Global IoT Telecom Services Market Size, Share Report By Connectivity (Cellular Technology, LPWAN, NB-IoT, RF-Based), By Network Management Solution (Network Performance Monitoring and Optimization, Network Traffic Management, Network Security Management), By Service Type (Business Consulting Services, Installation and Integration Services, Devices and Applicaton Management Solution, IoT Billing and Subscription Management, M2M Billing Management, Others), By Application (Smart Building and Home Automation, Capillary Network Management, Industrial Manufacturing and Automation, Vehicle Telematics, Energy and Utilities, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154016

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Performance Metrics

- Growth Factor

- Features and Latest Trends

- Connectivity Analysis

- Network Management Solution Analysis

- Service Type Analysis

- Application Analysis

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

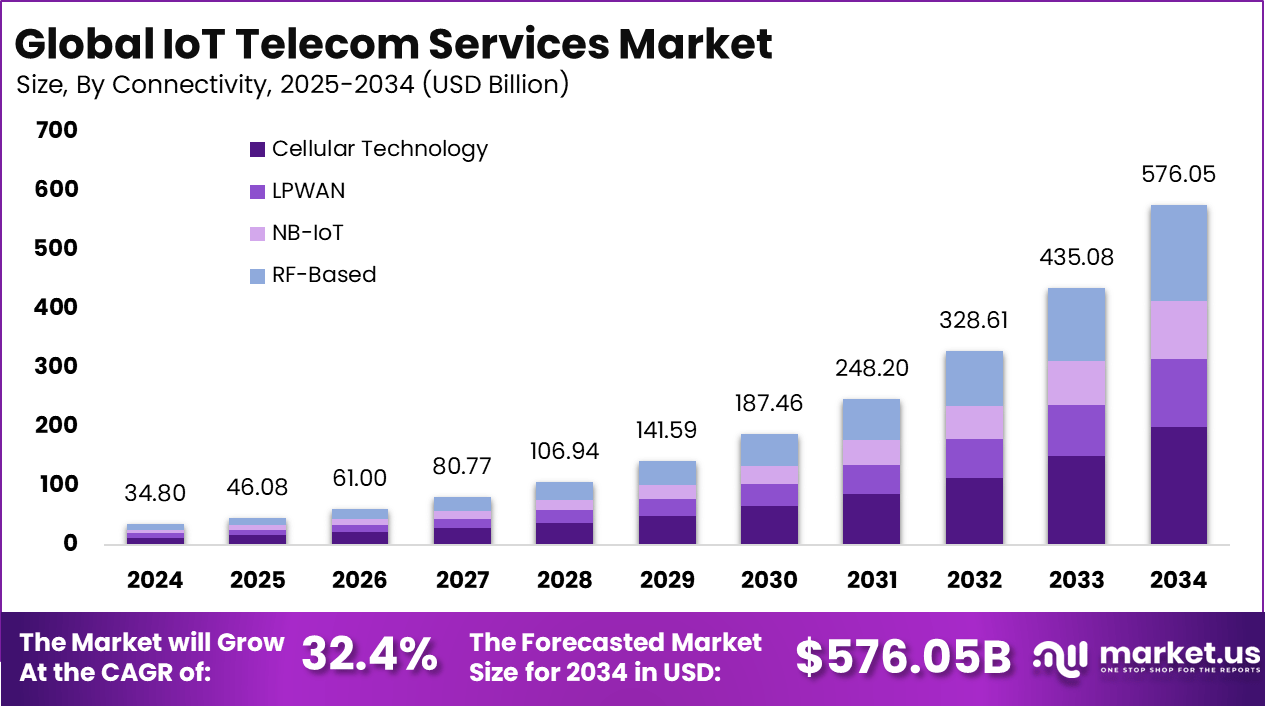

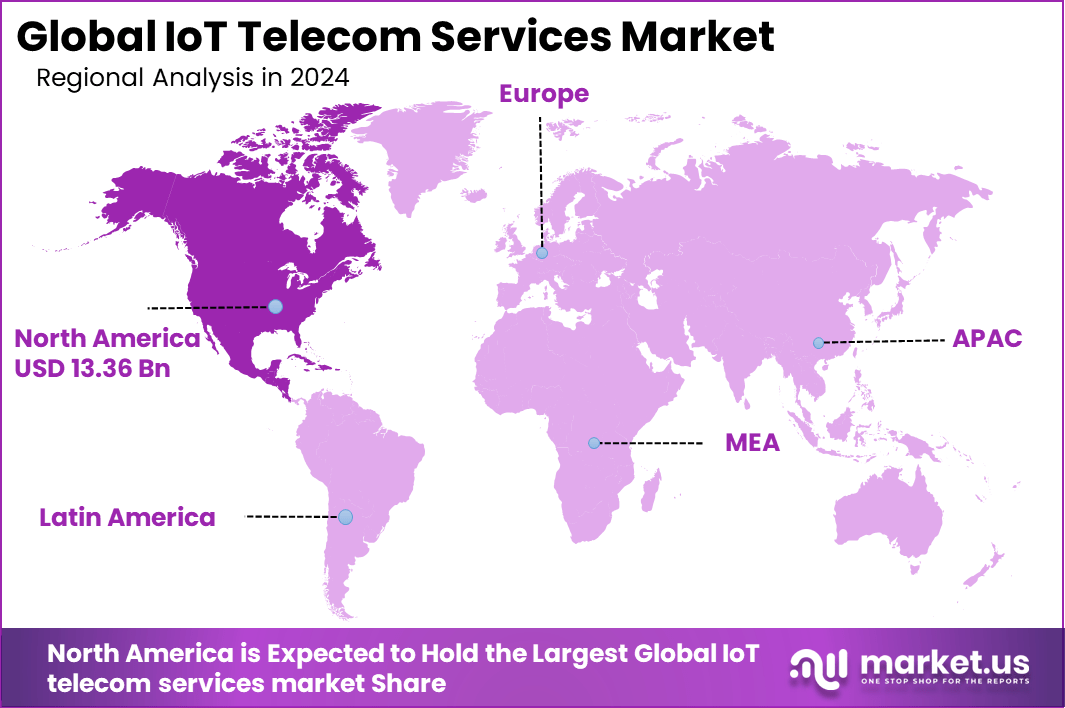

The Global IoT Telecom Services Market size is expected to be worth around USD 576.05 billion by 2034, from USD 34.8 billion in 2024, growing at a CAGR of 32.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.4% share, holding USD 13.36 billion in revenue.

The IoT telecom services market is experiencing robust momentum in recent years. The surge in connected devices across sectors such as manufacturing, smart cities, and healthcare has created a pronounced need for telecom services to manage connectivity, data flows, and device orchestration. The development of network infrastructure and the rise of low‑power communication standards have underpinned this expansion.

