Induced Pluripotent Stem Cells Production Market By Product Type (Consumables & Kits, Automated Platforms, Services, Media, Kits, and Others), By Process (Manual iPSC Production Process and Automated iPSC Production Process), By Application (Regenerative Medicine, Toxicology Studies, Research & Academic Studies, Drug Development & Discovery, and Others), By Workflow (Reprogramming, Cell Characterization/Analysis, Cell Culture, Engineering, and Other), By End-user (Biotechnology & Pharmaceutical Companies, Hospitals & Clinics, Research & Academic Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151426

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

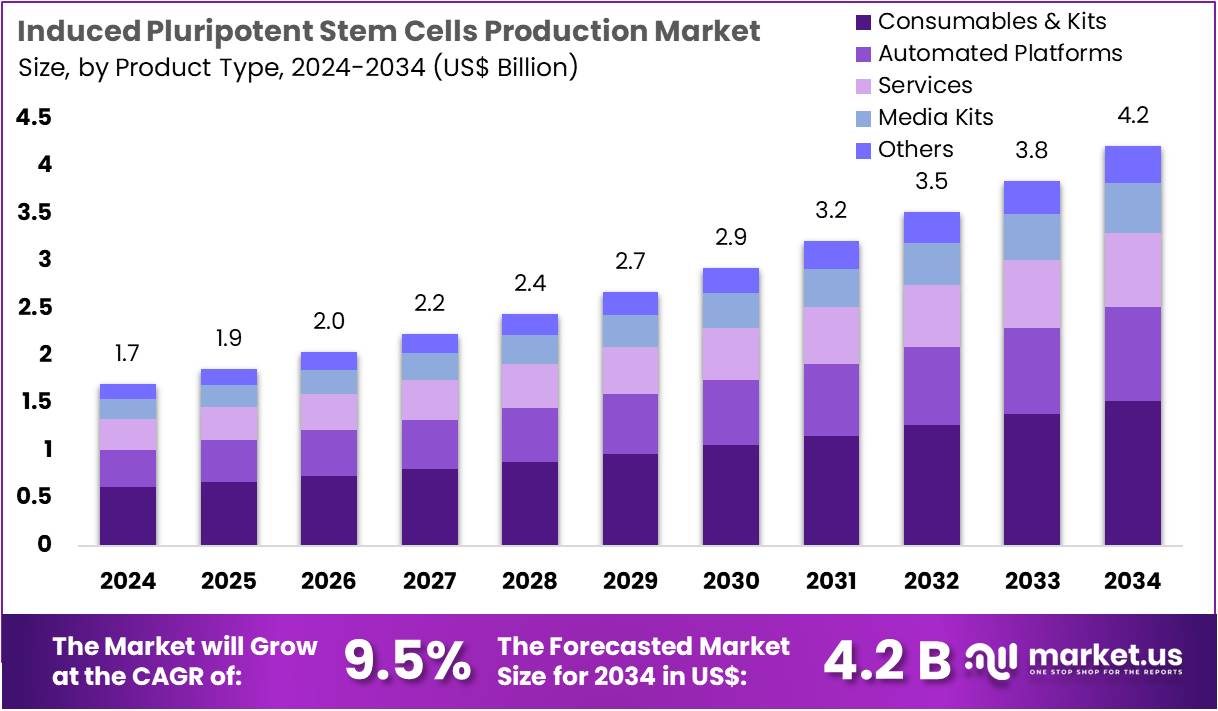

The Induced Pluripotent Stem Cells Production Market Size is expected to be worth around US$ 4.2 billion by 2034 from US$ 1.7 billion in 2024, growing at a CAGR of 9.5% during the forecast period 2025 to 2034.

Increasing advancements in stem cell research and the growing potential of regenerative medicine are driving the growth of the induced pluripotent stem cells (iPSC) production market. iPSCs, which are derived from adult somatic cells and reprogrammed to an embryonic-like state, have vast applications in disease modeling, drug discovery, and personalized medicine.

These cells hold promise for developing patient-specific therapies, offering potential treatments for conditions such as neurodegenerative diseases, heart disease, and diabetes. As the demand for iPSC-based applications rises, there is an increasing need for high-quality, cost-effective production methods to meet the demands of researchers and clinicians. The market is benefiting from ongoing innovations in reprogramming technologies, as well as advancements in cell culture systems and differentiation protocols, enabling more efficient and scalable iPSC production.

