Global Assistive Furniture Market Size, Share, Growth Analysis By Product Type (Mobility Aids (Wheelchairs, Walkers), Adjustable Beds, Recliners and Lift Chairs, Grab Bars and Shower Chairs, Cushions and Supports, Transfer and Positioning Furniture, Ramps, Hospital Furniture), By End-Use (Homecare, Hospitals and Healthcare Facilities, Elderly Care Centers, Rehabilitation Centers), By Distribution Channel (Online Retail, Offline Retail, Direct Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139277

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

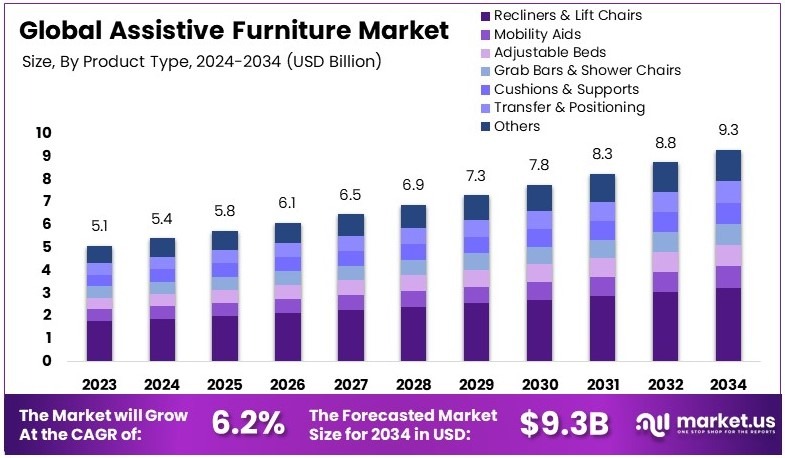

The Global Assistive Furniture Market size is expected to be worth around USD 9.3 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Assistive furniture includes specialized furniture designed to assist individuals with physical disabilities or impairments. It provides comfort and support for daily tasks such as sitting, standing, or eating. Examples include adjustable chairs, recliners, and accessible tables, helping individuals maintain independence and improve their quality of life.

The Assistive Furniture Market consists of products specifically created to aid people with physical disabilities. These items range from ergonomic chairs to specialized beds and other custom furniture solutions. The market caters to individuals seeking greater comfort and support in both home and healthcare environments.

The assistive furniture market is growing due to increased demand from aging populations and individuals with disabilities. According to the U.S. Bureau of Labor Statistics, the industry is expected to create over 236,500 new jobs in 2025, emphasizing its importance in healthcare and home decor. As such, opportunities in this market continue to expand.

Government initiatives have played a vital role in promoting the use of assistive furniture. For example, the U.S. General Services Administration (GSA) opened a 25,000-square-foot Workplace Innovation Lab in January 2023. This space allows federal employees to test modern furniture solutions designed to improve both individual and team productivity.

With an increasing focus on enhancing user comfort and smart mobility, assistive furniture meets a growing need across various sectors. As healthcare spending increases, so does the demand for specialized products that support individuals’ independence and comfort. This growing demand presents an opportunity for companies to expand their offerings and innovate new solutions tailored to diverse consumer needs.

However, the market faces challenges, including high production costs and the need for skilled artisans. Customizing furniture to meet specific needs can be expensive, limiting access for some consumers. Moreover, competition is increasing, as more companies enter the market, making it important to differentiate products based on quality, design, and functionality.

Key Takeaways

- The Assistive Furniture Market was valued at USD 5.1 Billion in 2024, and is expected to reach USD 9.3 Billion by 2034, with a CAGR of 6.2%.

- In 2024, Recliners & Lift Chairs dominate the product type segment with 35.2%, serving the growing demand for comfort and mobility aids.

