Global Ion Chromatography Market By Technology (Ion-Exchange Chromatography, Ion-Exclusion Chromatography and Ion-Pair Chromatography), By Detector Type (Conductivity Detectors, UV/Vis Detectors and Mass Spectrometry Detectors (IC-MS)), By Application (Environmental Testing, Pharmaceutical Industry, Food & Beverage Industry, Chemical & Petrochemical Industry, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153139

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

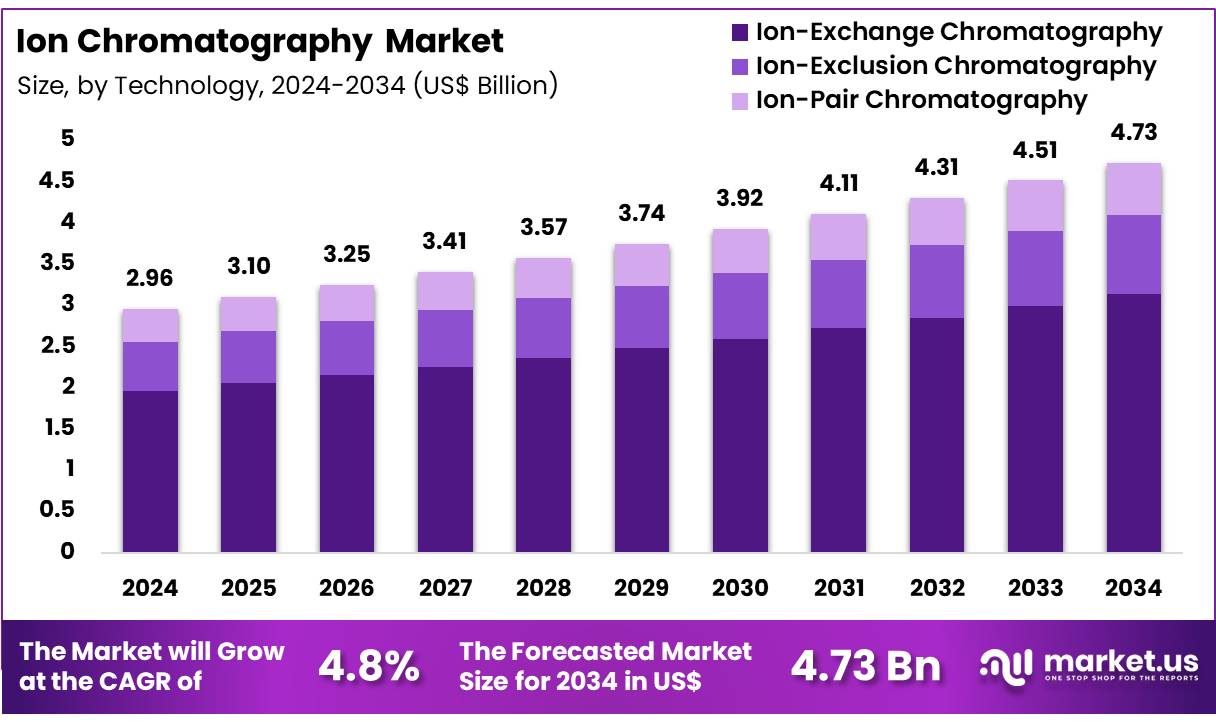

Global Ion Chromatography Market size is expected to be worth around US$ 4.73 Billion by 2034 from US$ 2.96 Billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 33.6% share with a revenue of US$ 994.6 Million.

The Ion Chromatography (IC) market is a vital segment of the global analytical instruments industry, offering precise and reliable techniques for separating and analyzing ions in complex samples.

It is widely used in sectors like pharmaceuticals, environmental testing, food and beverage, and chemical industries for applications such as quality control, water quality monitoring, and research. IC systems are valued for their accuracy in measuring anions, cations, and other ionic components with high sensitivity, making them essential in complying with stringent regulatory standards.

