Global Meat Substitutes Market By Source (Plant-based Protein, Soy-based, Mycoprotein, and Other Sources), By Distribution Channel (Retail and Foodservice), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 14305

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

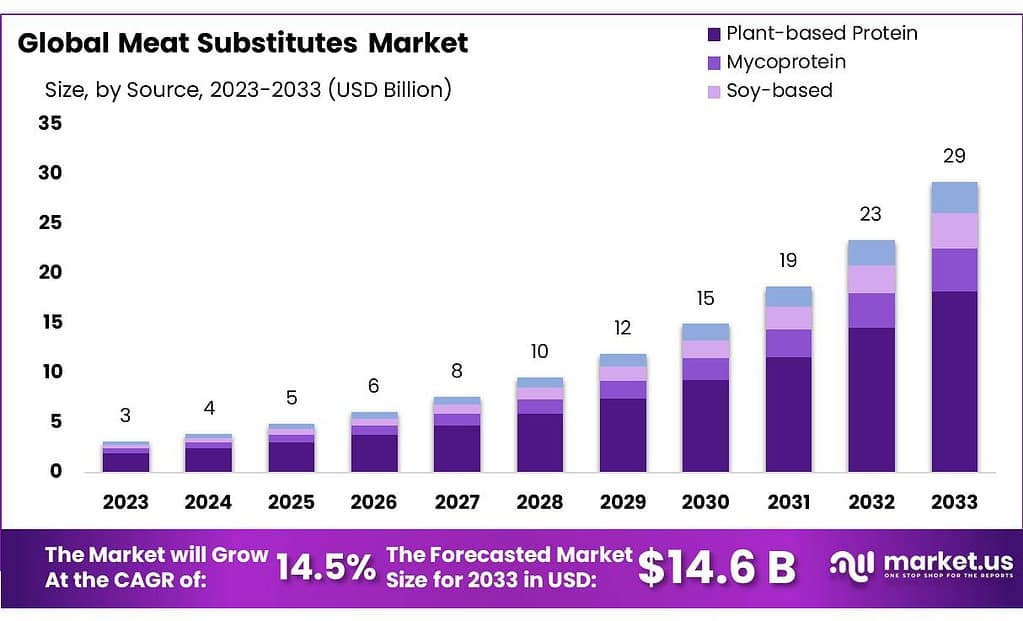

The global Meat Substitutes Market size is expected to be worth around USD 57.6 billion by 2033, from USD 14.65 billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2023 to 2033.

Due to its detrimental impacts on animal and environmental welfare, intensive animal husbandry is coming under increasing criticism by certain sectors of society. There have even been diets that restrict or prohibit the consumption of animal products.

This should help to expand the market for meat replacements. Due to the rising awareness of consumers about their health, the COVID-19 epidemic has dramatically impacted traditional meat consumption.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The Meat Substitutes Market is projected to witness substantial growth, expected to reach around USD 57.6 billion by 2033 from USD 14.6 billion in 2023, at a CAGR of 14.5%.

- Source Analysis: Plant-based protein products accounted for a significant portion of revenue, holding 62.2% in 2023, Mycoprotein is anticipated to experience the highest CAGR between 2023-2032 due to its nutritional value and satiety benefits.