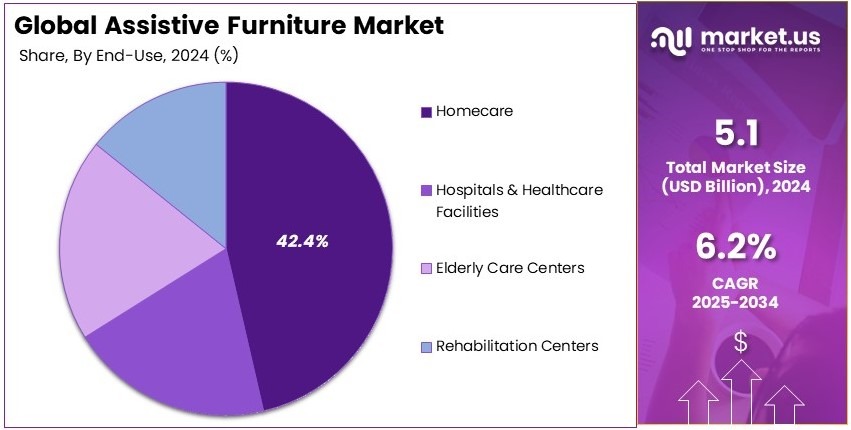

- In 2024, Homecare dominates the end-use segment with 42.4%, emphasizing the importance of in-home care solutions for the elderly and disabled.

- In 2024, Offline Retail leads the distribution channel segment with 43.2%, demonstrating a preference for physical shopping for assistive products.

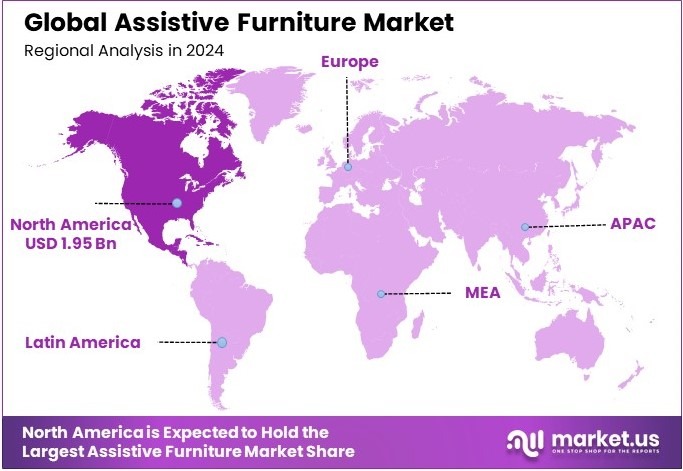

- In 2024, North America dominates the market with 38.2%, contributing USD 1.95 Billion due to the region’s aging population and healthcare needs.

Product Type Analysis

Recliners & Lift Chairs dominate with 35.2% due to high demand for comfort and ease of use in mobility assistance.

In the assistive furniture market, recliners & lift chairs hold the largest share, with a 35.2% market dominance. This growth is driven by the increasing demand for comfort and independence among individuals with limited mobility. These chairs are equipped with motors that help users sit down and stand up easily, which is a major benefit for elderly individuals or those recovering from surgery.

The demand for these products has seen a surge, particularly in regions with an aging population. For instance, in the U.S., the rising senior population significantly boosts the market for recliners and lift chairs. Moreover, their affordability and versatility make them attractive for both homecare and healthcare settings, contributing to their market leadership.

Other segments like adjustable beds, mobility aids (wheelchairs and walkers), and healthcare furniture also play important roles in the assistive furniture market. Adjustable beds, for example, offer comfort and support to individuals with chronic conditions or those recovering from surgery.

End-Use Analysis

Homecare dominates with 42.4% due to growing preferences for independent living and at-home healthcare solutions.

The largest share in the End-Use segment of the Assistive Furniture Market is held by Homecare, accounting for 42.4%. As more elderly individuals choose to live independently at home rather than in institutional care facilities, the demand for assistive furniture designed for home use has surged.

Products like mobility aids, adjustable beds, and recliners are essential in helping people with disabilities or mobility impairments maintain their independence at home. This shift toward aging in place, where seniors are provided with the necessary tools to live comfortably at home, has greatly driven the growth of this market segment.

