Global Insulation Coatings Market By Type (Acrylic, Ероху, Polyurethane, Yttria Stabilized Zirconia, Others), By End use (Aerospace, Automotive, Marine, Building and Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151129

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

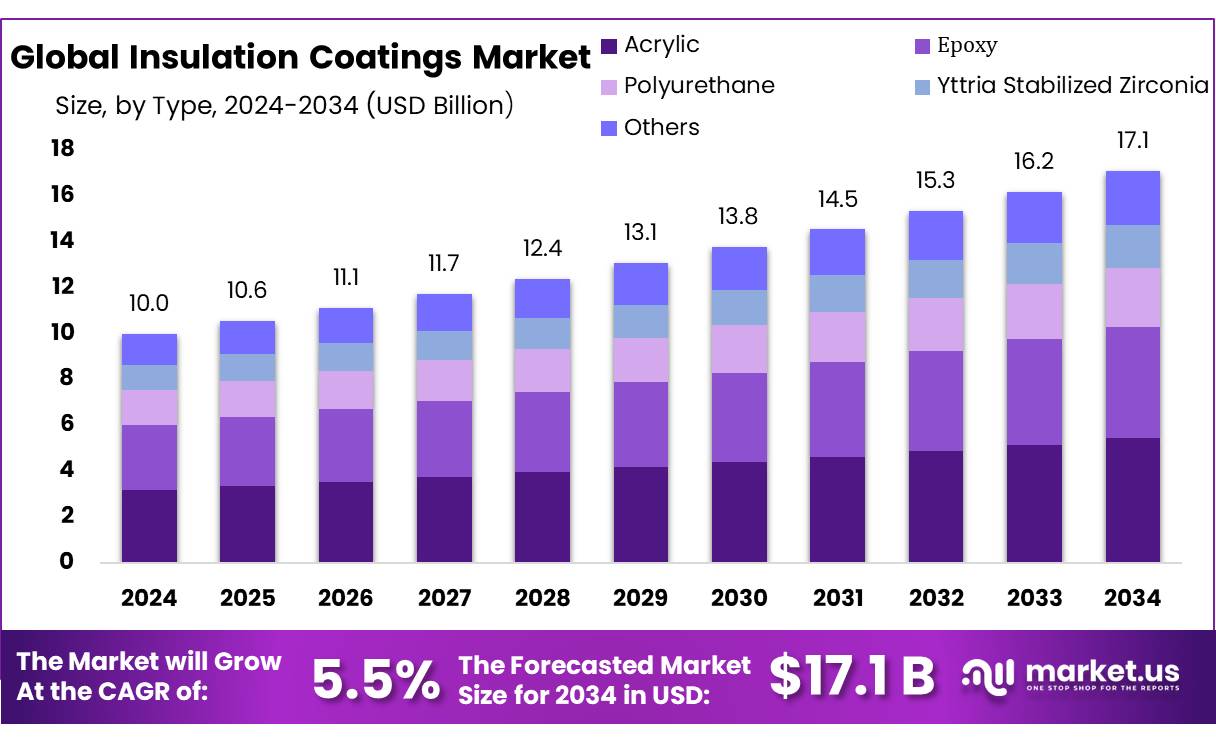

The Global Insulation Coatings Market size is expected to be worth around USD 17.1 Billion by 2034, from USD 10.0 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

An insulation coatings concentrate denotes a formulation designed to substantially reduce thermal conductivity when applied to industrial surfaces. Utilization occurs across sectors such as manufacturing, oil & gas, construction, and aerospace, where they are applied to substrates including pipelines, boilers, tanks, and insulation panels. These concentrates are often blended with resins (e.g., acrylic, epoxy, polyurethane) to create high-performance coatings exhibiting low VOC emissions, environmental compliance, and improved durability. Such formulations contribute to corrosion prevention under insulation (CUI) and energy conservation.

Regulatory and government-driven initiatives significantly underpin this market expansion. The U.S. Department of Energy (DOE) indicates that thermal insulation initiatives can achieve up to 20% energy savings in industrial operations, thereby stimulating policy support and utility-backed programs.

