Indonesia Pet Care Market Size, Share, Growth Analysis By Pet Type (Dog, Cat, Fish, Bird, Others), By Type (Pet Food, Functional/Therapeutic, Pet Healthcare, Grooming and Hygiene, Accessories and Smart Devices), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158744

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

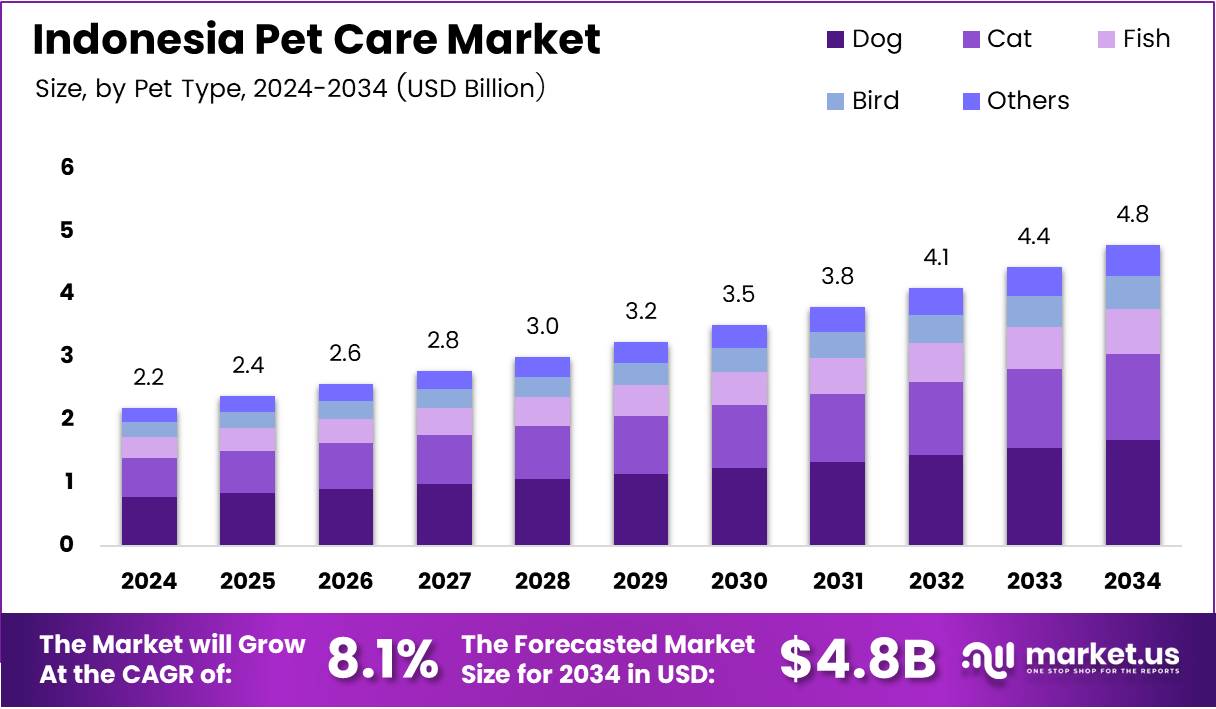

The Indonesia Pet Care Market size is expected to be worth around USD 4.8 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The Indonesia Pet Care Market has seen remarkable growth, driven by an increasing awareness of pet health and well-being. As urbanization continues, Indonesian pet owners are increasingly seeking premium products and services for their pets. This growing trend is fostering the expansion of pet food, grooming, and healthcare markets, presenting new business opportunities.

The market for pet care products in Indonesia is expanding due to a shift in consumer behavior. Pet ownership is no longer seen as a hobby but as a lifestyle choice, with more families treating pets as family members. This change is fostering the growth of pet care products, such as high-quality pet food and accessories.

