Global Industrial Wearables Market By Device Type (AR Glasses, VR Headsets, Smartwatches, Smart Bands, Others), By Component (Processors and Memory Modules, Optical Systems and Displays, Camera Modules, Touchpads and Sensors, Connectivity Components, Electromechanicals, Cases, And Frames, Others), By Product Type (Head-Mounted Displays, Body-Worn Devices, Sensing Devices), By Industrial Wearable (Bluetooth, Wi-Fi, Zigbee), By Industry Vertical (Automotive, Aerospace and Defense, Manufacturing, Oil or Gas, Power and energy, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 73259

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

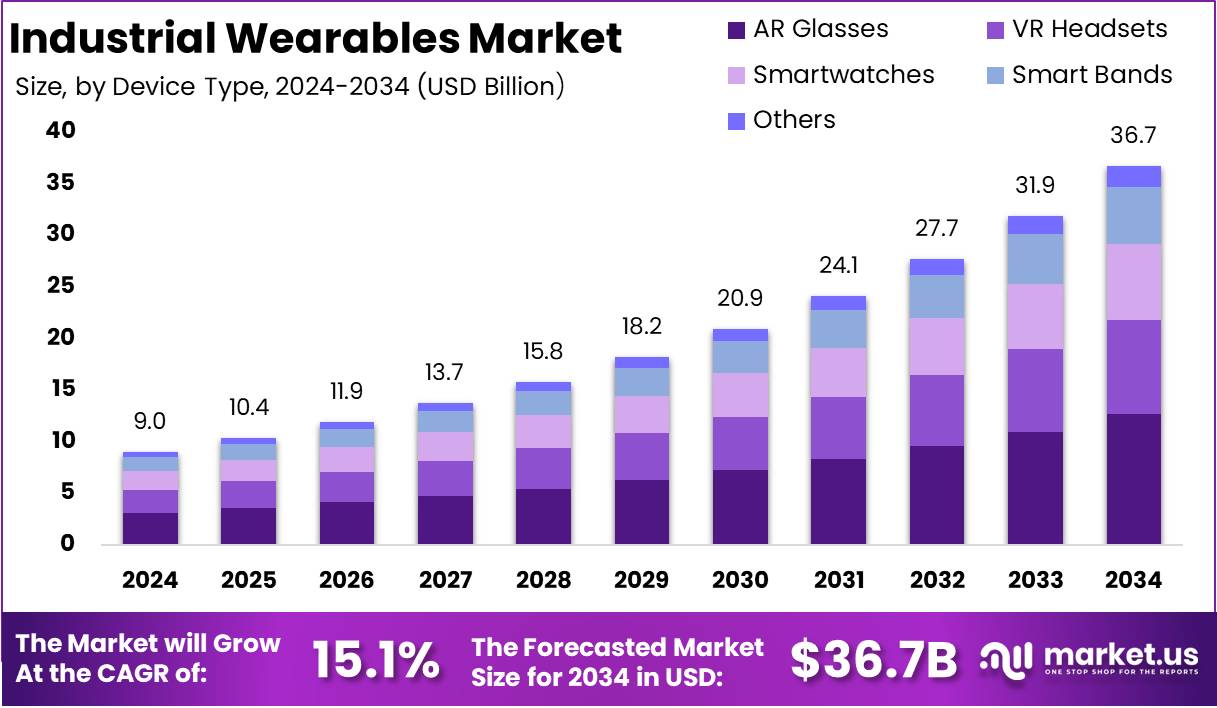

The Global Industrial Wearables Market size is expected to be worth around USD 36.7 Billion by 2034 from USD 9.0 Billion in 2024, growing at a CAGR of 15.1% during the forecast period from 2025 to 2034.

Industrial wearables refer to smart, technologically advanced devices worn by workers in industrial environments to improve safety, enhance productivity, and streamline operations. These devices can range from smart helmets and glasses to wearable sensors and exoskeletons, all designed to provide real-time data and insights, monitor health and safety metrics, and facilitate communication in high-risk settings.

Typically integrated with IoT technology, industrial wearables enable workers to access vital information hands-free, aiding in more efficient decision-making processes while minimizing the risk of human error.

The industrial wearables market encompasses the design, manufacturing, and deployment of wearable technologies specifically developed for use in industrial settings. These devices, supported by sensors, connectivity features, and data analytics capabilities, are increasingly integrated into operational workflows to boost safety standards, reduce downtime, and enhance worker performance.

