Global Medical Digital Imaging Systems Market By Type-(CT, MRI, Ultrasound, X-ray, Nuclear Imaging) By Technology-(2D, BnW, Color, 3D/4D) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 45753

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

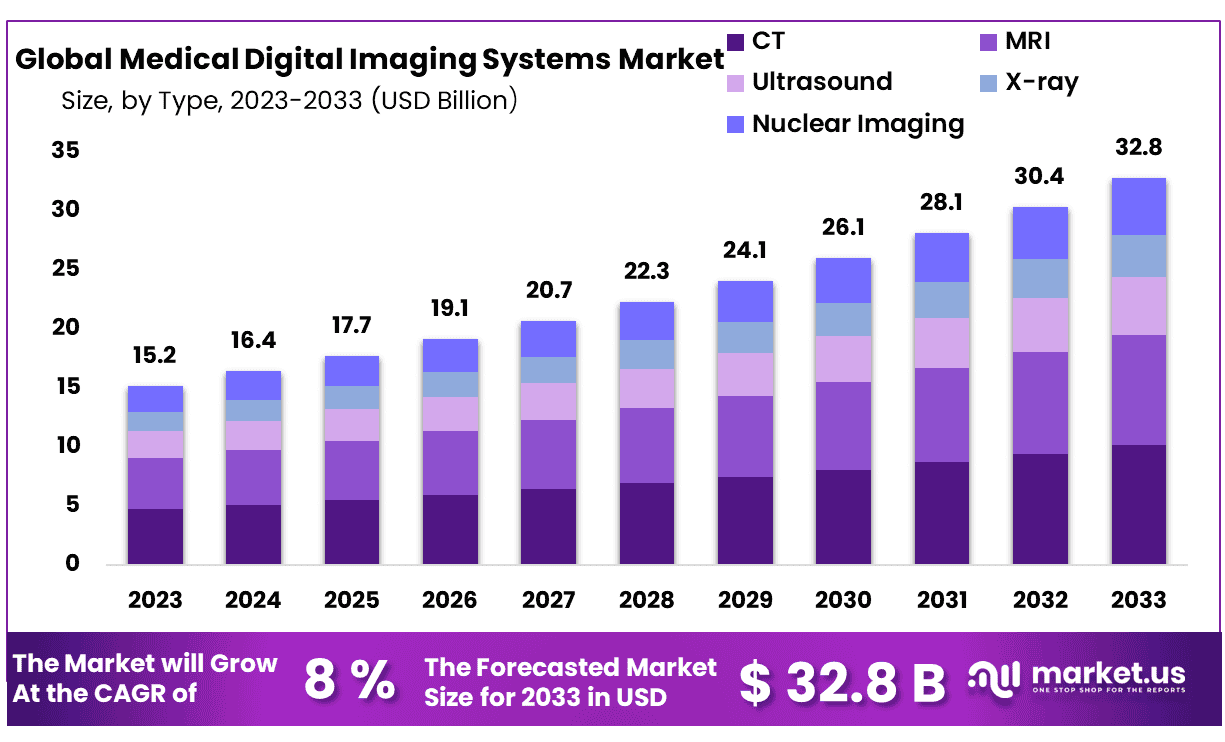

The Global Medical Digital Imaging Systems Market size is expected to be worth around USD 32.8 Billion by 2033 from USD 15.2 Billion in 2023, growing at a CAGR of 8% during the forecast period from 2024 to 2033.

The medical digital imaging system encompasses a diverse range of imaging techniques employed to capture visual representations of the inner workings of the human body, primarily for diagnostic and therapeutic objectives. These systems encompass a multitude of modalities designed to scan the human body comprehensively, enabling the diagnosis and treatment of various medical conditions.

Consequently, their role in advancing healthcare is pivotal. From bedside observations to state-of-the-art digital imaging solutions, the market for medical digital imaging systems is undergoing a profound transformation.

The market has grown due to a growing demand for early diagnosis methods and a larger population of the elderly. The market’s growth is expected to be fueled by technological advancements, as well as increased investments and funds from governments, particularly in developing countries like India and China.

The market is being augmented by technological advancements in digital and communications technologies. The majority of diagnostic radiology procedures can now be performed using new imaging techniques that provide precise anatomical details. This has led to an increase in medical digital imaging’s use in exploratory surgery.

