Global Meningitis Diagnostic Testing Market by Test Type (Latex Agglutination Tests, Lateral Flow Assay, Other Test Types), By End-user (Hospitals, Diagnostic Centers, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 102390

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

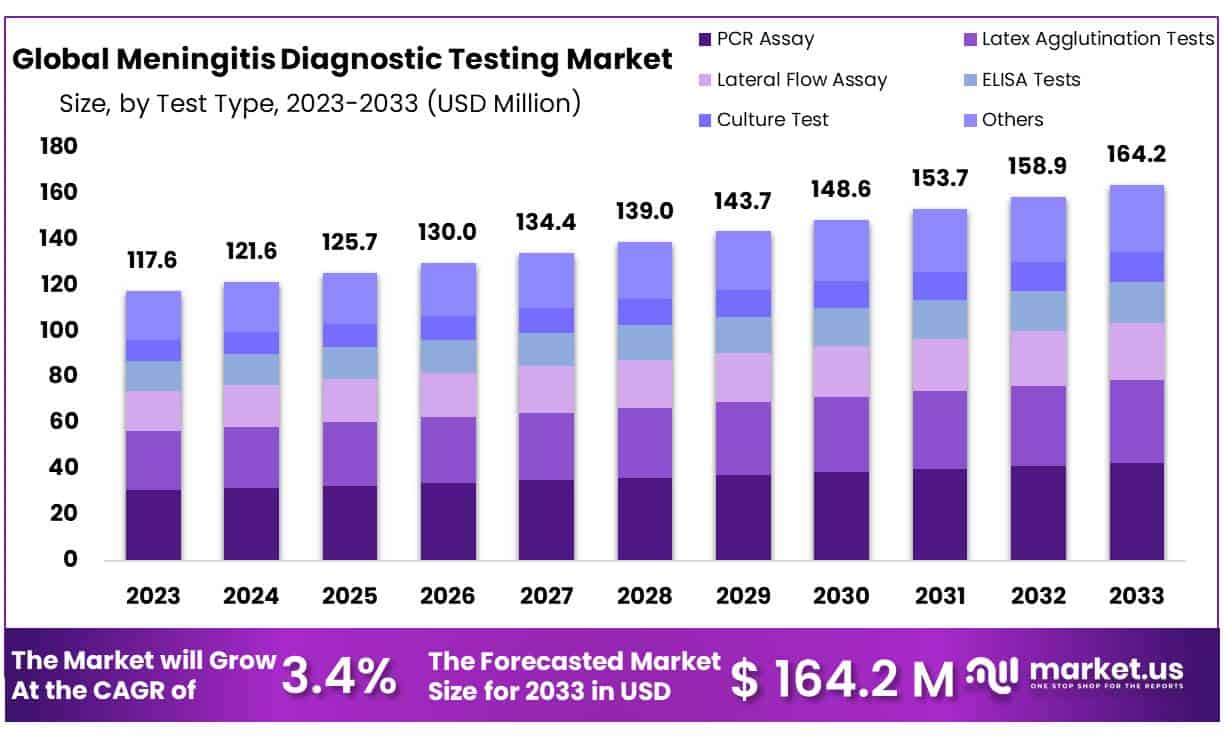

The global Meningitis Diagnostic Testing Market size is expected to be worth around USD 164.2 Million by 2033 from USD 117.6 Million in 2023, growing at a CAGR of 3.4% during the forecast period from 2024 to 2033.

Meningitis is an inflammation of the membranes that surround the spinal cord and brain, known as the meninges. Some kinds of meningitis are extremely hazardous, even fatal. Meningitis may be caused due to bacteria, fungi, viruses, parasites, or non-infectious causes such as malignancy or rheumatologic conditions.

It is rare that it is caused by other medications, infections, or disorders (such as cancer). Meningitis caused by viruses or bacteria frequently begins in another part of the body. The germs then move to the meninges via the bloodstream. Meningitis diagnostic techniques include latex agglutination tests, imaging, and spinal taps, as well as the cerebrospinal fluid test, which is also used to detect meningitis.

