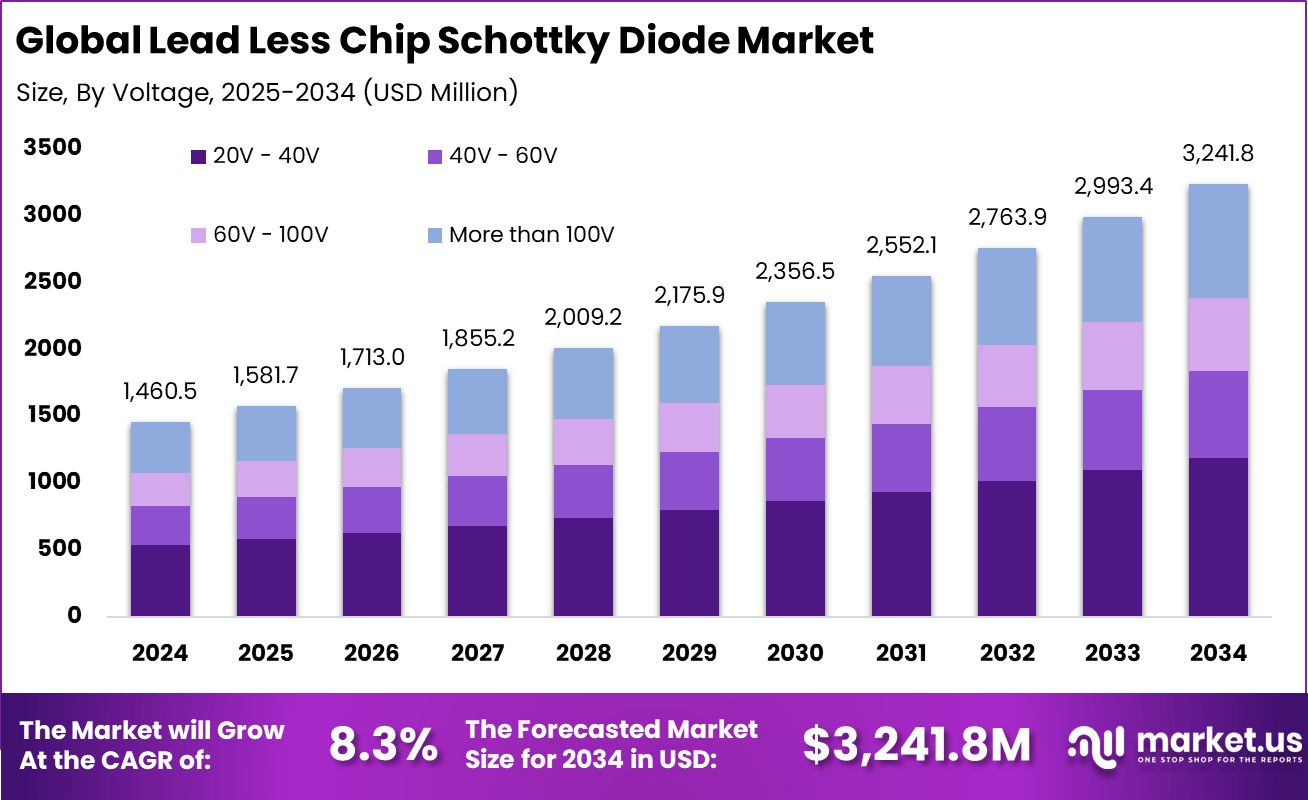

Global Lead Less Chip Schottky Diode Market Size, Share, Industry Analysis Report By Voltage (20V - 40V, 40V - 60V, 60V - 100V, More than 100V), By Application (Switch Mode Power Supplies, High Frequency Rectification, Portable Battery Powered Devices, Reverse Bias Protection, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158936

