Global Magnetoencephalography Market By Product Type (Cryogenic/Conventional and Wearable MEG Systems), By Application (Clinical Applications (Epilepsy Diagnosis and Pre-Surgical Mapping, Brain Tumor Localization, Dementia, Multiple Sclerosis, Schizophrenia, Autism, Stroke and Others) and Research Applications), By End-User (Hospitals and Neurology Clinics, Imaging Centers and Academic & Research Institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172653

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

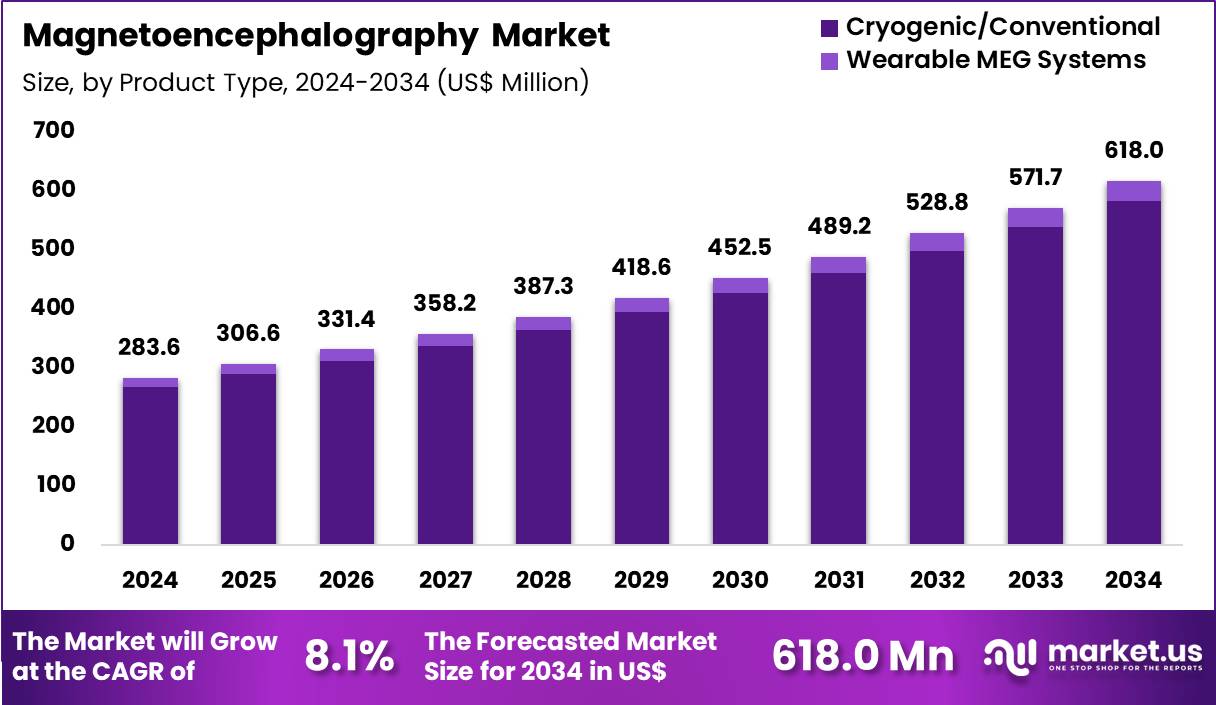

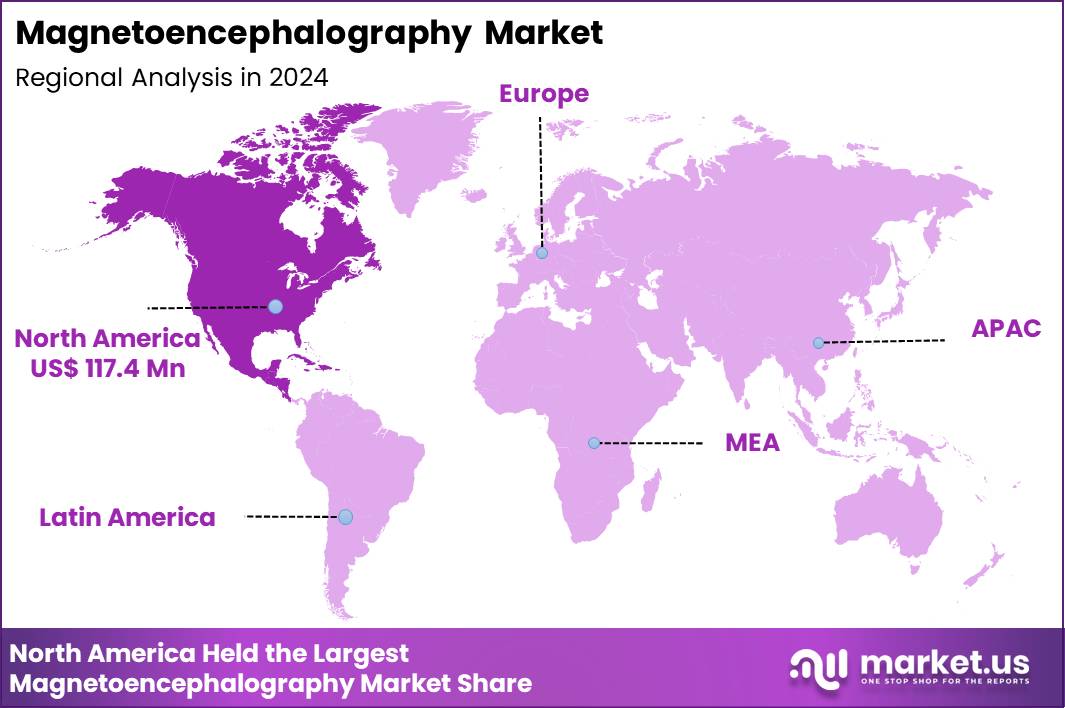

The Global Magnetoencephalography Market size is expected to be worth around US$ 618.0 Million by 2034 from US$ 283.6 Million in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 117.4 Million.

Growing demand for precise, non-invasive neuroimaging techniques accelerates the adoption of magnetoencephalography systems that deliver millisecond-level temporal resolution for mapping neural activity. Neurologists increasingly rely on these platforms to localize epileptogenic zones in patients with refractory epilepsy, guiding surgical resection to minimize seizure recurrence. These systems support preoperative functional mapping by identifying eloquent cortical areas responsible for language, motor, and sensory processing, preserving critical functions during tumor removals.

Researchers employ magnetoencephalography to investigate oscillatory brain dynamics in cognitive tasks, revealing mechanisms underlying attention, memory, and perceptual processing. Clinicians utilize these tools for assessing connectivity disruptions in autism spectrum disorders, informing targeted behavioral interventions.

In February 2025, UK-based brain health technology firm MYndspan announced a collaboration with MEGIN to broaden access to high-resolution MEG brain imaging. The partnership enables MYndspan to offer consumer-facing MEG scans, with the first system scheduled for installation at its London site, marking a step toward wider availability of advanced neuroimaging outside traditional research institutions.

