Global Meat, Poultry, Seafood Market Report By Product (Meat, Poultry, Seafood), By Type (Conventional, Organic), By Form (Fresh, Frozen), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121855

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

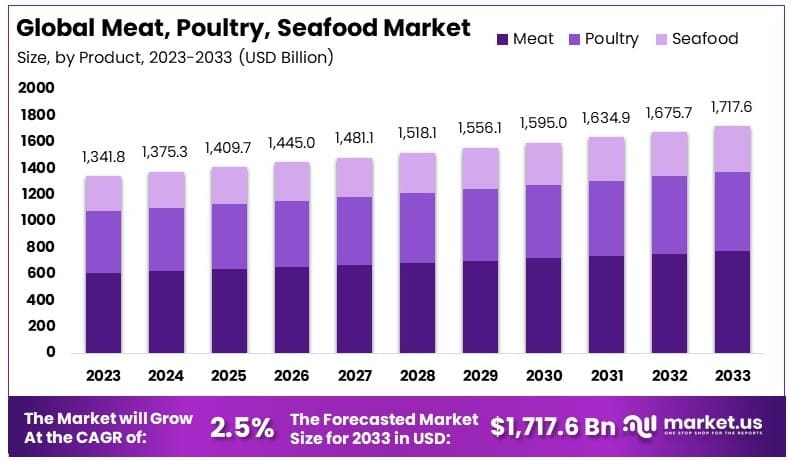

The Global Meat, Poultry, Seafood Market size is expected to be worth around USD 1,717.6 Billion by 2033, from USD 1,341.8 Billion in 2023, growing at a CAGR of 2.5% during the forecast period from 2024 to 2033.

This market entails the production, processing, and distribution of fresh and processed meat, poultry, and seafood products. Driven by global consumption patterns, the market is influenced by factors such as dietary trends, health considerations, and fast-paced lifestyles demanding convenient, high-protein foods.

The meat, poultry, and seafood market is experiencing sustained growth, driven by rising global demand and evolving consumer preferences. Global meat production has surged to over 340 million tonnes annually, a significant increase from around 90 million tonnes in 1961. This growth reflects the expanding population and increasing per capita meat consumption, particularly in developed regions.

North America leads in meat consumption, with an average intake of around 100 kilos per person per year. This high consumption rate underscores the region’s strong demand for meat products, which drives market expansion. Additionally, the global production of beef and veal reached approximately 64 million tonnes in 2020, highlighting the substantial contribution of these segments to the overall market.

Consumer health trends also influence market dynamics. Studies indicate that high-protein diets can aid weight loss and improve body composition. For instance, overweight women consuming 30% of their calories from protein lost 11 pounds (5 kg) in 12 weeks without intentionally restricting their diet. Furthermore, a 12-month study of 130 overweight individuals on a calorie-restricted diet found that the high-protein group lost 53% more body fat than the normal-protein group, despite consuming the same number of calories.

These health benefits drive consumer interest in high-protein meat, poultry, and seafood products. Producers are responding by offering a diverse range of protein-rich options to meet this demand. The market is also seeing innovation in sustainable and ethically sourced products, addressing growing consumer concerns about environmental impact and animal welfare.

Key Takeaways

- Market Value: The Meat, Poultry, Seafood Market was valued at USD 1,341.8 billion in 2023, and is expected to reach USD 1,717.6 billion by 2033, with a CAGR of 2.5%.

- By Product Analysis: Meat led with 45%; it remains a staple diet component globally, reinforcing its market position.

- By Type Analysis: Conventional products dominated with 65%, reflecting widespread availability and lower price points compared to organic options.

- By Form Analysis: Frozen products accounted for 55%, highlighting their convenience and longer shelf life.

- By Distribution Channel Analysis: Supermarkets & Hypermarkets dominated with 42.6%, underscoring their pivotal role in consumer accessibility.

- Dominant Region: APAC held 46.2% of the market, driven by increasing consumption rates and expanding retail sectors.

- Analyst Viewpoint: The market shows steady growth with significant opportunities in organic and sustainably sourced products.

- Growth Opportunities: Expansion into plant-based and alternative protein options could capture evolving consumer preferences and boost market share.

Driving Factors

Rising Demand for Protein-Rich Diets Drives Market Growth

The rising demand for protein-rich diets has significantly contributed to the growth of the meat, poultry, and seafood market. Increasing awareness of the benefits of a balanced diet has led consumers to prioritize protein intake. High-protein diets like Ketogenic diet food have gained popularity, promoting the consumption of lean meats and seafood. This trend is evident in statistics showing a steady rise in per capita meat consumption globally.

