Global LNG Bunkering Market By Type(Truck-to-Ship (TTS), Terminal-to-Ship (TTS), Ship-to-Ship (STS)), By Vessel Type(Container Ships, Tankers, Ferries, Cruise Ships, Offshore Support Vessels, Others), By Application (Industrial and Commercial, Defense, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116084

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

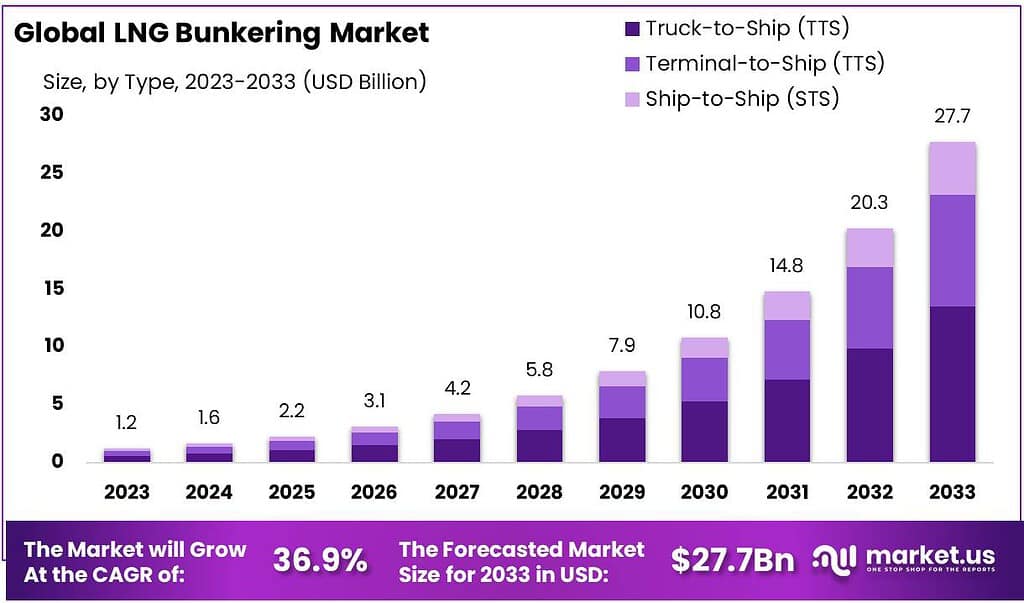

The global LNG Bunkering market size is expected to be worth around USD 27.7 billion by 2033, from USD 1.2 billion in 2023, growing at a CAGR of 36.9% during the forecast period from 2023 to 2033.

The LNG Bunkering Market refers to the provision and distribution of liquefied natural gas (LNG) to ships for use as fuel. LNG bunkering involves the process of transferring LNG to a ship for its consumption, serving as a cleaner alternative to traditional marine fuels such as heavy fuel oil, marine diesel oil, and marine gas oil. This market has gained significant traction as a result of the maritime industry’s shift towards more environmentally sustainable operations, driven by stringent regulations aimed at reducing air pollution and greenhouse gas emissions from ships.

LNG as a marine fuel offers several environmental benefits, including the significant reduction of sulfur oxides (SOx), nitrogen oxides (NOx), particulate matter, and carbon dioxide emissions, compared to conventional marine fuels.

The development of the LNG bunkering market is supported by the establishment of LNG bunkering infrastructure, including bunkering vessels, port facilities, and mobile truck-to-ship bunkering, to ensure the efficient and safe supply of LNG to ships. The expansion of this market is further facilitated by the growing fleet of LNG-powered vessels, driven by the maritime sector’s commitment to reducing its environmental impact and enhancing fuel efficiency.

Key Takeaways

- Market Growth: LNG bunkering market projected to reach USD 27.7 billion by 2033, with a CAGR of 36.9% from 2023’s USD 1.2 billion.

- Bunkering Methods: Truck-to-Ship (TTS) dominated with 48.6% market share in 2023, offering flexibility.

- Vessel Types: Container ships lead with 62.4% market share in 2023, driven by global trade reliance.