The key drivers of the market are the rising prevalence of meningitis and the increased need for improved diagnostics. Furthermore, rising demand for point-of-care diagnostic services, as well as increased R&D investments for improved diagnosis and treatment, are likely to boost the global meningitis diagnostic testing market during the forecast period.

Also, growing government involvement in meningitis outbreak control and an increase in demand for immediate diagnosis systems are projected to contribute to market growth. Furthermore, different organic and inorganic initiatives made by leading market players to obtain a competitive advantage and advance their market position are expected to provide the market with substantial growth possibilities during the forecast period.

Key Takeaways

- In 2023, the global Meningitis Diagnostic Testing market was estimated at USD 117.6 Million – representing its size at that time.

- Projected growth estimates show the market reaching USD 164.2 million by 2033, representing an upward trajectory.

- Between 2024-2033, it is projected to experience a compound annual growth rate of 3.4%; suggesting steady yet modest expansion over the specified time.

- PCR segment dominate 26.1% market share in 2023.

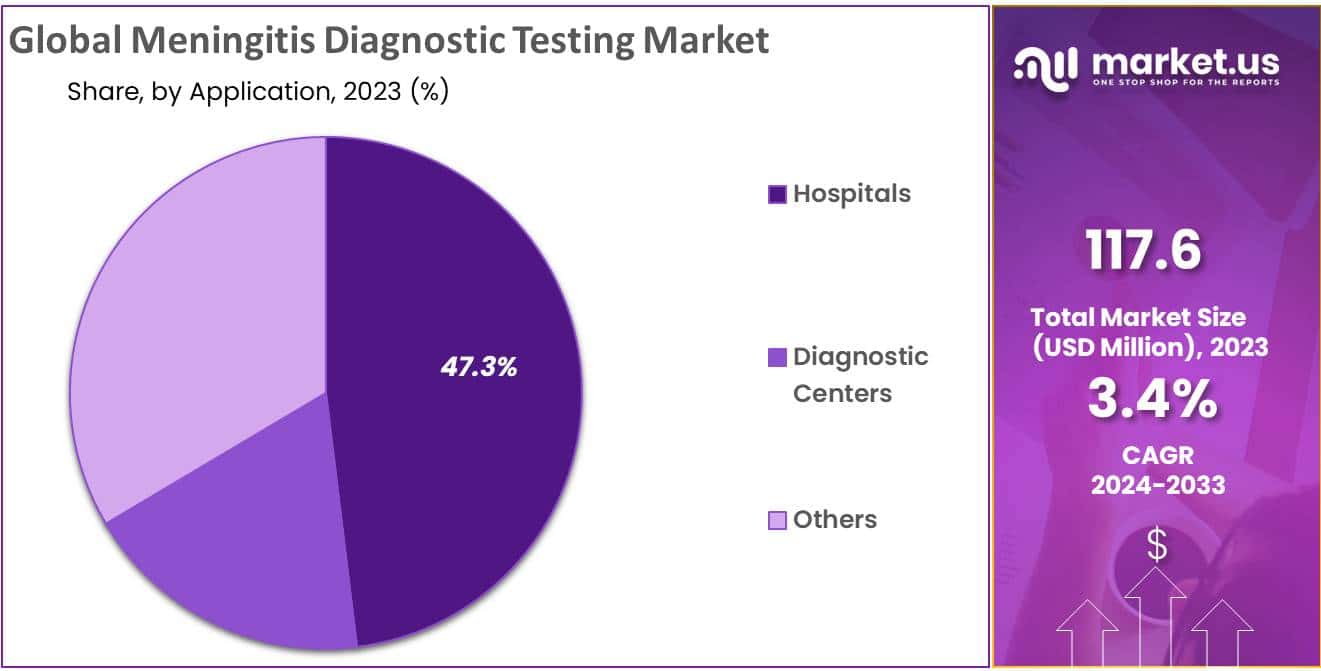

- The hospital segment accounts 47.3% market share in Meningitis Diagnostics.