The market is characterized by the growing demand for real-time data, increased automation, and the need for comprehensive worker safety solutions. The industrial wearables market is driven by advancements in wearable technology, the growing emphasis on worker well-being, and the integration of industrial IoT systems.

The industrial wearables market is experiencing robust growth, driven by several key factors. First, the rising focus on worker safety and the integration of health-monitoring systems in hazardous environments are critical drivers.

The demand for industrial wearables is being largely driven by the need to enhance workforce safety, improve operational efficiency, and reduce costs. Industries such as manufacturing, construction, logistics, and oil and gas are increasingly adopting wearable devices to address common challenges, including workplace injuries, equipment malfunctions, and inefficient workflows.

Real-time monitoring of health metrics, such as heart rate and fatigue levels, allows employers to take preventive action, reducing the incidence of workplace accidents. Furthermore, the ability to track key performance indicators (KPIs) in real-time is driving demand for wearables to ensure that operations run smoothly and on schedule, enhancing overall productivity.

The industrial wearables market presents significant opportunities for growth, particularly as companies embrace digital transformation and smart technologies. With the integration of artificial intelligence (AI), machine learning (ML), and augmented reality (AR), wearables can offer more sophisticated, data-driven insights to enhance decision-making processes and improve worker productivity.

According to Ambiq, nearly 1 billion people worldwide use smart wearables daily, about 13% of the global population. In the U.S., 20% of people regularly use smartwatches or fitness trackers, with women 25% using them more than men 18%.

Wearables are also more common among younger individuals, with 25% of those aged 18-49 using them. Fitness trackers contribute to higher activity levels, with users taking 2,000 more steps daily than non-users.

Studies show 70% of pedometer-related research links these devices to increased physical activity. Privacy concerns affect 40% of users, rising to 60% among those subscribed to health services. Despite these issues, 79% of businesses adopting wearables see them as a key part of future success, highlighting strong market growth potential.

The Industrial Wearables Market is witnessing significant growth, with females more likely than males to use these devices regularly 25% vs 18%, respectively, in the US. 16BEST reports that 63% of smartwatch owners are male.

Global user distribution shows that 34% of wearable users are from the low-income category, 41% from the medium-income group, and 25% from the high-income group. These insights highlight demographic trends that are influencing market growth and provide opportunities for targeted marketing strategies tailored to specific income segments.

Key Takeaways

- The Global Industrial Wearables Market is projected to grow from USD 9.0 Billion in 2024 to USD 36.7 Billion by 2034, at a CAGR of 15.1% from 2025 to 2034.

- AR Glasses hold a dominant position within the Industrial Wearables Market, capturing over 34.4% of the total market share in 2024.

- Processors and Memory Modules dominate the market, commanding more than 26.5% of the total market share in 2024.