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

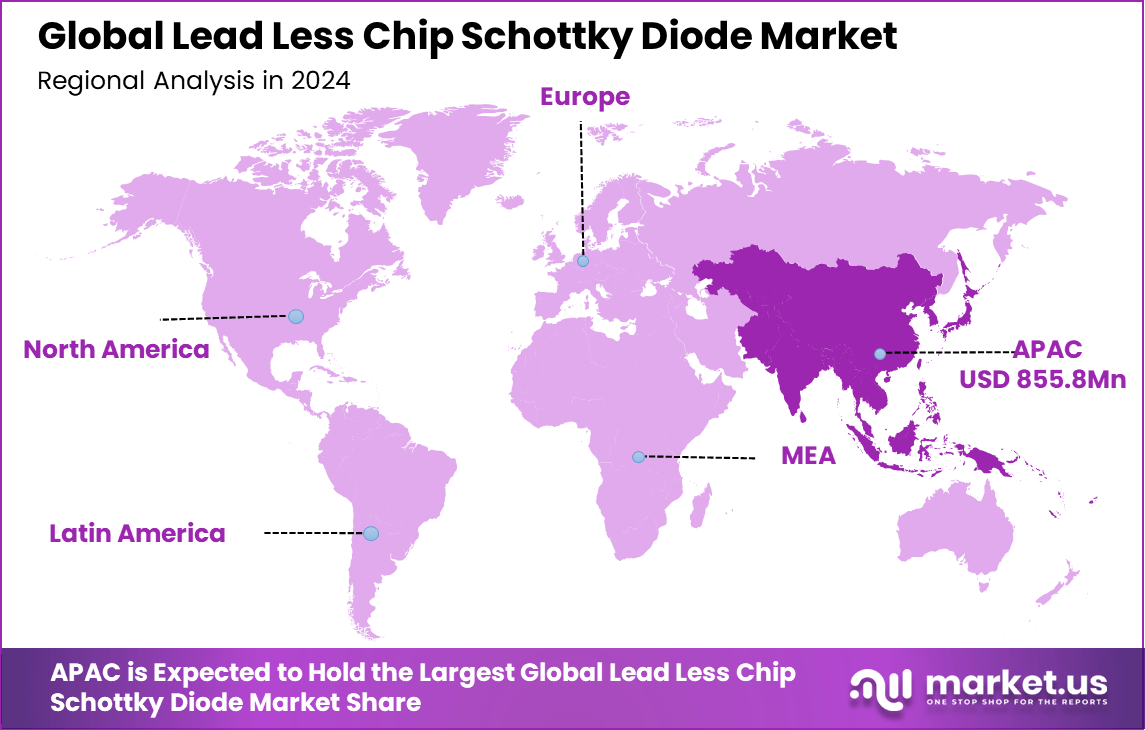

The Global Lead Less Chip Schottky Diode Market size is expected to be worth around USD 3,241.8 million by 2034, from USD 1,460.5 million in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 58.6% share, holding USD 855.8 million in revenue.

The Leadless Chip Schottky Diode Market refers to the industry producing Schottky diodes in compact, leadless packages that are widely used in high-frequency and high-efficiency electronic circuits. Schottky diodes are characterized by low forward voltage drop and fast switching speed, making them suitable for power rectification, RF applications, and voltage clamping.

The market is driven by the increasing demand for compact and energy-efficient components in modern electronic devices. Growth in consumer electronics, including smartphones, laptops, and wearables, strongly supports adoption. The rise of electric vehicles and advanced automotive electronics requiring efficient power conversion is another key driver. Expanding use in communication infrastructure, including 5G networks, further fuels demand.

For instance, in April 2025, Diodes Incorporated announced the release of 650V SiC Schottky diodes with exceptionally low Figure of Merit (FOM), providing high efficiency for power solutions. These diodes are designed to deliver industry-leading performance in power conversion applications.

Key Takeaway

- In 2024, the 20V-40V segment dominated the market, accounting for 36.7% share, reflecting its widespread use in compact, energy-efficient circuits.

