Global Laptop Market By Type (Traditional & 2-in-1), By Screen Size (Up to 10.9, 11 to 12.9, 13 to 14.9, 15 to 16.9, and More Than 17), By End User (Personal, Business, and Gaming), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 52919

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

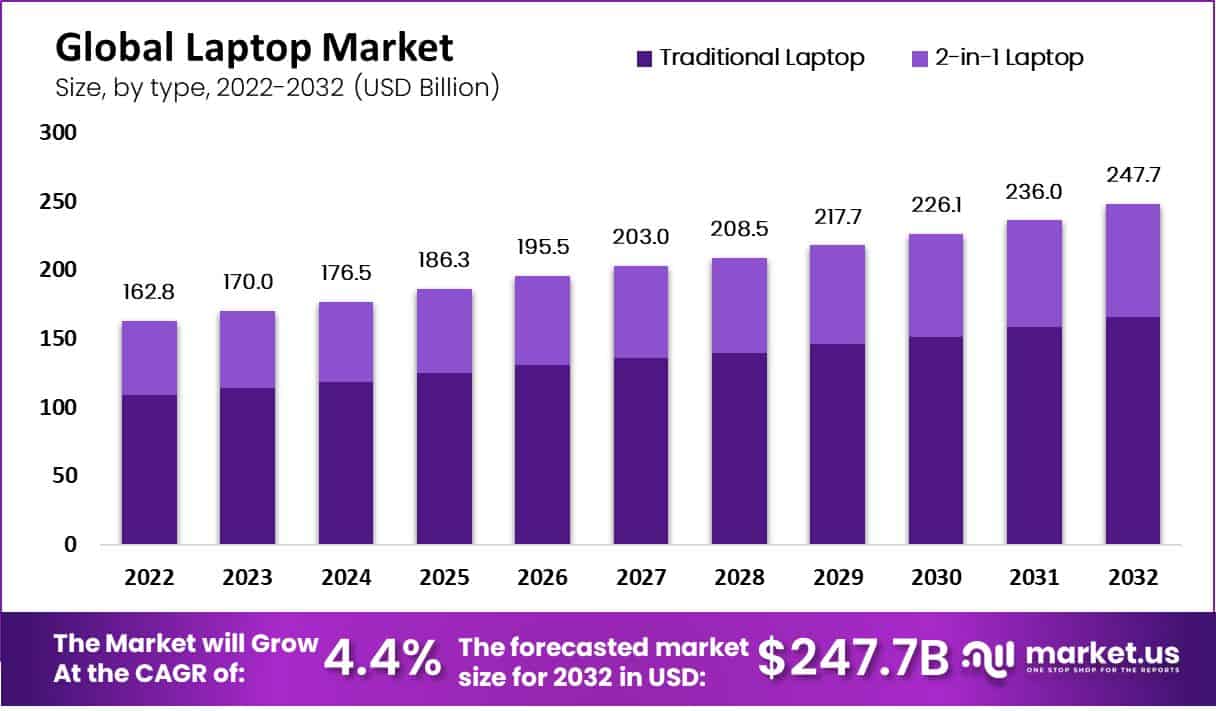

The Global Laptop Market size is expected to be worth around USD 247.7 Billion by 2032 from USD 170.0 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2023 to 2033.

The laptop market comprises the global ecosystem of portable personal computers used for various applications such as work, education, gaming, and entertainment. This market includes different segments, ranging from entry-level, budget-friendly laptops to high-performance, gaming, and business-oriented models.

Companies in this sector cater to diverse consumer needs by integrating advanced features like high-speed processors, extended battery life, lightweight design, and enhanced graphics capabilities.

The market is marked by a high degree of competition among established players like Apple, Dell, HP, Lenovo, and Asus, as well as emerging brands that focus on niche demands. The laptop market, therefore, represents a dynamic sector where innovation and technological advancement are crucial for maintaining competitive advantages.

The growth of the laptop market is primarily driven by the increasing reliance on digital platforms for work, education, and entertainment. The shift towards hybrid work models and remote education has significantly boosted the demand for laptops.

