Global Commercial Coffee Urn Market By Type (Traditional, Digital), By Capacity (30 - 45 Cups, 46 - 65 Cups, 66 - 100 Cups, 101 - 120 Cups, and More Than 120 Cups), By Material Type (Stainless Steel, Aluminum, and Other Material Types), By Style (Double Wall, Single Wall), By Features(NSF Listed, Sight Gauge), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 106987

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

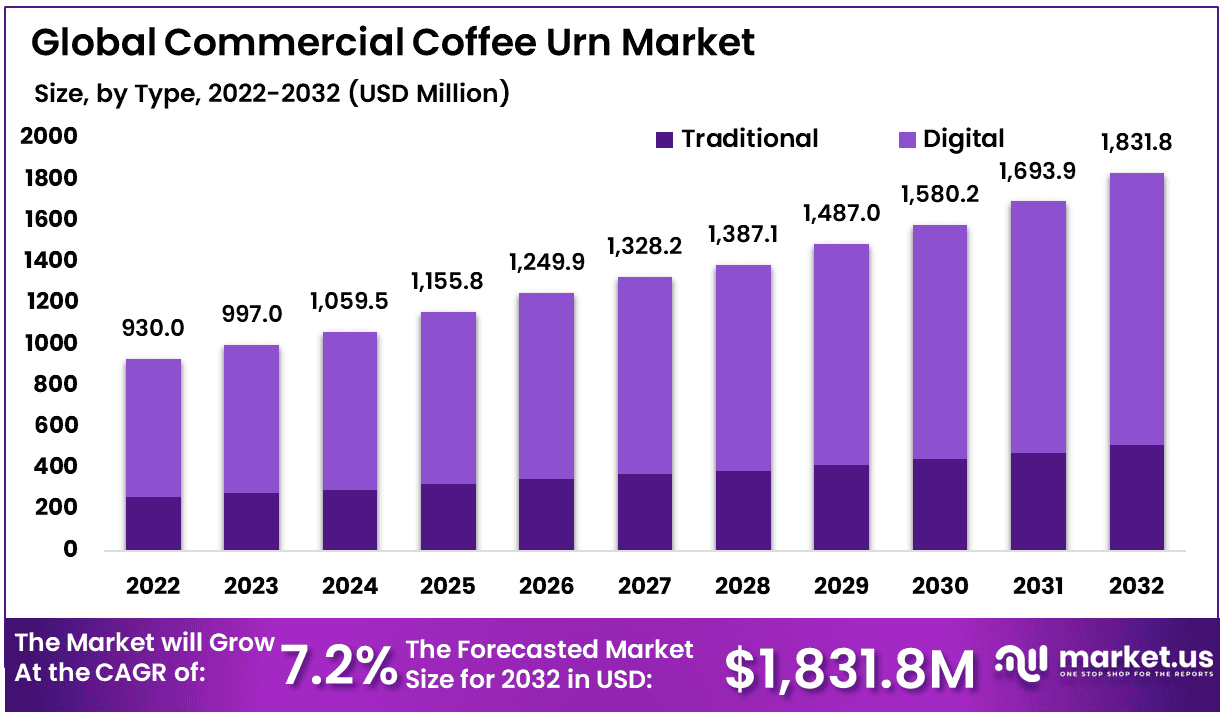

The Global Commercial Coffee Urn Market size is expected to be worth around USD 1831.8 Million by 2032, From USD 997.0 Million by 2023, with growth at a CAGR of 7.2% during the forecast period from 2023 to 2032.

The Commercial Coffee Urn Market refers to the industry surrounding the production, distribution, and sales of large-capacity coffee brewing equipment designed for commercial use, such as in restaurants, hotels, catering services, and large corporate settings. These coffee urns are designed to brew and dispense large volumes of coffee, catering to high-demand environments where efficiency, consistency, and capacity are crucial.

With the growing culture of coffee consumption and the expansion of the hospitality industry, this market plays a pivotal role in the foodservice equipment sector.

Key growth factors driving the commercial coffee urn market include the expanding global coffee culture, increased demand for convenience in food and beverage services, and the rise of quick-service restaurants (QSRs). The proliferation of coffee chains and cafes, especially in developing regions, is a significant growth enabler.

