Global Lip Care Products Market By Product (Lip Balm, Lip Scrub, Other), By Distribution Channel (Hypermarkets and Supermarkets, Pharmacy and Drug Store, Specialty Store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2032

- Published date: Nov 2024

- Report ID: 15050

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

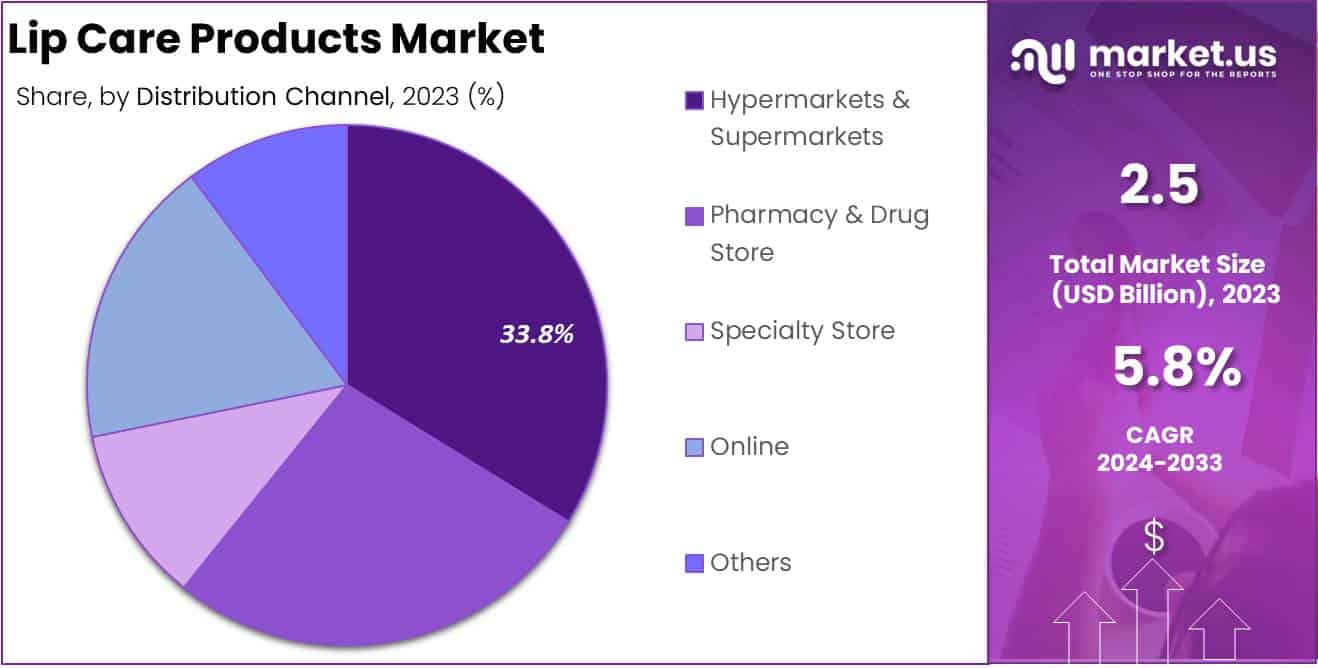

The Global Lip Care Products Market size is expected to be worth around USD 4.3 Billion by 2033, from USD 2.5 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Lip care products are specialized formulations designed to protect, hydrate, and repair the delicate skin of the lips. These products range from basic lip balms to more advanced treatments such as lip scrubs, masks, and serums. They often contain ingredients like beeswax, shea butter, vitamin E, and SPF components to address issues such as dryness, chapping, and UV damage.

The lip care products market encompasses the global industry focused on the production, distribution, and sale of lip care formulations. It is a dynamic and competitive sector driven by both established beauty brands and emerging players.

This market includes a broad spectrum of products catering to different consumer needs, ranging from daily protection and hydration to specialized solutions for aging and sensitive lips.

The industry spans multiple sales channels, including online platforms, retail stores, and pharmacies, reflecting its wide consumer reach and adaptability to evolving purchasing behaviors.

Several key factors are driving the growth of the lip care products market. Rising consumer awareness of skincare and personal grooming has significantly increased demand for high-quality lip care solutions. Additionally, the growing prevalence of environmental factors, such as exposure to harsh weather and pollution, has heightened the need for protective lip products.

