Global Infectious Disease Therapeutics Market By Disease Type (HIV, Hepatitis, Influenza, TB, Malaria, and Others), By Treatment Type (Antibiotics, Antiviral Drugs, Antifungal Drugs, Antiparasitic Drugs, and Others), By End-use (Hospitals, Clinics, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 126309

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

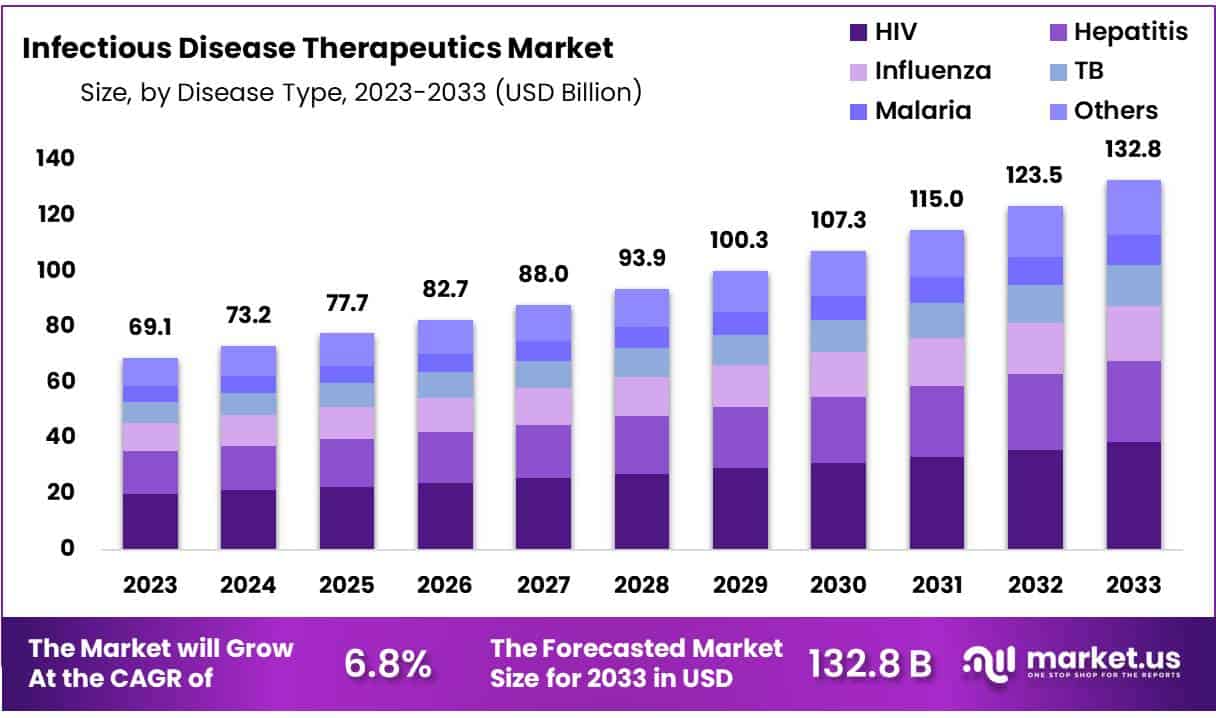

The Global Infectious Disease Therapeutics Market size is expected to be worth around USD 132.8 Billion by 2033 from USD 69.1 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Infectious disease therapeutics encompass a diverse array of treatments aimed at combating illnesses caused by pathogens such as bacteria, viruses, fungi, and parasites. Antibiotics are crucial for bacterial infections, targeting specific bacterial mechanisms to halt their growth. Antiviral medications inhibit viral replication, crucial in managing diseases like influenza or HIV.

Antifungal drugs combat fungal infections, preventing their spread in vulnerable individuals. Parasitic infections are treated with antiparasitic medications, targeting various parasites like malaria or worms. Immunizations play a pivotal role in prevention, bolstering immunity against specific pathogens. Advances in therapeutics continually evolve, emphasizing tailored approaches for effective infection management and public health strategies.

Infectious disease therapeutics constitute a critical segment of healthcare driven by increasing global incidence rates of infections. Factors fueling this growth include antimicrobial resistance, globalization, and population density. However, the industry faces challenges such as stringent regulatory requirements, high costs of research and development, and the complexity of clinical trials. These obstacles impede the rapid advancements in treatment options.

