Global Metallocene Polyethene Market Size, Share Analysis Report By Type (mLLDPE, mHDPE, Others), By Catalyst Type (Zerconocene, Ferrocene, Tetanocene, Others), By Application ( Films, Sheets, Injection Molding, Extrusion Coatings, Others), By End-use (Packaging, Food and Beverages, Automotive, Building and Construction, Agriculture, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160896

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

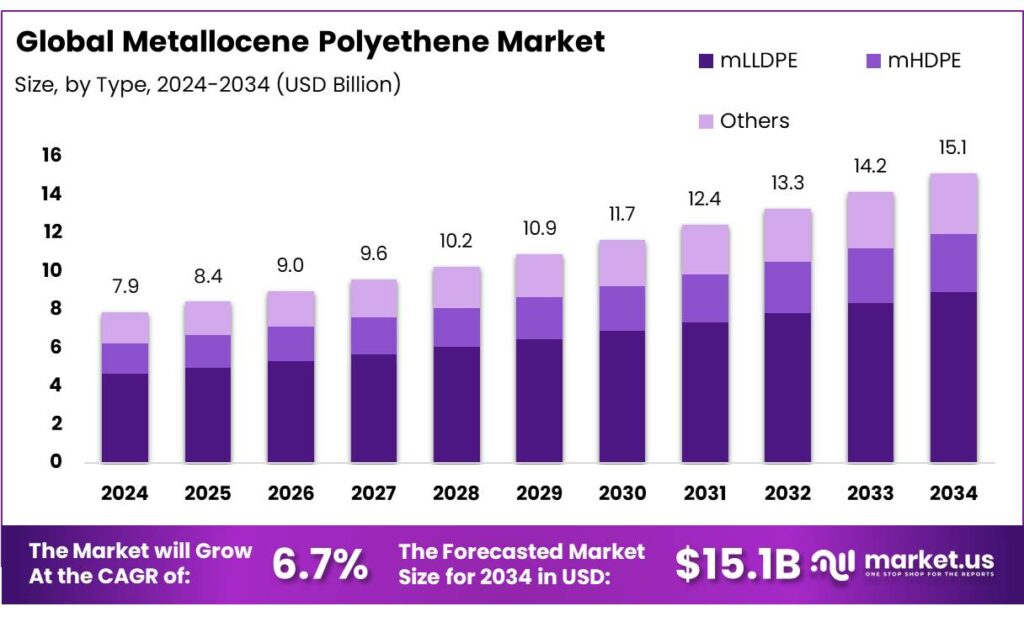

The Global Metallocene Polyethene Market size is expected to be worth around USD 15.1 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

Metallocene polyethylene (mPE) refers to polyethylene grades synthesized using metallocene catalysts (typically single-site catalysts), which impart superior control over polymer microstructure (molecular weight distribution, branching, comonomer incorporation) compared to conventional Ziegler-Natta catalysts. These materials include metallocene linear low density polyethylene (mLLDPE), metallocene high density polyethylene (mHDPE), and other specialty variants. mPE finds use in films, sheets, coatings, extrusion, injection molding, and specialty packaging, owing to enhanced clarity, toughness, sealability, and processability.

The broader petrochemicals and plastics context further underscores mPE’s significance. The International Energy Agency (IEA) forecasts that petrochemicals will drive over one-third of the growth in oil demand through 2030, and nearly half by 2050, making polymers and specialty plastics a central component of future energy consumption patterns. The chemical sector is already the largest industrial energy consumer, and about half of its energy input is consumed as feedstock rather than fuel. In addition, the IEA expects that petrochemicals (including plastics) will consume an additional 56 billion cubic meters of natural gas by 2030.

From the policy and government side, in India the Plastic Parks Scheme under the Department of Chemicals and Petrochemicals supports cluster development of downstream plastics units with grants of up to 50% of project cost. To date, 10 plastic parks have been approved. Under India’s National Policy on Petrochemicals, Centers of Excellence (CoEs) have been set up with grant support up to 50% of project cost for developing new polymer technologies or improving manufacturing processes; 18 CoEs established so far. The government also permits 100 % FDI in chemicals; in the past five years, chemical & petrochemicals sector attracted ~₹ 42,641 crore in FDI.

Key Takeaways

- Metallocene Polyethene Market size is expected to be worth around USD 15.1 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 6.7%.

- mLLDPE held a dominant market position, capturing more than a 59.2% share of the global metallocene polyethylene market.