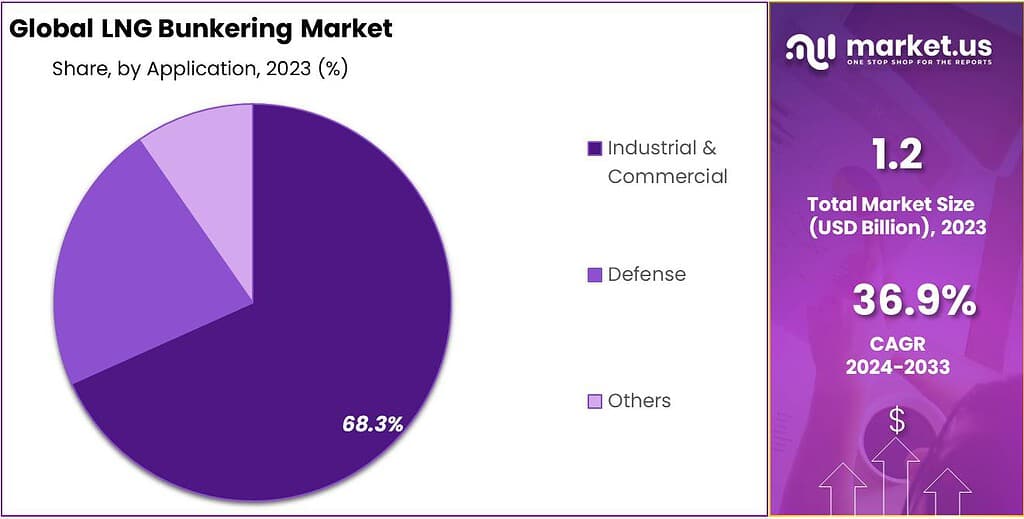

- Applications: Industrial & Commercial segment holds 68.3% market share in 2023, driven by cargo transport.

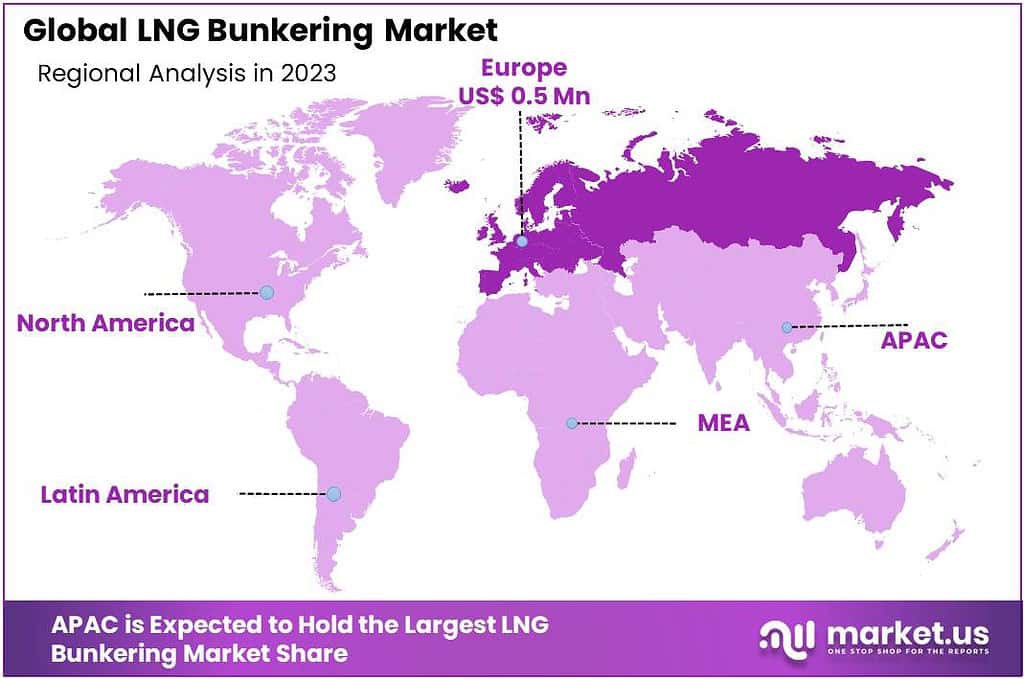

- Europe’s Dominance: Europe maintains 45.6% market share in 2023, driven by stringent regulations and sustainability initiatives.

By Type

Truck-to-Ship (TTS): In 2023, Truck-to-Ship held a dominant market position, capturing more than a 48.6% share. This method involves the direct transfer of LNG from a tanker truck to a vessel while it is docked at the port. Its popularity stems from its flexibility and ease of implementation, especially in ports lacking dedicated LNG infrastructure.