For instance, the global per capita meat consumption increased from 41.3 kg in 2014 to 43.2 kg in 2019. Additionally, the increased disposable income allows consumers to spend more on high-quality protein sources. This demand is further bolstered by the growing number of health-conscious consumers who prefer protein for its muscle-building and weight management benefits. The combined effect of these dietary trends and economic factors has resulted in a robust market growth trajectory for meat, poultry, and seafood products.

Urbanization and Changing Lifestyles Drive Market Growth

Urbanization and changing lifestyles are major drivers of the meat, poultry, and seafood market. As more people move to urban areas, their busy lifestyles create a demand for convenient and ready-to-eat protein-rich foods. Urban consumers often prefer fast-food chains and quick-service restaurants, which frequently feature meat-based items.

The convenience factor is crucial, with the ready-to-cook food industry expected to grow at a CAGR of 7.5% from 2023 to 2033. Moreover, urbanization brings higher income levels, allowing people to afford more varied and high-quality food products. This shift in consumer behavior has led to increased sales of processed and pre-cooked meat products. The interaction of urbanization with rising incomes and a preference for convenience fuels continuous market expansion, making meat, poultry, and seafood more accessible and appealing to urban populations.

Product Innovation and Diversification Drive Market Growth

Product innovation and diversification are pivotal in driving the growth of the meat, poultry, and seafood market. Manufacturers are continuously developing new products to meet evolving consumer preferences. Innovations include organic, free-range, and specialty products, alongside convenience-focused items like marinated meats and pre-cooked seafood dishes.

This diversification has attracted a broader consumer base, including health-conscious and time-pressed individuals. For example, the organic meat market is projected to grow at a CAGR of 8.1% from 2023 to 2033. Such innovations address consumer demand for healthier and more ethical food choices. Additionally, value-added products have gained traction, providing options that are easy to prepare and consume. The synergy of product innovation with consumer trends towards health and convenience drives market growth by expanding product offerings and reaching new market segments.

Restraining Factors

Food Safety and Disease Concerns Restrain Market Growth

Food safety and disease concerns significantly restrain the growth of the meat, poultry, and seafood market. Outbreaks of foodborne illnesses and animal diseases like avian influenza and contamination incidents in seafood can erode consumer confidence. For instance, the 2019 outbreak of African swine fever led to a substantial drop in pork consumption.

Such health scares necessitate strict regulations and stringent quality controls, increasing operational costs for producers. In turn, this can limit market expansion as companies strive to maintain safety standards and regain consumer trust. The negative impact on consumer demand due to safety concerns underscores the importance of rigorous safety measures in sustaining market growth.

Environmental and Sustainability Issues Restrain Market Growth

Environmental and sustainability issues pose significant challenges to the meat, poultry, and seafood market. Livestock production is a major source of greenhouse gas emissions, contributing to climate change. For example, livestock farming accounts for approximately 14.5% of global greenhouse gas emissions.

Deforestation for grazing lands and overfishing also exacerbate environmental degradation, leading to increased consumer awareness and demand for sustainable practices. Companies in this market face pressure to adopt eco-friendly methods, which can incur higher costs and operational changes. These environmental concerns not only affect production processes but also influence consumer choices, potentially limiting market growth as more people seek sustainable alternatives.

Product Analysis

Meat Segment Dominates with 45% due to high protein demand and diverse product offerings

The meat segment holds a dominant position within the Meat, Poultry, Seafood Market, accounting for 45% of the total market share. This dominance is primarily driven by the high demand for protein-rich diets. Consumers across the globe are increasingly aware of the nutritional benefits of meat, including its high protein content, essential vitamins, and minerals. This awareness, coupled with the popularity of protein-focused diets such as Paleo and Keto, has led to a sustained demand for various meat products.

Within the meat segment, beef and pork are the leading sub-segments. Beef is particularly popular due to its rich flavor and versatility in various cuisines. Pork, on the other hand, is widely consumed due to its affordability and adaptability in numerous dishes. These sub-segments benefit from extensive product offerings, including fresh cuts, processed meats, and value-added products such as marinated or pre-cooked options. The introduction of organic and specialty meat products also caters to health-conscious consumers, further expanding the market reach.

Despite the dominance of the meat segment, poultry and seafood also play crucial roles in the overall market growth. Poultry is favored for its lower fat content and affordability, making it a staple in many households. Seafood, rich in omega-3 fatty acids and essential nutrients, appeals to health-conscious consumers and those seeking variety in their protein sources. Both segments are expected to witness steady growth, driven by ongoing product innovations and increasing consumer interest in diverse protein options.

