Global Indium Market Report By Product (Primary Indium, Secondary Indium), By Application (Indium Tin Oxide, Semiconductor, Solder and Alloy), By End-Use Industry (Electronics, Automotive, Aerospace, Energy, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122416

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

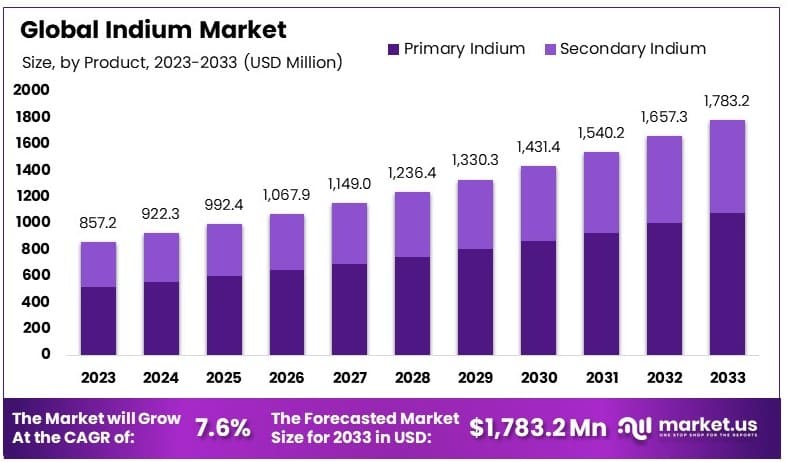

The Global Indium Market size is expected to be worth around USD 1,783.2 Million by 2033, from USD 857.2 Million in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

The Indium market centers on the production and distribution of indium, a rare metal used primarily in electronics. Indium is crucial for manufacturing touchscreens, flat-panel displays, and solar panels due to its unique conductive properties.

The market is driven by the rising demand for consumer electronics and renewable energy technologies. Key market participants include mining companies, electronics manufacturers, and material suppliers. Market trends show consistent growth, fueled by technological advancements and increasing investments in renewable energy.

The indium market is currently navigating a complex landscape characterized by fluctuating production levels and significant trade activities. Indium, predominantly sourced from Canada where reserves are estimated at over 1,500 tons, is a rare metal with an abundance of 0.1 parts per million in Earth’s crust. This scarcity underscores its critical status and the importance of strategic sourcing and reserve management.

India’s involvement in the indium market is particularly noteworthy. In 2023, India imported approximately 1,300 shipments of indium metal from 33 suppliers, with the United Kingdom emerging as the primary supplier, accounting for 849 of these shipments. This highlights India’s increasing reliance on international markets to meet its indium needs, reflecting broader global trade dynamics within the industry.

Moreover, indium’s applications are diverse, with major products related to its use including various types of machinery such as Metal Shearing Machines, Hydraulic Shearing Machines, Rolling Machines, and Thread Rolling Machines. These applications indicate indium’s integral role in manufacturing and industrial processes, driving its demand across multiple sectors.

China, as the leading producer and exporter of indium, plays a pivotal role in the global supply chain. However, in 2023, China’s indium exports witnessed a 9% decline compared to the previous year, totaling 381 tons in the first eight months, primarily directed to the Republic of Korea, Hong Kong, and Singapore. This decrease could signal shifting market dynamics or adjustments in production strategies, potentially impacting global supply and pricing structures.

The indium market is marked by its criticality in modern technology and manufacturing, coupled with challenges related to its rarity and geopolitical influences on its trade. These factors collectively contribute to the market’s complexity and the strategic importance of indium in the global economic landscape.

Key Takeaways

- Market Value: The Indium Market was valued at USD 857.2 million in 2023, and is expected to reach USD 1,783.2 million by 2033, with a CAGR of 7.6%.

- Product Analysis: Primary Indium dominated with 60.2%; important for its high purity and critical applications.

- Application Analysis: Indium Tin Oxide led with 45.1%; significant for its use in electronic displays and touchscreens.

- End-Use Industry Analysis: Electronics dominated with 30.6%; crucial for its role in various electronic devices and components.

- Dominant Region: APAC held 38.6%; significant due to its strong electronics manufacturing base.

- Analyst Viewpoint: The indium market is moderately competitive with strong growth potential. Future trends indicate increased demand driven by advancements in electronics and renewable energy technologies.

- Growth Opportunities: Key players can focus on sustainable sourcing, recycling initiatives, and expanding applications in emerging technologies to stand out.