Additionally, the rise of gaming and content creation industries has led to greater demand for specialized laptops with enhanced graphics and processing power.

Technological advancements, such as 5G connectivity and integration of AI capabilities, are also contributing to the market’s expansion, as consumers and businesses seek to capitalize on faster and more efficient computing solutions.

Laptops continues to grow across both developed and developing markets. In developed economies, the focus is on high-performance and specialized laptops for professional, creative, and gaming needs, while in developing regions, affordable models for education and small business use are in high demand.

Educational institutions and enterprises are key purchasers, driven by the need for digital learning and operational efficiency.

The increasing availability of internet access globally has also expanded the potential market, as more people and businesses become connected. Seasonal factors, such as back-to-school periods and promotional events like Black Friday, further stimulate sales, highlighting the cyclical nature of consumer demand in this market.

The laptop market presents numerous opportunities, particularly in the areas of product innovation, regional expansion, and sustainability. With the growing demand for hybrid work solutions, there is potential for manufacturers to develop products tailored for portability, longer battery life, and enhanced video conferencing capabilities.

Emerging markets in Asia, Latin America, and Africa are becoming increasingly significant as these regions experience economic growth and digital infrastructure development, which opens up avenues for expansion.

Additionally, as consumers become more environmentally conscious, there is a rising demand for eco-friendly and sustainable laptop models. Companies that prioritize recyclability, energy efficiency, and sustainable sourcing of components have the opportunity to capture this emerging market segment and differentiate themselves in an otherwise saturated market.

According to Coolest Gadgets, the laptop market is showing steady growth with revenue per person estimated at USD 16.61 in 2023, and global sales projected to reach 188.1 million units, a 3% increase from 2022.

This expansion is influenced by the increasing adoption of hybrid work models and remote education solutions, alongside growing demand in emerging economies where digitalization and internet penetration are on the rise. China remains the largest market, generating USD 23.2 billion in revenue with an anticipated annual growth rate of 3.28% through 2028.

The post-pandemic period has also seen a 10% increase in global revenue over the past two years, signaling a recovery and expansion phase for the industry.

Major players such as Apple, Lenovo, and HP currently dominate the market with shares of 17%, 15%, and 12%, respectively, as of mid-2023. In North America, which is leading the global market with a 42% CAGR from 2023 to 2028, demand for laptops remains robust, driven by enterprise and educational needs.

The consumer shift towards mobility and portability is evident, with the 11″ to 12.9″ screen size segment showing notable growth, particularly among professionals and students. This trend aligns with the broader movement towards digital learning environments, where smaller, more compact laptops are increasingly preferred for educational purposes.

Additionally, gaming hardware ownership is set to account for 23.7% of consumers in 2023, emphasizing the growing niche for performance-oriented models. The 13″ to 14.9″ screen size remains popular, providing a balance between portability and usability.

The market is projected to maintain its upward trajectory, with laptop sales expected to grow incrementally through 2028, reaching 207.1 million units.

Despite the rise of 2-in-1 devices, traditional laptops continue to dominate due to their superior performance and durability, particularly in the business segment where OEMs like Dell, HP, and Lenovo focus on creating high-performance solutions tailored to enterprise needs.

According to Fortunly, the global laptop market saw sales totaling USD 127.6 billion in the first half of 2023, with 114.8 million units shipped. Despite dominance by leading manufacturers like Lenovo, HP, Dell, Apple, ASUS, and Acer, the overall PC market has faced headwinds, showing a 7.6% year-over-year decline in Q3 2023 as consumers increasingly turn to smartphones and tablets for everyday computing tasks.

This trend is highlighted by a significant rise in tablet ownership, with approximately 1.3 billion global users, leading to reduced laptop and PC demand, particularly in households with children.

Nonetheless, the market’s longer-term outlook remains optimistic, with an estimated CAGR of 2.93% through 2028, driven by expanding internet infrastructure and rising disposable incomes, especially in emerging markets outside of North America and Europe.

Companies like Dell are leveraging strategic contracts, such as government deals for Chromebooks, to capture a greater share of the low-end segment, helping it achieve a 17.4% global market share by Q3 2023.

