Global Furniture, Fixtures and Equipment Market By Product (Furniture, Fixtures, Equipment), By End Use (Hospitality, Offices, Hospital and Healthcare facilities, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139345

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

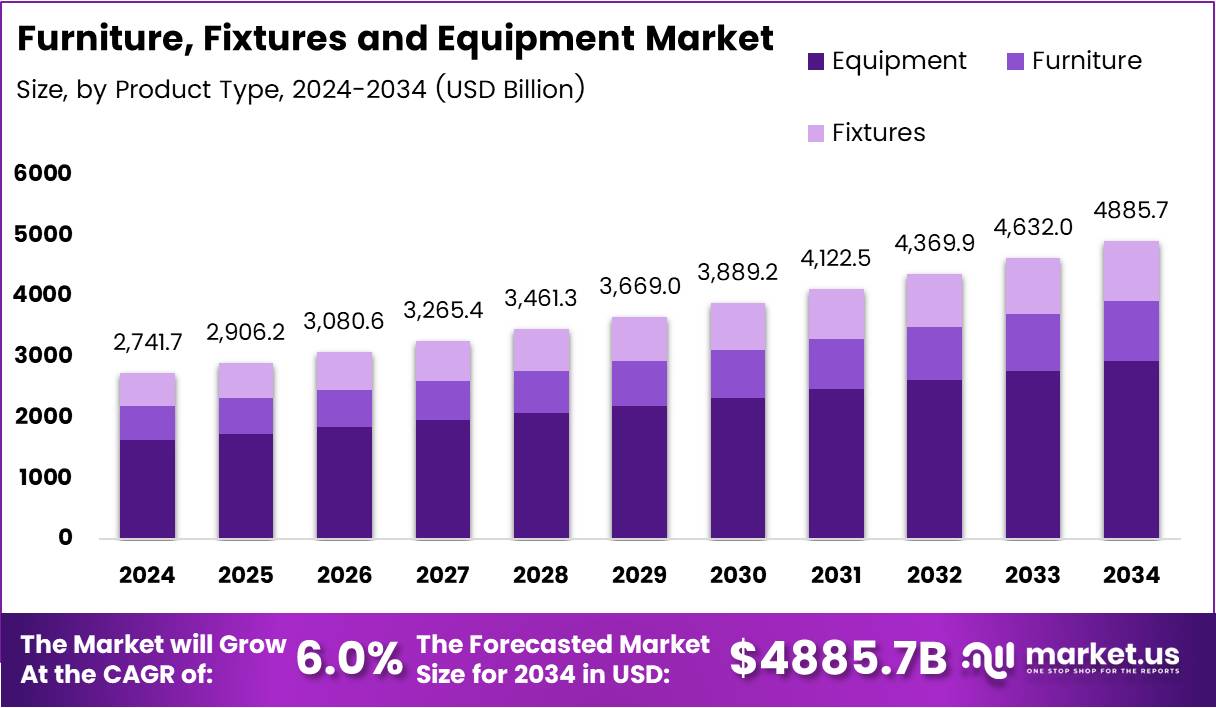

The Global Furniture, Fixtures and Equipment Market size is expected to be worth around USD 4,885.7 Billion by 2034, from USD 2,741.7 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

The Furniture, Fixtures, and Equipment (FF&E) market refers to the industry encompassing the manufacturing, distribution, and retail of furniture, fixtures, and related equipment. These goods play an essential role in both residential and commercial sectors. FF&E includes items such as chairs, tables, desks, lighting, shelving units, and other movable and non-permanent fixtures that enhance the functionality and aesthetic of a space.

The FF&E market serves various segments, including home furnishings, office equipment, hospitality, and educational institutions, among others. As consumer preferences evolve, there has been a growing demand for innovative, sustainable, and technologically integrated furniture solutions that meet both functional and aesthetic requirements.

The Furniture, Fixtures, and Equipment market has witnessed steady growth, driven by factors such as urbanization, an increase in disposable income, and the rising demand for modern, high-quality furnishings. Residential housing demand and the rapid expansion of the hospitality and office sectors are also fueling market expansion.

Additionally, consumer behavior is shifting toward customization, with consumers increasingly interested in eco-friendly furniture options. Governments across various regions are investing in infrastructure projects, which is expected to further boost the demand for FF&E, particularly in the hospitality, education, and healthcare industries.