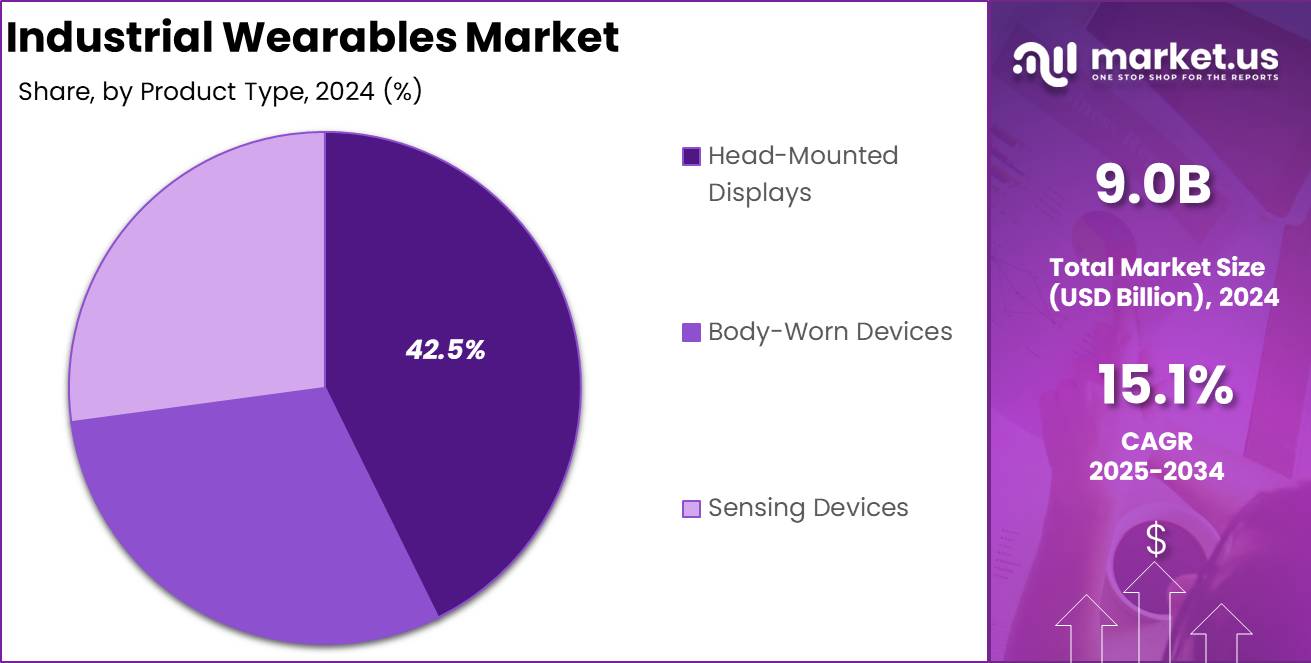

- Head-Mounted Displays emerge as the leading product category, holding a dominant market share of over 42.5% in 2024.

- Bluetooth technology captures over 49.2% of the market share in 2024, enabling seamless communication and data transmission.

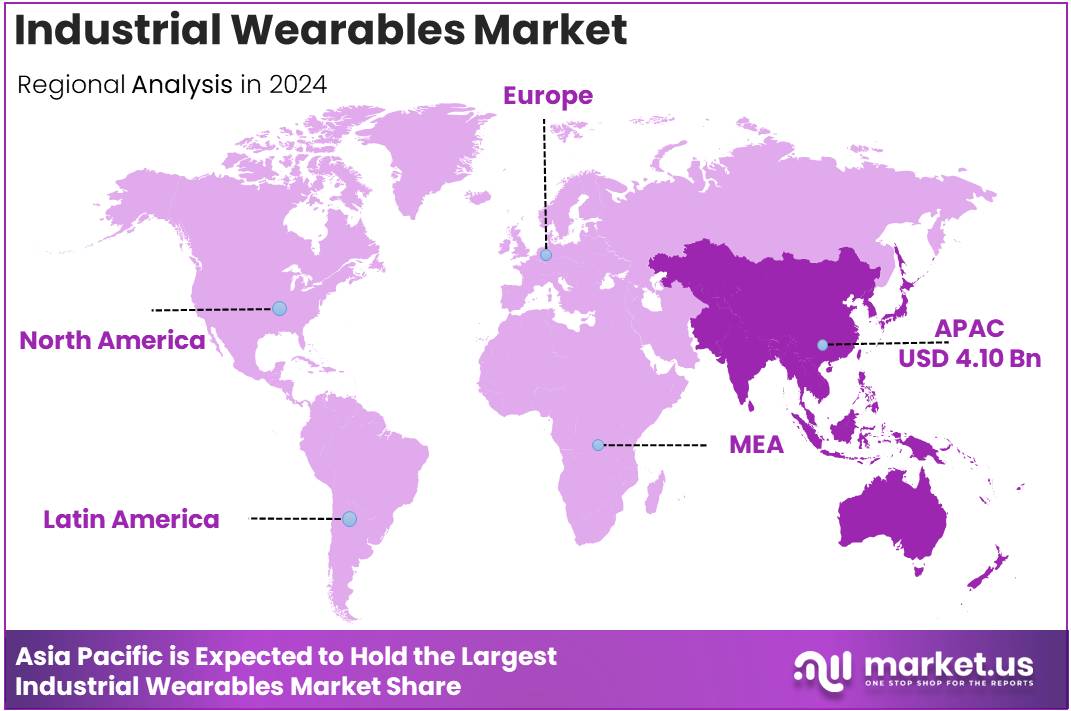

- The Asia Pacific region is the dominant player, accounting for 45.6% of the total market share, translating to a market value of USD 4.10 Billion in 2024.

By Device Type Analysis

AR Glasses Dominate Industrial Wearables Market with 34.4% Share

In 2024, AR Glasses hold a dominant position within the Industrial Wearables Market, capturing more than 34.4% of the total market share. This segment is expected to continue its leadership due to increasing adoption across industries such as manufacturing, logistics, and healthcare, where real-time data visualization and hands-free operation are crucial.

