Global Lighting Fixture Market By Source (Fluorescent, Incandescent, LED and OLED), By Product (Ceiling, Pendant and Chandeliers, Wall Mounted, Portable, Others), By Distribution Channel (Offline, Online), By Applications (Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139593

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

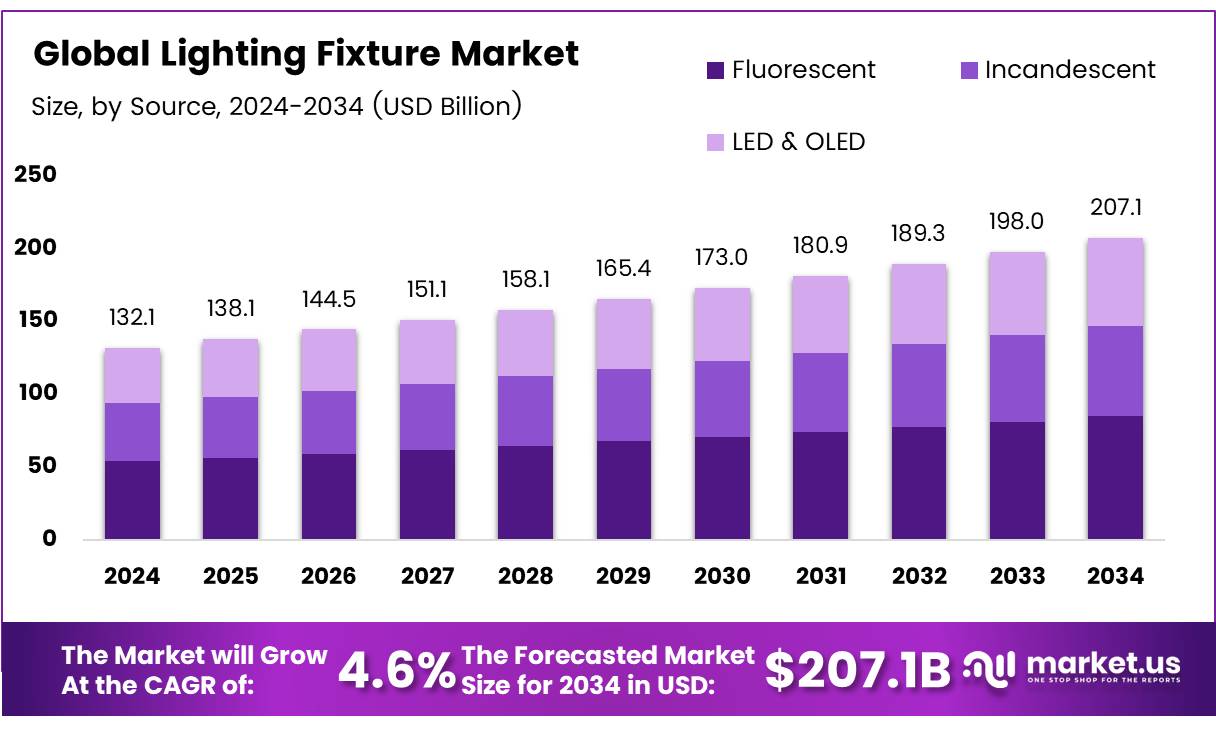

The Global Lighting Fixture Market size is expected to be worth around USD 207.1 Billion by 2034, from USD 132.1 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The lighting fixture market encompasses a broad spectrum of products designed for diverse applications across residential, commercial, and industrial sectors. Central to this market are the devices that house and support light bulbs, managing electrical connections and optimizing light distribution.

Modern market dynamics are increasingly influenced by technological advancements, particularly with the rise of energy-efficient solutions such as LED technology, which dominate discussions around sustainability and cost-effectiveness in lighting.

Market growth is primarily driven by urbanization and infrastructure development, with a notable shift towards smart lighting systems integrated with IoT technologies. This shift not only caters to enhanced energy efficiency but also opens avenues for innovative lighting solutions tailored to the contemporary demands of urban spaces.

The expansion of smart cities globally further augments the demand for advanced lighting fixtures that contribute to intelligent energy management systems.

The lighting fixture market is poised for significant growth, fueled by government investments and stringent regulations aimed at promoting energy efficiency. For instance, projections by the U.S. Energy Information Administration indicate a steady increase in electricity generation, expected to rise by 2% in 2025 and 1% in 2026, following a 3% growth in 2023.

