Global Industrial Ethernet IP Market Size, Share Analaysis Report By Offering (Hardware (Switches, Gateways, Routers, Controllers and Connectors, Communication Interfaces and Converters, Power Supply Devices, Others), Software, Services), By Protocol (Profinet, Ethernet/IP, Ethercat, Modbus-TCP, Powerlink, Servos III, CC-Link IE), By End-Use Industry (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Oil & Gas, Chemical & Fertilizer, Food & Beverage, Pharmaceutical, Energy & Power, Mining, Water & Wastewater, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154189

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

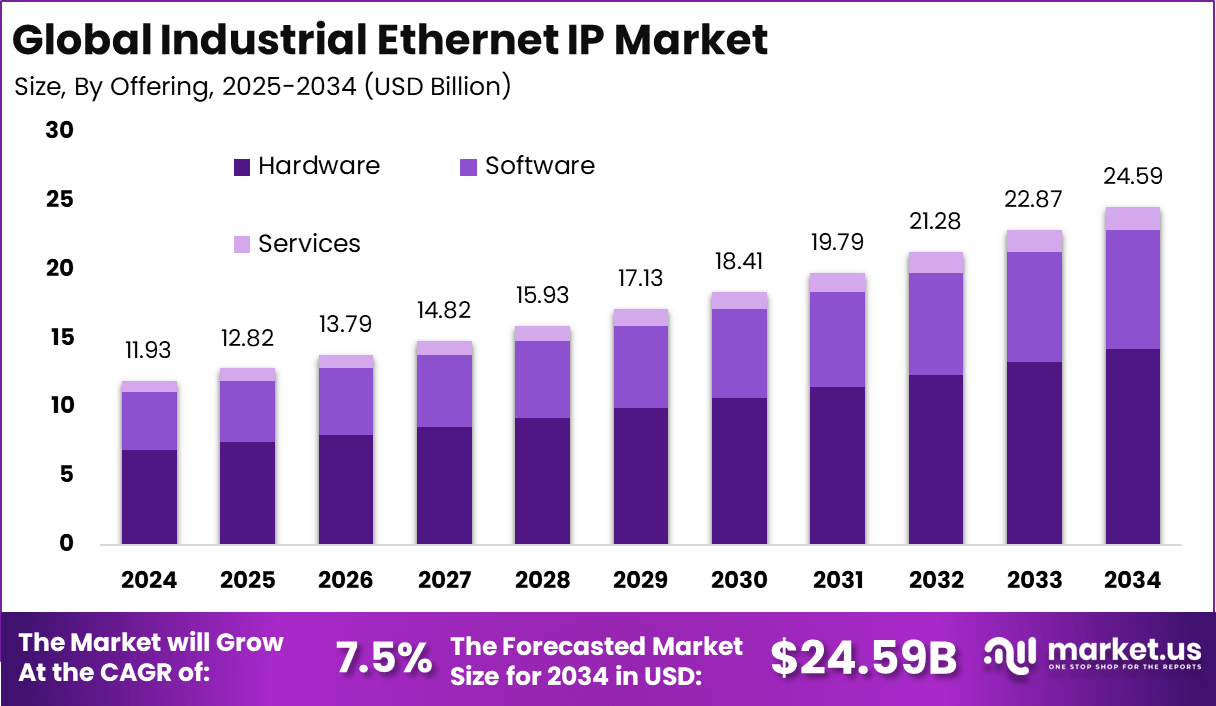

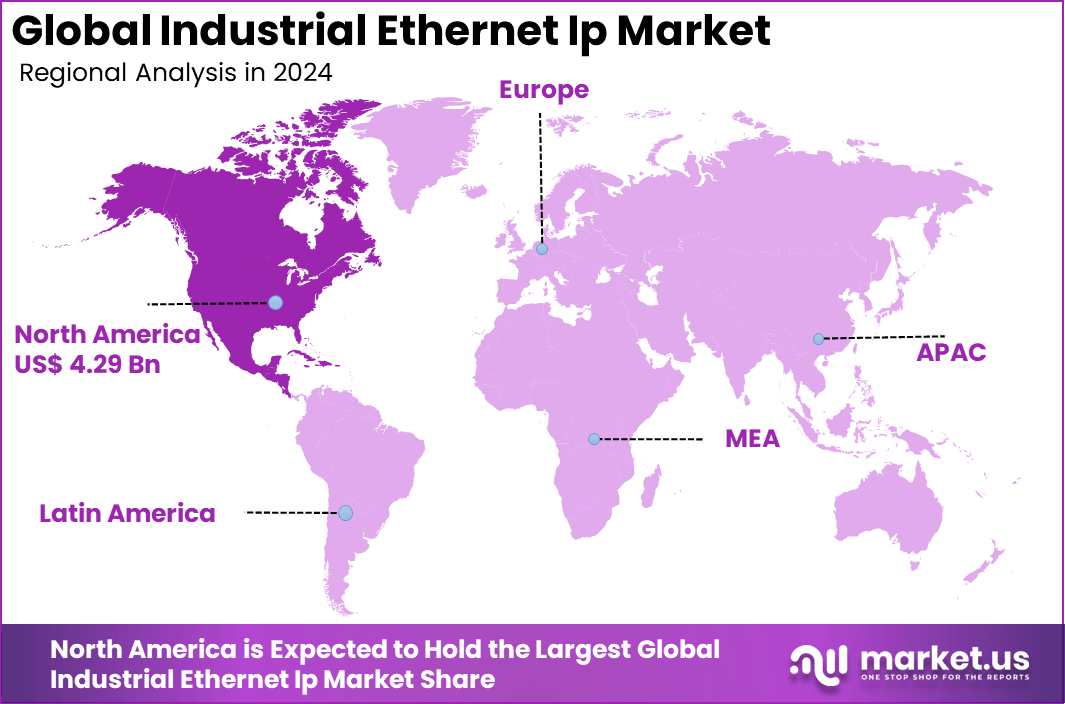

The Global Industrial Ethernet Ip Market size is expected to be worth around USD 24.59 billion by 2034, from USD 11.93 billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 4.29 billion in revenue.

The Industrial Ethernet IP market is experiencing a dynamic transformation, propelled by the urgent need for fast, reliable, and secure networking solutions across complex industrial environments. As manufacturing evolves towards smart factories, businesses increasingly turn to Industrial Ethernet IP protocols to deliver real-time data transfer and robust system integration.

Top driving factors can be attributed to the expansion of smart manufacturing ecosystems. Increasing implementation of automation and IIoT in industrial environments has created demand for robust, secure and high‑speed communication links. Regulatory encouragement of Industry 4.0 and smart grid programs supports broad technology adoption. Government incentives, digital infrastructure reforms and sustainable industry agendas also contribute positively to market momentum.

For instance, In May 2025, Rockwell Automation launched a new Ethernet/IP solution tailored for control cabinets, aiming to improve the reliability and efficiency of industrial networks. This compact and robust system simplifies Ethernet-based communication by reducing installation complexity and streamlining integration. The development highlights the rising significance of Industrial Ethernet IP in driving automation and enhancing performance across industrial environments.

Key Takeaway

- The global market is projected to rise from USD 11.93 Billion in 2024 to USD 24.59 Billion by 2034, growing at a CAGR of 7.5%.

- North America led the market in 2024, capturing over 36% share and generating approximately USD 4.29 Billion in revenue.

