Global Leather Sofa Market By Type Analysis (Full-grain Leather Sofa, Top-grain Leather Sofa, Bonded Leather Sofa), By Application Analysis (Household, Commercial), By Distribution Channel Analysis (Hypermarkets/supermarkets, Specialised Stores, Online Retail, Others) , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: November 2024

- Report ID: 16647

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

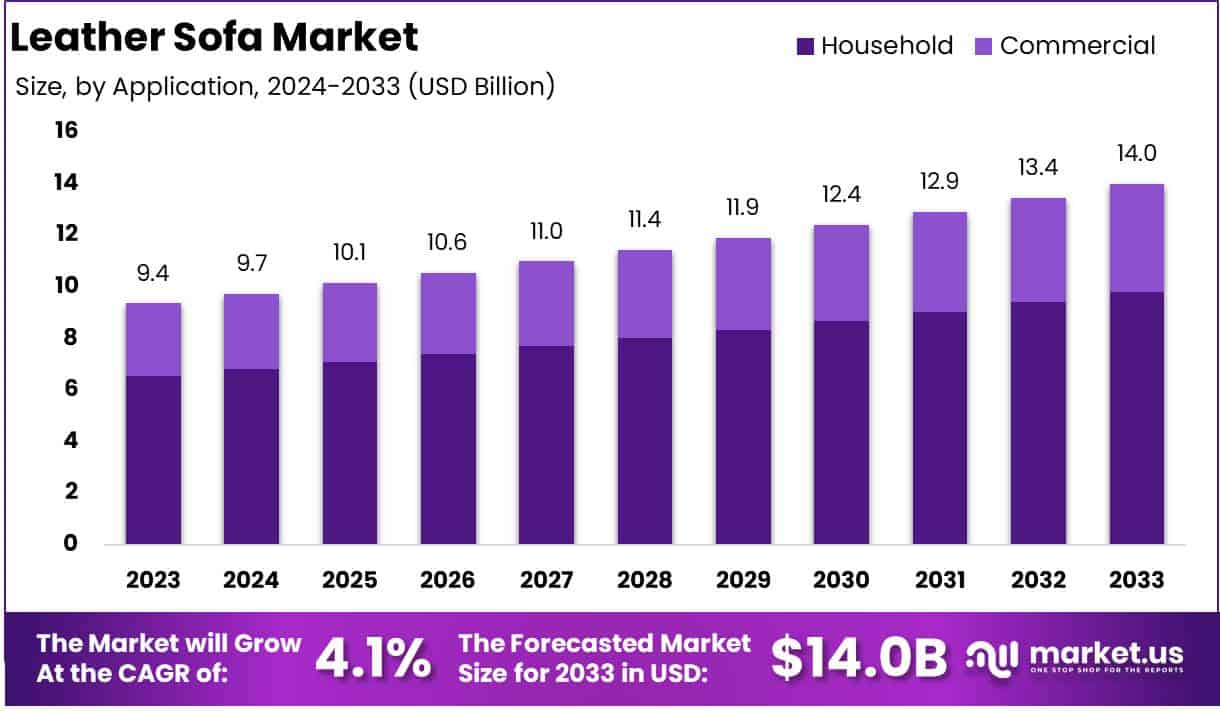

The Global Leather Sofa Market size is expected to be worth around USD 14.0 Billion by 2033, from USD 9.4 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033.

A leather sofa is a type of seating furniture upholstered in leather, valued for its durability, premium look, and feel. Leather, a natural material sourced from animal hides, is processed through tanning and finishing to make it resilient and soft, ideal for household and commercial furniture.

Leather sofas are known for their longevity, comfort, and timeless aesthetic, often available in various finishes and grades, including genuine leather, top-grain leather, and synthetic options like faux or bonded leather. These sofas are designed to fit a range of interior styles, from classic and rustic to modern and minimalist, and are typically associated with a sense of luxury and sophistication.

The market is part of the broader furniture industry and involves stakeholders such as manufacturers, suppliers, designers, and retailers. Key regions for the leather sofa market include North America, Europe, and the Asia-Pacific, where demand for premium home furnishings continues to rise.

The market is influenced by factors such as consumer income, interior design trends, and evolving lifestyles that drive demand for high-quality and comfortable home furnishings.

