Global Luxury Sunglasses Market Size, Share, Growth Analysis By Product Type (Polarized, Non-polarized), By Frame Material (Acetate, Injected, Metal, Others), By End User (Male, Unisex, Female), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152191

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

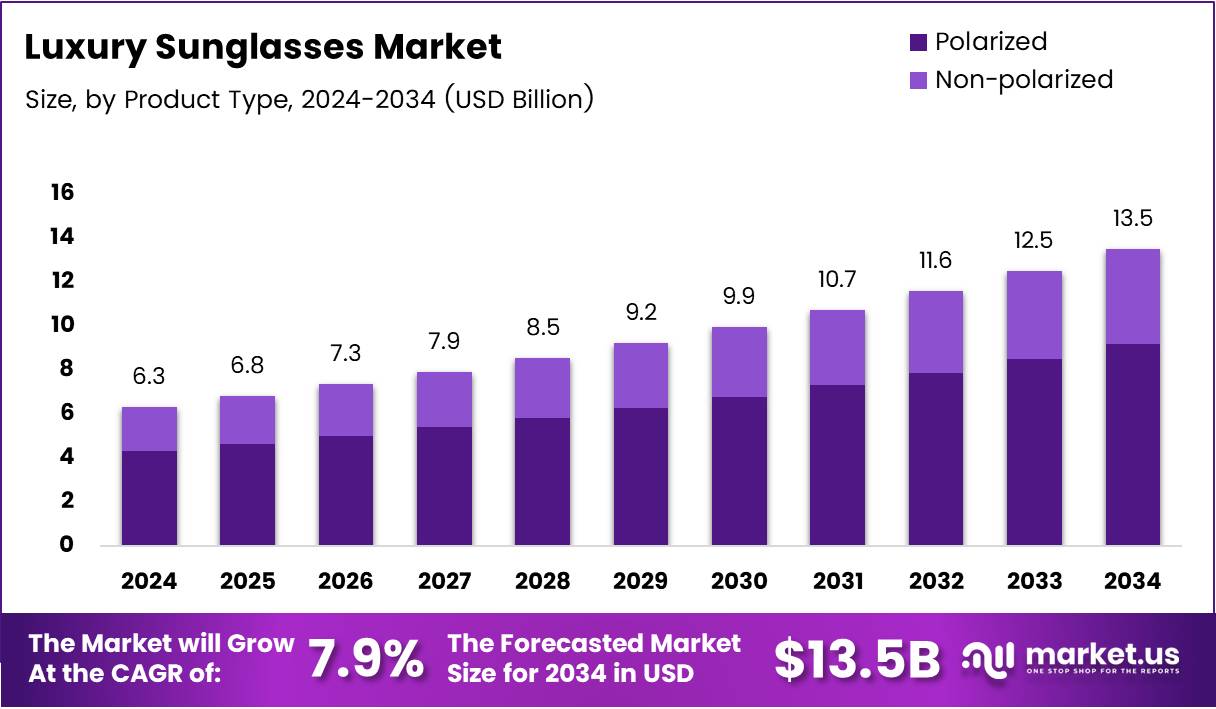

The Global Luxury Sunglasses Market size is expected to be worth around USD 13.5 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The luxury sunglasses market is growing rapidly due to increasing consumer demand for high-quality and stylish eyewear. As disposable income rises, particularly in emerging economies, more consumers are willing to invest in premium products that not only provide functionality but also enhance their fashion statement. The luxury sunglasses segment is becoming an integral part of the overall luxury goods market, with brands like Gucci, Prada, and Ray-Ban leading the charge.

This market is highly driven by the changing consumer preferences, particularly among the younger, fashion-conscious demographic. Many consumers seek sunglasses that blend style with advanced technology, such as UV protection and polarized lenses. Additionally, a growing interest in personalized and exclusive designs is fueling the demand for high-end sunglasses, making it a competitive yet lucrative industry for both established and emerging brands.