Type Analysis

Conventional Segment Dominates with 65% due to affordability and widespread availability

The conventional segment leads the Meat, Poultry, Seafood Market by type, capturing 65% of the market share. This dominance is attributed to the affordability and widespread availability of conventionally produced meat, poultry, and seafood products. Conventional farming and production methods are well-established and efficient, allowing for mass production and distribution at lower costs compared to organic alternatives.

Within the conventional segment, meat remains the most significant contributor, followed by poultry and seafood. Conventional meat products are popular due to their competitive pricing and accessibility in various retail channels, including supermarkets and hypermarkets. Poultry, often viewed as a budget-friendly protein source, also enjoys high demand in the conventional category. Seafood, despite facing challenges such as overfishing and sustainability concerns, continues to attract consumers with its health benefits and diverse product offerings.

Organic products, although representing a smaller market share, are gaining traction due to growing consumer awareness about health, environmental sustainability, and animal welfare. The organic segment, while more expensive, appeals to a niche market that values quality and ethical production practices. The increasing availability of organic meat, poultry, and seafood in mainstream retail channels is expected to drive gradual growth in this segment, providing consumers with more choices and contributing to overall market expansion.

Form Analysis

Frozen Segment Dominates with 55% due to convenience and extended shelf life

The frozen segment dominates the Meat, Poultry, Seafood Market by form, accounting for 55% of the total market share. The primary drivers of frozen food dominance are the convenience and extended shelf life offered by frozen products. Consumers with busy lifestyles prefer frozen meat, poultry, and seafood because they can be stored for longer periods without compromising quality, allowing for flexible meal planning and reduced food waste.

Within the frozen segment, seafood is particularly significant due to its perishability. Freezing seafood ensures that it retains its nutritional value and freshness, making it a preferred choice for consumers who seek the benefits of seafood without the need for frequent purchases. Meat and poultry also benefit from the frozen format, with products like frozen chicken breasts, ground beef, and ready-to-cook meatballs being popular among consumers for their ease of preparation and long shelf life.

Fresh products, although representing a smaller share of the market, remain important due to their appeal to consumers who prioritize taste and texture. Fresh meat, poultry, and seafood are often perceived as higher quality and are favored for their flavor and tenderness. However, the shorter shelf life and higher risk of spoilage compared to frozen products limit their market share. Despite these challenges, fresh products continue to be in demand, particularly in specialty stores and premium retail outlets.

Distribution Channel Analysis

Supermarkets & Hypermarkets Segment Dominates with 42.6% due to extensive reach and variety

The supermarkets and hypermarkets segment leads the Meat, Poultry, Seafood Market by distribution channel, holding 42.6% of the market share. This dominance is driven by the extensive reach and variety offered by these retail channels. Supermarkets and hypermarkets provide consumers with a one-stop shopping experience, offering a wide range of meat, poultry, and seafood products under one roof. This convenience, combined with competitive pricing and frequent promotions, attracts a large consumer base.

Within this segment, meat products are the most prominent, followed by poultry and seafood. Supermarkets and hypermarkets often feature dedicated sections for fresh, frozen, and processed meat products, catering to diverse consumer preferences. Poultry and seafood also benefit from prominent placement and variety, with options ranging from budget-friendly choices to premium and organic selections. The ability to offer an array of products at different price points ensures that supermarkets and hypermarkets cater to a broad audience, driving their market dominance.

Specialty stores, online channels, and other distribution channels, while smaller in market share, play crucial roles in the market. Specialty stores attract consumers seeking high-quality, niche products, including organic and sustainably sourced options. Online channels have seen significant growth due to the increasing popularity of e-commerce, offering convenience and home delivery services. Other channels, such as butchers and local markets, continue to serve specific consumer segments, contributing to the overall diversity and resilience of the market.

Key Market Segments

By Product

- Meat

- Poultry

- Seafood

By Type

- Conventional

- Organic

By Form

- Fresh

- Frozen

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Growth Opportunities

Expansion of Plant-Based and Alternative Protein Products Offers Growth Opportunity

The expansion of plant-based and alternative protein products presents a significant growth opportunity within the Meat, Poultry, and Seafood Market. As consumers become more environmentally conscious and health-focused, the demand for plant-based and lab-grown meat substitutes is increasing. In 2022, the global plant-based meat market was valued at USD 6.7 billion and will reach USD 35.1 billion by 2032.