Moreover, innovations in genomics, immunotherapy, and vaccine development will offer lucrative growth opportunities. Key stakeholders in this dynamic industry include pharmaceutical companies, biotechnology firms, academic institutions, and governmental organizations. Collaboration among these market players is pivotal in overcoming challenges and seizing opportunities to improve global health outcomes in the face of evolving infectious disease threats.

Key Takeaways

- Market Size: The Global Infectious Disease Therapeutics Market size is expected to be worth around USD 132.8 Billion by 2033 from USD 69.1 Billion in 2023.

- Market Growth: The market growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

- Disease Analysis: HIV segment stands out prominently, commanding a substantial market share of 29.12% as of 2023.

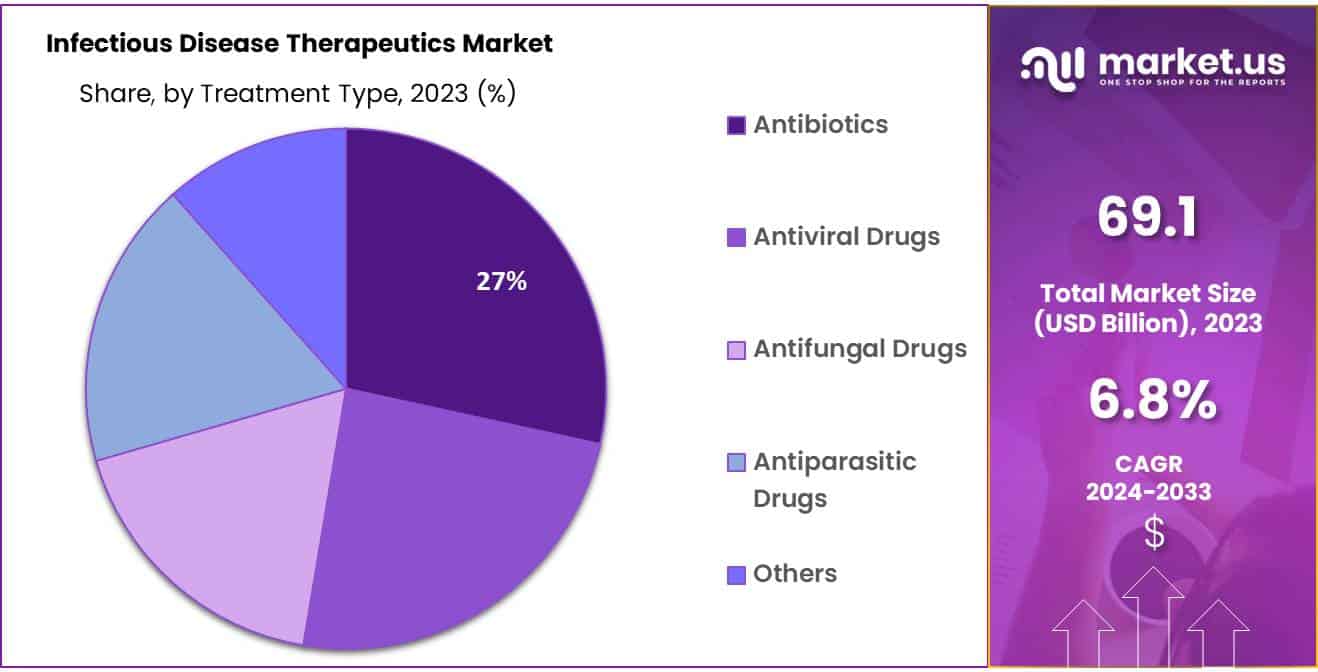

- Treatment Type Analysis: Antibiotics segment occupied a larger market revenue share of 25.23%

- Regional Analysis: North america dominating the market capturing a huge market revenue share of 38.41% in the year 2023.

- Vaccine Dominance: Vaccines remain a dominant segment, driven by advancements in vaccine technology and the global demand for effective immunization strategies.

- Antiviral Therapies: The demand for antiviral drugs, particularly for diseases like HIV, hepatitis, and influenza, is a key growth driver in the market.