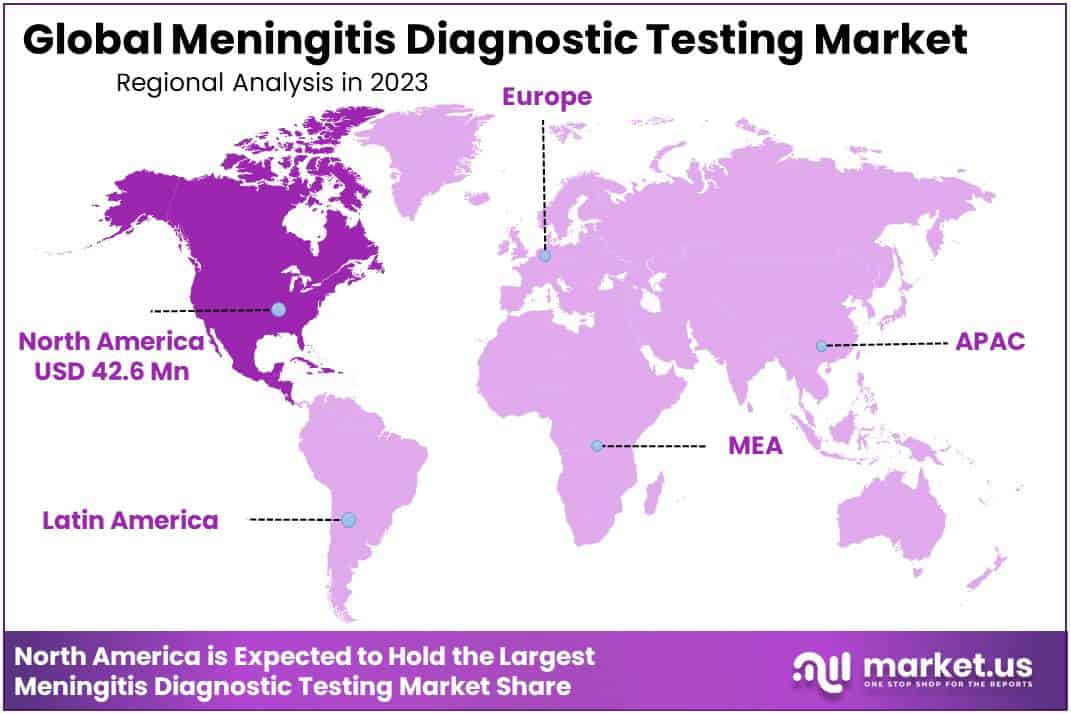

- The North American region dominate share of 36.4% in the market

- The data provides insights into the market’s growth potential over the next decade, indicating opportunities and trends within the Meningitis Diagnostic Testing industry.

- PCR Assay tests are in high demand due to their accuracy and speed.

- Lateral Flow Assay tests are gaining popularity for their speed, home-based testing, and cost-effectiveness.

Driving Factors

Rising prevalence of meningitis

According to the CDC, 2.5 million cases of meningitis are reported worldwide each year, with roughly 250,000 deaths. Each year, 600 to 1,000 persons in the United States get meningococcal illness. Meningococcal illness kills 10-15% of individuals who get it. Approximately one-fifth of those who survive have lasting problems such as brain damage, hearing loss, kidney function loss, or limb amputations.

Preteens, teens, and young adults aged 11 to 24 account for 21% of all meningococcal illness cases. According to NORD or National Organization for Rare Disorders, each year, the number of people diagnosed with bacterial meningitis in the U.S., is around 2,600 persons. It is expected that one in every two or three people who survive bacterial meningitis will have one or more long-term issues.