Key growth factors driving the commercial coffee urn market include the expanding global coffee culture, increased demand for convenience in food and beverage services, and the rise of quick-service restaurants (QSRs). The proliferation of coffee chains and cafes, especially in developing regions, is a significant growth enabler.Moreover, the growing number of corporate offices, which frequently require bulk coffee brewing solutions for meetings and events, further fuels demand. Advances in technology, such as automated and energy-efficient coffee urns, also contribute to market growth by improving operational efficiency for businesses.

The commercial coffee urns is largely driven by the rising preference for high-quality coffee beverages in public and commercial spaces. Hospitality sectors, such as hotels and event venues, require reliable brewing solutions to serve large groups efficiently.

As more businesses prioritize customer experience, the need for modern, sleek, and durable coffee urns has increased. Additionally, the global trend toward sustainable practices in food services has led to a surge in demand for energy-efficient, eco-friendly urns.

The commercial coffee urn market lie in both technological innovation and geographic expansion. Manufacturers are focusing on developing smart urns with features like programmable settings, touch interfaces, and Internet of Things (IoT) connectivity, which allow for remote operation and monitoring.

Furthermore, as coffee consumption rises in emerging markets across Asia-Pacific and Latin America, companies can capitalize on untapped demand by entering these regions. Offering customized, premium urns with enhanced design and functionality to cater to luxury hotels and high-end establishments presents another growth avenue.

According to Perfect Daily Grind, US coffee consumption reached a 20-year high, with 65% of Americans drinking coffee daily, amounting to 491 million cups. This surge in demand highlights the increasing need for efficient coffee solutions in high-traffic settings such as hotels, offices, and event spaces.

As coffee becomes more ingrained in daily routines, commercial coffee urns play a crucial role in meeting bulk brewing requirements, especially for venues catering to large crowds and events.

According to a recent study by Driveresearch, the Commercial Coffee Urn Market is poised for growth, driven by evolving consumer behaviors and increasing coffee consumption. Notably, 36% of consumers drink 3 to 5 cups of coffee daily, while 51% purchase coffee from shops at least once a week, indicating sustained demand across retail and out-of-home channels.

Health-conscious consumers also play a significant role, with 48% agreeing that coffee consumption benefits their health.

Additionally, there’s a rising trend in premiumization, as 11% of people spend over $40 a month on home-brewed coffee, reflecting growing demand for high-quality, home-based coffee solutions. This shift is further complemented by 25% of consumers enjoying espresso martinis, a 79% increase since 2022, reflecting growing interest in coffee-based specialty drinks.

Brands like Starbucks and Dunkin’ remain favorites, with 48% and 45% of consumers favoring these brands, respectively, reinforcing the importance of brand loyalty in this competitive market.

According to Dailycoffeenews, Cumulus Coffee Company recently secured $20.3 million in seed funding to bring its home cold coffee machine to market. This reflects a trend toward more advanced coffee-making solutions, which is also impacting the commercial sector.

As consumers expect higher quality and convenience, commercial coffee urns must innovate to stay competitive, offering versatile brewing options to meet evolving consumer preferences.

Key Takeaways

- The global commercial coffee urn market, valued at USD 997.0 million in 2023, is expected to reach USD 1831.8 million by 2032, growing at a CAGR of 7.2%.

- The digital segment dominates the commercial coffee urn market with over 72% share in 2022, driven by demand for precision and automation in high-traffic commercial settings.

- The 46 – 65 cups capacity segment leads the market with a 42% share, as it balances capacity and efficiency, catering to mid-sized commercial environments.