Furthermore, regulatory frameworks such as the new standards proposed in the United Kingdom, which aim to increase the minimum energy performance for lighting to 120 Lumens per Watt (lm/W) by 2023 and 140 lm/W by 2027, set a global benchmark. These regulations not only encourage innovation in product design but also open market opportunities for manufacturers to lead in high-efficiency lighting technologies.

Government policies play a pivotal role in shaping the landscape of the lighting fixture market. Enhanced energy standards serve as a catalyst for technological advancements, compelling manufacturers to develop products that comply with increasingly rigorous efficiency criteria.

For example, according to Warehouse-Lighting, up to 91% of indoor illumination energy consumption in the commercial and industrial sectors comes from linear, low, and high bay lighting fixtures, highlighting the potential for energy-saving innovations in these areas.

The adoption of LED lighting, which converts approximately 95% of energy into light while losing just 5% as heat, exemplifies the shift towards more sustainable lighting options. These fixtures not only offer substantial energy savings but also have a longer lifespan, which, according to Lightco, can be up to 20 times that of traditional bulbs.

Key Takeaways

- Global Lighting Fixture Market projected to grow from USD 132.1 billion in 2024 to USD 207.1 billion by 2034, at a CAGR of 4.6%.

- Fluorescent lighting held a dominant 52.6% market share in 2024 due to cost-effectiveness and broad availability.

- Ceiling lights were the most popular product in 2024, capturing 60.5% of the market with their widespread use in various settings.

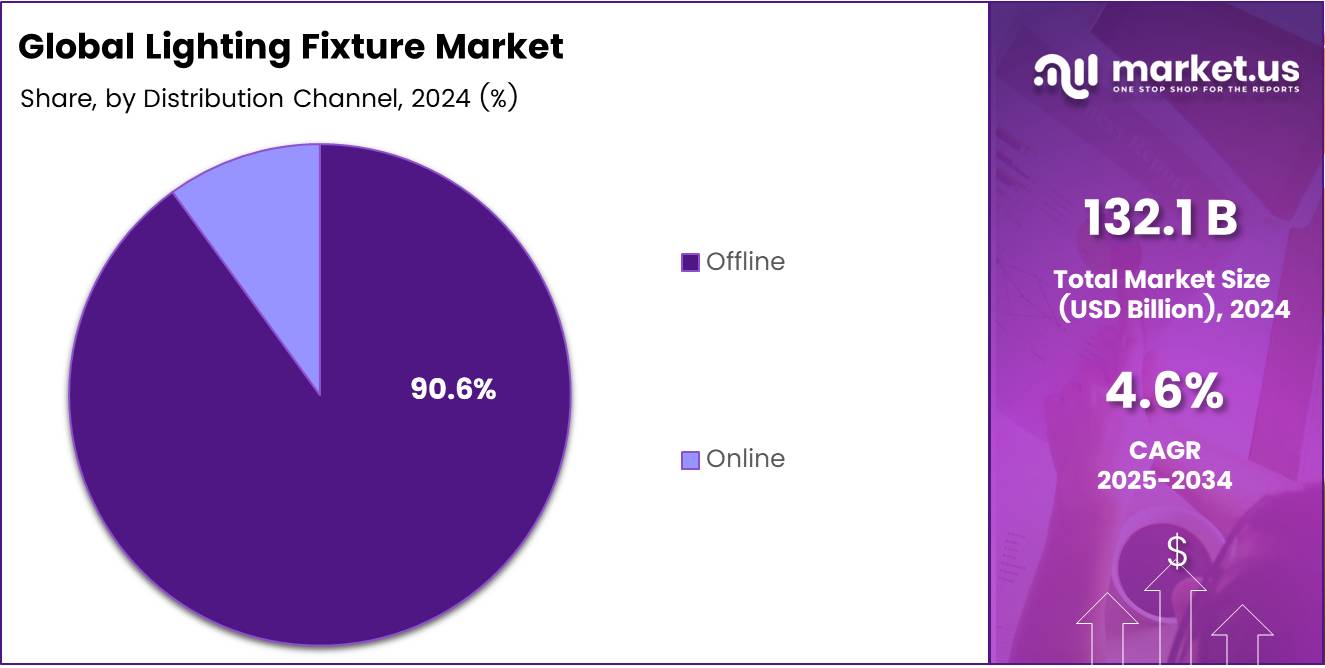

- Offline sales channels dominated the distribution in 2024, accounting for 90.6% of lighting fixture sales.