In February 2024, Thermo Fisher Scientific Inc. introduced the Thermo Scientific Dionex Inuvion Ion Chromatography (IC) system, designed to enhance ion chromatography analysis for a broader range of applications. This new instrument aims to simplify and streamline ion analysis, offering an intuitive solution for labs of all sizes. Its reconfigurable design allows users to efficiently analyze ionic and small polar compounds, providing a comprehensive and reliable tool for consistent ion analysis.

Technological advancements, including the integration of automation and mass spectrometry (IC-MS), are driving the market’s growth, enabling faster results and increased analytical capacity. The rising demand for advanced testing methods in environmental monitoring, particularly water and air quality analysis, is also fueling the market. Moreover, the increasing need for purity and safety in pharmaceuticals is contributing to the adoption of ion chromatography in drug development and quality testing.

However, the high initial investment required for sophisticated systems remains a challenge, especially for smaller organizations. Despite this, the market is expected to continue expanding due to increasing industrialization, regulatory compliance, and the demand for precise analytical solutions across various industries. The Asia Pacific region is anticipated to witness significant growth, driven by emerging economies and expanding industrial sectors.

Key Takeaways

- In 2024, the market for Ion Chromatography generated a revenue of US$ 2.96 billion, with a CAGR of 4.8%, and is expected to reach US$ 4.73 billion by the year 2034.

- The Technology segment is divided into Ion-Exchange Chromatography, Ion-Exclusion Chromatography, and Ion-Pair Chromatography with Ion-Exchange Chromatographytaking the lead in 2024 with a market share of 66.2%.

- By Detector Type, the market is bifurcated into Conductivity Detectors, UV/Vis Detectors and Mass Spectrometry Detectors (IC-MS), with Conductivity Detectors leading the market with 52.6% of market share.

- Furthermore, concerning the Application segment, the market is segregated into Environmental Testing, Pharmaceutical Industry, Food & Beverage Industry, Chemical & Petrochemical Industry, and Others. The Environmental Testing stands out as the dominant segment, holding the largest revenue share of 37.3% in the Ion Chromatography market.

- North America led the market by securing a market share of 33.6% in 2024.

Technology Analysis

Ion-Exchange Chromatography is the dominating technology in the ion chromatography market accounting for 66.2% market share, accounting for the largest market share. This method is widely used due to its versatility in separating and quantifying both anions and cations in complex mixtures. Ion-exchange chromatography is particularly favored for environmental testing, pharmaceutical analysis, and quality control in various industries.

The high accuracy and precision offered by ion-exchange resins in capturing and separating ions contribute to its dominance. Additionally, technological advancements have enhanced its efficiency, making it suitable for high-throughput applications.

In May 2025, DuPont enhanced its bioprocessing portfolio with the introduction of DuPont™ AmberChrom TQ1 chromatography resin, designed for the purification of oligonucleotides and peptides across various biopharma applications. This new agarose-based resin delivers greater loading capacity, improved throughput, and operates at lower pressures compared to other similar products in the market.

Detector Type Analysis

Conductivity Detectors dominated the ion chromatography market with 52.6% market share due to their simplicity, cost-effectiveness, and sensitivity. These detectors measure the conductivity of ions in a solution, making them ideal for a wide range of ion analysis applications.

They are especially effective in detecting inorganic ions, which are commonly analyzed in environmental, food safety, and pharmaceutical industries. The widespread adoption of conductivity detectors is driven by their reliability, ease of use, and lower operational costs compared to more complex detectors.

Application Analysis

Environmental Testing is the dominating application segment in the ion chromatography market which accounted for 37.3% market share in 2024. With the growing emphasis on environmental protection and sustainability, there is a rising demand for accurate and efficient methods to monitor water, air, and soil quality.