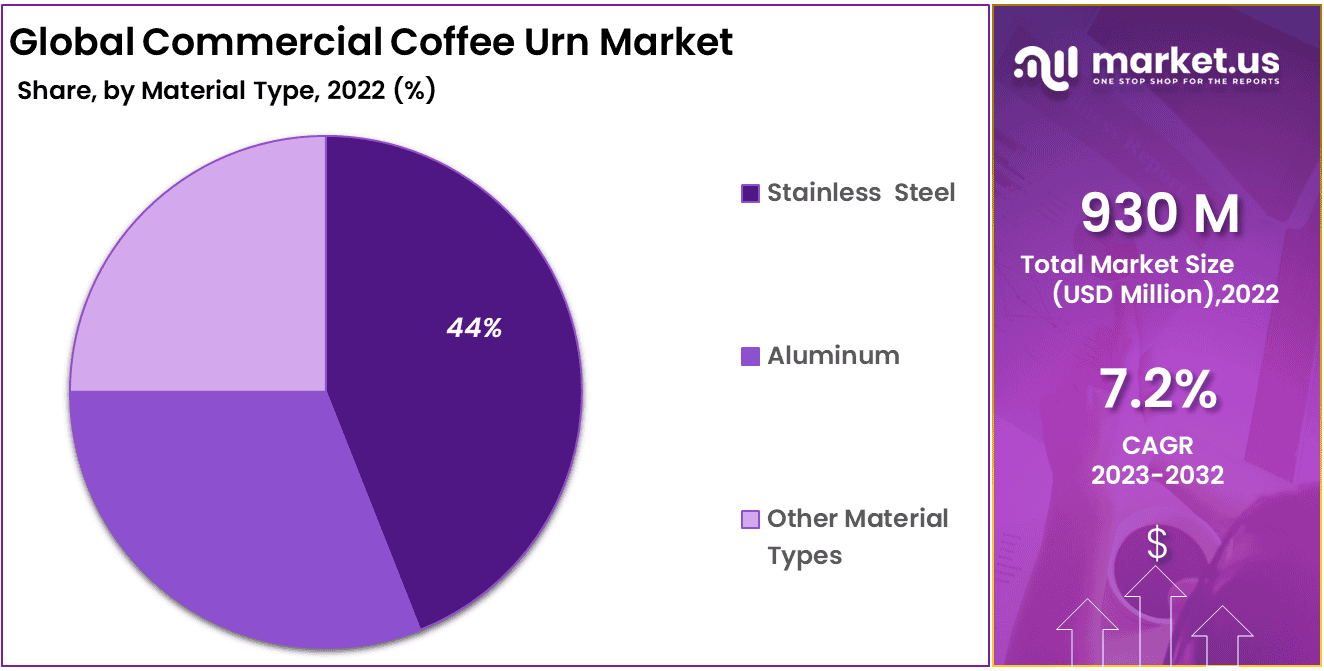

- Stainless steel leads with over 44% market share due to its durability, heat resistance, and aesthetic appeal, making it a preferred choice in the hospitality industry.

- Double wall urns dominate with a 54.3% share, valued for their insulation, safety, and efficiency in maintaining coffee temperature in high-demand settings.