TTS is particularly advantageous for smaller ports and vessels, offering a cost-effective and relatively quick solution for LNG fueling. This method’s adaptability makes it an attractive option for shipping companies initiating their transition to LNG fuel, despite the limitation in the volume of LNG that can be delivered in a single operation.

Terminal-to-Ship (TTS): Terminal-to-Ship bunkering involves the transfer of LNG from a fixed bunkering terminal to a vessel, utilizing a pipeline system. This segment has shown significant growth, attributed to its ability to supply larger quantities of LNG, making it suitable for bigger vessels and those with higher fuel consumption.

The establishment of dedicated LNG terminals at major ports has facilitated the expansion of TTS bunkering, offering more efficient, reliable, and continuous supply chains for LNG. As ports invest in LNG infrastructure, the TTS method is poised for further growth, supported by its ability to serve a wide range of vessels, including container ships, tankers, and bulk carriers, thereby enhancing the operational efficiency of LNG fueling.

Ship-to-Ship (STS): Ship-to-Ship bunkering involves the transfer of LNG from a bunker vessel to another ship at sea or while docked. This method offers the highest flexibility in terms of location and scheduling, allowing ships to be refueled without the need to divert from their planned routes significantly. The STS method is crucial for ensuring the availability of LNG fuel across major shipping routes and in regions where port infrastructure is still developing.

By Vessel Type

Container Ships: In 2023, Container Ships held a dominant market position, capturing more than a 62.4% share. This segment’s significant share is attributed to the global trade’s reliance on container shipping for the transportation of goods. Container ships often operate on fixed routes with predictable schedules, making the logistics of LNG bunkering more manageable and efficient.

The drive towards reducing emissions on these high-volume trade routes has pushed operators to adopt LNG as a cleaner fuel alternative. The adoption of LNG by this segment is further propelled by the need to comply with stringent environmental regulations, making LNG an attractive option for new builds and retrofits alike.

Tankers: Tankers, which transport liquid cargoes such as crude oil, chemicals, and liquefied gases, also form a critical part of the LNG bunkering market. While the adoption rate of LNG as a bunker fuel is growing, operational considerations such as cargo compatibility and voyage distances play a significant role in fuel choice. However, the environmental benefits of LNG, coupled with operational cost savings over time, have encouraged a gradual shift towards LNG-fueled tankers, especially for those operating in emission control areas (ECAs).

Ferries: Ferries, particularly those serving short sea routes, have emerged as early adopters of LNG bunkering solutions. The localized nature of their operations makes it easier to establish the necessary LNG bunkering infrastructure. Moreover, ferries often operate within or near ECAs, where stricter emissions standards necessitate the use of cleaner fuels. The transition to LNG for these vessels is driven by both regulatory compliance and the benefits of reduced operational costs and lower emissions.

Cruise Ships: The cruise industry, with its focus on environmental stewardship and passenger comfort, has increasingly turned to LNG as a means to reduce emissions and minimize air pollution. Cruise ships benefit from LNG’s cleaner combustion, which significantly reduces the emission of pollutants.

This is particularly advantageous for ships operating in sensitive ecological areas or regions with stringent air quality standards. As the industry grows, more cruise lines are investing in LNG-powered vessels to meet sustainability targets and enhance their environmental credentials.

Offshore Support Vessels: Offshore Support Vessels (OSVs), which provide services to the offshore oil and gas industry, are also transitioning to LNG. This shift is driven by the dual need to reduce operational costs and adhere to environmental regulations in offshore fields.

LNG offers a cleaner alternative to conventional marine fuels, aligning with the industry’s broader sustainability goals. As offshore exploration and production activities continue, the demand for LNG-fueled OSVs is expected to rise.

By Application

Industrial & Commercial: In 2023, the Industrial & Commercial segment held a dominant market position, capturing more than a 68.3% share. This segment encompasses a wide range of commercial shipping activities, including cargo transport, container shipping, and bulk carriers, which are integral to global trade and supply chains. The substantial share of this segment is attributed to the maritime industry’s concerted efforts to meet stringent environmental regulations and reduce greenhouse gas emissions.

Defense: The Defense segment represents the adoption of LNG bunkering solutions by naval forces and other defense-related maritime operations. While this segment captures a smaller share of the market compared to Industrial & Commercial, it is nonetheless significant due to the strategic importance of enhancing energy security and reducing the environmental impact of defense operations.