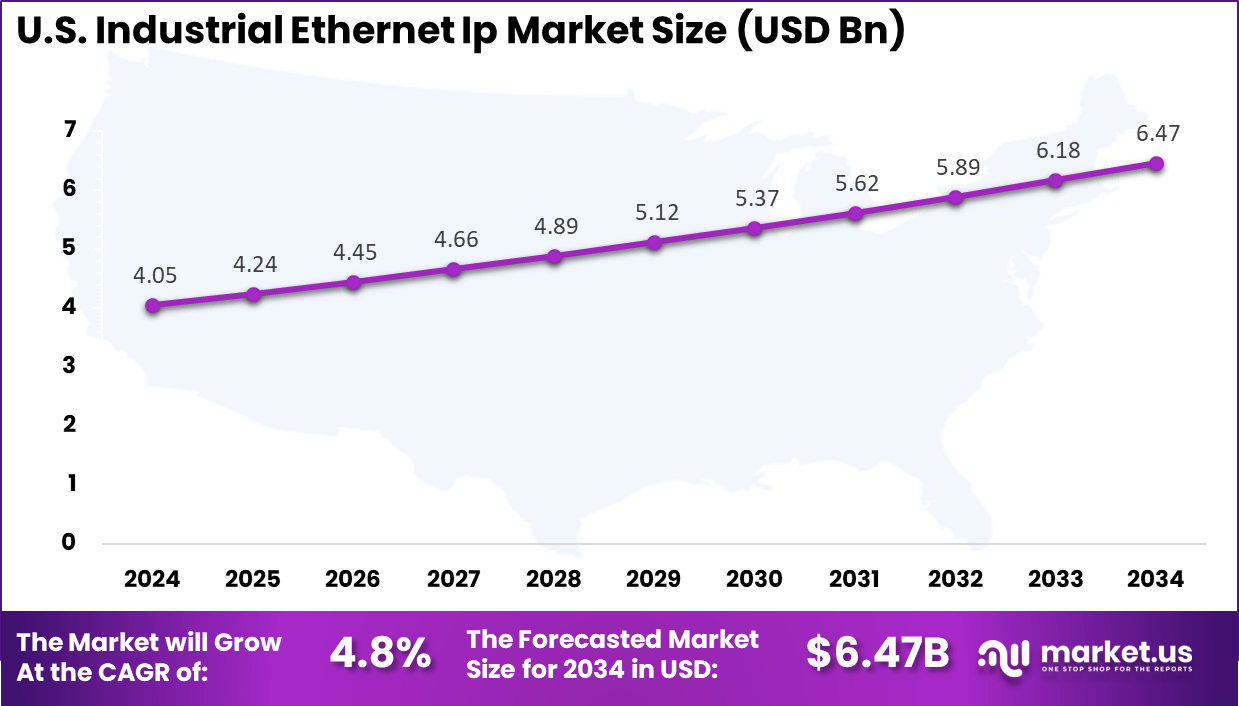

- The U.S. market alone contributed USD 4.05 Billion, with a steady CAGR of 4.8%, supported by investments in factory automation and smart grid infrastructure.

- By offering, Hardware dominated with a 58% share, reflecting strong demand for switches, routers, and connectors in industrial networking environments.

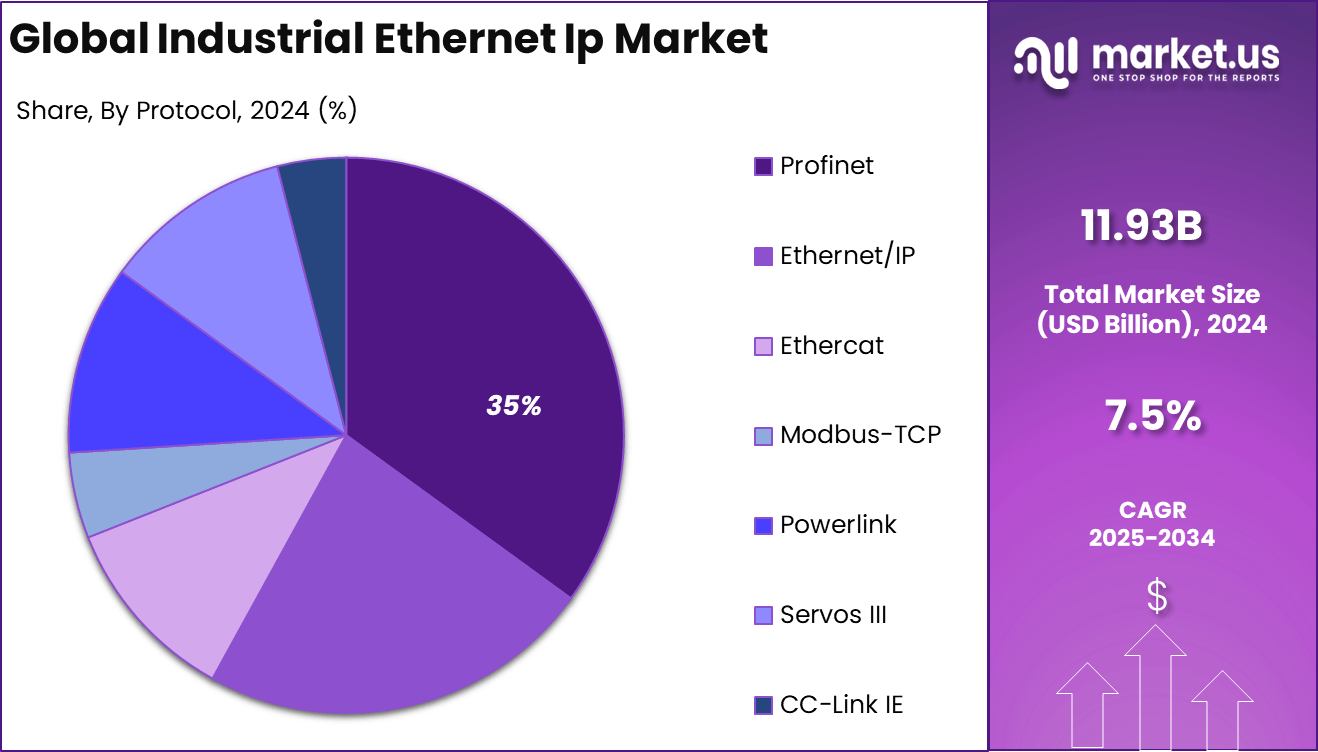

- Among protocols, Profinet led the market with 35% share, driven by its flexibility, deterministic performance, and compatibility with real-time industrial control systems.