Several growth factors propel the leather sofa market. Rising disposable incomes and a growing inclination toward luxury and premium home decor significantly boost demand for high-quality leather sofas. Urbanization and the development of high-income residential spaces, particularly in emerging economies, have also created a strong demand for premium home furniture.

Furthermore, leather sofas’ appeal as durable, easy-to-maintain, and aesthetically pleasing furniture options makes them attractive to consumers prioritizing long-term investments in home furnishings. Additionally, a growing trend in remote working and increased time spent at home have prompted consumers to enhance their living spaces, further stimulating market growth.

Demand for leather sofas is rising globally, particularly in markets where consumers have greater purchasing power and interest in high-end home furnishings. Consumers view leather sofas as a stylish yet practical choice, offering a blend of aesthetics, durability, and ease of maintenance, which is highly valued in both residential and commercial spaces.

Additionally, the customization options available for leather sofas from color and finish to sectional configurations—add to their appeal, allowing consumers to personalize their furniture choices. The increased emphasis on home aesthetics and functional interior design also drives demand, with retailers noting a growing preference for versatile leather furniture that complements diverse interior styles.

Significant opportunities exist within the leather sofa market, particularly in the premium segment and sustainable product lines. Innovations in leather manufacturing, such as eco-friendly tanning processes and the use of vegan and recycled leather, align with growing consumer awareness about sustainability. This trend opens avenues for manufacturers to tap into eco-conscious consumers seeking luxury furniture with minimal environmental impact.

Furthermore, the expansion of e-commerce and online furniture platforms presents an opportunity to reach a wider consumer base. By leveraging online channels, brands can showcase their leather sofa offerings and engage directly with consumers, offering tailored shopping experiences and expanding their market footprint in new geographic regions.

According to Idus Blog, Italian leather is renowned for its high standards and exceptional quality in leather sofas, with an optimal thickness between 1.0 mm and 3.5 mm. This range supports sophisticated, durable designs without compromising softness, aligning with consumer demand for both luxury and comfort in home furnishings.

According to Plant Services, Ashley Furniture Industries is set to bolster the Leather Sofa Market with a significant investment. The company plans to expand its operations in Lee County, Mississippi, investing $80 million and creating 500 new jobs. This expansion includes the renovation of a facility in Verona and the enhancement of mattress production in Saltillo, showcasing a strategic move to increase production capabilities and meet growing market demand.

Key Takeaways

- The Global Leather Sofa Market is projected to reach approximately USD 14.0 billion by 2033, up from USD 9.4 billion in 2023, with an expected compound annual growth rate (CAGR) of 4.1% from 2024 to 2033.

- Top-grain leather sofas dominate the market type segment, holding a 41% share, attributed to their optimal balance of quality, durability, and cost-efficiency.

- The household sector leads with a 70% share, driven by a preference for durable and stylish home furniture.