AR Glasses are anticipated to maintain their dominance, driven by their ability to enhance operational efficiency through augmented reality applications. These devices provide workers with on-site instructions, real-time data, and hands-free capabilities, significantly improving productivity and reducing the margin for error.

Virtual Reality (VR) Headsets continue to capture a significant portion of the market, primarily due to their increasing use in employee training and simulations. VR technology provides workers with immersive, risk-free environments for skill development, making it a preferred solution in industries such as construction, aerospace, and healthcare, where complex procedures can be safely practiced and refined.

Smartwatches are increasingly integrated into industrial environments to monitor employee health, track vital signs, and ensure safety compliance. Their multifunctionality, ease of use, and long battery life have made them a staple in industries such as manufacturing, field services, and high-risk operations. These devices offer both practical safety features and worker wellness capabilities, contributing to their widespread adoption.

Smart Bands have emerged as an affordable entry point into the industrial wearables market, driven by their focus on health and wellness monitoring. These devices are commonly used for tracking steps, heart rate, and sleep patterns, helping to ensure the well-being of employees, especially in sectors where workforce health is a critical focus. As the importance of employee wellness continues to rise, Smart Bands are expected to see continued adoption.

The Others category encompasses a variety of specialized industrial wearables, including exoskeletons, body sensors, and environmental monitoring devices. While this segment currently represents a smaller share of the market, it is expected to grow as innovation continues and industries increasingly focus on worker ergonomics, safety, and environmental conditions. The expansion of this segment is driven by niche applications that improve efficiency and reduce workplace risks.

By Component Analysis

Processors and Memory Modules Dominate Industrial Wearables Market with 26.5% Share

The industrial wearables market is experiencing significant growth, with various components driving this expansion. In 2024, Processors and Memory Modules continue to hold a dominant market position, commanding over 26.5% of the total market share. This segment’s growth is largely attributed to the increasing demand for high-performance computing in industrial applications, where real-time data processing and seamless communication are paramount.

Optical systems and displays, representing the second-largest component category, are driven by the need for enhanced visual interfaces in industrial environments, where wearables are increasingly utilized for augmented reality (AR) applications. Optical displays provide workers with real-time visual information, improving decision-making and operational efficiency.

Camera modules play a critical role in enabling industrial wearables to capture and transmit visual data. Camera modules facilitate real-time monitoring, training, and remote assistance, enhancing safety and operational effectiveness in industries like manufacturing, logistics, and healthcare.

Touchpads and sensors are another significant component in industrial wearables. The growth of this segment is driven by the rising adoption of intuitive interfaces and the need for precision in data capture. Sensors are integral for tracking worker movements, environmental conditions, and machine status, contributing to improved safety and predictive maintenance capabilities.

Connectivity components are essential for enabling seamless data transmission between industrial wearables and central systems. The demand for reliable connectivity solutions, such as Wi-Fi, Bluetooth, and 5G, is increasing as wearables are integrated into larger IoT ecosystems. These components ensure continuous communication and data exchange, which are critical for real-time decision-making and operational coordination.

Electromechanicals, cases, and frames account for a significant portion of the industrial wearables market. These components ensure the durability, protection, and functionality of wearables in harsh industrial environments. As the demand for ruggedized wearables increases, so does the need for robust electromechanical components, durable cases, and protective frames to withstand extreme conditions such as heat, dust, and moisture.

The Others category, comprising miscellaneous components and accessories, represents a smaller yet noteworthy portion of the market. This category includes items such as power supplies, microcontrollers, and other specialized components that complement the primary segments in industrial wearables. Although this segment is smaller, it is expected to grow steadily as the market diversifies and the need for customized wearable solutions expands.

By Product Type Analysis

Head-Mounted Displays Dominate Industrial Wearables Market with 42.5% Share

The industrial wearables market is undergoing robust growth, with Head-Mounted Displays emerging as a leading product category. In 2024, this segment holds a dominant market share of over 42.5%. The increasing adoption of augmented reality (AR) and virtual reality (VR) applications in industries such as manufacturing, logistics, and healthcare is fueling this growth. Head-mounted displays provide users with immersive, hands-free visual experiences, significantly enhancing operational efficiency and safety in industrial environments.