Naval vessels, including submarines and surface ships, are exploring LNG as an alternative fuel to decrease reliance on conventional fuels and to operate more sustainably. The adoption of LNG in defense vessels is influenced by considerations of operational efficiency, fuel availability during missions, and the need to adhere to environmental standards, even in military operations.

Market Key Segments

By Type

- Truck-to-Ship (TTS)

- Terminal-to-Ship (TTS)

- Ship-to-Ship (STS)

By Vessel Type

- Container Ships

- Tankers

- Ferries

- Cruise Ships

- Offshore Support Vessels

- Others

By Application

- Industrial & Commercial

- Defense

- Others

Drivers

Stringent Environmental Regulations

Regulations such as the IMO 2020 sulfur cap, which limits the sulfur content in ship fuel to 0.5%, and the IMO’s strategy to reduce greenhouse gas emissions from ships by at least 50% by 2050 compared to 2008 levels, have significantly increased the demand for cleaner marine fuels like LNG. LNG’s lower emissions profile makes it an attractive option for compliance, driving the growth of the bunkering market.

Operational Cost Benefits

The economic advantages of using LNG as a marine fuel, including the potential for lower long-term operational costs, serve as another critical driver. Despite initial conversion or newbuild costs, LNG-fueled vessels can benefit from reduced fuel expenses over time, especially in the context of fluctuating oil prices. Additionally, the increasing availability of LNG globally has made it a more viable option for ship operators, further bolstering the market.

Restraints

High Initial Investment Costs

The transition to LNG fueling requires significant upfront investment in vessel modification or new buildings designed to run on LNG, as well as in developing the necessary bunkering infrastructure. These high initial costs can act as a barrier to entry for some ship operators, slowing down the adoption rate of LNG as a marine fuel.

Regulatory and Safety Concerns

Despite LNG’s benefits, there are regulatory and safety concerns related to its storage, handling, and bunkering. The need for strict compliance with safety standards and the development of comprehensive regulations for LNG bunkering operations can pose challenges to the market’s growth. Addressing these concerns requires ongoing collaboration between industry stakeholders, regulatory bodies, and technology providers.

Opportunities

Innovation and Technological Advancements

The LNG Bunkering Market presents significant opportunities for innovation and technological advancements. Developments in bunkering vessel design, fueling systems, and safety mechanisms can enhance the efficiency and safety of LNG bunkering operations. Additionally, advancements in LNG production and supply chain logistics can further support the market’s growth by making LNG more accessible and cost-effective.

Emerging Markets and New Shipping Routes

The expansion of LNG bunkering services to emerging markets and new shipping routes offers considerable growth opportunities. As trade patterns evolve and new maritime routes open up, there is potential for establishing LNG bunkering hubs in strategic locations. These developments can facilitate the broader adoption of LNG fuel, contributing to the global effort to reduce maritime emissions and promote sustainable shipping practices.

Trends

Expansion of LNG Bunkering Infrastructure

A significant trend is the global expansion of LNG bunkering infrastructure. Major ports worldwide are investing in LNG bunkering facilities and services to accommodate the growing fleet of LNG-fueled vessels. This expansion includes the development of permanent bunkering terminals, the commissioning of bunkering vessels, and the implementation of truck-to-ship bunkering options, enhancing the accessibility and efficiency of LNG fueling operations.

Growth in LNG-Powered Fleet

The maritime industry is witnessing a surge in the number of LNG-powered vessels, spanning various types such as container ships, tankers, and cruise ships. This growth is driven by the industry’s efforts to meet environmental regulations and reduce carbon footprints. As more LNG-fueled ships enter service, the demand for LNG bunkering solutions continues to rise, propelling the market forward.

Regional Analysis

Europe is anticipated to maintain its leading position in the global LNG Bunkering Market, securing an impressive market share of 45.6% as of 2023. This dominance is largely attributed to Europe’s proactive stance on enforcing stringent environmental regulations and its unwavering commitment to sustainable maritime practices.

European governments have played a pivotal role in championing initiatives aimed at reducing greenhouse gas emissions and enhancing energy efficiency within the maritime sector. These efforts have set a global benchmark, emphasizing the critical role of LNG bunkering in achieving these ambitious environmental goals. The regulatory impetus provided by European authorities has significantly boosted the demand for LNG as a marine fuel, making LNG bunkering an indispensable component of the region’s strategy to curb maritime emissions.