Hospitals & Healthcare Facilities are vital for the assistive furniture market, though they represent a smaller portion of the market. The need for specialized furniture in these settings, such as hospital beds and transfer furniture, remains strong but is secondary to the increasing preference for homecare.

Elderly Care Centers and Rehabilitation Centers, which offer more focused care, also contribute to the market but do not match the scale of homecare services. These centers typically require a wide range of assistive products to support patients or residents, but their growth has been slower than that of homecare due to the rising trend of in-home care solutions.

Distribution Channel Analysis

Offline Retail dominates with 43.2% due to a preference for in-person shopping and product testing.

In the assistive furniture market, offline retail holds the dominant share with 43.2%. This dominance can be attributed to the preference many consumers have for in-person shopping, particularly when it comes to products like recliners, lift chairs, or mobility aids. Customers often prefer to test the products for comfort, durability, and ease of use before making a purchase.

Retailers, such as medical supply stores and specialized furniture outlets, provide an opportunity to experience the products firsthand, which can be reassuring for those purchasing assistive furniture for loved ones or themselves. Additionally, the personal interaction and guidance from store staff offer a level of customer service that online platforms cannot replicate.

While online retail is growing rapidly and accounts for 33.4% of the market, it cannot entirely replace the tactile experience and immediate gratification offered by offline retail. Online shopping may be convenient, but some consumers are still hesitant to purchase high-cost items without first trying them out in person.

Direct sales remain relevant for healthcare facilities and rehabilitation centers, which often place bulk orders directly from manufacturers or suppliers. However, this channel is smaller in comparison, focusing on large-scale purchases rather than individual consumer sales.

Key Market Segments

By Product Type

- Mobility Aids (Wheelchairs, Walkers)

- Adjustable Beds

- Recliners & Lift Chairs

- Grab Bars & Shower Chairs

- Cushions & Supports

- Transfer & Positioning Furniture

- Ramps

- Hospital Furniture

By End-Use

- Homecare

- Hospitals & Healthcare Facilities

- Elderly Care Centers

- Rehabilitation Centers

By Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

Driving Factors

Aging Population Drives Market Growth

The aging population is a key driver for the growth of the assistive furniture market. As the number of elderly individuals increases worldwide, there is a growing demand for solutions that can help them live independently.

Senior care solutions are essential to ensure that older adults can maintain their quality of life, and assistive furniture plays a crucial role in this. Items like lift chairs, adjustable beds, and other mobility aids are becoming increasingly popular as the elderly seek to stay in their homes for longer periods.

Additionally, as physical disabilities and mobility issues rise among older individuals, the demand for furniture designed to meet their specific needs continues to grow. These products provide comfort, safety, and convenience, which are vital for seniors and their families.

Moreover, technological advancements in ergonomic and adaptive furniture have made it easier for older adults to access solutions tailored to their needs. These innovations help improve posture, comfort, and overall well-being, making life easier for those who struggle with physical limitations. As the aging population continues to expand, these factors will drive the market for assistive furniture.

Restraining Factors

High Costs and Limited Awareness Restrain Market Growth

Despite the increasing demand, several factors are hindering the growth of the assistive furniture market. One of the main challenges is the high cost of assistive furniture and equipment. These products often require advanced materials, custom designs, and specialized features, which make them expensive. This cost barrier can limit their accessibility, particularly for individuals on fixed incomes or without sufficient financial resources.

In addition to the high costs, there is limited awareness about the various assistive furniture options available. Many people are unaware of the wide range of products that can support those with physical disabilities or mobility issues. This lack of knowledge makes it harder for consumers to make informed decisions about what’s best for their needs.

Furthermore, challenges in customization and adaptability add to the problem. Assistive furniture needs to be tailored to individual requirements, which can complicate production and increase costs. Not all products are easily adjustable for various needs, and some consumers may find it difficult to find the right fit. Lastly, the lack of insurance coverage for assistive furniture products makes them even more costly, as many individuals may not be able to afford them without financial assistance.

