In-Silico Clinical Trials Market By Industry (Medical Devices and Pharmaceutical), By Therapeutic Area (Oncology, Infectious Disease, Cardiology, and Others), By Phase (Phase IV, Phase III, Phase II, and Phase I), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148194

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

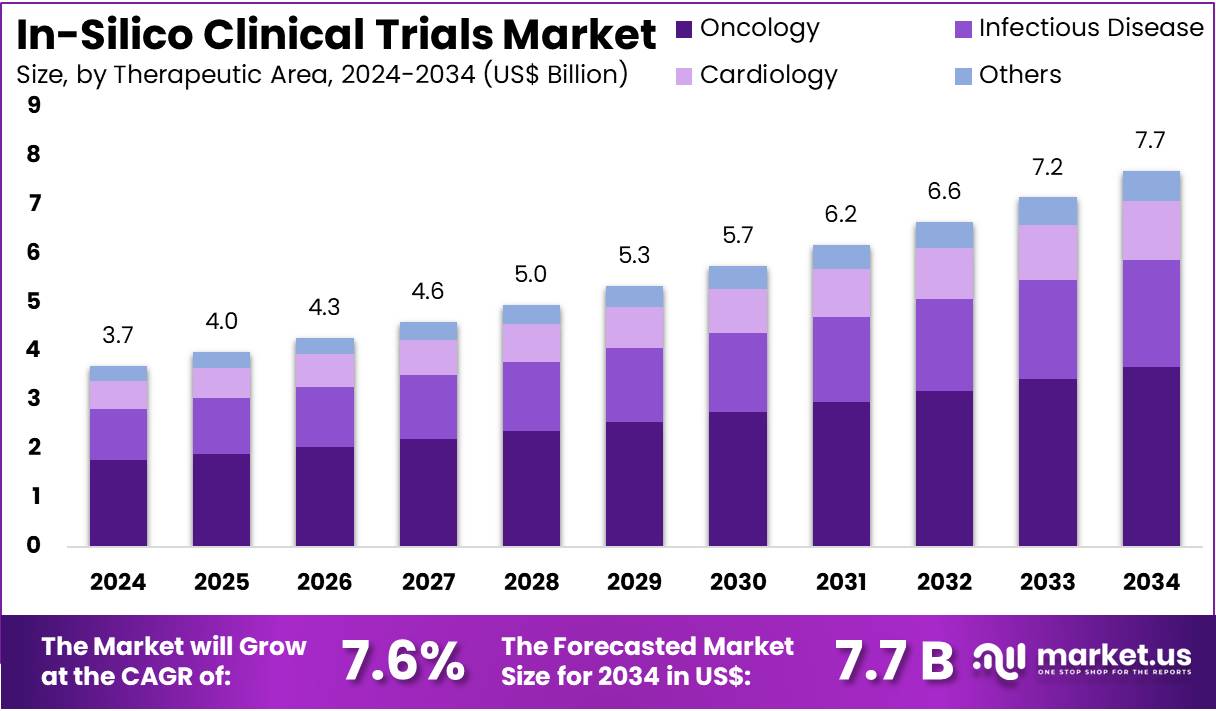

The In-Silico Clinical Trials Market size is expected to be worth around US$ 7.7 billion by 2034 from US$ 3.7 billion in 2024, growing at a CAGR of 7.6% during the forecast period 2025 to 2034.

Increasing demand for more efficient and cost-effective drug development processes is driving the growth of the in-silico clinical trials market. In-silico trials use computational models and simulations to predict the outcomes of clinical trials, offering a faster and more affordable alternative to traditional methods. These virtual trials reduce the reliance on costly and time-consuming human subject testing, allowing researchers to optimize study designs and predict potential outcomes earlier in the drug development process.

The growing adoption of artificial intelligence (AI) and machine learning in predictive modeling is enhancing the accuracy and reliability of these simulations. In November 2024, Debiopharm’s Novadiscovery demonstrated the capabilities of its technology by predicting the outcomes of the MARIPOSA Phase III clinical trial, highlighting the effectiveness of in-silico trials in assessing complex clinical scenarios. Furthermore, Novadiscovery’s partnership with Janssen aims to redefine drug development, leveraging in-silico trials to accelerate the process and improve patient outcomes.

As pharmaceutical companies and research institutions face increasing pressure to reduce development timelines and costs, in-silico trials present significant opportunities. The ability to simulate patient populations, model disease progression, and predict treatment responses makes in-silico trials particularly valuable in personalized medicine and rare disease research. With advancements in computational power and regulatory support, the market for in-silico clinical trials is set to continue growing, revolutionizing the way new therapies are developed and tested.

Key Takeaways

- In 2024, the market for in-silico clinical trials generated a revenue of US$ 3.7 billion, with a CAGR of 7.6%, and is expected to reach US$ 7.7 billion by the year 2033.

- The industry segment is divided into medical devices and pharmaceutical, with medical devices taking the lead in 2024with a market share of 61.4%.

- Considering therapeutic area, the market is divided into oncology, infectious disease, cardiology, and others. Among these, oncology held a significant share of 47.9%.

- Furthermore, concerning the phase segment, the market is segregated into phase IV, phase III, phase II, and phase I. The phase II sector stands out as the dominant player, holding the largest revenue share of 38.9% in the in-silico clinical trialsmarket.

