Global Intelligent Network Market Report By Application (Traffic Prediction and Classification, Information Cognition, Performance Prediction and Configuration Extrapolation, Resource Management and Network Adoption), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By End-User (Cloud Service Providers, Telecom Service Providers, Managed Network Service Providers, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128657

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

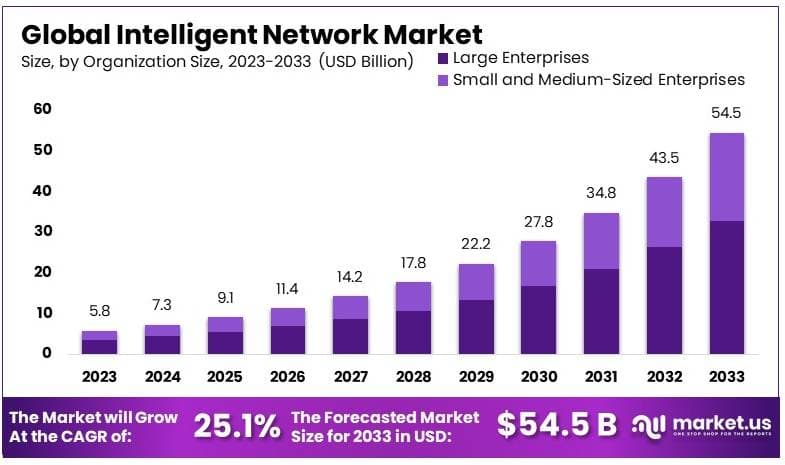

The Global Intelligent Network Market size is expected to be worth around USD 54.5 Billion by 2033, from USD 5.8 Billion in 2023, growing at a CAGR of 25.1% during the forecast period from 2024 to 2033.

Intelligent networks use software to manage and optimize network resources, allowing them to adapt to real-time demands. The growth of this technology is driven by factors such as the rollout of 5G networks, the need for enhanced security, and the growing use of AI to manage large volumes of data.

The rising demand for improved customer experiences in industries like telecommunications and retail is also pushing the need for intelligent networks. Opportunities are emerging as companies seek solutions that can handle increased traffic and reduce latency.

Governments across the globe are investing in advanced telecommunications infrastructure, particularly in regions like North America and Asia-Pacific. These investments are driving the development of intelligent network technologies, especially with the expansion of 5G networks. In the U.S., the government has allocated billions of dollars toward upgrading national network.

The Intelligent Network sector is expanding rapidly, driven by advances in AI, 5G services, Software-Defined Networking (SDN), and Network Function Virtualization (NFV). An intelligent network is designed to optimize traffic and automate processes, allowing telecom operators and businesses to enhance performance and reduce operational complexity.

Telecom companies like ZTE have already begun integrating AI-powered networks to improve flexibility and manage large customer bases efficiently. In 2024, ZTE partnered with izzi Telecom in Mexico to deploy NFV solutions, supporting over 6.3 million subscribers with virtualized infrastructures, illustrating the growing adoption of these technologies.

Several factors contribute to the growth of intelligent networks. Technological advancements in 5G, AI, and NFV are reshaping the way industries manage and optimize their networks. Telecom operators are projected to invest approximately $275 billion in 5G infrastructure in the U.S. to meet the growing demand for faster, more efficient networks.

Government support plays a critical role in fostering the development of intelligent networks. In the U.S., the $1.5 billion Wireless Innovation Fund, part of the CHIPS and Science Act of 2022, supports the advancement of 5G and future networks.

These funds are designed to strengthen the telecom supply chain, encourage innovation, and promote competition in the industry. Additionally, state-level initiatives such as New York’s $500 million Broadband Program, alongside $235 million from private sector partners, have extended high-speed internet access to 98% of the state’s population.

Public-private partnerships are also driving research and development in next-generation wireless networks. The RINGS program, launched by the National Science Foundation (NSF) with a $40 million investment, involves collaborations with major tech companies like Google, IBM, and Nokia. These efforts ensure the continued innovation and deployment of intelligent networks, keeping the U.S. at the forefront of wireless technology.