Based on data from telecom.com, Indian telecom operators have the potential to boost their subscriber revenue by up to 10 times through the integration of IoT solutions with end-to-end SIM offerings. Industry estimates suggest that IoT services could contribute 15–20% of total revenue for Indian telcos if widely adopted. However, long-term projections are more conservative.

According to a consultant at Analysys Mason, IoT may account for 5% of revenues, or up to 10% for highly successful operators. At present, most telecom companies generate less than 1% from IoT, with Vodafone standing out at approximately 1.4%. According to Vodafone’s Annual IoT Barometer Report 2016, 25% of companies in the Asia-Pacific region experienced a rise in revenue due to IoT adoption, alongside cost reductions from automation.

Market Size and Growth

Report Features Description Market Value (2024) USD 34.8 Bn Forecast Revenue (2034) USD 576.05 Bn CAGR(2025-2034) 32.8% Leading Segment Network Performance Monitoring and Optimization: 43.8% Largest Market North America [38.4% Market Share] Largest Country US: USD 12.03 Bn Market Revenue, CAGR: 30.7% Top driving factors include the rapid deployment of 5G networks. These networks offer ultra‑low latency, high bandwidth, and scalability for millions of IoT endpoints, which enables new use cases such as industrial automation and precision services. Alongside this, low‑power wide‑area networks (LPWAN) technologies such as LoRa and NB‑IoT deliver long‑range, energy‑efficient connectivity for asset tracking and smart metering applications.