By Disease Type

HIV segment is at the forefront

Based on disease type the global infectious disease therapeutics market is segmented into key categories such as HIV, hepatitis, influenza, tuberculosis (TB), malaria, and others. Among these, the HIV segment stands out prominently, commanding a substantial market share of 29.12% as of 2023. This leadership position stems from the high prevalence of HIV/AIDS and the critical need for effective treatments.

- According to Joint United Nations Programme on HIV/AIDS (UNAIDS), in 2023, 40.0 million people worldwide were living with HIV, with 2.38 million of these being children aged 0-19. Each day, around 685 new HIV infections occurred among children, and approximately 250 children died from AIDS-related causes. These deaths are largely attributed to inadequate access to HIV prevention, care, and treatment services.

Further, antiretroviral therapies, including advanced combination regimens and long-acting formulations, have significantly improved patient outcomes and are central to the market’s growth. The ongoing development of new therapies, alongside enhanced global access to HIV care, continues to drive the segment’s prominence. Additionally, substantial investments in research and public health initiatives to combat HIV further solidify its leading role in the infectious disease therapeutics landscape.

Hepatitis disease, on the other hand, is anticipated to witness fastest growth during the forecast period. This growth is driven by advances in antiviral therapies, particularly for hepatitis C, where new direct-acting antiviral (DAA) drugs offer high cure rates and shorter treatment durations. Hepatitis B treatments have also improved, with newer therapies enhancing long-term management.

Increased awareness, expanded screening programs, and global health initiatives targeting hepatitis are contributing to the segment’s rapid expansion. These factors, combined with the significant burden of hepatitis worldwide, fuel the market’s robust growth trajectory.

By Treatment Type Analysis

Antibiotics segment occupied market revenue share of 25.23% in 2023

Based on treatment type, the global Infectious Disease Therapeutics Market is broadly classified into Antibiotics, Antiviral Drugs, Antifungal Drugs, Antiparasitic Drugs, and Others. Antibiotics segment occupied a larger market revenue share of 25.23%, dominating the market in the year 2023. This leading position is attributed to the widespread use of antibiotics in treating various bacterial infections, ranging from common illnesses to serious conditions. Their effectiveness, established treatment protocols, and relatively lower costs compared to other therapeutic classes contribute to their market leadership.

In the global infectious disease therapeutics market, the fastest-growing segment is antiviral drugs. This rapid growth is driven by the increasing prevalence of viral infections and the critical need for effective treatments. Antiviral drugs, particularly those targeting diseases like HIV, hepatitis C, and influenza, have seen significant advancements. Innovations such as direct-acting antivirals for hepatitis C and novel antiviral agents for emerging viral threats contribute to this expansion.

Key Market Segments

By Disease Type

- HIV

- Hepatitis

- Influenza

- TB

- Malaria

- Others

By Treatment Type

- Antibiotics

- Antiviral Drugs

- Antifungal Drugs

- Antiparasitic Drugs

- Others

By End-use

- Hospitals

- Clinics

- Others

Market Drivers

Rising Prevalence of Infectious Diseases

The rising prevalence of infectious diseases is a key driver of growth in the global infectious disease therapeutics market. Increased urbanization, climate change, and global travel contribute to the spread of infectious diseases, intensifying the need for effective treatments. For instance, the resurgence of tuberculosis (TB) and the ongoing challenge of antimicrobial resistance are some of the major concerns that drive market expansion.

Further, the high incidence of chronic viral infections such as HIV and hepatitis continues to expand the market for antiviral drugs. As these diseases persist, there is a constant need for improved therapies to manage and treat them effectively. Moreover, the spread of vector-borne diseases like malaria, exacerbated by climate change, also contributes to market growth. Therefore, the increasing prevalence of various infectious diseases enhanced the market growth.

- According to World Health Organization, in 2022, approximately 10.6 million people globally were diagnosed with tuberculosis (TB). This figure includes 5.8 million men, 3.5 million women, and 1.3 million children. TB remains a substantial public health challenge, affecting individuals across diverse demographics.

Advancements in Medical Research and Technology

Advancements in medical research and technology are pivotal in driving growth within the global infectious disease therapeutics market. Innovations in areas such as drug discovery, genomics, and biotechnology have led to the development of more effective and targeted treatments for various infectious diseases. For instance, the progress in understanding the genetic makeup of pathogens has enabled the creation of precise molecular diagnostics, improving early detection and treatment outcomes.