Ion chromatography is particularly well-suited for this purpose, as it can detect a wide range of environmental contaminants, such as heavy metals, nitrates, chlorides, and pesticides. Regulatory bodies across the globe are implementing more stringent environmental guidelines, further increasing the reliance on ion chromatography for compliance testing. This segment’s dominance is also fueled by growing industrialization, urbanization, and agricultural activities that increase environmental contamination.

Governments are investing heavily in monitoring systems to ensure public health and safety, driving the demand for ion chromatography. Additionally, the versatility of ion chromatography systems allows them to analyze complex environmental matrices, offering reliable results even in the most challenging conditions. With global environmental concerns on the rise, ion chromatography’s role in environmental testing is expected to expand, ensuring its continued dominance in the market.

Key Market Segments

By Technology

- Ion-Exchange Chromatography

- Ion-Exclusion Chromatography

- Ion-Pair Chromatography

By Detector Type

- Conductivity Detectors

- UV/Vis Detectors

- Mass Spectrometry Detectors (IC-MS)

By Application

- Environmntal Testing

- Pharmaceutical Industry

- Food & Beverage Industry

- Chemical & Petrochemical Industry

- Others

Drivers

Technological Advancements in Ion Chromatography Systems

Technological innovations in ion chromatography are a significant driver of market growth. New advancements such as automated systems, enhanced detectors, and more precise ion-exchange materials have greatly improved the accuracy, speed, and efficiency of ion chromatography (IC).

For instance, high-performance ion chromatography (HPIC) systems have advanced to meet the demands of industries like pharmaceuticals, environmental testing, and food safety. These improvements allow laboratories to achieve faster turnaround times, higher resolution, and better detection limits, making IC an indispensable tool in analytical chemistry.

Furthermore, the integration of ion chromatography with mass spectrometry (IC-MS) enables more comprehensive analysis, particularly in complex matrices like environmental samples and biological fluids. These technological breakthroughs enable industries to meet stringent regulatory requirements, especially in environmental testing and pharmaceutical applications, boosting the demand for ion chromatography equipment and services.

In September 2023, DuPont introduced its first product specifically aimed at green hydrogen production – the DuPont™ AmberLite™ P2X110 Ion Exchange Resin. This newly launched resin is designed to support hydrogen generation from water, tailored to the unique chemistry of electrolyzer loops.

Restraints

High Initial Investment Costs

A significant restraint in the ion chromatography market is the high initial cost of advanced ion chromatography systems. These systems are often expensive, requiring substantial upfront capital investment, which can be prohibitive for smaller laboratories or institutions with limited budgets. While the technology offers long-term operational benefits, including high precision and efficiency, the cost of equipment, maintenance, and consumables can create a barrier to entry, especially in developing regions.

The complexity of IC systems also necessitates skilled personnel for operation and maintenance, further driving up costs. For smaller businesses or research institutes, this high cost can limit their ability to adopt cutting-edge ion chromatography systems, slowing market penetration and adoption, especially in price-sensitive regions.

For instance, high-end ion chromatography systems can cost between $30,000 and $100,000 per instrument (excluding expenses for consumables and maintenance). These costs are significantly higher when considering large-scale laboratory setups or specialized configurations for automation and high throughput.

Opportunities

Growing Demand in Environmental Testing

The growing emphasis on environmental protection presents a significant opportunity for ion chromatography market growth. As environmental regulations tighten globally, there is increasing demand for accurate and reliable testing methods to monitor water, soil, and air quality. Ion chromatography offers high sensitivity and precision for analyzing environmental samples, detecting contaminants like heavy metals, nitrates, and other ions that could pose environmental or health risks.

Regulatory bodies are enforcing stricter environmental standards, prompting industries and government agencies to invest in advanced testing methods like IC. This opens up lucrative opportunities in environmental monitoring, especially in developed markets where environmental consciousness and regulatory frameworks are strong.