The introduction of innovative formulations, including organic, vegan, and cruelty-free options, aligns with the broader shift toward sustainability and health-conscious consumer preferences, further fueling market expansion.

The demand for lip care products is witnessing a consistent upward trajectory, driven by diverse consumer segments. Millennials and Gen Z are particularly influential, as they prioritize both functionality and aesthetics in their purchasing decisions. Seasonal fluctuations, such as increased product usage during colder months, also play a significant role in shaping demand patterns.

The lip care products market presents several promising opportunities for growth and innovation. The increasing penetration of e-commerce offers brands a direct channel to engage with consumers and expand their reach globally.

There is also significant potential in emerging markets, where rising disposable incomes and growing urbanization are driving demand for premium and specialized skincare products.

According to Gitnux, Inc., the lip care products market demonstrates strong consumer engagement, with the average person using 2-3 lip balms annually and owning approximately 4 products at any given time. Each product retails at an average price of $3.50.

Consumers, particularly those aged 18-34, are key to the market, as this demographic accounts for 60% of all lip balm purchases and 40% of overall spending. Medicated lip balms represent 20% of the total market, while Chapstick holds a dominant 20% share in the U.S. Additionally, 75% of women use lip balm regularly, compared to 50% of men, with consumers applying it 2-3 times per day.

According to SEC.gov, e.l.f. Beauty (NYSE: ELF) has signed a definitive agreement to acquire Naturium, a fast-growing skincare brand, for $355 million in a combination of cash and stock.

This acquisition, set to close by September 30, 2023, will significantly enhance e.l.f.’s skincare presence, increasing its retail market share to approximately 18%. This strategic expansion into skincare underscores the growing demand for high-performance beauty products, particularly in categories like lip care, where consumers are increasingly seeking multifunctional and effective solutions.

Key Takeaways

- The global lip care products market is set to grow from USD 2.5 billion in 2023 to USD 4.3 billion by 2033, with a CAGR of 5.8% during the forecast period.

- Lip Balm leads the product segment with a commanding market share of 67.8%.

- Hypermarkets & Supermarkets dominate distribution channels, holding 33.8% of the market share.