In the realm of drug development, new methodologies such as high-throughput screening and structure-based drug design have accelerated the discovery of novel antibiotics and antivirals. These advancements are crucial in addressing the growing challenge of antimicrobial resistance, which demands the development of new therapeutic agents.

Additionally, improvements in drug delivery systems, such as extended-release formulations and targeted delivery technologies, enhance the efficacy and safety of treatments.

Market Restraints

lack of Awareness

Lack of awareness about infectious disorders and low adoption of treatments are significant factors that may restrain market growth in the coming years. In regions such as Africa and Asia, where the incidence of infectious diseases is high, there remains a notable gap in the penetration of effective treatments. Limited public awareness, inadequate healthcare infrastructure, and barriers to accessing medical care contribute to this challenge.

Consequently, despite the availability of therapeutic options, their impact is diminished by these barriers, hindering progress in controlling and managing infectious diseases.

High Development Costs

The high cost developing new therapeutics significantly impacts the global infectious disease therapeutics market, particularly by constraining the ability of smaller companies to enter and compete effectively. The development process involves extensive research and development (R&D) costs, including preclinical studies, lengthy of developing and expensive clinical trials, and the regulatory approval process.

Each of these stages requires substantial financial investment, often running into billions of dollars. For smaller companies and startups, these costs prohibit and limiting their ability to bring innovative therapeutics to market.

Opportunities

Lucrative opportunities are gained by the market

Growing economies and improving healthcare infrastructure in emerging markets present significant opportunities for expansion in the global infectious disease therapeutics market. As countries in regions like Africa, Asia, and Latin America experience economic growth, they are increasingly investing in healthcare systems and infrastructure. This investment is crucial for addressing the high burden of infectious diseases prevalent in these areas.

Further, Emerging markets are enhancing healthcare access by building new facilities, expanding medical training, and increasing availability of essential treatments. Governments and organizations are prioritizing healthcare reforms that include the procurement of advanced diagnostics and therapeutics, improved healthcare delivery systems, and expanded vaccination programs.

Such improvements not only address existing health challenges but also foster an environment conducive to market growth. For example, increased funding for healthcare initiatives enables better management of diseases like tuberculosis, malaria, and HIV, while also supporting public health campaigns and education programs.

Additionally, the expansion of health insurance coverage and subsidized treatment programs improves access to therapeutics, driving demand and market growth. The combined effect of these efforts creates a promising landscape for pharmaceutical companies to enter and expand their presence in these burgeoning markets, ultimately enhancing global health outcomes.

Moreover, Collaborations between pharmaceutical companies, research institutions, and governments are pivotal in accelerating drug development and improving therapeutic options for infectious diseases. These partnerships leverage the strengths and resources of each entity to address complex challenges in drug discovery, development, and deployment.

Pharmaceutical companies provide the expertise in drug formulation and commercial scaling, while research institutions contribute cutting-edge scientific knowledge and innovative approaches. Governments play a critical role by facilitating regulatory approvals, offering funding, and supporting public health initiatives.

Latest Trends

Focus on Preventive Measures: There is an increasing emphasis on preventive measures, such as vaccines and early detection systems, to manage infectious diseases and reduce the need for therapeutic interventions.

Advancements in Antimicrobial Agents: Continued research into new classes of antibiotics and antiviral drugs, as well as novel mechanisms of action, is a significant trend. The development of agents that combat resistant strains is particularly noteworthy.

Integration of Artificial Intelligence (AI): AI and machine learning are being used to accelerate drug discovery, analyze large datasets, and identify potential therapeutic targets, thereby transforming the development of infectious disease therapeutics.

Impact of Macroeconomic factors

Macroeconomic factors significantly impact the global infectious disease therapeutics market by influencing investment, pricing, and accessibility. Economic growth, for example, enhances healthcare budgets and infrastructure, leading to greater investment in research and development of new therapeutics. Conversely, economic downturns may result in budget cuts and reduced spending on healthcare, potentially stalling innovation and limiting access to essential treatments.