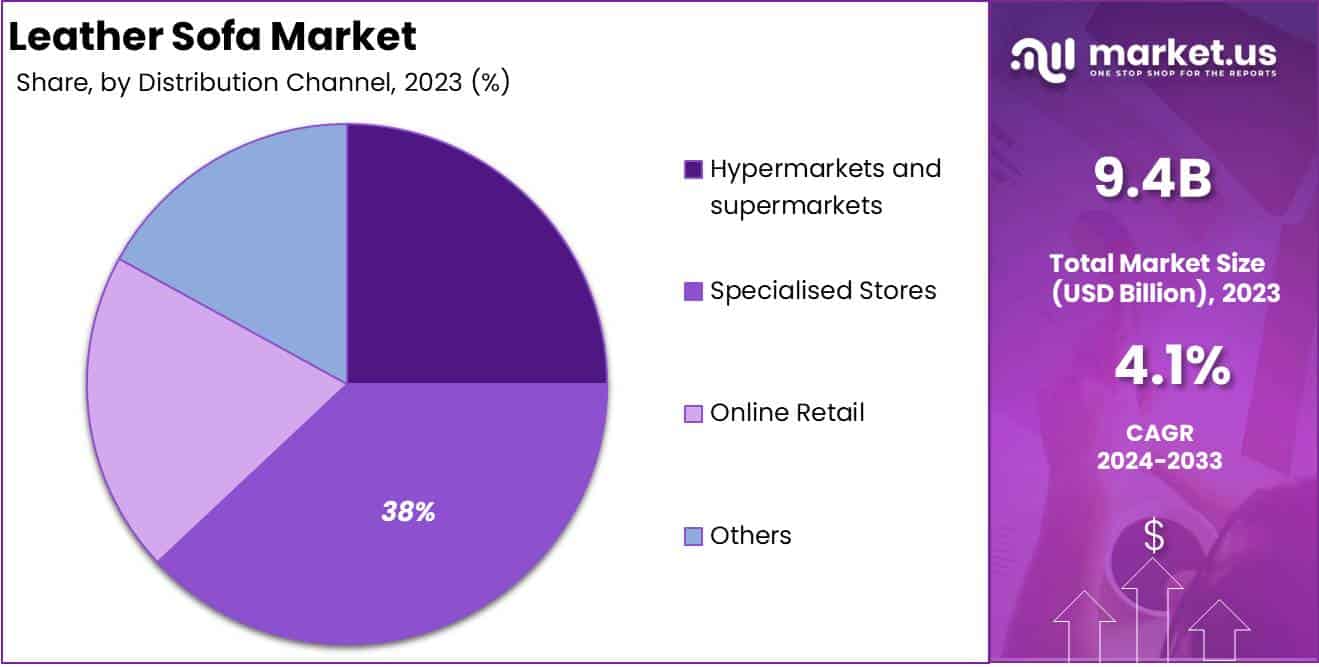

- Specialized stores are the leading distribution channel, capturing 38% of the market, offering personalized shopping experiences and product expertise.

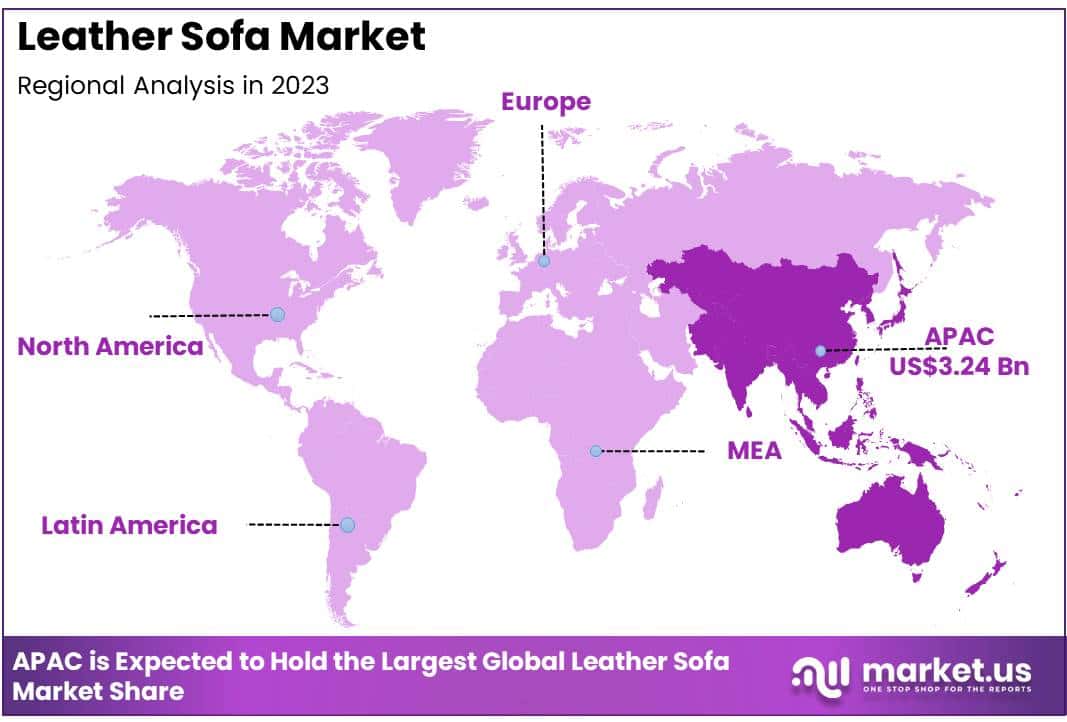

- The Asia-Pacific region leads the market with a 34.7% share, propelled by rapid urbanization, increased income levels, and a robust manufacturing base.

