Global Laryngeal Mask Market By Product (Reusable and Disposable), By Age-Group (Adults, Pediatric and Geriatric), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), and Diagnostic Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170624

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

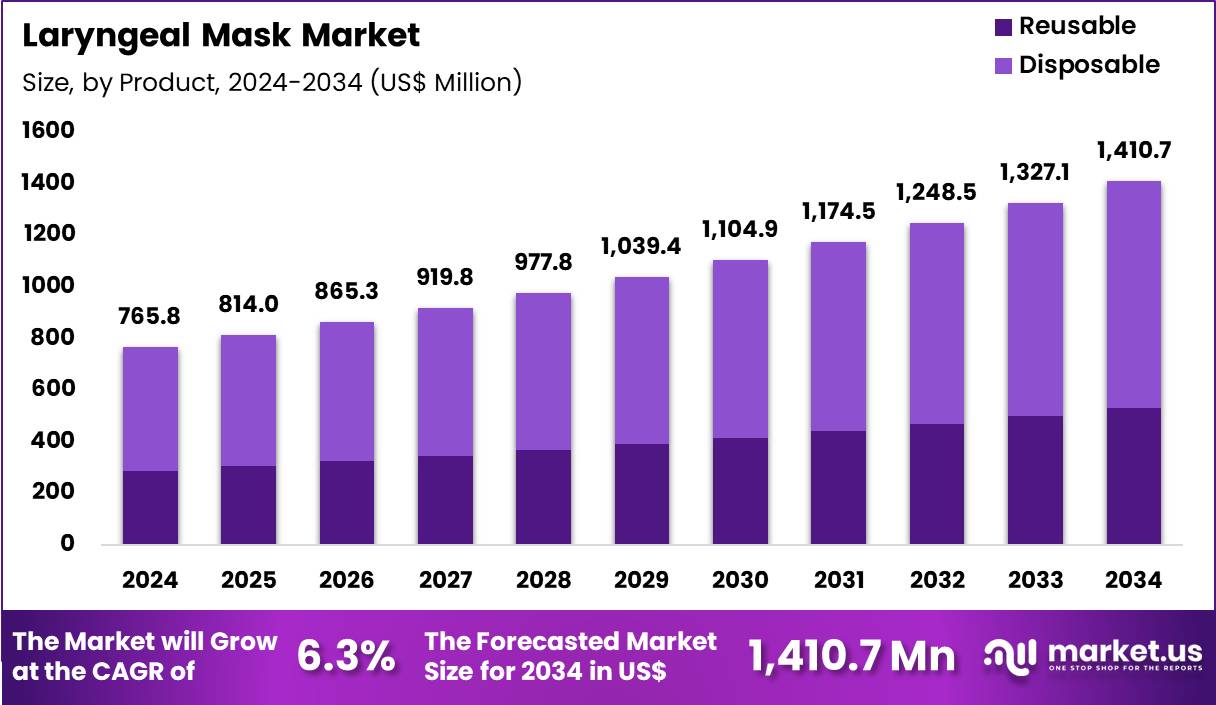

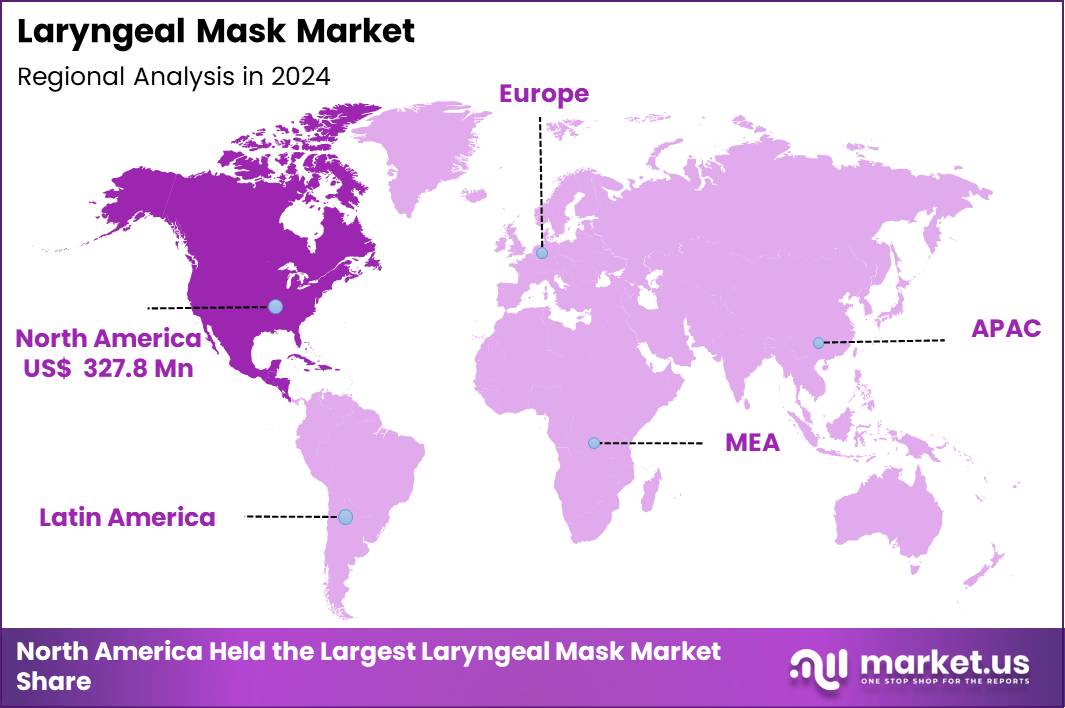

The Global Laryngeal Mask Market size is expected to be worth around US$ 1,410.7 Million by 2034 from US$ 765.8 Million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.8% share with a revenue of US$ 327.8 Million.

Laryngeal Mask Airway (LMA) is a supraglottic device consisting of an inflatable cuff attached to a tube, inserted blindly through the mouth to form a low-pressure seal over the laryngeal inlet, facilitating ventilation without tracheal intubation. Invented in 1983 by Archie Brain, it bridges bag-valve-mask and endotracheal tubes, ideal for anesthesia, emergencies, and difficult airways. Some examples include Classic LMA: Original 1st-generation; basic seal for short surgeries.; ProSeal LMA: 2nd-generation with gastric drain to reduce aspiration risk.; i-gel: Non-inflatable gel cuff for easy insertion; no cuff pressure needed and Intubating LMA (ILMA): Guides endotracheal tube placement.

The Laryngeal Mask Market represents a critical segment of airway management, supporting anesthesia, emergency medicine, and pre-hospital care with minimally invasive supraglottic devices. Laryngeal masks allow clinicians to secure the airway without endotracheal intubation, reducing trauma, simplifying ventilation, and improving turnaround time in operating rooms. Hospitals worldwide increasingly adopt these devices for routine surgeries, difficult airway situations, and rapid-sequence interventions.

Growth is supported by rising surgical volumes, expansion of ambulatory surgical centers, and advancements in disposable and anatomically-contoured airway devices. For example, more than 310 million surgeries are performed globally every year according to WHO, and laryngeal masks are widely used as primary or backup airway devices in a significant share of elective procedures. Manufacturers continuously introduce improved materials such as medical-grade silicone, softer cuffs, and integrated bite blocks to enhance patient comfort and reduce complications.

Laryngeal masks are also essential in emergency response. Pre-hospital teams use LMAs during cardiac arrest, trauma cases, and respiratory failures where rapid airway access is crucial. EMS protocols in countries like the US and UK list LMAs as approved airway devices for out-of-hospital ventilation, strengthening recurrent demand. The adoption of disposable LMAs increased notably after global infection-control initiatives, where single-use airway devices helped minimize cross-contamination risks.

Key Takeaways

- In 2024, the market generated a revenue of US$ 765.8 Million, with a CAGR of 6.3%, and is expected to reach US$ 1,410.7 Million by the year 2034.

- The Product segment is divided into Reusable, and Disposable, with Disposable taking the lead in 2024 with a market share of 62.5%