Head-mounted displays are vital for enabling real-time visual communication, training, and data visualization. The rise in demand for AR applications, where wearables are used to overlay digital information onto the physical world, is one of the key drivers for this segment. Their integration with IoT ecosystems and the need for streamlined communication between workers and machines have also bolstered the demand for head-mounted displays.

Body-worn devices are a significant product category in the industrial wearables market. These devices, including smart vests, belts, and exoskeletons, are designed to enhance worker mobility and physical capabilities.

As industries focus more on improving worker safety and productivity, the market share of body-worn devices is expected to grow. These devices are particularly popular in industries such as construction and manufacturing, where workers perform physically demanding tasks that require support and monitoring.

Sensing devices are another important segment within the industrial wearables market. These devices, which include sensors for tracking movements, detecting environmental conditions, and monitoring worker health, contribute to improved safety, predictive maintenance, and operational efficiency.

The growing emphasis on data-driven insights and real-time monitoring to optimize workflows is pushing the demand for sensing devices. This segment is seeing steady growth as industries continue to leverage sensor technology to collect and analyze critical data for decision-making.

By Industrial Wearable Analysis

Bluetooth Dominate Industrial Wearables Market with 49.2% Share

The industrial wearables market continues to expand, with Bluetooth technology holding a dominant position in 2024. Capturing over 49.2% of the market share, Bluetooth enables seamless communication and data transmission between wearables and other devices. Its popularity is driven by its low power consumption, cost-effectiveness, and ease of integration with various industrial systems. As more industrial environments adopt wearables for real-time data sharing and communication, Bluetooth remains the leading connectivity solution in this space.

Bluetooth technology is essential for the functionality of industrial wearables, allowing for reliable and energy-efficient communication. It supports a wide range of wearables, from headsets and sensors to body-worn devices, enabling these products to connect with other devices in real-time. The segment’s growth is supported by the increasing integration of industrial wearables with IoT networks, where Bluetooth serves as the backbone for data transmission across devices.

Wi-Fi technology plays a crucial role in industrial wearables, particularly in environments that require high data bandwidth and longer-range connectivity. Although Wi-Fi accounts for a smaller portion of the market compared to Bluetooth, it remains essential for applications that require faster data transfer rates, such as real-time video streaming and cloud-based analytics. As more enterprises seek to leverage wearables for complex, data-intensive tasks, Wi-Fi’s market share is expected to grow, particularly in large-scale industrial settings.

Zigbee, a low-power, low-data rate wireless communication standard, is another key connectivity option in the industrial wearables market. While its market share is smaller compared to Bluetooth and Wi-Fi, Zigbee is particularly suitable for applications where power efficiency is critical, such as in remote monitoring and sensor networks.

Its growing adoption in industrial automation and smart systems contributes to the steady demand for Zigbee technology in wearables. The segment is poised for growth as industries increasingly look for efficient, scalable connectivity solutions for IoT-enabled wearables.

By Industry Vertical Analysis

Manufacturing Dominate Industrial Wearables Market with 33.4% Share

In 2024, the Manufacturing sector holds a dominant market position in the industrial wearables market, accounting for over 33.4% of the total market share. The demand for industrial wearables in this sector is driven by the need for enhanced worker safety, productivity, and operational efficiency. Wearables such as smart helmets, augmented reality glasses, and exoskeletons are increasingly adopted to streamline processes, improve real-time communication, and ensure safety in high-risk environments.

Manufacturing continues to be the largest adopter of industrial wearables due to the sector’s focus on operational efficiency and workforce safety. Wearables are used for a variety of applications, including real-time monitoring of workers, predictive maintenance of equipment, and remote assistance. The integration of wearables with IoT technologies enables manufacturers to collect valuable data, optimize production lines, and ensure worker safety in environments such as assembly lines and warehouses.

The Automotive industry is another significant vertical in the industrial wearables market. Wearables are increasingly being used for both assembly line operations and in autonomous vehicle development. In the automotive sector, wearables such as smart glasses and exoskeletons are utilized to improve precision in manufacturing processes and reduce the physical strain on workers. The rise of electric vehicles and advanced manufacturing techniques further accelerates the adoption of industrial wearables in this industry.

The Aerospace & Defense industry also contributes to the growing demand for industrial wearables. Wearables in this sector are used for enhanced training, real-time diagnostics, and safety monitoring of both personnel and equipment. With the increasing complexity of aerospace manufacturing and defense operations, wearables provide crucial support for remote diagnostics, inspection, and collaboration in high-risk environments, ensuring both operational success and personnel safety.