In June 2023, Merck KGaA expanded its reagent manufacturing operations in China with a US$ 74.2 million investment. This expansion aims to increase the production of reagents essential for iPSC generation, supporting the growth of the iPSC market and enhancing the availability of key materials for stem cell research and therapies. The rising emphasis on personalized therapies and drug discovery continues to drive demand for iPSCs, creating significant opportunities for market players to innovate and meet the evolving needs of the healthcare and research sectors.

Key Takeaways

- In 2024, the market for induced pluripotent stem cells production generated a revenue of US$ 1.7 billion, with a CAGR of 9.5%, and is expected to reach US$ 4.2 billion by the year 2034.

- The product type segment is divided into consumables & kits, automated platforms, services, media, kits, and others, with consumables & kits taking the lead in 2023 with a market share of 36.2%.

- Considering process, the market is divided into manual iPSC production process and automated iPSC production process. Among these, manual iPSC production process held a significant share of 61.8%.

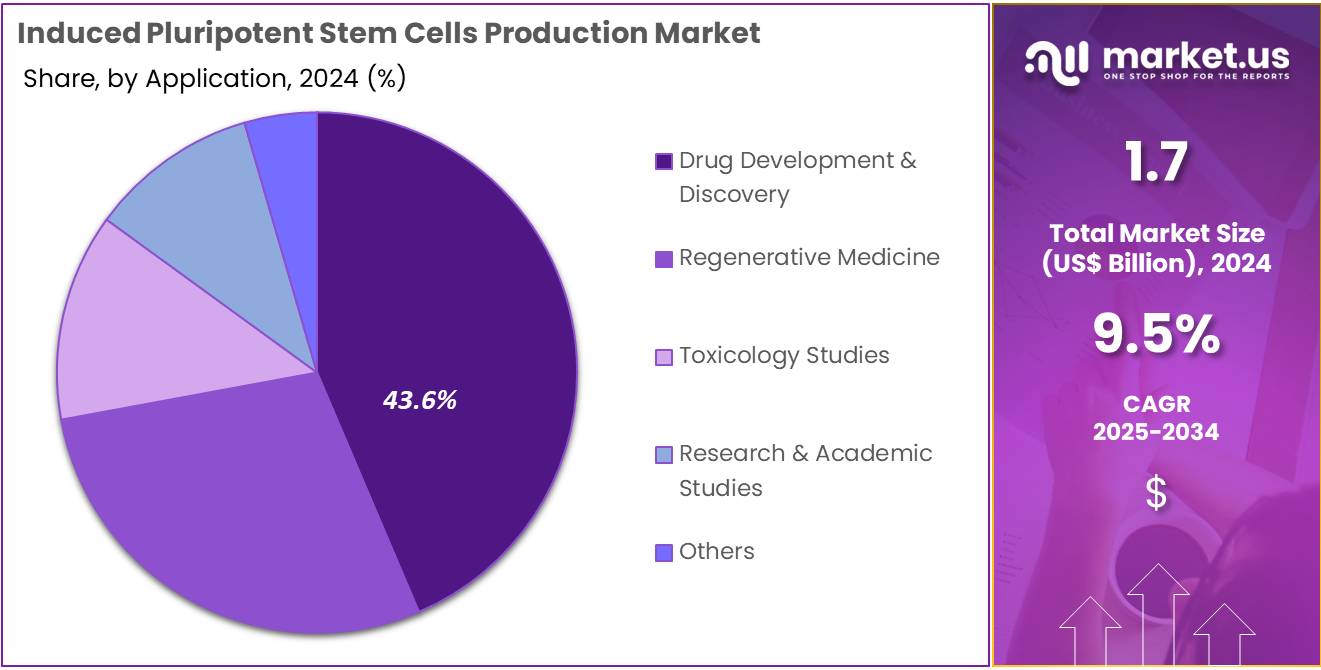

- Furthermore, concerning the application segment, the drug development & discovery sector stands out as the dominant player, holding the largest revenue share of 43.6% in the induced pluripotent stem cells production market.

- The workflow segment is segregated into reprogramming, cell characterization/analysis, cell culture, engineering, and other, with the cell culture segment leading the market, holding a revenue share of 33.1%.

- Considering end-user, the market is divided into biotechnology & pharmaceutical companies, hospitals & clinics, research & academic institutes, and others. Among these, biotechnology & pharmaceutical companies held a significant share of 58.3%.