Driving Factors

Expanding Electronics Industry Drives Market Growth

The fast growing electronics sector is a primary driver for the indium market. Indium’s unique properties, such as its low melting point and excellent conductivity, make it indispensable in manufacturing indium tin oxide (ITO), a transparent conductive coating used in touchscreens, flat-panel displays, and solar panels. For instance, the rapid adoption of smartphones and tablets has led to a surge in demand for ITO. According to a report by IDC, global smartphone shipments reached 1.28 billion units in 2020, indicating the vast scale of this market and its impact on indium demand.

This widespread use of ITO in consumer electronics illustrates how the electronics industry’s growth directly influences indium consumption. Additionally, the increasing preference for high-definition displays and advancements in OLED and LED technologies further amplify the need for ITO, thereby driving indium market expansion. As the electronics industry continues to innovate and evolve, the demand for indium is expected to remain robust, underscoring its critical role in the sector.

Growth in Renewable Energy Drives Market Growth

The global push towards renewable energy, particularly solar power, is another significant growth factor for the indium market. Indium is a key component in copper indium gallium selenide (CIGS) thin-film solar cells, known for their high efficiency and flexibility. As governments worldwide incentivize solar energy adoption to combat climate change, the demand for CIGS cells is rising. For example, the European Union’s target to derive 32% of its energy from renewables by 2030 is driving substantial investments in solar projects, thereby boosting the indium market.

The increasing implementation of solar panels in both residential and commercial applications highlights the critical role of indium in the renewable energy sector. Additionally, advancements in thin-film technology and the growing trend towards sustainable energy solutions further enhance the market’s growth prospects. As countries continue to prioritize green energy initiatives, the indium market is poised to benefit significantly from these developments.

Advancements in Semiconductor Technology Drive Market Growth

The ongoing miniaturization and performance enhancement in semiconductors are fueling indium’s demand. Indium is used in high-speed semiconductors, notably in the form of indium phosphide (InP) for high-frequency applications like 5G networks and data centers power. The rollout of 5G by telecom giants like Verizon and AT&T in the US has increased the need for InP-based components, illustrating how technological advancements directly impact the indium market.

The shift towards more powerful and efficient semiconductor devices underscores the importance of indium in this sector. Furthermore, the growing demand for data storage and processing capabilities, driven by the proliferation of cloud computing and IoT devices, enhances the market for high-performance semiconductors. As technology continues to advance, the reliance on indium for semiconductor applications is expected to grow, highlighting its vital role in the industry’s evolution.

Restraining Factors

Supply Chain Vulnerabilities Restrain Market Growth

The concentrated nature of indium production significantly restrains market growth. China dominates global indium production, accounting for over 50% of the supply. This concentration makes the market vulnerable to geopolitical tensions, trade disputes, or supply disruptions. For example, during the US-China trade war in 2019, concerns over potential export restrictions on rare metals like indium led to price volatility and uncertainty among buyers, highlighting the risks of overdependence on a single source.

Such supply chain vulnerabilities can lead to inconsistent availability and increased prices, affecting manufacturers reliant on indium. This reliance on a predominant supplier underscores the need for diversification in indium sourcing to mitigate risks associated with geopolitical and trade conflicts.

Environmental and Health Concerns Restrain Market Growth

The indium market faces challenges from growing environmental and health concerns. Indium extraction and processing can lead to toxic waste and emissions, posing significant health risks. Studies have shown that indium compounds can cause lung damage in workers exposed to indium tin oxide dust. In 2010, a study published in the Journal of Occupational Health linked indium exposure to pulmonary alveolar proteinosis in workers at an ITO plant in Japan.

Such incidents have led to strict regulatory measures and increased scrutiny of indium processing practices. The heightened awareness of environmental and health impacts may result in higher compliance costs and stricter regulations, which can impede the market’s growth. Additionally, companies may face increased pressure to adopt cleaner and safer production methods, further challenging the market.

Product Analysis

Primary Indium dominates with 60.2% due to its higher purity and consistency.

The Indium Market is divided into two main segments by product: Primary Indium and Secondary Indium. Primary Indium, accounting for 60.2% of the market, is the dominant sub-segment. Primary Indium is sourced directly from zinc ores, where indium is a byproduct. This sub-segment’s dominance can be attributed to the consistent and higher purity levels of indium obtained through primary production processes, which are crucial for high-tech applications like electronics and semiconductors.