According to an NCBI research study published in December 2021, the global prevalence of confirmed bacterial meningitis ranged from 0.5% to 61.8% in the pediatric population (0-14 years) and was widespread in patients of all ages (0-75 years), with a prevalence ranging from 8.7% to 78.9%. Thus, an increase in the prevalence of meningitis is likely to drive the demand for meningitis diagnostic testing devices, and this is a major factor driving the growth of the market over the forecast period.

Government initiatives

The increased engagement of government entities in controlling worldwide meningococcal disease outbreaks, as well as an increase in demand for quick diagnostic methods, are expected to drive market expansion over the forecast period. For example, in November 2020, the World Health Organization (WHO), joined forces with its global partners involved in the control and prevention of meningitis, leading to a global road map preparation that establishes a new vision for combating meningitis by 2030.

Through iterative, diverse, and thorough dialogues, it involved hundreds of delegates from member states, partners, experts, private sector representatives, and civil society organizations. Such measures would raise awareness about the importance of early detection of meningitis, boosting market growth.

New research related to meningitis

Increased research into the prevention and treatment of meningitis may also boost market expansion. In May 2021, for example, a Lancet study found that cerebrospinal fluid adenosine deaminase levels (10 IU/L) were essentially related to tubercular and bacterial meningitis, a central nervous system infection. As a result, this biomarker could aid in the diagnosis of tubercular meningitis. The rising use of biomarkers, coupled with companion diagnostic tests, is likely to have a positive impact on the growth of the market in the upcoming years.

Restraining Factors

Lack of access to newer diagnostic technologies

According to a report issued in October 2021 by the Lancet Commission on Diagnostics, about half of the global population lacks access to basic diagnostics for several common diseases. The Commission emphasizes the importance of diagnostics in any functioning healthcare system and urges policymakers to eliminate the gap in diagnostics, enhance access, and spread diagnostic development beyond high-income nations.

The gap for diagnostic services is highest in primary or primitive care, where just 19% of populations in and lower or middle-income countries have access to the most basic diagnostic tests (other than for HIV or malaria), according to the research. It was projected that reducing the diagnostic gap to 10% from 35-62% would save 1.1 million lives in low and middle-income nations. Therefore, a lack of access to newer diagnostic technologies in these nations may negatively impact the market growth during the forecast period.

Stringent regulatory guidelines

Over the years, regulatory guidelines for the approval of diagnostic equipment and medical devices have become much more stringent. MDR 2017/745 is the most recent set of regulations governing the production, clinical investigation, and distribution of medical devices in Europe. This law relates to medical devices that have direct contact with humans (for example, bandages, catheters, and implants).

Medical device businesses that want to sell their products in the European market must comply with this rule. MDR 2017/745 replaced the EU’s earlier Active Implantable Medical Devices Directive and Medical Device Directive (MDD) on May 26, 2021. Some medical devices will be subject to tougher inspection by notified authorities under this new law, and manufacturers will be required to give more detailed clinical data to support their safety and performance claims.

Furthermore, the classification of certain medical equipment (e.g., Class I, IIa, IIb, or III) will alter. Devices that meet the regulations’ standards will be given a CE Mark. Thus, such stringent guidelines for the approval of diagnostic equipment may restrain the growth of the market during the estimated time period.

Test Type Analysis

PCR Assay test is experiencing high demand

In comparison to other conventional assay tests,PCR segment dominate 26.1% market share in 2023. PCR assays are mostly utilized in diagnostics due to their higher accuracy and precision, and reliability in producing data in a short time. It is a major factor fuelling the growth of the segment. In addition, new product launches are projected to increase demand for PCR assay testing. Furthermore, the increased sensitivity of PCR tests, as well as the exact and accurate results offered by PCR tests, are expected to promote the demand for these tests in meningitis diagnosis.

Also, the lateral flow assay segment is anticipated to witness high growth during the forecast period. The segment growth can be attributed to key factors such as faster testing, an increase in preference for home-based testing, and considerably lower costs compared to other tests. Furthermore, increased demand for point-of-care testing in various healthcare facilities is likely to support segment expansion.