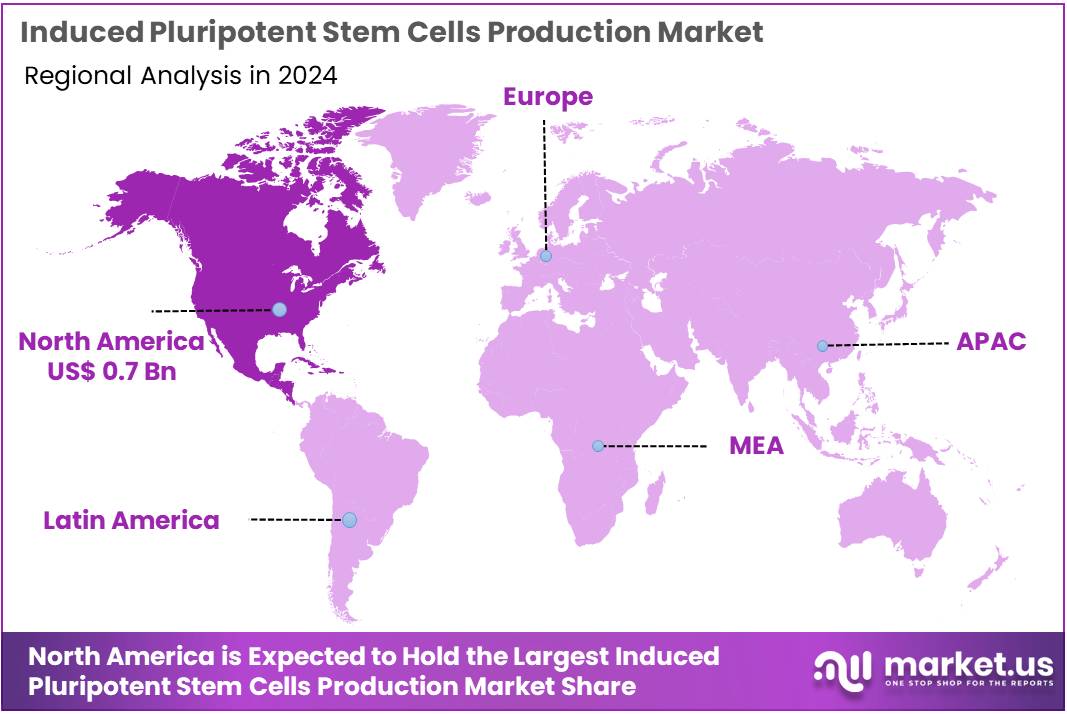

- North America led the market by securing a market share of 41.3% in 2023.

Product Type Analysis

Consumables & kits are expected to be the dominant product type in the iPSC production market, accounting for 36.2% of the market share. This segment’s growth is anticipated to be driven by the increasing demand for reliable and high-quality consumables and kits necessary for iPSC production. As the use of iPSCs expands across various applications, including drug development, regenerative medicine, and toxicity testing, the need for consistent and efficient consumables will continue to rise.

Additionally, advancements in kit formulations that provide better control and improved results in iPSC production are likely to drive further market growth. The ease of use and reproducibility of these consumables make them indispensable in both academic and commercial research settings, boosting the overall demand for this segment.

Process Analysis

The manual iPSC production process is projected to remain the dominant method in the iPSC production market, with a market share of 61.8%. This process is expected to continue to be widely adopted in research and clinical settings due to its flexibility and lower initial cost compared to automated systems. The manual process allows for better customization and optimization of protocols for specific research applications, particularly in areas like regenerative medicine and disease modeling.

While automated systems are growing in popularity, manual iPSC production is still the preferred method in many labs due to its hands-on control and adaptability. As more researchers and clinicians seek to refine their techniques and generate highly specific cell types, the manual iPSC production process is likely to remain the preferred choice.

Application Analysis

Drug development and discovery is expected to be the largest application segment in the iPSC production market, representing 43.6% of the share. The increasing adoption of iPSCs in drug discovery is anticipated to drive this segment’s growth, particularly in creating disease models for testing new compounds. iPSCs are gaining popularity for their ability to mimic human disease processes, offering a more accurate representation of human physiology compared to traditional models.