While traditional giants like HP and Apple have seen fluctuations in market share and shipment volumes, the shift towards specialized models and growing interest in eco-friendly and high-performance laptops suggest opportunities for sustained growth in targeted segments.

Key Takeaways

- The global laptop market is projected to reach USD 247.7 billion by 2033, up from USD 170.0 billion in 2023, growing at a CAGR of 4.4% over the forecast period.

- Traditional laptops continue to lead, contributing over 65% of market revenue, driven by robust demand in the commercial and gaming sectors.

- Laptops with 15.0″ to 16.9″ screens hold approximately 35% market share, favored for their versatility in both business and gaming applications.

- Business laptops account for 40% of the market, fueled by enterprises’ increasing need for productivity-focused devices.

- North America holds the largest market share at 30%, while the Asia-Pacific region is expected to grow at the highest CAGR of 5.6%, supported by government initiatives and investments.

- The global shift to digital learning is expected to drive 20% of market growth, as educational institutions increasingly adopt laptops for remote and digital learning environments.

- The rising adoption of smartphones and tablets, with a 15% increase in usage, is a restraining factor, affecting the demand for traditional laptops.

By Type Analysis

Traditional Laptop Dominates Laptop Market Segment with Over 65% Market Share in 2022

In 2022, Traditional Laptop held a dominant market position in the by type segment of the Laptop Market, capturing more than a 65% share. This significant market share can be attributed to its widespread adoption across consumer and enterprise segments due to its familiarity, reliability, and balance of performance and cost.

Traditional laptops remain the preferred choice for users who prioritize a robust and straightforward computing experience, particularly in sectors like education, corporate, and government services where stability and standardization are essential.

Traditional laptops, with their classic clamshell design, continue to be the backbone of the laptop market. Their dominance is driven by a combination of affordability, versatility, and proven performance.

These laptops offer a wide range of price points, making them accessible to various consumer segments, from budget-conscious students to professional users requiring high-performance computing.

Key manufacturers in this segment, such as Dell, HP, and Lenovo, have maintained strong product portfolios, introducing new models equipped with advanced processors, increased battery life, and enhanced durability features, catering to both entry-level and premium users.

The 2-in-1 Laptop segment has shown considerable growth potential, albeit with a smaller market share relative to traditional laptops. In 2022, this segment accounted for a significant portion of sales, driven by the increasing preference for flexible, multi-functional devices that can seamlessly transition between laptop and tablet modes.

Consumers seeking portability and versatility, particularly digital nomads, creative professionals, and students, are increasingly attracted to 2-in-1 laptops.

Notably, the rise of remote work and digital learning has amplified the demand for these devices, as they combine the functionalities of both tablets and laptops, providing users with enhanced productivity and entertainment options.

Leading brands such as Microsoft (Surface series) and Lenovo (Yoga series) are at the forefront of this segment, continuously innovating to improve user experience through touchscreen capabilities, stylus integration, and lightweight designs.

Despite their lower overall market share compared to traditional laptops, 2-in-1 laptops are poised for growth, driven by consumer trends favoring adaptable and compact devices.

As advancements in flexible screen technology and battery efficiency continue, this segment is expected to gain further traction, challenging traditional laptops’ dominance in niche user markets.