- The Automotive & Transportation sector accounted for 24% of the market, as manufacturers integrate Ethernet-based communications for robotics, diagnostics, and in-plant logistics.

U.S. Market Size

The market for Industrial Ethernet Ip within the U.S. is growing tremendously and is currently valued at USD 4.05 billion, the market has a projected CAGR of 4.8%. The market is growing tremendously due to several factors, including the rapid adoption of Industry 4.0 technologies and the increasing demand for automation across key industries such as manufacturing, automotive, and energy.

The U.S. is at the forefront of digital transformation, where Ethernet IP offers the high-speed, reliable communication networks needed to support complex industrial operations and real-time data exchange. Additionally, the expansion of Industrial IoT (IIoT) and smart factory initiatives in the U.S. further drives the need for scalable, secure, and efficient networking solutions.

For instance, in April 2023, ODVA announced its support for the process industry by incorporating new features into the Ethernet/IP standard, strengthening its role in the U.S. industrial sector. This move enhances the capabilities of Industrial Ethernet IP, aligning with the growing demand for advanced, real-time communication in process automation.

In 2024, North America held a dominant market position in the Global Industrial Ethernet Ip Market, capturing more than a 36% share, holding USD 4.29 billion in revenue. This dominance is due to its advanced industrial infrastructure and early adoption of automation technologies.

The region’s strong manufacturing base, particularly in sectors like automotive, aerospace, and electronics, drives demand for high-speed, reliable networking solutions. Furthermore, the rapid expansion of Industrial IoT (IIoT) and the push for smart factories and digital transformation initiatives have accelerated the adoption of Ethernet IP in the U.S. and Canada.

For instance, In March 2020, HARTING partnered with TE Connectivity to strengthen Industrial Ethernet solutions in North America. This collaboration combined HARTING’s connectivity expertise with TE’s automation capabilities, aiming to promote the adoption of reliable, high-performance Ethernet technologies for industrial use.

Offering Analysis

In 2024, the Hardware segment held a significant 58% share of the Industrial Ethernet IP Market. This dominance reflects the essential role of physical components such as switches, routers, connectors, and network interface cards in enabling industrial connectivity. As manufacturing plants and processing units continue to modernize, there is growing demand for rugged and high-speed Ethernet hardware that can withstand harsh industrial environments.

The rise of Industry 4.0 and smart factory initiatives has also contributed to this trend, with businesses investing heavily in Ethernet-enabled hardware to ensure reliable and real-time data communication across machines, sensors, and control systems. Hardware remains the foundational element for building scalable, low-latency, and secure industrial networks.

For Instance, in December 2024, Synopsys announced the industry’s first ultra-Ethernet and UALink IP solutions, designed to connect massive AI accelerator clusters. These solutions leverage advanced hardware capabilities to enhance data throughput and low-latency communication, which are crucial for AI-driven industrial applications.

Protocol Analysis

In 2024, Profinet emerged as the leading protocol, capturing 35% of the market share in 2024. Its strong position is due to its widespread adoption in automation systems and its ability to support high-speed, deterministic communication. Profinet is especially preferred in discrete and process industries for its integration with PLCs and compatibility with real-time applications, which are critical for motion control, robotic systems, and time-sensitive networking.

In addition, Profinet’s robustness and flexibility make it suitable for complex industrial environments where devices need to exchange data quickly and with minimal delay. Its open standard also allows seamless integration across multi-vendor platforms, making it a favored choice among industrial automation providers.

For instance, in December 2024, a new Single Pair Ethernet (SPE) media switch was introduced to support Profinet, Ethernet/IP, and Modbus networks, marking a significant advancement in industrial networking solutions. This switch enables efficient and reliable communication across different industrial protocols using a single pair of wires, reducing installation complexity and cost.

End-Use Industry Analysis

In 2024, The Automotive & Transportation sector held a 24% share in 2024, making it the leading end-use industry for Industrial Ethernet IP solutions. Automotive manufacturers increasingly rely on Ethernet-based networking to support connected assembly lines, robotic operations, and real-time quality inspection systems.

