Global Insect Protein Market By Source (Coleoptera, Lepidoptera, Orthoptera, Hymenoptera, Hemipetera, and Others), By Application (Food & Beverages, Animal Nutrition, Pharmaceuticals & Supplements, and Personal Care and Cosmetics), By Distribution Channel (Online and Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Jan 2024

- Report ID: 24497

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

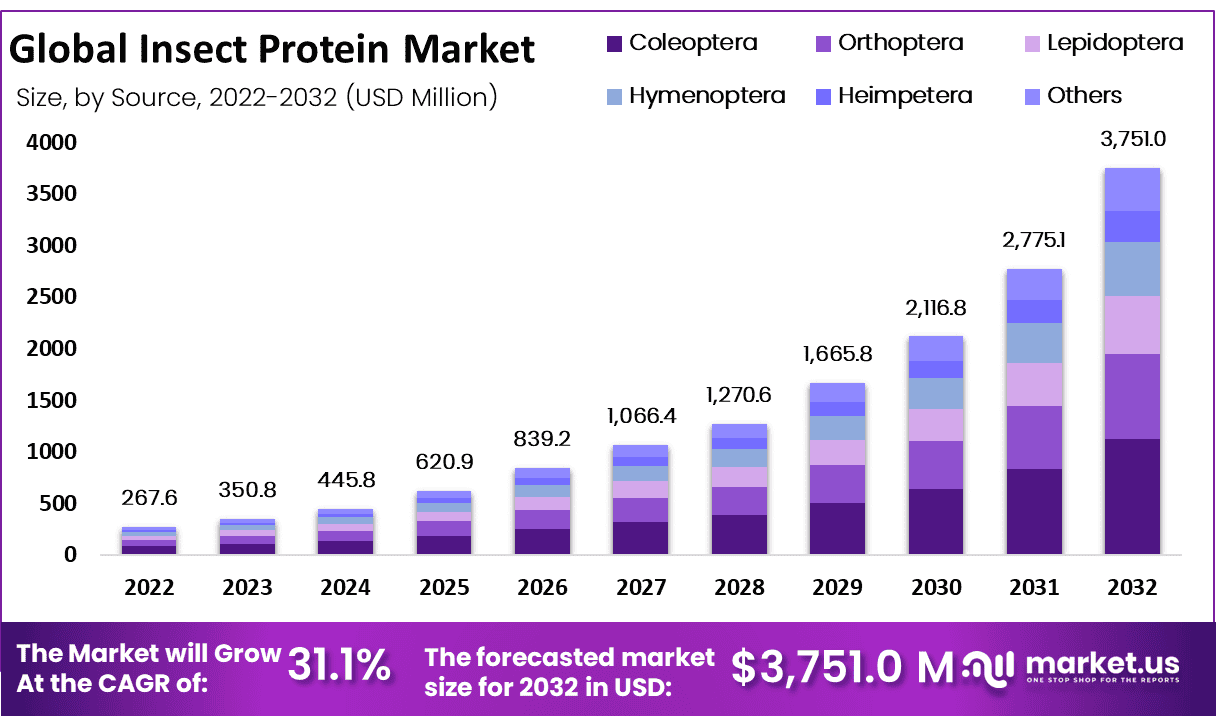

The Global Insect Protein Market size is expected to be worth around USD 3,715.0 Million by 2032 from USD 267.6 Million in 2022, growing at a CAGR of 31.10% during the forecast period from 2023 to 2032.

Insect protein is excellent feedstock obtained from insects that can be used as an ingredient for feed for animals, fish, and pets. They are derived from edible insects and depend on what species are fed with them. Manufactured materials can also obtain insect protein.

Insects, including crickets, grasshoppers, black solder flies, and ants, have a high protein content and can be easily increased in areas with minimal resources. Therefore, insects are an important part of everyday food intake for over 2 billion individuals worldwide. Insect-based protein can be mainly used in animal feed, pet food, and fish. In addition, insects are very sustainable and beneficial to the environment as a protein source.

Key Takeaways

- Market Growth: The global insect protein market is projected to reach USD 3,715.0 million by 2032, with a remarkable CAGR of 31.10% from USD 267.6 million in 2022.