Healthcare innovators pursue opportunities to extend magnetoencephalography into early detection of neurodegenerative conditions, analyzing resting-state networks to identify subtle deviations in Alzheimer’s and Parkinson’s disease progression. Developers integrate these systems with multimodal imaging for enhanced localization of aberrant activity in traumatic brain injury evaluations, supporting rehabilitation planning. These technologies create pathways for monitoring treatment responses in psychiatric disorders, tracking changes in neural synchrony following pharmacological or neuromodulation therapies.

Opportunities expand in pediatric neurology applications, mapping developmental trajectories of sensory and language networks in children with developmental delays. Companies advance protocols for real-time neurofeedback training, empowering patients to regulate brain activity in attention deficit hyperactivity disorder management. Firms invest in hybrid setups combining magnetoencephalography with transcranial magnetic stimulation, facilitating closed-loop interventions for mood disorder treatments.

Market pioneers incorporate optically pumped magnetometers into next-generation systems, eliminating cryogenic requirements and enabling flexible sensor arrays for natural movement during scans. Developers refine source localization algorithms with machine learning integration, improving accuracy in identifying deep brain sources for movement disorder assessments. Industry participants launch wearable magnetoencephalography prototypes that accommodate head motion, broadening utility in naturalistic cognitive neuroscience studies.

Innovators embed advanced connectivity analyses to quantify network alterations in schizophrenia, aiding differential diagnosis and personalized therapy selection. Companies prioritize consumer-oriented platforms for proactive brain health monitoring, detecting early markers of cognitive decline in aging populations. Ongoing initiatives emphasize multimodal fusion with electroencephalography, delivering comprehensive insights into sleep architecture disruptions in insomnia and related conditions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 283.6 Million, with a CAGR of 8.1%, and is expected to reach US$ 618.0 Million by the year 2034.