- Commercial applications led the market in 2024 with a 58.6% share.

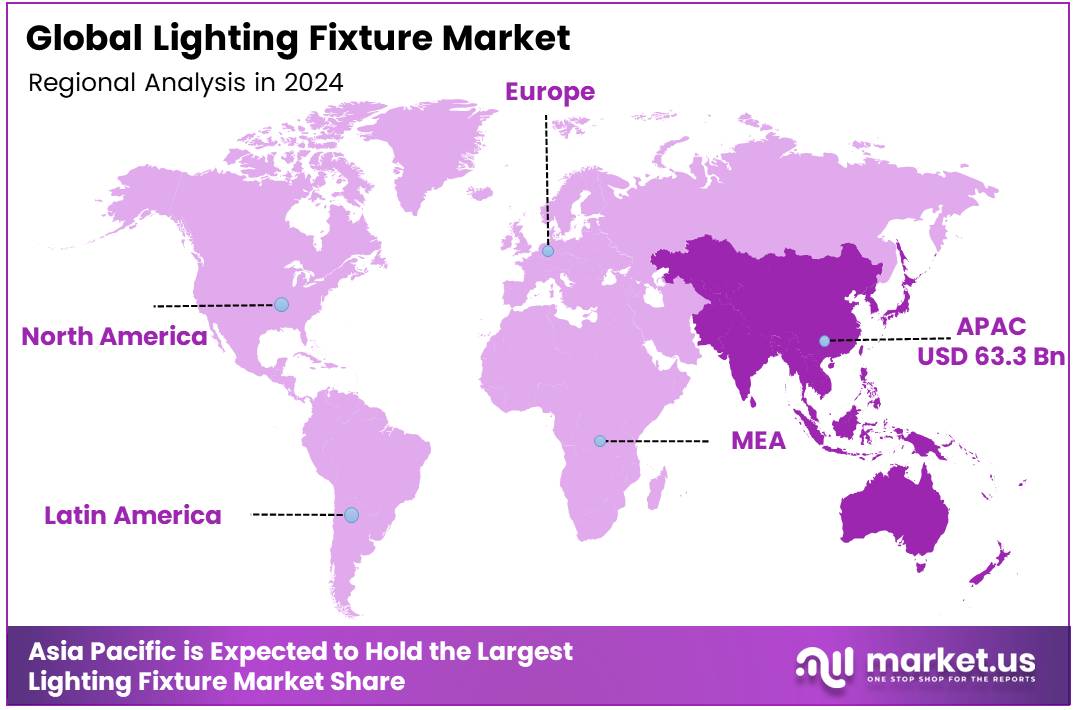

- Asia Pacific was the leading region in 2023 with 48.3% market share, driven by urbanization and energy-efficient lighting adoption.

Source Analysis

Fluorescent Shines Bright with a 52.6% Share in the Lighting Fixture Market

In 2024, the Lighting Fixture Market witnessed significant dominance by Fluorescent sources, holding a commanding 52.6% market share in the By Source Analysis segment. This segment’s resilience stems largely from the cost-effective nature and widespread availability of fluorescent fixtures, particularly in industrial and commercial applications.

Despite the growing environmental concerns and shift towards more energy-efficient technologies, fluorescent lighting remains a staple due to its relatively lower upfront costs and high luminous efficacy.

Incandescent lighting, although losing favor due to higher energy consumption and upcoming regulations restricting its use, continues to hold a niche market. It caters primarily to aesthetic applications where the warmth of the light is prized, such as in hospitality and residential settings.

Meanwhile, the LED & OLED segment is rapidly expanding. Technological advancements and a strong push for energy efficiency drive its growth. LEDs, known for their long lifespan and significant energy savings, are increasingly preferred for both new installations and retrofitting existing systems.

OLEDs, with their potential for flexible, thin, and efficient displays, are beginning to carve out a market in specialty applications, promising a future where they could potentially disrupt traditional market dynamics further.

These trends highlight the evolving landscape of the Lighting Fixture Market, where sustainability and efficiency are becoming increasingly important drivers of change.

Product Analysis

Ceiling Lights Illuminate the Lighting Fixture Market with a 60.5% Share

In 2024, the By Product Analysis segment of the Lighting Fixture Market saw Ceiling lights maintaining a dominant market position, holding a substantial 60.5% share. This category outshined others due to its versatile applications across residential, commercial, and industrial settings.

