Global Lead Acid Battery for Energy Storage Market By Type (Utility Owned, Custom Owned, Third Party Owned), By Capacity (Up to 100 Ah, 100-200 Ah, 200-500 Ah, 500-1000 Ah, Above 1000 Ah), By Voltage (2V, 4V, 6V, 8V, 12V, 24V, 48V), By Chemistry (Flooded, Valve-Regulated Lead-Acid (VRLA), Gel, Absorbed Glass Mat (AGM)), By Application (Utilities and Grid Storage, Telecommunications and Data Centers, Backup Power Systems, Renewable Energy Integration, Transportation, Mining and Energy Exploration, Aerospace and Defense, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131323

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

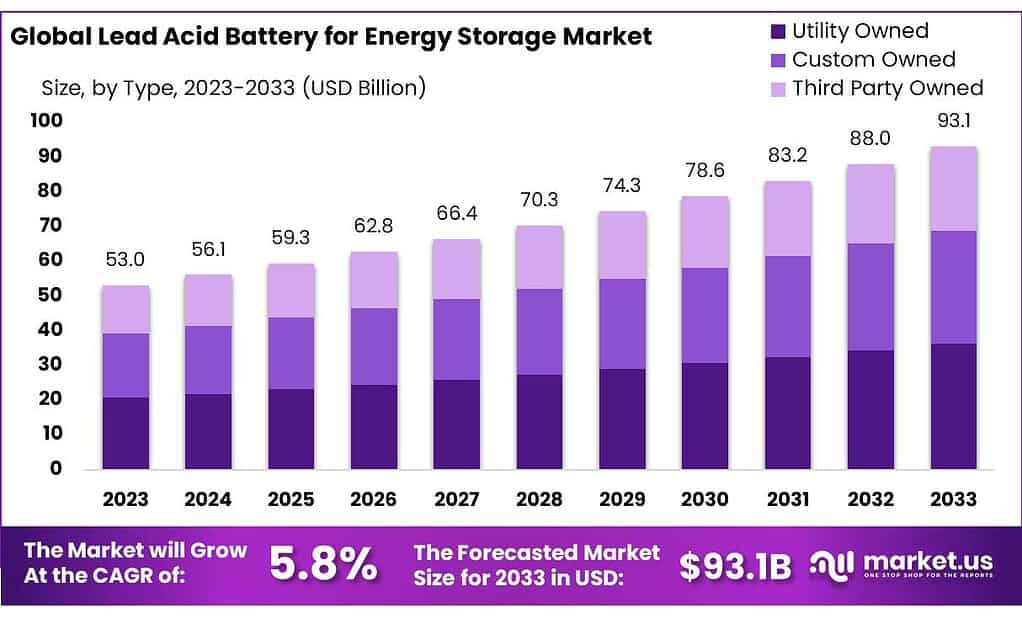

The Global Lead Acid Battery for Energy Storage Market size is expected to be worth around USD 93.1 Bn by 2033, from USD 53.0 in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The Lead Acid Battery for Energy Storage Market refers to the commercial and industrial segment focused on the production, distribution, and sale of lead acid batteries specifically for energy storage applications.

Lead acid batteries, known for their reliability and cost-effectiveness, are used extensively to store electrical energy in various forms. This market caters to a range of applications including emergency power backups, renewable energy systems like solar and wind, utility support for grid stabilization, and in settings requiring large-scale energy storage solutions.

According to the Press Information Bureau (PIB), the Government of India has launched the Battery Energy Storage System (BESS) scheme aimed at developing projects with a target capacity of 4,000 MWh by 2030-31. This initiative includes substantial financial support that covers up to 40% of capital costs through a mechanism known as Viability Gap Funding (VGF).

The scheme is designed to enhance the viability of battery storage systems, making them more accessible and cost-effective for distribution companies and consumers alike. The initial budget allocation for this scheme is approximately INR 9,400 crore (USD 1.129 billion), which includes INR 3,760 crore (USD 451.95 million) earmarked specifically for VGF support.

Furthermore, the Indian government plans to make energy storage mandatory for renewable energy projects exceeding 5 MW, ensuring a stable market for battery manufacturers.

This regulatory framework is expected to significantly boost investments in renewable energy and storage technologies, facilitating the integration of renewable sources like solar and wind into the national grid24.