The Oil & Gas industry relies on industrial wearables for worker safety, real-time data monitoring, and remote diagnostics. Given the hazardous environments in which oil and gas operators work, wearables such as smart helmets, body sensors, and communication devices are vital for ensuring safety and improving operational efficiency. Wearables are also used for environmental monitoring, tracking hazardous conditions, and providing real-time communication during complex drilling operations.

The Power & Energy sector is increasingly adopting industrial wearables for preventive maintenance, safety monitoring, and remote assistance. Wearables such as smart goggles and sensor-equipped clothing are used to monitor equipment performance and alert workers to potential hazards. In energy generation and distribution, wearables improve operational efficiency and worker safety, particularly in high-risk environments such as power plants and renewable energy facilities.

The Others category represents various smaller yet growing sectors that are adopting industrial wearables, including healthcare, logistics, and construction. In these industries, wearables are used for tracking worker health, improving productivity, and ensuring safety. The Others category is expected to grow steadily as more industries explore the potential of wearable technologies to enhance operational efficiency and safety in specialized environments.

Key Market Segments

By Device Type

- AR Glasses

- VR Headsets

- Smartwatches

- Smart Bands

- Others

By Component

- Processors and Memory Modules

- Optical Systems and Displays

- Camera Modules

- Touchpads and Sensors

- Connectivity Components

- Electromechanicals, Cases, And Frames

- Others

By Product Type

- Head-Mounted Displays

- Body-Worn Devices

- Sensing Devices

By Industrial Wearable

- Bluetooth

- Wi-Fi

- Zigbee

By Industry Vertical

- Automotive

- Aerospace & Defense

- Manufacturing

- Oil & Gas

- Power & energy

- Others

Driver

Rising Demand for Worker Safety and Efficiency in Industrial Environments

One of the primary drivers propelling the growth of the global industrial wearables market in 2024 is the heightened focus on worker safety and operational efficiency across industrial environments. As industries such as manufacturing, construction, and logistics face increasing demands for safety standards and workplace optimization, wearable technologies are becoming a critical component in safeguarding workers and improving operational workflows.

The implementation of industrial wearables, including smart helmets, exoskeletons, and connected devices, allows real-time monitoring of workers’ health and movements, ensuring that potential hazards are identified and mitigated swiftly. These devices contribute to reducing accidents, enhancing productivity, and ensuring compliance with regulatory safety standards. The increased adoption of wearables for safety monitoring is expected to continue rising as industries prioritize risk reduction and operational efficiency in high-risk environments.

The market’s growth can also be attributed to advancements in sensor technologies and data analytics, which enable these devices to gather and interpret a vast amount of real-time data. This, in turn, empowers managers to optimize workforce allocation and improve decision-making processes.

Moreover, these wearables provide valuable insights into fatigue levels, physical strain, and posture, which can be used to prevent workplace injuries and enhance overall worker performance. As industries become more data-driven, wearables are poised to play an even larger role in providing actionable insights that contribute directly to improving both safety and efficiency. The ongoing demand for industrial wearables will thus continue to be fueled by the increasing need for enhanced safety protocols and operational productivity across industries.

Restraint

High Cost and Integration Challenges

Despite the rapid growth potential of the industrial wearables market, the high upfront cost of these technologies remains a significant restraint. In many cases, industrial wearables involve significant capital investment due to the advanced sensors, hardware, and software integration required to ensure full functionality. For smaller businesses or industries with constrained budgets, this initial cost can be a major deterrent.

While wearables may result in long-term savings by improving safety and productivity, the upfront financial burden can limit adoption, particularly among smaller enterprises or in regions where access to capital is limited.

Additionally, the complexity of integrating these technologies into existing industrial systems presents another obstacle. The seamless integration of wearables with legacy equipment and software systems is often challenging, requiring extensive training and time for system adjustments, which can delay adoption.

Furthermore, there are concerns regarding data privacy and security when deploying wearable technologies. These devices continuously collect large volumes of sensitive data about workers, such as their health status, movement patterns, and performance metrics. Companies must ensure that adequate cybersecurity measures are in place to protect this data, especially in industries where confidential information is critical.

These additional concerns around data management and the costs associated with securing sensitive information can slow down market penetration, especially in markets where data protection laws are stringent. As a result, the combination of high costs and integration complexities remains a key restraint, preventing faster widespread adoption of industrial wearables in certain sectors.