- Insect Protein Usage: Insect protein, derived from insects like crickets, grasshoppers, and ants, serves as feedstock for animals, fish, and pets, and is also utilized in various products.

- Drivers for Growth: The market is driven by increasing demand for alternative protein sources, technological innovations, and investments in insect farming. Growing consumer awareness of nutritional foods and healthy lifestyles is boosting insect protein demand.

- Restraining Factors: Limited regulations on insect protein usage, high production costs, and the risk of allergies are hindrances to market growth.

- Source Analysis: Coleoptera (beetles) are the dominant source of insect protein due to their wide application in various products, while Orthoptera (crickets, locusts, grasshoppers) are also significant.

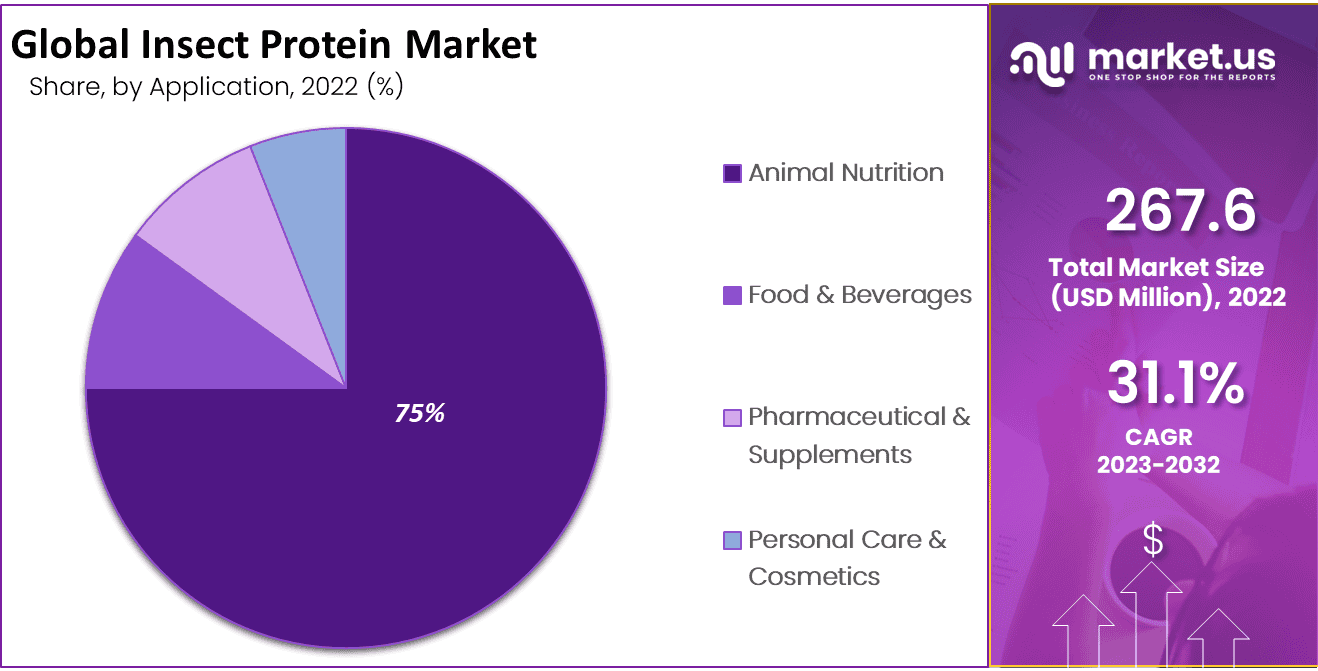

- Application Analysis: Animal nutrition holds the largest market share, especially in aquaculture and poultry feed, while food & beverages are expected to grow rapidly.

- Distribution Channels: Offline distribution channels, including supermarkets and convenience stores, dominate the market, but online channels are also growing.

- Growth Opportunities: Rising population, increasing R&D activities, and demand for healthy and nutritive food products provide growth opportunities.

- Trends: Increased interest in protein-rich foods, the development of next-generation plant-based meats, and rising acceptance of insect-based products are notable trends.