In terms of opportunities, the pet care industry in Indonesia is well-positioned to capitalize on the growing middle class and pet ownership rates. With rising disposable incomes, consumers are willing to spend more on their pets’ health and grooming. Moreover, the increasing number of veterinary clinics and pet grooming services reflects the expanding demand for comprehensive pet care solutions.

Government initiatives and regulations play an important role in supporting market growth. While pet care regulations are still developing, the government’s increasing attention to animal welfare is laying the foundation for a more regulated and structured pet care market. Such support could further stimulate growth, creating opportunities for new players to enter the market.

According to a recent survey, Indonesia’s pet population grew by 75.7% between 2017 and 2022, reaching approximately 7.8 million pets in 2022. This growth is indicative of the increasing attachment Indonesian families have to pets. Additionally, the pet cat population is expected to balloon to 5.9 million by the end of 2026, signaling a lucrative opportunity for businesses in pet food, accessories, and health care. This significant growth reflects the untapped potential in Indonesia’s pet care industry.

Key Takeaways

- The Indonesia Pet Care Market size is expected to be worth around USD 4.8 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 8.1% from 2025 to 2034.

- In 2024, Dog held a dominant market position in the By Pet Type Analysis segment with a 58.9% share.

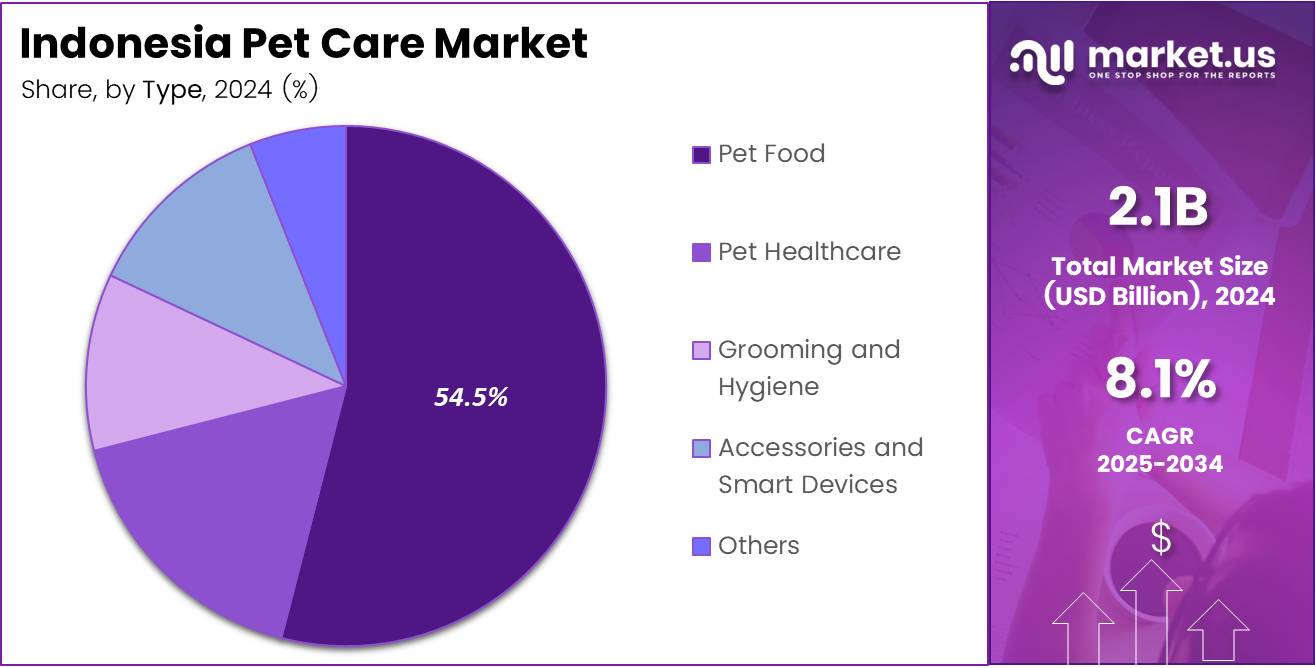

- In 2024, Pet Food held a dominant market position in the By Type Analysis segment with a 54.5% share.