Opportunity

Expansion of Wearables in Predictive Maintenance

One of the most promising opportunities for the global industrial wearables market is the integration of these technologies into predictive maintenance strategies. As industries look to reduce downtime, optimize asset management, and improve operational efficiency, industrial wearables can provide real-time monitoring and analytics that can predict machinery failures before they occur.

By embedding sensors into wearables that workers can use on-site, companies can track the condition of equipment and monitor various metrics such as vibration, temperature, and pressure. This data is then analyzed using advanced algorithms to identify patterns that might indicate potential equipment failure, enabling proactive maintenance rather than reactive repairs.

This shift towards predictive maintenance not only helps minimize unplanned downtime but also extends the lifespan of critical machinery and reduces repair costs. The cost-efficiency of predictive maintenance is expected to drive greater investment in wearables that can monitor equipment in real time.

Furthermore, as artificial intelligence and machine learning continue to improve, the ability of industrial wearables to provide accurate and timely insights will only grow, offering more precise predictions and contributing to the overall digital transformation of industries. Companies embracing this opportunity stand to benefit from reduced operational disruptions and enhanced productivity, driving further market growth for wearables in industrial applications.

Trends

Increasing Adoption of Augmented Reality (AR) and Virtual Reality (VR) Wearables

A notable trend within the industrial wearables market is the increasing adoption of augmented reality (AR) and virtual reality (VR) technologies. These wearable solutions, particularly in the form of smart glasses or headsets, are gaining traction across industries such as manufacturing, construction, and field service.

AR and VR wearables provide workers with real-time data overlays, step-by-step instructions, and remote guidance, facilitating more efficient workflows and improving training procedures. For example, workers can receive virtual schematics of machinery they are repairing or assembling, reducing the likelihood of errors and enhancing productivity.

The immersive capabilities of AR and VR enable workers to interact with digital information in a real-world context, offering a more intuitive way to access complex data and perform tasks.

This trend is expected to expand as industries invest in technologies that improve worker collaboration and efficiency. The use of AR/VR wearables for remote assistance, where experts can guide workers from afar, is becoming increasingly prevalent.

This helps reduce operational downtime and minimize the need for on-site expertise. The combination of AR/VR wearables with other industrial technologies, such as IoT sensors and AI-powered analytics, is setting the stage for more integrated and intelligent work environments. As the cost of AR/VR hardware decreases and the technology becomes more sophisticated, the adoption of these wearables is anticipated to grow significantly, offering a significant avenue for growth in the industrial wearables market in the coming years.

Regional Analysis

Asia Pacific Lead Industrial Wearables Market with Largest Market Share of 45.6% in 2024

The global industrial wearables market is experiencing dynamic growth across various regions, with the Asia Pacific region emerging as the dominant player. In 2024, Asia Pacific is projected to account for 45.6% of the total market share, translating to a market value of USD 4.10 billion. This strong market presence can be attributed to the region’s rapid industrialization, increasing adoption of automation technologies, and a growing focus on worker safety.

The demand for industrial wearables, such as smart helmets, safety glasses, and exoskeletons, is particularly high in countries like China, Japan, and India, which are known for their large manufacturing sectors. The emphasis on reducing workplace injuries and enhancing operational efficiency further drives the regional demand for advanced wearables.

North America holds a significant share in the industrial wearables market, driven primarily by the United States’ robust industrial infrastructure and technological advancements. The region’s focus on enhancing worker safety and streamlining industrial operations with innovative wearable solutions supports the ongoing market growth. North America’s market value is expected to continue to grow steadily, backed by increasing investment in industrial automation and Industry 4.0 technologies.

Europe, while also a notable player in the industrial wearables market, is projected to hold a relatively smaller market share compared to Asia Pacific and North America. The region benefits from stringent workplace safety regulations and a strong presence of key industries such as automotive, manufacturing, and energy. However, the slower pace of industrial automation in certain parts of Europe may limit the rapid expansion seen in other regions.

The Middle East & Africa (MEA) is witnessing a gradual rise in the adoption of industrial wearables, primarily in the oil and gas, construction, and mining sectors. The growth is driven by the increasing focus on worker safety in hazardous environments, though the market remains in its nascent stages compared to other regions.