This trend opens new avenues for companies to diversify their product portfolios. By introducing innovative plant-based or lab-grown meat alternatives, companies can cater to a growing segment of consumers seeking sustainable and health-friendly options. This shift not only addresses consumer preferences but also aligns with global sustainability goals, making it a lucrative area for investment and development in the market.

Adoption of Advanced Processing and Packaging Technologies Offers Growth Opportunity

The adoption of advanced processing and packaging technologies offers significant growth opportunities in the Meat, Poultry, and Seafood Market. Technologies such as modified atmosphere packaging (MAP), vacuum packaging, and high-pressure processing (HPP) enhance the shelf life, safety, and convenience of products.

For example, MAP can extend the shelf life of fresh meat by up to 14 days. These technologies appeal to consumers seeking longer-lasting and convenient options. By improving product freshness and safety, companies can reduce waste and meet consumer demands for high-quality products. The implementation of these technologies also allows for innovation in product offerings, such as ready-to-eat meals and premium packaged goods, further driving market growth and expanding the potential customer base.

Trending Factors

Clean Label and Organic Products Are Trending Factors

Clean label and organic products are trending factors in the Meat, Poultry, and Seafood Market. Consumers increasingly seek products free from artificial additives, preservatives, and hormones. This trend has led to a growing demand for organic and natural meat, poultry, and seafood products.

Manufacturers are adapting their production methods and labeling strategies to meet these preferences. By offering clean label and organic options, companies can appeal to health-conscious consumers and those concerned about food safety and environmental impact. This trend supports the growth of niche markets and drives overall industry innovation.

Emphasis on Traceability and Transparency Are Trending Factors

Emphasis on traceability and transparency is a trending factor in the Meat, Poultry, and Seafood Market. Consumers are increasingly concerned about the origin and journey of their food. This trend has led companies to provide detailed information about sourcing, processing, and handling of their products. In 2021, 75% of consumers stated that they would switch to brands offering more in-depth product information.

By enhancing traceability and transparency, companies can build trust with consumers and differentiate themselves in a competitive market. Technologies like blockchain and IoT are being used to track and share product information, ensuring authenticity and quality. This emphasis not only meets consumer demands but also aligns with regulatory requirements, further supporting market growth.

Regional Analysis

APAC Dominates with 46.2% Market Share

The APAC region leads the Meat, Poultry, Seafood Market with a 46.2% market share, valued at USD 620 billion. Several key factors contribute to this dominance. High population density and increasing disposable incomes drive demand for meat, poultry, and seafood. Countries like China, Japan, and India are major consumers, significantly boosting market growth. Rapid urbanization and changing dietary habits also contribute to the high market share.

Key factors driving APAC’s market share include a large and growing population, rising incomes, and increasing urbanization. The region’s dietary preferences, with a strong emphasis on seafood, also play a crucial role. Additionally, advancements in aquaculture and meat processing technologies enhance production efficiency and product availability.

Regional characteristics such as diverse culinary traditions and high seafood consumption rates affect the industry’s performance. The APAC region is also seeing significant investment in meat and seafood processing industries. Government initiatives to support domestic production and exports further bolster the market. For instance, China and India have implemented policies to enhance their meat and seafood sectors.

North America: 26.1% Market Share

North America holds a 26.1% market share. The region benefits from advanced processing technologies and high consumer spending on premium meat products. The market is driven by demand for high-quality beef and poultry. The U.S. and Canada are key contributors, with a significant focus on organic and free-range products.

Europe: 20.3% Market Share

Europe captures a 20.3% market share. The region’s market is influenced by strict food safety regulations and a growing preference for organic and sustainable products. Countries like Germany, France, and the UK are major markets. The European market emphasizes traceability and high standards in meat production.

Middle East & Africa: 4.8% Market Share

The Middle East & Africa region holds a 4.8% market share. The market is driven by a growing population and increasing demand for halal meat products. Urbanization and rising incomes in the Gulf countries contribute to market growth. However, the market faces challenges such as limited domestic production and reliance on imports.

Latin America: 2.6% Market Share

Latin America has a 2.6% market share. The region benefits from a strong agricultural base and significant meat production, especially in Brazil and Argentina. The market is driven by exports and growing domestic demand. Economic volatility and trade policies influence market dynamics in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Meat, Poultry, Seafood Market is significantly influenced by several key players, each strategically positioned to drive market growth. Tyson Foods, Inc., and JBS S.A. are among the largest global meat processors, leveraging their extensive supply chains and diverse product portfolios to maintain market leadership. Cargill, Incorporated focuses on sustainable practices and innovation, enhancing its market influence. BRF S.A. and Hormel Foods Corporation emphasize product diversification and quality, catering to varying consumer preferences.