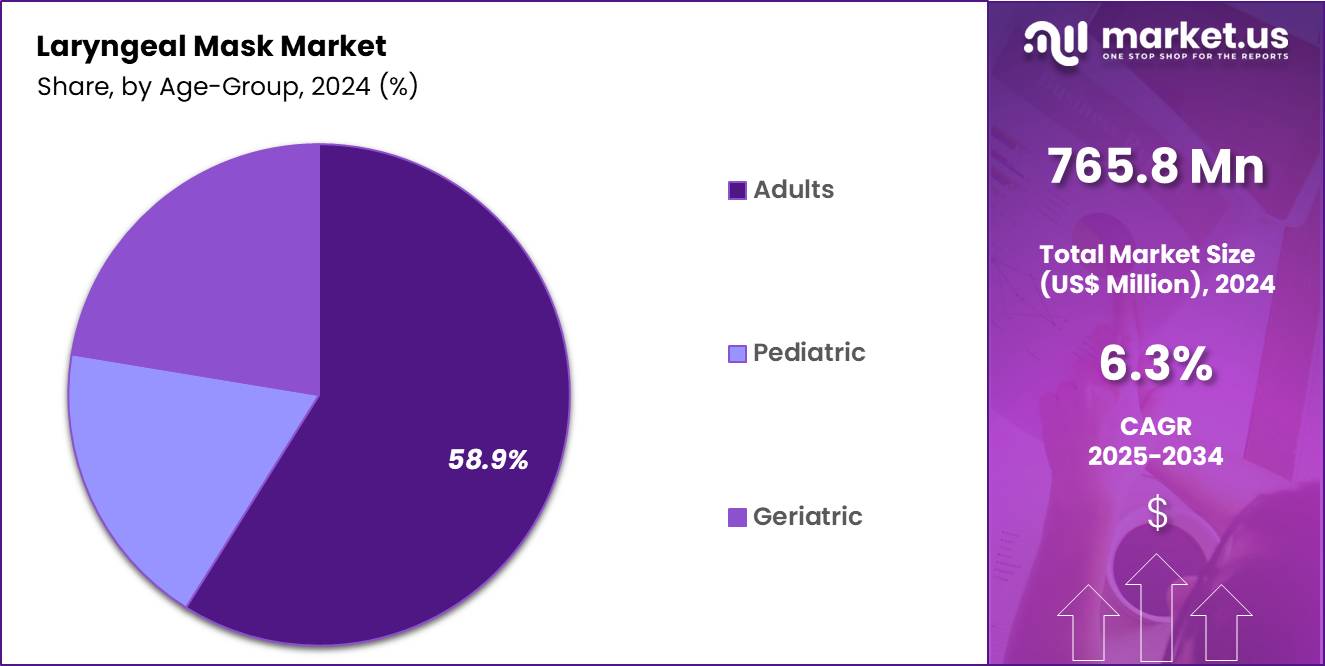

- The Age-Group segment is divided into Adults, Pediatric, and Geriatric, with Adults taking the lead in 2024 with a market share of 58.9%

- The End-User segment is divided into Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), and Diagnostic Centers, with Hospitals & Clinics taking the lead in 2024 with a market share of 59.3%

- North America led the market by securing a market share of 42.8% in 2024.

Product Analysis

Disposable laryngeal masks dominated the market with 62.5% market share in 2024 as they have gained strong traction as infection-control standards in hospitals and surgical centers continue to stiffen. Single-use designs eliminate cross-contamination risk, particularly important in high-risk cases such as respiratory infections or immunocompromised patient populations.

Many emergency guidelines, such as those followed by EMS systems in Europe and North America, recommend disposable LMAs because they require no sterilization and can be rapidly deployed in the field. Disposable LMAs are also lighter, easier to stock, and available in specialized variants such as gastric-channel LMAs and reinforced tubes for head-and-neck surgeries. Their role expanded after global public-health events increased awareness of contamination risk, leading clinicians to favor sterile, ready-to-use airway devices.

Reusable laryngeal masks are widely adopted in healthcare systems that emphasize cost efficiency and sterilization capability. These devices, usually made from high-durability silicone, are designed to withstand multiple autoclave cycles. For example, studies published in anesthesiology journals show reusable LMAs can be sterilized more than 30–40 times without structural degradation when proper protocols are followed.

Teaching hospitals and government-funded facilities frequently prefer reusable devices due to predictable reprocessing workflows. The surgical units performing ENT procedures, orthopedic surgeries, and day-care interventions rely on reusable LMAs to reduce equipment turnover costs.

Age-Group Analysis

Adults represent the largest user group for laryngeal mask procedures which accounted for 58.9% market share in 2024 because the adult demographic undergoes the majority of surgical interventions globally. WHO data confirms that elective surgeries are most frequent in the adult population, contributing to increased LMA use for general anesthesia, laparoscopic procedures, gynecologic surgeries, and day-care operations.

Adult LMAs are available across a wide size range, allowing anesthetists to maintain consistent ventilation across varying body weights and anatomical structures. Adult emergency cases such as cardiac arrest, trauma, airway obstruction, and respiratory collapse further add to usage.

Pediatric laryngeal masks are essential for safe airway management in children, especially in tonsillectomies, appendectomies, and diagnostic procedures requiring anesthesia. Pediatric LMAs reduce the risk of airway trauma compared to endotracheal tubes, as children are more prone to laryngeal irritation. Several studies highlight that LMAs reduce postoperative sore throat in children and offer faster recovery.