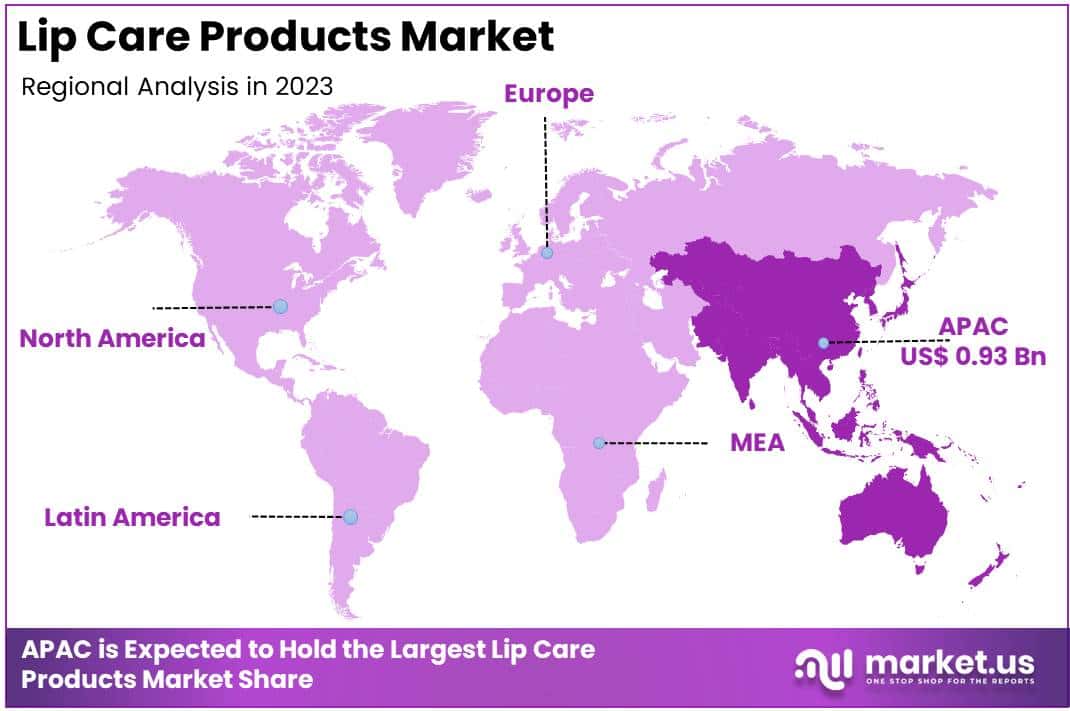

- Asia Pacific leads regional markets with a 37.2% share, driven by rapid urbanization and rising disposable incomes.

By Product Analysis

Lip Balm Dominating Segment in Lip Care Products with a Market Share of 67.8%

In 2023, Lip Balm secured a dominant market position within the Lip Care Products market, accounting for more than 67.8% of the total market share. This product category continues to thrive due to its essential role in daily skincare routines and widespread consumer preference for hydration and protection against environmental factors.

The growth is further supported by innovations in organic and medicated formulations, appealing to health-conscious consumers. Lip Scrub, while a smaller segment, is gaining traction as consumers increasingly prioritize exfoliation in their lip care regimen.

The growing popularity of beauty and self-care routines has fueled demand for lip scrubs, particularly among younger demographics. This segment is expected to see steady growth in the coming years as awareness around the benefits of exfoliating products continues to rise.

The Others category, encompassing a variety of specialized lip care products such as lip masks and lip oils, caters to niche markets. Though accounting for a smaller share of the market, this segment is characterized by innovation and premium offerings.

Consumers seeking targeted treatments and luxurious formulations drive growth in this segment, reflecting broader trends toward personalization and indulgence in skincare.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Dominating Distribution Channel in Lip Care Products with a Market Share of 33.8%

In 2023, Hypermarkets & Supermarkets held a dominant position in the Lip Care Products market, capturing over 33.8% of the total market share. These outlets remain the preferred choice for consumers due to their convenience, wide product variety, and frequent promotional offers.

The accessibility of both premium and budget-friendly lip care options under one roof continues to drive their strong performance.

Pharmacy & Drug Stores accounted for a significant portion of the market, serving as a trusted channel for medicated and dermatologist-recommended lip care products. This segment benefits from consumer reliance on professional advice and the availability of specialized treatments, driving consistent demand.

Specialty Stores cater to consumers seeking premium and niche lip care products. These outlets often emphasize curated selections, including organic, vegan, and luxury brands. Their focus on providing a personalized shopping experience positions them as a key player in the premium segment of the market.

The Online channel continues to experience rapid growth, driven by the increasing popularity of e-commerce and the convenience of home delivery. Offering a vast selection of products, competitive pricing, and detailed customer reviews, online platforms are gaining preference, particularly among tech-savvy and younger consumers.

The Others category, which includes kiosks, convenience stores, and direct sales, accounts for a smaller but essential share of the market. These channels provide flexibility and cater to specific consumer needs, particularly in regions where larger retail formats or online delivery may be less accessible.

Key Market Segments

By Product

- Lip Balm

- Lip Scrub

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy & Drug Store

- Specialty Store

- Online

- Others

Driver

Rising Consumer Awareness and Demand for Natural and Organic Lip Care Products

In recent years, there has been a significant shift in consumer preferences toward natural and organic lip care products. This change is largely driven by increased awareness of the potential health risks associated with synthetic chemicals commonly found in traditional lip care formulations.

Consumers are becoming more informed about the ingredients in their personal care products and are actively seeking options that are free from harmful substances such as parabens, phthalates, and synthetic fragrances.

This heightened awareness has led to a growing demand for lip care products made with natural and organic ingredients, which are perceived as safer and more beneficial for overall health.

The market has responded to this demand by introducing a variety of natural and organic lip care products. These products often feature ingredients like shea butter, coconut oil, and beeswax, which are known for their moisturizing and protective properties.

Additionally, the emphasis on sustainability and environmental responsibility has further propelled the popularity of these products, as consumers prefer brands that align with their values.

This trend is not only evident in developed markets but is also gaining traction in emerging economies, indicating a global shift toward more conscious consumerism. As a result, the lip care products market is experiencing growth, with natural and organic segments leading the way.