Growth Opportunities

Smart Furniture Solutions Provide Growth Opportunities

The assistive furniture market is ripe with opportunities for growth, particularly in the development of smart and connected solutions. As technology continues to advance, consumers are looking for furniture that offers more than just comfort and support.

Smart furniture, integrated with IoT and other technologies, can provide personalized assistance, making life easier for those with physical disabilities or elderly individuals who require ongoing care. These smart products can be connected to healthcare systems, enabling users to monitor their health, adjust furniture settings remotely, or receive alerts when assistance is needed.

In addition, the increasing investments in home healthcare and elderly care technologies open up new opportunities. With more people seeking to live independently in their homes, there is a growing demand for solutions that support this lifestyle.

Additionally, collaborations between furniture brands and healthcare providers can lead to more specialized products that meet the unique needs of individuals. These partnerships can help integrate medical and assistive furniture, making it easier for consumers to access both.

Emerging Trends

Smart, Sustainable, and Adaptive Solutions Are Latest Trending Factor

Several emerging trends are shaping the future of the assistive furniture market. One significant trend is the integration of IoT and smart technology for personalized assistance. Smart furniture solutions are gaining popularity for their ability to provide tailored support based on the user’s specific needs, offering comfort, convenience, and improved functionality. These technologies can adapt to individual preferences, making daily life more manageable for users.

Another growing trend is the focus on sustainable and eco-friendly materials in furniture production. Consumers are becoming more environmentally conscious, and furniture manufacturers are responding by incorporating green materials that reduce the environmental impact.

Additionally, multi-functional furniture is gaining popularity, particularly for individuals living in small spaces. Furniture that serves multiple purposes, such as convertible beds or chairs, helps maximize space while offering necessary assistance.

Lastly, there is an increasing emphasis on developing adaptive furniture for specific disabilities, such as autism or stroke. These specialized products cater to individuals with unique needs, providing them with better support and a higher quality of life. These trends reflect a shift toward more personalized, eco-conscious, and functional solutions in the assistive furniture market.

Regional Analysis

North America Dominates with 38.2% Market Share

North America holds a commanding 38.2% share of the Assistive Furniture Market, valued at USD 1.95 billion. This dominance stems from the region’s strong healthcare infrastructure, aging population, and a growing demand for furniture designed to improve mobility and comfort. The market is also fueled by high disposable income, which allows consumers to invest in customized solutions that enhance daily living.

Key factors contributing to North America’s market share include the rapid increase in the aging population, especially in countries like the United States and Canada. This demographic shift has led to higher demand for assistive products, such as mobility aids, adjustable beds, and specialized seating. Furthermore, the region’s well-developed healthcare system, along with a greater emphasis on patient care and home healthcare, creates a steady market for these products.

Regional dynamics like strong government healthcare initiatives and growing healthcare expenditure further support the market’s expansion. Companies in North America are focusing on innovation to cater to the diverse needs of consumers, which will likely boost the market in the coming years. As the trend towards aging in place continues, the demand for home-use assistive furniture is expected to rise significantly.

Regional Mentions:

- Europe: Europe is experiencing steady growth in the assistive furniture market, driven by its aging population and a growing awareness of elderly care. Countries like Germany and the UK have strong healthcare systems that support the adoption of assistive solutions in both home and healthcare settings.

- Asia Pacific: Asia Pacific is witnessing rapid growth, fueled by urbanization and the rising middle class. Countries like Japan and China are investing heavily in elderly care, which includes the demand for assistive furniture, creating new opportunities for manufacturers.

- Middle East & Africa: The Middle East and Africa are slowly adopting assistive furniture solutions, particularly in healthcare facilities and senior living communities. Investments in healthcare infrastructure and increased focus on elderly care drive demand for mobility aids and comfort solutions.

