Indolent Systemic Mastocytosis Treatment Market By Drug Class (Proton-pump Inhibitors, Mast Cell Stabilizer, Multikinase Inhibitors, Corticosteroids, and Others), By Drug Type (Prescription Drugs and Over-the-counter Drugs), By Route of Administration (Oral, Topical, and Parenteral), By Distribution Channel (Hospital Pharmacies, Drug Stores, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133747

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

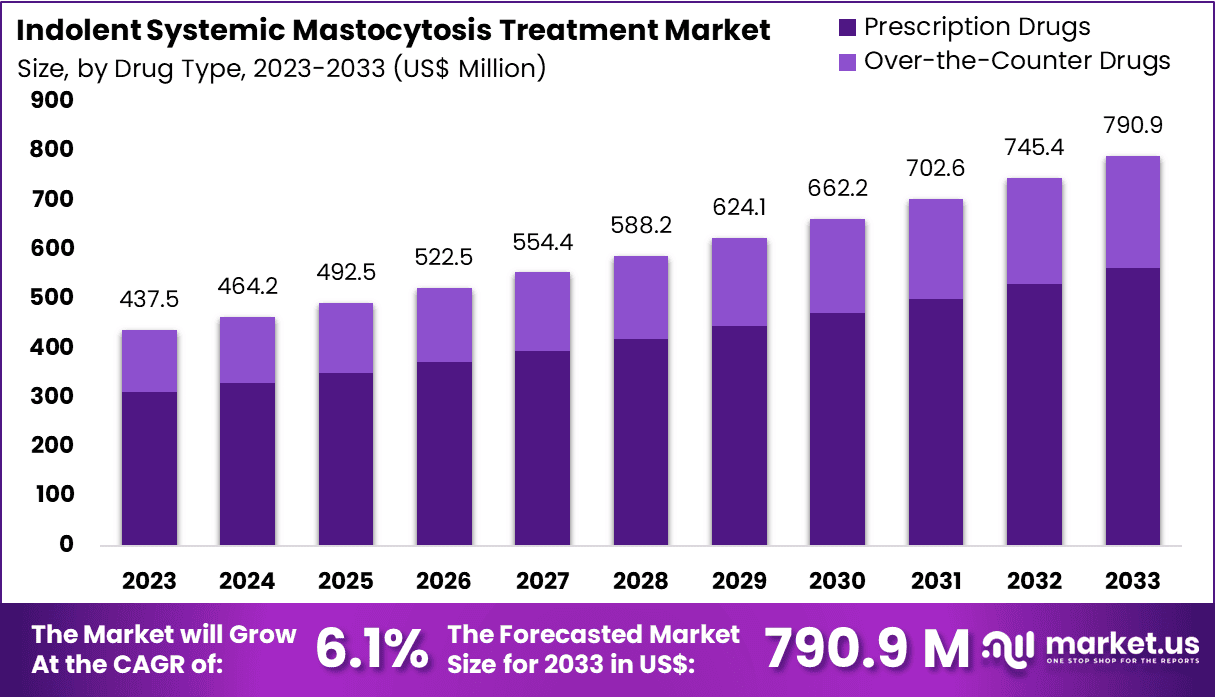

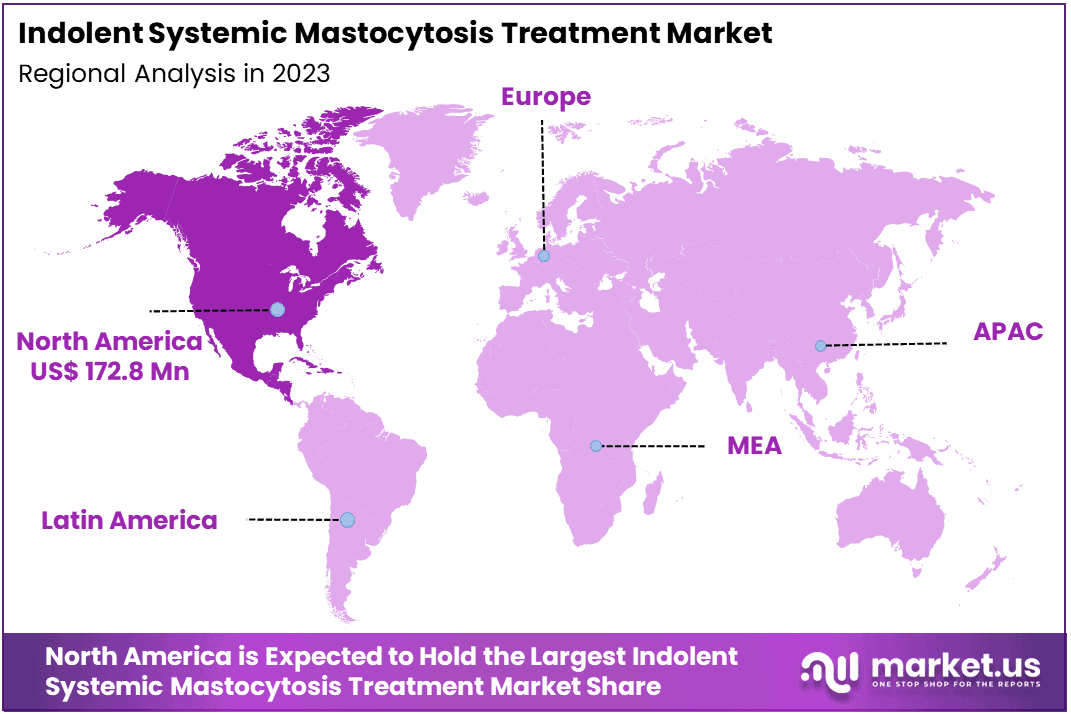

The Global Indolent Systemic Mastocytosis Treatment Market size is expected to be worth around US$ 790.9 Million by 2033, from US$ 437.5 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033. North America dominated the market, securing a 39.5% share and achieving a market value of US$ 172.8 billion.

Growing recognition of indolent systemic mastocytosis (ISM) as a complex and chronic condition is driving the expansion of the treatment market. ISM, a rare form of mast cell disorder characterized by excessive mast cell accumulation, leads to symptoms such as skin rashes, gastrointestinal distress, and anaphylaxis, necessitating effective therapeutic solutions.

The recent advancements in targeted therapies are significantly enhancing treatment options for patients suffering from ISM. In January 2023, Blueprint Medicines Corporation announced that the US Food and Drug Administration (FDA) had accepted its supplemental new drug application for AYVAKIT (avapritinib), a treatment aimed at managing indolent systemic mastocytosis in adults.

This marks a pivotal moment in the development of precision therapies for this underserved patient population. Rising demand for more effective, less invasive treatments presents ample opportunities for the development of innovative therapies, particularly those targeting the underlying molecular mechanisms of mastocytosis.

Recent trends in the market reflect a shift towards personalized medicine, with an emphasis on biologic and small molecule therapies designed to modulate mast cell activity. Additionally, increased awareness among healthcare professionals about the diagnostic and treatment challenges associated with ISM is accelerating the adoption of new treatments.

The market also benefits from ongoing research into the safety and efficacy of combination therapies, which may offer enhanced outcomes for patients with refractory or severe disease manifestations. As the understanding of ISM deepens, the treatment market will continue to evolve, creating new opportunities for pharmaceutical companies to address the unmet needs of these patients.

Key Takeaways

- In 2023, the market for indolent systemic mastocytosis treatment generated a revenue of US$ 437.5 million, with a CAGR of 6.1%, and is expected to reach US$ 790.9 million by the year 2033.

- The drug class segment is divided into proton-pump inhibitors, mast cell stabilizer, multikinase inhibitors, corticosteroids, and others, with mast cell stabilizer taking the lead in 2023 with a market share of 33.8%.