Neonatal and infant airway sizes require precision, leading manufacturers to produce LMAs in sizes 1 to 2.5 specifically tailored for small anatomies. The pediatric adoption rate continues to rise as more regions develop specialized pediatric surgical units.

End-User Analysis

Hospitals and clinics represent the largest end-user segment with accounted for 59.3% market share in 2024 due to extensive use in operating rooms, emergency departments, ICUs, and trauma units. Surgical centers performing high volumes of anesthesia procedures rely on LMAs for predictable sealing, ease of placement, and reduced airway trauma.

LMAs are increasingly used in fast-track surgeries where rapid recovery is needed. In emergency departments, LMAs are life-saving devices during cardiopulmonary resuscitation when traditional intubation is difficult. Clinical guidelines such as the American Heart Association’s CPR standards acknowledge LMAs as an acceptable supraglottic airway device, reinforcing their widespread adoption.

Ambulatory surgical centers are among the fastest-growing users of laryngeal masks as minimally invasive outpatient surgeries expand. ASCs prioritize devices that support quick induction and fast patient turnover. LMAs allow shorter anesthesia time, reduced coughing on emergence, and smooth recovery, which aligns with ASC efficiency goals.

Procedures performed in ASCs including arthroscopies, cosmetic surgeries, ophthalmic surgeries, and gynecologic interventions commonly rely on LMAs for airway maintenance. The increasing shift of surgical volume from hospitals to outpatient centers strengthens this segment.

Key Market Segments

By Product

- Reusable

- Disposable

By Age-Group

- Adults

- Pediatric

- Geriatric

By End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

Drivers

Rising volume of global surgical procedures

A major driver of the Laryngeal Mask Market is the rising volume of global surgical procedures and the increasing preference for minimally invasive airway devices. According to the World Health Organization, more than 310 million surgical procedures are performed each year worldwide, and laryngeal masks are used in a significant share of these cases due to their ease of placement, reduced airway trauma, and faster recovery profiles compared to intubation. LMAs are especially popular in outpatient surgeries, which have grown rapidly as healthcare systems shift toward same-day surgical models, reducing hospital stays and costs.

Emergency medicine also contributes strongly out-of-hospital cardiac arrests exceed 7 million cases globally per year, and EMS providers in countries such as the US, UK, Germany, Australia, and Japan routinely include LMAs in advanced airway management protocols. Furthermore, the global burden of chronic diseases such as cancer, diabetes, and cardiovascular conditions has increased overall surgical demand, leading to more routine anesthesia procedures where LMAs play a central role.

Infection-control initiatives following global health crises have further expanded the use of disposable laryngeal masks, especially in high-risk respiratory cases. Collectively, these clinical and systemic factors make LMAs indispensable across surgical, emergency, and diagnostic care pathways.

Restraints

Risk of aspiration and inadequate sealing

A key restraint for the Laryngeal Mask Market is the potential risk of aspiration and inadequate sealing in high-risk patients, particularly those undergoing emergency surgery, trauma interventions, or procedures requiring deep anesthesia.

Clinical studies have shown that while LMAs provide effective ventilation for most routine cases, they may not fully prevent aspiration in patients with full stomachs, morbid obesity, severe reflux, or compromised airway anatomy. This leads anesthesiologists in many hospitals to prefer endotracheal intubation for high-risk profiles, reducing LMA usage in certain settings.

Another restraint is the variability in provider skill. Although LMAs are easier to use compared to intubation, improper placement may cause leaks, hypoventilation, or suboptimal oxygenation. Regulatory agencies and clinical institutions emphasize competency, yet global disparities in training persist, particularly in developing regions where anesthesia specialists are limited.

Supply-chain challenges also affect adoption. Single-use LMAs rely on consistent availability of silicone and PVC components, which can be disrupted by geopolitical tensions, transportation delays, or raw-material shortages. During past health emergencies, several regions experienced shortages of disposable airway devices, forcing clinicians to improvise with alternatives.

Opportunities

Development of next-generation LMAs with enhanced safety and functionality

A major opportunity in the Laryngeal Mask Market lies in the development of next-generation LMAs with enhanced safety and functionality, particularly those incorporating gastric drainage channels, pressure-regulated cuffs, and fiber-optic compatibility. Gastric-channel LMAs significantly reduce aspiration risk by allowing passive drainage of gastric contents, a feature increasingly in demand in both elective and emergency surgeries.