Moreover, government regulations promoting sustainable manufacturing practices are helping to shape the market’s future trajectory, pushing for innovations in environmentally friendly materials and production methods.

According to Recent Study, UK households spent over £74.8 billion on furnishings, furniture, and other household equipment, including garden tools, in 2023. This highlights the growing importance of furniture spending in developed markets. In the U.S., consumer spending on furniture is also on the rise.

According to industry report, the majority of U.S. consumers are willing to spend between $501 and $1,000 on furniture in 2024, with 28% willing to spend between $1,001 and $2,500. Living room furniture in the U.S. is expected to be the largest segment in 2024, valued at $94.43 billion, showcasing the dominant consumer preference for furniture that enhances living spaces.

These statistics suggest that both the demand for and the willingness to invest in high-quality furniture are on the rise, providing ample opportunities for market participants.

Key Takeaways

- Global Furniture, Fixtures & Equipment market projected to reach USD 4,885.7 Billion by 2034 from USD 2,741.7 Billion in 2024, growing at 6.0% CAGR.

- Equipment segment dominated by product type in 2024 with a 70.4% share.

- Furniture Location segment led the market by location in 2024 due to increasing layout personalization.

- New Construction application held 76.8% share in 2024, driven by rising building projects.

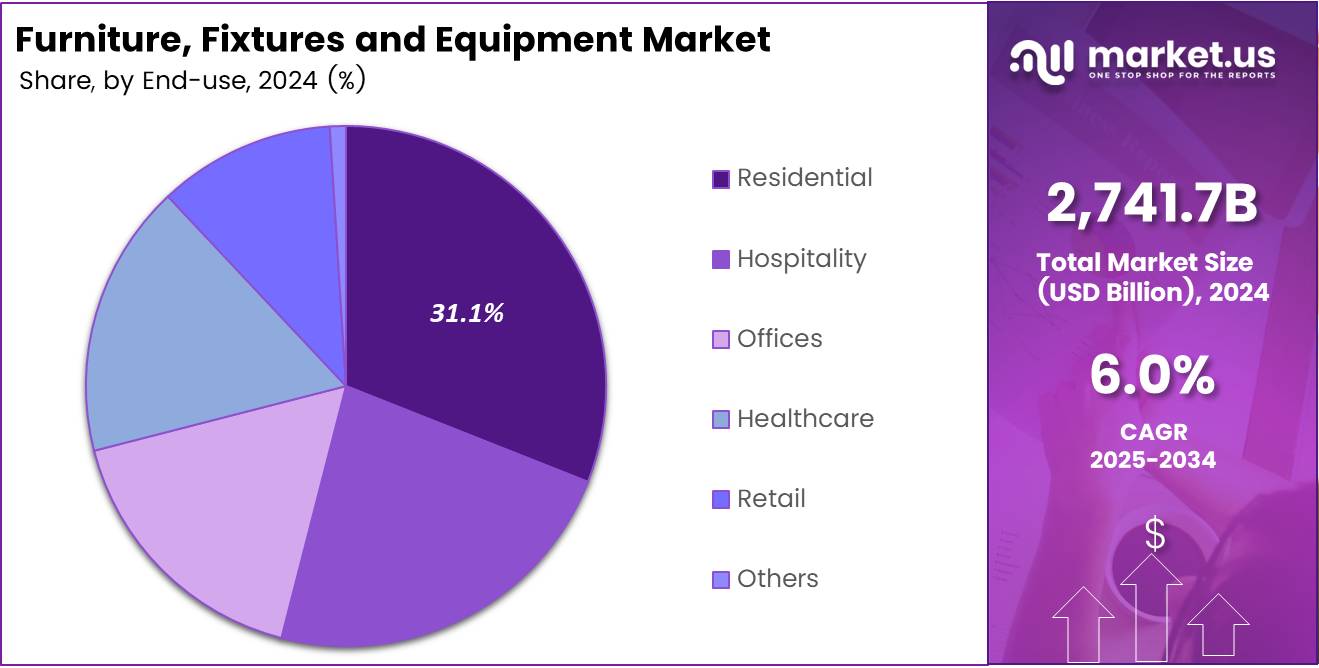

- Residential end-use accounted for 31.1% share in 2024, reflecting growth in home décor and lifestyle upgrades.