- Considering drug type, the market is divided into prescription drugs and over-the-counter drugs. Among these, prescription drugs held a significant share of 71.3%.

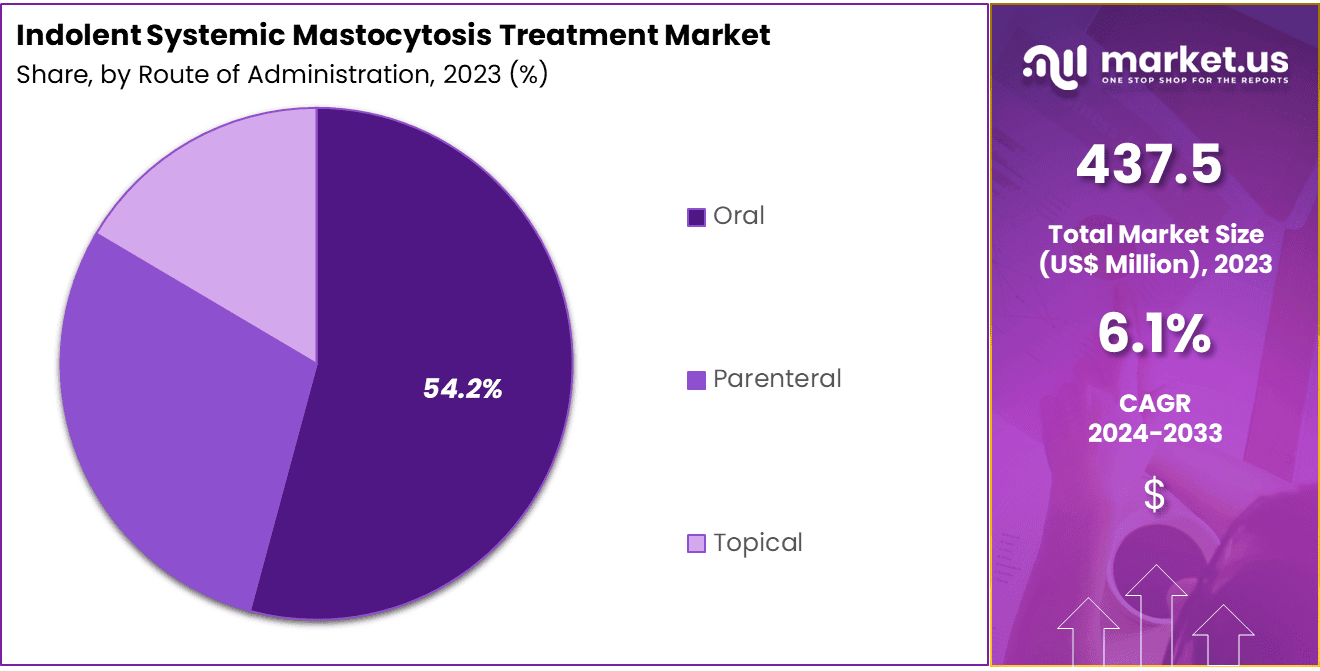

- Furthermore, concerning the route of administration segment, the market is segregated into oral, topical, and parenteral. The oral sector stands out as the dominant player, holding the largest revenue share of 54.2% in the indolent systemic mastocytosis treatment market.

- The distribution channel segment is segregated into hospital pharmacies, drug stores, retail pharmacies, and online pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 40.5%.

- North America led the market by securing a market share of 39.5% in 2023.

Drug Class Analysis

The mast cell stabilizer segment led in 2023, claiming a market share of 33.8% owing to the increasing recognition of their role in managing mast cell-related conditions. Mast cell stabilizers, such as cromolyn sodium, are anticipated to remain a preferred treatment for managing symptoms associated with indolent systemic mastocytosis, as they help prevent mast cell degranulation and release of inflammatory mediators.

The rising prevalence of indolent systemic mastocytosis, along with the increasing demand for therapies that can provide long-term symptom control, is likely to drive growth in this segment. Additionally, the growing understanding of the disease’s pathophysiology and the role of mast cell stabilizers in mitigating symptoms like flushing, itching, and anaphylaxis is projected to further support market expansion.