Key Takeaways

- Market Size: Medical Digital Imaging Systems Market size is expected to be worth around USD 32.8 Billion by 2033 from USD 15.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 8% during the forecast period from 2024 to 2033.

- Type Analysis: Computed Tomography (CT) stands as the undisputed leader, commanding a significant 31% market share.

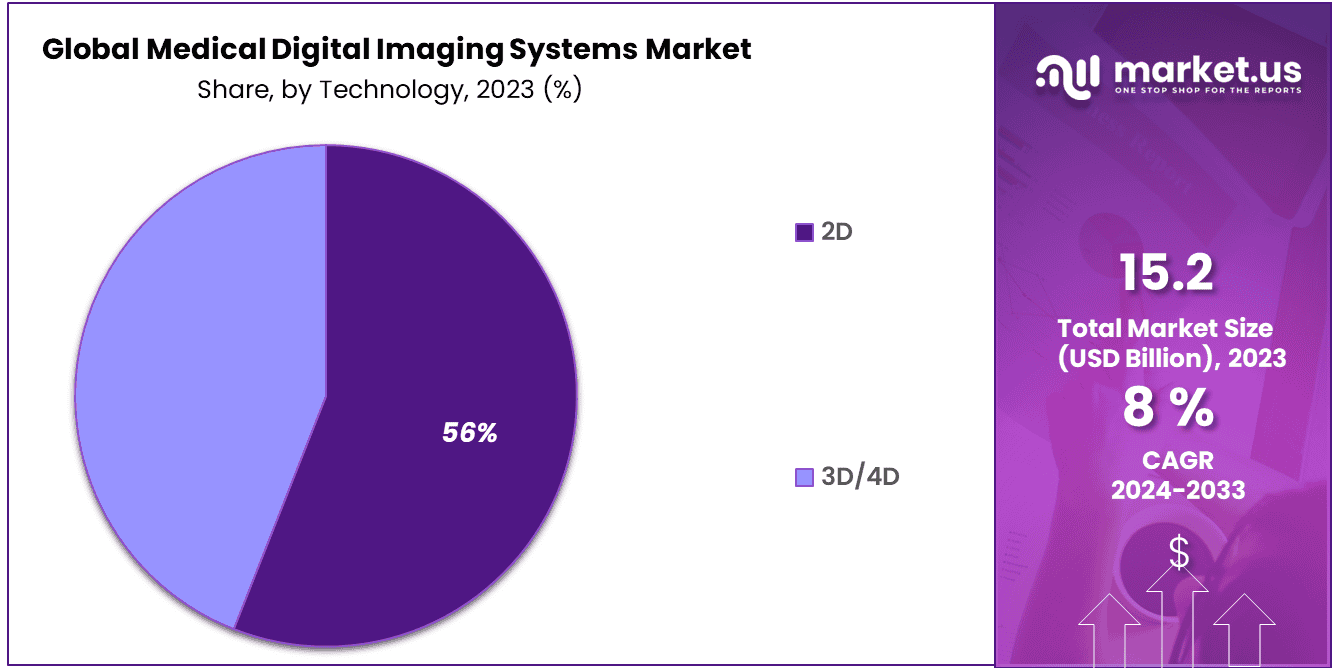

- Technology Analysis: 3D/4D imaging technology, which commands an impressive 56% market share in 2023.

- Regional Analysis: North America dominated the market with a 33% revenue share and held USD 5 billion market revenue.

- Aging Population: The rising elderly population contributes to increased demand for medical digital imaging systems to diagnose age-related conditions.

- Telemedicine Integration: Integration into telemedicine platforms enhances access to healthcare services, especially in remote areas.

- Precision Medicine: Medical imaging systems play a crucial role in personalized treatment plans based on individual patient data.

- Cost Challenges: High upfront costs and regulatory hurdles pose challenges to market expansion.

Type Analysis

In the Medical Digital Imaging Systems, a comprehensive analysis reveals intriguing insights into market dynamics. Computed Tomography (CT) stands as the undisputed leader, commanding a significant 31% market share. Its non-invasive approach and exceptional diagnostic capabilities make it a cornerstone in medical imaging.