Primary Indium’s role in market growth is substantial. The electronics industry’s expansion, particularly in Asia-Pacific regions like China, South Korea, and Japan, drives the demand for Primary Indium. The manufacturing of flat-panel displays, touchscreens, and advanced semiconductor devices heavily relies on the high-quality indium derived from primary sources. Additionally, the push for renewable energy solutions, such as CIGS solar cells, further propels the demand for Primary Indium, as these applications require indium with minimal impurities to ensure optimal performance and longevity.

Secondary Indium, though not the dominant sub-segment, plays a critical role in the market. It involves the recycling of indium from industrial waste and used products, which is both economically and environmentally advantageous. Secondary Indium contributes to sustainable practices in the industry, as recycling reduces the need for new mining operations and helps mitigate environmental impacts. The market for Secondary Indium is expected to grow as industries increasingly adopt circular economy principles and as regulations around electronic waste management become more stringent. The role of Secondary Indium in supporting market growth, therefore, lies in its ability to provide a more sustainable and cost-effective source of indium, complementing the supply from primary production.

Application Analysis

Indium Tin Oxide dominates with 45.1% due to its essential role in electronic displays.

In the Indium Market, the application segments include Indium Tin Oxide (ITO), Semiconductor, and Solder and Alloy. Indium Tin Oxide dominates with 45.1% of the market due to its extensive use in various high-tech applications. ITO is primarily utilized as a transparent conductive coating in electronic displays, such as LCDs, OLEDs, and touchscreens, making it indispensable for the consumer electronics industry.

The demand for ITO is driven by the proliferation of smartphones, tablets, and flat-panel displays. According to IDC, global smartphone shipments reached 1.28 billion units in 2020, showcasing the vast scale of this market and its impact on indium demand. Additionally, ITO is crucial for solar panels, particularly in thin-film photovoltaic cells, which are increasingly used in renewable energy projects worldwide. The growing emphasis on renewable energy and the continuous advancement in display technologies are key factors propelling the demand for ITO.

Other segments, such as Semiconductors and Solder and Alloy, also contribute significantly to the market. The Semiconductor segment is growing rapidly due to the increasing need for high-speed, high-frequency electronic devices, including 5G technology and advanced computing systems. Indium Phosphide (InP) is a critical material in this segment, used for its superior electron velocity and thermal conductivity properties. The Solder and Alloy segment, while smaller, remains important for its use in joining metals in electronic circuits and components, offering low melting points and excellent wetting properties.

End-Use Industry Analysis

Electronics dominate with 30.6% due to high demand for electronic components and devices.

The Indium Market is segmented by end-use industry into Electronics, Automotive, Aerospace, Energy, Medical, and Others. The Electronics industry is the dominant sub-segment, accounting for 30.6% of the market. This dominance is due to the extensive use of indium in various electronic components and devices.

The rapid growth of the electronics industry, particularly in emerging markets, drives the demand for indium. The proliferation of consumer electronics, such as smartphones, tablets, and flat-panel displays, requires substantial amounts of indium, particularly in the form of Indium Tin Oxide (ITO) for display technologies. Additionally, the development of advanced semiconductor devices for applications in computing, telecommunications, and consumer electronics further boosts the demand for indium. The increasing adoption of renewable energy solutions, where indium plays a crucial role in the production of high-efficiency solar cells, also contributes to this growth.

Other end-use industries, such as Automotive, Aerospace, Energy, and Medical, also play significant roles in the market. The Automotive industry leverages indium in various electronic systems and sensors, while the Aerospace sector uses it in advanced alloys and coatings for high-performance applications. The Energy industry benefits from indium’s application in renewable energy technologies, particularly in solar panels. The Medical industry utilizes indium in imaging devices and diagnostic equipment. While these segments may not be as large as Electronics, they collectively contribute to the robust demand and diverse applications of indium, supporting the overall growth of the market.

Key Market Segments

By Product

- Primary Indium

- Secondary Indium

By Application

- Indium Tin Oxide

- Semiconductor

- Solder and alloy

By End-Use Industry

- Electronics

- Automotive

- Aerospace

- Energy

- Medical

- Others

Growth Opportunities

5G and IoT Expansion Offers Growth Opportunity

The rollout of 5G networks and the Internet of Things (IoT) presents substantial growth opportunities for the indium market. Indium phosphide (InP) is crucial for high-speed, low-latency applications required by 5G and IoT devices. For example, Ericsson predicts that 5G connections will reach 4.4 billion by 2027, driving demand for InP-based components in base stations and mobile devices.