Additionally, DOE’s Building Technologies Office has been funding early-stage clean energy technologies to drive energy efficiency in industry. The OECD echoes this momentum, with countries strengthening energy codes and environmental standards, such as the EU’s revised Energy Efficiency Directive (EU/2023/1791), which mandates cumulative end-use energy savings of up to 1.9% by 2028–2030

Several drivers are paramount in propelling this industry. Firstly, rising industrial energy costs and carbon emission targets have induced manufacturers to adopt insulation coatings to optimize heat retention and diminish fossil fuel use. Secondly, environmental regulations targeting VOCs and greenhouse gases have caused a shift toward water-based and low-VOC resin formulations . Thirdly, technology advances—marked by the integration of nanomaterials and self-healing additives—have enhanced coating performance at elevated temperatures (upwards of 300 °C) and extended lifecycle, thus improving end-user appeal .

Key Takeaways

- Insulation Coatings Market size is expected to be worth around USD 17.1 Billion by 2034, from USD 10.0 Billion in 2024, growing at a CAGR of 5.5%.

- Acrylic held a dominant market position, capturing more than a 31.8% share of the global insulation coatings market.

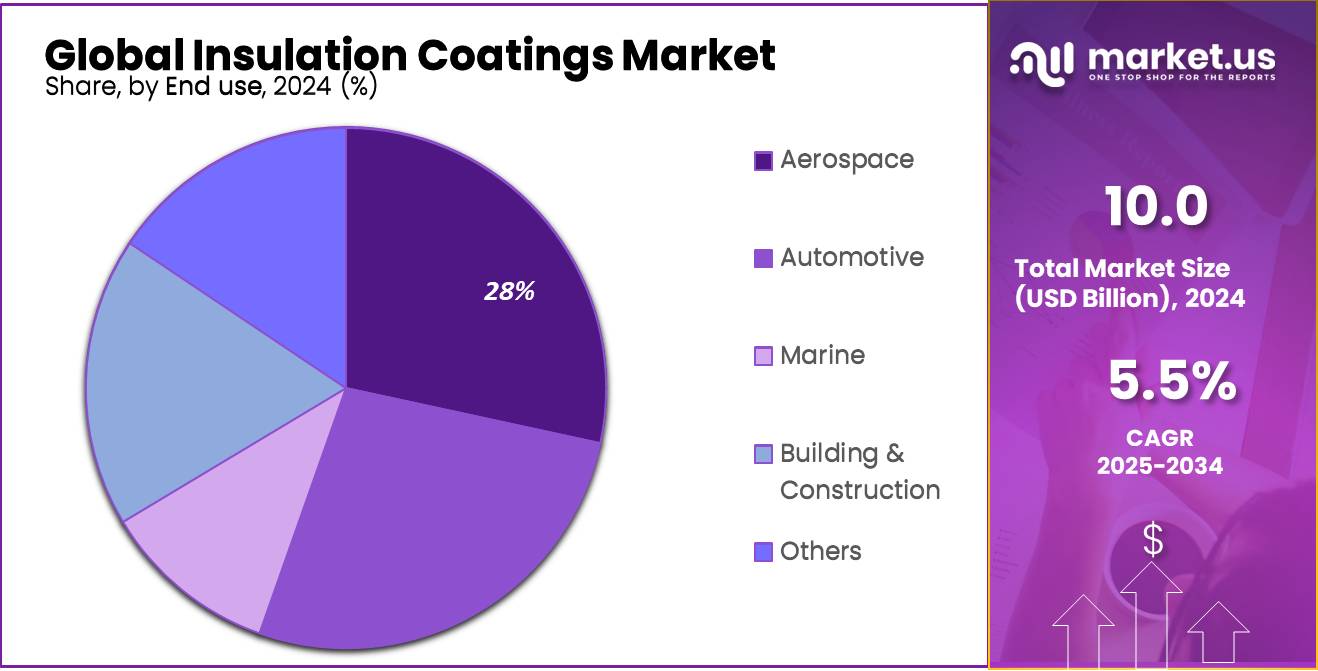

- Aerospace held a dominant market position, capturing more than a 28.4% share of the global insulation coatings market.