Positron emission tomography/ computed tomography (CT), allows simultaneous determination of the metabolic information for PET and CT. High-resolution CT allows for images with a higher spatial resolution. Magnetic resonance imaging is replacing older techniques like CT, myelography, and arthrography.

MRI, Magnetic Resonance Imaging, follows closely, offering unparalleled soft tissue visualization. Ultrasound, another indispensable modality, excels in real-time imaging and its non-ionizing nature. Meanwhile, X-ray, a time-tested technology, remains an essential tool for various diagnostic applications.

The realm of Nuclear Imaging, with its specialized techniques like PET and SPECT, is gaining traction for its pivotal role in oncology and cardiology. The market’s growth can be attributed to evolving healthcare demands, technological advancements, and a heightened focus on early disease detection.

The creation of radiotracers, the rise in cancer cases, and the introduction of new goods due to technological improvements are all good for the market as a whole. 1,762,450 new cases of cancer were reported in the United States in 2019, according to the American Cancer Society. The growth of the CT segment will be influenced by the development of radiotracers like single-photon emission computed tomography (SPECT), which improves image quality while exposing less radiation.

Technology Analysis

The Medical Digital Imaging Systems Market is currently experiencing a significant transformation, driven by the dominance of 3D/4D imaging technology, which commands an impressive 56% market share. This groundbreaking development has brought about a revolution in medical imaging, offering clinicians multidimensional perspectives that not only boost diagnostic precision but also provide a deeper insight into anatomical structures and pathology.

In contrast, conventional 2D imaging, while still relevant, is gradually losing its prominence in the market. Its limitations, including the inability to capture intricate three-dimensional structures and subtle nuances, have become increasingly evident in the era of 3D/4D systems.

The increasing adoption of 3D/4D technology can be attributed to its capacity to deliver dynamic, real-time images, particularly crucial in fields such as obstetrics, cardiology, and orthopedics. This technology not only elevates diagnostic accuracy but also facilitates surgical planning and monitoring, leading to enhanced patient outcomes.

As the Medical Digital Imaging Systems Market continues to evolve, it is evident that 3D/4D imaging is poised to reshape the landscape, establishing new benchmarks for excellence in medical imaging and redefining how we approach the diagnosis of complex medical conditions.

Кеу Маrkеt Ѕеgmеntѕ

Type

- CT

- MRI

- Ultrasound

- X-ray

- Nuclear Imaging

Technology

2D

- BnW

- Color

3D/4D

Drivers

Technological Advancements

The relentless advancement in digital imaging technologies is a significant driver of this market. Innovations like 3D and 4D imaging, AI-driven diagnostics, and the integration of electronic health records (EHRs) have transformed the landscape. These innovations enhance diagnostic accuracy, reduce radiation exposure, and streamline workflows, driving the adoption of digital imaging systems.

Aging Population

The global demographic shift toward an aging population is another key driver. Elderly individuals often require more extensive medical evaluations and monitoring, creating a heightened demand for medical digital imaging systems to diagnose and manage age-related conditions such as cardiovascular diseases, cancer, and orthopedic issues.

Trends

Telemedicine Integration

The COVID-19 pandemic accelerated the adoption of telemedicine, and this trend is here to stay. Medical digital imaging systems are increasingly being integrated into telemedicine platforms, enabling remote consultations and diagnosis. This trend enhances access to healthcare services, especially in underserved regions.

Precision Medicine

Tailoring medical treatments to individual patients based on their genetic makeup and other factors is a burgeoning trend. Medical digital imaging systems play a vital role in this by providing detailed patient data that aids in personalized treatment plans. This trend not only improves patient outcomes but also drives demand for more sophisticated imaging solutions.

Restraints

High Costs

One of the primary restraints in the medical digital imaging systems market is the substantial upfront costs associated with acquiring and maintaining these technologies. Smaller healthcare facilities and institutions in resource-constrained regions may find it challenging to invest in advanced imaging systems.

Regulatory Hurdles

Stringent regulatory requirements for medical devices can slow down product development and market entry. Navigating the complex landscape of approvals and certifications poses a restraint for manufacturers, potentially delaying the introduction of innovative solutions.