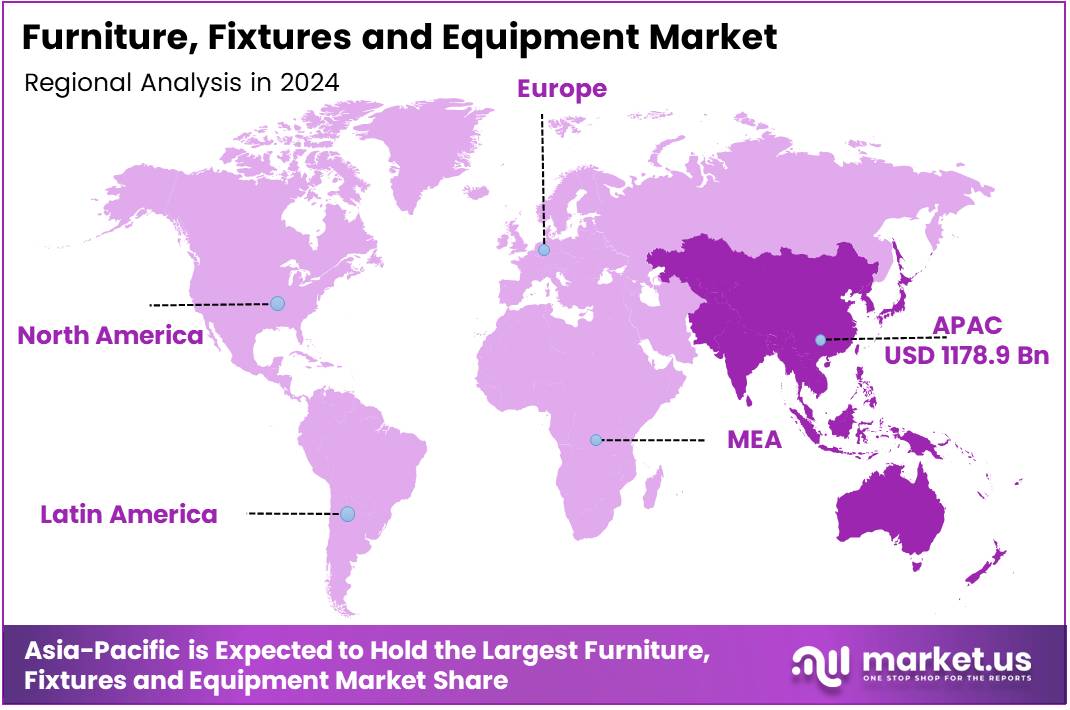

- Asia Pacific led the regional market with 43.3% share valued at USD 1178.9 Billion.

By Product Type Analysis

Equipment dominates with 70.4% due to its essential role in operational efficiency and functional setup.

In 2024, Equipment held a dominant market position in the By Product Type segment of the Furniture, Fixtures and Equipment Market, with a 70.4% share. This dominance stems from the rising demand for operational machinery and essential tools that support both residential and commercial infrastructures, enhancing functionality and user convenience.

Furniture remains a crucial segment, supporting aesthetic appeal and ergonomic comfort. The focus on innovative designs and material sustainability continues to shape its adoption. Manufacturers are introducing modular and multi-purpose furniture, making it suitable for evolving interior layouts across homes, offices, and hospitality spaces, thus maintaining consistent market relevance.

Fixtures contribute significantly to enhancing interior quality and lasting value. This segment benefits from increased attention to structural finishing and decorative detailing. As consumers and businesses emphasize better space utilization and visual appeal, fixtures provide essential support in modernizing environments, helping balance both practical utility and interior aesthetics.

By Location Analysis

Furniture Location leads the segment due to increasing interior customization and modular setup requirements.

In 2024, Furniture Location held a dominant role in the By Location segment. This positioning is supported by the rising priority for layout personalization across residential and commercial spaces. Flexible placement options and adaptable furniture products encourage unique interior arrangements, making this segment essential to effective space planning.

Lighting Fixtures Location contributes by elevating ambiance, safety, and energy efficiency. As lighting design becomes integral to indoor environments, this segment supports diverse needs, from mood-setting illumination to functional workspace lighting. Technological advances in smart lighting further expand adoption across various settings.

By Application Analysis

New Construction dominates with 76.8% driven by increasing development and infrastructure expansion.

In 2024, New Construction held a dominant market position in the By Application segment of the Furniture, Fixtures and Equipment Market, with a 76.8% share. Rising building projects across residential, commercial, and institutional sectors drive demand for integrated furnishing and equipment solutions from the early stages of property development.