There is a significant opportunity for growth, especially in regions such as Asia-Pacific, where rapid urbanization and a growing middle class present new consumer bases for luxury brands. The rise of e-commerce also opens new avenues for reaching a global audience, as luxury sunglasses can now be purchased online, providing convenience and accessibility. This growth trajectory signals a bright future for the luxury eyewear sector, which is expected to see continued expansion in the coming years.

Government investment and regulations play a vital role in shaping the growth of the luxury sunglasses market. In several regions, stricter regulations around UV protection standards have driven innovation in the industry. Additionally, government investments in infrastructure and retail development, especially in emerging markets, have supported the expansion of both online and offline sales channels for luxury eyewear brands. As a result, companies are benefitting from favorable market conditions that support long-term growth.

Statistically, the luxury sunglasses market is evolving, with women making up a significant portion of the market. According to Trovelle, women account for approximately 55% of total sunglasses sales, often purchasing more frequently and spending more on high-end brands.

However, different consumer segments also show varying preferences in where to shop. According to Overnightglasses, 19% of consumers plan to buy sunglasses at discount stores, which offer lower prices but may not provide the same personalized service as other retail outlets. On the other hand, 27% of consumers prefer chain stores for their competitive pricing and variety.

Key Takeaways

- The global luxury sunglasses market is expected to reach USD 13.5 billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034.

- Polarized sunglasses dominate the By Product Type Analysis segment, driven by superior visual performance and reduced glare.

- Acetate leads the By Frame Material Analysis segment, appreciated for its rich finish, color vibrancy, and durability.

- Male consumers hold a 45.2% share in the By End User Analysis segment, prioritizing utility, style, and brand.

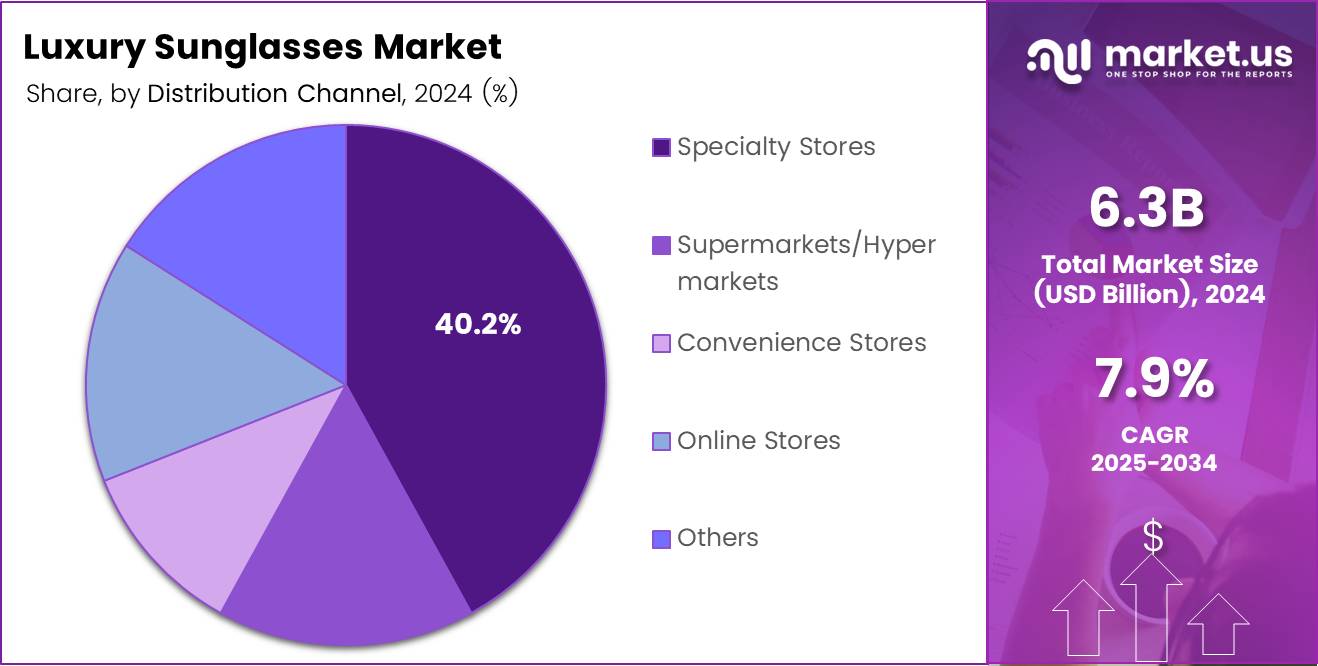

- Specialty stores account for 40.2% of the market share in the By Distribution Channel Analysis segment, offering personalized service and exclusive collections.