The BESS scheme aims to achieve a Levelized Cost of Storage (LCoS) ranging from INR 5.50 to 6.60 per kilowatt-hour (kWh), promoting efficient energy management across the country.

Key Takeaways

- Lead Acid Battery for Energy Storage Market size is expected to be worth around USD 93.1 Bn by 2033, from USD 53.0 in 2023, growing at a CAGR of 5.8%.

- Utility Owned lead-acid batteries for energy storage held a dominant market position, capturing more than a 39.3% share.

- 200-500 Ah segment of the lead-acid battery market for energy storage held a dominant position, capturing more than a 27.4% share.

- 12V batteries held a dominant market position in the lead acid battery for energy storage market, capturing more than a 42.3% share.

- Flooded lead-acid batteries maintained a dominant position in the energy storage market, capturing more than a 48.3% share.

- Utilities and Grid Storage held a dominant market position in the lead acid battery for energy storage market, capturing more than a 36.7% share.

- Asia Pacific region dominated the lead acid battery market for energy storage, commanding a 44.3% share.

By Type

Utility-Owned Lead Acid Batteries for Energy Storage with a 39.3% Share

In 2023, Utility Owned lead-acid batteries for energy storage held a dominant market position, capturing more than a 39.3% share. This segment includes batteries owned and operated by utility companies, primarily used for grid stabilization and managing peak load demands. The high share reflects the increasing reliance on lead-acid batteries for cost-effective energy storage solutions in utility applications.

Custom Owned lead-acid batteries, owned by individual businesses or households, also represent a significant segment. These batteries are typically used for backup power and energy cost management in private properties. While they do not command as large a market share as utility-owned systems, their importance grows as more consumers look to improve energy independence and manage utility costs effectively.

Third Party Owned batteries, managed by independent operators who provide energy storage as a service, are an emerging segment. These operators install and manage batteries on behalf of customers, offering energy storage benefits without the upfront investment. This model is gaining traction, particularly among businesses that require energy storage solutions but prefer to avoid owning and maintaining the systems themselves.

By Capacity

200-500 Ah Segment Dominates with 27.4% Share

In 2023, the 200-500 Ah segment of the lead-acid battery market for energy storage held a dominant position, capturing more than a 27.4% share. This capacity range is particularly favored in medium-scale applications, such as commercial energy storage and backup systems, where it offers an optimal balance between capacity and cost-effectiveness.

The segment for batteries up to 100 Ah, suitable for smaller scale applications like residential backup and small renewable energy integrations, also holds a significant portion of the market. These batteries are valued for their affordability and are adequate for low-energy requirements.

In the 100-200 Ah range, these batteries are commonly utilized in settings that require a moderate amount of energy storage without the substantial investment required for larger systems. This segment caters to small businesses and more substantial residential uses.

The 500-1000 Ah batteries are designed for larger, industrial applications where substantial energy storage is necessary. These batteries are ideal for industrial backup systems and energy storage solutions that support larger facilities.

batteries with a capacity of above 1000 Ah are used in very large-scale operations, such as utility-scale energy storage and industrial applications that demand high capacity for energy management and operational continuity.

By Voltage

12V Lead Acid Batteries Command 42.3% Market Share in Energy Storage Sector

In 2023, 12V batteries held a dominant market position in the lead acid battery for energy storage market, capturing more than a 42.3% share. This voltage is commonly used due to its versatility in various applications, including automotive, solar energy systems, and UPS systems, where moderate voltage and reliable power are necessary.

Other voltage categories include 2V, which are typically used in large-scale energy storage systems due to their ability to be combined into higher voltage configurations. The 4V and 6V batteries are often found in smaller consumer devices and emergency lighting systems, offering a balance between size and power output.

The 8V batteries are less common but are used in applications requiring slightly higher power outputs than what 6V batteries can provide. On the higher end, 24V and 48V batteries are essential for larger systems, such as electric vehicles and large solar installations, where higher voltage requirements are needed for efficient power management.

By Chemistry

Flooded Batteries Dominate with a 48.3% Share

In 2023, Flooded lead-acid batteries maintained a dominant position in the energy storage market, capturing more than a 48.3% share. This type of battery is favored for its cost-effectiveness and reliability, particularly in stationary applications such as backup power systems and off-grid energy storage where maintenance access is manageable.