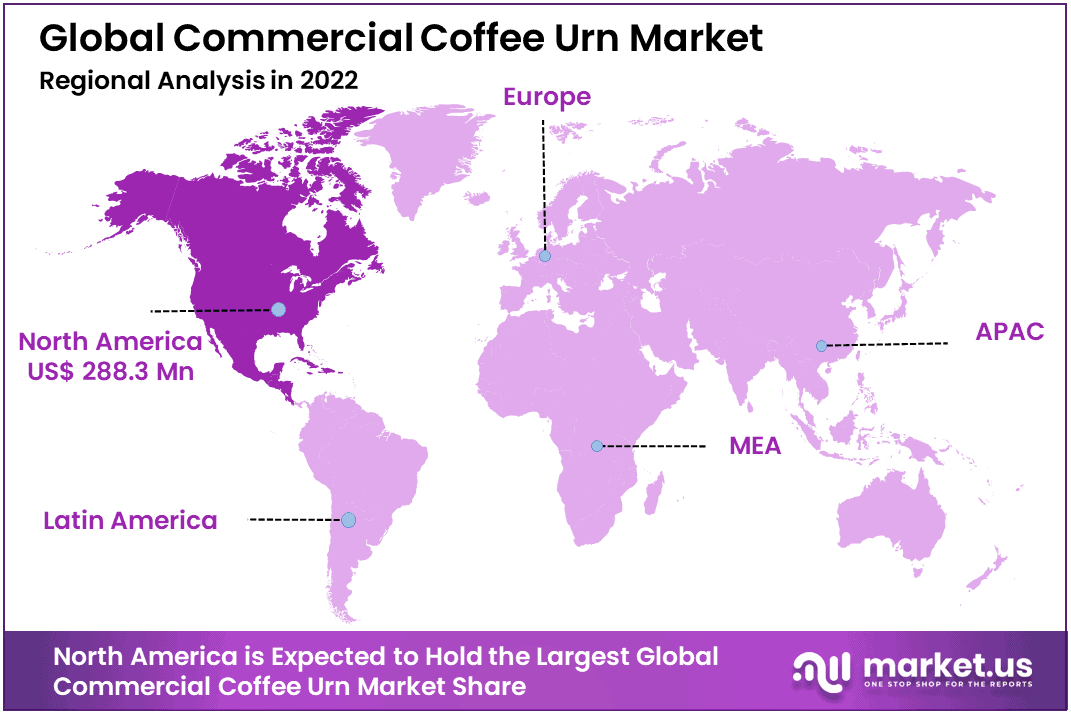

- North America holds 31% of the global market share, with its established coffee culture and demand for energy-efficient coffee urns driving growth.

- Growth Opportunity : The expanding HoReCa sector, particularly in emerging markets like Asia-Pacific, creates significant growth opportunities as café culture and hospitality demand surge.

- Restraint: High initial costs and ongoing maintenance expenses present challenges, particularly for small and mid-sized businesses looking to invest in commercial coffee urns.

By Type Analysis

Digital Segment Dominates Commercial Coffee Urn Market with Over 72% Share

In 2022, the digital segment held a dominant market position in the type segment of the Commercial Coffee Urn Market, capturing more than 72% of the total market share. This dominance can be attributed to the increasing preference for digitally advanced coffee urns, which offer greater precision, automation, and user-friendly interfaces.

Businesses and consumers are leaning towards digital coffee urns due to their enhanced functionality, such as programmable settings and temperature control, driving their widespread adoption across commercial settings.

While traditional coffee urns continue to serve niche markets that prioritize simplicity and cost-effectiveness, they held a comparatively smaller market share in 2022. These urns remain popular in more conventional or budget-conscious environments where minimalistic design and ease of use are valued over advanced digital features.

However, their market presence has been overshadowed by the technological advancements and growing demand for smart appliances in the hospitality and catering sectors.

By Capacity Analysis

46 – 65 Cups Capacity Dominates the Commercial Coffee Urn Market with 42% Share

In 2022, the 46 – 65 Cups capacity segment held a dominant position in the global commercial coffee urn market, capturing over 42% of the market share. This segment’s leadership is driven by its ideal balance between capacity and operational efficiency, making it the preferred choice for a wide range of commercial settings such as mid-sized restaurants, hotels, and corporate offices.

The ability to brew larger quantities of coffee while maintaining consistent quality is critical for establishments that experience moderate to high foot traffic, contributing to the segment’s substantial demand.

The versatility of urns in this capacity range caters to both peak service periods and regular operations without the need for constant refilling, reducing downtime and improving service efficiency. Additionally, many urns in this segment come equipped with advanced features like programmable brewing and insulated designs, further enhancing their appeal to commercial users.

The 30 – 45 Cups capacity segment is popular among smaller establishments, such as boutique cafes and small offices, where space and brewing volume are more constrained. Although this segment holds a smaller market share compared to larger urns, it remains a key choice for businesses seeking affordable, space-efficient brewing solutions.

The relatively lower cost of units in this range makes them an attractive option for operators with limited budgets or space, helping sustain steady growth in this capacity segment.

The 66 – 100 Cups capacity segment caters to large events, banquet halls, and high-traffic commercial spaces where substantial coffee output is required. This segment is experiencing increasing demand from large-scale catering operations and event management companies, where bulk coffee production is essential.

These urns are ideal for situations requiring rapid coffee service, though they account for a smaller overall market share compared to mid-range capacities.

The 101 – 120 Cups capacity segment holds a niche position in the market, primarily serving large-scale operations such as industrial canteens and conference centers. While these urns offer significant brewing capacity, their market share is limited by the specialized nature of the demand.

This segment is generally favored in environments where coffee is served in large quantities over short time frames, but it remains less common compared to mid-capacity units.