Moreover, emerging economies are also gradually adopting these technologies, fueling further demand for ion chromatography solutions. In April 2025, The Water Research foundation announced a project which aims to create an affordable, lab-based analytical system for the real-time detection and quantification of total organic fluorine (TOF) and specific PFAS compounds in water. The primary goal is to design a prototype boron-doped diamond (BDD) microfluidic reactor that integrates with an ion chromatography (IC) system, facilitating the analysis of PFAS.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the Ion Chromatography (IC) market, influencing demand, pricing, and technological advancements. From a macroeconomic perspective, economic stability and growth directly affect industrial investments in laboratory equipment, including IC systems.

In regions with strong economic growth, industries such as pharmaceuticals, environmental monitoring, and food safety increase their spending on advanced analytical equipment to ensure regulatory compliance and enhance productivity. Conversely, during economic downturns or recessions, companies may delay or scale back such investments, slowing market growth.

Geopolitical factors, particularly trade policies, tariffs, and international relations, can also affect the IC market. For instance, geopolitical tensions or trade disputes between major economies, like the U.S. and China, can lead to tariff increases on imported chromatography systems or critical components, impacting pricing and availability.

These disruptions can hinder market growth, especially for companies dependent on international supply chains. Additionally, shifting regulatory landscapes driven by geopolitical shifts, such as stricter environmental regulations in response to climate change, can increase the demand for accurate testing methods like ion chromatography.

Latest Trends

Integration of Ion Chromatography with Automation and AI

The integration of ion chromatography with automation and artificial intelligence (AI) is a key trend shaping the market. Automation in sample preparation, data acquisition, and analysis has significantly increased the throughput and efficiency of ion chromatography systems. AI-driven data analysis helps in quicker pattern recognition and predictive maintenance, enhancing the overall performance of ion chromatography systems.

AI can also assist in optimizing analysis parameters, reducing human error, and ensuring higher accuracy and reproducibility in complex analyses. As automation and AI continue to develop, their adoption in ion chromatography will help labs and industries streamline workflows, reduce operational costs, and improve the consistency of results, driving broader adoption of these systems across diverse sectors. This trend aligns with the overall push towards smarter, more efficient analytical technologies in laboratories.

In July 2025, the United States Food and Drug Administration (FDA) granted Breakthrough Device Designation status to TOBY, a biotechnology startup specializing in non-invasive cancer detection, for its bladder cancer test. This test utilizes gas chromatography–mass spectrometry (GC–MS) and proprietary AI to analyze volatile organic compounds (VOCs) in a single urine sample, generating a real-time cancer risk score.

Regional Analysis

North America is leading the Ion Chromatography Market

The North American ion chromatography market is a significant segment of the global analytical instrumentation industry accounting for major share of 33.6% in 2024, driven by stringent regulatory standards, technological advancements, and increasing demand across various sectors. Key drivers include regulatory compliance, especially in environmental monitoring, as well as the pharmaceutical industry’s focus on quality control and drug safety.

The demand for precise analytical methods for monitoring pollutants in water, soil, and air is also increasing. Additionally, technological advancements like automation, miniaturization, and integration with mass spectrometry have improved the efficiency and applicability of ion chromatography, expanding its use in various industries.

The United States Environmental Protection Agency’s sub-ng/L PFAS limits are driving ongoing upgrades in instrumentation, while Canada’s biosimilar programs sustain demand for advanced impurity testing (epa.gov). Mexico’s expanding industrial sector, bolstered by recent vendor expansions, presents additional growth opportunities. The availability of a skilled workforce supports high analytical throughput, although labor costs contribute to an increased total cost of ownership.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Ion Chromatography market includes Thermo Fisher Scientific Inc., Metrohm AG, Agilent Technologies Inc., Shimadzu Corporation, Waters Corporation, Bio-Rad Laboratories Inc., PerkinElmer Inc., Danaher Corporation (Cytiva), Mitsubishi Chemical Corporation, Tosoh Bioscience, Qingdao Shenghan Chromatograph Technology Co., Ltd., MembraPure GmbH, Sykam GmbH, Cecil Instruments Ltd., Hitachi High-Tech Corporation, JASCO Corporation, and Hamilton Company.