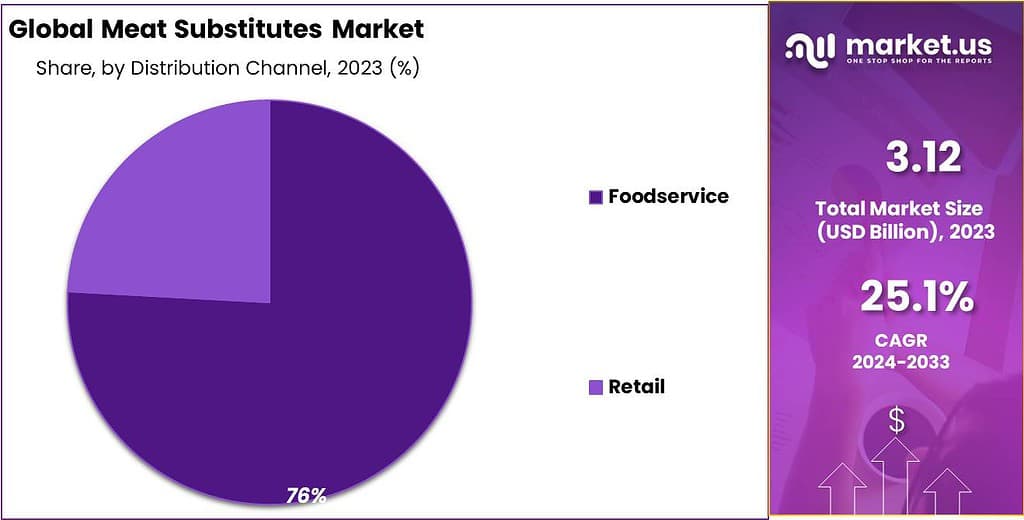

- Distribution Channels: Retail segments captured a dominant market share in 2023, accounting for over 47.2%. Food service channels experienced a lower CAGR due to pandemic-related lockdowns but are expected to grow as economies reopen.

- Drivers: Growing preference for plant-based proteins driven by health awareness, environmental concerns, and dietary choices. Shifts in consumer habits, especially in regions like the US, Germany, France, and the UK, where veganism is gaining traction.

- Challenges: Allergy concerns related to soy products among consumers. Costliness in producing pea protein due to shortages and climate change impacts.

- Opportunities: Advancements in technology aiding the extrusion and processing of plant-based proteins, enhancing product quality and texture.

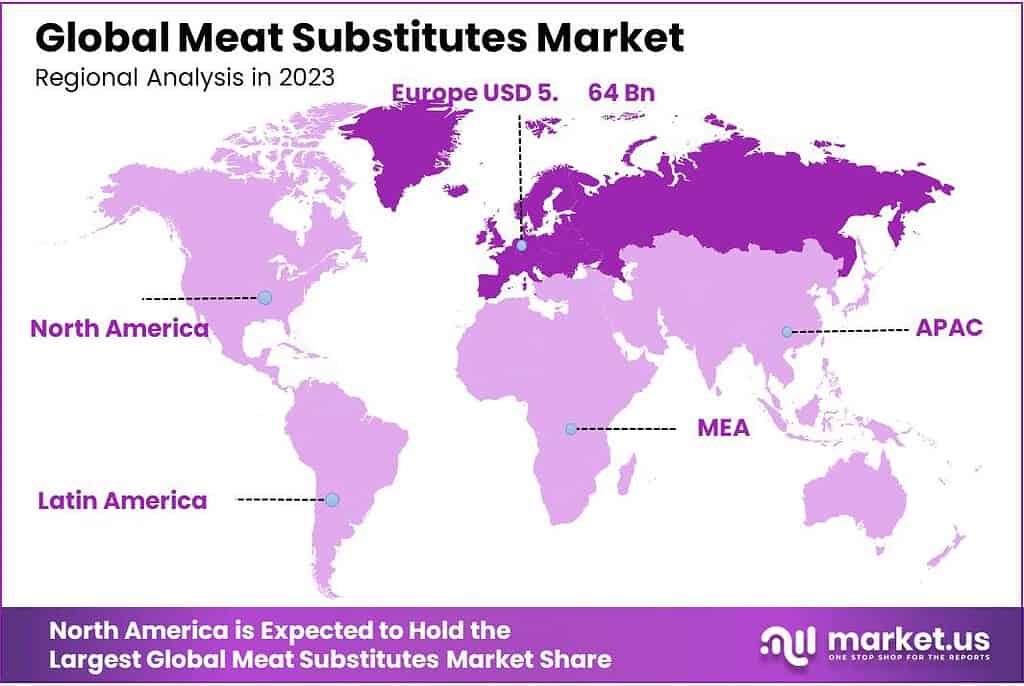

- Regional Analysis: Europe leads the market, attributed to a rising vegan and flexitarian population and increased awareness of animal welfare. Asia-Pacific countries, particularly Australia and China, are expected to witness significant growth due to health-conscious consumers and social media influence. Europe was the market leader in meat substitutes, accounting for 38.3% of the total revenue share in 2023.

- Key Players: Major companies dominating the market include Amy’s Kitchen, Impossible Foods Inc., Beyond Meat Inc., among others.

Source Analysis

In 2023, plant-based protein products held 62.2% of revenue. This trend is projected to continue during the forecast period as this market thrives due to limited access to meat in various parts of the world, environmental concerns, and demand for healthier eating habits.