By Screen Size Analysis

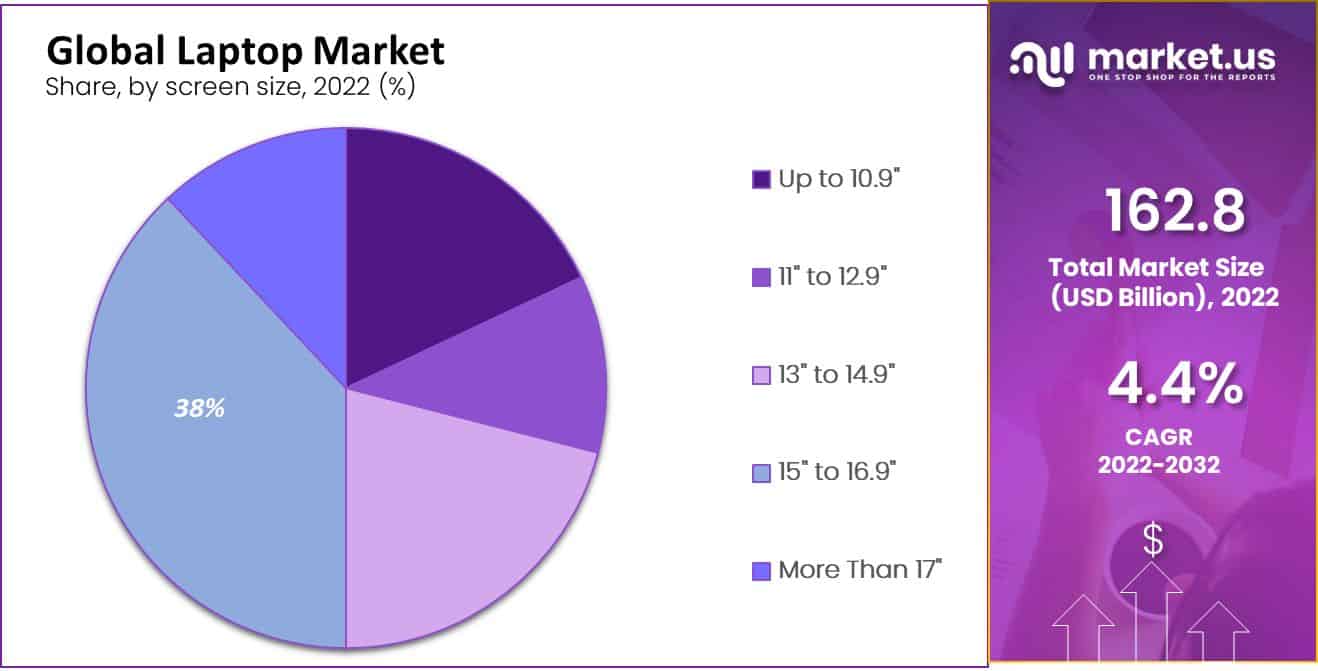

15.0 to 16.9 Screen Size Segment Dominates Laptop Market with Over 38% Market Share in 2022

In 2022, 15.0 to 16.9 held a dominant market position in the by Screen Size segment of the Laptop Market, capturing more than a 38% share. This dominance can be attributed to the widespread preference for laptops that offer a balanced combination of screen real estate, portability, and performance, making them ideal for both professional and personal use.

This segment’s popularity is primarily fueled by its suitability for multitasking, entertainment, and productivity applications, which are increasingly essential in hybrid work and learning environments.

The Up to 10.9 screen size category holds a niche market share, primarily targeting ultra-portable and tablet-style laptops. While these devices offer excellent mobility, they often lack the performance and usability required for more demanding tasks, limiting their appeal mostly to consumers prioritizing portability above all.

This segment is popular among on-the-go users and students seeking lightweight devices for basic computing tasks.

The 11 to 12.9 segment is moderately popular, particularly among users who seek an optimal balance between portability and screen size. It appeals to consumers who need a compact device without sacrificing too much usability, such as digital nomads and students who favor lightweight laptops that fit easily into backpacks or small bags.

However, this segment remains less dominant as users increasingly prefer slightly larger screens for improved productivity and visual comfort.

The 13 to 14.9 segment is a strong contender, representing a significant share of the market due to its portability and versatility. Laptops in this category are especially popular among professionals and business travelers, as they offer an ideal blend of size, weight, and performance capabilities.

Many brands focus on this range, optimizing it for battery life, portability, and computing power, making it a key growth area in the market. Laptops in the 15.0 to 16.9 screen size range dominate the market, holding the largest share due to their optimal balance between screen size and portability.

This segment caters to a broad spectrum of users, from students and business professionals to gamers and content creators, who demand larger displays for multitasking, media consumption, and graphic-intensive applications.

Major brands such as Dell, HP, and Lenovo prioritize this segment, enhancing product offerings with high-resolution displays, improved graphics, and powerful processors that support a wide range of use cases.