Drug Type Analysis

The prescription drugsheld a significant share of 71.3% due to the need for more effective and targeted treatment options. Prescription drugs are expected to dominate the market as they offer stronger, more reliable therapeutic effects compared to over-the-counter alternatives.

As the prevalence of indolent systemic mastocytosis increases, healthcare providers are anticipated to rely more on prescription medications to manage the condition, including antihistamines, mast cell stabilizers, and corticosteroids.

The growing complexity of treating systemic mastocytosis with personalized therapy regimens is likely to drive the demand for prescription drugs, as they are tailored to meet the specific needs of patients. Increased investment in research and development for more effective prescription treatments is also expected to further fuel growth in this segment.

Route of Administration Analysis

The oral segment had a tremendous growth rate, with a revenue share of 54.2% owing to patient preference for convenient and non-invasive treatment options. Oral medications are anticipated to remain the most popular route of administration due to their ease of use, adherence benefits, and ability to be taken at home.

The growing number of oral drugs available for managing symptoms of indolent systemic mastocytosis is expected to support the demand for this route of administration. Additionally, the rise in the number of treatments targeting the underlying causes of mast cell activation is likely to further boost the adoption of oral therapies.

As healthcare providers focus on providing personalized treatment options for patients, oral medications are expected to remain a key component of long-term management strategies for indolent systemic mastocytosis.

Distribution Channel Analysis

The hospital pharmacies segment grew at a substantial rate, generating a revenue portion of 40.5% due to their critical role in the administration and dispensation of prescription treatments. Hospital pharmacies are projected to be a leading distribution channel as they are the primary point of access for patients requiring specialized treatments for indolent systemic mastocytosis.

The increasing number of patients diagnosed with the condition and the need for customized therapeutic regimens is likely to drive growth in this segment. Additionally, hospitals often have specialized clinical teams that provide personalized treatment plans and monitor patient progress, making them a key setting for managing complex conditions like systemic mastocytosis. The rising focus on precision medicine and the growing number of hospital-based outpatient services are expected to further support the expansion of this segment in the market.

Key Market Segments

By Drug Class

- Proton-pump Inhibitors

- Mast Cell Stabilizer

- Multikinase Inhibitors

- Corticosteroids

- Others

By Drug Type

- Prescription Drugs

- Over-the-Counter Drugs

By Route of Administration

- Oral

- Topical

- Parenteral

By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Online Pharmacies

Drivers

Advancements in Targeted Therapies

Recent advancements in targeted therapies have greatly advanced the treatment of indolent systemic mastocytosis (ISM). In August 2022, Blueprint Medicines reported significant success with avapritinib in the PIONEER trial. This drug, a selective KIT D816V inhibitor, met its primary and all key secondary endpoints. This breakthrough emphasizes its potential to reduce mast cell burden and alleviate symptoms effectively.

The U.S. Food and Drug Administration (FDA) has recognized the importance of avapritinib by granting it priority review. This decision highlights the drug’s potential to transform treatment paradigms in ISM. Approval of such therapies is crucial as they promise to enhance patient outcomes and quality of life.

The availability of these targeted therapies is set to drive market growth, offering more effective management options for ISM. As these treatments become more accessible, they are expected to be adopted as standard care. This shift is likely to propel the market further, providing patients with better disease control options.

This trend of integrating targeted therapies into clinical practice marks a significant move towards precision medicine in hematologic disorders. The progress in developing these treatments is projected to lead to improved disease control and increased patient satisfaction. As the market evolves, these therapies are poised to become integral to managing ISM effectively.

Restraints

High Treatment Costs

The high costs associated with advanced treatments for ISM are expected to restrain market growth. Innovative therapies, such as avapritinib, offer significant benefits but come with substantial price tags, which may limit accessibility for some patients. In August 2022, Blueprint Medicines announced that avapritinib achieved the primary and all key secondary endpoints in the PIONEER trial for non-advanced systemic mastocytosis. While this development is promising, the financial burden of such treatments could impede widespread adoption.