For daily protein, plant-based patties are a great option. Well-heeled young people and wellness seekers are driving this trend. Plant protein and mycoprotein products have the same texture, taste, and nutritional characteristics as meat but are made from non-animal sources.

To increase their functionality, target plant proteins are hydrolyzed from plants. Plant protein is combined with other components like flour, food adhesives, and plant-based oils for a meat texture. The price of protein inputs for plant-based meat is reasonable and plentiful. The market is dominated by meat substitutes made with plant-based protein sources.

Mycoprotein will see the highest CAGR between 2023-2032. Consumers prefer mycoprotein food because it contains more nutrients such as fiber which can help control blood sugar and cholesterol. Mycoprotein also makes you feel fuller than animal proteins such as chicken. This helps prevent weight gain and excess eating.

Mycoprotein is also rich in essential amino acids and rare in other protein sources. Quorn is a mycoprotein brand that offers high-protein, healthy meals. The only meat options for vegetarians and vegans were mushrooms, cottage cheese, and soya pieces. The versatility and texture of jackfruit have made it a popular newcomer to the market.

Jackfruit is often referred to by its unique characteristics as a superfood for its numerous nutritional benefits. Wakao Foods in India has been serving jackfruit-based burger patties and stir-fries for meat-eaters.

Distribution channel Analysis

In 2023, Retail Segment held a dominant market position, capturing more than a 47.2% share. This includes all retail outlets, including supermarkets, convenience stores, hypermarkets, departmental stores, mini-markets, and supermarkets.

These stores offer discounts and other offers that consumers love. Most of these brands launch their products through major supermarket chains such as Walmart and Target to reach consumers. Between 2023 and 2032, the CAGR for food service is 8%. This includes outlets such as restaurants, hotels, or lounges. There have been lockdowns all over the globe due to the COVID-19 epidemic.

These channels have resulted in a decrease in sales. The reopening and socialization of economic activities worldwide, which focuses on parties and socializing, will likely boost sales through these distribution channels. Global food service is driven by the increasing demand for customized and innovative food menu options. Consumers can customize their meals according to their financial, dietary, and taste preferences.

There is a huge demand for plant proteins. Many retailers offer plant-based protein products, and many restaurants have introduced plant-protein menu innovations. All consumers, vegetarians, non-vegetarians, and flexitarians worldwide are enthusiastic about innovative products like meat-like plant protein hamburgers or plant-based meal kits.

The enthusiastic response of manufacturers to this trend benefits consumers in two ways. First, availability and price obstacles decrease as more plant-based protein products are sold in specialty, conventional supermarkets, and food service outlets.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Source

- Plant-based Protein

- Soy-based

- Mycoprotein

- Other Sources

By Distribution Channel

- Retail

- Foodservice

Drivers

Growing Preference for Plant-based Proteins

Over the past decade, there’s been a big push for meat-based proteins globally, especially in Europe and North America, where most folks rely on meat for their protein intake. But, meat proteins come with cholesterol that’s linked to major health issues.

This has resulted in increased demand for plant-based protein foods in countries like the US, Germany, France and UK, where veganism has seen significant gains – in particular within these three nations alone – especially as reported by Food Revolution Organization’s article from 2018 which stated that vegan numbers had grown 600% within just three years in just the US alone! These shifts toward plant-based proteins are expected to drive the market for meat substitutes.

Restraints

Allergy concerns among consumers of soy products

Soybeans contain beneficial vitamins, minerals, and proteins but can cause issues, including soy allergy. When an individual reacts negatively to soy they might get itchy skin rashes or have other reactions such as gas build-up in their gut and gas formation; other possible symptoms could include gas, bloating or any irritation in their system.

Opportunities

Technological advancements in extrusion and processing will expand

The way we process plant-based proteins is key in the meat substitutes market. Extraction of proteins from peas, soy, and wheat is crucial. Traditional methods give protein flour with 20% to 40% proteins or concentrate with 46% to 60%.

Now, there’s new tech from Coasun—extrudable fat tech—that mimics animal fat, giving plant-based meats a more genuine fat texture, like marbling. This tech lets fat and protein combine better, linked physically after running fat through an extruder.

Another innovation is Prolamin tech, licensed from the University of Guelph. It uses plant-based ingredients to make plant-based cheese act like animal-based dairy—it melts, bubbles, and stretches just like the real thing.