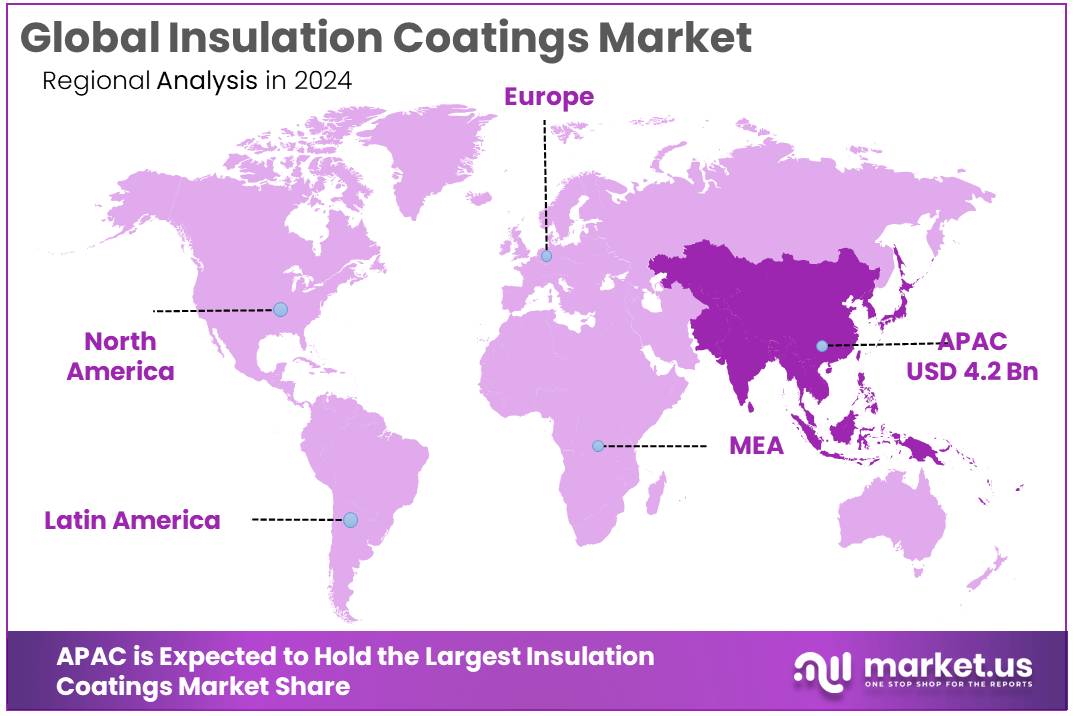

- Asia‑Pacific (APAC) region took the lead in the global insulation coatings market, holding a dominant 42.8% share and generating approximately USD 4.2 billion.

By Type

Acrylic dominates with 31.8% due to its durability, water resistance, and ease of application.

In 2024, Acrylic held a dominant market position, capturing more than a 31.8% share of the global insulation coatings market. The popularity of acrylic-based insulation coatings can be attributed to their excellent thermal insulation properties, along with high UV resistance and long-term weather protection. These coatings are widely used in construction, automotive, and manufacturing sectors due to their cost-effectiveness and easy water-based formulation, which makes them safer to apply and environmentally friendly.

By End use

Aerospace dominates with 28.4% due to its demand for high-performance thermal protection in extreme conditions.

In 2024, Aerospace held a dominant market position, capturing more than a 28.4% share of the global insulation coatings market. This significant share reflects the growing reliance on advanced thermal barrier coatings in both commercial and defense aviation. These coatings are essential in protecting critical components such as turbine blades, engine casings, and exhaust systems from high-temperature exposure and oxidation. As aircrafts are continuously exposed to harsh atmospheric conditions, aerospace manufacturers increasingly prefer insulation coatings that offer durability, corrosion resistance, and lightweight protection.