By Type Analysis

Top-grain Leather Sofa Leading Segment in Leather Sofa Market with 41% Market Share

In 2023, the Top-grain Leather Sofa held a dominant market position in the leather sofa market by type, capturing over 41% of the total market share. This segment’s leading status is attributed to the balance it offers between quality, durability, and affordability.

Top-grain leather sofas appeal to a broad customer base seeking luxury seating options with enhanced durability and a refined appearance, yet at a price point lower than full-grain leather. As consumer preferences increasingly shift toward value-based premium products, the demand for top-grain leather sofas is anticipated to remain robust.

The Full-grain Leather Sofa segment accounted for approximately 33% of the market share in 2023, positioning itself as the premium choice within the leather sofa market. Full-grain leather sofas are distinguished by their superior quality, natural texture, and longevity, making them highly desirable for high-end buyers who prioritize authenticity and durability.

This segment is primarily driven by consumers with a preference for luxury interiors and high-end craftsmanship, supporting its steady growth trajectory as demand rises in the upscale residential and hospitality sectors.

In 2023, Bonded Leather Sofas held a 26% share of the leather sofa market. Positioned as a value-oriented option, this segment appeals to budget-conscious consumers who desire the aesthetic appeal of leather without the high cost.

Bonded leather sofas, made from reconstituted leather materials, provide a cost-effective alternative for customers with modest budgets. Although it lacks the durability of full-grain or top-grain leather, this segment remains popular in regions and consumer groups prioritizing affordability over longevity.

By Application Analysis

Household Segment Leading Segment in Leather Sofa Market with 70% Share in 2023

In 2023, the Household segment held a dominant market position in the application segment of the Leather Sofa Market, accounting for more than 70% of the total market share. The widespread demand for leather sofas in households is driven by a growing preference for durable, aesthetically pleasing furniture that adds a premium touch to home interiors.

Households increasingly favor leather sofas for their longevity, ease of maintenance, and timeless style, further supported by rising disposable incomes and a global trend towards home renovation and decor. This segment is expected to sustain its leading position as consumers continue to prioritize high-quality, comfortable, and visually appealing furniture for their living spaces.

The Commercial segment, accounting for around 30% of the leather sofa market share in 2023, also reflects significant growth potential. Leather sofas are popular across commercial settings, including offices, hotels, lounges, and restaurants, where they add a luxurious yet professional touch to interiors.

Increased investments in hospitality, co-working spaces, and upscale corporate environments are fueling demand for leather sofas due to their reputation for sophistication, durability, and ease of maintenance.

As businesses continue to invest in elevating their interiors for customer and employee experiences, the commercial segment is projected to gradually increase its market share, leveraging the functional and aesthetic advantages of leather furnishings.

By Distribution Channel Analysis

Specialized Stores Leading Segment in Leather Sofa Market with 38% Share in 2023

In 2023, Specialized Stores held a dominant position in the leather sofa market by distribution channel, capturing more than 38% of the total market share. These stores are a preferred choice for consumers seeking a high-touch shopping experience where they can view, test, and receive personalized advice on premium leather sofa selections.

The expertise offered by specialized stores and the ability to physically experience the product quality play a significant role in driving sales. As consumers continue to value the in-store experience for high-investment purchases like leather sofas, this segment is expected to maintain its leading market position.

The Hypermarkets/Supermarkets channel holds approximately 25% of the leather sofa market share. These retail spaces appeal to budget-conscious customers who value convenience and accessibility.

Although they may not offer the same level of product specialization as dedicated furniture stores, hypermarkets and supermarkets are increasingly adding furniture sections to cater to demand for affordable leather sofa options. With their large customer base and frequent foot traffic, this channel is positioned for steady growth, especially in regions with expanding urban populations.

Online Retail accounted for about 22% of the leather sofa market in 2023, reflecting robust growth driven by the convenience and extensive selection offered through digital platforms. Online channels appeal to tech-savvy consumers who prefer the ease of comparing products, reading reviews, and accessing exclusive deals.

Enhanced delivery and return policies, along with virtual room visualization tools, have further increased consumer confidence in purchasing furniture online. As digital adoption continues to grow, online retail is anticipated to capture an increasing share of the market.

The Other distribution channels collectively held around 15% of the leather sofa market in 2023. This category includes a range of distribution methods, such as furniture exhibitions, direct-to-consumer (DTC) sales, and independent distributors.