Valve-Regulated Lead-Acid (VRLA) batteries also play a significant role in the market. These batteries are preferred in settings where maintenance needs to be minimal and space is limited. They are commonly used in telecommunications and uninterruptible power supply (UPS) systems due to their compact size and leak-proof design.

Gel batteries, a subtype of VRLA, are recognized for their excellent deep discharge recovery and suitability for harsh temperature environments. Their maintenance-free operation makes them ideal for marine, RV, and deep-cycle applications where regular maintenance checks are difficult.

Absorbed Glass Mat (AGM) batteries represent another segment of the VRLA market. Known for their high power density and ability to handle high charge and discharge rates, AGM batteries are particularly suited for applications that require durability and high performance, such as in high-end vehicles and modern renewable energy systems.

By Application

Utilities and Grid Storage Command a 36.7% Share

In 2023, Utilities and Grid Storage held a dominant market position in the lead acid battery for energy storage market, capturing more than a 36.7% share. This segment benefits significantly from the need for large-scale energy storage solutions to manage grid stability and store excess energy generated from both conventional and renewable sources.

Telecommunications and Data Centers also rely heavily on lead acid batteries, primarily for backup power to ensure uninterrupted service and data integrity during power outages. This application remains critical as global data traffic grows and network reliability becomes more crucial.

Backup Power Systems in various industries, including healthcare and financial services, utilize lead acid batteries to maintain operations during electrical failures, underscoring the importance of reliable energy solutions in critical sectors.

Renewable Energy Integration is another significant application. Lead acid batteries are used to store energy from solar, wind, and other renewable sources, facilitating a smoother integration into the power grid and enhancing the efficiency of energy use.

In Transportation, lead acid batteries provide essential power for starting, lighting, and ignition in vehicles, and support for electric vehicles (EVs) is expanding, although they face strong competition from other battery chemistries.

The Mining and Energy Exploration sector uses these batteries for power supply and safety in remote and off-grid locations, where durability and reliability are paramount.

Aerospace and Defense applications demand high reliability, and lead acid batteries are used in various military and aviation equipment for energy storage and backup power.

Key Market Segments

By Type

- Utility Owned

- Custom Owned

- Third Party Owned

By Capacity

- Up to 100 Ah

- 100-200 Ah

- 200-500 Ah

- 500-1000 Ah

- Above 1000 Ah

By Voltage

- 2V

- 4V

- 6V

- 8V

- 12V

- 24V

- 48V

By Chemistry

- Flooded

- Valve-Regulated Lead-Acid (VRLA)

- Gel

- Absorbed Glass Mat (AGM)

By Application

- Utilities and Grid Storage

- Telecommunications and Data Centers

- Backup Power Systems

- Renewable Energy Integration

- Transportation

- Mining and Energy Exploration

- Aerospace and Defense

- Others

Driving Factors

Renewable Energy Integration

The integration of renewable energy sources such as solar and wind power is a significant driving factor for the growth of the lead acid battery market for energy storage. As the global focus shifts towards sustainable energy solutions, the need for effective storage systems to manage the intermittent nature of renewable energy sources has become crucial.

Lead acid batteries are particularly valued in this context for their ability to provide cost-effective storage for short-duration applications, making them a practical choice for small-scale renewable projects.

The expansion of the lead acid battery market is also driven by technological advancements that enhance the performance and efficiency of these batteries.

Improvements in areas such as energy density, cycle life, and charging speed are making lead acid batteries more competitive with other battery technologies. This is crucial for their continued use in a wide range of energy storage applications, from utility-scale projects to residential energy systems.

Additionally, the growth of this market is supported by increasing regulatory focus on sustainability and the advancement of battery recycling practices. These factors help mitigate the environmental impact of lead acid batteries and enhance their appeal in an increasingly eco-conscious market.

Restraining Factors

Environmental Concerns and Advancements in Alternative Technologies

One of the primary restraining factors for the growth of the lead acid battery market is the environmental concern associated with lead toxicity. Lead acid batteries contain lead and sulfuric acid, which can pose serious environmental risks if not properly disposed of or recycled.

This has led to stringent regulatory policies focused on the disposal and recycling of lead acid batteries, potentially limiting market growth.

Furthermore, the market faces challenges from technological advancements in alternative battery technologies, such as lithium-ion batteries, which offer higher energy densities and longer life spans.