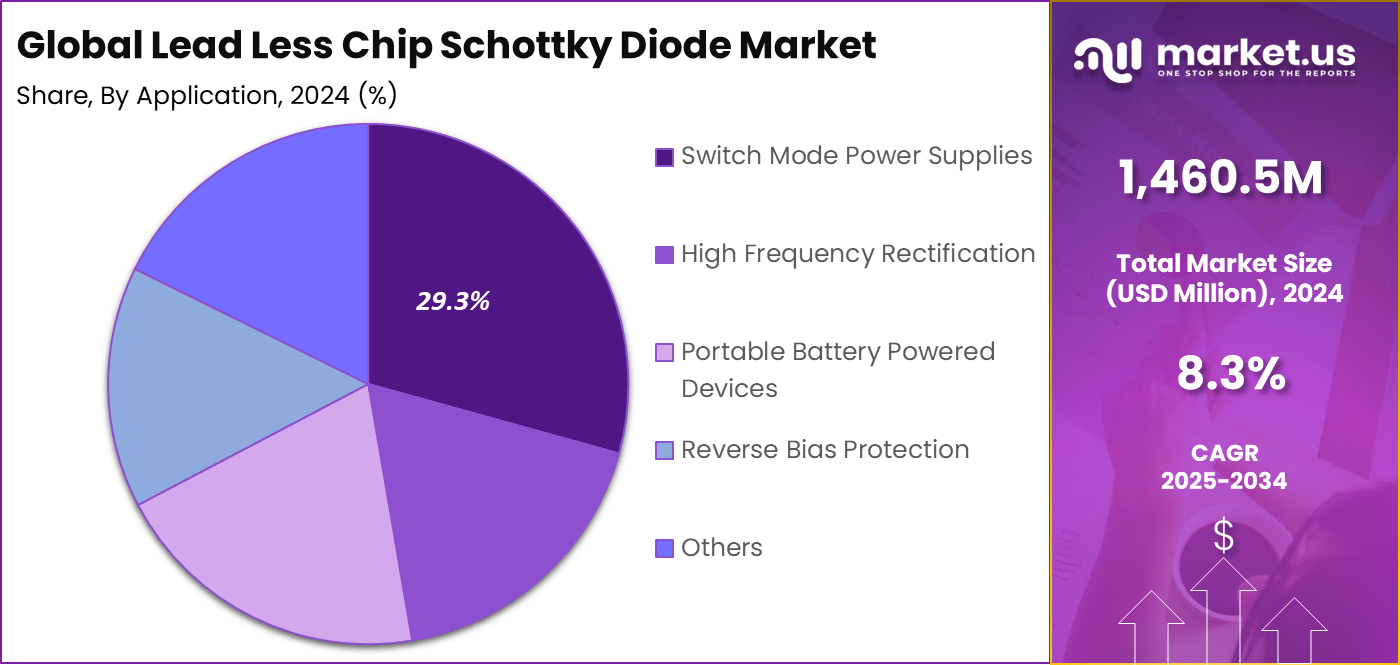

- By application, Switch Mode Power Supplies (SMPS) led with a 29.3% share, driven by rising demand in consumer electronics and industrial power systems.

- Regionally, Asia Pacific captured 58.6% share in 2024, cementing its leadership in semiconductor manufacturing and electronics demand.