Healthcare systems and patients may face challenges in affording these therapies, potentially leading to disparities in treatment access. Insurance coverage and reimbursement policies will play crucial roles in determining patient access to these medications. The economic impact of high treatment costs may also influence healthcare providers’ prescribing practices. Efforts to negotiate pricing and improve insurance coverage are essential to mitigate this restraint. Addressing the financial aspects of treatment is crucial to ensure equitable access to effective therapies.

Opportunities

Increased Research and Clinical Trials

The surge in research activities and clinical trials presents significant opportunities for the ISM treatment market. In January 2023, the FDA granted priority review to the supplemental new drug application for avapritinib in ISM, highlighting the growing interest in developing effective treatments. Ongoing clinical trials are exploring various therapeutic agents and combinations, aiming to improve patient outcomes.

This research is expected to lead to the discovery of novel treatments and biomarkers, enhancing diagnostic precision and personalized medicine approaches. Collaborations between pharmaceutical companies, academic institutions, and healthcare providers are fostering innovation in this field. The expansion of clinical trial networks is likely to accelerate the development and approval of new therapies.

Patient participation in these trials is crucial for advancing treatment options and understanding disease mechanisms. The focus on research and development is anticipated to drive market growth by introducing more effective and targeted therapies. This momentum reflects a broader commitment to improving patient care in hematologic disorders.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert significant influence on the indolent systemic mastocytosis treatment market, affecting both healthcare expenditures and access to medications. Economic recessions typically lead to tighter healthcare budgets, which may result in limited funding for specialized treatments, including those for rare diseases such as systemic mastocytosis.

On the other hand, periods of economic expansion encourage higher healthcare investments, potentially increasing the availability and affordability of treatments. Geopolitical factors, such as trade restrictions or shifts in healthcare regulations, may disrupt the supply of critical therapeutic agents or delay the introduction of new treatments to the market.

However, the rising global awareness of rare diseases, coupled with growing support for innovative therapies in both developed and emerging markets, helps stimulate the market. Advances in research and the development of targeted therapies offer promising opportunities, with new treatment options likely to enhance patient outcomes. As the medical community continues to focus on improving care for patients with systemic mastocytosis, the market is expected to expand positively in the future.

Trends

Standardized Diagnostic Approaches

A recent trend in the ISM treatment market is the implementation of standardized diagnostic approaches. In August 2023, a study published in Blood highlighted the importance of standardized evaluations across healthcare systems to improve diagnostic accuracy and patient outcomes in ISM. The research emphasized the need for consistent diagnostic criteria and protocols to ensure timely and accurate identification of the disease.

Standardization is expected to enhance the effectiveness of treatment strategies and facilitate better patient management. By adopting uniform diagnostic methods, healthcare providers can more effectively monitor disease progression and response to therapy. This trend is likely to lead to improved patient outcomes and more efficient use of healthcare resources.

The adoption of standardized diagnostic approaches is anticipated to become a cornerstone of clinical practice in ISM. This development reflects a broader movement towards evidence-based and consistent medical practices. The focus on standardization is expected to drive improvements in patient care and treatment efficacy.

Regional Analysis

North America is leading the Indolent Systemic Mastocytosis Treatment Market

North America dominated the market with the highest revenue share of 39.5% owing to advancements in therapeutic options and increased awareness of the condition. The U.S. Food and Drug Administration (FDA) approved avapritinib (Ayvakit) in May 2023 as the first and only treatment specifically for adults with ISM, marking a pivotal development in the management of this rare disease.