The More Than 120 Cups capacity segment is the least common, with adoption largely confined to specialty markets like large events, conventions, and industrial settings.

These high-capacity urns are typically used in situations requiring large-scale coffee production, but their limited versatility and high operational costs keep them from becoming a mainstream option. Despite their specialized utility, this segment represents a relatively small portion of the overall commercial coffee urn market.

By Material Type Analysis

Stainless Steel Dominating the Commercial Coffee Urn Market with Over 44% Share

In 2022, Stainless Steel held a dominant market position in the Material Type segment of the Commercial Coffee Urn Market, capturing more than a 44% share. This strong performance can be attributed to stainless steel’s superior durability, corrosion resistance, and aesthetic appeal, making it the preferred choice for both commercial kitchens and hospitality establishments.

Its ability to withstand high temperatures and resist staining makes stainless steel a highly practical and long-lasting option, especially for high-volume coffee production environments.

Furthermore, its premium appearance aligns well with the design preferences of cafes, hotels, and restaurants seeking to enhance their customer experience. As a result, stainless steel is expected to maintain its leadership in this segment over the forecast period.

In comparison, Aluminum accounted for a smaller yet notable share of the market in 2022. While it is a more lightweight and cost-effective option than stainless steel, aluminum lacks the same level of durability and corrosion resistance.

However, its affordability and ease of handling make it an attractive option for budget-conscious operators or for smaller establishments where the demands on equipment are less rigorous.

Despite these advantages, the aluminum segment is anticipated to grow at a modest pace, constrained by increasing preferences for more durable materials in commercial settings.

The Other Material Types category, comprising plastic, copper, and various alloys, captured a minor share of the market. These materials are typically found in lower-end or niche products. While plastic, for example, is lightweight and inexpensive, it is less common in commercial coffee urns due to concerns over its heat resistance and durability.

Copper and other specialty alloys, though aesthetically pleasing and thermally efficient, are often more expensive and require more maintenance, limiting their widespread adoption. The overall growth of this segment is expected to be slow, as stainless steel continues to dominate the market.

By Style Analysis

Double Wall Leading the Commercial Coffee Urn Market with Over 54.3% Share

In 2022, Double Wall held a dominant market position in the Style segment of the Commercial Coffee Urn Market, capturing more than a 54.3% share. The double-wall design offers superior insulation, maintaining optimal beverage temperature for extended periods.

This feature is particularly valuable in commercial settings such as catering, restaurants, and cafes where coffee is served continuously over several hours.

Additionally, the outer layer remains cool to the touch, enhancing safety for users, a critical factor in high-traffic environments. The combination of temperature retention and user safety makes double-wall coffee urns a popular choice among operators, solidifying its leadership position in this segment.

Single Wall urns accounted for a smaller portion of the market in 2022. Single-wall designs, while more cost-effective and lighter, do not offer the same level of insulation as their double-wall counterparts. This makes them better suited for smaller operations or short-term use where maintaining coffee temperature over long periods is less critical.

Although they remain a viable option for budget-conscious buyers, the growth potential of single-wall urns is expected to be limited, as market preferences increasingly shift towards the enhanced functionality provided by double-wall models.

By Features Analysis

NSF Listed: Dominating the Commercial Coffee Urn Market with Over 59.6% Share

In 2022, NSF Listed held a dominant market position in the Features segment of the Commercial Coffee Urn Market, capturing more than a 59.6% share. NSF (National Sanitation Foundation) certification is highly valued in the commercial food service industry as it guarantees that the equipment meets strict health, safety, and quality standards.

Coffee urns that are NSF listed ensure compliance with food safety regulations, making them the preferred choice for restaurants, cafes, and institutional kitchens that prioritize hygiene and regulatory compliance.

This certification is especially critical for establishments aiming to maintain high operational standards and avoid potential health code violations, driving its dominant market share in this segment.

On the other hand, Sight Gauge features, while beneficial, accounted for a smaller share of the market in 2022. Sight gauges allow users to easily monitor coffee levels, improving operational efficiency by preventing overflows or unexpected shortages during service.

However, while this feature adds convenience, it is not seen as critical as NSF certification in the purchasing decision process. As a result, sight gauge-equipped coffee urns are generally positioned as supplementary or secondary in importance compared to NSF listed products.