This has led to their widespread use in the early stages of drug development, particularly in the pharmaceutical and biotechnology industries. As the need for more predictive, human-relevant testing models grows, the demand for iPSCs in drug discovery is projected to increase, further driving growth in this application.

Workflow Analysis

Cell culture is expected to remain the dominant workflow in the iPSC production market, holding a 33.1% share. Cell culture is a critical step in iPSC production, providing the necessary environment for cells to grow and differentiate. The segment’s growth is driven by the increasing demand for high-quality and reproducible iPSC lines for a variety of applications, including drug testing, regenerative medicine, and disease modeling.

Advancements in culture media, techniques, and protocols are expected to improve the efficiency of the cell culture process, enhancing the growth of this segment. The continued emphasis on standardizing iPSC production and improving cell culture conditions to increase yield and reduce variability is likely to contribute significantly to the growth of this workflow.

End-User Analysis

Biotechnology and pharmaceutical companies are projected to be the largest end-users in the iPSC production market, comprising 58.3% of the market share. These companies are expected to lead the market due to their heavy investment in iPSC-based research for drug development, personalized medicine, and regenerative therapies. iPSCs provide a unique tool for developing disease models and testing potential drug candidates, particularly for diseases that are difficult to study using traditional models.

As pharmaceutical and biotechnology companies continue to expand their research into personalized and cell-based therapies, the demand for high-quality iPSCs and production systems will continue to grow. Additionally, collaborations between iPSC suppliers and pharmaceutical companies are likely to further accelerate the use of iPSCs in drug development and clinical applications.

Key Market Segments

By Product Type

- Consumables & Kits

- Automated Platforms

- Services

- Media

- Kits

- Others

By Process

- Manual iPSC Production Process

- Automated iPSC Production Process

By Application

- Regenerative Medicine

- Toxicology Studies

- Research & Academic Studies

- Drug Development & Discovery

- Others

By Workflow

- Reprogramming

- Cell Characterization/Analysis

- Cell Culture

- Engineering

- Other

By End-user

- Biotechnology & Pharmaceutical Companies

- Hospitals & Clinics

- Research & Academic Institutes

- Others

Drivers

Growing Applications in Drug Discovery and Regenerative Medicine is Driving the Market

The increasing application of induced pluripotent stem cells (iPSCs) in drug discovery, disease modeling, and the burgeoning field of regenerative medicine is a primary driver for the iPSC production market. iPSCs offer a powerful tool for creating patient-specific cell lines, enabling researchers to study disease mechanisms in vitro, screen for new therapeutic compounds with higher precision, and develop personalized cell therapies.

The National Institutes of Health (NIH) continues to heavily fund research utilizing iPSCs; for example, the NIH RePORTER database shows hundreds of active grants involving iPSCs in 2023-2024, emphasizing their integral role in advancing biomedical science. Furthermore, iPSCs are being explored for generating various cell types for transplantation, such as neurons for Parkinson’s disease or cardiomyocytes for heart repair, showcasing their broad therapeutic potential and driving demand for high-quality, scalable iPSC production.

Restraints

High Cost and Technical Complexity of Reprogramming and Culture are Restraining the Market

The induced pluripotent stem cells production market faces significant restraint due to the high cost and inherent technical complexity associated with the reprogramming, expansion, and long-term culture of iPSCs. Establishing and maintaining high-quality iPSC lines requires specialized expertise, sophisticated laboratory equipment, and expensive reagents, making the process resource-intensive.

The National Academies of Sciences, Engineering, and Medicine’s 2024 report on “Future of Advanced Biomanufacturing” highlighted that manufacturing challenges, including the high cost and technical complexity of cell culture, remain significant hurdles in the broader cell therapy and regenerative medicine fields.

Furthermore, ensuring genetic stability and pluripotency across numerous passages adds layers of complexity and cost. These factors limit the accessibility of iPSC technology for smaller research groups and increase the overall cost of downstream therapeutic development.

Opportunities

Advancements in Automation and Gene Editing Technologies Create Growth Opportunities

Ongoing advancements in automation technologies and gene editing tools, particularly CRISPR-Cas9, present significant growth opportunities in the induced pluripotent stem cells production market. Automation platforms, such as robotic cell culture systems, are enabling high-throughput iPSC generation and expansion, reducing manual labor, improving consistency, and significantly scaling up production capabilities.