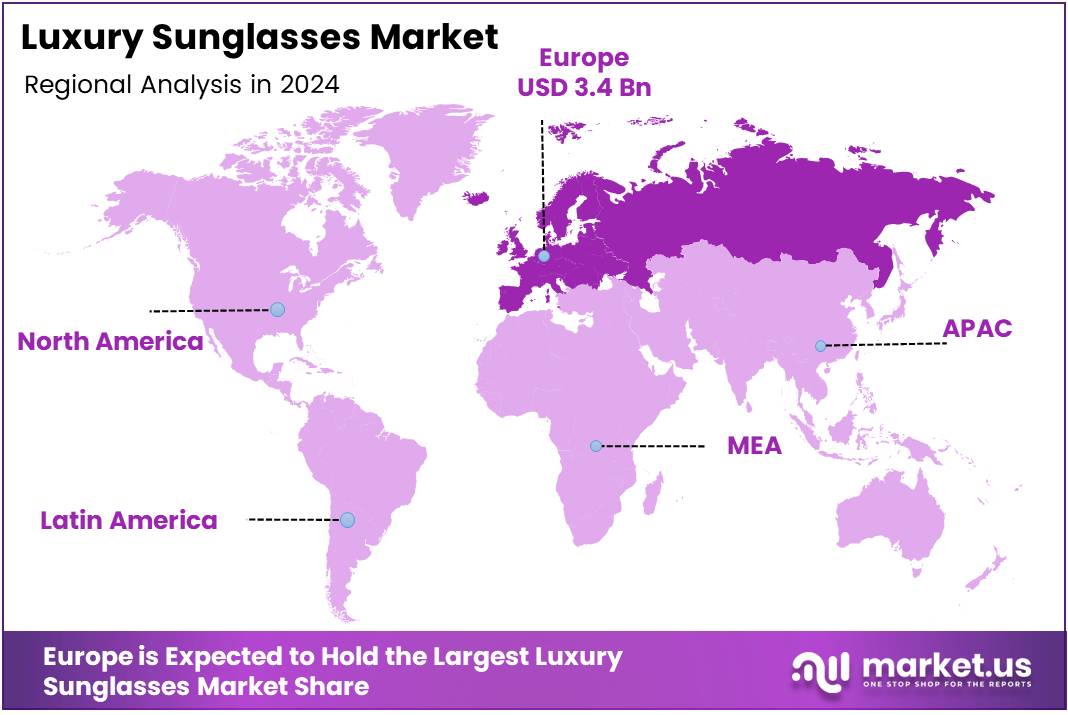

- Europe holds 38.2% of the global luxury sunglasses market, valued at USD 2.4 billion, driven by high demand in fashion hubs like France, Italy, and Germany.

Product Type Analysis

Polarized dominates due to enhanced visual clarity and glare reduction.

In 2024, Polarized held a dominant market position in the By Product Type Analysis segment of the Luxury Sunglasses Market. Polarized sunglasses have gained significant traction among luxury consumers owing to their superior visual performance, particularly in bright outdoor environments. They reduce glare from reflective surfaces like water, snow, and glass, making them a preferred choice for driving, travel, and leisure.

The increasing preference for eye protection and comfort in luxury eyewear has further driven the demand for polarized sunglasses. High-end brands continue to integrate polarization technology into their premium models, which appeals to affluent buyers prioritizing both fashion and function.

On the other hand, Non-polarized sunglasses remain a steady segment, catering to consumers seeking style-forward designs without the added cost of lens treatment. Though they offer aesthetic appeal, they are generally perceived as less functional in bright light conditions.