For instance, in October 2024, Vodafone Business IoT partnered with E& (formerly Etisalat) and the UAE to provide advanced IoT connectivity solutions in the region. This collaboration aims to enhance the deployment of IoT services across various sectors, including transportation, healthcare, and utilities, by leveraging Vodafone’s global IoT capabilities combined with E&’s local infrastructure.

Enterprises and governments are increasingly adopting IoT telecom services to support digital transformation initiatives. Applications in sectors like smart manufacturing, utility monitoring, and remote health monitoring continue to expand. The need for real‑time analytics, predictive maintenance, and automation has elevated demand for managed connectivity and network‑management services.

Regulatory concerns about data security and interoperability are prompting investment in standardized platforms and secure service tiers to meet compliance and quality demands. The rising adoption of technologies such as edge computing, AI‑enabled network analytics, and standardized platforms (e.g. oneM2M) is driving higher service sophistication. Edge computing brings compute closer to devices, reducing latency and enabling real‑time decision‑making.

Key Takeaway

- In 2024, the global IoT telecom services market was valued at USD 34.8 billion and is projected to reach USD 576.05 billion by 2034, growing at a CAGR of 32.4% from 2025 to 2034.

- By connectivity, cellular technology accounted for 34.7% of the market share in 2024.

- By network management solution, network performance monitoring and optimization led the segment with a 43.8% revenue share.

- By service type, IoT billing and subscription management held a 26.7% share in 2024.

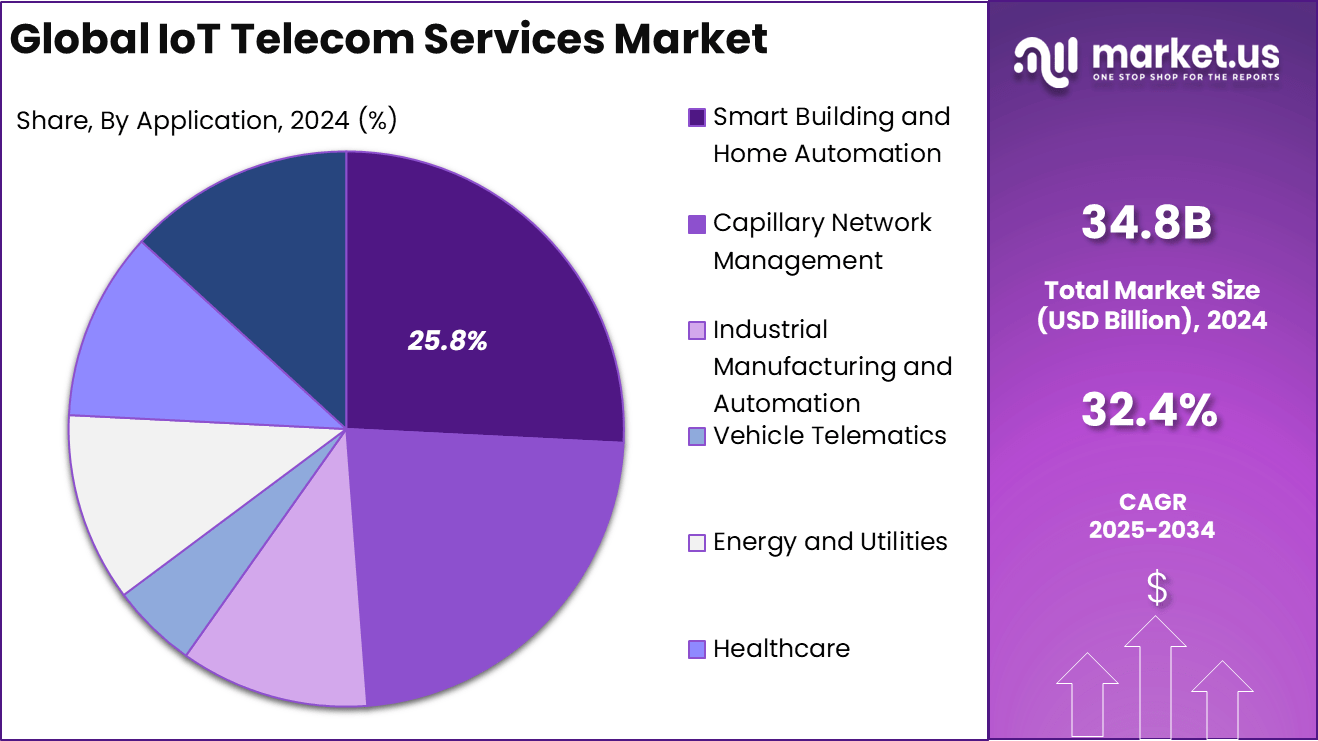

- By application, smart building and home automation dominated with a 25.8% revenue share.