- Zerconocene held a dominant market position, capturing more than a 49.7% share of the global metallocene polyethylene market.

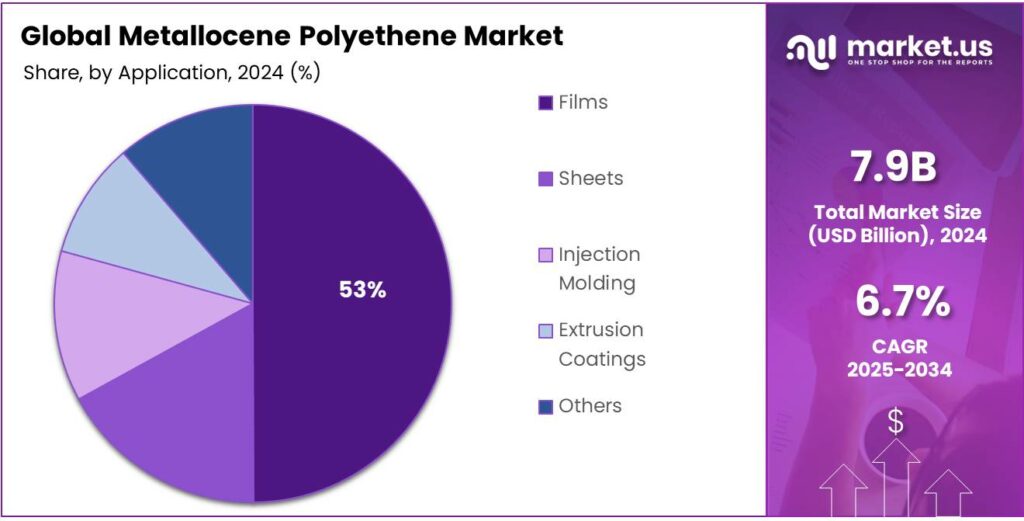

- Films held a dominant market position, capturing more than a 53.9% share of the global metallocene polyethylene market.

- Packaging held a dominant market position, capturing more than a 45.1% share of the global metallocene polyethylene market.

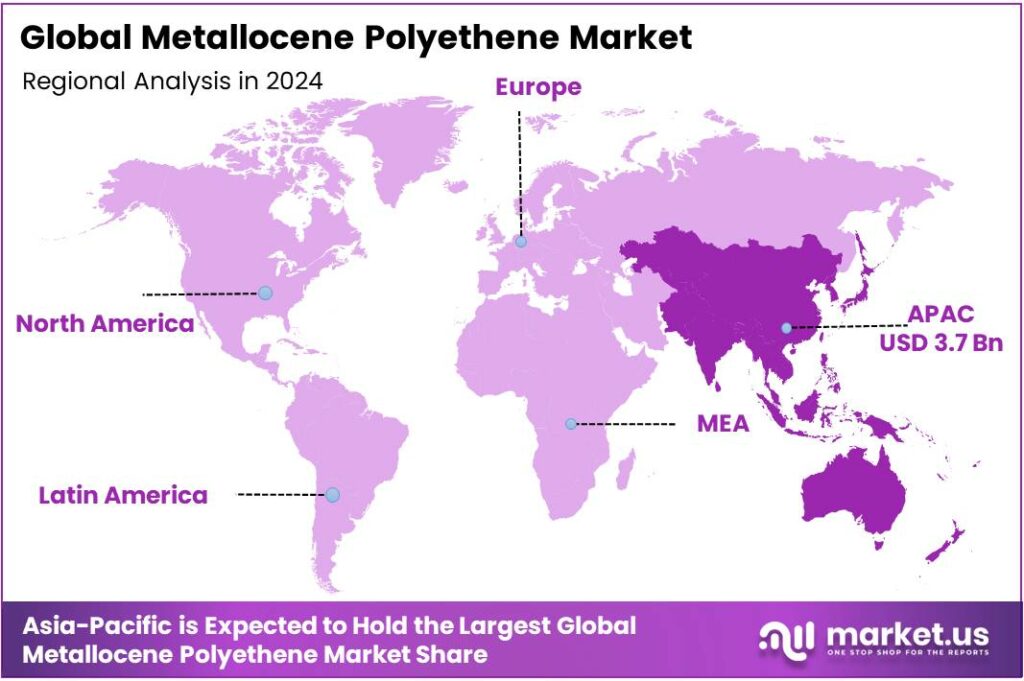

- Asia Pacific region held a dominant position in the global metallocene polyethylene (mPE) market, accounting for 46.9% of the market share, valued at approximately USD 3.7 billion.

