034.

- The product type segment is divided into instruments & systems, reagents & kits, and software & others, with reagents & kits taking the lead in 2023 with a market share of 52.4%.

- Considering technology, the polymerase chain reaction (PCR) held a significant share of 44.8%.

- Concerning the application segment, the infectious disease sector stands out as the dominant player, holding the largest revenue share of 49.7% in the molecular diagnostic market.

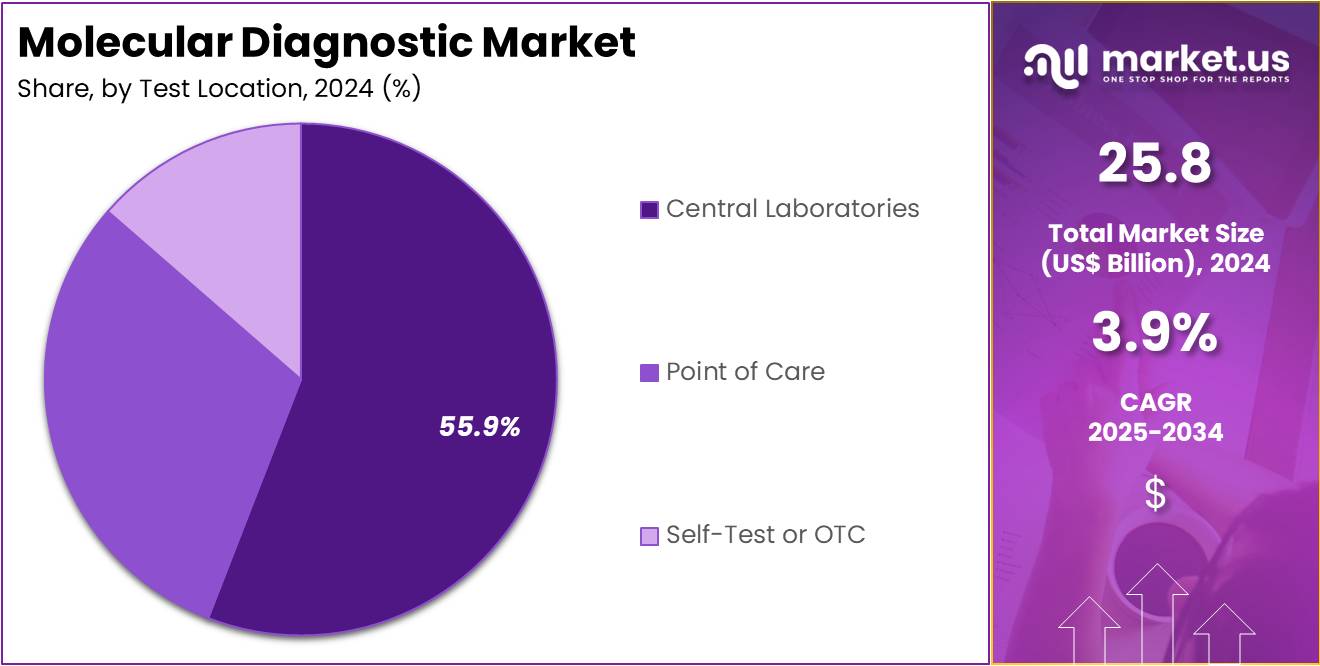

- The test location segment is segregated into point of care, central laboratories, and self-test or OTC, with the central laboratories segment leading the market, holding a revenue share of 55.9%.

- North America led the market by securing a market share of 41.9% in 2023.

Product Type Analysis

Reagents & kits account for 52.4% of the product type segment in the molecular diagnostic market. This growth is expected to continue as reagents and kits are essential for the successful execution of molecular diagnostic tests. These products enable the detection of specific pathogens, genetic mutations, and biomarkers, making them integral to a wide range of applications, including infectious disease diagnosis, genetic testing, and oncology. The increasing number of molecular diagnostic tests being performed across various healthcare settings is driving the demand for high-quality reagents and kits.

The rise in personalized medicine, where treatments are tailored to an individual’s genetic makeup, is likely to increase the use of reagents in testing procedures. Additionally, the ongoing improvements in test sensitivity and specificity are expected to further boost the demand for reagents and kits. As the healthcare industry focuses on improving the accuracy of diagnostics and reducing time to results, the reagents & kits segment is anticipated to continue growing at a rapid pace.