Ceiling fixtures, known for their ability to provide consistent and widespread illumination, have been the cornerstone in architectural and ambient lighting, driving their high adoption rate.

Pendant & Chandeliers, another significant category, brings aesthetic and functional value to spaces, yet it holds a smaller market slice compared to Ceiling due to its more decorative nature and higher price points. Wall Mounted lights, valued for their space-saving designs, serve well in corridors and residential exteriors, marking their own steady demand in the market landscape.

The Portable segment caters to the growing demand for flexibility and mobility in lighting solutions, particularly in outdoor and emergency applications. Despite its utility, it captures a lesser share due to the specificity of its applications compared to more permanently installed fixtures.

Other lighting fixtures, including specialized and niche applications, collectively account for the remainder of the market. Each of these segments addresses unique customer needs, contributing to a dynamic and evolving market ecosystem.

Distribution Channel Analysis

Offline Sales Continue to Brighten the Lighting Fixture Market with a 90.6% Share

In 2024, the By Distribution Channel Analysis segment of the Lighting Fixture Market was overwhelmingly dominated by offline sales channels, which captured a massive 90.6% market share. This substantial presence underscores the continued consumer preference for physical store purchases where customers can experience the quality, design, and illumination of lighting fixtures firsthand.

Brick-and-mortar stores—from large home improvement retailers to boutique lighting shops—provide the tactile feedback and immediate gratification that many consumers seek when making decisions about home and commercial lighting solutions.

Meanwhile, the online segment, although smaller, is gradually brightening its footprint in the market. With a 9.4% share, online sales are fueled by the growing comfort of consumers with e-commerce and the increasing effectiveness of online retail logistics.

This channel offers the convenience of home shopping and a broader range of products that might not be available locally. However, the experience gap, particularly in assessing the true look and feel of the products, continues to be a hurdle for greater market penetration.

The contrasting dynamics between these channels highlight a market in transition, with traditional purchasing methods still leading yet slowly integrating with digital advancements.

Applications Analysis

Commercial Dominates Lighting Fixture Market with 58.6% Share

In 2024, the By Applications Analysis segment of the Lighting Fixture Market was strongly led by the Commercial category, capturing a dominant 58.6% market share.

This significant hold is driven by continuous advancements in commercial infrastructure, including upgrades in office spaces, new commercial constructions, and enhancements in public facilities that demand robust and energy-efficient lighting solutions.

The commercial sector’s reliance on high-quality, durable lighting is essential for not only functional illumination but also for enhancing aesthetic appeal and meeting stringent energy regulations.

The Residential sector, while substantial, trails with a smaller share of the market. Home lighting trends, focusing on smart and energy-saving solutions, contribute to this segment’s growth, reflecting changing consumer preferences and technological innovations. Despite its lower share, residential lighting continues to be an integral part of the market, propelled by renovations and new housing developments.

The dominance of commercial applications underscores the broader market dynamics, where demand is fueled by both economic development and infrastructural investments.

Key Market Segments

By Source

- Fluorescent

- Incandescent

- LED & OLED

By Product

- Ceiling

- Pendant & Chandeliers

- Wall Mounted

- Portable

- Others

By Distribution Channel

- Offline

- Online

By Applications

- Commercial

- Residential

Drivers

Energy Efficiency Efforts Fuel Lighting Fixture Market Expansion

As an analyst observing the lighting fixture market, one can identify several key drivers propelling its growth. First and foremost, global initiatives aimed at reducing energy consumption have significantly increased the adoption of energy-efficient lighting fixtures.

This shift is largely due to heightened environmental awareness and the desire to cut energy costs, which encourage consumers and businesses alike to invest in advanced lighting solutions.

Additionally, the lighting fixture market is receiving a considerable boost from the ongoing expansion in real estate development. Both new constructions and renovations require modern lighting solutions, thus expanding the market.

Moreover, government regulations and incentives that promote the use of energy-saving products further support the adoption of eco-friendly lighting options. This regulatory landscape is crucial in guiding consumer and commercial behaviors towards more sustainable practices.

Lastly, there is a noticeable surge in consumer interest in aesthetic home decor, which now plays a significant role in driving the demand for stylish and contemporary lighting fixtures.

These fixtures are not only functional but also enhance the visual appeal of spaces, aligning well with current interior design trends. These market drivers collectively foster a robust growth environment for the lighting fixture industry, making it a dynamic and evolving sector.