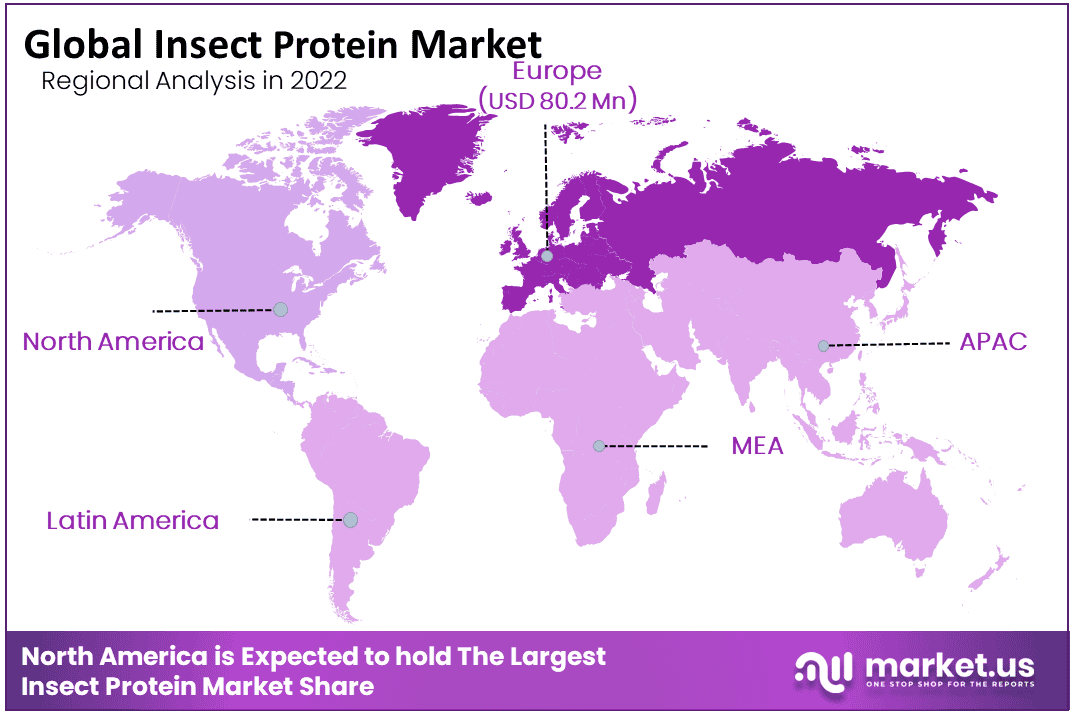

- Regional Dominance: Europe leads the market, followed by North America and the Asia-Pacific region, with factors like customer acceptance and regulatory approvals influencing growth.

- Key Players: The market is highly competitive, with companies like Aspire Food Group, Enviro Flight LLC, and Swarm Nutrition GmbH among the key players.

Driving Factors

Increasing Demand for Alternate Proteins to Drive the Insect Protein Market Growth

Increasing development, technological invention, and rising responsibility of investments in other protein companies drive market growth. Since insects are vastly accessible, manufacturers have started commercializing insect farming and extracting protein from them. The increasing customer consciousness regarding the consumption of nutritional foodstuffs and rising preferences for a healthy lifestyle are anticipated to propel the need for insect protein during the forecast period.

Moreover, the quickly growing demand and depletion of meat-producing animals have motivated the requirement for alternative protein sources. Owing to the protein content, some insects are upraised, and their application as another source of protein is rising as consciousness of the high content of insects rises. The demand for nutritious protein products will provide a novel growth path for the market in the upcoming years. Additionally, insect-based protein is used in various products such as food & beverages, cosmetics, nutraceuticals, and poultry feed.

Sustainable Protein Source

The global protein demand is set to double by 2050, positioning insects as a key sustainable protein source. This surge is driven by the increasing global population and the need for sustainable food sources. About 1,900 insect species are already consumed worldwide, showcasing a substantial market potential yet to be fully explored.