Although smaller in share compared to mainstream channels, these options provide alternative points of access for consumers, particularly in niche or custom furniture markets. With growing interest in unique and customized pieces, other channels may gradually increase their presence in the market.

Key Market Segments

By Type

- Full-grain Leather Sofa

- Top-grain Leather Sofa

- Bonded Leather Sofa

By Application

- Household

- Commercial

By Distribution Channel

- Hypermarkets/supermarkets

- Specialised Stores

- Online Retail

- Others

Driver

Rising Demand for Premium Home Decor and Aesthetic Appeal

The global leather sofa market is witnessing significant growth, driven by the increasing consumer demand for premium home décor products. Leather sofas have become a popular choice due to their luxurious appeal, durability, and versatility, catering to a growing consumer preference for high-end, long-lasting furniture.

As more individuals invest in enhancing their home environments, particularly in urban areas, leather sofas are viewed as an ideal choice for both aesthetics and comfort.

The trend toward modern, minimalist, and sophisticated interiors has further elevated the demand for leather sofas, which blend seamlessly into various décor themes.

Additionally, the shift to remote work arrangements has led homeowners to spend more time at home, fueling investments in quality furniture that promotes comfort and reflects personal style. This shift has increased the demand for leather sofas, as they are perceived as a long-term, high-value purchase.

Furthermore, rising disposable incomes and changing consumer lifestyles, especially in emerging economies, have expanded the market for leather sofas. A growing middle-class population with higher purchasing power is increasingly inclined toward luxury products, with leather furniture seen as an aspirational item that enhances living standards.

Leather’s reputation for sophistication and its association with status contribute to its appeal among affluent consumers, who prioritize both style and quality in home furnishings.

The leather sofa market is expected to benefit from this continued emphasis on premium aesthetics and durable investments, making it a lucrative segment for manufacturers focusing on the premium furniture market. This demand surge, spurred by lifestyle shifts and economic factors, is a major driving force for the leather sofa market’s sustained growth trajectory through 2024 and beyond.

Restraint

Environmental and Ethical Concerns Over Leather Production

Despite growing demand, the leather sofa market faces significant restraints from environmental and ethical concerns associated with leather production. The leather industry is frequently scrutinized for its environmental impact, particularly the high water consumption, chemical use, and carbon emissions involved in tanning processes.

Additionally, leather production contributes to deforestation and animal welfare issues, as it relies on cattle farming, which has a substantial ecological footprint.

As consumers become more environmentally conscious, there is a growing reluctance to purchase products associated with unsustainable practices. Many consumers today are prioritizing eco-friendly and cruelty-free products, opting for alternative materials over traditional leather. This shift in consumer attitudes has led some to reconsider leather furniture, including sofas, potentially slowing market growth.

Moreover, regulatory pressures in various countries are increasing, with governments implementing stricter guidelines on emissions and waste management for industries including leather manufacturing.

The push for sustainable practices is compelling manufacturers to adopt more eco-friendly processes, which, while beneficial in the long term, may increase production costs in the short term.

This can result in higher prices for leather sofas, potentially deterring price-sensitive consumers and impacting demand. The combined pressure of consumer expectations and regulatory mandates represents a significant challenge for the leather sofa market, as companies are forced to balance environmental responsibilities with market demands.

This restraint could encourage some consumers to pivot toward synthetic leather or other alternative materials, potentially impacting the market’s expansion and creating a competitive shift toward sustainable furniture options.

Opportunity

Growth in Online Retail and E-Commerce Channels

The expansion of e-commerce presents a significant growth opportunity for the global leather sofa market, especially as consumers increasingly shift to online shopping for furniture. Online retail has transformed consumer purchasing habits, offering convenience, variety, and the ability to easily compare products, making it particularly appealing for large, durable goods like leather sofas.

The convenience of e-commerce aligns well with the evolving lifestyle preferences of consumers who prioritize streamlined, contactless purchasing processes. As internet access and smartphone usage grow worldwide, particularly in developing regions, more people are expected to purchase furniture online.

This trend is creating an expansive customer base for leather sofa manufacturers who leverage e-commerce channels, thus facilitating growth in previously untapped markets.

In addition, advancements in digital tools and technology are enhancing the online shopping experience, allowing consumers to visualize how products like leather sofas would look in their homes.

Virtual reality (VR) and augmented reality (AR) tools enable users to view furniture in 3D and virtually place it within their living spaces, reducing the uncertainty that often comes with buying high-value items online.