Marfrig Global Foods S.A. and Smithfield Foods, Inc. have strong market positions due to their robust production capacities and strategic acquisitions. Thai Union Group PCL and Charoen Pokphand Foods PCL dominate the seafood segment, capitalizing on the growing demand for seafood products. Mowi ASA leads in aquaculture, setting industry standards for sustainable fish farming.

Beijing DQY Agriculture Technology Co., Ltd. and Sanderson Farms, Inc. focus on efficiency and technological advancements in poultry production. Grupo Bimbo S.A.B. de C.V. and SeaPak Shrimp & Seafood Company diversify into processed and ready-to-eat products, appealing to convenience-seeking consumers. Nichirei Corporation, with its strong presence in frozen foods, taps into the demand for long-lasting and easily prepared food products.

Collectively, these companies shape the market dynamics through their strategic initiatives, extensive product offerings, and focus on sustainability and innovation. Their influence extends across global markets, driving growth and setting industry trends.

Market Key Players

- Tyson Foods, Inc.

- JBS S.A.

- Cargill, Incorporated

- BRF S.A.

- Hormel Foods Corporation

- Marfrig Global Foods S.A.

- Smithfield Foods, Inc.

- Thai Union Group PCL

- Charoen Pokphand Foods PCL

- Mowi ASA

- Beijing DQY Agriculture Technology Co., Ltd.

- Sanderson Farms, Inc.

- Grupo Bimbo S.A.B. de C.V.

- SeaPak Shrimp & Seafood Company

- Nichirei Corporation

Recent Developments

- June 2024: The UK’s largest crayfish processing plant opens in Berkshire, aiming to meet the growing demand for crayfish in the UK and Europe. The facility features state-of-the-art technology for efficient processing and high-quality products, expected to boost the local economy and provide new job opportunities.

- June 2024: Vital Meat, a French cultivated meat start-up, seeks regulatory approval in the UK for its cultivated chicken product. The company plans to enter the British market with its antibiotic- and hormone-free cultivated chicken, aiming to supply major retailers and restaurants if approved.

- June 2023: Upside Foods becomes the first company to obtain USDA approval for selling cultivated chicken in the US, marking a significant milestone for the industry. Shiok Meats, a Singapore-based company, shifts its focus from cell-cultivated seafood to red meat to capitalize on the growing demand for alternative protein sources.

Report Scope

Report Features Description Market Value (2023) USD 1,341.8 Billion Forecast Revenue (2033) USD 1,717.6 Billion CAGR (2024-2033) 2.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Meat, Poultry, Seafood), By Type (Conventional, Organic), By Form (Fresh, Frozen), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tyson Foods, Inc., JBS S.A., Cargill, Incorporated, BRF S.A., Hormel Foods Corporation, Marfrig Global Foods S.A., Smithfield Foods, Inc., Thai Union Group PCL, Charoen Pokphand Foods PCL, Mowi ASA, Beijing DQY Agriculture Technology Co., Ltd., Sanderson Farms, Inc., Grupo Bimbo S.A.B. de C.V., SeaPak Shrimp & Seafood Company, Nichirei Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current market size of the global meat, poultry, and seafood market?The global meat, poultry, and seafood market was valued at USD 1,341.8 billion in 2023.

Which region holds the largest Meat, Poultry, Seafood Market share?The Asia-Pacific (APAC) region holds the largest Meat, Poultry, Seafood Market share at 46.2%.

What growth opportunities exist in the market?Growth opportunities include the expansion of plant-based and alternative protein products and the adoption of advanced processing and packaging technologies.

Who are the key players in the market?Key players include Tyson Foods, Inc., JBS S.A., Cargill, Incorporated, BRF S.A., Hormel Foods Corporation, Marfrig Global Foods S.A., Smithfield Foods, Inc., Thai Union Group PCL, and Charoen Pokphand Foods PCL.

Meat, Poultry, Seafood MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Meat, Poultry, Seafood MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Tyson Foods, Inc.

- JBS S.A.

- Cargill, Incorporated

- BRF S.A.

- Hormel Foods Corporation

- Marfrig Global Foods S.A.

- Smithfield Foods, Inc.

- Thai Union Group PCL

- Charoen Pokphand Foods PCL

- Mowi ASA

- Beijing DQY Agriculture Technology Co., Ltd.

- Sanderson Farms, Inc.

- Grupo Bimbo S.A.B. de C.V.

- SeaPak Shrimp & Seafood Company

- Nichirei Corporation