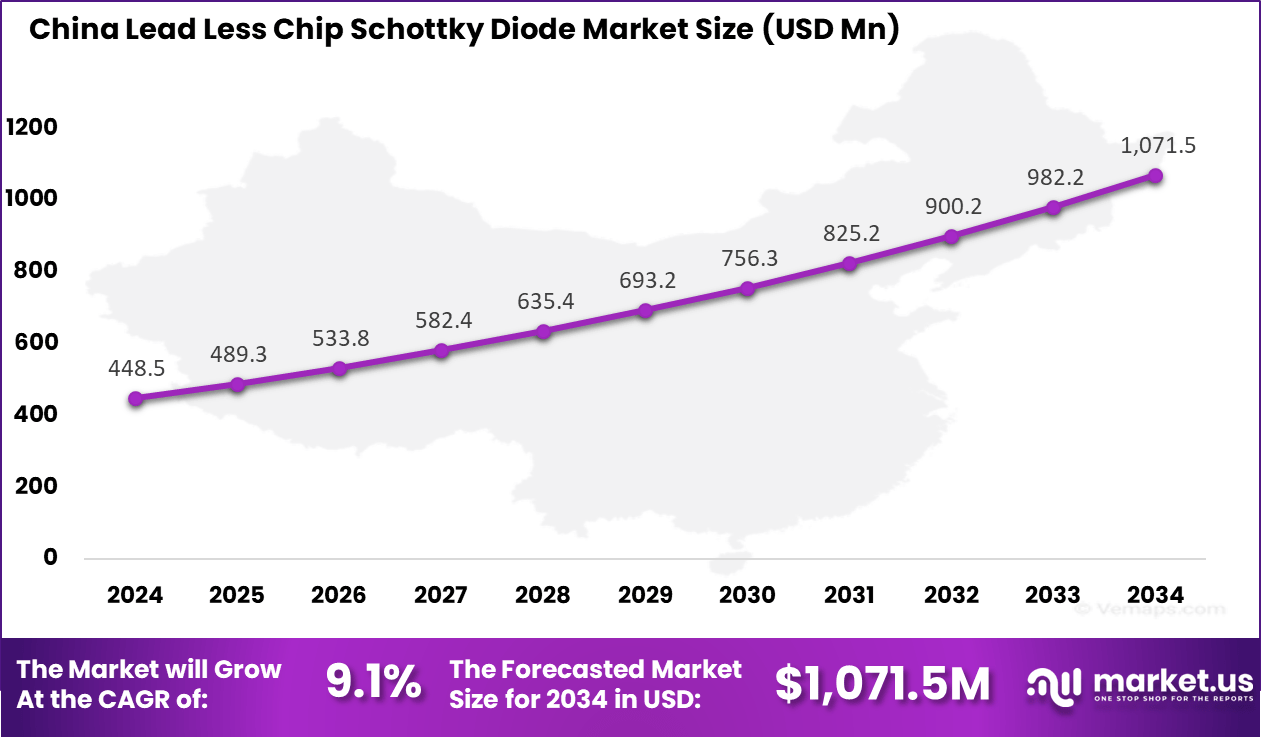

- Within the region, the China market was valued at USD 448.5 Million in 2024, growing at a strong CAGR of 9.1%, supported by expanding domestic electronics production.

Analysts’ Viewpoint

Demand is strongest in consumer electronics, where these diodes are used in chargers, adapters, and portable devices. Automotive demand is increasing as electric drivetrains and advanced driver assistance systems rely on efficient rectifiers and power management components. Industrial sectors adopt them in switch-mode power supplies, renewable energy systems, and motor drives.

The market is witnessing greater adoption of advanced semiconductor materials such as silicon carbide (SiC) and gallium nitride (GaN) in Schottky diode designs. These materials enhance efficiency, reduce losses, and improve thermal management, particularly in high-power applications. Advances in packaging technology, including wafer-level chip scale packaging (WLCSP), are enabling further miniaturization and performance gains.

Manufacturers adopt leadless chip Schottky diodes to reduce power losses, improve efficiency, and enable high-frequency operation. Their low forward voltage drop supports energy savings in battery-powered devices. Compact packaging helps meet design requirements for miniaturized electronics. In automotive and industrial applications, adoption ensures reliable power management under high temperature and high-frequency conditions.