- The product type segment is divided into cryogenic/conventional and wearable MEG systems, with cryogenic/conventional taking the lead in 2023 with a market share of 94.3%.

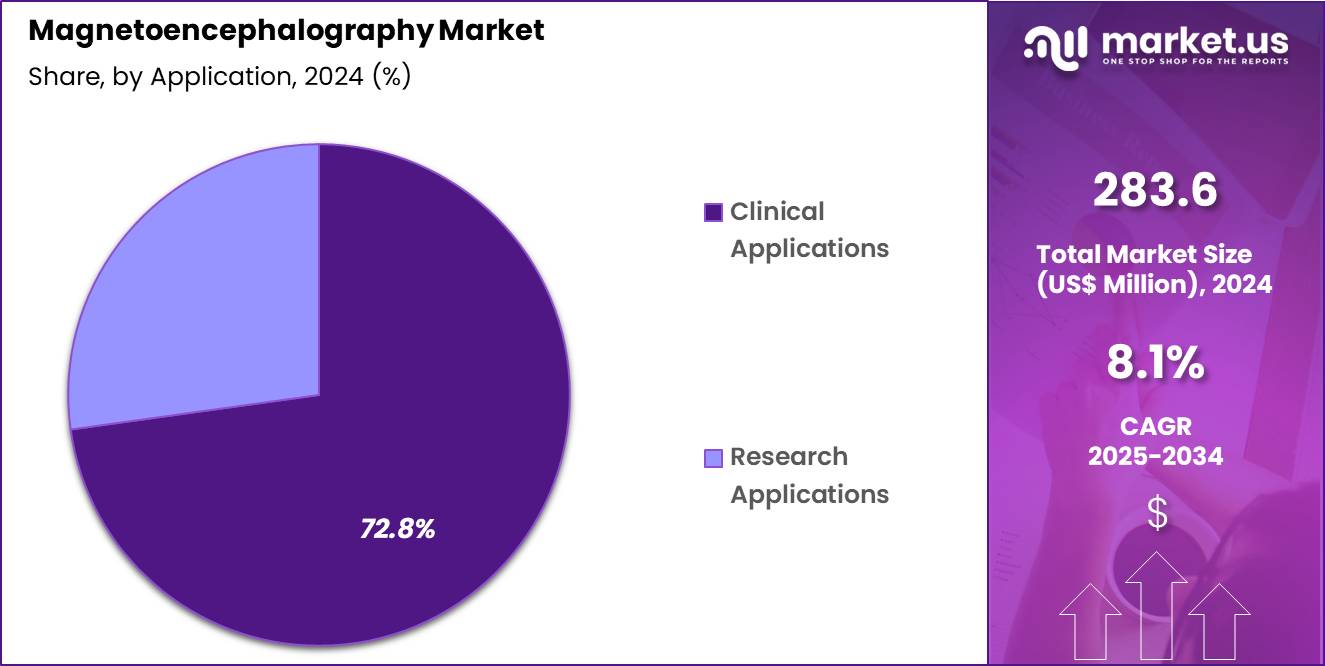

- Considering application, the market is divided into clinical applications and research applications. Among these, clinical applications held a significant share of 72.8%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and neurology clinics, imaging centers and academic & research institutions. The hospitals and neurology clinics sector stands out as the dominant player, holding the largest revenue share of 45.1% in the market.

- North America led the market by securing a market share of 41.4% in 2024.

Product Type Analysis

Cryogenic or conventional MEG systems accounted for 94.3% of the Magnetoencephalography market, reflecting their established position as the clinical benchmark for high precision brain signal detection. These systems deliver consistently high signal fidelity using superconducting sensors, which supports accurate localization of epileptic zones and functional cortical regions.

Neurology teams depend on this performance for complex presurgical evaluations, particularly in epilepsy and brain tumor cases. Longstanding clinical validation and widespread regulatory acceptance strengthen institutional confidence in these systems. Manufacturers continue to enhance shielding efficiency, cooling stability, and system uptime, which improves long term operational reliability.