Technology Analysis

Polymerase chain reaction (PCR) technology holds the largest share of 44.8% in the molecular diagnostic market, and its growth is projected to remain strong. PCR is widely used due to its ability to amplify small segments of DNA or RNA, making it a powerful tool for diagnosing infectious diseases, detecting genetic mutations, and performing forensic analysis. The growing demand for PCR-based testing in areas like oncology, infectious diseases, and genetic testing is a major driver for the growth of this segment.

Additionally, the rise of COVID-19 testing, where PCR is the gold standard for detecting the virus, has further accelerated the adoption of this technology. PCR testing is expected to become even more prevalent with the ongoing advances in technology that reduce costs and increase speed, such as real-time PCR and digital PCR. The increased accessibility of PCR testing in both clinical and research settings, combined with its superior accuracy, is likely to ensure its continued dominance in the molecular diagnostics field.

Application Analysis

Infectious disease diagnostics represent 49.7% of the application segment in the molecular diagnostic market. This growth is expected to continue as the need for rapid, accurate diagnostics for infectious diseases remains critical. The increasing incidence of infectious diseases, including respiratory infections, sexually transmitted diseases, and gastrointestinal infections, is driving the demand for molecular diagnostic tests. Technologies such as PCR, sequencing, and mass spectrometry are becoming integral in diagnosing infections with higher accuracy and faster turnaround times.

The COVID-19 pandemic has particularly highlighted the importance of rapid infectious disease diagnostics and has driven innovations in testing technologies. As global health initiatives focus on reducing the spread of infectious diseases, the demand for molecular diagnostic tools in this area is likely to grow. Furthermore, the push for global health security and the rising need for real-time disease surveillance are projected to further increase the adoption of molecular diagnostics for infectious disease detection.

Test Location Analysis

Central laboratories represent 55.9% of the end-user segment in the molecular diagnostic market. This dominance is expected to continue as central laboratories are equipped with advanced technologies and staffed with highly skilled personnel to perform a wide variety of complex molecular diagnostic tests. Central laboratories play a critical role in diagnostic workflows, particularly in the areas of oncology, infectious diseases, and genetic testing. The ability to conduct large-scale testing with high throughput, combined with the integration of molecular diagnostic systems and technologies, makes central labs ideal for processing samples efficiently and accurately.

Furthermore, as the demand for diagnostic testing increases globally, central laboratories are likely to see an expansion in their testing capabilities to meet the needs of both public and private healthcare providers. The increasing reliance on central laboratories for conducting diagnostic tests at a higher volume and with greater precision is expected to support the continued growth of this segment in the molecular diagnostic market.

Key Market Segments

By Product Type

- Instruments & Systems

- Reagents & Kits

- Software & Others

By Technology

- Polymerase chain reaction (PCR)

- Multiplex PCR

- Others

- Transcription Mediated Amplification (TMA)

- Sequencing

- Mass Spectrometry

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- In Situ Hybridization (ISH)

- Chips & Microarrays

- Other Technologies

By Application

- Infectious Disease

- Oncology

- Prostate Cancer

- Lung Cancer

- Colorectal Cancer

- Breast Cancer

- Others

- Pharmacogenomics

- Tuberculosis & Drug-resistant TBA

- Meningitis

- Infectious Diseases

- HIV

- Hepatitis C

- Candida

- Hepatitis B

- Others

- Genetic Testing

- Newborn Screening

- Predictive & Presymptomatic Testing

- Other Genetic Testing

- Neurological Disease

- Microbiology

- Cardiovascular Disease

- Others

By Test Location

- Point of Care

- Central Laboratories

- Self-test or OTC

Drivers

Rising chronic disease prevalence and technological innovation are driving the market

The market is being driven by the rising prevalence of chronic diseases and ongoing technological advancements. The molecular diagnostics sector is experiencing rapid growth due to a combination of demographic and technological factors. One key driver is the aging population, which is more prone to chronic illnesses such as cancer, cardiovascular conditions, and neurodegenerative diseases—conditions that are commonly assessed through molecular diagnostics.