China Market Size

China is a major contributor within this region, with a market value of approximately 448.5 million units. The country’s focus on technological advancement, electric vehicle adoption, and renewable energy solutions underpins strong diode demand. The region is projected to grow steadily with a CAGR of 9.1%, driven by increasing power conversion needs and electronics miniaturization.

The Asia Pacific region commands a dominant market share of 58.6%. This leadership comes from the robust electronics manufacturing ecosystem and rapid growth in automotive, consumer electronics, and industrial automation sectors. The region benefits from cost-effective production capabilities and expanding demand from infrastructure and technology development.

For instance, in October 2024, ROHM Semiconductor showcased its latest advancements at Electronica 2024, reinforcing its leadership in the Asia Pacific region for leadless chip Schottky diodes. The company highlighted its innovative solutions in power conversion, with a strong focus on energy-efficient applications in automotive, industrial, and renewable energy sectors.

Voltage Analysis

In 2024, the 20V – 40V segment held a dominant market position, capturing a 36.7% share of the Global Lead Less Chip Schottky Diode Market. This dominance is due to the widespread use of these voltage ranges in power management systems, particularly in consumer electronics, automotive applications, and industrial equipment.

This range is ideal for efficient power conversion in devices such as power supplies, inverters, and battery chargers. As the demand for compact and energy-efficient solutions grows, this segment continues to lead the market.

For instance, in July 2024, Nexperia launched the PMEG4002ELD-Q, a planar Schottky barrier rectifier encapsulated in a leadless SOD882D package. This ultra-small diode, with a voltage rating in the 20V – 40V range, is designed for high-efficiency power conversion applications. The PMEG4002ELD-Q is ideal for switch-mode power supplies and other compact, energy-efficient devices.

Application Analysis

In 2024, the Switch Mode Power Supplies segment held a dominant market position, capturing a 29.3% share of the Global Lead Less Chip Schottky Diode Market. This dominance is due to the increasing demand for energy-efficient power conversion in various electronic devices, including computers, telecommunications equipment, and consumer electronics.

Schottky diodes are preferred in SMPS due to their fast switching speeds, low forward voltage drop, and high efficiency, which are crucial for reducing power losses and improving overall system performance. With the growing need for energy-efficient power supplies in industries like consumer electronics, telecommunications, and automotive, this segment continues to lead the market.

For instance, in July 2025, Vishay Intertechnology announced the launch of its new Gen 3 650V and 1200V SiC Schottky diodes, which are designed to improve efficiency and reliability in switch-mode power supplies (SMPS). These diodes, available in the compact SlimSMA package, are ideal for high-efficiency power conversion, including in applications such as power supplies for industrial and consumer electronics.

Key Market Segments

By Voltage

- 20V – 40V

- 40V – 60V

- 60V – 100V

- More than 100V

By Application

- Switch Mode Power Supplies

- High Frequency Rectification

- Portable Battery-Powered Devices

- Reverse Bias Protection

- Others

Emerging Trends

One clear trend is the rising adoption of wide bandgap materials like silicon carbide and gallium nitride in Schottky diodes, which improve performance at higher frequencies and temperatures. Integration trends are also gaining ground, with lead-less chip Schottky diodes increasingly being combined with other components into system-in-package solutions for even more compact designs.

The surge in renewable energy systems, such as solar and wind, is propelling demand for efficient power conversion components, making Schottky diodes essential. Additionally, the growth of 5G infrastructure and energy-efficient data centers is pushing the need for better thermal management and higher current-handling capabilities.

Growth Factors

Several key factors underpin the growth of the lead-less chip Schottky diode market. The relentless push towards miniaturization in electronics is pivotal, as smaller, more powerful devices require components that deliver performance without occupying excessive space.

Energy efficiency focus globally adds another layer of demand, supported by regulatory shifts emphasizing lower emissions and sustainable electronics manufacturing. The expansion of automotive electronics, especially with electric and hybrid vehicles, requires high-performance diodes capable of withstanding demanding conditions.