- North America held a dominant position with a 38.4% market share in 2024, generating USD 13.36 billion in revenue.

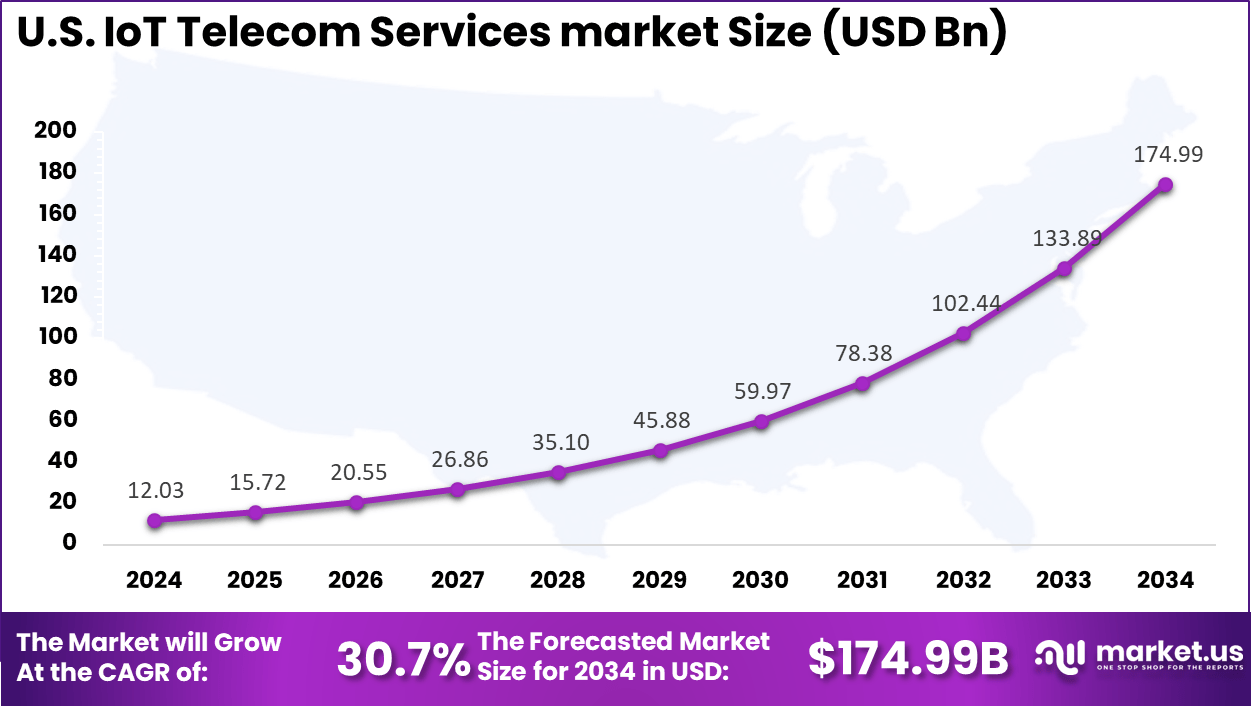

- The United States contributed USD 12.03 billion in 2024, with a projected CAGR of 30.7%.

U.S. Market Performance Metrics

The market for IoT telecom services within the U.S. is growing tremendously and is currently valued at USD 12.03 billion, the market has a projected CAGR of 30.7%. The market is expanding rapidly, driven by the widespread adoption of smart devices, the robust deployment of 5G and low-power wide-area networks (like LTE-M and NB-IoT), and strong government backing for smart city and digital infrastructure projects.

The integration of AI and edge computing enhances real-time analytics and automation, while private 5G networks ensure secure, scalable IoT deployments. Strategic investments from tech giants and ongoing digital transformation in industries such as healthcare, manufacturing, and logistics are further accelerating the demand for IoT services in the country.