By Distribution Channel Analysis

Offline Dominating the Commercial Coffee Urn Market with Over 66% Share

In 2022, Offline held a dominant market position in the distribution channel segment of the Commercial Coffee Urn Market, capturing more than a 66% share. The offline channel, which includes specialty retail stores, distributors, and direct sales, remains the preferred choice for commercial buyers due to the ability to physically inspect products before purchase.

For businesses such as cafes, hotels, and restaurants, where durability and functionality are critical, the tactile experience of evaluating a coffee urn in person, combined with immediate customer service and support, drives the appeal of offline purchasing.

Additionally, established relationships with trusted suppliers and the ability to negotiate terms and after-sales service further reinforce the dominance of this channel.

In contrast, the Online distribution channel accounted for a smaller but growing share of the market. Online platforms offer convenience, a broader range of options, and often competitive pricing.

However, despite these advantages, many commercial buyers still prefer the assurance provided by physical inspections and personal interactions, which limits the growth of online sales in this category.

Nonetheless, the online segment is expected to see steady growth as digital purchasing habits become more prevalent and as suppliers improve online customer service offerings, including virtual consultations and enhanced product descriptions.

Moving forward, while the offline channel is projected to retain its majority share, the online segment is likely to grow at a faster pace due to increasing e-commerce adoption and technological improvements in the purchasing process.

Key Market Segments

Based on Type

- Traditional

- Digital

Based on Capacity

- 30 – 45 Cups

- 46 – 65 Cups

- 66 – 100 Cups

- 101 – 120 Cups

- More Than 120 Cups

Based on Material Type

- Stainless Steel

- Aluminum

- Other Material Types

Based on Style

- Double Wall

- Single Wall

Based on Features

- NSF Listed

- Sight Gauge

Based on Distribution Channel

- Online

- Offline

Driver

Growing Demand for Coffee Consumption in Commercial Spaces

The increasing global coffee consumption, particularly in commercial settings such as offices, cafes, restaurants, and hotels, is a significant driver for the commercial coffee urn market. According to the International Coffee Organization (ICO), global coffee demand has been rising steadily, with consumption reaching over 170 million bags annually in 2023.

This trend is being driven by a growing coffee culture in emerging markets like China and India, alongside sustained high levels of consumption in the U.S. and Europe. As businesses increasingly adopt coffee as a productivity-enhancing and customer-attracting amenity, the need for reliable, high-capacity brewing solutions like commercial coffee urns is expected to grow.

Additionally, the preference for fresh, brewed coffee over pre-packaged alternatives is pushing establishments to invest in high-volume coffee brewing equipment. Commercial coffee urns, which can brew and maintain large quantities of coffee for extended periods, are an ideal solution for businesses with high customer traffic.

These devices are particularly valuable during peak service hours, where efficiency and quality are essential. Consequently, this growing demand for fresh coffee in high-traffic environments directly boosts the adoption of commercial coffee urns, making it a key growth driver for the market in 2024.

Restraint

High Initial Costs and Maintenance Expenses

Despite the promising demand, the high upfront costs of commercial coffee urns, coupled with ongoing maintenance expenses, present a notable restraint for market growth. Commercial-grade coffee urns, particularly those with advanced features like digital controls, stainless steel construction, and dual brewing systems, can be expensive to purchase.

For small and mid-sized businesses, these initial investments may prove to be a financial hurdle, limiting adoption in cost-sensitive markets. Maintenance costs further compound the challenge, as commercial coffee urns require regular cleaning and upkeep to function efficiently. Factors such as scaling, mineral buildup, and wear on mechanical parts can lead to frequent repairs or the need for professional servicing.

In highly competitive hospitality and foodservice environments, where cost management is critical, these ongoing expenses can dissuade operators from investing in commercial coffee urns, especially when cheaper alternatives or smaller brewing systems are available. Therefore, the high cost of ownership remains a limiting factor for wider adoption of commercial coffee urns.

Opportunity

Expansion of the HoReCa Sector in Emerging Markets

The growth of the HoReCa (Hotels, Restaurants, and Cafes) sector, particularly in emerging economies, offers significant opportunities for the commercial coffee urn market. As disposable incomes rise and urbanization accelerates in regions like Asia-Pacific, Latin America, and parts of Africa, consumer spending on dining and hospitality experiences is increasing.