Key Market Segments

By Type

- Acrylic

- Ероху

- Polyurethane

- Yttria Stabilized Zirconia

- Others

By End use

- Aerospace

- Automotive

- Marine

- Building & Construction

- Others

Drivers

Government Incentives and Energy Efficiency Regulations

A significant driver of the insulation coatings market is the increasing emphasis on energy efficiency, supported by government incentives and regulations. For instance, the U.S. Department of Energy reports that up to 20% of industrial energy can be saved with thermal insulation, encouraging the government to lend its backing.

Similarly, the European Union’s revised Energy Efficiency Directive (EU/2023/1791) underscores the imperative of energy savings, setting targets for cumulative end-use energy savings projected to rise from 0.8% to 1.3% in the near term and further to 1.9% by 2028–2030.

In the United Kingdom, the Great British Insulation Scheme, with a budget of £1 billion over its three-year duration, aims to enhance energy efficiency in residential properties through insulation measures. This initiative is expected to treat 315,000 homes, with around 17% of these homes being in fuel poverty, leading to average annual energy bill reductions of £300–£400.

Restraints

High Initial Costs and Application Complexities

One of the primary challenges hindering the widespread adoption of insulation coatings is the high initial investment required for both the materials and their application processes. Advanced insulation coatings often involve complex formulations and specialized application techniques, which can lead to elevated costs compared to traditional insulation methods.

For instance, the incorporation of nanotechnology or specialized polymers to enhance thermal performance can significantly increase the price of these coatings. This price disparity makes it challenging for small and medium-sized enterprises (SMEs) to justify the upfront expenditure, especially when operating under tight budget constraints. Moreover, the application of these coatings may require specialized equipment and skilled labor, further adding to the overall cost.

Additionally, the complexity of applying insulation coatings can pose operational challenges. These coatings often require precise application techniques to ensure uniform coverage and optimal performance. Inconsistent application can lead to areas of insufficient insulation, reducing the effectiveness of the coating and potentially leading to increased energy consumption. Furthermore, certain substrates may not be compatible with specific insulation coatings, necessitating additional preparation or treatment of surfaces before application. Such requirements can extend project timelines and increase labor costs.

These factors combined—high initial costs and application complexities—create significant barriers to the adoption of insulation coatings, particularly in cost-sensitive markets or for projects with limited budgets. Addressing these challenges through technological advancements, standardization of application procedures, and financial incentives could facilitate broader acceptance and integration of insulation coatings into various industries.

Opportunity

Leveraging U.S. Energy-Efficiency Tax Deductions to Accelerate Market Expansion

One major growth avenue for the insulation coatings market emerges from the U.S. Internal Revenue Code Section 179D, which provides commercial building owners with meaningful federal tax deductions tied to building performance enhancements. For the taxable year 2024, this legislation offers a deduction ranging from USD0.57 to USD1.13per square foot, with the higher end ($1.13/ft²) applicable when design improvements exceed 25% in energy savings, increasing incentive as savings deepen.

Furthermore, projections for 2025 anticipate an expanded deduction range of USD0.58 to USD1.16per square foot, maintaining the structure that rewards deeper energy conservation initiatives . This tax mechanism heightens the appeal of insulation coatings—particularly high-performance formulations with low thermal conductivity and enhanced longevity—by effectively reducing implementation costs and shortening payback periods.

The influence of Section 179D is especially pronounced in large commercial and industrial facilities, where investment decisions are anchored in both upfront cost and ongoing operational efficiency. When owners and developers calculate that reducing energy usage by more than 25% can yield USD 1.13–1.16 per square foot in tax relief, an enhanced business case arises for specifying premium insulation coatings in building envelopes, mechanical systems, and process infrastructure. This deduction becomes particularly impactful in new construction or significant retrofits, enabling heat-loss mitigation without penalizing initial capital outlay.

Trends

Growth in Sustainable Construction Practices

One of the significant growth drivers for the insulation coatings market is the increasing adoption of sustainable construction practices. Governments worldwide are implementing stringent energy efficiency regulations and promoting green building initiatives, which are boosting the demand for insulation coatings.