The precision and speed offered by Industrial Ethernet are essential for maintaining productivity and safety in fast-paced production environments. In transportation infrastructure, Ethernet networks are used to manage traffic control systems, railway automation, and electric vehicle charging stations.

As the automotive sector embraces digital transformation, the deployment of Ethernet IP solutions is expected to increase, driven by the need for synchronized communication between various systems and subsystems.

For Instance, In October 2024, Ethernovia presented its advanced semiconductor and networking solutions at the IEEE 2024 Ethernet/IP Automotive Technology Day. The focus was on Industrial Ethernet IP innovations that improve communication between vehicles and infrastructure. These solutions aim to support high-speed, low-latency networks essential for connected and autonomous vehicles.

Growth Factors

Key Factor Description Adoption of Industry 4.0 & Smart Manufacturing The shift toward automation, smart factories, and digitalization in manufacturing drives demand for robust, high-speed networking. Rise of Industrial IoT (IIoT) Proliferation of connected sensors and devices requires scalable Ethernet IP networks for real-time data and control. Need for Real-Time & Reliable Communication Industrial operations increasingly need low latency, high-reliability data exchange to optimize efficiency and safety. Migration from Legacy Fieldbus to Ethernet-Based Networks Ethernet IP offers better bandwidth, management, and integration compared to traditional fieldbus systems. Investments in Emerging Markets & Infrastructure Emerging economies are increasing investments in industrial automation infrastructure, fueling expansion of Ethernet IP adoption. Emerging Trends

Key Trend Description Adoption of Time-Sensitive Networking (TSN) Enhancing real-time capabilities and determinism for mission-critical industrial applications. Integration with Cloud & Edge Computing Ethernet IP supports cloud and edge deployments for remote monitoring, analytics, and decision-making. Heightened Focus on Cybersecurity Increased threats drive the implementation of robust security protocols in Ethernet IP networks. Growth of AI & Machine Learning for Data Analytics Ethernet IP networks are used to support advanced AI/ML analytics in industrial settings, enhancing operational efficiency. Convergence of IT & OT Networks Blurring boundaries between Information Technology (IT) and Operational Technology (OT) for unified data and control. Drivers

Increased Adoption of Industrial IoT (IIoT)

The emergence of Industrial IoT (IIoT) is leading to a surge in demand for Ethernet-based communication. Through the integration of real-world devices, sensors, and machines, IIoT facilitates the sharing of data and automation, with added benefits.

Ethernet IP’s high-speed, reliable, and secure data transfer capabilities make it an ideal solution for IIoT applications, where seamless communication between devices and control systems is crucial. This shift toward IIoT significantly accelerates the adoption of Ethernet IP in industrial networks.

For instance, In May 2025, Qualcomm and Aramco Digital partnered to develop advanced edge AI solutions for Industrial IoT (IIoT). This collaboration combines Qualcomm’s strength in AI and edge computing with Aramco Digital’s industrial expertise to enable real-time data processing and smart decision-making. The initiative highlights rising demand for advanced networking in Industrial Ethernet IP, especially in IIoT settings.

Restraint

Security Concerns

The higher the number of Ethernet IP networks that are connected, the greater the potential for cyber threats such as hacking, viruses, and data theft. These vulnerabilities in security pose a significant challenge for businesses that rely on Ethernet IP for crucial tasks.

Strengthening cybersecurity efforts is crucial to shield these networks from potential attacks. Without adequate protection, the integration of Ethernet IP into industrial environments could lead to substantial financial and operational risks, hindering widespread adoption.

For instance, in July 2023, Rockwell Automation revealed vulnerabilities in its ControlLogix communication modules, which are widely deployed across critical industrial infrastructure. These vulnerabilities exposed potential security risks for industrial Ethernet IP networks, emphasizing the growing concerns around cybersecurity in interconnected industrial environments.

Opportunities

Adoption of 5G and Advanced Networking Technologies

The adoption of 5G technology presents a transformative opportunity for Industrial Ethernet IP systems. The combination of 5G’s faster response time, larger data capacity, and stronger network dependability will make Ethernet IP more efficient. This technological advancement opens up new use cases, particularly in remote monitoring, automation, and control, allowing industries to scale their operations with greater precision and responsiveness. As 5G becomes more widespread, Ethernet IP applications are anticipated to experience greater usage.