Existing installations across tertiary hospitals drive repeat demand for upgrades and service contracts. Training infrastructure already aligns with conventional MEG platforms, reducing barriers to continued use. Funding bodies often favor proven technologies for clinical deployment, reinforcing procurement trends. Integration with MRI and EEG workflows further supports routine adoption. This segment is projected to sustain dominance due to its unmatched diagnostic credibility and clinical trust.

Application Analysis

Clinical applications represented 72.8% of the Magnetoencephalography market, driven by rising demand for advanced neurological diagnosis and treatment planning. Clinicians use MEG to capture real time neural activity with high temporal accuracy, which improves outcomes in epilepsy surgery and functional brain mapping. Growing prevalence of epilepsy, neurodevelopmental disorders, and brain tumors directly expands clinical scan volumes.

Hospitals increasingly adopt MEG as part of multimodal imaging strategies alongside MRI and EEG. Improvements in source localization algorithms enhance diagnostic confidence and speed of interpretation. Pediatric neurology benefits from the noninvasive and radiation free nature of MEG, supporting wider clinical acceptance.

Expanding specialized epilepsy centers accelerate routine clinical usage. Translational research increasingly moves MEG protocols into standard care pathways. Select reimbursement progress improves economic feasibility for clinical deployment. As a result, clinical applications are anticipated to remain the primary growth driver due to expanding neurological care needs.

End-User Analysis

Hospitals and neurology clinics held a 45.1% share of the Magnetoencephalography market, reflecting their role as primary hubs for advanced neurological care. These settings manage complex cases that require high resolution functional brain mapping for surgical planning. Integrated hospital infrastructure enables seamless coordination between neurology, neurosurgery, and imaging departments. High patient throughput supports better utilization rates and return on investment.

Availability of specialized neurophysiologists and technical staff improves operational efficiency. Hospitals prioritize technologies that directly influence treatment accuracy and patient outcomes. Expansion of comprehensive epilepsy centers within hospital networks boosts sustained demand. Clinical trials conducted in hospital environments further normalize routine MEG use.

Partnerships with technology providers enhance service continuity and system upgrades. This end user segment is likely to maintain leadership due to scale advantages, clinical expertise, and concentrated diagnostic demand.

Key Market Segments

By Product Type

- Cryogenic/Conventional

- Wearable MEG Systems

By Application

- Clinical Applications

- Epilepsy Diagnosis and Pre-Surgical Mapping

- Brain Tumor Localization

- Dementia

- Multiple Sclerosis

- Schizophrenia

- Autism

- Stroke

- Others

- Research Applications

By End-User

- Hospitals and Neurology Clinics

- Imaging Centers

- Academic & Research Institutions

Drivers

Rising prevalence of epilepsy is driving the market

The magnetoencephalography market experiences significant growth due to the rising prevalence of epilepsy, a neurological disorder that requires advanced neuroimaging for precise localization of seizure foci prior to surgical interventions. Clinicians employ MEG systems to map brain activity with high temporal resolution, aiding in treatment planning for drug-resistant cases. This technology offers non-invasive insights into cortical dynamics, surpassing limitations of electroencephalography in spatial accuracy.

Increasing awareness among neurologists promotes MEG utilization in comprehensive epilepsy evaluations. Population aging and genetic factors contribute to sustained epilepsy incidence, expanding diagnostic needs. Research institutions integrate MEG data with other modalities for enhanced therapeutic strategies. Governmental health agencies monitor epilepsy burdens to inform resource allocation for neuroimaging infrastructure.

Pharmaceutical developments in antiepileptic drugs complement MEG’s role in efficacy assessments. According to the Centers for Disease Control and Prevention, during 2021 and 2022, about 2.9 million U.S. adults aged 18 and older reported having active epilepsy, representing approximately 1% of the adult population. This statistic highlights the clinical imperative that sustains demand for MEG technologies in epilepsy management.

Restraints

High costs of MEG systems and installation are restraining the market

The magnetoencephalography market faces constraints from the high costs associated with acquiring and installing MEG systems, which require specialized shielded rooms and cryogenic cooling for superconducting sensors. These expenses limit adoption in smaller hospitals and academic centers with restricted budgets. Maintenance demands for helium-based systems add recurring financial burdens, deterring long-term investments.

Regulatory compliance for electromagnetic shielding further elevates setup complexities and costs. Emerging markets encounter additional barriers due to infrastructure deficiencies and currency fluctuations. Manufacturers struggle to reduce pricing without compromising sensor sensitivity. Insurance coverage inconsistencies for MEG scans hinder reimbursement viability in routine care.