Renovation & Redevelopment continues to grow as older structures and interiors undergo modernization. This segment thrives on the increasing preference for space upgrades, sustainability improvements, and aesthetic enhancements. Consumers and businesses are investing in optimized layouts and refreshed designs to improve utility, efficiency, and comfort levels.

End-use Analysis

Residential dominates with 31.1% supported by lifestyle upgrades and rising home improvement investments.

In 2024, Residential held a dominant market position in the End-use segment of the Furniture, Fixtures and Equipment Market, with a 31.1% share. Growing interest in home décor, functional furnishing, and personalized living spaces drives demand, supported by increasing urbanization trends and improved household spending.

Hospitality maintains significant growth due to the expansion of hotels, resorts, and dining spaces. Enhanced guest experiences and comfort-focused interior planning elevate demand for tailored furniture and fixtures that align with brand identity and ambiance expectations.

Offices experience steady demand as companies redesign workspaces for collaboration and productivity. Ergonomic furniture and flexible layouts support evolving workplace cultures, remote-work integration, and employee well-being considerations.

Healthcare relies on specialized furniture and equipment to support patient comfort, staff efficiency, and hygiene compliance. Increased healthcare infrastructure investment drives adoption of durable, functional, and safety-focused furnishing solutions.

Retail prioritizes visual merchandising and customer engagement. Fixture and furniture placement supports brand presentation and shopping flow, making the segment essential in shaping store environments.

Others include institutional, educational, and public facility applications, where standardized furnishing solutions support diverse functional needs and durability requirements.

Key Market Segments

By Product Type

- Equipment

- Appliances

- Electronic Devices

- Specialized Equipment

- Furniture

- Seating

- Tables & Desks

- Storage Units

- Bedroom

- Dining

- Others

- Fixtures

- Lighting Fixtures

- Ceiling

- Pendant & Chandeliers

- Wall Mounted

- Portable

- Others

- Plumbing Fixtures

- Bathtub & Shower Fixtures

- Sink Fixtures

- Toilet Fixtures

- Others

- Lighting Fixtures

By Location

- Furniture Location

- Interior

- Exterior

- Lighting Fixtures Location

- Interior

- Exterior

By Application

- New Construction

- Renovation & Redevelopment

By End-use

- Residential

- Family Houses

- Apartments

- Others

- Hospitality

- Hotels

- Resorts

- Restaurants

- Pubs, Bars & Cafe’s

- Others

- Offices

- Traditional Office

- Coworking Spaces

- Others

- Healthcare

- Private

- Government

- Charitable

- Retail

- Others

Drivers

Urbanization and Population Growth Boost Demand for Furniture and Fixtures

The furniture, fixtures, and equipment (FF&E) market is significantly driven by increasing urbanization and population growth, particularly in developing countries. As more people move to urban areas for better job opportunities and living conditions, the need for both residential and commercial furniture grows rapidly.

New housing developments, office spaces, and hospitality projects all require a variety of furniture and fixtures, making this sector a crucial part of urban expansion. The demand is not just for basic furnishings but also for more stylish, functional, and durable options, reflecting the preferences of the growing middle class in these regions. As cities grow and more people populate these areas, the demand for FF&E becomes more pronounced, making it a key driver of market growth.

Restraints

Raw Material Price Fluctuations and Supply Chain Issues Impact FF&E Market Stability

One of the main challenges facing the furniture, fixtures, and equipment (FF&E) market is the volatility in raw material prices. Key materials like wood, metal, and fabric are essential for production, and when their prices fluctuate unexpectedly, it can increase manufacturing costs, leading to higher prices for consumers and reduced profit margins for producers. This unpredictability can deter investments and slow down market growth, especially for smaller manufacturers who may not have the capacity to absorb these price increases.

Additionally, supply chain disruptions have become a significant restraint. Global supply chains are often affected by geopolitical tensions, natural disasters, or unforeseen events like pandemics, all of which can cause delays in the delivery of raw materials or finished products.

These disruptions not only affect production timelines but can also lead to shortages, further driving up costs and limiting the availability of key products. As a result, businesses in the FF&E sector are finding it increasingly difficult to maintain smooth operations, which hinders the overall growth and stability of the market.

Growth Factors

Smart Furniture Integration Opens New Growth Opportunities for FF&E Market

The furniture, fixtures, and equipment (FF&E) market has several exciting growth opportunities, especially as technological advancements reshape consumer needs. The integration of smart furniture is one of the key drivers, with products like desks that adjust height automatically or beds with built-in charging stations becoming increasingly popular.