For instance, in September 2024, Nokia and Rockwell Automation announced a strategic partnership to enable private 5G standalone networks for industrial transformation. This collaboration aims to provide high-speed, low-latency connectivity, essential for real-time data exchange and automation in industrial environments. By combining Nokia’s advanced 5G technology with Rockwell’s industrial automation solutions, the partnership enhances the adoption of 5G in industrial IoT applications.

Challenges

Regulatory and Compliance Issues

Ethernet IP solutions are being adopted by businesses globally, but they are confronted with a complex set of regulations regarding data protection, communication protocols, and operational safety. However, the rules can vary widely between areas and industries, making the setup and operation of Ethernet IP systems more difficult.

The implementation of these regulations can be time-consuming and costly, particularly for large multinational corporations operating in different countries, which could hinder the widespread adoption of Ethernet IP in various sectors.

For instance, In April 2025, Belden Inc. introduced the Hirschmann GREYHOUND2000 Standard Switch, setting a new benchmark for industrial Ethernet switches. With high fiber port density and configurable modules, it is tailored for harsh industrial settings. This launch reflects the rising need for advanced networking solutions that comply with strict regulatory standards across various sectors.

Key Market Segments

By Offering

- Hardware

- Switches

- Gateways

- Routers

- Controllers and Connectors

- Communication Interfaces and Converters

- Power Supply Devices

- Others

- Software

- Services

By Protocol

- Profinet

- Ethernet/IP

- Ethercat

- Modbus-TCP

- Powerlink

- Servos III

- CC-Link IE

By End-Use Industry

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defense

- Oil & Gas

- Chemical & Fertilizer

- Food & Beverage

- Pharmaceutical

- Energy & Power

- Mining

- Water & Wastewater

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Industrial Ethernet IP market, Cisco Systems, Inc., Siemens AG, and Schneider Electric SE have maintained strong influence through continuous innovations in industrial networking infrastructure. These companies are widely recognized for integrating advanced protocols, cybersecurity capabilities, and scalable Ethernet architectures into industrial environments.

Rockwell Automation, Inc., ABB Ltd., Belden Inc., and its sub-brand Hirschmann, along with General Electric Company, have played a pivotal role in expanding industrial Ethernet capabilities. These players emphasize high-speed communication, interoperability, and deterministic control in real-time environments. Their robust product lines support mission-critical industrial operations and are designed to withstand harsh operating conditions.

Additionally, Mitsubishi Electric Corporation, Phoenix Contact GmbH & Co. KG, Omron Corporation, Moxa Inc., and SICK contribute significantly through region-specific innovations and customized industrial networking solutions. These firms offer a wide range of switches, gateways, and protocol converters optimized for industrial settings.

Top Key Players in the Market

- Cisco Systems, Inc.

- Siemens AG

- Schneider Electric SE

- Rockwell Automation, Inc.

- Belden Inc.

- ABB Ltd.

- Hirschmann (A Belden Brand)

- General Electric Company

- Mitsubishi Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Omron Corporation

- Belden Inc.

- Moxa Inc.

- SICK

- Other Key Players

Recent Developments

- In October 2024, Siemens launched the next generation of its Scalance XC-/XR-300 series industrial Ethernet switches. These upgraded switches offer enhanced functions to support next-generation industrial networks, addressing the increasing complexity of machine, control, and IT system networking in industrial plants.

- In July 2024, Moxa launched a high-bandwidth Ethernet switch portfolio to accelerate data-driven transformation in industrial applications. The new portfolio includes advanced industrial switches designed to meet the increasing demands for data throughput and network reliability in modern industrial environments.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Protocol (Profinet, Ethernet/IP, Ethercat, Modbus-TCP, Powerlink, Servos III, CC-Link IE), By End-Use Industry (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Oil & Gas, Chemical & Fertilizer, Food & Beverage, Pharmaceutical, Energy & Power, Mining, Water & Wastewater, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Siemens AG, Schneider Electric SE, Rockwell Automation, Inc., Belden Inc., ABB Ltd., Hirschmann (A Belden Brand), General Electric Company, Mitsubishi Electric Corporation, Phoenix Contact GmbH & Co. KG, Omron Corporation, Belden Inc., Moxa Inc., SICK, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Ethernet IP MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Ethernet IP MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Siemens AG

- Schneider Electric SE

- Rockwell Automation, Inc.

- Belden Inc.

- ABB Ltd.

- Hirschmann (A Belden Brand)

- General Electric Company

- Mitsubishi Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Omron Corporation

- Belden Inc.

- Moxa Inc.

- SICK

- Other Key Players