Further, Inflation and currency fluctuations also affect drug pricing and market dynamics. High inflation increase the cost of raw materials and manufacturing, leading to higher prices for therapeutics and potentially reducing affordability. Currency volatility impact international sales and profitability, particularly for companies operating in multiple regions.

Additionally, economic stability affects healthcare access and insurance coverage, influencing the availability and affordability of treatments. In emerging markets, economic improvements expand healthcare access and drive market growth, while economic instability exacerbate healthcare disparities and limit therapeutic reach.

Regional Analysis

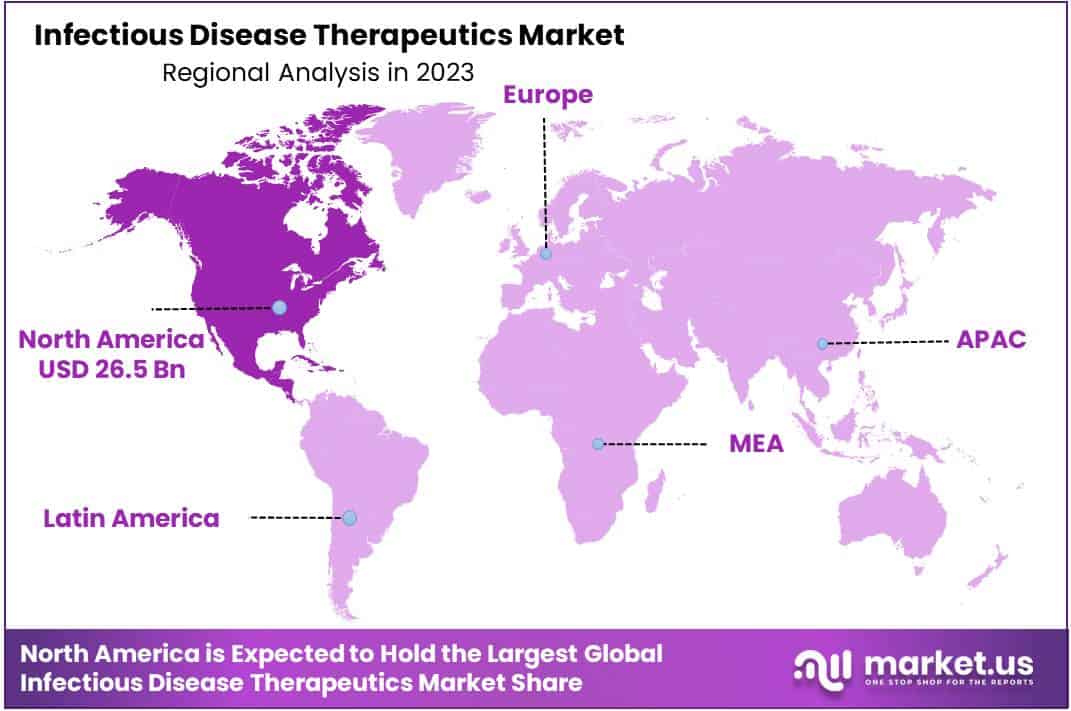

North America Accounted for the Largest Revenue Share in Infectious Disease Therapeutics Market in 2023

North America is at the forefront of Infectious Disease Therapeutics Market, dominating the market capturing a huge market revenue share of 38.41% in the year 2023. The notable growth of the region is highly attributed to rising healthcare expenditure by people combined with the presence of well-established healthcare infrastructure.

- According to National Health Expenditure data published by Centers for Medicare & Medicaid services, healthcare services in United States has grew by 4.6% in 2018 and reached to the USD 3.6 trillion of the USD 11,172 per person.

- According to nations’ Gross Domestic Product (GDP) healthcare spending account for nearly 18% of the total GDP.

Asia-Pacific on the other side, is projected to register second most rapidly growing region, owing to the presence of large patient population that are undiagnosed for the critical diseases, rise in disposable income, rapid urbanization and scaling recognition related to early diagnosis. In addition to this, the region witnessed huge growth by virtue of rapid development of various therapeutics for infectious diseases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape:

Key players in the global infectious disease therapeutics market include Novartis AG, Gilead, GlaxoSmithKline plc, Janssen Pharmaceutical, Inc., F. Hoffmann-La Roche Ltd., BioCryst Pharmaceuticals, Inc., Merck & Co., Inc., and other key players. These companies dominate the market due to their extensive portfolios and continuous efforts in securing regulatory approvals for anti-infective treatments.