The rise of IoT (Internet of Things) allows for more personalized and functional furniture, opening doors for tech-driven innovation. Another growth opportunity comes from the increasing demand for luxury and high-end furniture.

As incomes rise in emerging markets, there is a growing appetite for designer furniture and high-quality fixtures, creating a premium market segment. Additionally, the trend toward multi-functional furniture is gaining traction, especially in urban areas with limited living space.

Items such as foldable desks, convertible couches, and compact storage solutions are in high demand as consumers look for furniture that maximizes space while providing functionality.

Finally, expansion in developing regions represents a huge growth opportunity. The rise of the middle class in countries across Asia, Africa, and Latin America creates a massive untapped market for affordable, yet stylish furniture and home décor. As these regions continue to urbanize and improve their economic standing, demand for modern and practical FF&E will rise significantly, presenting both challenges and rewards for manufacturers.

Emerging Trends

Minimalist and Modern Designs Lead Current Trends in the FF&E Market

In the furniture, fixtures, and equipment (FF&E) market, several trends are shaping consumer preferences and driving growth. One of the most prominent trends is the demand for minimalist and modern furniture designs.

Simplified, clean lines and multi-functional pieces are particularly popular, especially in smaller living spaces where maximizing functionality is key. Along with this, sustainability is becoming a top priority for many consumers.

Eco-friendly materials such as sustainably sourced wood, recycled metals, and non-toxic fabrics are in high demand as people become more conscious of the environmental impact of their purchases. This shift is prompting brands to adopt greener practices and offer more sustainable options.

The rise of hybrid workspaces also significantly influences the market, as more people work from home or split time between office and home environments.

This has led to increased demand for ergonomic furniture, such as adjustable desks, comfortable chairs, and storage solutions that cater to home office needs. Additionally, 3D printing is emerging as a game-changer in furniture design. This technology allows for intricate and customized designs, enabling brands to offer unique, made-to-order pieces that meet individual preferences.

As these trends continue to evolve, manufacturers in the FF&E market must adapt to meet the changing demands of consumers who are seeking style, functionality, and sustainability in their furniture choices.

Regional Analysis

Asia Pacific Dominates the Furniture, Fixtures and Equipment Market with a Market Share of 43.3%, Valued at USD 1178.9 Billion

The Asia Pacific region holds the leading position in the Furniture, Fixtures and Equipment market, accounting for 43.3% of the global share and valued at USD 1178.9 Billion. Rapid urbanization, rising residential construction, and expanding commercial infrastructure development drive significant demand across the region. Growing disposable income and increasing interior renovation trends further support consistent market expansion. Additionally, strong manufacturing capabilities and cost-efficient production contribute to the region’s market dominance.

North America Furniture, Fixtures and Equipment Market Trends

North America demonstrates steady growth driven by rising refurbishment activities across residential and commercial spaces. Consumers in this region show strong preference for high-quality, durable, and ergonomic furniture and equipment. Additionally, sustainability-focused product innovation and smart office solutions further influence purchasing patterns in the market.

Europe Furniture, Fixtures and Equipment Market Trends

Europe’s market growth is supported by strong design-focused manufacturing and rising demand for contemporary home and office furnishings. Increasing emphasis on eco-friendly production and use of recyclable materials contributes to market expansion. The region also benefits from well-established infrastructure development and a mature consumer base prioritizing quality and aesthetics.

Middle East and Africa Furniture, Fixtures and Equipment Market Trends

The Middle East and Africa region is experiencing increasing market activity due to large-scale commercial and hospitality infrastructure developments. Rising urban migration and government initiatives toward smart city projects further enhance market opportunities. However, the market remains price-sensitive, with growth differing significantly between developed and developing economies within the region.

Latin America Furniture, Fixtures and Equipment Market Trends

In Latin America, market expansion is driven by increasing residential construction and the growth of the retail and hospitality sectors. Consumer preferences are evolving toward modern and multifunctional furniture solutions. Economic fluctuations may influence spending patterns, but gradual urbanization continues to support the market’s positive outlook.