For instance, in July 2025, the U.S. Department of Justice cleared the way for T-Mobile’s $4.4 billion acquisition of UScellular. This strategic acquisition allows T-Mobile to expand its wireless operations, customer base, and spectrum assets, further solidifying its dominance in the U.S. telecom market. The deal is expected to enhance T-Mobile’s network quality and coverage, enabling it to meet the growing demand for IoT telecom services.

In 2024, North America held a dominant market position in the Global IoT telecom services market, capturing more than a 38.4% share, holding USD 13.36 billion in revenue. This dominance is due to North America’s advanced technological infrastructure, widespread adoption of IoT devices, and strong demand for connected solutions across various industries.

The region benefits from robust 5G deployment, government initiatives supporting smart cities, and significant investments from both public and private sectors in IoT-driven innovations. Additionally, North America’s leadership in sectors such as healthcare, manufacturing, and transportation, coupled with high levels of automation, further drives the demand for IoT telecom services, solidifying its dominant position in the global market.

For instance, In April 2024, OXIO expanded its Telecom-as-a-Service platform to support global M2M and IoT connectivity, strengthening North America’s leadership in the IoT telecom services market. Leveraging the region’s advanced telecom infrastructure, this move enhances scalability and seamless deployment of IoT solutions across industries, meeting the rising demand for connected devices.

Growth Factor

Attributes Details Demand for Connected Devices The increase in smart devices for homes, cities, healthcare, and industry is driving need for IoT telecom services. Advanced Wireless Technology Progress in 5G and Low-Power Wide-Area Networks (LPWAN) boosts fast, reliable connections for billions of devices. Cloud & Data Analytics Adoption More organizations are using cloud-based systems and analytics for real-time insights and better decision-making. Urbanization & Automation Growth in smart cities and automated systems in manufacturing and logistics increases IoT telecom applications. Security Needs Demand for better monitoring and automated security systems strengthens IoT’s importance in telecom. Features and Latest Trends

Feature/Trend Description 5G & LPWAN networks Adoption of high-speed (5G) and low-power (LPWAN) networks for different IoT needs. Real-time analytics Collecting and analyzing data instantly for better decisions. Integration with AI & cloud AI and cloud technologies improve automation and data processing in telecom. Security enhancements Improved network security for protection from cyber threats. Focus on smart homes/cities Providing solutions for home automation and urban infrastructure. Rising use in new sectors Expansion into healthcare, transport, logistics, and agriculture. Connectivity Analysis

Cellular technology is currently the leading connectivity medium in the global IoT telecom services market, accounting for approximately 34.7 % of the total connectivity segment. This dominance can be attributed to the widespread deployment of 4G and emerging 5G infrastructure, which support high-speed, wide-area coverage and enable real‑time communication for millions of IoT devices.

The reliability and mature support ecosystem of cellular networks have positioned them as the preferred choice for enterprise and industrial applications. The widespread presence of cellular infrastructure and its compatibility with both existing 4G and new 5G networks are further supporting its adoption.

Enterprises are increasingly relying on cellular connectivity to maintain reliable and secure connections across vast networks of devices. As a result, cellular technology continues to lead in terms of preference among businesses seeking scalable IoT solutions.

For Instance, in March 2025, Nordic Semiconductor announced a collaboration with Deutsche Telekom to make every device cellular-connected, enhancing the cellular technology segment within the IoT telecom services market. This partnership aims to enable seamless connectivity for a wide range of IoT applications by integrating Nordic’s low-power cellular solutions with Deutsche Telekom’s network infrastructure.

Network Management Solution Analysis

In 2024, Network performance monitoring and optimization holds the largest segment share, capturing 43.8% of the IoT telecom services market. This segment is critical due to the sheer complexity and scale of today’s IoT deployments, where thousands of devices and applications interact over dynamic networks.

Businesses are prioritizing visibility into their telecom infrastructure – tools for performance tracking, bandwidth management, and predictive analytics have become must-haves for industrial, commercial, and even consumer IoT projects. With network performance solutions, operators can quickly pinpoint bottlenecks, anticipate faults, and ensure connectivity stays smooth, reducing both downtime and operational costs.