Similarly, the IoT market, projected to reach 25 billion connected devices by 2030 (GSMA), will require indium in sensors and communication modules. The rapid expansion of these technologies underscores the increasing need for high-performance materials like indium. As connectivity and smart devices proliferate, indium’s role in enhancing communication speed and efficiency will continue to grow, presenting significant market potential.

Advanced Packaging in Semiconductors Offers Growth Opportunity

Significant potential exists in advanced semiconductor packaging techniques like 2.5D and 3D integration. These methods use indium for high-density interconnects and bumps. For instance, AMD’s Radeon R9 Fury X GPU, launched in 2015, used 2.5D packaging with a silicon interposer, showcasing indium’s role in enabling higher performance and smaller form factors.

As demand for AI, cloud computing, and edge devices grows, this trend will accelerate, boosting indium consumption. The shift towards advanced packaging is driven by the need for improved performance, reduced power consumption, and compact designs in electronic devices. Indium’s properties make it ideal for these applications, supporting the growth and innovation in the semiconductor industry.

Trending Factors

Shift Towards Mini and Micro-LED Displays Are Trending Factors

The display industry is trending towards Mini and Micro-LED technologies due to their superior contrast, energy efficiency, and durability. These displays use indium in the form of ITO for transparent electrodes. Samsung’s launch of The Wall, a modular Micro-LED TV, in 2018 signaled this shift.

As these technologies penetrate smartphones, wearables, and automotive displays, indium demand will rise. The superior performance of Mini and Micro-LED displays compared to traditional LCDs and OLEDs drives their adoption in various high-end applications. Indium’s role in these advanced display technologies underscores its importance in the evolving display market, reflecting a significant trend that boosts demand.

Sustainable Electronics Are Trending Factors

There’s a growing trend towards sustainable and circular electronics, driven by concerns over indium’s scarcity and the environmental impact of its extraction. This trend is fostering research into recycling and recovery methods. For example, the European project DOTTED (2020-2024) aims to develop technologies for recovering indium from e-waste. As sustainability becomes a corporate priority, efficient indium recycling could become a key factor in the market.

The focus on reducing environmental footprints and improving resource efficiency highlights the importance of sustainable practices in the electronics industry. Recycling initiatives not only alleviate supply constraints but also support the circular economy, making sustainability a critical trend in the indium market.

Regional Analysis

APAC Dominates with 38.6% Market Share

The Asia-Pacific (APAC) region dominates the indium market with a 38.6% market share, valued at USD 330.8 million. This dominance is driven by several factors. The region’s robust electronics manufacturing industry, especially in China, Japan, and South Korea, is a significant contributor. These countries are leading producers of smartphones, flat-panel displays, and other high-tech electronics, which heavily rely on indium. Additionally, the growing adoption of renewable energy technologies in APAC, particularly solar panels that use indium tin oxide (ITO), further boosts the demand for indium.

APAC’s market dynamics are characterized by its strong industrial base, technological advancements, and substantial investments in R&D. The presence of major electronics manufacturers and the high consumption of consumer electronics drive continuous demand for indium. Furthermore, government policies supporting renewable energy projects and technological innovations in the region enhance the market’s growth potential. The availability of raw materials and a well-established supply chain infrastructure also play crucial roles in maintaining APAC’s market leadership.

North America: 25% Market Share

North America holds a 25% market share in the indium market. The region benefits from its advanced semiconductor industry and significant investments in renewable energy. The United States, being a major player in technology and innovation, drives demand for high-purity indium used in advanced electronics and solar panels. Additionally, initiatives to boost domestic production and reduce dependency on imports contribute to market growth. As the region continues to adopt cutting-edge technologies and expand its renewable energy projects, the market share is expected to grow steadily.

Europe: 20% Market Share

Europe accounts for 20% of the global indium market. The region’s emphasis on renewable energy and stringent environmental regulations drive demand for indium in solar panel production. Countries like Germany, Spain, and Italy are leading adopters of solar technology. Europe’s strong focus on sustainable practices and recycling initiatives also supports the market. The European Union’s target to derive 32% of its energy from renewables by 2030 will further enhance the demand for indium, bolstering the region’s market presence.