By Type Analysis

mLLDPE dominates with 59.2% share in 2024 due to its versatile applications and superior performance

In 2024, mLLDPE held a dominant market position, capturing more than a 59.2% share of the global metallocene polyethylene market. This leadership can be attributed to its exceptional flexibility, high tensile strength, and enhanced clarity, which make it suitable for a wide range of applications including packaging films, stretch wraps, and agricultural films. The adoption of mLLDPE in flexible packaging was particularly strong, as it allowed manufacturers to produce thinner films without compromising durability, thereby reducing material costs and improving sustainability.

The industrial scenario in 2024 highlighted the increasing preference for mLLDPE over conventional polyethylene types, especially in regions witnessing rapid urbanization and growing consumer goods demand. Its ability to perform under diverse processing conditions, coupled with superior sealability and puncture resistance, reinforced its market dominance. In 2025, this trend is expected to continue as manufacturers focus on cost-effective, high-performance polymer solutions to meet evolving packaging standards and regulatory requirements.

By Catalyst Type Analysis

Zerconocene leads with 49.7% share in 2024 owing to its high efficiency and consistent polymer quality

In 2024, Zerconocene held a dominant market position, capturing more than a 49.7% share of the global metallocene polyethylene market by catalyst type. Its prominence can be linked to its ability to produce polymers with uniform molecular weight distribution and superior mechanical properties, which are critical for high-performance applications in packaging, automotive, and medical sectors. The consistent polymerization offered by Zerconocene enables manufacturers to achieve high clarity films, improved tensile strength, and better processability, meeting the growing demand for advanced polyethylene products.

The industrial scenario in 2024 showed that Zerconocene catalysts were increasingly preferred over other metallocene variants due to their efficiency in large-scale production and ability to reduce production costs while maintaining high-quality output. By 2025, this trend is expected to continue as manufacturers focus on delivering high-performance, cost-effective polyethylene solutions to address stricter regulatory standards and rising consumer expectations for durability and sustainability.

By Application Analysis

Films dominate with 53.9% share in 2024 due to their versatility and wide industrial use

In 2024, Films held a dominant market position, capturing more than a 53.9% share of the global metallocene polyethylene market by application. This leadership is driven by the material’s excellent mechanical strength, clarity, and flexibility, which make it highly suitable for packaging films, stretch wraps, and agricultural coverings. Films manufactured from metallocene polyethylene offer superior sealability, puncture resistance, and durability, meeting the rising demand for high-quality, lightweight, and sustainable packaging solutions.

The industrial scenario in 2024 highlighted strong adoption of mPE films across food and beverage, healthcare, and consumer goods sectors, where protective and flexible packaging is critical. By 2025, this trend is expected to continue, as industries increasingly prioritize efficiency, product shelf-life, and environmental compliance. The ability to produce thinner films without compromising performance has further contributed to the widespread use of mPE films, reducing material consumption and lowering overall production costs.

By End-use Analysis

Packaging leads with 45.1% share in 2024 due to its critical role in protecting and preserving products

In 2024, Packaging held a dominant market position, capturing more than a 45.1% share of the global metallocene polyethylene market by end-use. This dominance is largely driven by the growing need for lightweight, durable, and flexible packaging solutions across food and beverage, consumer goods, and pharmaceutical sectors. Metallocene polyethylene offers excellent clarity, high tensile strength, and superior sealability, making it an ideal choice for packaging applications that require both protection and aesthetic appeal.

The industrial scenario in 2024 showed increasing adoption of mPE in packaging films, bags, pouches, and shrink wraps, as manufacturers focus on improving product shelf life and reducing material usage. By 2025, the demand for mPE in packaging is expected to grow further due to rising e-commerce activities and expanding packaged goods markets in emerging economies, which require safe and reliable packaging solutions.