Restraints

High Installation Costs Challenge Lighting Fixture Market Growth

As an analyst evaluating the lighting fixture market, it’s essential to consider not only the drivers but also the restraints that impact growth. One significant challenge facing the market is the high cost of installation associated with modern lighting systems. These initial expenses can be prohibitively expensive for many consumers and businesses, deterring them from upgrading to newer, more efficient lighting technologies.

This issue is particularly acute in settings where the cost-benefit ratio of installing advanced lighting does not immediately yield visible savings, thereby slowing down market penetration. Furthermore, market saturation in developed regions presents another substantial hurdle. In areas where advanced lighting solutions are already highly penetrated, there are limited opportunities for new sales.

This saturation leads to fierce competition among manufacturers and suppliers, often resulting in a race to offer lower prices, which can erode overall market profitability. These factors combined—high installation costs and market saturation in developed areas—form significant barriers that restrain the lighting fixture market’s expansion, especially in regions that have already embraced energy-efficient lighting solutions extensively.

Growth Factors

Smart Lighting and IoT Integration Open New Growth Avenues for the Lighting Fixture Market

The lighting fixture market presents several promising growth opportunities that can drive its expansion in the coming years. One of the most significant opportunities lies in the integration of smart lighting with the Internet of Things (IoT).

As technology advances, consumers and businesses are increasingly looking for lighting solutions that offer automation, remote control, and energy management through smart home systems and IoT-enabled devices. This trend not only enhances convenience but also helps in reducing energy consumption, making smart lighting an attractive investment.

Additionally, continuous innovations in lighting design provide another key opportunity for market players. Consumers today seek customizable and aesthetically pleasing lighting solutions that align with modern interior design trends.

By offering unique and adaptable designs, manufacturers can cater to evolving consumer preferences and create a strong market presence. Furthermore, strategic partnerships with construction and real estate firms present a valuable growth avenue.

Builders and architects are increasingly integrating advanced lighting solutions into new residential and commercial projects, creating a steady demand for modern fixtures. By collaborating with industry professionals, lighting companies can secure long-term contracts and expand their market reach. These factors together position the lighting fixture market for sustained growth, as innovation and strategic collaborations continue to shape its future.

Emerging Trends

Voice and Remote-Controlled Lighting Gain Popularity in the Lighting Fixture Market

The lighting fixture market is evolving rapidly, driven by several trending factors that are shaping consumer preferences and industry innovations. One of the most notable trends is the increasing demand for voice-activated and remote-controlled lighting systems.

Smart home technology has gained significant traction, with consumers preferring lighting fixtures that can be controlled through voice assistants like Alexa and Google Assistant or via mobile apps. This trend enhances convenience and energy efficiency, making smart lighting an integral part of modern homes.

Additionally, the market for outdoor and landscape lighting is expanding as more homeowners and businesses invest in aesthetically appealing and security-enhancing outdoor lighting solutions. From decorative garden lighting to motion-sensor security lights, outdoor fixtures are becoming a priority for consumers.

Another key trend driving market growth is the rebound of the hospitality sector. As hotels, resorts, and restaurants recover post-pandemic, there is a renewed focus on creating inviting and well-lit spaces using innovative lighting solutions. Modern, energy-efficient, and customizable lighting fixtures are being incorporated into hospitality designs to enhance guest experiences.

Furthermore, technological advancements like augmented reality (AR) are transforming the shopping experience for lighting fixtures. AR allows customers to visualize how different lighting options would look in their space before making a purchase, reducing uncertainty and improving satisfaction.

These trends collectively highlight the dynamic nature of the lighting fixture market, with technological advancements, consumer preferences, and industry recoveries playing a crucial role in shaping its future.

Regional Analysis

Asia Pacific Leads Global Lighting Fixture Market with 48.3% Share, Driven by Urbanization and Energy Efficiency Initiatives

The global lighting fixture market exhibits diverse dynamics across various regions, reflecting localized economic conditions, consumer preferences, and regulatory environments.

In 2023, Asia Pacific emerged as the dominant region in the lighting fixture industry, accounting for 48.3% of the market share and generating revenue of USD 63.3 billion. This significant market share is driven by rapid urbanization, infrastructural developments, and the increasing adoption of energy-efficient lighting solutions in countries such as China, India, and Japan.