Simultaneously, precise gene editing allows for the correction of disease-causing mutations in patient-derived iPSCs or the introduction of specific reporters, enhancing their utility for disease modeling and drug screening. For example, a 2024 publication in Cell Stem Cell highlighted progress in automated stem cell manufacturing, showcasing its potential to overcome scalability challenges. These technological leaps are making iPSC production more efficient, cost-effective, and reproducible, broadening their application in both research and clinical settings.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the induced pluripotent stem cells (iPSC) production market, primarily through their impact on global research and development (R&D) funding, venture capital investment in the biotechnology sector, and government healthcare priorities. During periods of economic prosperity, there is generally increased public and private funding directed towards cutting-edge biomedical research, including advanced stem cell technologies, fostering innovation and the expansion of iPSC production capabilities.

Conversely, economic downturns or persistent high inflation can lead to tighter research budgets, reduced venture capital availability, and more cautious investment decisions, potentially slowing the pace of iPSC research and the development of downstream therapies. The National Science Foundation reported that total US R&D expenditures reached US$ 892 billion in 2022, with an estimated further increase to US$ 940 billion in 2023, indicating a generally favorable, though slowing, investment climate.

Geopolitical factors, such as international scientific collaborations, intellectual property protections, and the stability of global supply chains for specialized reagents, growth factors, and cell culture equipment, are also crucial. Disruptions caused by geopolitical tensions, as seen in 2024 with various trade and logistics issues, can increase costs and delay the delivery of critical raw materials, impacting the efficiency and cost-effectiveness of iPSC production. However, the transformative potential of iPSCs for disease modeling and regenerative medicine ensures continued strategic investment and scientific pursuit, providing a robust foundation for the market’s long-term growth even amidst economic and political volatility.

Current US tariff policies can directly impact the induced pluripotent stem cells production market by altering the cost of imported specialized reagents, cell culture media components, laboratory plastics, and advanced bioprocessing equipment. Given the highly specialized nature of iPSC research and manufacturing, many critical raw materials and instruments are sourced globally. The US International Trade Commission (USITC) reported that US imports of cell culture media and reagents, which are essential for iPSC production, were valued at over US$ 4 billion in 2023, indicating a substantial volume that could be subject to tariffs.

Such tariffs would directly increase the operational costs for US-based academic institutions and biotechnology companies involved in iPSC production. This could translate to higher prices for research-grade iPSCs, or increased costs for preclinical and clinical development of iPSC-derived therapies, potentially slowing down scientific progress. Conversely, these tariff policies can act as a powerful incentive for manufacturers to invest in expanding or establishing domestic production capabilities for critical iPSC raw materials and equipment within the US.

This strategic shift towards localized production could lead to a more secure and resilient supply chain for iPSC research and therapeutic development in the long term, reducing dependence on potentially volatile international sources and enhancing national leadership in this crucial biotechnological field, despite the initial challenges of increased investment and compliance costs.

Latest Trends

Increased Investment in Regenerative Medicine and Cell Therapy Startups is a Recent Trend

A prominent recent trend in the induced pluripotent stem cells production market is the surge in investment, particularly from venture capital and government initiatives, into regenerative medicine and cell therapy startups that heavily rely on iPSC technology. This reflects growing confidence in the clinical and commercial potential of iPSCs for therapeutic applications.

The Alliance for Regenerative Medicine (ARM) reported that global financing for the cell and gene therapy sector, which heavily utilizes iPSCs, reached US$13.7 billion in 2023, following US$14.7 billion in 2022, demonstrating sustained significant investment in this innovative space. This influx of capital supports the establishment of new iPSC production facilities, accelerates research into iPSC-derived cell therapies, and fosters collaborations aimed at bringing these advanced treatments to patients, directly driving demand for high-quality iPSC lines.

Regional Analysis

North America is leading the Induced Pluripotent Stem Cells Production Market

North America dominated the market with the highest revenue share of 41.3% owing to robust government funding for regenerative medicine research and a rapidly expanding pipeline of iPSC-based clinical trials. The National Institutes of Health (NIH), a major federal agency, sustained significant investment in biomedical research, with a budget of approximately US$ 48.6 billion in fiscal year 2024, a portion of which directly supports stem cell science and its translational applications.

Concurrently, clinical trial activity involving iPSCs has steadily increased in the United States, as evidenced by registrations on ClinicalTrials.gov, indicating a growing need for high-quality iPSC lines and related production services. Key players in the life sciences sector, which supply the necessary tools and reagents for iPSC generation and expansion, reflect this escalating demand.