Key Takeaways

- The Intelligent Network Market was valued at USD 5.8 Billion in 2023, and is expected to reach USD 54.5 Billion by 2033, with a CAGR of 25.1%.

- In 2023, Information Cognition led the application segment with 37.1%, driven by the need for advanced data processing.

- In 2023, Large Enterprises dominated the organization size segment with 60.3%, reflecting their higher capacity for adopting intelligent network solutions.

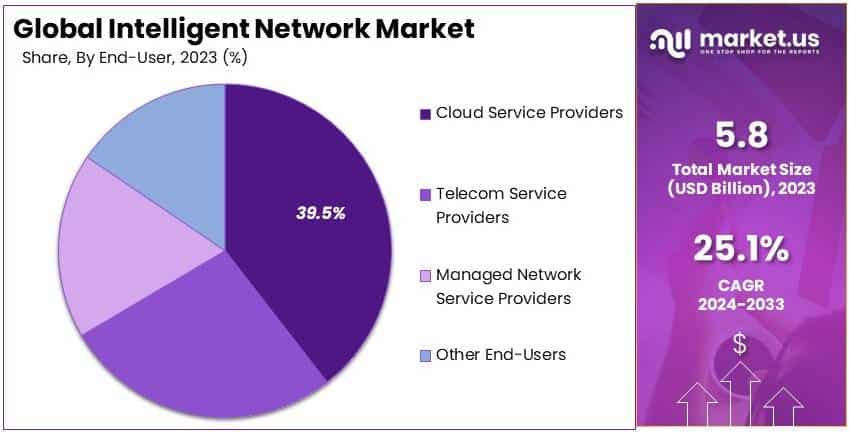

- In 2023, Cloud Service Providers held 39.5% in the end-user segment, owing to their critical role in data-driven industries.

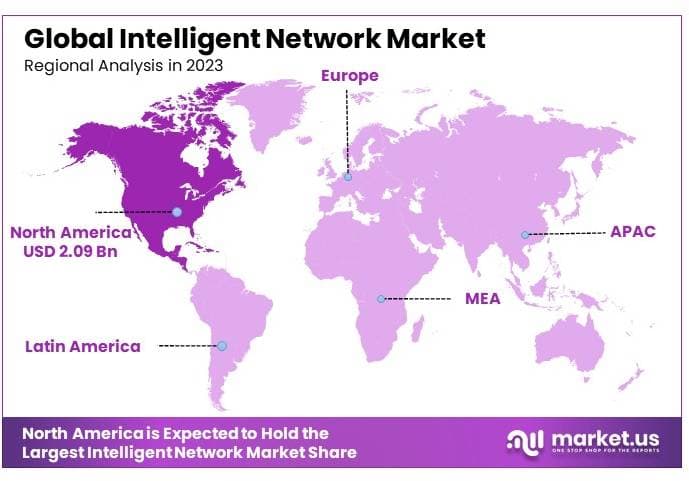

- In 2023, North America accounted for 36.0% market share, supported by significant investments in network infrastructure.

Application Analysis

Information Cognition dominates with 37.1% due to its critical role in enhancing network intelligence.

In the intelligent network market, the application segment is pivotal for understanding how networks can be optimized and automated using AI and machine learning. Information cognition, holding a 37.1% share, stands out as the dominant sub-segment.

Information cognition involves the use of advanced analytical tools and algorithms to process and interpret network data. This capability allows networks to understand patterns, predict requirements, and make autonomous decisions to optimize performance and manage resources effectively. It’s particularly crucial in environments where real-time data analysis and rapid response are necessary.

Other application segments include traffic prediction and classification, which helps in managing network flow and optimizing bandwidth usage; performance prediction and configuration extrapolation, which anticipates potential network failures and bottlenecks; and resource management and network adoption, which ensures optimal allocation of network resources.

The importance of information cognition is projected to grow as networks become more complex and generate larger volumes of data. By enabling more intelligent and proactive network management, this segment not only enhances network performance but also supports the growth and efficiency of other segments, contributing significantly to the overall advancement of intelligent networks.

Organization Size Analysis

Large Enterprises dominate with 60.3% due to their extensive network requirements and capacity for investment.