Regional Mentions:

North America, with its robust demand for advanced and smart lighting solutions, also holds a substantial portion of the market. The region’s growth is bolstered by the increasing integration of IoT in lighting systems, which is popular among both residential and commercial users. Europe follows closely, with a focus on sustainable and eco-friendly lighting fixtures spurred by stringent regulations regarding energy consumption and environmental impact. The European market is characterized by high demand for LED fixtures that offer longer lifespans and lower energy usage.

The Middle East & Africa region is witnessing moderate growth due to the expanding construction sector, particularly in the Gulf Cooperation Council (GCC) countries, which are experiencing an increase in luxury and infrastructure projects. This region shows a growing preference for luxury lighting fixtures that complement its architectural advancements.

Latin America, although smaller in comparison, is experiencing growth in the lighting fixture market driven by gradual economic recovery and urbanization, particularly in countries like Brazil and Mexico. The region shows potential for increased adoption of cost-effective and energy-efficient lighting solutions due to rising energy costs and environmental awareness.

Collectively, these regional markets contribute to a global landscape where Asia Pacific not only leads in market share but also sets trends in technology adoption and energy efficiency, influencing global market strategies and product development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global lighting fixture market features several key players that are anticipated to drive industry trends and innovations. Koninklijke Philips N.V., a leader in health technology, is likely to continue its integration of advanced lighting solutions across healthcare environments, leveraging IoT connectivity for smart building applications. Cree, Inc., known for its innovations in LED technology, is expected to further penetrate the market with high-efficiency lighting solutions, emphasizing sustainability and reduced energy consumption.

OSRAM Licht AG, with its diversified portfolio, including automotive lighting and smart applications, is poised to expand its market share by capitalizing on the growing demand for intelligent lighting systems. Hubbell Incorporated is likely to focus on enhancing its product offerings in both residential and commercial sectors, improving user experience through adaptive lighting technologies.

Acuity Brands and Eaton Corporation are set to emphasize the development of integrated lighting solutions that incorporate both artificial intelligence and IoT capabilities, aiming to offer more adaptable and energy-efficient lighting systems. This approach not only responds to energy efficiency demands but also caters to the increasing preference for smart home and building automation technologies.

General Electric, with its extensive history and expertise in lighting solutions, is expected to innovate in the areas of LED and smart lighting solutions, maintaining its competitive edge by focusing on high-quality, durable products. Everlight Electronics and NICHIA CORPORATION will likely continue their focus on LED technology advancements, pushing the boundaries in terms of light output and efficiency.

Lastly, Panasonic Corporation is projected to enhance its lighting fixture offerings by integrating advanced electronic technologies, possibly expanding into new geographic markets to leverage its well-established brand reputation. This diverse array of companies, each with their own strategic focus, ensures a dynamic and competitive landscape in the global lighting fixture market in 2024.

Top Key Players in the Market

- Koninklijke Philips N.V.

- Cree, Inc.

- OSRAM Licht AG

- Hubbell Incorporated

- Acuity Brands

- Eaton Corporation

- General Electric

- Everlight Electronics

- NICHIA CORPORATION

- Panasonic Corporation

Recent Developments

- In June 2024, the home decor brand Trampoline secured a $5 million seed investment, with the funding round led by Matrix Partners and WaterBridge Ventures to bolster its market presence.

- In December 2023, Nestroots successfully secured INR 3 crore from Bestvantage Investments, marking a significant step forward in home decor innovation.

- In September 2024, HomeLane announced its intention to acquire Design Cafe, alongside raising $30 million in fresh funding to fuel its expansion strategies.

- In July 2024, Corvi LED successfully raised $8 million in a Series B financing round led by Enam Investments, aimed at accelerating product development and expanding market reach.

Report Scope

Report Features Description Market Value (2024) USD 132.1 billion Forecast Revenue (2034) USD 207.1 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Fluorescent, Incandescent, LED & OLED), By Product (Ceiling, Pendant & Chandeliers, Wall Mounted, Portable, Others), By Distribution Channel (Offline, Online), By Applications (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Koninklijke Philips N.V., Cree, Inc., OSRAM Licht AG, Hubbell Incorporated, Acuity Brands, Eaton Corporation, General Electric, Everlight Electronics, NICHIA CORPORATION, Panasonic Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Koninklijke Philips N.V.

- Cree, Inc.

- OSRAM Licht AG

- Hubbell Incorporated

- Acuity Brands

- Eaton Corporation

- General Electric

- Everlight Electronics

- NICHIA CORPORATION

- Panasonic Corporation