End-user Analysis

Hospitals are key end-users

Some of the drivers driving the growth of the hospital segment accounts 47.3% market share in Meningitis Diagnostics, improved healthcare coverage, increased availability of novel diagnostic technology, and affordability. A high rate of hospitalization for the treatment of meningitis is likely to drive segment growth throughout the projection period.

On the other hand, diagnostic centers are anticipated to grow at a high rate during the estimated time period. Rising utilization of technologically sound products for accurate results, along with the rise in the prevalence of infectious diseases, are major factors driving the overall growth of the segment. Furthermore, the availability of a significant number of diagnostic centers providing meningitis diagnostic tests is fuelling segment expansion. ARUP Laboratories, UCSF Labs, and others, for example, are some of the diagnostic centers that provide meningitis testing.

Key Market Segments

By Test Type

- Latex Agglutination Tests

- Lateral Flow Assay

- PCR Assay

- ELISA Tests

- Culture Test

- Other Test Types

By End-User

- Hospitals

- Diagnostic Centers

- Other End-Users

Growth Opportunity

Investment in healthcare

Many governments across the globe are investing extensively in the healthcare sector. Healthcare spending is expanding faster than the rest of the global economy, accounting for 10% of global GDP. A new World Health Organization (WHO) report on global health expenditure reveals a rapid upward trajectory of global health spending, particularly in low- and middle-income countries, where health spending is growing at a rate of 6% per year on average, compared to 4% in high-income countries.

Government health spending per capita in middle-income countries has more than doubled since 2000. Governments spend an average of US$60 per person on health in lower-middle-income nations and nearly US$270 per person in upper-middle-income countries. The Australian Government, as part of a strategy for a better future, announced that it will spend a record $132 billion in 2022–2023 and an additional $140 billion in 2025–2026 on a stronger health system, for a total commitment of $537 billion over the following four years.

According to the 2019–20 National Health Account Estimates, the Indian government spent 1.3% of the nation’s Gross Domestic Product (GDP) on healthcare during the year, recovering from a minor decline seen for a limited time in the financial year 2018–19. Thus, high investments in the healthcare sector by various governments around the world are likely to provide promising growth opportunities for major players as well as key vendors operating in the market.

Latest Trends

R&D for developing precise diagnostic treatments

Global research efforts to create precise and rapid diagnostic treatments for meningococcal diseases is a new trend that is likely to positively impact market expansion in the upcoming years. For example, scientists from Imperial College London were awarded a five-year EU grant of US$ 23.5 million in February 2020 to develop and commercialize a quick diagnostic test for meningitis throughout the Europe region.

The personalized gene signatures are the most advanced component of this exploratory test, which helps to diagnose critical diseases. Such beneficial research initiatives and projects for the development of advanced and efficient diagnostic treatments for meningitis are expected to significantly contribute to the growth of the market in the upcoming years.

Regional Analysis

The North American region dominate share of 36.4% in the market. The market growth in North America is stimulated by key factors such as the increasing prevalence of meningitis, widespread use of modern diagnostic technologies, an expansion in the number of diagnostic centers, and the convenience with which diagnostic test kits are available.

According to a June 2021 CDC report, roughly 375 cases of meningococcal illness were reported in the United States, with an incidence rate of 0.11 cases per 100,000 people. Thus, the high prevalence of meningitis is a major factor expected to fuel market expansion in the region throughout the forecast period.

Over the forecast period, the Asia Pacific region is expected to increase at the fastest rate. Some of the key reasons driving market expansion include the increasing incidence of meningitis, ongoing research initiatives, and growing economies. Furthermore, continuing trials in the region, favorable government efforts, and increased investments by regional market participants are expected to boost regional growth throughout the forecast period.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Meningitis Diagnostic Testing market is growing at a significant pace due to the high adoption of advanced diagnostic methods for the diagnosis as well as treatment of chronic conditions like meningitis. Also, key players are looking to invest in new technology, which is one of the main factors stimulating competition among major industry players. Additionally, the implementation of key strategic initiatives, along with new product launches by key market players, is likely to have a positive impact on market growth in the upcoming years.