The More Than 17 segment accounts for a smaller share of the market, appealing primarily to users who prioritize screen size and performance over portability. These devices are typically marketed as desktop replacements, suitable for gaming enthusiasts, designers, and professionals in industries like media production, where larger displays and higher processing power are crucial.

While this segment is not as popular due to its bulkier nature, it maintains a dedicated consumer base that values high-end performance and screen quality.

By End-User Analysis

Business Segment Dominates Laptop Market with Over 43.1% Market Share in 2022

In 2022, Business held a dominant market position in the by end-user segment of the Laptop Market, capturing more than a 43.1% share. This significant market share is driven by the ongoing need for robust, reliable, and secure computing solutions across various industries.

As businesses continue to adapt to hybrid and remote work models, the demand for high-performance laptops designed to handle professional workloads, enable seamless connectivity, and offer enhanced security features remains a priority. Companies are increasingly investing in fleet upgrades and modernization efforts, fueling the growth of this segment.

The Personal segment represents a substantial share of the laptop market, as individual consumers consistently seek versatile and affordable laptops for everyday use, such as web browsing, entertainment, and educational purposes.

With the rise of online learning and the proliferation of home entertainment options, consumers continue to prioritize lightweight, portable, and multimedia-friendly devices. This segment has been bolstered by demand for affordable models that balance performance and cost, appealing particularly to students, families, and budget-conscious buyers.

The Gaming segment is a fast-growing area within the laptop market, fueled by the increasing popularity of esports, streaming, and immersive gaming experiences. Laptops designed specifically for gaming have captured a niche yet expanding market, targeting enthusiasts who value high-performance processors, advanced graphics cards, and high-refresh-rate displays.

As gaming culture continues to expand globally, this segment is seeing strong growth, supported by brands such as ASUS (ROG series), MSI, and Alienware that are continuously innovating to meet the performance demands of the gaming community. Although the market share of gaming laptops remains smaller than that of business and personal categories, its growth trajectory shows a substantial opportunity for expansion in the coming years.

Key Market Segments

Based on Type

- Traditional Laptop

- 2-in-1 Laptop

Based on Screen Size

- Up to 10.9″

- 11″ to 12.9″

- 13″ to 14.9″

- 15″ to 16.9″

- More Than 17″

Based on End-User

- Personal

- Business

- Gaming

Driver

Technological Advancements

Technological advancements have been a fundamental catalyst for growth in the laptop market, enabling manufacturers to introduce more powerful, efficient, and versatile devices that cater to a broad spectrum of consumer needs.

Innovations such as the development of faster processors (e.g., Intel’s latest Core series and AMD’s Ryzen chips), high-performance GPUs, and advancements in solid-state drive (SSD) technology have significantly enhanced laptop performance, appealing to both general consumers and professional users.

For instance, the integration of AI-powered software optimizations in newer models has improved battery efficiency by up to 20%, directly addressing consumer demand for longer-lasting devices.

Additionally, display technologies like OLED and high-refresh-rate screens have become increasingly accessible, boosting demand among gamers and creative professionals who prioritize visual fidelity and smooth performance.

The rollout of 5G connectivity and Wi-Fi 6E compatibility further supports the laptop market’s expansion, enhancing mobile computing experiences and enabling high-speed, reliable internet access for remote work and digital collaboration key drivers in a post-pandemic, hybrid work environment.

These technological advancements not only raise the performance standards of laptops but also intersect with other growth factors, such as changing work models and the surge in digital content creation, to create a more integrated and dynamic ecosystem.

By constantly evolving to incorporate cutting-edge technology, the laptop market remains adaptable, meeting diverse consumer needs and sustaining robust market growth.

Restraint

Long Replacement Cycles

Long replacement cycles present a significant restraint in the laptop market, as many consumers and businesses tend to retain their devices for extended periods, often 4 to 5 years or more.

This trend is largely due to the durability and reliability of modern laptops, which are now built with advanced materials and technologies designed to withstand years of usage without significant degradation in performance.

Additionally, incremental improvements in new models often fail to provide a compelling reason for consumers to upgrade frequently, as the performance gap between older and newer models remains relatively narrow for average users.