Middle East & Africa: 10% Market Share

The Middle East and Africa hold a 10% market share in the indium market. The region’s growth is primarily driven by investments in renewable energy projects, particularly solar power. Countries like Saudi Arabia and South Africa are investing heavily in solar energy to diversify their energy sources. Additionally, the region’s developing electronics sector contributes to indium demand. As these industries continue to grow, the market share of the Middle East and Africa is expected to increase, supported by favorable government policies and international investments.

Latin America: 6.4% Market Share

Latin America represents 6.4% of the global indium market. The region’s growth is fueled by the expanding electronics industry and renewable energy projects. Countries like Brazil and Mexico are witnessing increased adoption of solar panels and electronic devices, driving indium demand. Government incentives for renewable energy and technological advancements in the region further support market growth. With continued investment in these sectors, Latin America’s market share is anticipated to grow, contributing to the overall expansion of the indium market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Indium Market is characterized by the presence of several key players who significantly impact its dynamics. Companies such as China Germanium and China Tin Group dominate the market due to their extensive production capacities and strategic control over supply chains. These companies leverage their geographical advantages and access to raw materials to maintain a leading position. PPM Pure Metals and Teck Cominco are also influential, focusing on high-purity indium production, catering to the electronics and semiconductor industries’ stringent quality requirements.

Nyrstar and Yuguang contribute to the market through diversified metal production, ensuring a steady supply of indium as a byproduct of their primary operations. AXT Inc. and Wafer World Inc. are pivotal in the semiconductor sector, utilizing advanced technologies to produce indium phosphide (InP) components essential for high-speed electronics and 5G networks.

Logitech Ltd. and Western Minmetals (sc) Corporation are notable for their innovative approaches in recycling and sustainability, addressing environmental concerns associated with indium extraction and processing. Their commitment to sustainable practices enhances their market positioning and appeal to eco-conscious consumers.

Collectively, these companies shape the Indium Market through strategic positioning, technological advancements, and sustainable practices, driving growth and stability in the industry. Their influence extends globally, ensuring the continuous development and application of indium across various high-tech and renewable energy sectors.

Market Key Players

- China Germanium

- China Tin Group

- PPM Pure Metals

- Teck Cominco

- Nyrstar

- Yuguang

- AXT Inc.

- Wafer World Inc.

- Logitech Ltd.

- Western Minmetals (SC) Corporation

Recent Developments

- June 2024: Indium Corporation Technical Manager Karthik Vijay will present at the High-Temperature Electronics Network Conference in July 2024, discussing innovative high-reliability solder materials for power electronics applications with increased electrification demands.

- June 2024: Iltani Resources has expanded the Orient silver-indium deposit in north Queensland by 550 meters. Reverse circulation drill holes intersected extensive silver-lead-zinc-indium mineralization, including assays of 7 meters at 63 grams per tonne (g/t) silver equivalent (AgEq) and 69 meters at 45 g/t AgEq. The deposit’s open pit potential is supported by the results.

- June 2024: Researchers investigated the effects of laser treatment on terbium-doped indium oxide (Tb: In2O3) thin films and transistors. The study explored how varying laser energy densities influence physical, optical, and electrical properties of Tb: In2O3 thin films and their impact on transistor performance and stability.

Report Scope

Report Features Description Market Value (2023) USD 857.2 Million Forecast Revenue (2033) USD 1,783.2 Million CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Primary Indium, Secondary Indium), By Application (Indium Tin Oxide, Semiconductor, Solder and Alloy), By End-Use Industry (Electronics, Automotive, Aerospace, Energy, Medical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape China Germanium, China Tin Group, PPM Pure Metals, Teck Cominco, Nyrstar, Yuguang, AXT Inc., Wafer World Inc., Logitech Ltd., Western Minmetals (sc) Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current size of the Global Indium Market?The Global Indium Market was valued at USD 857.2 million in 2023 and is expected to reach USD 1,783.2 million by 2033, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

Which region dominates the global indium market?The Asia-Pacific (APAC) region holds the largest market share at 38.6%, driven by its strong electronics manufacturing base and growing renewable energy sector.

Who are the major players in the indium market?Key players include China Germanium, China Tin Group, PPM Pure Metals, Teck Cominco, Nyrstar, Yuguang, AXT Inc., Wafer World Inc., Logitech Ltd., and Western Minmetals (SC) Corporation.

-

-

- China Germanium

- China Tin Group

- PPM Pure Metals

- Teck Cominco

- Nyrstar

- Yuguang

- AXT Inc.

- Wafer World Inc.

- Logitech Ltd.

- Western Minmetals (SC) Corporation