According to the World Health Organization (WHO), the global population aged 60 and above is expected to grow from 1.1 billion in 2023 to 1.4 billion by 2030, creating a larger patient base in need of effective diagnostic solutions. This demographic shift calls for more precise and efficient diagnostic tools to address complex health challenges. At the same time, the industry is seeing a wave of innovation, with companies continually developing new products.

For example, in March 2023, Sysmex Life Science introduced the Sentifit® 800 analyzer, an advanced, fully automated device designed for high-throughput fecal immunochemical testing, which improves diagnostic speed and accuracy. Additionally, increased research and development funding, highlighted by a 2024 study from Northwestern University’s Feinberg School of Medicine, revealed that the institution received over $461 million in NIH funding for 2023-2024, much of which is directed toward advancing diagnostic technology.

Restraints

Stringent regulations and increased costs are restraining the market

A major challenge facing the market is the strict regulatory environment, which can delay product development and raise costs, restricting access to advanced diagnostic tools. In particular, the regulatory landscape in the United States is becoming increasingly complex as agencies like the FDA intensify their oversight of diagnostic products.

For instance, experts voiced concerns in a February 2024 article from the Yale School of Medicine regarding the FDA’s proposed regulations on laboratory-developed tests (LDTs), fearing that such measures could restrict access to vital diagnostics, especially for rare diseases. These regulations might impede rapid responses to health crises like pandemics and raise costs for laboratories, potentially compromising patient care and safety.

The financial impact of complying with these regulations is significant. A 2022 study by the National Bureau of Economic Research (NBER) found that companies typically spend around 1.34% of their total wage bill on regulatory compliance, with this figure being much higher in heavily regulated industries. These costs and the lengthy approval processes can delay the introduction of innovative diagnostic solutions, stifling progress and creating barriers for smaller companies, thus limiting the availability of new, potentially life-saving tests for patients.

Opportunities

Strategic mergers and acquisitions are creating growth opportunities

The molecular diagnostics sector is experiencing a surge in mergers and acquisitions (M&A), which have become a key strategy for growth. These strategic moves enable companies to strengthen their product offerings and broaden their market reach, thereby enhancing their competitive position. By acquiring smaller, innovative companies, larger players can rapidly access advanced technologies and new customer bases. For example, in January 2023, Thermo Fisher Scientific acquired The Binding Site Group, bolstering its specialty diagnostics segment, particularly in oncology testing for multiple myeloma. This acquisition was projected to increase adjusted earnings per share by $0.07 in 2023, highlighting both its strategic and financial advantages.

Another major deal occurred in 2024, when Thermo Fisher acquired Olink for a significant sum, aiming to expand its capabilities in proteomics discovery and development. This wave of consolidation reflects a broader trend toward creating integrated, comprehensive diagnostic platforms, allowing companies to offer a wider array of services, streamline their operations, and capitalize on economies of scale to increase investment in R&D. This, in turn, accelerates the development of next-generation diagnostic tools.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are significantly impacting the operations of manufacturers and suppliers in the molecular diagnostics industry. Rising global inflation has increased the cost of critical raw materials, such as enzymes and chemical reagents, which are essential for molecular diagnostic tests. According to a 2024 biopharma supply cost analysis, the cost of laboratory supplies is expected to increase by 1-2% in the second quarter of 2024, primarily due to fluctuations in raw material prices. This, in turn, directly affects the costs of manufacturing diagnostic products.

At the same time, geopolitical tensions are disrupting global supply chains, especially for specialized chemicals used in diagnostics. A report on global supply chain risks pointed out that ongoing conflicts and trade disputes have caused delays in shipping and changes in sourcing strategies. For example, the US Producer Price Index (PPI) for chemicals and allied products saw a 0.9% increase in February 2024, reflecting the effects of these disruptions.

In response, the industry is prioritizing operational efficiency and strategic sourcing. Companies with resilient supply chains, capable of absorbing or mitigating these rising costs, are in a better position to maintain stability and profitability, proving that flexibility and forward-thinking are key to overcoming such challenges.