For instance, In August 2024, the launch of the RAN Intelligent Controller (RIC) marked a significant advancement in network management within the IoT telecom services market. By using predictive AI and machine learning, RIC enables real-time optimization of radio access networks. This technology supports predictive maintenance, improves traffic management, and ensures dynamic resource allocation, helping telecom providers enhance overall network performance.

Service Type Analysis

Among service types, In 2024, IoT billing and subscription management holds the highest share at 26.7%. This segment leads due to the complexity involved in managing millions of connected devices that often operate under different pricing plans, usage terms, and subscription cycles. Automated billing systems are enabling service providers to efficiently handle usage tracking, invoicing, and customer lifecycle management.

With the growing diversity in IoT services and varying data consumption levels, customized billing models have become essential. These platforms simplify operations and reduce errors while offering end users greater transparency. As a result, the demand for such systems continues to grow, securing this segment’s leadership in the service category.

For Instance, in July 2025, BluLogix launched the Telematics Monetization Ultimate Playbook, designed to help IoT companies address the complexities of billing and subscription management. This new solution is aimed at streamlining the billing process for IoT telecom services, offering businesses a comprehensive framework to handle usage-based pricing, subscription models, and complex billing scenarios.

Application Analysis

In 2024, Smart Building and Home Automation stands out as the leading application, accounting for 25.8% of the total share. This growth is driven by increased adoption of connected devices for energy management, security systems, and environmental control. Consumers and businesses alike are embracing smart environments to enhance comfort, reduce operational costs, and promote sustainability.

Telecom providers are playing a key role in integrating IoT solutions into residential and commercial spaces. These systems rely on continuous data exchange, requiring stable and intelligent network infrastructure. The widespread focus on automation and energy efficiency ensures that this segment will remain at the forefront of IoT telecom applications.

For Instance, In July 2025, a new low-power Zigbee module was launched to support smart home, building, and industrial IoT applications. This module enhances energy efficiency and connectivity by leveraging Zigbee’s low power usage and dependable short-range communication. It enables seamless integration of IoT devices such as lighting, HVAC, and security systems, making it ideal for smart environments requiring consistent and efficient performance.

Drivers

Rising Demand for Connected Devices

The need for IoT telecom services has been growing with the rise of smart homes, wearable technology (like Alexa), connected cars, and even drones. With the growing number of people and businesses using IoT devices, telecom providers are essential in ensuring that connections remain strong, data flows smoothly, and processing is efficient.

For instance, in June 2022, Ordr secured $40 million in Series C funding to address the growing demand for connected device security. As IoT adoption accelerates, the need for robust security solutions becomes increasingly critical. The funding will enable Ordr to expand its capabilities in providing advanced security for IoT networks, ensuring that organizations can safeguard their devices from cyber threats.

Restraint

Security and Privacy Concerns

As IoT networks become more widespread, it becomes essential to maintain the safety and privacy of connected devices and their data. Telecom companies are obligated to adhere to strict regulations and safeguard sensitive information.

Data breaches, cyberattacks, or privacy violations can lead to a loss of consumer trust and hinder IoT adoption. These security challenges necessitate the expenditure of significant amounts on high-quality cybersecurity systems and measures to adhere to IoT services’ rules.

For instance, in February 2025, cybersecurity firm Cyberscoop reported an ongoing wave of cyberattacks by the Chinese cyber espionage group, Salt Typhoon, targeting telecom providers worldwide. The group has been exploiting vulnerabilities in network equipment and IoT devices, highlighting the increasing security and privacy risks faced by telecom operators in the IoT sector.

Opportunities

Global IoT Expansion in Emerging Markets

Emerging markets, such as Asia-Pacific, Latin America, and Africa, present significant opportunities for IoT telecom services to expand. The increasing availability of affordable mobile connectivity and IoT-enabled devices is driving adoption in these regions.

Telecom companies can capitalize on this emerging market by providing personalized IoT solutions that meet the local requirements for connected services in areas such as farming, healthcare, and shipping, thereby opening up new business opportunities.

For instance, In August 2024, Liquid Telecom partnered with Globalstar to provide 5G connectivity across the Middle East and Africa. Using satellite communication, the collaboration aims to improve IoT access in remote areas with limited infrastructure. This move supports the global growth of IoT services, especially in emerging markets.