Restraint

Regulatory Challenges and Compliance Costs

The lip care products industry faces significant challenges due to stringent regulatory requirements imposed by health and safety authorities across various regions. These regulations are designed to ensure product safety and efficacy, necessitating rigorous testing and compliance procedures.

For manufacturers, adhering to these standards involves substantial financial investment in research and development, quality assurance, and certification processes.

The complexity of navigating different regulatory landscapes, especially for companies operating in multiple countries, can lead to increased operational costs and extended time-to-market for new products.

Moreover, the dynamic nature of regulatory frameworks, with frequent updates and revisions, requires continuous monitoring and adaptation by manufacturers. Non-compliance can result in severe penalties, product recalls, and damage to brand reputation, further emphasizing the importance of adherence.

For smaller companies and new entrants, these regulatory hurdles can be particularly burdensome, potentially limiting innovation and market entry. Consequently, while regulations are essential for consumer safety, they also pose a significant restraint on the growth and agility of the lip care products market.

Opportunity

Expansion into Emerging Markets

The global lip care products market presents substantial growth opportunities through expansion into emerging markets. Regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rapid economic development, leading to increased disposable incomes and a growing middle-class population.

This economic uplift is accompanied by heightened consumer awareness and demand for personal care products, including lip care items. Companies that strategically enter these markets can tap into a vast and relatively untapped consumer base, driving significant revenue growth.

To capitalize on this opportunity, businesses must tailor their products and marketing strategies to align with local preferences, cultural nuances, and purchasing behaviors. This may involve developing products that cater to specific climatic conditions, skin types, or aesthetic preferences prevalent in these regions.

Additionally, establishing robust distribution networks and partnerships with local retailers can enhance market penetration and brand visibility. By effectively addressing the unique needs of consumers in emerging markets, companies can not only expand their global footprint but also achieve a competitive advantage in the increasingly diverse lip care products industry.

Trends

Integration of Advanced Technologies in Product Development

The lip care products market is witnessing a notable trend toward the integration of advanced technologies in product development. Innovations such as encapsulation technology, which enhances the delivery and stability of active ingredients, are being increasingly adopted to improve product efficacy.

Additionally, the use of artificial intelligence and data analytics enables manufacturers to analyze consumer preferences and feedback, facilitating the creation of personalized lip care solutions. This technological advancement allows for the development of products that cater to specific consumer needs, such as long-lasting hydration, sun protection, or anti-aging benefits.

Furthermore, advancements in packaging technology are contributing to the trend of sustainable and user-friendly products. Eco-friendly materials and innovative designs that ensure product integrity and ease of use are becoming more prevalent.

The incorporation of smart packaging, which provides consumers with information about product usage and shelf life through digital means, is also emerging.

These technological integrations not only enhance the consumer experience but also enable companies to differentiate their offerings in a competitive market. As a result, the adoption of advanced technologies is playing a pivotal role in shaping the future of the lip care products industry.

Regional Analysis

Asia Pacific Leading Region in Lip Care Products with a Market Share of 37.2%

In 2023, the Asia Pacific dominated the global lip care products market, accounting for 37.2% of the total share, valued at approximately USD 0.93 billion. This leadership is driven by a combination of factors, including rapid urbanization, increasing disposable incomes, and a heightened focus on skincare.

The region benefits from a large, diverse consumer base, particularly in countries like China, India, and Japan, where demand for both basic and premium lip care products is on the rise. The growth of e-commerce and the popularity of natural and organic formulations further reinforce Asia Pacific’s dominance.

North America holds a significant position in the global lip care products market, supported by high consumer awareness regarding personal care and lip health. The region shows consistent demand for innovative and high-quality products, including medicated lip balms and SPF-infused lip care.

The United States, being the largest market in the region, contributes substantially to the growth, driven by a well-established retail infrastructure and strong promotional activities.

Europe represents a mature market for lip care products, with steady demand for premium and luxury brands. The region’s focus on sustainability and natural ingredients aligns with consumer preferences for eco-friendly and cruelty-free products.

Western Europe, in particular, demonstrates strong demand for organic lip care solutions, while Eastern Europe exhibits growth potential due to increasing consumer spending on personal care.