These alternatives are becoming increasingly popular in applications where space and weight are critical factors, such as in electric vehicles and portable electronic devices.

The combination of environmental concerns and competition from advanced battery technologies is prompting the lead acid battery industry to invest in research and development to improve the performance characteristics of their batteries.

These efforts include enhancing energy density, reducing weight, and improving charge rates to make lead acid batteries more competitive in a rapidly evolving energy storage market.

Growth Opportunity

Expansion in Energy Storage Applications

A significant growth opportunity for the lead acid battery market lies in its expanding role in energy storage systems, particularly for grid-scale applications. The demand for energy storage is being driven by the increasing integration of renewable energy sources, such as wind and solar, which require robust storage solutions to manage their intermittent nature and ensure a stable energy supply.

The global market for grid-scale battery energy storage systems saw an extraordinary growth rate of 159.5% in 2023 over the previous year, with forecasts indicating continued robust expansion. This surge is facilitated by government policies and incentives promoting renewable energy and energy storage technologies, reflecting a strong commitment to enhancing grid stability and energy sustainability.

Additionally, lead acid batteries are recognized for their cost-effectiveness and reliability, making them suitable for both small and large-scale energy storage applications. These attributes are particularly valued in regions with high growth in renewable energy installations, where cost-effective storage solutions are crucial for balancing supply and demand dynamics.

Technological advancements are also enabling lead acid batteries to be more efficient and environmentally friendly, enhancing their appeal in the energy storage market. With these developments, lead acid batteries are expected to remain a key component of the energy storage ecosystem, contributing significantly to the global push towards renewable energy and grid modernization

Latest Trends

Current Trends and Advancements in the Lead Acid Battery Market for Energy Storage

A significant trend in the lead acid battery market for energy storage is the increasing shift towards cost-effectiveness and sustainability, making these batteries a key choice for various applications.

Despite the competition from advanced battery technologies like lithium-ion, lead acid batteries remain popular due to their lower upfront costs and proven track record in reliability and durability across diverse environmental conditions.

This has maintained their viability for both small-scale and large-scale energy storage systems, supporting a broad range of applications from automotive to renewable energy integration.

Furthermore, there’s a notable rise in the adoption of advanced lead acid battery technologies such as Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM), which offer improved performance metrics over traditional lead acid batteries.

These advancements are crucial for meeting the increased demands of modern energy storage applications, particularly in areas requiring high reliability and maintenance ease.

The market is also witnessing growth driven by the expanding use of lead acid batteries in grid storage applications. This trend is supported by the increasing need for cost-effective energy storage solutions that enhance grid stability and support the integration of renewable energy sources.

With ongoing advancements and a focus on enhancing energy density and reducing environmental impact, lead acid batteries continue to evolve, securing their place in the future of energy storage solutions.

Regional Analysis

In 2023, the Asia Pacific region dominated the lead acid battery market for energy storage, commanding a 44.3% share and generating revenues of USD 9.03 billion. This leadership is largely driven by the region’s rapid industrialization, significant investments in grid infrastructure, and the expanding adoption of renewable energy sources. China, India, and South Korea are key contributors, leveraging extensive manufacturing capabilities and government incentives to foster growth in both automotive and industrial battery applications.

North America remains a significant market, characterized by robust demand in the automotive sector and a growing focus on renewable energy integrations. The United States and Canada are investing heavily in energy storage solutions to support grid stability and energy management, further propelled by technological innovations and supportive regulatory frameworks.

Europe’s market is largely driven by stringent environmental regulations and the increasing shift towards electric vehicles and renewable energy sources. Countries like Germany, the UK, and France are leading in the adoption of advanced energy storage technologies, with substantial investments in smart grid and energy efficiency technologies.

The Middle East & Africa region is witnessing gradual growth, supported by the development of renewable energy projects and the modernization of energy infrastructure. The region’s focus is on improving energy security and managing the expanding energy demands of its rapidly growing urban environments.

Latin America, though smaller in comparison, shows potential due to its increasing focus on renewable energy and the necessity for reliable energy storage solutions to stabilize its evolving energy networks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The lead acid battery market for energy storage features several key players that significantly influence its dynamics and growth. Panasonic Corp and LG Energy Solution are notable for their technological advancements and substantial market presence in both consumer electronics and automotive sectors.