Additionally, the imposition of US tariffs is creating further hurdles for the supply chain. The introduction of duties on imported diagnostic equipment and reagents from major trading partners has raised the landed cost of these products. A 2025 study on US tariffs revealed that some diagnostic reagents and lab supplies face tariffs of up to 25% or higher, depending on their classification and country of origin. These increased costs are passed along the supply chain, impacting distributors’ margins and eventually leading to higher prices for healthcare providers and laboratories. This raises the cost of implementing new diagnostic solutions, which could limit access to healthcare and reduce profitability for medical practices.

On the other hand, these tariffs are benefiting US-based manufacturers who are not subject to such import duties. As a result, some healthcare providers are shifting their purchasing toward domestically produced goods, ensuring more stable supply chains and predictable pricing. This shift is encouraging growth in domestic manufacturing and prompting companies to invest in local production to avoid the burden of tariffs and improve their market positioning. The industry is responding by seeking new suppliers and refining logistics, demonstrating a strong ability to adapt and navigate through these complexities.

Latest Trends

The increasing use of next-generation sequencing in clinical oncology is a recent trend

A notable trend observed in 2024 and 2025 is the increasing integration of next-generation sequencing (NGS) into routine clinical oncology practice. NGS technology allows for the rapid and comprehensive analysis of a tumor’s genetic makeup, enabling clinicians to identify specific mutations and biomarkers that guide personalized treatment decisions. This shift away from traditional, single-gene testing to multi-gene panel testing is revolutionizing cancer care.

According to a 2024 report on clinical oncology, the companion diagnostics segment, which is highly reliant on NGS, held the largest market share. This is because these tests enable clinicians to identify the most effective therapy based on a patient’s genetic profile, improving treatment outcomes.

The FDA has also been a key facilitator of this trend, approving a record number of new AI and ML-based medical devices in 2024, many of which are designed to analyze the complex genomic data generated by NGS. This adoption is making personalized cancer therapies more accessible and effective, as a 2025 study found that the use of NGS panels in cancer cases has a therapeutic utility in approximately 64% of cases.

Regional Analysis

North America is leading the Molecular Diagnostic Market

In 2024, the North American molecular diagnostics market maintained a leading position, securing the largest revenue share of 41.9%. This dominance is largely attributed to the increasing adoption of molecular diagnostics, which are highly regarded for their exceptional accuracy, sensitivity, and specificity.

The rising demand for genetic testing, especially in personalized medicine for oncology and other complex diseases, plays a major role in driving market growth. This trend is supported by a strong research and development infrastructure and a high concentration of leading industry players. The American Cancer Society projects over 2 million new cancer diagnoses in the US in 2024, highlighting the significant disease burden that underscores the need for advanced molecular diagnostics for early detection, precise staging, and personalized treatment strategies.

The market’s growth is also bolstered by favorable regulatory and reimbursement conditions. Regulatory agencies like the US Food and Drug Administration (FDA) offer clear pathways for new molecular diagnostic tests, facilitating the faster introduction of innovative solutions. For example, in 2022, the FDA approved Myriad Genetics, Inc.’s BRACAnalysis CDx test, a companion diagnostic designed to identify breast cancer patients who might benefit from targeted treatments. Such regulatory support fosters continued innovation in the sector. Additionally, the Centers for Medicare & Medicaid Services (CMS) have expanded reimbursement for various molecular tests, enhancing their accessibility and encouraging wider adoption in clinical environments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the molecular diagnostics market is expected to grow rapidly during the forecast period. This growth is driven by the high burden of infectious diseases, a fast-evolving healthcare infrastructure, and an aging population. According to the World Health Organization’s (WHO) Global TB Report 2023, the WHO South-East Asia Region, which accounts for about a quarter of the global population, is responsible for over 45% of the global tuberculosis (TB) incidence. In 2022, more than 4.8 million people in this region were affected by TB, with over 600,000 deaths. This ongoing health crisis underscores the urgent need for accurate and efficient molecular diagnostic tools.

The expansion of the market is further fueled by growing research and development activities and strong government support. Countries like China are making substantial investments in healthcare, and the rising middle class is driving demand for advanced diagnostic solutions. In India, the government’s “National TB Elimination Programme” is promoting the use of cutting-edge diagnostic technologies. Additionally, China’s healthcare system is expanding, with a growing number of healthcare professionals, evidenced by a density of 4.5 dentists per 10,000 people in 2021, a figure that continues to rise. These factors, along with a stronger focus on personalized medicine, are positioning Asia Pacific as a crucial driver of growth in the molecular diagnostics market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the molecular diagnostics market focus on innovation, strategic partnerships, and global expansion to fuel growth. Companies invest heavily in developing next-generation testing platforms that offer faster, more accurate, and cost-effective diagnostic solutions. Many also prioritize collaborations with healthcare providers, research institutions, and academic organizations to advance product development and gain access to new markets.