Advances in semiconductor processes and materials continue to enhance diode efficiency and reliability, making them more attractive for various applications. Additionally, growing awareness of environmental regulations that target the elimination of lead in electronics is accelerating a switch to lead-less components.

Drivers

Rising Demand for Energy-Efficient Devices

The lead-less chip Schottky diode market is propelled by a growing global focus on energy efficiency across multiple sectors. These diodes are valued for their low forward voltage drop and fast switching capabilities, which translate into reduced power loss in electronic devices.

Electric vehicles (EVs) heavily rely on efficient power management components, including these diodes, to enhance battery life and overall vehicle performance. This rising demand for energy-efficient electronics, fueled by climate goals and regulatory pressures for greener technology, significantly drives market growth.

For instance, in March 2024, MPE Electronics highlighted the ongoing trend of miniaturization in electronics, emphasizing the increasing demand for smaller components that do not compromise on performance. This trend is particularly relevant to the Leadless Chip Schottky Diode market, where compact and efficient diodes are essential for meeting the space and power requirements of modern devices.

Restraint

Fluctuating Raw Material Prices

One significant limitation faced by the lead-less chip Schottky diode market is the volatility in raw material costs, especially those critical for semiconductor manufacturing. The prices of silicon and other semiconductor-grade materials can fluctuate due to supply chain disruptions or geopolitical tensions.

The recent disturbances in global supply chains have caused uncertainty in the availability and pricing of key materials, negatively impacting manufacturing costs and ultimately the product pricing. This increase in production costs can reduce profitability for manufacturers and lead to pricing pressures, particularly in cost-sensitive segments like consumer electronics or industrial automation.

For instance, In July 2024, Shin-Etsu Chemical raised silicone product prices due to higher raw material costs, especially silicon, highlighting a key challenge for the semiconductor industry as silicon price volatility directly drives up production costs for components such as Schottky diodes.

Opportunities

Growth in Renewable Energy and EV Applications

The expanding renewable energy sector and electric vehicle market present significant growth opportunities for lead-less chip Schottky diodes. Schottky diodes are critical in power conversion and charging circuits, where efficiency and thermal management are essential. For example, solar inverters and wind power systems increasingly incorporate these diodes to optimize energy conversion and enhance system reliability.

Similarly, the rapid adoption of electric vehicles and hybrid models globally boosts demand for efficient power electronics. The diodes contribute to improved battery management and charging efficiency, enabling longer driving ranges and quicker charging times. These applications allow manufacturers to design advanced diodes for green energy and automotive needs, driving strong market growth.

For instance, in September 2023, CDIL Semiconductors, an Indian company, announced its expansion into the production of Silicon Carbide (SiC) devices, which are crucial for electric vehicles (EVs) and solar panel applications. This move aligns with the growing demand for energy-efficient components in the EV sector, where Schottky diodes, including leadless chip variants, play a critical role in power management systems.

Challenges

Competition from Alternative Technologies

The lead-less chip Schottky diode market faces challenges from competing semiconductor technologies that may offer advantages in specific applications. Alternatives such as silicon carbide (SiC) and gallium nitride (GaN) based diodes promise higher efficiency and operation under extreme conditions, which can surpass traditional Schottky diode performance.

For instance, In November 2024, ROHM Semiconductor launched surface-mount SiC Schottky barrier diodes that improve insulation resistance by increasing creepage distance, ensuring reliability in high-voltage power systems. The first models target automotive use, with expansion planned for industrial applications.

Regional Trends

North America Market Trends

North America shows strong interest in lead-less chip Schottky diodes, driven by advanced technology sectors such as aerospace, defense, automotive, and smart manufacturing. The adoption of electric vehicles and AIoT (Artificial Intelligence of Things) integration propels the need for efficient power components. Policies promoting clean energy and infrastructure upgrades further stimulate market growth.