- Latin America: Latin America is growing in the assistive furniture market, driven by an increasing elderly population and growing awareness of healthcare needs. Countries like Brazil and Mexico are seeing higher demand for affordable assistive furniture solutions in both urban and rural areas.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Assistive Furniture Market is growing rapidly, driven by an aging population, increasing awareness of disabilities, and the rising demand for furniture that enhances accessibility and comfort. Top players like Stryker Corporation, Invacare Corporation, Drive DeVilbiss Healthcare, and Medline Industries lead this transformation.

Stryker Corporation is a prominent player in the assistive furniture market, offering a wide range of products such as hospital beds, chairs, and mobility aids. The company is recognized for its innovation in healthcare and assistive devices. Stryker’s focus on advanced medical technology, such as pressure-relieving mattresses and ergonomic furniture solutions, has helped it maintain its market leadership.

Invacare Corporation specializes in products for people with limited mobility, including home care furniture like adjustable beds, wheelchairs, and lifts. Invacare is committed to improving the quality of life for individuals with physical limitations by developing high-quality, affordable, and accessible furniture solutions. The company has a strong global presence, particularly in North America and Europe.

Drive DeVilbiss Healthcare is a major player in the medical equipment and assistive furniture market. Known for its broad product portfolio, including powered mobility aids, hospital beds, and seating systems, Drive DeVilbiss focuses on creating innovative solutions that promote patient comfort and safety. The company has a robust distribution network and continues to innovate with new product lines aimed at enhancing accessibility.

Medline Industries provides a variety of healthcare products, including assistive furniture. The company is a key player in the hospital and long-term care markets, offering items like adjustable beds, overbed tables, and recliners designed for patient comfort and mobility. Medline’s reputation for high-quality products and efficient distribution channels has helped it secure a strong position in the assistive furniture market.

These companies lead the Assistive Furniture Market by innovating solutions that enhance the lives of individuals with mobility challenges, focusing on comfort, safety, and accessibility. Their diverse product portfolios and global presence allow them to cater to a wide range of customer needs.

Major Companies in the Market

- Stryker Corporation

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Medline Industries

- Pride Mobility Products Corporation

- Ottobock

- The Help-U-Sit Company

- Vermeiren Group

- GF Health Products

- EZ-ACCESS

- Axxess Industries

- SpinLife

Recent Developments

- Oak Tree Mobility & Parker Knoll: On January 2025, Parker Knoll debuted its first-ever adjustable bed, The Clifton, exclusively through Oak Tree Mobility. The five-point adjustable bed features Chesterfield-style detailing and enhances circulation with a 40st weight capacity. This collaboration builds on their May 2024 rise-and-recline chair launch, aimed at luxury and accessibility.

- Remsen: On August 2024, design firm Remsen launched a range of high-end assistive products, including a $215 pill container and $295–$445 wall-mounted grab bars. The grab bars eliminate bulky flanges, while the pill container seamlessly integrates into home décor. Remsen plans to expand its offerings to include walkers and shower chairs, with the goal of rebranding geriatric goods as luxury home products.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 9.3 Billlion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mobility Aids (Wheelchairs, Walkers), Adjustable Beds, Recliners and Lift Chairs, Grab Bars and Shower Chairs, Cushions and Supports, Transfer and Positioning Furniture, Ramps, Hospital Furniture), By End-Use (Homecare, Hospitals and Healthcare Facilities, Elderly Care Centers, Rehabilitation Centers), By Distribution Channel (Online Retail, Offline Retail, Direct Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stryker Corporation, Invacare Corporation, Drive DeVilbiss Healthcare, Medline Industries, Pride Mobility Products Corporation, Ottobock, The Help-U-Sit Company, Vermeiren Group, GF Health Products, EZ-ACCESS, Axxess Industries, SpinLife Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stryker Corporation

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Medline Industries

- Pride Mobility Products Corporation

- Ottobock

- The Help-U-Sit Company

- Vermeiren Group

- GF Health Products

- EZ-ACCESS

- Axxess Industries

- SpinLife