Market Key Players

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Luminex Corporation

- Seegene Inc.

- Abbott Laboratories

- IMMY

- ELITechGroup

- Siemens Healthineers AG

- Becton, Dickinson, and Company

- BioFire Diagnostics LLC

- Other Key Players

Recent Developments

- Bio-Rad Laboratories, Inc.: Launched the BioPlex 2200 Meningitis/Encephalitis Panel in June 2023, detecting multiple pathogens from a single sample.

- Thermo Fisher Scientific Inc.: Received FDA clearance for the TaqPath Meningitis/Encephalitis Multiplex PCR Assay in May 2023, offering high sensitivity and specificity.

- Luminex Corporation: Launched the Aries® Meningitis Panel in July 2023, providing accurate and fast results for multiple meningitis-causing pathogens.

- Seegene Inc.: Received CE Mark approval for the Allplex™ Meningitis/Encephalitis Panel in September 2023, covering a broad range of pathogens.

- Abbott Laboratories: Received FDA clearance for the Alinity m Multiplex Meningitis/Encephalitis assay in October 2023, offering high throughput and rapid results.

Report Scope

Report Features Description Market Value (2023) USD 117.6 Million Forecast Revenue (2033) USD 164.2 Million CAGR (2024-2033) 3.4% Base Year for Estimation 2023 Historic Period 2016-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type- Latex Agglutination Tests, Lateral Flow Assay, PCR Assay, ELISA Tests, Culture Test, and Other Test Types, and by End-user Hospitals, Diagnostic Centers, and Other End-users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Luminex Corporation, Seegene Inc., Abbott Laboratories, IMMY, ELITechGroup, Siemens Healthineers AG, Becton, Dickinson and Company, BioFire Diagnostics LLC, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Meningitis Diagnostic Testing Market?The Meningitis Diagnostic Testing Market involves the development, manufacturing, and distribution of diagnostic tests and tools used to detect and diagnose meningitis, a potentially life-threatening inflammation of the membranes surrounding the brain and spinal cord.

How big is the Meningitis Diagnostic Testing Market?The global Meningitis Diagnostic Testing Market size was estimated at USD 117.6 Million in 2023 and is expected to reach USD 164.2 Million in 2033.

What is the Meningitis Diagnostic Testing Market growth?The global Meningitis Diagnostic Testing Market is expected to grow at a compound annual growth rate of 3.4%. From 2024 To 2033

Who are the key companies/players in the Meningitis Diagnostic Testing Market?Some of the key players in the Meningitis Diagnostic Testing Markets are Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Luminex Corporation, Seegene Inc., Abbott Laboratories, IMMY, ELITechGroup, Siemens Healthineers AG, Becton, Dickinson and Company, BioFire Diagnostics LLC, and Other Key Players.

Why is early diagnosis of meningitis important?Early diagnosis is crucial as meningitis can progress rapidly and have serious health consequences. Prompt treatment can significantly improve patient outcomes.

Who uses meningitis diagnostic tests?Healthcare professionals, including doctors, nurses, and laboratory technicians, use these tests to identify and confirm cases of meningitis in patients presenting with symptoms such as fever, severe headache, and neck stiffness.

What role does technology play in meningitis diagnostics?Technological advancements have led to more sensitive and specific diagnostic tests, enabling quicker and more accurate identification of the causative agents, whether bacterial, viral, or fungal.

Meningitis Diagnostic Testing MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Meningitis Diagnostic Testing MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Luminex Corporation

- Seegene Inc.

- Abbott Laboratories

- IMMY

- ELITechGroup

- Siemens Healthineers AG

- Becton, Dickinson, and Company

- BioFire Diagnostics LLC

- Other Key Players