While Non-polarized options maintain relevance through fashion collections and seasonal styles, the practical advantages of Polarized lenses have solidified their market leadership in the premium category.

Frame Material Analysis

Acetate leads thanks to its luxurious feel and design flexibility.

In 2024, Acetate held a dominant market position in the By Frame Material Analysis segment of the Luxury Sunglasses Market. Acetate has long been favored in the premium eyewear category due to its rich finish, color vibrancy, and high durability. Its lightweight yet sturdy build enhances comfort, making it ideal for extended wear in luxury sunglasses.

Consumers are increasingly drawn to acetate frames for their premium appearance and tactile quality, which distinguishes them from more conventional materials. Luxury brands also favor acetate for its versatility in achieving bespoke shapes and textures, aligning well with high-fashion trends.

Injected frames offer cost efficiency and are easier to mass-produce, which supports their steady adoption in entry-level luxury collections. Meanwhile, Metal frames appeal to a niche demographic valuing sleek, minimalistic aesthetics and robust structure.

The Others category includes innovative or blended materials but remains comparatively limited in market reach. Despite the variety of options, acetate continues to command a strong presence in the luxury segment due to its perceived value and wide design adaptability.

End User Analysis

Male consumers dominate with 45.2% driven by brand affinity and functional design preferences.

In 2024, Male held a dominant market position in the By End User Analysis segment of the Luxury Sunglasses Market, with a 45.2% share. This segment has shown consistent growth as male consumers increasingly prioritize both utility and style in their eyewear choices. The preference for bold, classic designs and brand-oriented shopping behavior has played a crucial role in sustaining demand.

Luxury brands have responded with collections tailored specifically for men, featuring masculine aesthetics, polarized lenses, and premium finishes. The emphasis on craftsmanship and functionality resonates well with male buyers seeking statement accessories that blend performance and prestige.

The Unisex segment is also growing, offering versatile styles that cater to broader tastes, particularly among younger demographics. However, its market share remains below that of Male consumers.

Meanwhile, the Female segment, though influential in fashion-forward styles and seasonal trends, trails slightly behind in market share. Women’s luxury sunglasses tend to be more influenced by style cycles, while men tend to exhibit stronger brand loyalty and long-term product use, further consolidating the dominance of the Male end user category.

Distribution Channel Analysis

Specialty Stores lead with 40.2% as personalized service enhances luxury buying experience.

In 2024, Specialty Stores held a dominant market position in the By Distribution Channel Analysis segment of the Luxury Sunglasses Market, with a 40.2% share. These stores provide a curated shopping experience, often accompanied by expert consultation, which aligns well with the expectations of luxury consumers. The personalized service, exclusive collections, and in-store brand storytelling play a key role in building customer loyalty.

Luxury buyers value the ability to try products physically, assess fit and comfort, and receive tailored recommendations—factors that give specialty outlets a distinct edge over mass-market retail.

Supermarkets/Hypermarkets and Convenience Stores cater more to value-conscious consumers and impulse purchases, making them less impactful in the premium segment. Though they provide accessibility, they lack the brand-specific ambiance and exclusive offerings that define luxury retail.

Online Stores have gained relevance but still trail in market share within the luxury segment. While e-commerce platforms offer convenience and wide product access, many high-end buyers still prefer the tactile and experiential aspect of specialty retail.

The Others category includes niche formats, pop-up boutiques, or department stores, but they remain peripheral in terms of market influence compared to established specialty stores.

Key Market Segments

By Product Type

- Polarized

- Non-polarized

By Frame Material

- Acetate

- Injected

- Metal

- Others

By End User

- Male

- Unisex

- Female

By Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Drivers

Rising Demand for Premium Lifestyle Products Drives Market Growth

Luxury sunglasses are increasingly seen as a symbol of style and high social status. More people, especially in urban areas, are buying premium lifestyle products to match their fashion-forward lifestyles. This shift is directly boosting the demand for luxury eyewear.

Social media and celebrity culture play a big role in popularizing luxury sunglasses. Influencers and famous personalities often wear stylish branded eyewear, encouraging their followers to make similar purchases. These online trends significantly impact consumer buying behavior.