This results in a slower turnover rate, directly impacting the sales volume and revenue growth opportunities for manufacturers. The prolonged replacement cycles are particularly pronounced in business environments, where companies prioritize stability and compatibility over frequent upgrades.

For instance, organizations typically deploy laptops in bulk and aim for a 3-5 year usage period to maximize their return on investment (ROI), reducing the frequency of large-scale replacements.

This trend is further compounded by economic factors, such as global economic uncertainty and inflationary pressures, which prompt businesses and individual consumers to extend the lifespan of their devices rather than invest in new ones.

This restraint also interplays with other factors, such as the increasing focus on sustainability and environmental impact. As consumers become more environmentally conscious, there is a growing emphasis on extending device lifespans and reducing electronic waste, further reinforcing the preference for longer replacement cycles.

While this is beneficial from a sustainability perspective, it poses a challenge for laptop manufacturers seeking to drive consistent growth and encourages them to focus on developing products that can capture niche markets or offer significant technological leaps that justify faster upgrade cycles.

Opportunity

Surge in Remote Work and Education

The global laptop market in 2024 is poised for growth, significantly driven by the sustained demand for remote work and education solutions. The shift toward hybrid work models remains robust, with many organizations standardizing flexible work policies post-pandemic.

As a result, businesses continue to invest in high-performance, portable laptops equipped with advanced connectivity features, such as 5G and Wi-Fi 6E, to support remote collaboration and productivity.

According to industry data, around 70% of organizations now operate in hybrid models, underscoring the need for reliable mobile computing devices that can handle professional workloads outside traditional office environments.

Similarly, the education sector offers substantial growth opportunities as online and hybrid learning platforms become increasingly integrated into curricula worldwide.

Governments and educational institutions are investing in laptops for students, with initiatives aimed at closing the digital divide and ensuring that every student has access to a device.

By 2024, it is expected that over 60% of K-12 and higher education institutions globally will have digital learning infrastructures in place, boosting laptop sales and demand for affordable yet functional models suitable for academic use.

These dual trends in remote work and education not only enhance demand but also encourage innovation in product design, including lightweight, long-lasting, and versatile laptops capable of meeting both professional and academic needs.

Companies capitalizing on these segments by offering tailored solutions like rugged laptops for students or high-security models for corporate clients stand to gain a competitive advantage, translating to significant market growth in the year ahead.

Trends

Increased Connectivity Options

In 2024, one of the most transformative trends in the global laptop market is the rise of advanced connectivity options, such as 5G integration and Wi-Fi 6E. As users demand seamless and high-speed internet access for work, gaming, and streaming, manufacturers are increasingly incorporating these technologies into their new models.

With hybrid and remote work becoming the standard for many organizations, having fast and stable connectivity is crucial for maintaining productivity outside traditional office settings.

Over 75% of newly released laptops in 2024 are expected to support these enhanced connectivity standards, providing users with faster download speeds, lower latency, and more reliable connections, even in crowded network environments.

This trend is particularly significant in markets where mobile workforces and digital nomads are growing rapidly.

Professionals who travel frequently or work from multiple locations benefit from laptops that can switch seamlessly between high-speed 5G networks and Wi-Fi, ensuring they remain connected wherever they are.

By offering devices equipped with the latest connectivity features, laptop manufacturers are not only meeting current consumer demands but also positioning themselves to capture future growth opportunities in an increasingly interconnected world.

This shift toward better connectivity solutions is expected to drive innovation and sales in 2024, as consumers look for laptops that enhance their productivity and provide flexibility in how and where they work.