- In 2024, Online held a dominant market position in the By Distribution Channel Analysis segment with a 79.4% share.

By Pet Type Analysis

Dog dominates the market with a 58.9% share in the Indonesia Pet Care Market.

In 2024, Dog held a dominant market position in the By Pet Type Analysis segment of Indonesia Pet Care Market, with a 58.9% share. The large market share can be attributed to the increasing adoption of dogs as pets, driven by urbanization and changing lifestyles. As more Indonesian households welcome dogs as companions, demand for dog-specific products such as food, healthcare, and grooming services is expected to rise.

Cats, while popular, represent a smaller segment compared to dogs. They hold a significant portion of the pet care market, reflecting a steady rise in their popularity, especially among city dwellers. Pet care products for cats are becoming more tailored to their specific needs, such as specialized food and litter solutions.

Fish, though often a more affordable pet option, hold a niche yet dedicated market segment in Indonesia. Their care requires specific products such as fish food, tanks, and water treatments, contributing to their position in the pet care market.

Birds and others make up a smaller yet steady portion of the market. Bird owners typically focus on food, cages, and health-related products. The Others category includes exotic pets, which, although less common, still drive demand for niche pet care items.

By Type Analysis

Pet Food dominates with a 54.5% share in the Indonesia Pet Care Market.

In 2024, Pet Food held a dominant market position in the By Type Analysis segment of Indonesia Pet Care Market, with a 54.5% share. The growing awareness of pet nutrition, along with a rising number of pet owners who treat their pets like family members, is boosting the demand for high-quality food products. Pet food is expected to continue its dominance as pet owners seek tailored nutrition for their pets.

Functional/Therapeutic products are also gaining popularity, particularly for pets with health issues. These products address specific needs, such as joint care or digestive health, offering opportunities for growth in the pet care market.

Pet Healthcare is a growing segment, driven by increasing awareness about preventive care and the need for vaccinations, treatments, and supplements. With the rise of pet insurance, healthcare spending is anticipated to rise, contributing to market growth.

Grooming and Hygiene products are also essential for pet owners, especially as pets are seen more as family members. Products such as shampoos, conditioners, and grooming tools continue to see steady demand, with owners looking to maintain their pets hygiene and appearance.

Accessories and Smart Devices are becoming increasingly popular, with pet owners investing in high-tech items such as automatic feeders, GPS collars, and fitness trackers. This segment is expected to see growth as more consumers seek convenience and innovation in caring for their pets.

By Distribution Channel Analysis

Online dominates the market with a 79.4% share in the Indonesia Pet Care Market.

In 2024, Online held a dominant market position in the By Distribution Channel Analysis segment of Indonesia Pet Care Market, with a 79.4% share. The shift to online shopping has been a key driver, as consumers increasingly prefer the convenience and variety of e-commerce platforms. Online retailers offer a wide range of products, enabling consumers to access international brands and niche items.

Offline distribution channels also continue to play a significant role in pet care sales. Pet owners prefer in-store shopping for immediate purchases and personal interaction with product experts. Pet stores, supermarkets, and specialized pet care shops provide a tactile shopping experience, especially for those buying products like pet food, grooming items, and accessories.

Key Market Segments

By Pet Type

- Dog

- Cat

- Fish

- Bird

- Others

By Type

- Pet Food

- Dry

- Wet

- Fresh/Refrigerated

- Functional/Therapeutic

- Pet Healthcare

- Veterinary Diets

- Probiotics and Supplements

- Tele-health Services

- Grooming and Hygiene

- Shampoos and Conditioners

- Brushes and Combs

- Clippers and Scissors

- Accessories and Smart Devices

- Smart Collars and Trackers

- Interactive Toys

- Feeding and Litter Automation

- Others

By Distribution Channel

- Online

- Offline

Drivers

Rapid Urbanization and Increased Pet Ownership in Metropolitan Areas Drives Indonesia Pet Care Market Growth

Rapid urbanization and increased pet ownership in metropolitan areas have significantly contributed to the growth of the Indonesia pet care market. As more people migrate to cities, owning pets is becoming a popular lifestyle choice. This urban trend leads to higher demand for pet products and services.