For instance, Thermo Fisher Scientific’s Life Sciences Solutions Group, a significant provider of such materials, generated US$13.43 billion in revenue for the full year 2023. This increased research and development activity, coupled with the progression of iPSC-derived therapies towards clinical application, directly fuels the need for scalable and standardized iPSC manufacturing capabilities in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing governmental support for regenerative medicine, a burgeoning number of iPSC-related clinical trials, and expanding biopharmaceutical manufacturing capabilities. In Japan, a leader in stem cell research, the Japan Agency for Medical Research and Development (AMED) continues to allocate significant funds, with its budget for medical R&D reaching approximately JPY 211.7 billion (about US$1.35 billion) in fiscal year 2024, directly supporting iPSC-based research and its translation.

Clinical trial registries show a rising number of studies involving iPSCs across countries like Japan and China, indicating a growing pipeline that will necessitate more sophisticated and large-scale cell generation and differentiation services. Companies supplying crucial materials for cellular engineering are also expanding their regional presence; for example, Thermo Fisher Scientific’s Life Sciences Solutions Group, which provides key components for cell production, contributes to its strong international performance. This intensifying research landscape and the push towards clinical translation are anticipated to significantly drive the demand for these specialized cell production services throughout Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the induced pluripotent stem cell (iPSC) production market employ several strategies to drive growth. They focus on expanding their product portfolios by developing novel iPSC lines and enhancing differentiation protocols to cater to diverse research and therapeutic needs. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in cell production processes.

Strategic partnerships with academic institutions and biotechnology firms facilitate innovation and accelerate the translation of iPSC-based therapies into clinical applications. Additionally, players aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of products to support the growing demand for iPSC-based solutions.

FUJIFILM Cellular Dynamics, Inc. is a prominent player in the iPSC production market. Headquartered in Madison, Wisconsin, FUJIFILM Cellular Dynamics specializes in developing and manufacturing human iPSC-derived cells for use in drug discovery, toxicology testing, and regenerative medicine. The company offers a comprehensive portfolio of products, including iCell and MyCell lines, which are utilized by researchers and pharmaceutical companies worldwide.

FUJIFILM Cellular Dynamics emphasizes innovation and quality, providing high-quality, reproducible cell models that enable more accurate and efficient drug development processes. Through its integration with FUJIFILM Holdings, the company leverages advanced technologies and global resources to advance the field of iPSC-based applications.

Top Key Players in the Induced Pluripotent Stem Cells Production Market

- Ushio Inc

- Thermo Fisher Scientific

- QHP Capital

- Merck KGaA

- Lonza

- Fate Therapeutics

- Evotec

- Axol Bioscience Ltd

Recent Developments

- In October 2023: QHP Capital acquired Applied StemCell. This acquisition aims to increase the production of various cell types, including induced pluripotent stem cells (iPSCs), enhancing the company’s ability to meet the growing demand for iPSCs in research and therapeutic applications.

- In September 2023: Ushio Inc. entered into a collaboration with Axol Bioscience, with Axol supplying iPSC-derived sensory neuron cells. This partnership enables Ushio to incorporate these human-derived axoCells sensory neurons into its Nerve Plate platform for in vitro applications. The collaboration is set to advance research in neurobiology and contribute to the development of innovative therapies targeting sensory neurons.

Report Scope

Report Features Description Market Value (2024) US$ 1.7 billion Forecast Revenue (2034) US$ 4.2 billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables & Kits, Automated Platforms, Services, Media, Kits, and Others), By Process (Manual iPSC Production Process and Automated iPSC Production Process), By Application (Regenerative Medicine, Toxicology Studies, Research & Academic Studies, Drug Development & Discovery, and Others), By Workflow (Reprogramming, Cell Characterization/Analysis, Cell Culture, Engineering, and Other), By End-user (Biotechnology & Pharmaceutical Companies, Hospitals & Clinics, Research & Academic Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ushio Inc, Thermo Fisher Scientific, QHP Capital, Merck KGaA, Lonza, Fate Therapeutics, Evotec, Axol Bioscience Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Induced Pluripotent Stem Cells Production MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Induced Pluripotent Stem Cells Production MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ushio Inc

- Thermo Fisher Scientific

- QHP Capital

- Merck KGaA

- Lonza

- Fate Therapeutics

- Evotec

- Axol Bioscience Ltd