Increased investments in electric vehicles and data centers have heightened demand for efficient power supplies, where these diodes play a critical role. North America’s emphasis on innovation and sustainable technologies positions it as a key region for ongoing development and use of lead-less chip Schottky diodes.

Europe Market Trends

Europe’s market exhibits steady growth with a focus on renewable energy and electric vehicle sectors, which rely heavily on efficient power management components. Stringent energy efficiency regulations and investment in green technologies encourage adoption of lead-less chip Schottky diodes in power supplies, automotive electronics, and industrial applications.

The region benefits from a mature industrial base and strong semiconductor manufacturing presence. European industries are increasingly integrating these diodes in electric fleet developments and smart grid projects, reflecting a shift toward sustainability and innovation in power electronics.

Latin America Market Trends

Latin America is experiencing moderate but growing demand for lead-less chip Schottky diodes, mainly fueled by expanding industrial automation and urbanization efforts. Growing manufacturing activities and infrastructure projects create increasing needs for efficient power supplies in the region.

While the market size is smaller compared to other regions, Latin America offers opportunities as local companies adopt new technologies and electronic device penetration rises. The region’s gradual shift towards modern manufacturing and energy-efficient solutions supports steady growth prospects for these diodes.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the leadless chip Schottky diode market, Texas Instruments, Infineon Technologies, STMicroelectronics, and ON Semiconductor are recognized as major players. Their strong portfolios in power electronics and semiconductor devices make them leading suppliers for automotive, consumer electronics, and industrial applications.

Other global manufacturers such as Nexperia, Vishay Intertechnology, Diodes Incorporated, and Rohm Semiconductor strengthen the market with specialized diode products. Their offerings are widely used in switching power supplies, battery-powered devices, and renewable energy systems.

Additional contributors including Microchip Technology, Kyocera Corporation, Toshiba Corporation, and Semtech Corporation play an important role by expanding product diversity and addressing niche requirements. Their diodes are deployed in communications, computing, and high-frequency applications, where compact size and thermal efficiency are critical.

Top Key Players in the Market

- Texas Instruments (TI)

- Infineon Technologies

- Nexperia

- STMicroelectronics

- ON Semiconductor

- Vishay Intertechnology

- Diodes Incorporated

- Rohm Semiconductor

- Microchip Technology

- Kyocera Corporation

- Toshiba Corporation

- Semtech Corporation

- Other Major Players

Recent Developments

- In July 2025, Vishay Intertechnology launched new Gen 3 650V and 1200V SiC Schottky diodes, enhancing efficiency and reliability for switching power designs. These diodes are available in the compact SlimSMA package.

- In April 2025, Infineon launched a new lineup of Gallium Nitride (GaN) transistors with integrated Schottky diodes, addressing the historical lack of reverse body diodes in GaN devices. This advancement enhances the performance and efficiency of GaN in power conversion applications.

Report Scope

Report Features Description Market Value (2024) USD 1,460.5 Mn Forecast Revenue (2034) USD 3,241.8 Mn CAGR(2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Voltage (20V – 40V, 40V – 60V, 60V – 100V, More than 100V), By Application (Switch Mode Power Supplies, High Frequency Rectification, Portable Battery Powered Devices, Reverse Bias Protection, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Texas Instruments (TI), Infineon Technologies, Nexperia, STMicroelectronics, ON Semiconductor, Vishay Intertechnology, Diodes Incorporated, Rohm Semiconductor, Microchip Technology, Kyocera Corporation, Toshiba Corporation, Semtech Corporation, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lead Less Chip Schottky Diode MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Lead Less Chip Schottky Diode MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Texas Instruments (TI)

- Infineon Technologies

- Nexperia

- STMicroelectronics

- ON Semiconductor

- Vishay Intertechnology

- Diodes Incorporated

- Rohm Semiconductor

- Microchip Technology

- Kyocera Corporation

- Toshiba Corporation

- Semtech Corporation

- Other Major Players