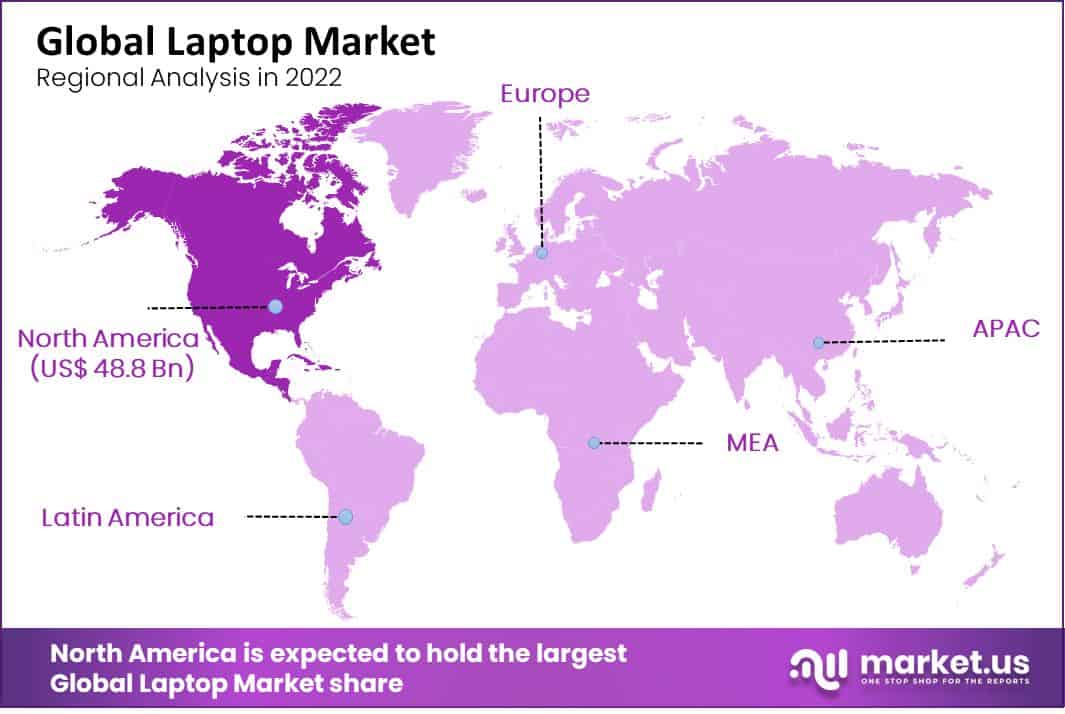

Regional Analysis

North America Leads with Largest Regional Share, Holding 30.0% of the Global Laptop Market

In 2022, North America emerged as the largest regional market for laptops, accounting for 30.0% of the global market share and generating a revenue of USD 48.8 billion. The dominance of North America can be attributed to high consumer purchasing power, widespread adoption of remote work models, and strong educational demand for digital learning tools.

The presence of major technology companies, including HP, Dell, and Apple, has also played a critical role in driving innovation and market penetration in the region. As companies continue to invest in upgrading their IT infrastructure to support hybrid and remote work environments, North America’s laptop market is expected to maintain its leadership position in the foreseeable future.

In Europe, the laptop market remains robust due to the demand for flexible working solutions and the digital transformation initiatives undertaken by enterprises and governments. The emphasis on sustainability in European Union countries also influences the market, as consumers increasingly opt for eco-friendly and energy-efficient laptops.

Western European countries, particularly Germany, the UK, and France, are major contributors, driving the region’s growth with their focus on corporate technology upgrades and education sector investments.

The Asia Pacific region shows the highest growth potential, with increasing urbanization, rising disposable incomes, and a booming digital economy in countries like China, India, and Japan.

The push for digital education and government programs to enhance IT infrastructure is expanding the market. Furthermore, the presence of key laptop manufacturers and a growing base of young, tech-oriented consumers ensure Asia Pacific remains a critical growth engine for the global laptop market.

The Middle East & Africa (MEA) region is steadily expanding, with governments investing in education and tech infrastructure, especially in the UAE, Saudi Arabia, and South Africa. Though the region’s market share is smaller, it shows potential for growth as businesses modernize and remote work becomes more widespread.

In Latin America, economic development and increasing access to digital education and remote work tools are driving demand for laptops.

Brazil and Mexico lead the region’s market growth, supported by initiatives aimed at bridging the digital divide and promoting technology use in education. While the region’s share remains modest, continued investments in IT infrastructure could unlock further growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global laptop market is dominated by several key players who continue to innovate and compete aggressively across various segments, including consumer, business, gaming, and educational laptops.