Challenges

Producing pea protein is costly, and shortages caused by climate change are driving up pea prices. To cope, manufacturers aim to boost production using advanced extraction and processing tech.

But with less pea protein around, food makers are importing more, hiking up raw material costs and, in turn, raising prices for meat substitute products. This makes pea protein-based meat substitutes a high-end product in many places.

Regional Analysis

Europe was the market leader in meat substitutes, accounting for 38.3% of the total revenue share in 2023. Both young and old consumers are putting a lot of demand on the region. This is due to an increasing vegan and flexitarian population and increased awareness about animal welfare.

Due to well-known processors, Germans now enjoy meatless options comparable to what Americans consume. McDonald’s, one of the main meatless players, teamed up with Nestle in Germany to launch its Vegan Burger service and help bridge German and American tastes for meat alternatives.

Asia-Pacific countries are projected to experience an 8.2% surge in meat substitute demand between 2023-2032. Australia and China account for most of this increase due to health-conscious consumer mindset and social media influencers driving demand for such products.

Since more individuals are shifting toward plant-based diets, demand has skyrocketed for nutritious vegan and vegetarian alternatives that don’t contain unhealthy or highly processed ingredients. Prior to now, vegan/vegan options were limited and often produced using unsuitable materials like wheat gluten.

The COVID-19 pandemic has made Asian consumers more concerned about food safety and health. They are changing their diets to lead healthier and more sustainable lives. Asia offers a lot of potential for tasty, new foods that customers will want as their first choice.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market for meat replacements is dominated by companies specializing in meat substitutes. It is still developing, and there are new entrants to the market. Other key players in this market plan to launch their products because of rising animal-borne disease rates. These are just a few of the many initiatives that were taken.

Next Meats Japan, based in Japan, joined forces with Vegan Meats India, an Indian food tech startup, to launch meat replacements in India. The company will set up a manufacturing plant and a laboratory in India.

ITC Ltd, for instance, launched plant-based meat products in India in December 2023 in anticipation of the growing demand for vegetarian and vegan food options. KFC launched Beyond Fried Chicken, a range of plant-based meats in different locations worldwide, in January 2022.

Маrkеt Кеу Рlауеrѕ

- Amy’s Kitchen

- Impossible Foods Inc.

- Beyond Meat Inc.

- The Kellogg Company

- Quorn Foods

- Unilever Plc

- VBites Foods Ltd.

- Meatless B.V.

- Other Key Players

Recent Developments

In November 2022, Ingredion Incorporated entered into an agreement with its joint venture partners to acquire 100% of Verdient Foods (Canada), a manufacturer of plant-based protein. This acquisition is expected to enable Ingredion Incorporated to cater to the rising consumer demand for plant-based foods

In April 2023, ADM announced its new cutting-edge, plant-based innovation lab, located in ADM’s Biopolis research hub in Singapore. The new lab enabled the company to develop next-level, on-trend, and nutritious products, catering to the needs of the Asia Pacific market.

Report Scope

Report Features Description Market Value (2023) USD 14.6 Bn Forecast Revenue (2033) USD 57.6 Bn CAGR (2024-2033) 14.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-based Protein, Soy-based, Mycoprotein, and Other Sources), By Distribution Channel (Retail and Foodservice) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amy’s Kitchen, Impossible Foods Inc., Beyond Meat Inc., The Kellogg Company, Quorn Foods, Unilever Plc, VBites Foods Ltd., Meatless B.V., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Meat Substitutes Market?The global Meat Substitutes Market size is expected to be worth around USD 57.6 billion by 2033, from USD 14.6 billion in 2023.

What is the CAGR of Meat Substitutes Market?The global Meat Substitutes Market is growing at a CAGR of 14.5% during the forecast period 2022 to 2033.Who are the major players operating in the Meat Substitutes Market?Amy’s Kitchen, Inc., Beyond Meat, Impossible Foods Inc., Quorn Foods, Kellogg Co., Unilever, Meatless B.V., VBites Foods Ltd., SunFed, Tyson Foods, Inc.

-

-

- Amy’s Kitchen

- Impossible Foods Inc.

- Beyond Meat Inc.

- The Kellogg Company

- Quorn Foods

- Unilever Plc

- VBites Foods Ltd.

- Meatless B.V.

- Other Key Players