This shift is driving the proliferation of cafes, restaurants, and boutique hotels, each of which requires high-capacity brewing solutions to cater to a growing customer base. In addition, the trend of café culture, previously concentrated in Western markets, is spreading to new geographies. For example, in China, the number of coffee shops has been growing by 7% annually, creating demand for commercial-grade coffee brewing equipment.

Moreover, government initiatives to support small businesses in the hospitality sector, particularly post-pandemic recovery efforts, are fueling investments in commercial coffee equipment. As new businesses in these sectors look to scale their operations efficiently, the demand for durable, large-capacity coffee urns will increase, making it a ripe opportunity for market players to capture.

Trends

Technological Innovations Enhancing Operational Efficiency

Technological advancements are shaping the future of the commercial coffee urn market, with innovations focused on enhancing operational efficiency and user convenience. Modern coffee urns now come equipped with programmable digital controls, allowing for precise brewing temperature, volume settings, and automated start-stop functions.

These innovations are critical in environments where consistency and speed are paramount, such as large catering events, restaurants, and hotels. Such features not only improve the quality of the coffee produced but also reduce the need for constant monitoring, freeing staff to focus on other tasks.

Additionally, the integration of energy-efficient technologies is gaining traction. Energy-efficient coffee urns are designed to minimize electricity consumption by optimizing heating cycles and maintaining coffee at the desired temperature for longer periods without continuous heating.

This trend is particularly important as sustainability becomes a key focus in the food service industry, with operators looking for equipment that aligns with their environmental goals while keeping operating costs low.

The continued advancement in smart technology and energy efficiency is expected to drive the adoption of more sophisticated commercial coffee urns, further stimulating market growth in 2024 and beyond.

Regional Analysis

North America Leads the Commercial Coffee Urn Market with 31% Market Share

North America dominates the global commercial coffee urn market, accounting for 31% of the total market share in 2022, with a market value of USD 288.3 million. This leadership is driven by the region’s well-established coffee culture, high consumption rates, and the widespread adoption of coffee urns in the hospitality and foodservice industries.

The U.S., in particular, plays a pivotal role in this dominance due to the large number of cafes, restaurants, and corporate offices that require efficient, high-volume coffee brewing solutions. The increasing demand for energy-efficient and technologically advanced coffee urns further contributes to North America’s market strength.

Europe represents a significant portion of the commercial coffee urn market, with steady growth driven by the increasing café culture across countries like Germany, France, and Italy.

European consumers, known for their strong preference for quality coffee, are pushing demand for premium coffee urns in both urban and suburban settings.

The HoReCa (Hotels, Restaurants, and Cafes) sector plays a crucial role in driving this demand, as establishments seek reliable, large-capacity coffee brewing systems to serve growing customer bases. Additionally, the rise of sustainability-focused equipment, particularly energy-efficient urns, is expected to further enhance market growth in this region.

Asia Pacific is witnessing rapid growth in the commercial coffee urn market, driven by rising urbanization and the increasing number of international and domestic café chains. Countries like China, India, and Japan are key markets where the coffee culture is spreading quickly.

The expanding middle class and higher disposable incomes are fueling demand for coffee urns in restaurants, hotels, and office spaces. As urban populations continue to rise, the need for high-capacity coffee brewing solutions will further boost market expansion in the region, making Asia Pacific a key area for future growth.

Latin America is an emerging market in the commercial coffee urn industry, with growing demand driven by the region’s rich coffee heritage and increasing hospitality sector.

Brazil, Colombia, and Mexico are key markets, where coffee consumption is deeply rooted in local culture. The region’s hotel and restaurant sector is expanding, particularly in urban centers, which is driving demand for high-capacity brewing solutions.

While Latin America currently represents a smaller portion of the global market, its growth potential is significant, supported by the increasing adoption of commercial-grade equipment in both small and large businesses.

The Middle East & Africa region is also witnessing growth in the commercial coffee urn market, primarily due to the rising demand for coffee in hotels, restaurants, and catering businesses. Countries like the UAE, Saudi Arabia, and South Africa are seeing a surge in hospitality-related investments, fueling the need for high-capacity coffee urns.