Workforce training for system operation imposes indirect expenditures on facilities. Geographic disparities restrict access in rural regions, perpetuating uneven market penetration. These economic challenges collectively slow broader implementation and innovation uptake in the sector.

Opportunities

Increasing NIH funding for neuroscience research is creating growth opportunities

The magnetoencephalography market benefits from increasing National Institutes of Health funding for neuroscience research, which supports projects advancing MEG applications in brain mapping and cognitive studies. Researchers utilize these funds to develop hybrid MEG systems integrated with functional MRI for multimodal insights. Collaborative grants foster innovations in sensor arrays and data processing algorithms. Academic consortia leverage funding to explore MEG’s potential in psychiatric disorders and neurodevelopment.

Regulatory pathways encourage translational efforts from funded basic science to clinical trials. Investments enable upgrades in real-time analysis capabilities for intraoperative use. Global partnerships align with NIH initiatives to standardize MEG protocols internationally. Emerging applications in traumatic brain injury assessments expand utility scopes.

According to analyses from the Simons Foundation, funding for neuroscience-related projects by NIH rose to $10.5 billion in 2024. This escalation opens avenues for enhanced MEG infrastructure and diversified research-driven market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends propel the magnetoencephalography market forward as rising healthcare budgets and increasing neurological disorder prevalence worldwide encourage research institutions and hospitals to invest in advanced brain mapping systems for epilepsy and cognitive studies. Leading manufacturers actively develop helium-free and portable devices, capitalizing on technological advancements to expand applications in clinical diagnostics and neuroscience research across growing economies.

Persistent inflation and economic slowdowns, however, elevate costs for superconducting sensors and installation, compelling smaller facilities to delay acquisitions and limit operational scales in budget-constrained regions. Geopolitical tensions, particularly U.S.-China trade disputes and regional conflicts, frequently disrupt supplies of critical electronic components and rare earth materials, generating production delays and sourcing uncertainties for globally dependent producers.

Current U.S. tariffs, including Section 232 duties up to 100 percent on imported medical imaging equipment from key suppliers like China, amplify procurement expenses for American distributors and erode competitive pricing in domestic healthcare channels. These tariffs also provoke counter-tariffs from trading partners that curtail U.S. exports of innovative MEG technologies and impede multinational R&D alliances.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Advancement in optically pumped magnetometers for MEG is a recent trend

In 2024 and 2025, the magnetoencephalography market has observed a prominent trend toward advancements in optically pumped magnetometers, which enable room-temperature operation and eliminate the need for cryogenic cooling in traditional systems. These sensors enhance portability, allowing MEG applications in non-shielded environments for broader clinical access.

Developers focus on improving signal-to-noise ratios to match superconducting quantum interference devices. Integration with wearable designs supports longitudinal studies in naturalistic settings. Clinical trials evaluate OPM-MEG for pediatric epilepsy mapping with reduced motion artifacts. Manufacturers collaborate on scalable arrays for whole-head coverage at lower costs.

Regulatory discussions address validation standards for these emerging technologies. Academic publications highlight OPM’s utility in cognitive neuroscience experiments. Ethical considerations guide deployment in vulnerable populations. This trend, as detailed in a 2025 scientific review, positions OPM-MEG as a transformative approach for accessible and efficient brain imaging.

Regional Analysis

North America is leading the Magnetoencephalography Market

In 2024, North America held a 41.4% share of the global magnetoencephalography market, bolstered by heightened investments in neurological research and the expanding application of non-invasive brain mapping technologies for epilepsy surgery planning and cognitive neuroscience studies. Leading academic institutions and hospitals integrated high-density sensor arrays to improve spatiotemporal resolution, enabling precise localization of epileptic foci in refractory cases resistant to conventional EEG monitoring.

Federal grants from the National Institutes of Health supported multicenter trials evaluating MEG’s role in autism spectrum disorder assessments, driving device upgrades with cryogenic-free systems for broader clinical accessibility. Pharmaceutical firms collaborated on pharmacodynamic evaluations using MEG to track neural responses to novel antiepileptic drugs, accelerating regulatory pathways for personalized therapies.

Demographic rises in aging populations amplified demands for early dementia detection, prompting outpatient clinics to adopt portable MEG variants for routine functional connectivity analyses. Vendor innovations in optically pumped magnetometers reduced operational costs, facilitating adoption in community-based neurology practices amid workforce shortages.