This capability increases consumer confidence in purchasing furniture without physically visiting a showroom, thereby accelerating sales growth through online platforms. The combination of online shopping trends and digital tools positions e-commerce as a key growth channel for the leather sofa market.

As e-commerce expands, it presents a vital opportunity for manufacturers to broaden their market reach and engage a tech-savvy consumer base, setting a strong foundation for market growth in 2024 and beyond.

Trends

Rising Popularity of Sustainable and Vegan Leather Alternatives

A prominent trend shaping the leather sofa market is the rising demand for sustainable and vegan leather alternatives. As environmental awareness grows, consumers are increasingly looking for eco-friendly products, including alternatives to traditional animal leather.

Sustainable leather alternatives, such as those made from recycled materials or bio-based sources like pineapple leaves, mushrooms, and cactus, are gaining traction as they offer a similar aesthetic and durability without the environmental impact.

Vegan leather has become particularly popular among younger consumers who value ethical and sustainable practices. This shift is pushing the leather sofa industry to innovate and expand its offerings, accommodating consumers who prefer environmentally responsible options without compromising on style or quality.

Manufacturers are responding to this trend by integrating sustainable materials and production methods into their product lines, creating leather sofas that appeal to eco-conscious customers.

This evolution not only aligns with consumer expectations but also offers companies the opportunity to differentiate themselves in a competitive market. Many manufacturers are investing in research and development to improve the quality and durability of vegan leather, aiming to match or even surpass the performance of traditional leather.

The trend toward sustainable materials is expected to drive market growth, as it attracts a new segment of consumers interested in both aesthetic appeal and environmental impact.

By catering to the demand for vegan leather and eco-friendly alternatives, companies in the leather sofa market can capitalize on this trend and position themselves as leaders in sustainable luxury, fueling growth through product innovation and ethical appeal.

Regional Analysis

Asia-Pacific Leads Leather Sofa Market with Largest Market Share at 34.7%

The Asia-Pacific region dominates the global leather sofa market, holding the largest market share of 34.7% as of 2023, with a market valuation of USD 3.24 billion. This substantial market presence is driven by the rapid growth of urbanization, rising disposable incomes, and an expanding middle-class population across countries like China, India, and Japan.

These factors contribute to an increased demand for high-quality home furnishings as consumers seek to elevate their living spaces with premium products, including leather sofas.

The flourishing e-commerce sector across Asia-Pacific also significantly supports the market by offering a broad range of products and convenient shopping options, further boosting sales. The region’s robust manufacturing base, particularly in China, provides a cost advantage for leather sofa production, making Asia-Pacific not only a leading consumer market but also a major production hub.

North America holds a significant position in the global leather sofa market, supported by a steady demand for luxury home furnishings. The region’s market is fueled by high consumer spending on premium furniture, reflecting a strong preference for aesthetically pleasing and durable items in households across the U.S. and Canada.

North America’s established retail sector, combined with a high penetration of online shopping, facilitates accessibility to a wide range of leather sofa options.

Additionally, the trend toward larger living spaces and home upgrades has increased investments in quality furniture items. The North American market benefits from a mature economy and consumer willingness to invest in durable, high-value products, helping sustain its solid market position.

Europe remains a key region in the leather sofa market, characterized by a growing demand for sustainable and eco-friendly products. Consumers in the European Union prioritize ethical production practices, and leather sofa manufacturers are increasingly adopting sustainable materials to meet these expectations.

Countries like Germany, France, and the U.K. are at the forefront of this demand for environmentally responsible products, driven by strong environmental regulations and heightened consumer awareness.

The European market’s emphasis on eco-friendly alternatives has led to a steady rise in vegan leather and other sustainable options, making Europe a trendsetter for sustainable innovation in the leather sofa market. This preference for sustainability aligns with broader market trends, positioning Europe as a strong contributor to the market’s global value.

Latin America represents an emerging market for leather sofas, supported by an expanding middle class and increased disposable incomes across countries such as Brazil, Argentina, and Mexico.

As consumer lifestyles improve, there is a rising inclination toward premium and durable furniture, which includes leather sofas. However, price sensitivity remains a consideration for Latin American consumers, and competitive pricing strategies are critical for market success in this region.