When analyzing the intelligent network market by organization size, large enterprises emerge as the dominant group, accounting for 60.3% of the market. This dominance is primarily due to their extensive network requirements and their capacity to invest in advanced network technologies.

Large enterprises are typically more capable than smaller organizations to invest in cutting-edge technologies such as artificial intelligence and machine learning for network management. This investment enables them to leverage large-scale data analytics, automate network operations, and enhance security measures, which are critical for maintaining uptime and protecting against cyber threats.

While large enterprises lead the market, small and medium-sized enterprises (SMEs) also play a crucial role. SMEs are increasingly adopting intelligent network solutions to compete more effectively with larger firms by improving their operational efficiency and agility. Although they contribute less to the market share, the growth potential in the SME segment is significant as these businesses continue to recognize the benefits of intelligent network technologies.

The expansion of intelligent network solutions within large enterprises is expected to continue as these organizations seek to further automate their operations and enhance their data-driven decision-making capabilities. As technology evolves, it’s likely that the adoption rate among SMEs will accelerate, driven by more accessible and scalable solutions, thus broadening the market landscape.

End-User Analysis

Cloud Service Providers dominate with 39.5% due to the critical need for scalable and reliable network infrastructures.

In the end-user segment of the intelligent network market, cloud service providers hold the largest share at 39.5%. This segment’s dominance is fueled by the exponential growth in cloud computing, which requires robust and intelligent networks to manage vast amounts of data and ensure service reliability and efficiency.

Cloud service providers rely on intelligent networks to optimize data routing, manage traffic loads, and predict service demands to prevent downtimes and ensure customer satisfaction. The adoption of intelligent network technologies allows these providers to automate network operations and scale services according to customer needs efficiently.

Other key end-users in the intelligent network market include telecom service providers, managed network service providers, and various other industries that increasingly depend on reliable network services. Telecom service providers, for instance, use intelligent networks to enhance their service delivery and manage the growing demand for high-bandwidth applications.

The role of cloud service providers in the intelligent network market is expected to become even more significant as more businesses and consumers opt for cloud-based solutions. The continuous advancements in cloud technology, coupled with the increasing demand for more sophisticated network management solutions, are likely to drive further growth in this segment.

Key Market Segments

By Application

- Traffic Prediction and Classification

- Information Cognition

- Performance Prediction and Configuration Extrapolation

- Resource Management and Network Adoption

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By End-User

- Cloud Service Providers

- Telecom Service Providers

- Managed Network Service Providers

- Other End-Users

Driver

Rising Demand for Automation and AI Drives Market Growth

The increasing demand for network automation, the integration of artificial intelligence (AI), growing adoption of 5G technology, and the need for efficient traffic management are key factors driving the growth of the intelligent network market. Network automation is becoming essential as businesses strive to streamline operations, reduce costs, and improve network performance.

AI is playing a critical role by enabling predictive maintenance and enhancing network security. With AI, intelligent networks can monitor performance, detect anomalies, and respond to threats in real-time, leading to better reliability and security.

The rollout of 5G technology is another major driver. Intelligent networks are essential for managing the complex, high-speed traffic that 5G networks generate. This technology ensures efficient bandwidth utilization and minimizes latency, making it crucial for the future of mobile communications.

Additionally, the growing need for efficient and intelligent traffic management across increasingly congested networks is driving the adoption of intelligent networks. These systems optimize traffic flow, ensuring high-quality service even during peak demand. Together, these factors are accelerating the growth of the intelligent network market.

Restraint

High Implementation Costs and Security Concerns Restrain Market Growth

High implementation costs, security concerns, network complexity, and lack of skilled personnel are significant restraints in the intelligent network market. Implementing intelligent network solutions requires substantial investment in both hardware and software. Many small and medium-sized businesses are unable to afford these solutions, slowing down market growth.

Security concerns are another key restraint. Intelligent networks often handle sensitive data, and any breach can lead to significant financial and reputational damage. Despite advancements in AI-based security measures, vulnerabilities still exist, making some businesses hesitant to adopt these technologies.

The complexity of managing intelligent networks also limits growth. These networks require advanced infrastructure and constant monitoring, which adds operational complexity, particularly for organizations lacking technical expertise.