This approval was supported by data from the phase 2 PIONEER trial, which demonstrated significant improvements in patient outcomes. The introduction of avapritinib has provided clinicians with a targeted therapy option, enhancing treatment efficacy and patient quality of life. Additionally, the growing recognition of ISM among healthcare professionals has led to earlier diagnosis and more personalized treatment approaches, further contributing to market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to experience the fastest growth in the CAGR due to rising healthcare investments and advancements in medical research. Countries like Japan and China are expected to significantly contribute to this growth. For instance, in June 2022, Otsuka Pharmaceutical Co., Ltd. launched Moizerto Ointment in Japan, aimed at treating atopic dermatitis. This new treatment is available in two formulations: 1 percent and 0.3 percent difamilast, highlighting the region’s efforts to enhance therapeutic options for dermatological conditions.

This development could also impact related diseases such as ISM. The introduction of Moizerto Ointment underscores a broader commitment to expanding and improving therapeutic strategies within the region. Such advancements are crucial for addressing the increasing need for effective treatments that cater to a diverse range of dermatological conditions.

Additionally, the rising prevalence of chronic diseases and an aging population are anticipated to boost the demand for effective treatments in Asia Pacific. With expected enhancements in healthcare infrastructure and research initiatives, the region is poised to lead in the development of novel therapies. This is likely to result in significant expansion of the ISM treatment market across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the indolent systemic mastocytosis treatment market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the indolent systemic mastocytosis treatment market employ strategies such as developing targeted therapies, expanding clinical trials, and forming strategic partnerships to accelerate growth.

Companies focus on advancing treatments that specifically target mast cell proliferation and degranulation to improve patient outcomes. Investment in research and development (R&D) plays a crucial role in discovering novel drug formulations and expanding therapeutic options. Collaborations with academic institutions, healthcare providers, and biotechnology firms help to speed up the commercialization of new therapies.

Additionally, players are increasing their global presence to meet the rising demand for effective treatments in emerging markets. One of the key players in the market is Novartis, a global healthcare company that specializes in innovative therapies for rare diseases. Novartis’ oncology division focuses on developing treatments for hematologic cancers and rare conditions such as systemic mastocytosis.

The company’s growth strategy revolves around advancing its drug pipeline through substantial investments in R&D, forming partnerships with research institutions, and pursuing regulatory approvals to bring effective treatments to market. Novartis also aims to enhance patient access to its therapies through collaborations with healthcare systems and organizations worldwide.

Top Key Players in the Indolent Systemic Mastocytosis Treatment Market

- Teva Pharmaceuticals

- Pfizer Inc.

- Novartis

- Mylan N.V.

- Merck KgaA

- GSK Plc.

- Blueprint Medicines Corporation

- AstraZeneca

Recent Developments

- In September 2023, Hoth Therapeutics, Inc., a biopharmaceutical company with a patient-centered focus, submitted a Pre-Investigational New Drug (IND) meeting request to the U.S. FDA. This request outlines the proposed drug development plan for HT-KIT, a novel treatment for advanced systemic mastocytosis (AdvSM).

- In January 2022: Ritedose, a prominent key player, launched its new Cromolyn Sodium Oral Solution, a single-dose generic product, 100 mg/5 ml. This marks the introduction of a new product for Ritedose, which has previously specialized in generic inhalation solutions.

Report Scope

Report Features Description Market Value (2023) US$ 437.5 million Forecast Revenue (2033) US$ 790.9 million CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Proton-pump Inhibitors, Mast Cell Stabilizer, Multikinase Inhibitors, Corticosteroids, and Others), By Drug Type (Prescription Drugs and Over-the-counter Drugs), By Route of Administration (Oral, Topical, and Parenteral), By Distribution Channel (Hospital Pharmacies, Drug Stores, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva Pharmaceuticals, Pfizer Inc., Novartis, Mylan N.V., Merck KgaA, GSK Plc., Blueprint Medicines Corporation, and AstraZeneca. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Indolent Systemic Mastocytosis Treatment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Indolent Systemic Mastocytosis Treatment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Teva Pharmaceuticals

- Pfizer Inc.

- Novartis

- Mylan N.V.

- Merck KgaA

- GSK Plc.

- Blueprint Medicines Corporation

- AstraZeneca