Expansion into emerging economies allows companies to tap into untapped customer bases. Regulatory compliance and the ability to meet stringent industry standards are crucial for maintaining market trust. Additionally, players emphasize enhancing product portfolios through acquisitions and offering personalized solutions that meet diverse healthcare needs.

Thermo Fisher Scientific is a leader in the molecular diagnostics market, offering a broad range of diagnostic solutions that help healthcare providers detect and manage diseases more effectively. The company’s expertise in advanced genetic testing and PCR technology has positioned it at the forefront of molecular diagnostics. Through strategic partnerships, acquisitions, and a strong global distribution network, Thermo Fisher continues to expand its reach and product offerings, solidifying its leadership in the market.

Top Key Players in the Molecular Diagnostic Market

- Sysmex Corporation

- Siemens Healthineers AG

- QIAGEN

- Illumina, Inc

- Hologic Inc. (Gen Probe)

- Hoffmann-La Roche, Ltd

- Danaher

- Bio-Rad Laboratories, Inc

- bioMérieux SA

- BD

- Agilent Technologies, Inc

- Abbott

Recent Developments

- In January 2025: Lantheus Holdings, a prominent company in the field of radiopharmaceuticals focused on advancing diagnostic solutions and improving patient outcomes, announced its decision to acquire Life Molecular Imaging Limited in a cash deal valued at $350 million, with an additional $400 million based on future milestones and performance. This acquisition will enhance Lantheus’ capabilities in delivering innovative diagnostic solutions.

- In October 2024: LabGenomics USA finalized its acquisition of Integrated Molecular Diagnostics’ CLIA-certified labs, increasing its lab count to four across the United States. This acquisition will strengthen LabGenomics’ position in the molecular diagnostics market and expand its reach in providing advanced healthcare solutions nationwide.

- In May 2024: Bruker Corporation concluded its acquisition of ELITechGroup for a sum of €870 million, excluding its clinical chemistry division. This acquisition will significantly enhance Bruker’s capabilities in molecular diagnostics and microbiology, enabling it to offer a broader range of diagnostic solutions in the life sciences and in vitro diagnostics fields.

Report Scope

Report Features Description Market Value (2024) US$ 25.8 billion Forecast Revenue (2034) US$ 37.8 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments & Systems, Reagents & Kits, and Software & Others), By Technology (Polymerase Chain Reaction (PCR) (Multiplex PCR and Others), Transcription Mediated Amplification (TMA), Sequencing, Mass Spectrometry, Isothermal Nucleic Acid Amplification Technology (INAAT), In Situ Hybridization (ISH), Chips & Microarrays, and Other Technologies), By Application (Infection Disease, Oncology (Prostate Cancer, Lung Cancer, Colorectal Cancer, Breast Cancer, and Others), Pharmacogenomics (Tuberculosis & Drug-resistant TBA, Meningitis, Infectious Diseases, HIV, Hepatitis C, Candida, Hepatitis B, and Others), Genetic Testing (Newborn Screening, Predictive & Presymptomatic Testing, and Other Genetic Testing), Neurological Disease, Microbiology, Cardiovascular Disease, and Others), By Test Location (Point of Care, Central Laboratories, and Self-test or OTC) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Siemens Healthineers AG, QIAGEN, Illumina, Inc, Hologic Inc. (Gen Probe), F. Hoffmann-La Roche, Ltd, Danaher, Bio-Rad Laboratories, Inc, bioMérieux SA, BD, Agilent Technologies, Inc, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Molecular Diagnostics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Molecular Diagnostics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- Siemens Healthineers AG

- QIAGEN

- Illumina, Inc

- Hologic Inc. (Gen Probe)

- Hoffmann-La Roche, Ltd

- Danaher

- Bio-Rad Laboratories, Inc

- bioMérieux SA

- BD

- Agilent Technologies, Inc

- Abbott