Another opportunity arises from the rapid expansion of ambulatory surgical centers (ASCs) worldwide, which now perform a growing portion of orthopedic, gynecologic, ENT, and general surgeries. These centers favor LMAs because they support quicker induction and smoother emergence from anesthesia, enabling efficient patient turnover. Emerging markets also provide substantial growth potential. Asia Pacific, Latin America, and parts of the Middle East are experiencing rising surgery rates due to improved healthcare access, government investment, and medical tourism.

For instance, India alone performs more than 60 million surgeries annually, while China continues to expand surgical capabilities in urban and rural areas. EMS modernization across Southeast Asia and Africa further opens demand for easy-to-use airway devices such as LMAs. Innovations in biomaterials — including softer silicone blends and latex-free materials — create additional market opportunities by improving patient comfort and reducing allergic reactions. Combined, these advancements position LMAs for broad, long-term expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical conditions have a significant influence on the Laryngeal Mask Market by shaping global supply chains, procurement budgets, healthcare spending patterns, and the availability of medical-grade materials. Laryngeal masks rely heavily on silicone, PVC, stainless steel, and specialized elastomers, many of which are sourced from geographically diverse regions.

Trade restrictions, port delays, or regional conflicts can disrupt raw-material flow, leading to shortages or increased production costs. For example, during global shipping bottlenecks, several medical device manufacturers reported delays of 30–45 days for silicone shipments, directly affecting the supply of disposable LMAs. Inflationary pressure in major economies also impacts hospital purchasing behavior. Rising costs for consumables force hospitals, especially in low- and middle-income countries, to prioritize reusable LMAs over disposable ones or reduce overall procurement volumes.

Geopolitical instability additionally affects cross-border regulatory collaboration. Sanctions or diplomatic tensions may delay regulatory approvals, inhibit technology transfer, or restrict exports of medical equipment. Currency fluctuations in emerging markets impact affordability, altering demand patterns for both premium and standard airway devices.

Public health funding is also tied to macroeconomic cycles; during economic downturns, governments frequently reallocate budgets away from elective surgeries, temporarily lowering demand for LMAs. Conversely, global health crises often accelerate emergency spending, leading to short-term spikes in airway device consumption.

Latest Trends

Shift toward decentralized and point-of-care airway management

A prominent trend in the Laryngeal Mask Market is the shift toward decentralized and point-of-care airway management, supported by rising demand for portable, easy-to-use supraglottic devices. Healthcare systems worldwide are increasingly prioritizing rapid-response tools that can be used in ambulances, remote clinics, military settings, and mobile medical camps.

LMAs fit these needs due to their simple insertion technique and minimal requirement for advanced equipment. Emergency medical services in the US, UK, Canada, and Germany widely include LMAs in pre-hospital airway protocols, and many Asian countries have begun updating EMS guidelines to include supraglottic devices as standard equipment.

Another trend is the adoption of single-use LMAs, which surged after global health crises heightened awareness around cross-contamination risks. Hospitals now prefer disposable devices for respiratory and infectious-disease cases, and advanced disposable models such as dual-seal and reinforced LMAs continue to gain traction. Digital training and simulation-based learning have also become influential trends.

Medical schools and anesthesia societies increasingly incorporate LMA placement into virtual reality and mannequin-based training modules, improving proficiency among new clinicians. Finally, manufacturers are focusing on ergonomic designs, softer materials, and integrated monitoring features, signaling some broader trend toward user-friendly, patient-centric airway devices.

Regional Analysis

North America is leading the Laryngeal Mask Market

North America remains a leading region in the Laryngeal Mask Market accounting for 42.8% market share due to its advanced surgical infrastructure, high anesthesia standards, and strong adoption of supraglottic airway devices across hospitals and emergency care systems. The US performs one of the highest numbers of surgeries per capita globally, driven by orthopedic, cardiovascular, bariatric, and ambulatory procedures where LMAs are routinely used. EMS agencies across the US and Canada widely incorporate LMAs into pre-hospital airway protocols, accelerating usage beyond hospital settings.

Clinical guidelines from professional bodies support the use of LMAs as first-line devices in many elective and difficult-airway scenarios. The region also benefits from strong research institutions and medical device manufacturers, fostering rapid product innovation such as dual-seal cuffs, gastric-channel LMAs, and softer silicone blends. High healthcare spending and awareness of infection control further strengthen demand for disposable LMAs, making North America a stable and technologically progressive market.