Challenges

Skill Gap and Talent Shortage

The rapid growth of the IoT telecom services market has created a demand for a skilled workforce capable of managing complex networks, devices, and data analytics. The absence of skilled individuals, such as engineers, data scientists, and cybersecurity experts, is a significant issue.

Telecommunications companies are facing a major challenge with the lack of qualified individuals, as they require specific skills to create, launch, and support IoT solutions. Companies must invest in talent development and recruitment strategies to address this shortage and remain competitive.

For instance, in March 2025, a report highlighted the growing telecom talent gap in Africa, focusing on the challenges of recruiting skilled professionals for the region’s rapidly expanding telecom and IoT sectors. With the rise of 5G deployment and IoT services, there is a significant shortage of qualified engineers, data scientists, and cybersecurity experts.

Key Market Segments

By Connectivity

- Cellular Technology

- LPWAN

- NB-IoT

- RF-Based

By Network Management Solution

- Network Performance Monitoring and Optimization

- Network Traffic Management

- Network Security Management

By Service Type

- Business Consulting Services

- Installation and Integration Services

- Devices and Application Management Solution

- IoT Billing and Subscription Management

- M2M Billing Management

- Others

By Application

- Smart Building and Home Automation

- Capillary Network Management

- Industrial Manufacturing and Automation

- Vehicle Telematics

- Energy and Utilities

- Healthcare

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the IoT telecom services market, established players like Sierra Wireless, Sequans Communications, and LM Ericsson Telephone Company have maintained strong influence through advanced module design and robust network infrastructure. These companies are actively expanding their IoT connectivity offerings, focusing on LPWAN, NB-IoT, and LTE-M technologies to support various industrial use cases.

Meanwhile, firms such as Puresoftware Ltd, Telstra, and MediaTek Inc are focusing on customized IoT platforms and chipset innovation to enhance telecom support for connected devices. Telstra’s regional dominance, coupled with MediaTek’s chipset versatility, is supporting wider adoption of IoT telecom solutions in smart agriculture, urban mobility, and industrial automation.

Additionally, telecom giants like TELUS Corporation, Vodafone Idea Ltd, Orange, and T-Mobile are playing a key role by leveraging their wide network reach and spectrum availability. These companies are offering end-to-end IoT services, including data analytics, SIM management, and subscription billing. Their offerings are tailored to enterprises looking for scalable and carrier-grade solutions.

Top Key Players in the Market

- Sierra Wireless

- Sequans Communications

- LM Ericsson Telephone Company

- Puresoftware ltd

- Telstra

- MediaTek Inc

- TELUS Corporation

- Vodafone Idea Ltd

- Orange

- T-Mobile

- Others

Recent Developments

- In May 2024, Happiest Minds Technologies announced the acquisition of PureSoftware Technologies for $94 million. This strategic move aims to strengthen Happiest Minds’ capabilities in digital engineering and transformation services, particularly in the IoT and telecom sectors.

- In December 2024, Telstra announced the acquisition of Boost Mobile, a leading prepaid mobile service provider in Australia, for approximately $94 million. This acquisition is part of Telstra’s strategy to diversify its offerings and strengthen its competitive position in the Australian market.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Connectivity (Cellular Technology, LPWAN, NB-IoT, RF-Based), By Network Management Solution (Network Performance Monitoring and Optimization, Network Traffic Management, Network Security Management), By Service Type (Business Consulting Services, Installation and Integration Services, Devices and Applicaton Management Solution, IoT Billing and Subscription Management, M2M Billing Management, Others), By Application (Smart Building and Home Automation, Capillary Network Management, Industrial Manufacturing and Automation, Vehicle Telematics, Energy and Utilities, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sierra Wireless, Sequans Communications, LM Ericsson Telephone Company, Puresoftware ltd, Telstra, MediaTek Inc, TELUS Corporation, Vodafone Idea Ltd, Orange, T-Mobile, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IoT Telecom Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

IoT Telecom Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sierra Wireless

- Sequans Communications

- LM Ericsson Telephone Company

- Puresoftware ltd

- Telstra

- MediaTek Inc

- TELUS Corporation

- Vodafone Idea Ltd

- Orange

- T-Mobile

- Others