The integration of LNG bunkering services across European ports reflects a harmonious blend of preserving the continent’s rich maritime heritage and embracing cutting-edge sustainable practices. This unique approach ensures that the maritime industry can continue to thrive while significantly reducing its environmental footprint, showcasing the adaptability and crucial importance of LNG bunkering in modern maritime operations.

Furthermore, Europe’s dedication to sustainability has catalyzed considerable advancements in research and development within the LNG bunkering sector. These advancements have led to the creation of more efficient, safe, and environmentally friendly LNG bunkering solutions, reinforcing Europe’s position as a leader in the global push towards cleaner maritime fuel alternatives. The region’s pioneering efforts in this field not only enhance the operational efficiency of LNG bunkering but also position Europe as a key innovator and a global reference point for best practices in the LNG bunkering industry.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the LNG bunkering market, key players play a pivotal role in shaping the industry and driving the transition towards cleaner maritime fuel solutions. Prominent entities across the LNG bunkering value chain have emerged as leaders, each contributing to the advancement and widespread adoption of liquefied natural gas (LNG) as a marine fuel.

The company’s strategic positioning in the LNG bunkering sector is underscored by its focus on developing comprehensive bunkering infrastructure and solutions to meet the growing demand for cleaner maritime fuel. Gazprom Neft’s commitment to environmental sustainability aligns with the industry’s push for reduced emissions and compliance with stringent maritime regulations.

Market Key Players

- Shell

- TotalEnergies

- Engie

- ENN Energy Holdings Ltd.

- Gasum Ltd.

- Equinor ASA

- Korea Gas Corporation (KOGAS)

- Harvey Gulf International Marine LLC

- Skangas

- Gaslog Ltd.

- Crowley Maritime Corporation

- Polskie LNG

- Bomin Linde LNG GmbH & Co. KG

- Eagle LNG Partners

- Titan LNG

Recent Developments

Shell 2023: Announced plans to build a new LNG bunkering vessel for the ARA region (Amsterdam-Rotterdam-Antwerp).

TotalEnergies 2022: Launched a new LNG bunkering vessel in Northwest Europe, expanding its bunkering network.

Engie 2023: Signed an agreement with a port operator to develop LNG bunkering infrastructure in Southeast Asia.

Report Scope

Report Features Description Market Value (2022) USD 1.2 Bn Forecast Revenue (2032) USD 27.7 Bn CAGR (2023-2032) 36.9% Base Year for Estimation 2022 Historic Period 2017-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Truck-to-Ship (TTS), Terminal-to-Ship (TTS), Ship-to-Ship (STS)), By Vessel Type(Container Ships, Tankers, Ferries, Cruise Ships, Offshore Support Vessels, Others), By Application (Industrial and Commercial, Defense, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Shell, TotalEnergies, Engie, ENN Energy Holdings Ltd., Gasum Ltd., Equinor ASA, Korea Gas Corporation (KOGAS), Harvey Gulf International Marine LLC, Skangas, Gaslog Ltd., Crowley Maritime Corporation, Polskie LNG, Bomin Linde LNG GmbH & Co. KG, Eagle LNG Partners, Titan LNG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of LNG Bunkering market?LNG Bunkering market size is expected to be worth around USD 27.7 billion by 2033, from USD 1.2 billion in 2023

What is the CAGR for the LNG Bunkering Market?The LNG Bunkering Market expected to grow at a CAGR of 36.9% during 2023-2032.

Who are the key players in the LNG Bunkering Market?Shell, TotalEnergies, Engie, ENN Energy Holdings Ltd., Gasum Ltd., Equinor ASA, Korea Gas Corporation (KOGAS), Harvey Gulf International Marine LLC, Skangas, Gaslog Ltd., Crowley Maritime Corporation, Polskie LNG, Bomin Linde LNG GmbH & Co. KG, Eagle LNG Partners, Titan LNG

-

-

- Shell

- TotalEnergies

- Engie

- ENN Energy Holdings Ltd.

- Gasum Ltd.

- Equinor ASA

- Korea Gas Corporation (KOGAS)

- Harvey Gulf International Marine LLC

- Skangas

- Gaslog Ltd.

- Crowley Maritime Corporation

- Polskie LNG

- Bomin Linde LNG GmbH & Co. KG

- Eagle LNG Partners

- Titan LNG