Key Market Segments

By Type

- mLLDPE

- mHDPE

- Others

By Catalyst Type

- Zerconocene

- Ferrocene

- Tetanocene

- Others

By Application

- Films

- Sheets

- Injection Molding

- Extrusion Coatings

- Others

By End-use

- Packaging

- Food and Beverages

- Automotive

- Building and Construction

- Agriculture

- Healthcare

- Others

Emerging Trends

Rise of Chemical Recycling and Advanced Feedstock Recovery

Globally, the push for chemical recycling is gaining regulatory and industrial momentum. The European Union, under its Circular Economy Action Plan, is pushing for higher recyclability of plastics and setting stricter requirements for packaging waste. In Europe, regulation R10/2011 governs plastic food contact materials and lays out safety criteria for recycled plastics. The challenge has always been ensuring that recycled plastics don’t contaminate food with migrating substances — chemical recycling helps address that by purifying at the molecular level.

A recent article in IFT’s “Recent and emerging food packaging alternatives” mentions that national recycling strategies are reaffirming goals to increase recycling rates of plastics to 50% by 2030, which implicitly supports investments in advanced recycling methods. This trend gives incentive for polymer producers to develop chemical recycling pathways for high-performance polymer types like metallocene PE.

Some governments are supporting this shift. In many regions, subsidies, tax incentives, or funding are directed toward advanced recycling infrastructure. For instance, in the EU, the European Green Deal and Circular Economy programs fund R&D in novel recycling technologies. Although I did not find direct numeric figures from a food organization for mPE chemical recycling, the regulatory and policy environment clearly favors innovations in feedstock recovery.

Drivers

Growing Demand for Flexible High-Performance Food Packaging

One of the biggest driving forces behind the adoption of metallocene polyethylene (mPE) in food applications is the rising demand for high-performance flexible packaging—especially in food & beverage sectors. Traditional polyethylene (PE) films often struggle with trade-offs: thickness vs strength, clarity vs barrier, sealing vs puncture resistance. Metallocene PE, due to its more uniform molecular structure, brings improved mechanical strength, better sealability, higher clarity, and enhanced resistance to puncture, while still being relatively light and flexible.

From a somewhat broader but still relevant perspective: many governments and regulatory bodies emphasize food safety, recyclability, and limiting harmful chemical migration in packaging. In the U.S., the Food & Drug Administration (FDA) maintains a Food Contact Substance (FCS) inventory and regulates packaging materials that contact food. This implicit requirement for safer and better-performing polymers in food contact pushes innovation and adoption of materials like mPE.

In Europe, under sustainability regulations, member states are being asked to ensure that by 2029, 90 % of single-use plastics are recycled, and that beverage bottles contain at least 30 % recycled plastic by 2030. Such regulatory pressures encourage packaging makers to look for polymers which can be more readily engineered for recycling or better performance in thinner forms (less waste), giving materials like mPE an advantage.

Restraints

High Cost And Complexity of Recycling And Regulatory Barriers

Globally, only 14% of plastic packaging is collected for recycling, and just 5% is successfully recycled into new plastics. That low conversion rate partly reflects how hard it is to clean, sort, and reprocess plastics without contamination. Now imagine if you want to use that recycled material in food packaging — not just any reuse, but food-grade reuse. That raises the bar significantly.

When you try to use recycled polyethylene (rPE) in food packaging, regulators demand stringent proof: the recycled polymer must avoid carryover of banned chemicals, ensure purity, maintain chain of custody, and meet migration limits. As the Plastics Industry association notes, even common additives (like antioxidants, stabilizers, colorants) may not be fully removed in conventional recycling, making regulatory approval a challenge.

In the U.S., for each recycling method intended for food-contact use, companies often must file a “Letter of Non Objection” with the FDA (or equivalent) to show compliance. Many packaging and recycling firms say that navigating such regulatory processes adds cost, time, and risk.

On the regulatory side, consider the new European rules: the EU’s Packaging and Packaging Waste Regulation (PPWR) 2025/40 demands that all packaging be recyclable by 2030 and sets strict requirements on packaging design, recyclability, and material composition. Moreover, from 12 August 2026, food packaging on the EU market will be prohibited if it contains PFAS (per- and polyfluorinated alkyl substances) above certain thresholds: 25 ppb for any PFAS, 250 ppb for the sum, or 50 ppm for polymeric PFAS.

Opportunity

Expansion into Recycled-Content & Circular Packaging Solutions

People nowadays care more about what’s inside—and outside—the package. When you pick up a food item, you want to know it’s safe, fresh, and that its packaging doesn’t harm the environment. That shift is pushing packaging producers to incorporate recycled plastics, design for recyclability, and reduce waste. In Europe, for instance, plastics used in food contact materials (FCM) make up about 50% of total plastic packaging. Because mPE has favorable mechanical and barrier properties, if it’s engineered to accept recycled feedstock or be more easily recycled itself, it could become one of the more attractive materials in the “green” toolkit.