Professional societies issued updated guidelines endorsing MEG for presurgical evaluations, fostering standardized protocols across regional networks. The Centers for Disease Control and Prevention estimates that about 2.9 million U.S. adults had active epilepsy during 2021 and 2022, highlighting the critical need for advanced neuroimaging tools like MEG in diagnostic workflows.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts forecast significant escalation in magnetoencephalography deployment across Asia Pacific during the forecast period, propelled by rapid urbanization and intensifying focus on mental health initiatives. National health bodies allocate budgets to equip tertiary neurology centers with superconducting quantum interference devices, targeting accurate seizure onset zone identification in densely populated epilepsy hotspots.

Local innovators customize helmet-style sensors for pediatric applications, addressing developmental disorders amid youthful demographics facing environmental stressors. International alliances transfer expertise on source localization algorithms, empowering researchers to probe schizophrenia endophenotypes in multicultural cohorts. Private hospitals integrate hybrid MEG-MRI systems, optimizing evaluations for traumatic brain injuries from road accidents in emerging economies.

Community screening drives utilize mobile units to detect cortical dysplasias early, curtailing long-term disability burdens. Regulatory agencies harmonize safety standards, expediting market entry for cost-effective optically pumped alternatives suited to tropical conditions. The World Health Organization indicates that nearly 80% of the world’s 50 million people with epilepsy reside in low- and middle-income countries, as stated in its February 2024 fact sheet, underscoring regional imperatives for enhanced diagnostic capacities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the magnetoencephalography market drive growth by advancing sensor sensitivity, cryogen-free systems, and AI-assisted signal analysis that lower operational complexity and expand clinical usability beyond research centers. Companies accelerate adoption through collaborations with neuroscience institutes and epilepsy surgery programs that integrate functional brain mapping into routine diagnostic pathways.

Commercial strategies emphasize modular system upgrades, service contracts, and lifecycle support to improve return on investment for hospitals and academic buyers. Innovation priorities include portability, faster setup times, and seamless integration with MRI and EEG data to enhance multimodal brain assessment.

Geographic expansion targets regions investing in advanced neuroimaging infrastructure and precision neurology initiatives. Elekta exemplifies leadership with its MEGIN business unit, combining deep neuroscience expertise, a global installed base, and strong clinical partnerships to deliver comprehensive brain-mapping solutions for epilepsy, tumor localization, and cognitive research.

Top Key Players

- Compumedics Limited

- MEGIN

- Ricoh

- CTF MEG NEURO INNOVATIONS, INC.

- FieldLine Inc.

- Cerca Magnetics Limited

- MAG4Health

- Croton Healthcare

Recent Developments

- In September 2025, Cerca Magnetics Limited deployed Ireland’s first optically pumped magnetometer–based MEG system at Trinity College Dublin. The installation supports advanced neuroscience research, enabling earlier investigation of neurological conditions such as epilepsy, dementia, and attention-deficit hyperactivity disorder through highly sensitive, non-invasive brain imaging.

- In March 2025, Compumedics Limited confirmed a new magnetoencephalography system order from Hangzhou Normal University. The transaction, executed through its long-standing regional partner Beijing Fistar, strengthens Compumedics’ footprint in China’s growing academic and clinical brain research market.

Report Scope

Report Features Description Market Value (2024) US$ 283.6 Million Forecast Revenue (2034) US$ 618.0 Million CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cryogenic/Conventional and Wearable MEG Systems), By Application (Clinical Applications (Epilepsy Diagnosis and Pre-Surgical Mapping, Brain Tumor Localization, Dementia, Multiple Sclerosis, Schizophrenia, Autism, Stroke and Others) and Research Applications), By End-User (Hospitals and Neurology Clinics, Imaging Centers and Academic & Research Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Compumedics Limited, MEGIN, Ricoh, CTF MEG NEURO INNOVATIONS, INC., FieldLine Inc., Cerca Magnetics Limited, MAG4Health, Croton Healthcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Magnetoencephalography MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Magnetoencephalography MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Compumedics Limited

- MEGIN

- Ricoh

- CTF MEG NEURO INNOVATIONS, INC.

- FieldLine Inc.

- Cerca Magnetics Limited

- MAG4Health

- Croton Healthcare