The European region is expected to experience the steady during the forecast period

Europe demonstrates strong and steady adoption of laryngeal masks, supported by well-developed national health systems, standardized training programs in anesthesia, and widespread use of LMAs across elective surgery and emergency medicine. The UK, which played a pioneering role in the development of the original laryngeal mask airway, remains a major adopter due to long-standing clinical familiarity.

Germany, France, and the Nordic countries continue to integrate LMAs into surgical protocols for ENT, gynecologic, orthopedic, and general procedures. European EMS organizations are also well-established, often utilizing LMAs for pre-hospital airway management, particularly in non-intubatable cases.

Stringent EU regulations encourage high-quality device manufacturing, pushing companies to develop improved materials and ergonomic designs. Growth in day-care surgery centers and rising geriatric populations who require less invasive airway solutions — further support demand. Additionally, Europe’s investment in cross-border health programs strengthens procurement capabilities across emerging EU member states.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Teleflex Incorporated, Ambu A/S, Intersurgical Ltd, Medtronic Plc, Smiths Medical, Medline Industries, Inc, SunMed, Hitec Medical Co., Ltd, Vyaire Medical, Besmed Health Business Corp, Fannin, Legend Medical Devices, Well Lead Medical Co., Ltd, Koo Medical Equipment, Flexicare Medical Ltd, and Others

Teleflex Incorporated plays a central role in the Laryngeal Mask Market as the developer of the original LMA portfolio, offering a wide range of reusable and disposable supraglottic devices used in surgeries, emergency medicine, and airway rescue. Its products are widely adopted in hospitals across North America and Europe due to strong clinical evidence and standardized performance.

Ambu A/S is a major innovator in single-use airway devices, driving global demand for disposable laryngeal masks through infection-control advantages and ergonomic designs. Ambu’s focus on visualization and pre-hospital use strengthens its presence in emergency and outpatient settings.

Intersurgical Ltd is recognized for its extensive airway management line, especially cost-effective disposable LMAs used across Europe and emerging markets, supported by strong manufacturing and supply-chain capabilities.

Top Key Players

- Teleflex Incorporated

- Ambu A/S

- Intersurgical Ltd

- Medtronic Plc

- Smiths Medical

- Medline Industries, Inc

- SunMed

- Hitec Medical Co., Ltd

- Vyaire Medical

- Besmed Health Business Corp

- Fannin

- Legend Medical Devices

- Well Lead Medical Co., Ltd

- Koo Medical Equipment

- Flexicare Medical Ltd

- Others

Recent Developments

- In February 2025, Teleflex announced its intention to separate into two publicly-traded companies: one (NewCo) consolidating Urology, Acute Care, and OEM businesses; the other (RemainCo) focusing on hospital-centric, high-acuity businesses (vascular access, surgical, respiratory/airway).

- In November 2025, Teleflex scheduled to present at the Jefferies Global Healthcare Conference — reflecting ongoing investor communication and possibly strategic updates across its airway / anesthesia portfolio which includes Laryngeal Mask.

- In August 2023, SourceMark Medical, a U.S. medical device manufacturer and certified Minority Business Enterprise (MBE), announced that it secured a group purchasing agreement with Premier, Inc. for its laryngeal mask airways (LMAs). Premier, a healthcare improvement organization, supports a network of about 4,400 U.S. hospitals and health systems along with more than 250,000 providers and affiliated organizations.

Report Scope

Report Features Description Market Value (2024) US$ 765.8 Million Forecast Revenue (2034) US$ 1,410.7 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Reusable and Disposable), By Age-Group (Adults, Pediatric and Geriatric), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), and Diagnostic Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teleflex Incorporated, Ambu A/S, Intersurgical Ltd, Medtronic Plc, Smiths Medical, Medline Industries, Inc, SunMed, Hitec Medical Co., Ltd, Vyaire Medical, Besmed Health Business Corp, Fannin, Legend Medical Devices, Well Lead Medical Co., Ltd, Koo Medical Equipment, Flexicare Medical Ltd, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teleflex Incorporated

- Ambu A/S

- Intersurgical Ltd

- Medtronic Plc

- Smiths Medical

- Medline Industries, Inc

- SunMed

- Hitec Medical Co., Ltd

- Vyaire Medical

- Besmed Health Business Corp

- Fannin

- Legend Medical Devices

- Well Lead Medical Co., Ltd

- Koo Medical Equipment

- Flexicare Medical Ltd

- Others