Lenovo Group Limited, the global leader in market share, maintains its dominance by offering a diverse product lineup that caters to budget-conscious consumers, business professionals, and high-performance gaming enthusiasts alike. HP Development Company, L.P. and Dell Inc. follow closely, leveraging their strong enterprise customer base and innovative product designs aimed at enhancing productivity in hybrid work environments.

Apple Inc. remains a premium player, focusing on its MacBook line, which continues to capture a loyal customer base due to its seamless integration within the Apple ecosystem and emphasis on design and performance.

ASUSTeK Computer, Inc. and Acer Inc. have carved out significant market niches by expanding their gaming and ultrabook offerings, catering to both mainstream users and gaming enthusiasts with products like the ASUS ROG series and Acer Predator series.

Microsoft Corporation plays a dual role as both a hardware and software provider, with its Surface lineup attracting professionals and students seeking 2-in-1 versatility and portability.

Meanwhile, Samsung Electronics Co., Ltd. and Xiaomi Inc. are expanding their presence in the Asia Pacific market, leveraging their competitive pricing strategies and strong brand recognition to gain market share. Razer Inc. targets the high-performance gaming segment, while Sony Group Corporation and other regional players contribute to niche markets.

Overall, competition among these major players remains intense, with each focusing on product differentiation, technological advancements, and geographical expansion to capture new consumer bases and strengthen their market positioning in 2024.

Top Key Players in the Market

- Lenovo Group Limited

- HP Development Company, L.P.

- Dell Inc.

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer, Inc.

- Sony Group Corporation

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Razer Inc.

- Xiaomi Inc.

- Other Key Players

Recent Developments

- In February 27, 2023, Lenovo launched its latest PC and Chromebook lineup at MWC™ 2023, emphasizing solutions for hybrid work environments. The updated ThinkPad series, featuring models like the Z13 and Z16, focuses on enhancing system performance, sustainability, and user experience. Notably, the Z13 includes an eco-friendly bio-based Flax Fiber cover. Lenovo also redesigned its ThinkPad X13 and X13 Yoga models and refreshed the T and L series, catering to diverse business needs and preferences.

- In April 10, 2024, Acer unveiled its new Nitro 14 and Nitro 16 gaming laptops in Taipei, equipped with AMD Ryzen™ 8040 Series processors and NVIDIA® GeForce RTX™ 4060 GPUs featuring DLSS 3.5 technology. These models are built to provide an immersive gaming experience, supporting NVIDIA G-SYNC® compatibility and offering resolutions up to WQXGA, enhancing visual performance for gaming enthusiasts.

- In 2024, Apple introduced its latest MacBook Air models powered by the new M3 chip, delivering up to 60% faster performance compared to the M1 version. Available in 13- and 15-inch sizes, these models boast a thin and lightweight design, offering up to 18 hours of battery life and support for dual external displays. They come in four color options and include features such as MagSafe charging, advanced AI capabilities, and high-quality camera and audio components, focusing on both productivity and entertainment needs.

- In February 22, 2024, Lenovo reported its Q3 financial results, with revenue increasing 3% year-on-year to US$15.7 billion, and a net income of US$357 million. Notably, non-PC businesses accounted for 42% of the total revenue, reflecting Lenovo’s successful strategy in diversifying its product portfolio beyond traditional PC offerings.

Report Scope

Report Features Description Market Value (2023) US$ 170.0 Bn Forecast Revenue (2032) US$ 247.7 Bn CAGR (2023-2032) 4.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Traditional Laptop, 2-in-1 Laptop), By Screen Size (Up to 10.9″, 11″ to 12.9″, 13″ to 14.9″, 15″ to 16.9″, and More Than 17″), By End User (Personal, Business, and Gaming) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Lenovo Group Limited, HP Development Company L.P., Dell Inc., Acer Inc., Apple Inc., ASUSTeK Computer Inc., Sony Group Corporation, Microsoft Corporation, Samsung Electronics Co. Ltd., Razer Inc., Xiaomi Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lenovo Group Limited

- HP Development Company, L.P.

- Dell Inc.

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer, Inc.

- Sony Group Corporation

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Razer Inc.

- Xiaomi Inc.

- Other Key Players