In addition to fashion appeal, more consumers are becoming aware of the health benefits of luxury sunglasses. Many high-end sunglasses offer strong UV protection, which helps prevent eye damage. This added value makes them a practical as well as fashionable choice.

Overall, these factors—premium lifestyle appeal, celebrity influence, and increased awareness of eye care—are driving consistent growth in the luxury sunglasses market.

Restraints

Economic Downturns Impacting Luxury Spending Restrain Market Growth

Luxury sunglasses are often considered non-essential items. During economic downturns, people tend to cut back on luxury spending. This has a direct impact on the sales of high-end eyewear brands.

The market is also facing challenges from counterfeit products. Fake sunglasses that mimic well-known brands are easily available at lower prices. These counterfeits harm the image of original brands and reduce consumer trust.

Another restraint is the limited availability of luxury sunglasses in some emerging markets. High-end products are often focused in large cities and developed countries, making it harder for consumers in smaller towns or developing regions to access them.

These challenges are important for market players to address as they can limit the growth potential of the luxury sunglasses industry.

Growth Factors

Expansion of Online Retail and E-Commerce Platforms Creates Growth Opportunities

Online shopping has made it easier for consumers to access luxury sunglasses from anywhere. E-commerce platforms now offer a wide variety of brands, styles, and price ranges, helping the market grow across different regions.

Collaborations between luxury eyewear makers and fashion designers are also boosting interest. These partnerships result in limited-edition or exclusive collections that attract both fashion lovers and collectors.

Another emerging opportunity is the use of eco-friendly materials. More consumers are interested in sustainable fashion, and luxury sunglasses made from recycled or biodegradable materials are becoming more popular.

The male demographic is also becoming a stronger part of the customer base. With more men showing interest in fashion accessories, the demand for stylish and high-end sunglasses in this group is growing steadily.

Emerging Trends

Integration of Advanced Technology in Eyewear Design Sets Market Trends

Luxury sunglasses are evolving with technology. Brands are now integrating features like smart lenses, augmented reality, and improved UV protection, making eyewear not just fashionable but also functional.

Personalization is another growing trend. Consumers want sunglasses that reflect their style and fit perfectly. Brands offering customization options—like choosing frame colors, lens types, or adding initials—are gaining popularity.

Comfort is equally important. Today’s consumers prefer sunglasses that are lightweight, durable, and easy to wear all day. Companies are investing in materials and designs that enhance comfort without compromising on style.

These tech-driven and user-friendly innovations are shaping the future of the luxury sunglasses market, keeping consumers engaged and willing to invest in premium products.

Regional Analysis

Europe Dominates the Luxury Sunglasses Market with a Market Share of 38.2%, Valued at USD 2.4 Billion

Europe leads the global luxury sunglasses market, holding a significant share of 38.2%, with a valuation of USD 2.4 billion. The region’s dominance is driven by strong consumer demand for premium fashion accessories, well-established fashion hubs, and a high concentration of luxury-conscious consumers. Additionally, the presence of affluent populations across countries like France, Italy, and Germany supports steady market expansion.

North America Luxury Sunglasses Market Trends

North America represents a mature and influential segment of the luxury sunglasses market, with growth driven by high per capita income and widespread brand awareness. The United States, in particular, has a large consumer base that values premium eyewear for both fashion and UV protection. The region also benefits from evolving retail channels, including e-commerce and luxury department stores.

Asia Pacific Luxury Sunglasses Market Trends

The Asia Pacific region is witnessing rapid growth in the luxury sunglasses market, spurred by increasing disposable incomes and a growing middle-class population. Countries like China, Japan, and South Korea are becoming key markets as consumers show rising interest in luxury fashion items. Urbanization and social media influence are also propelling demand in the region.

Middle East and Africa Luxury Sunglasses Market Trends

The Middle East and Africa market for luxury sunglasses is emerging, supported by a rise in luxury lifestyle adoption and tourism in regions like the UAE and Saudi Arabia. Consumer preferences are shifting towards premium eyewear, influenced by international fashion trends and increasing awareness about eye protection in sunny climates.