The Middle East & Africa region is an emerging market for lip care products, driven by rising disposable incomes and growing awareness of personal grooming. While the market share is relatively smaller compared to other regions, the demand for lip care products, particularly in urban centers, is on the rise.

Factors such as the harsh climate and increasing exposure to global beauty trends contribute to the growing adoption of lip balms and moisturizers. Latin America is witnessing growing demand for lip care products, fueled by expanding middle-class populations and increased spending on personal care.

Brazil and Mexico are key contributors to the regional market, with consumers showing a strong preference for moisturizing and protective lip care solutions. The region also presents opportunities for growth in the natural and organic product segments, driven by a rising awareness of health and wellness trends

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global lip care products market in 2024 is poised for intensified competition, driven by the strategic maneuvers of key players aiming to capture growing consumer demand for personal care and cosmetic products. L’Oréal S.A. and The Estée Lauder Companies, Inc. maintain leadership through their strong brand portfolios and premium positioning, leveraging innovation in skincare-infused lip care products.

Unilever and Beiersdorf AG, known for their mass-market appeal, are expected to benefit from their expansive distribution networks and focus on sustainability, which resonates with environmentally conscious consumers.

Adidas AG, while primarily a sportswear brand, has ventured into personal care, potentially expanding its footprint in lip care by targeting active, health-conscious users.

The Colgate-Palmolive Company and Johnson & Johnson are anticipated to capitalize on their expertise in health-centric products, promoting lip care offerings with therapeutic benefits. Shiseido Co., Ltd., with its focus on innovation and luxury, is well-positioned in Asia’s fast-growing markets, driving regional dominance.

The Procter & Gamble Company, renowned for its marketing prowess, may leverage data-driven consumer insights to enhance product personalization. Revlon, Inc. and Avon Products, Inc., with their emphasis on direct sales and color cosmetics, can gain competitive advantage by integrating lip care with beauty trends.

Collectively, these players are expected to shape the market through differentiation in product innovation, sustainability, and targeted marketing strategies, aligning with shifting consumer preferences and advancing digital platforms. This dynamic environment underscores the sector’s potential for sustained growth and transformation.

Top Key Players in the Market

- L’Oreal S.A.

- Unilever

- Beiersdorf AG

- The Colgate-Palmolive Company

- The Estée Lauder Companies, Inc.

- Johnson and Johnson

- Avon Products, Inc.

- Shiseido Co., Ltd.

- The Procter & Gamble Company

- Revlon, Inc.

Recent Developments

- In August 29, 2023, e.l.f. Beauty has agreed to acquire Naturium, a rising skincare brand, for $355 million in cash and stock. This move aims to expand e.l.f.’s skincare share to 18% of its retail sales. The deal is expected to close by September 30, 2023.

- In August 30, 2023, L’Oréal officially completed its acquisition of luxury beauty brand Aesop. CEO Nicolas Hieronimus expressed enthusiasm about leveraging Aesop’s unique appeal to drive growth, particularly in China.

- In July 29, 2024 Chipotle Mexican Grill teamed up with Wonderskin to launch a “Lipotle” guac-proof lip stain. The product, celebrating National Avocado Day, will be available online starting July 30, 2024, in select markets.

- In June 3, 2024, Yellow Wood Partners announced that Suave Brands Company, its portfolio firm, has acquired ChapStick from Haleon. As part of the deal, Haleon will retain a stake in Suave Brands.

Report Scope

Report Features Description Market Value (2023) USD 2.5 Billion Forecast Revenue (2033) USD 4.3 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Lip Balm, Lip Scrub, Other), By Distribution Channel (Hypermarkets and Supermarkets, Pharmacy and Drug Store, Specialty Store, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L’Oreal S.A., Unilever, Beiersdorf AG, The Colgate-Palmolive Company, The Estée Lauder Companies, Inc., Johnson and Johnson, Avon Products, Inc., Shiseido Co., Ltd., The Procter & Gamble Company, Revlon, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L’Oréal S.A.

- Unilever Plc

- The Estée Lauder Companies Inc.

- The Colgate-Palmolive Company

- Avon Products Inc.

- Johnson and Johnson

- Revlon Inc.

- The Procter & Gamble Company

- Other Key Players