The increasing popularity of coffee consumption, especially among younger demographics in urban areas, is creating new opportunities for market expansion. Though smaller compared to other regions, the market’s growth trajectory is expected to accelerate as the region’s food service industry continues to modernize and expand.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, leading players in the commercial coffee urn market are positioned to capitalize on rising demand, driven by their diverse product offerings and strategic innovations. Companies like Bon Chef Inc. and BUNN have established themselves as key industry leaders, known for their high-quality, durable urns used in catering, hospitality, and high-traffic foodservice environments.

Bon Chef Inc. specializes in premium, aesthetically designed urns that cater to upscale dining establishments, while BUNN focuses on high-performance, technologically advanced coffee brewing solutions, making it a favorite among large-scale operators.

Coffee Pro EQ and Cresimo offer affordable, efficient solutions targeting small to mid-sized businesses. Coffee Pro EQ’s emphasis on ease of use and Cresimo’s insulated urns, which maintain temperature for long periods, make them strong competitors in the mid-tier segment.

Meanwhile, Hamilton Beach Brands Inc. and Home Craft leverage their reputation for household appliances to extend their commercial coffee offerings, providing reliable, easy-to-maintain urns with accessible price points that appeal to budget-conscious operators.

NESCO and WestBend are notable for their focus on energy-efficient and user-friendly designs. Their urns, widely used in institutional settings like hospitals and educational establishments, are lauded for their durability and low maintenance needs.

Beyond these players, other key companies are likely to emerge with specialized innovations, addressing niche markets or sustainability trends, further intensifying competition.

Overall, these companies’ strategic focus on innovation, affordability, and operational efficiency will be critical in sustaining their competitive edge as the commercial coffee urn market continues to expand globally in 2024.

Top Key Players in the Market

- Bon Chef Inc.

- BUNN

- Coffee Pro EQ

- Cresimo

- Hamilton Beach Brands Inc.

- Home Craft

- NESCO

- WestBend

- Other Key Players

Recent Developments

- In 2023, Groupe SEB announced the acquisition of La San Marco, a renowned Italian brand specializing in professional coffee machines. This strategic move reflects Groupe SEB’s continued expansion in the professional coffee market. By acquiring the family-run business from Massimo Zanetti Beverage Group (MZBG), Groupe SEB is further strengthening its portfolio to align with its growth ambitions in this segment.

- In September 2024, JDE Peet’s will begin manufacturing, distributing, and selling Costa Coffee branded aluminum coffee capsules in Great Britain. This extended collaboration between JDE Peet’s and Costa Coffee signals a significant step forward in their partnership and is expected to be a key driver of future growth in the region.

- In 2024, Schaerer introduced the Coffee Skye with an enhanced Twin Milk System. Launched on August 29, 2024, this innovation allows for the use of two different types of milk or plant-based alternatives, expanding the variety of beverages offered. The Twin Milk System simplifies operations by automatically selecting the appropriate milk or foam, ensuring consistent, high-quality drinks such as latte macchiatos or flat whites. Available as a side cooling unit or a compact under-counter solution, it is designed to cater to diverse customer needs while reducing staff workload.

Report Scope

Report Features Description Market Value (2023) US$ 997.0 Mn Forecast Revenue (2032) US$ 1,831.8 Mn CAGR (2023-2032) 7.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type-Traditional, and Digital; By Capacity-30 – 45 Cups, 46 – 65 Cups, 66 – 100 Cups, 101 – 120 Cups, and More Than 120 Cups; By Material Type-Stainless Steel, Aluminum, and Other Material Types; By Style- Double Wall, Single Wall, By Features- NSF Listed, Sight Gauge, By Distribution Channel- Offline, and Online. Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Bon Chef Inc., BUNN, Coffee Pro EQ, Cresimo, Hamilton Beach Brands Inc., Home Craft, NESCO, WestBend, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commercial Coffee Urn MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Commercial Coffee Urn MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bon Chef Inc.

- BUNN

- Coffee Pro EQ

- Cresimo

- Hamilton Beach Brands Inc.

- Home Craft

- NESCO

- WestBend

- Other Key Players