Finally, the shortage of skilled personnel capable of managing and maintaining intelligent networks poses a challenge. As the technology evolves, the demand for specialists grows, but the talent pool remains limited, hindering the pace of adoption.

Opportunity

Expanding Use in IoT and Edge Computing Provides Opportunities

The growing application of intelligent networks in the Internet of Things (IoT), the rise of edge computing, increasing demand for smart city solutions, and expanding telecommunications infrastructure present significant opportunities for market players.

Edge computing is another area of opportunity. As data processing moves closer to the source, intelligent networks are crucial for enabling seamless communication between edge devices and central systems, improving latency and reliability.

The demand for smart city solutions also creates opportunities. Intelligent networks play a central role in managing interconnected systems, from traffic lights to energy grids, enhancing urban efficiency.

Lastly, expanding telecom infrastructure in emerging markets is opening new avenues. Companies that can offer scalable, intelligent networking solutions tailored to these markets will be well-positioned to capitalize on this growth.

Challenge

Integration and Performance Scalability Challenge Market Growth

Integration issues, performance scalability, vendor lock-in, and the need for continuous upgrades challenge the growth of the intelligent network market. Integrating intelligent networks with existing legacy systems is a major challenge for many organizations.

Scalability is another challenge. As businesses grow, their networks must handle increasing traffic without compromising performance. Many companies struggle to scale their intelligent networks efficiently, especially when dealing with varying data loads.

Vendor lock-in also poses a challenge. Once a business adopts a particular intelligent network solution, switching vendors or technologies becomes difficult and expensive, limiting flexibility and innovation.

Moreover, the need for continuous upgrades to keep up with technological advancements adds complexity. Intelligent networks must constantly evolve to stay competitive, requiring ongoing investment in new features, security patches, and infrastructure enhancements, which many businesses find challenging to manage.

Growth Factors

Rising Data Traffic and Cloud Adoption Are Growth Factors

The surge in data traffic, increasing adoption of cloud computing, growing demand for network virtualization, and the rise of software-defined networking (SDN) are significant growth factors for the intelligent network market.

Cloud computing is another major growth factor. As businesses move more operations to the cloud, intelligent networks provide the flexibility and scalability needed to manage dynamic workloads and ensure efficient cloud resource allocation.

Network virtualization is on the rise, and intelligent networks play a key role in creating virtual network environments that can be customized and scaled as needed, reducing the need for physical infrastructure.

The growth of SDN is driving intelligent network adoption. SDN separates network control from the hardware, allowing for more centralized and flexible network management. Intelligent networks enhance SDN’s capabilities by automating decision-making processes, improving network performance, and reducing downtime.

Emerging Trends

AI-Driven Network Management and Self-Healing Networks Are Latest Trending Factors

The rise of AI-driven network management, self-healing networks, integration with blockchain, and real-time analytics are the latest trending factors in the intelligent network market. AI-driven network management is transforming how networks are monitored and optimized.

Self-healing networks are another key trend. These networks can automatically detect and fix faults, reducing downtime and improving reliability. This trend is particularly important in industries where network availability is critical, such as healthcare and finance.

Blockchain integration is also gaining traction. Intelligent networks are increasingly being used to secure transactions and ensure data integrity through blockchain technology, providing a higher level of trust and transparency.

Real-time analytics is another growing trend. Businesses are leveraging intelligent networks to gain insights into network performance and user behavior, allowing them to make data-driven decisions to enhance efficiency and service quality. These emerging trends are shaping the future of intelligent networks, driving further innovation and adoption.

Regional Analysis

North America Dominates with 36.0% Market Share

North America leads the Intelligent Network Market with a 36.0% share, valued at USD 2.09 billion. This dominance is driven by the region’s strong focus on digital transformation, widespread adoption of advanced technologies like AI and IoT, and a robust telecommunications infrastructure. Major players in the tech industry contribute significantly to the market’s growth.

Key factors include high investments in AI-based network management solutions and increased demand for automation in sectors like IT, telecom, and healthcare. The presence of major cloud service providers and research institutions further enhances North America’s position in developing intelligent networks.