Thermo Fisher Scientific is a global leader in analytical instruments, offering a wide range of ion chromatography systems, including the Dionex ICS series. Their products are renowned for high precision, reliability, and integration with advanced technologies like mass spectrometry, serving industries such as pharmaceuticals, environmental testing, and food safety.

Metrohm AG is a Swiss-based company specializing in analytical instruments, including ion chromatography systems. Known for its high-quality IC solutions, Metrohm offers versatile, automated systems that meet the needs of sectors like pharmaceuticals, food & beverage, and environmental monitoring.

Their systems provide high sensitivity and accuracy for complex sample analyses. Agilent Technologies is a leading provider of ion chromatography solutions, offering advanced systems designed for complex analytical applications. Their IC systems are widely used in environmental, pharmaceutical, and chemical industries.

Top Key Players

- Thermo Fisher Scientific Inc.

- Metrohm AG

- Agilent Technologies Inc.

- Shimadzu Corporation

- Waters Corporation

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Danaher Corporation (Cytiva)

- Mitsubishi Chemical Corporation

- Tosoh Bioscience

- Qingdao Shenghan Chromatograph Technology Co., Ltd.

- MembraPure GmbH

- Sykam GmbH

- Cecil Instruments Ltd.

- Hitachi High-Tech Corporation

- JASCO Corporation

- Hamilton Company

- Other Prominent Players

Recent Developments

- In December 2024, Agilent Technologies launched the 1290 Infinity III LC and 1260 Infinity III Prime LC systems. These systems feature the new InfinityLab Assist Technology, designed to automate instrument routines, simplify sample preparation, and provide real-time system health monitoring, enhancing laboratory efficiency and performance.

- In February 2024, Thermo Fisher Scientific launched the Dionex Inuvion Ion Chromatography System, designed to streamline ion analysis and expand analytical testing capabilities for ionic and small polar compounds. This system offers enhanced reliability, efficiency, and functional adaptability for laboratories, supporting a wide range of ion chromatography analyses with one instrument.

- In September 2022, Metrohm AG launched MagIC Net 4.2 software, an update to their control and database software for ion chromatography instruments. This version features a modernized graphical user interface, improved performance for client/server systems, and full compliance with FDA Regulation 21 CFR Part 11 and GLP.

Report Scope

Report Features Description Market Value (2024) US$ 2.96 Billion Forecast Revenue (2034) US$ 4.73 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Ion-Exchange Chromatography, Ion-Exclusion Chromatography and Ion-Pair Chromatography), By Detector Type (Conductivity Detectors, UV/Vis Detectors and Mass Spectrometry Detectors (IC-MS)), By Application (Environmental Testing, Pharmaceutical Industry, Food & Beverage Industry, Chemical & Petrochemical Industry, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Metrohm AG, Agilent Technologies Inc., Shimadzu Corporation, Waters Corporation, Bio-Rad Laboratories Inc., PerkinElmer Inc., Danaher Corporation (Cytiva), Mitsubishi Chemical Corporation, Tosoh Bioscience, Qingdao Shenghan Chromatograph Technology Co., Ltd., MembraPure GmbH, Sykam GmbH, Cecil Instruments Ltd., Hitachi High-Tech Corporation, JASCO Corporation, and Hamilton Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Metrohm AG

- Agilent Technologies Inc.

- Shimadzu Corporation

- Waters Corporation

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Danaher Corporation (Cytiva)

- Mitsubishi Chemical Corporation

- Tosoh Bioscience

- Qingdao Shenghan Chromatograph Technology Co., Ltd.

- MembraPure GmbH

- Sykam GmbH

- Cecil Instruments Ltd.

- Hitachi High-Tech Corporation

- JASCO Corporation

- Hamilton Company

- Other Prominent Players