Rising disposable incomes among middle-class consumers are further driving market growth. As the economic conditions improve, many households can now afford better quality pet care products, including premium pet food, grooming services, and accessories. This economic uplift encourages a shift towards more specialized pet care.

There is also a cultural shift toward viewing pets as family members. Indonesians increasingly see pets as companions rather than mere animals. This change in mindset has boosted spending on pet healthcare, food, and entertainment, reflecting a growing concern for their well-being.

The expansion of e-commerce platforms has made pet products more accessible to consumers. Online platforms are convenient, offering a wide range of pet care products that can be delivered directly to consumers’ doorsteps. This has simplified the shopping experience, leading to increased sales in the sector.

Restraints

Restraints in the Indonesia Pet Care Market Due to Limited Availability and Other Factors

The limited availability of premium pet products in rural regions presents a challenge. Consumers in these areas face difficulties accessing high-quality pet food, grooming products, and healthcare services, which restricts market growth outside urban centers.

High import tariffs on specialty pet foods increase product costs. As a result, premium pet food options are often more expensive, limiting their accessibility for some consumers, especially in middle and lower-income households.

The lack of standardized regulations for pet food quality assurance is another constraint. Without clear guidelines, the quality of pet products can vary widely, affecting consumer trust and market stability. This inconsistency may lead to concerns regarding pet safety.

Cultural and religious preferences also influence pet ownership patterns in Indonesia. For some communities, certain types of pets are preferred or discouraged, impacting the market’s reach and growth potential in specific regions.

Growth Factors

Growth Opportunities in the Indonesia Pet Care Market for Affordable Solutions and Healthcare Expansion

The development of affordable pet food options for lower-income segments presents a significant growth opportunity. By creating budget-friendly yet nutritious pet foods, companies can cater to a wider audience, increasing market penetration.

The introduction of sustainable and eco-friendly pet care products is gaining traction. As consumers become more environmentally conscious, there is an increasing demand for products such as biodegradable pet waste bags, natural pet grooming solutions, and eco-friendly pet toys.

Expansion of veterinary services and pet healthcare facilities is another promising growth area. As pet ownership rises, so does the need for medical care and specialized services like vaccinations, routine check-ups, and emergency care, creating room for more veterinary clinics and pet hospitals.

The growth of the pet insurance market offers opportunities for addressing health and wellness needs. Pet owners are becoming more aware of the importance of insuring their pets, which provides an avenue for growth in pet insurance services, covering a range of treatments and emergencies.

Emerging Trends

Trending Factors in the Indonesia Pet Care Market Reflecting Consumer Preferences and Technological Innovations

The increasing demand for natural and organic pet foods is a prominent trend in Indonesia. Pet owners are becoming more conscious of the ingredients in pet food, opting for healthier, more sustainable options. This shift toward organic and natural foods is expected to continue shaping the market.

Adoption of smart pet care devices and wearables is on the rise. Products such as pet trackers, smart feeders, and health monitoring wearables are gaining popularity as they allow owners to monitor their pets’ health, behavior, and activity levels in real time. These innovations are transforming the pet care industry.

The rise in pet-friendly travel and accommodation options is another key trend. More hotels and resorts are offering services catering to pets, such as pet-friendly rooms and pet-sitting services. This growing trend is indicative of a broader acceptance of pets as part of family life.

Popularity of pet grooming and spa services is also on the rise. Pet owners are increasingly seeking out grooming services to ensure their pets look and feel their best. From basic grooming to luxurious spa treatments, this sector is gaining attention as part of the overall pet care market.