U.S. Furniture, Fixtures and Equipment Market Trends

The U.S. market benefits from strong demand across corporate offices, educational institutions, and healthcare environments. Increased focus on ergonomic office furniture due to remote and hybrid work trends boosts product innovation. Furthermore, premium and customized furniture solutions are gaining traction among consumers seeking enhanced interior aesthetics and long-term durability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Furniture, Fixtures, and Equipment (FF&E) market in 2024 is seeing strategic leadership from several diversified multinational companies that blend design innovation with advanced technology.

Samsung Electronics Co., Ltd. is influencing the FF&E sector through its smart home ecosystem integration. By embedding connected technologies into household devices and interior environments, Samsung enhances consumer convenience and drives demand for tech-enabled furniture solutions. The company’s focus on interoperability and digital lifestyle alignment positions it strongly in modern residential and commercial spaces.

Inter IKEA Group remains a cornerstone of the FF&E market, supported by its global retail footprint and affordability-driven product strategy. IKEA’s modular, ready-to-assemble designs cater to diverse consumer preferences, while its sustainability initiatives help align with growing environmental expectations. The brand’s emphasis on functional aesthetics continues to shape mainstream interior trends.

LG Electronics Inc is contributing to the market by integrating AI, energy efficiency, and smart management systems into household and commercial equipment. LG’s portfolio expansion into smart furniture and ergonomic appliances reflects rising demand for connected living environments. Their R&D investments allow them to introduce solutions that balance performance with minimalist design appeal.

Haier Smart Home Co., Ltd. is accelerating digital transformation across FF&E through IoT-enabled home platforms. The company’s customization capabilities and focus on localized consumer needs strengthen its competitive advantage in varied global markets. Haier’s strategy prioritizes seamless user experiences and adaptive functionalities, supporting long-term market penetration in both emerging and developed regions.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- Inter IKEA Group

- LG Electronics Inc

- Haier Smart Home Co., Ltd.

- Panasonic Holdings Corporation

- Stryker Corporation

- Toto Corporation

- Koninklijke Philips N.V.

- Geberit AG

- Herman Miller, Inc.

- HNI Corporation

- Kohler Co.

- Elkay Manufacturing Company

- Ashley Global Retail, LLC

- Jaquar & Company Private Limited

- HYUNDAI LIVART Corporation

- Teknion Corporation

- Global Furniture Group

- Century Furniture LLC.

- Haworth International, Ltd

- Other Key Players

Recent Developments

- In October 2024, Furnishka raised Rs 27 Cr in a pre-Series A funding round, with IndiaQuotient leading the investment. The startup aims to enhance its product offerings and expand its presence in the competitive Indian furniture market.

- In September 2023, Pepperfry secured $23 million in fresh funding from its existing investors while simultaneously promoting Ashish Shah to the role of CEO. The investment is expected to fuel Pepperfry’s growth and innovation in the home furniture space.

- In December 2024, Wooden Street successfully raised 34 million euros in Series C funding, with Premji Invest leading the round. This funding will help Wooden Street accelerate its expansion plans and strengthen its position as a leading online furniture retailer.

- In March 2023, Cityfurnish, a furniture rental startup, raised $2.5 million in debt funding to bolster its operations. The company intends to use the funds to scale its offerings in the fast-growing rental space and improve customer service.

Report Scope

Report Features Description Market Value (2024) USD 2,741.7 Billion Forecast Revenue (2034) USD 4,885.7 Billion CAGR (2025-2034) 6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment, Furniture, Fixtures), By Location (Furniture Location, Lighting Fixtures Location), By Application (New Construction, Renovation & Redevelopment), End-use (Residential, Hospitality, Offices, Healthcare, Retail, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Samsung Electronics Co., Ltd., Inter IKEA Group, LG Electronics Inc, Haier Smart Home Co., Ltd., Panasonic Holdings Corporation , Stryker Corporation, Toto Corporation, Koninklijke Philips N.V., Geberit AG, Herman Miller, Inc., HNI Corporation, Kohler Co., Elkay Manufacturing Company, Ashley Global Retail, LLC, Jaquar & Company Private Limited, HYUNDAI LIVART Corporation, Teknion Corporation, Global Furniture Group, Century Furniture LLC., Haworth International, Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Furniture, Fixtures and Equipment MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Furniture, Fixtures and Equipment MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kimball International Inc.

- Global Furniture Group

- IKEA

- Teknion

- Century Furniture LLC.

- Haworth International, Ltd

- Steelcase Inc.

- Herman Miller, Inc.

- Stryker Medical

- Ashley Furniture Industries, Inc.