Opportunities

Emerging Markets

With increasing healthcare infrastructure development in emerging economies, there is a substantial growth opportunity. These regions are witnessing rising investments in healthcare, including the procurement of advanced medical digital imaging systems.

Artificial Intelligence (AI) Integration

The integration of AI algorithms with digital imaging systems offers a promising opportunity. AI can assist radiologists in interpreting images more efficiently and accurately, potentially reducing diagnostic errors and improving patient care.

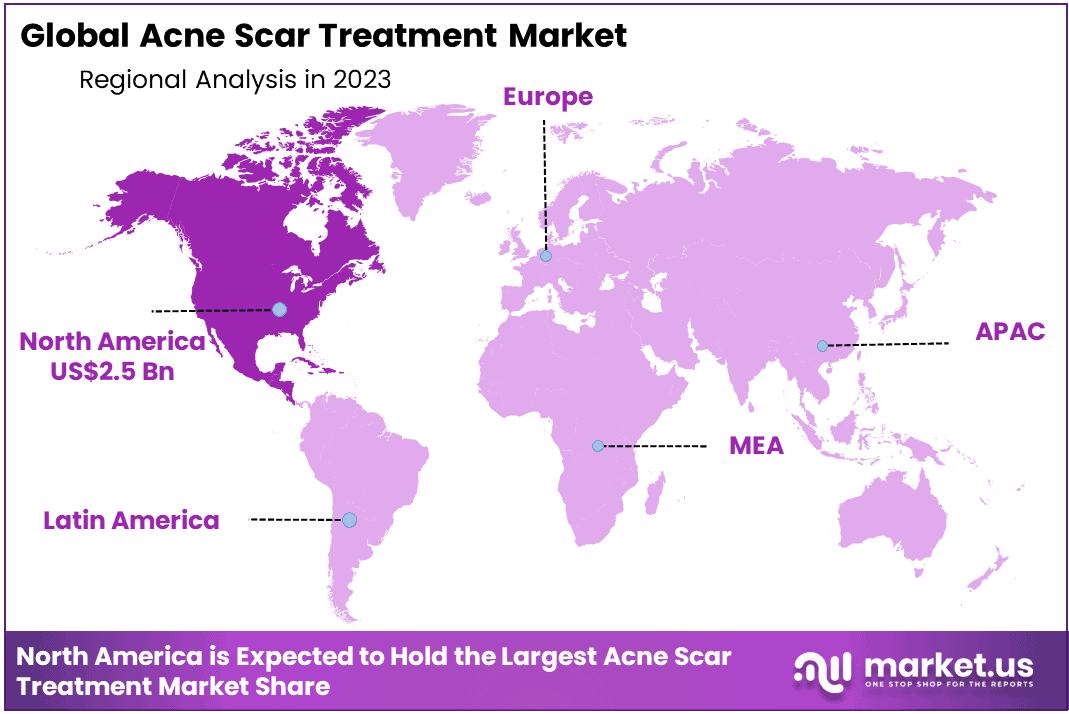

Regional Analysis

The market was divided geographically into North America, Europe, Asia Pacific, and Latin America. In 2023, North America dominated the market with a 33% revenue share and held USD 5 billion market revenue. This is due to its high adoption rate of advanced technology, better healthcare infrastructure, high purchasing power, and favorable reimbursement arrangements.

Asia Pacific will experience the highest CAGR, 11.8%, over the forecast period. This is due to the higher government incentives and lower cost of clinical trials.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

As part of their attempts to strengthen their market position, major players are implementing strategies like product upgrades, strategic agreements, and new product launches. To improve customer experience, they are also looking to form strategic partnerships with financial services providers.

MoneyGram International, a U.S.-based B2B, and P2P payments company, announced in April 2021 a partnership with Sigue. Sigue’s customers were able to access MoneyGram International’s new MoneyGram as a service business line.

Other financial institutions on Sigue platforms could also access MoneyGram International’s most recent API-driven payment technology. Key players are also investing heavily in expanding their product lines. Safaricom, for instance, announced in January 2021 the M Pesa billing management service. This service was designed to be used by landlords, schools, utilities, landlords, as well as other businesses that are subject to repeated customer payments.