The market growth is also supported by the rapid expansion of e-commerce, allowing consumers in smaller cities and rural areas access to a broader range of furniture options. This evolving consumer base and growing digital infrastructure position Latin America as a promising market with steady growth potential.

The Middle East & Africa (MEA) region is seeing increased demand for leather sofas due to rapid urbanization and modernization in major cities such as Dubai, Riyadh, and Johannesburg.

Wealthier consumers in the MEA region are inclined toward premium products that reflect a modern and sophisticated lifestyle. Additionally, a growing hospitality sector, particularly in the Gulf Cooperation Council (GCC) countries, has increased demand for luxury furniture, including leather sofas, for high-end hotels and residential developments.

While the MEA region’s leather sofa market is relatively small compared to other regions, it presents opportunities for growth, especially in segments focused on premium and luxury furniture. The region’s economic diversification efforts and expanding real estate developments are expected to drive steady demand in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global leather sofa market is marked by the significant contributions and competitive strategies of several prominent players. La-Z-Boy Incorporated and Ashley Furniture Industries are leveraging their strong brand equity and extensive distribution networks to maintain leadership, particularly in North America, by catering to middle-market and premium segments.

Natuzzi S.p.A., an Italian brand renowned for its luxury and high-quality craftsmanship, continues to emphasize European design aesthetics and sustainable manufacturing processes, appealing to environmentally conscious consumers and high-end markets.

Meanwhile, Herman Miller, Inc. and Steelcase Inc. are increasingly focused on leather seating solutions for commercial spaces, capitalizing on the hybrid work trend, which fuels demand for versatile, professional-grade leather seating that enhances home-office setups.

Luxury brands such as Flexform and Roche Bobois dominate the premium segment, emphasizing exclusivity and artisan-crafted pieces that resonate with affluent consumers seeking unique, customizable options. Baker Furniture also contributes to this market niche with its classic American designs, attracting consumers who value timeless style and quality.

American Leather, known for its focus on innovation and customizable leather products, is capturing attention through its made-to-order approach, aligning well with the rising demand for personalized home decor.

With evolving consumer preferences, other emerging players are bringing diversity and competition to the market, offering alternatives that cater to various styles and budgets. These established and emerging players are collectively driving innovation and expanding the leather sofa market’s reach across residential and commercial segments globally, reflecting a robust outlook for the industry in 2024.

Top Key Players in the Market

- La-Z-Boy Incorporated

- Ashley Furniture Industries

- Natuzzi S.p.A.

- Herman Miller, Inc.

- Steelcase Inc.

- Flexform

- Baker Furniture

- Roche Bobois

- American Leather

- Other Key Players

Recent Developments

- IKEA (2023): IKEA introduced a new range of eco-friendly leather sofas crafted from recycled materials, aligning with its commitment to sustainability. This product expansion targets the eco-conscious market, with projected sales growth of 15% in the upcoming year.

- Ashley Furniture Industries (2024): Ashley Furniture has committed $80 million to expand its operations in Lee County, Mississippi, adding 500 new jobs. The investment will include renovating a facility in Verona to boost foam and mattress production, and updating equipment in its Saltillo mattress plant. This expansion is supported by Mississippi’s MFLEX tax incentive program.

- Flexsteel Industries (2024): Flexsteel partnered with 3D Cloud to enhance product visualization for its network of 2,500 retailers. This collaboration will leverage advanced 3D technology, offering an integrated and cost-effective solution to improve customer experience and streamline digital visualization efforts, according to Flexsteel’s CIO, Mike McClaflin.

Report Scope

Report Features Description Market Value (2023) USD 9.4 Billion Forecast Revenue (2033) USD 14.0 Billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type Analysis (Full-grain Leather Sofa, Top-grain Leather Sofa, Bonded Leather Sofa), By Application Analysis (Household, Commercial), By Distribution Channel Analysis (Hypermarkets/supermarkets, Specialised Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape La-Z-Boy Incorporated, Ashley Furniture Industries, Natuzzi S.p.A., Herman Miller, Inc., Steelcase Inc., Flexform, Baker Furniture, Roche Bobois, American Leather, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- La-Z-Boy Incorporated

- Ashley Furniture Industries

- Natuzzi S.p.A.

- Herman Miller, Inc.

- Steelcase Inc.

- Flexform

- Baker Furniture

- Roche Bobois

- American Leather

- Other Key Players