Governments and regulators are already nudging this direction. The European Commission is proposing mandatory recycled-content targets for plastics used in food packaging, but with the caveat that only those plastics for which safe recycling processes are established can be included. That means mPE, if its recycling path is proven safe and traceable, could be included in future mandates. Further, as the International Finance Corporation (IFC) notes, the European Union is planning to require that food packaging and bottles include recycled plastic by 2040.

In India too, policies are shifting. The Indian government’s Plastic Waste Management Amendment Rules 2024 strengthened mandatory targets for recycling, reuse, and incorporation of recycled content into new products under the Extended Producer Responsibility (EPR) framework. This kind of regulation encourages packaging makers to find polymers that can adapt to recycled streams while maintaining safety, and mPE—with smart design—could benefit. Also, India has recently clarified that recycled plastics used in food-contact materials must meet the same health and safety standards as virgin polymers.

Regional Insights

Asia Pacific leads with 46.9% share in 2024, valued at USD 3.7 billion, driven by robust industrial demand and regional manufacturing strength

In 2024, the Asia Pacific region held a dominant position in the global metallocene polyethylene (mPE) market, accounting for 46.9% of the market share, valued at approximately USD 3.7 billion. This leadership is attributed to the region’s expansive manufacturing base, significant consumption across various end-use industries, and a growing emphasis on sustainable packaging solutions.

Government initiatives across the region have also played a crucial role in fostering market growth. Policies promoting the adoption of recyclable and eco-friendly materials have led to increased investments in metallocene polyethylene production. For instance, in December 2022, Dushi Petrochemical in China successfully produced metallocene polyethylene products using chromium powder as the domestic catalyst, marking a significant milestone in the country’s chemical industry.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Chevron Phillips Chemical Company LLC, a joint venture between Chevron Corporation and Phillips 66, is a significant player in the global polyethylene market. The company produces metallocene polyethylene resins that are known for their high clarity, strength, and flexibility, making them suitable for demanding applications in packaging and consumer goods. Chevron Phillips Chemical emphasizes innovation and operational excellence in its production processes.

Exxon Mobil Corporation is a leading multinational oil and gas company that also plays a significant role in the polyethylene market. The company’s metallocene polyethylene products are utilized in various applications, including packaging and consumer goods, where their superior performance attributes are essential. Exxon Mobil focuses on technological advancements and sustainability in its operations to provide high-quality materials that meet global standards.

Top Key Players Outlook

- Borealis AG

- Braskem

- Chevron Philips Chemical Company LLC

- Dow Chemical Company

- Exxon Mobil Corporation

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- LG Chem

- Mitsui & Co.

- SABIC

Recent Industry Developments

In 2024, Dow Chemical Company reaffirmed its leadership in the metallocene polyethylene (mPE) sector through strategic investments and technological advancements. The company initiated a $6.5 billion project in Fort Saskatchewan, Alberta, aimed at increasing polyethylene capacity by 2 million metric tons per annum (MTA) while achieving net-zero Scope 1 and 2 emissions.

In 2024, ExxonMobil reinforced its position in the metallocene polyethylene (mPE) market by expanding its production capabilities. The company inaugurated a new mPE production line at its Huizhou Ethylene Phase I Project in China, adding 730,000 metric tons per year to its capacity.

Report Scope

Report Features Description Market Value (2024) USD 7.9 Bn Forecast Revenue (2034) USD 15.1 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (mLLDPE, mHDPE, Others), By Catalyst Type (Zerconocene, Ferrocene, Tetanocene, Others), By Application ( Films, Sheets, Injection Molding, Extrusion Coatings, Others), By End-use (Packaging, Food and Beverages, Automotive, Building and Construction, Agriculture, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Borealis AG, Braskem, Chevron Philips Chemical Company LLC, Dow Chemical Company, Exxon Mobil Corporation, INEOS Group Holdings S.A., LyondellBasell Industries N.V., LG Chem, Mitsui & Co., SABIC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metallocene Polyethene MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Metallocene Polyethene MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Borealis AG

- Braskem

- Chevron Philips Chemical Company LLC

- Dow Chemical Company

- Exxon Mobil Corporation

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- LG Chem

- Mitsui & Co.

- SABIC