Key Indonesia Pet Care Company Insights

The Indonesia Pet Care Market in 2024 is characterized by a dynamic interplay of international and local players, each contributing uniquely to the sector’s growth.

MSD Animal Health stands out as a leader in veterinary pharmaceuticals and vaccines, offering a comprehensive range of products for companion and farm animals. Their commitment to innovation and animal welfare positions them as a key player in Indonesia’s pet health landscape.

Mars, Incorporated dominates the Indonesian pet food market, particularly in urban centers like Jakarta and Surabaya. With brands such as Pedigree and Whiskas, Mars has a significant presence across various retail channels, including supermarkets and minimarkets. Their extensive portfolio and strong distribution network underscore their market leadership.

HAPPY PET Investment Holding GmbH has made substantial inroads in Southeast Asia, including Indonesia, by introducing premium pet food brands like Happy Dog and Happy Cat. Their focus on high-quality, natural ingredients resonates with health-conscious pet owners, enhancing their appeal in the competitive market.

PT. NUTRICELL PACIFIC emerges as a significant domestic entity, recognized as the third-largest premix company in Indonesia. Their expertise in animal nutrition and health, coupled with a commitment to sustainability, positions them as a pivotal player in supporting local and export markets.

Together, these companies illustrate the diverse and evolving nature of Indonesia’s pet care market, driven by a blend of international expertise and local innovation.

Top Key Players in the Market

- MSD Animal Health

- Mars, Incorporated

- HAPPY PET Investment Holding GmbH

- PT. NUTRICELL PACIFIC

- Colgate-Palmolive Company

- Nestle SA

- PT Central Proteina Prima Tbk

- Groovy Vetcare Clinic

- KW Aquatic Supplies Sdn Bhd

- PT Citra Mandiri Kencana

- Menara Petskita Indonesia

Recent Developments

- In Sep 2025, Modern Animal announces a $100M run rate, funding, and board expansion to drive further growth in its innovative veterinary services. The company’s efforts focus on expanding its platform and improving pet healthcare services across the U.S.

- In Jan 2025, Purina awards $125,000 to five U.S.-based pet startups through the 2025 Pet Care Innovation Prize, aiming to foster the growth of innovative solutions within the pet care industry. This initiative supports emerging companies developing impactful products and services.

- In May 2025, Dogness (International) Corporation announces a strategic investment in a Petcare Internet of Things (IoT) platform, aiming to enhance its product offering with smart pet solutions. The investment emphasizes the growing demand for connected pet products and services.

- In Jan 2024, Wind Point’s Targeted PetCare acquires the pet-treat business Pet Brands, further expanding its portfolio in the pet care sector. This acquisition allows Targeted PetCare to increase its presence and strengthen its market position in the pet food and treat industry.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 4.8 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet Type (Dog, Cat, Fish, Bird, Others), By Type (Pet Food, Functional/Therapeutic, Pet Healthcare, Grooming and Hygiene, Accessories and Smart Devices), By Distribution Channel (Online, Offline) Competitive Landscape MSD Animal Health, Mars, Incorporated, HAPPY PET Investment Holding GmbH, PT. NUTRICELL PACIFIC, Colgate-Palmolive Company, Nestle SA, PT Central Proteina Prima Tbk, Groovy Vetcare Clinic, KW Aquatic Supplies Sdn Bhd, PT Citra Mandiri Kencana, Menara Petskita Indonesia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MSD Animal Health

- Mars, Incorporated

- HAPPY PET Investment Holding GmbH

- PT. NUTRICELL PACIFIC

- Colgate-Palmolive Company

- Nestle SA

- PT Central Proteina Prima Tbk

- Groovy Vetcare Clinic

- KW Aquatic Supplies Sdn Bhd

- PT Citra Mandiri Kencana

- Menara Petskita Indonesia