The platform provides details about the customer such as pending payments, reminders, and electronic bills. The following are some of the major players in the global medical digital imaging systems market:

Мarkеt Кеу Рlауеrѕ

- Koninklijke Philips N.V

- GE Healthcare

- Siemens Healthineers

- Esaote SPA

- Canon Medical Systems Corporation

- Hologic

- Hitachi

- Shimadzu

- Other Key Players

Recent Developments

- Koninklijke Philips N.V – In May 2024, Koninklijke Philips N.V. acquired CardioSystems Inc., a leader in advanced cardiac imaging solutions. This acquisition aims to bolster Philips’ portfolio in medical digital imaging, enhancing its capabilities in providing comprehensive diagnostic imaging systems for cardiology.

- GE Healthcare – In March 2024, GE Healthcare launched the Revolution Maxima CT scanner, featuring AI-driven image reconstruction and enhanced diagnostic accuracy. This new product aims to provide faster and more precise imaging, improving patient outcomes and operational efficiency in healthcare settings.

- Siemens Healthineers – In April 2024, Siemens Healthineers merged with BioImaging Technologies, a company known for its innovative MRI solutions. This merger is expected to integrate Siemens’ advanced imaging technologies with BioImaging’s expertise, expanding their product offerings and market reach.

- Canon Medical Systems Corporation – In January 2024, Canon Medical Systems Corporation introduced the Aquilion Exceed LB, an advanced CT system designed for oncology imaging. This new product features enhanced imaging capabilities and patient comfort, aiming to improve diagnostic accuracy in cancer care.

- Hologic – In June 2024, Hologic merged with Mammography Innovations, a company known for its cutting-edge mammography systems. This strategic merger aims to combine Hologic’s expertise in women’s health with Mammography Innovations’ technology, offering comprehensive solutions for breast cancer screening.

- Hitachi – In April 2024, Hitachi launched the Echelon Oval 1.5T MRI system, featuring an open design for enhanced patient comfort and advanced imaging capabilities. This new product aims to provide high-quality diagnostic imaging while improving the patient experience.

Report Scope

Report Features Description Market Value (2023) USD 15.2 Billion Forecast Revenue (2033) USD 32.8 Billion CAGR (2024-2033) 8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(CT, MRI, Ultrasound, X-ray, Nuclear Imaging);By Technology-(2D, BnW, Color, 3D/4D) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Koninklijke Philips N.V, GE Healthcare, Siemens Healthineers, Esaote SPA, Canon Medical Systems Corporation, Hologic, Hitachi, Shimadzu, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Medical Digital Imaging Systems?Medical digital imaging systems encompass various techniques to visualize the interior of the human body for diagnostic and therapeutic purposes.

How big is the Medical Digital Imaging Systems Market?The global Medical Digital Imaging Systems Market size was estimated at USD 15.2 Billion in 2023 and is expected to reach USD 32.8 Billion in 2033.

What is the Medical Digital Imaging Systems Market growth?The global Medical Digital Imaging Systems Market is expected to grow at a compound annual growth rate of 8%. From 2024 To 2033

Who are the key companies/players in the Medical Digital Imaging Systems Market?Some of the key players in the Medical Digital Imaging Systems Markets are Koninklijke Philips N.V, GE Healthcare, Siemens Healthineers, Esaote SPA, Canon Medical Systems Corporation, Hologic, Hitachi, Shimadzu, Other Key Players.

Why are these systems essential for healthcare?They enable accurate diagnosis and treatment of medical conditions, improving patient outcomes.

What technological trends are impacting this market?Innovations like AI-driven diagnostics and 3D/4D imaging are revolutionizing the field.

How does the aging population influence this market?An aging population leads to increased demand for medical imaging to address age-related illnesses.

What role do these systems play in telemedicine?They are integrated into telemedicine platforms, allowing remote consultations and diagnostics.

How do Medical Digital Imaging Systems contribute to precision medicine?They provide critical patient data for personalized treatment plans based on individual characteristics.

Medical Digital Imaging Systems MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Medical Digital Imaging Systems MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Koninklijke Philips N.V

- GE Healthcare

- Siemens Healthineers

- Esaote SPA

- Canon Medical Systems Corporation

- Hologic

- Hitachi

- Shimadzu

- Other Key Players