Latin America, similarly, is seeing a slow but steady increase in the use of industrial wearables, as companies in countries like Brazil and Mexico seek to enhance operational safety and productivity in their industrial sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global industrial wearables market is poised for significant growth in 2024, with a diverse range of players driving innovation and competition across various sectors. Leading companies such as Apple and Samsung are expected to leverage their established brand presence and advanced consumer technology capabilities to enter and expand within the industrial wearables space.

Apple’s focus on health and productivity-enhancing wearables, such as the Apple Watch, positions it as a strong contender, while Samsung’s innovative wearables, including its smart glasses and health monitoring devices, will likely cater to both personal and industrial applications. Similarly, Garmin and Fitbit, recognized for their fitness wearables, are increasingly expanding into industrial applications, capitalizing on their expertise in sensor technology and data analytics.

Meanwhile, Microsoft and Google will continue to be influential players, with their wearable ecosystems and partnerships enhancing workplace productivity through seamless integration with enterprise software. In contrast, industrial-focused firms like Honeywell and RealWear are tailoring solutions specifically for sectors such as manufacturing, logistics, and fieldwork, emphasizing durability, hands-free operation, and enhanced safety features.

Vuzix and Proglove represent niche players offering specialized products like smart glasses and wearable barcode scanners, respectively, which meet the growing demand for hands-free, real-time information access. As these key players continue to innovate and address industry-specific challenges, the competitive landscape will evolve, with increasing opportunities for both large technology firms and specialized players to gain traction in the global industrial wearables market.

Top Key Players in the Market

- Apple

- ASUS

- Epson

- Fitbit

- Fujitsu Ltd.

- Garmin

- Honeywell International Inc.

- IMEC

- Jawbone

- Microsoft Corporation

- Motorola

- Nike

- Pebble

- Proglove

- RealWear

- Samsung Electronics Co. Ltd.

- SAP

- Seiko Epson Corporation

- Sony

- Vuzix

- Vuzix Corporation

- Xiomi and Eurotech

Recent Developments

- In February 2025, Honeywell launched a new version of Honeywell Forge Production Intelligence, integrating advanced performance monitoring with a generative AI assistant. This update is designed to help industrial operators and production managers streamline tasks and improve troubleshooting efficiency through automation.

- In 2024, Cloud DX secured a contract to develop a wearable device that tracks vital signs, including ECG, in a comfortable wrist-based design. The deal, valued at C$115,000 with additional success fees, also includes a 4.5% royalty on the gross profit of all Cloud DX-designed devices sold.

- In June 2023, Accenture and Microsoft deepened their partnership to help businesses harness the potential of generative AI. Their collaboration, through joint venture Avanade, aims to co-develop innovative AI solutions that support organizations in transforming their operations through generative AI technologies.

- In 2024, SAP agreed to acquire WalkMe, a leader in digital adoption platforms. This acquisition will enhance SAP’s offerings, particularly in Business AI, by helping companies navigate digital transformations more effectively with WalkMe’s guidance and automation features.

Report Scope

Report Features Description Market Value (2024) USD 9.0 Billion Forecast Revenue (2034) USD 36.7 Billion CAGR (2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type (AR Glasses, VR Headsets, Smartwatches, Smart Bands, Others), By Component (Processors and Memory Modules, Optical Systems and Displays, Camera Modules, Touchpads and Sensors, Connectivity Components, Electromechanicals, Cases, And Frames, Others), By Product Type (Head-Mounted Displays, Body-Worn Devices, Sensing Devices), By Industrial Wearable (Bluetooth, Wi-Fi, Zigbee), By Industry Vertical (Automotive, Aerospace & Defense, Manufacturing, Oil & Gas, Power & energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple, ASUS, Epson, Fitbit, Fujitsu Ltd., Garmin, Google, Honeywell International Inc., IMEC, Jawbone, Microsoft Corporation, Motorola, Nike, Pebble, Proglove, RealWear, Samsung Electronics Co. Ltd., SAP, Seiko Epson Corporation, Sony, Vuzix, Vuzix Corporation, Xiomi and Eurotech Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Wearables MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Wearables MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple

- ASUS

- Epson

- Fitbit

- Fujitsu Ltd.

- Garmin

- Honeywell International Inc.

- IMEC

- Jawbone

- Microsoft Corporation

- Motorola

- Nike

- Pebble

- Proglove

- RealWear

- Samsung Electronics Co. Ltd.

- SAP

- Seiko Epson Corporation

- Sony

- Vuzix

- Vuzix Corporation

- Xiomi and Eurotech