Insect Farming will Play an Important Role in Future Food System

Insects, particularly species like Acheta domesticus (house crickets) and Tenebrio molitor larvae (mealworms), offer high protein content, often exceeding 40%. This is complemented by a favorable amino acid profile that meets the Food and Agriculture Organization (FAO) and World Health Organization (WHO) standards. This high nutritional value, combined with the lower environmental footprint of insect farming, underscores the significant role insects could play in future food systems.

Restraining Factors

Lack of Adequate Regulations Hamper Market Growth

Insufficient regulations on the usage of the insect protein industry in the feed can be a main hindrance to industrial growth. High cost and limited production capability is the major factor restraining market growth. Insect-based protein is still expensive; the devices and methods required to make them need optimization for large-scale production.

Furthermore, the insect protein intake by somebody allergic to arthropods may result in sensitivity. Further, numerous communications with insects during farming or breeding might be the outcome of individual reactions, one of the significant factors hampering the market growth.By Source Analysis

Coleoptera Segment to Witness Significant Growth

The global insect protein market is segmented into Coleoptera, Lepidoptera, Orthoptera, Hymenoptera, Hemiptera, and sources. The Coleoptera segment accounted for the highest market revenue share of 30% in 2022. Coleoptera is fit for individual consumption and is offered in several insect-based products including protein powder, insect-base oil, and flour.

Coleoptera states that the insect consists of the order of beetles, larvae, and weevils. It is the largest order of insects representing about 40% of the species. Edible beetles have been usually consumed in several countries. Mealworms are generally used to extract powders that find application in animal feed and pet food companies.

The increasing need for mealworm ingredients in several industries is anticipated to create opportunities for the key players in the market. The orthoptera segment dominated during the historical period and is estimated to hold the second-largest market share. Orthoptera is an order of insects that contain crickets, locusts, and grasshoppers. This insect is widely accessible and easy to breed and has high protein content.

By Application Analysis

The Animal Nutrition Segment Dominates the Market Growth of the Insect Protein Market

Based on application, the global insect protein market is classified into food & beverages, animal nutrition, pharmaceuticals & supplements, and personal care & cosmetics. The animal nutrition segment accounted for the maximum market revenue share of 75% in 2022.

Insect protein is mainly consumed as a feed stabilizer for aquaculture, poultry, and other animals. High digestibility band protein and amino acid content are obtaining traction from animal feed manufacturers. Animal nutrition can be utilized in powders or liquid by insect protein. which helps in their whole growth.

The food & beverages segment is anticipated to witness the fastest growth rate during the forecast period. Various countries authorizing insects for individual consumption are anticipated to propel market growth. Nutritional bars, functional food products, and protein-rich products are some of the products used in the food & beverage industry.

By Distribution Channel Analysis

The Offline Segment Dominated the Insect Protein Market

Based on the distribution channel the global insect protein market is categorized into online and offline. Among these, the offline segment registers the highest CAGR during the forecast period. Offline distribution includes hypermarkets, specialist retailers, convenience stores, and supermarkets.

The dominance of offline channel is mainly driven by the need from emerging regions These countries are large consumers of insect protein and doesn’t have well-established online distribution channel. The online segment registers a CAGR of 6.4% in the insect protein market. Due to the availability and convenience.

Key Market Segments

By Source

- Coleoptera

- Lepidoptera

- Orthoptera

- Hymenoptera

- Hemiptera

- Other Sources

By Application

- Food & Beverages

- Animal Nutrition

- Pharmaceuticals & Supplements

- Personal Care and Cosmetics

By Distribution Channel

- Online

- Offline

Growth Opportunities

Robust Interest in Protein is Developing Novel Opportunities For the Market

The increase in the development of novel opportunities in the market is due to the strong interest in protein. The increasing population and rapid development provide lucrative opportunities for the market. Customers must be aware of the nutritional benefits and are willing to try novel things.

An increase in R&D activities will offer lucrative opportunities for the market. There has also rise in the need for healthy and nutritive food products, thus offering opportunities for manufacturers in several industries to deliver such food products.