Latin America Luxury Sunglasses Market Trends

Latin America is gradually entering the luxury sunglasses landscape, with demand being led by countries such as Brazil and Mexico. While the market is still developing, urbanization, growing fashion awareness, and rising disposable incomes are contributing to increased interest in high-end eyewear products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Luxury Sunglasses Company Insights

In 2024, the global luxury sunglasses market continues to reflect strong brand positioning and strategic expansions among leading players, with innovation and premium design driving consumer demand.

Luxottica Group S.p.A. remains a dominant force in the market, leveraging its vast brand portfolio and retail distribution network to maintain market leadership. Its continuous focus on innovation and brand licensing keeps it ahead in both fashion and performance segments.

Safilo Group S.p.A. is strengthening its presence through diversification and targeted collaborations with fashion houses. The company has emphasized sustainable materials and digital retail strategies to appeal to environmentally conscious luxury buyers.

EssilorLuxottica benefits from its unique integration of lens technology with eyewear design, offering unmatched functionality and style. Its ability to merge vision care expertise with fashion-forward frames provides a competitive edge in the premium segment.

Italia Independent Group S.p.A. positions itself through avant-garde designs and a niche appeal to younger, fashion-savvy consumers. Its bold aesthetics and innovative use of materials help differentiate it in a crowded luxury market.

Collectively, these companies are shaping the future of luxury sunglasses by blending heritage craftsmanship with modern consumer preferences. The emphasis on brand identity, customization, and omnichannel experiences is becoming central to growth. As premium eyewear demand increases, particularly in emerging markets, these players are likely to continue leading through design innovation, strategic collaborations, and digital transformation.

Top Key Players in the Market

- Luxottica Group S.p.A.

- Safilo Group S.p.A.

- EssilorLuxottica

- Italia Independent Group S.p.A.

- Gentle Monster

- Oliver Peoples Inc.

- Kering Eyewear

- LVMH Moët Hennessy – Louis Vuitton SE

- Marcolin Group

- Maui Jim Inc.

- De Rigo Vision S.p.A.

- Marchon Eyewear Inc.

- Christian Dior SE (Dior)

- Fielmann AG

- Charmant Group

- Others

Recent Developments

- In Apr 2025, IXI raised $36.5M in a funding round led by Amazon and others. The investment will help IXI bring innovative autofocus technology to prescription glasses, enhancing user vision experience.

- In Apr 2025, the Jaipuria Group acquired budget eyewear brand ClearDekho. This strategic move strengthens their foothold in the value eyewear market across India.

- In Jun 2025, Kering Eyewear finalized its acquisition of Italian lens manufacturer Lenti. The deal boosts Kering’s vertical integration and manufacturing capabilities within the eyewear sector.

- In Apr 2024, JTV® expanded its product line to include luxury sunglasses and watches. This marks the brand’s entry into premium fashion accessories, aiming to attract a broader audience.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Billion Forecast Revenue (2034) USD 13.5 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Polarized, Non-polarized), By Frame Material (Acetate, Injected, Metal, Others), By End User (Male, Unisex, Female), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Luxottica Group S.p.A., Safilo Group S.p.A., EssilorLuxottica, Italia Independent Group S.p.A., Gentle Monster, Oliver Peoples Inc., Kering Eyewear, LVMH Moët Hennessy – Louis Vuitton SE, Marcolin Group, Maui Jim Inc., De Rigo Vision S.p.A., Marchon Eyewear Inc., Christian Dior SE (Dior), Fielmann AG, Charmant Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Luxottica Group S.p.A.

- Safilo Group S.p.A.

- EssilorLuxottica

- Italia Independent Group S.p.A.

- Gentle Monster

- Oliver Peoples Inc.

- Kering Eyewear

- LVMH Moët Hennessy – Louis Vuitton SE

- Marcolin Group

- Maui Jim Inc.

- De Rigo Vision S.p.A.

- Marchon Eyewear Inc.

- Christian Dior SE (Dior)

- Fielmann AG

- Charmant Group

- Others