Regional market dynamics are influenced by government initiatives aimed at upgrading network infrastructure and the rapid adoption of 5G technology. These factors enable North America to maintain its leadership position, especially as industries increasingly rely on intelligent network solutions.

Forecasts predict that North America’s market share will continue to grow as more industries move toward automation and advanced network solutions. Expansion in 5G infrastructure and AI-driven innovations will further strengthen the region’s position in the global intelligent network market.

Regional Mentions:

- Europe: Europe is growing steadily, driven by regulatory frameworks supporting network upgrades and the adoption of AI technologies in sectors like transportation and manufacturing.

- Asia Pacific: Asia Pacific is expanding rapidly due to heavy investments in smart cities and 5G networks, particularly in countries like China and South Korea.

- Middle East & Africa: Middle East & Africa are focusing on intelligent network adoption in oil and gas, and smart city projects, supported by government-backed technology initiatives.

- Latin America: Latin America’s growth is fueled by increasing investments in digital infrastructure and intelligent network solutions, especially in the telecommunications and financial sectors.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Intelligent Network Market, Cisco Systems, Inc., Huawei Technologies Co., Ltd., and Juniper Networks, Inc. are the top players driving innovation and growth. These companies lead the market with advanced network solutions, strong customer bases, and strategic investments in AI-driven technologies.

Cisco Systems, Inc. holds a dominant position through its extensive range of intelligent networking products and services. With a focus on integrating AI and machine learning into network management, Cisco provides solutions that enable automated, scalable, and secure networks for enterprises. Its strategic partnerships and robust global presence give Cisco a significant edge in the market.

Huawei Technologies Co., Ltd. is another key player with a strong presence, particularly in Asia and developing regions. Huawei’s intelligent network solutions, backed by its extensive R&D capabilities, are widely adopted in telecommunications, data centers, and enterprise sectors. Its focus on 5G technologies and smart infrastructure further enhances its competitive positioning.

Juniper Networks, Inc. is known for its innovative approach to intelligent networking, with a focus on automation and AI-driven solutions. Juniper’s strategic emphasis on simplifying network operations and delivering high-performance, scalable networks places it at the forefront of the market. Its strong presence in cloud and enterprise networking strengthens its influence.

These key players shape the future of the intelligent network market by continuously advancing network automation, AI capabilities, and scalable solutions, catering to the growing demand for efficient and secure network management across industries.

Top Key Players in the Market

- Juniper Networks, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Hewlett Packard Enterprise (HPE)

- Ciena Corporation

- Sandvine

- APCON, Inc.

- Other Key Players

Recent Developments

- Juniper Networks: On January 2024, Juniper Networks launched its AI-Native Networking Platform to deliver exceptional user experiences and reduce operational costs. This platform leverages AI-powered insights and automation to optimize network management, cutting trouble tickets by 90% and reducing operational expenses by 85%.

- Huawei: In April 2024, Huawei introduced advanced AI technologies at its 2024 Analyst Summit to support Net5.5G, aiming to make networks more intelligent at the case, process, and system levels. Huawei’s AI-enhanced network solutions are focused on optimizing 5G networks by integrating AI into real-time operations, intelligent traffic management, and system self-optimization.

- Cisco Systems: On March 2024, Cisco Systems acquired Valtix, a cloud-native network security platform, to bolster its multi-cloud security solutions. The acquisition enhances Cisco’s ability to deliver comprehensive, AI-powered security across hybrid and multi-cloud environments, catering to large enterprises and telecom operators looking to secure intelligent, cloud-based networks.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Billion Forecast Revenue (2033) USD 54.5 Billion CAGR (2024-2033) 25.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Traffic Prediction and Classification, Information Cognition, Performance Prediction and Configuration Extrapolation, Resource Management and Network Adoption), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By End-User (Cloud Service Providers, Telecom Service Providers, Managed Network Service Providers, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Juniper Networks, Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Hewlett Packard Enterprise (HPE), Ciena Corporation, Sandvine, APCON, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Network MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Intelligent Network MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Juniper Networks, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- Hewlett Packard Enterprise (HPE)

- Ciena Corporation

- Sandvine

- APCON, Inc.

- Other Key Players