These companies are actively expanding their energy storage solutions, focusing on enhancing battery efficiency and capacity to meet the growing demands of electric vehicles and renewable energy systems.

Companies like Duracell Inc., Energizer Holdings Inc., and VARTA AG are well-established in the consumer battery segment, renowned for their reliable and long-lasting lead acid battery products, which are extensively used in a variety of applications ranging from household to industrial power backup systems.

EVE Energy Co. Ltd. and Tianjin Lishen Battery Joint-Stock Co., Ltd., primarily operating in Asia, are expanding their reach in global markets by capitalizing on high-volume manufacturing and increasing exports.

Samsung SDI and Maxell, Ltd. also play crucial roles, particularly in innovation and development of high-density energy storage solutions, which are critical in today’s fast-evolving energy sector.

These companies are enhancing their product portfolios to include batteries that are not only more efficient but also environmentally friendly, aligning with global sustainability trends. Collectively, these companies drive the lead acid battery market forward through a combination of innovation, quality, and comprehensive market reach, catering to a wide range of industrial, automotive, and consumer applications.

Top Key Players in the Market

- Furukawa Electric Co., Ltd

- Zhejiang Narada Power Source Co., Ltd

- Clarios

- Leoch International Technology Ltd

- Yokohama Batteries Sdn. Bhd

- EnerSys

- Exide Industries Limited

- GS Yuasa Corporation

- Hoppecke Batterien GmbH & Co. KG

- Crown Battery Corporation

- C&D Technologies, Inc.

- Coslight Technology International Group Co. Ltd

- East Penn Manufacturing Co

- Chaowei Power Holdings Limited

- Zhangzhou Huawei Power Supply Technology Co., Ltd

- B. B. Battery Co., Ltd

- Camel Group Co., Ltd

Recent Developments

In 2023 Panasonic Corp. has been making significant strides in the lead acid battery sector for energy storage, especially focusing on expanding its role in the electric vehicle (EV) battery market.

In 2023, Duracell introduced a new line of 14-kWh lithium-iron phosphate (LFP) batteries, designed to support grid-connected solar self-consumption, time-of-use rate shifting, and provide backup power for homes.

Report Scope

Report Features Description Market Value (2023) USD 53.0 Bn Forecast Revenue (2033) USD 93.1 Bn CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Utility Owned, Custom Owned, Third Party Owned), By Capacity (Up to 100 Ah, 100-200 Ah, 200-500 Ah, 500-1000 Ah, Above 1000 Ah), By Voltage (2V, 4V, 6V, 8V, 12V, 24V, 48V), By Chemistry (Flooded, Valve-Regulated Lead-Acid (VRLA), Gel, Absorbed Glass Mat (AGM)), By Application (Utilities and Grid Storage, Telecommunications and Data Centers, Backup Power Systems, Renewable Energy Integration, Transportation, Mining and Energy Exploration, Aerospace and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Furukawa Electric Co., Ltd, Zhejiang Narada Power Source Co., Ltd, Clarios, Leoch International Technology Ltd, Yokohama Batteries Sdn. Bhd, EnerSys, Exide Industries Limited, GS Yuasa Corporation, Hoppecke Batterien GmbH & Co. KG, Crown Battery Corporation, C&D Technologies, Inc., Coslight Technology International Group Co. Ltd, East Penn Manufacturing Co, Chaowei Power Holdings Limited, Zhangzhou Huawei Power Supply Technology Co., Ltd, B. B. Battery Co., Ltd, Camel Group Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lead Acid Battery for Energy Storage MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Lead Acid Battery for Energy Storage MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Furukawa Electric Co., Ltd

- Zhejiang Narada Power Source Co., Ltd

- Clarios

- Leoch International Technology Ltd

- Yokohama Batteries Sdn. Bhd

- EnerSys

- Exide Industries Limited

- GS Yuasa Corporation

- Hoppecke Batterien GmbH & Co. KG

- Crown Battery Corporation

- C&D Technologies, Inc.

- Coslight Technology International Group Co. Ltd

- East Penn Manufacturing Co

- Chaowei Power Holdings Limited

- Zhangzhou Huawei Power Supply Technology Co., Ltd

- B. B. Battery Co., Ltd

- Camel Group Co., Ltd