Latest Trends

Next-Generation Plant- Base Meats on the Protein Snacks Increase Demand for Alternative Protein Sources

The global insect protein market is developing and increasing costumer’s need for protein rises the market growth. Additionally, with the rising worldwide population and welfare, the need for protein as a food nutritional component increases suddenly.

Owing to the rising demand for alternative protein among food & beverages manufacturers fulfill the customers’ increasing demand. The approval of insect-base protein has been rising in the food and beverage industry.

Regional Analysis

Europe Dominates the Global Insect Protein Market During the Forecast Period

Europe accounted for a significant insect protein market revenue share of 30%. Due to the high customer acceptance rate for insect protein for applications such as animal nutrition, food, and beverage industry, and personal care industry. The present authorization of insect protein for feed including pig and poultry is anticipated to further propel the need in the European region.

The high requirement from developed countries such as Germany, the UK, and France is anticipated to fuel the overall market growth. The European region is also considered the major market for insect-based protein.

North America accounted for the second-largest revenue share during the forecast period, due to the requirement for nutritional food products and increasing consciousness among customers regarding the consumption of insect-based products. Various countries in North America have a wide potential for growth of novel players and novel product launches which is projected to propel the demand for the market.

The Asia-Pacific market is expected to hold the maximum revenue share in 2022. Due to the rising customer base in the region. Additionally, some of the countries in the Asia-Pacific region have a long history of insect consumption and are among the large producers of insect’s additional raw material.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The insect protein market is highly competitive with small and medium level of key players focus on rising production capabilities, new product launches, and R&D of products. Some of the key players are looking for strategic business development.

Some of the prominent key players in the insect protein market include Aspire Food Group, Enviro Flight LLC, Swarm Nutrition GmbH, Next Protein Inc., Ynsect NL Nutrition & Health B.V., Entomo Farms, Protix, Insect Technology Group Holdings Limited, and other key players.

Top Key Players

- Aspire Food Group

- Enviro Flight LLC

- Swarm Nutrition GmbH

- Next Protein Inc.

- Ynsect NL Nutrition & Health B.V.

- Entomo Farms

- Protix

- Insect Technology Group Holdings Limited

- Other Key Players

Recent Developments

- March 2021-Nutrition Technologies secured millions to recognize insect protein production in Malaysia. The funds might benefit the firm enhancement into a novel Southeast Asian market.

- February 2021- Aspire Food Group and its partner were awarded from Next Generation Manufacturing in Canada to aid from cricket protein plants.

Report Scope

Report Features Description Market Value (2022) US$ 267.6 Mn Forecast Revenue (2032) US$ 3,751.0 Mn CAGR (2023-2032) 31.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source- Coleoptera, Lepidoptera, Orthoptera, Hymenoptera, Hemipetera, and Other Sources; By Application- Food & Beverages, Animal Nutrition, Pharmaceuticals & Supplements, and Personal Care and Cosmetics; By Distribution Channel- Online and Offline Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Aspire Food Group, Enviro Flight LLC, Swarm Nutrition GmbH, Next Protein Inc., Ynsect NL Nutrition & Health B.V., Entomo Farms, Protix, Insect Technology Group Holdings Limited, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Which region is more appealing for vendors employed in the Insect Protein Market?In 2021, North America accounted for a significant revenue share. Due to growing awareness concerning the benefits of eating insect-based foods and the increasing demand for nutritional products, this market is expected to be the largest by 2032.

Name the key business areas for the Insect Protein Market.The US, Canada, China, India, Brazil, South Africa, etc., are leading key areas of operation for the Insect Protein Market.

List the segments encompassed in this report on the Insect Protein Market?Market.US has segmented the Insect Protein Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented By Application Animal Nutrition, Food & Beverage, Personal Care & Cosmetics, and Pharmaceutical & Supplements. By Source Hemiptera, Coleoptera, Lepidoptera, Diptera, Orthoptera, Hymenoptera, and Other Sources.

-

-

- Aspire Food Group

- Enviro Flight LLC

- Swarm Nutrition GmbH

- Next Protein Inc.

- Ynsect NL Nutrition & Health B.V.

- Entomo Farms

- Protix

- Insect Technology Group Holdings Limited

- Other Key Players