For instance, the European Union’s revised Energy Efficiency Directive (EU/2023/1791) sets ambitious targets for energy savings, encouraging the use of energy-efficient materials like insulation coatings in buildings. Similarly, the U.S. Department of Energy reports that up to 20% of industrial energy can be saved with thermal insulation, highlighting the importance of insulation coatings in energy conservation efforts.

In the United Kingdom, the Great British Insulation Scheme, with a budget of £1 billion over its three-year duration, aims to enhance energy efficiency in residential properties through insulation measures. This initiative is expected to treat 315,000 homes, with around 17% of these homes being in fuel poverty, leading to average annual energy bill reductions of £300–£400.

Regional Analysis

In 2024, the Asia‑Pacific (APAC) region took the lead in the global insulation coatings market, holding a dominant 42.8% share and generating approximately USD 4.2 billion in revenue. This strong position reflects rapid industrial growth and extensive infrastructure development across China, India, Southeast Asia, and Australia.

The sector has witnessed robust growth in both construction and manufacturing industries. Urbanisation rates in emerging economies have increased housing and urban infrastructure needs, while industrial growth has boosted demand for thermal protection in process plants, oil and gas facilities, and power generation sites. APAC’s industrial coatings market, in which insulation coatings are a key category, was the world’s largest in 2024, accounting for over 42% of global demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M offers a range of electrical and thermal insulation products, such as its 3M™ Electrical Insulating Sealers and thermal insulation materials, which support industrial agitator systems by providing reliable protection against heat, moisture, and chemical exposure. These sealer products, designed for motor windings and moving components, help extend the service life of agitators in demanding industrial environments. With robust R&D and quality control processes ensuring RoHS compliance, 3M solutions align with evolving regulatory and performance standards.

AkzoNobel supplies performance coatings that are applicable to industrial agitator equipment. Their epoxy powder coatings—marketed under brands such as Resicoat—are often utilized in electrical insulation contexts, including motors and agitators. These powder coatings enhance protection against corrosion and electrical faults, and they are backed by AkzoNobel’s global manufacturing footprint. In 2023, AkzoNobel reported group revenue of €10.7 billion, underscoring its capacity to support large-scale industrial coating solutions.

Arkema provides advanced insulating coatings and binder systems for agitator components within chemical and food processing industries. Its Certincoat® low-emissivity glass coatings offer 30% heat retention improvement, improving efficiency in process observation equipment. Additionally, Arkema’s innovative polyamide and PEKK-based powders—certified under UL standards—are optimized for electric motor insulation in agitators. With annual revenue of €9.5 billion in 2024, Arkema combines scale with technical specialization.

Top Key Players in the Market

- 3M

- AkzoNobel

- Arkema Group

- Axalta Coating Systems LLC

- BASF SE

- Carboline Company

- Dow Inc.

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- PPG Industries

- Sherwin-Williams

- The Dow Chemical Company

Recent Developments

In 2024, Arkema Group achieved €9.54 billion in total sales, supported by a 16.1% EBITDA margin, delivering €1.53 billion in EBITDA.

In 2024, Axalta Coating Systems reported record full-year net sales of USD 5.3 billion, reflecting a 2% increase over 2023, while the Performance Coatings segment – which includes insulation coatings – contributed approximately USD 3.41 billion, up 2.4% year-over-year.

Report Scope

Report Features Description Market Value (2024) USD 10.0 Bn Forecast Revenue (2034) USD 17.1 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Acrylic, Ероху, Polyurethane, Yttria Stabilized Zirconia, Others), By End use (Aerospace, Automotive, Marine, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, AkzoNobel, Arkema Group, Axalta Coating Systems LLC, BASF SE, Carboline Company, Dow Inc., Hempel A/S, Jotun, Kansai Paint Co., Ltd., PPG Industries, Sherwin-Williams, The Dow Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insulation Coatings MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Insulation Coatings MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- AkzoNobel

- Arkema Group

- Axalta Coating Systems LLC

- BASF SE

- Carboline Company

- Dow Inc.

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- PPG Industries

- Sherwin-Williams

- The Dow Chemical Company