The ongoing regulatory support for the commercial availability of these therapeutics significantly contributes to their market leadership. For instance, in June 2022, NRG Therapeutics secured $16 million in Series A funding to advance mitochondrial therapeutics aimed at treating neurodegenerative diseases such as Parkinson’s and ALS. This investment underscores the importance of funding and innovation in developing new treatments across various therapeutic areas.

Market Key Players

- Novartis AG

- Gilead Sciences, Inc.

- GSK plc.

- Janssen Pharmaceutica NV

- Hoffmann-La Roche Ltd.

- BioCryst Pharmaceuticals, Inc.

- Boehringer Ingelheim Pharmaceuticals, Inc.

- Merck & Co., Inc.

- AbbVie Inc.

- Pfizer Inc.

- Moderna, Inc.

Recent Developments

- In June 2022: GSK announced £1 billion R&D investment over ten years to get ahead of infectious diseases in lower-income countries. This investment supports further innovation in malaria, tuberculosis, and HIV, with a new emphasis on Neglected Tropical Diseases and anti-microbial resistance.

- In September 2023: Moderna expanded the field of mRNA medicine with positive clinical results across cancer, rare disease, and infectious disease.

Report Scope

Report Features Description Market Value (2023) USD 69.1 Billion Forecast Revenue (2033) USD 132.8 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Disease Type (HIV, Hepatitis, Influenza, TB, Malaria, and Others), By Treatment Type (Antibiotics, Antiviral Drugs, Antifungal Drugs, Antiparasitic Drugs, and Others), By End-use (Hospitals, Clinics, and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Novartis AG , Gilead Sciences, Inc., GSK plc., Janssen Pharmaceutica NV, F. Hoffmann-La Roche Ltd., BioCryst Pharmaceuticals, Inc., Boehringer Ingelheim Pharmaceuticals, Inc., Merck & Co., Inc., AbbVie Inc., Pfizer Inc., Moderna, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the infectious disease therapeutics market?The infectious disease therapeutics market focuses on the development and distribution of drugs and treatments for infectious diseases, including vaccines, antibiotics, antivirals, antifungals, and antiparasitics.

How big is the Infectious Disease Therapeutics Market?The global Infectious Disease Therapeutics Market size was estimated at USD 69.1 Billion in 2023 and is expected to reach USD 132.8 Billion in 2033.

What is the Infectious Disease Therapeutics Market growth?The global Infectious Disease Therapeutics Market is expected to grow at a compound annual growth rate of 6.8%. From 2024 To 2033

Who are the key companies/players in the Infectious Disease Therapeutics Market?Some of the key players in the Infectious Disease Therapeutics Markets are Novartis AG , Gilead Sciences, Inc., GSK plc., Janssen Pharmaceutica NV, F. Hoffmann-La Roche Ltd., BioCryst Pharmaceuticals, Inc., Boehringer Ingelheim Pharmaceuticals, Inc., Merck & Co., Inc., AbbVie Inc., Pfizer Inc., Moderna, Inc.

Which regions are leading in the Infectious Disease Therapeutics market?North America dominating the market capturing a huge market revenue share of 38.41% in the year 2023.

What factors are driving the growth of this market?The market is driven by the increasing prevalence of infectious diseases, global pandemics like COVID-19, rising antimicrobial resistance, and significant investments in research and development for new therapeutics.

What are the challenges faced by the market?Key challenges include the high cost of drug development, regulatory hurdles, and the growing issue of antimicrobial resistance, which complicates the treatment of bacterial infections.

Infectious Disease Therapeutics MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample

Infectious Disease Therapeutics MarketPublished date: Aug 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Gilead Sciences, Inc.

- GSK plc.

- Janssen Pharmaceutica NV

- Hoffmann-La Roche Ltd.

- BioCryst Pharmaceuticals, Inc.

- Boehringer Ingelheim Pharmaceuticals, Inc.

- Merck & Co., Inc.

- AbbVie Inc.

- Pfizer Inc.

- Moderna, Inc.