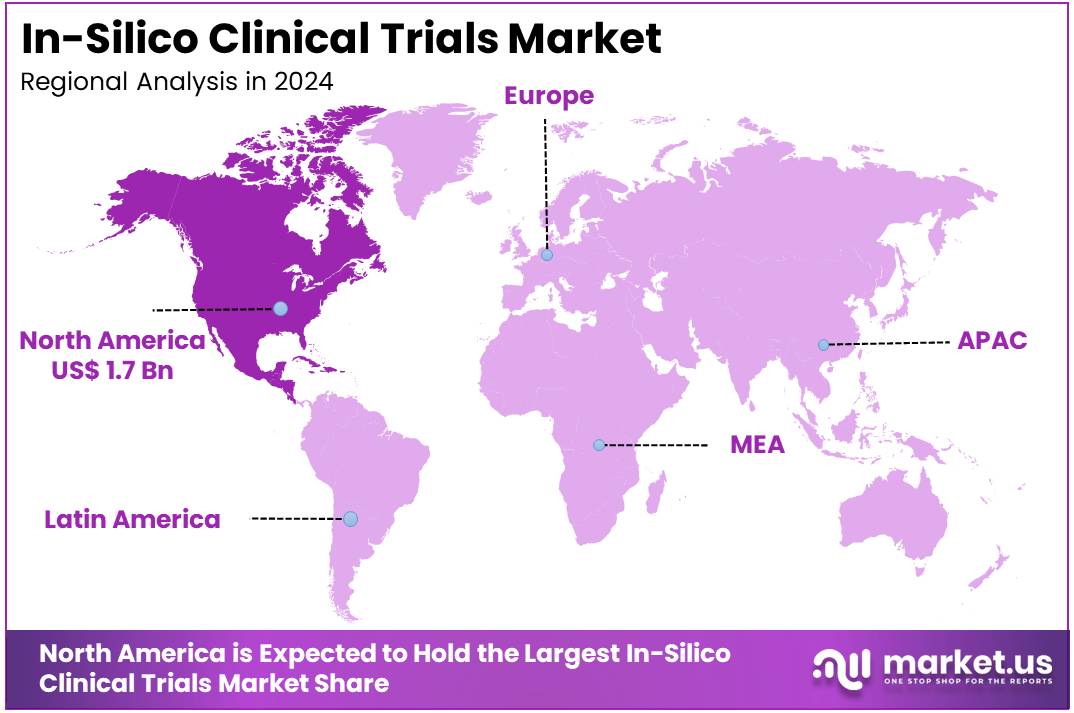

- North America led the market by securing a market share of 44.7% in 2024.

Industry Analysis

The medical devices segment led in 2024, claiming a market share of 61.4% owing to the increasing need for efficient and cost-effective testing of medical devices. In-silico clinical trials offer a platform for simulating real-world scenarios, which allows medical device manufacturers to test the safety and performance of their products without the need for extensive animal or human trials.

The rising regulatory pressure to accelerate time-to-market for medical devices while ensuring safety and efficacy is likely to drive the adoption of in-silico methods in device development. Moreover, the increasing focus on personalized medicine, coupled with the growing demand for digital health solutions and wearables, is anticipated to further fuel the need for in-silico clinical trials in the medical devices segment.

Therapeutic Area Analysis

The oncology held a significant share of 47.9% due to the rising demand for innovative cancer treatments and the increasing complexity of oncology drug development. In-silico clinical trials offer a powerful tool for simulating and optimizing treatment protocols in cancer research, which accelerates the discovery of novel therapies while minimizing patient exposure to experimental drugs.

The high failure rate of cancer drugs in clinical trials and the need for more effective therapies are expected to drive the market for in-silico trials in oncology. Additionally, the focus on personalized oncology treatments, such as immunotherapy and targeted therapies, is likely to further increase the adoption of in-silico trials, enabling better precision in drug development and clinical decision-making.

Phase Analysis

The phase II segment had a tremendous growth rate, with a revenue share of 38.9% as pharmaceutical companies increasingly turn to simulation-based methodologies to optimize clinical trial designs. Phase II trials, which focus on evaluating a drug’s efficacy and side effects, can benefit greatly from in-silico simulations, as they provide insights into patient responses and help predict the most effective treatment protocols.

The ability to simulate a larger pool of participants and explore multiple dosing strategies virtually is expected to make in-silico trials an essential tool in this phase. As drug developers seek to reduce trial costs and improve success rates, the use of in-silico clinical trials in phase II is projected to rise, offering a faster, more efficient route for evaluating drug efficacy and accelerating time-to-market.

Key Market Segments

By Industry

- Medical Devices

- Pharmaceutical

By Therapeutic Area

- Oncology

- Infectious Disease

- Cardiology

- Others

By Phase

- Phase IV

- Phase III

- Phase II

- Phase I

Drivers

Increasing regulatory acceptance is driving the market

Increasing regulatory acceptance is driving the in-silico clinical trials market. Regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are demonstrating a growing willingness to consider computational modeling and simulation as evidence in regulatory submissions for drugs and medical devices. This acceptance provides a crucial incentive for companies to invest in and utilize these advanced simulation techniques.

As regulators provide clearer guidelines and frameworks for validating computational models, the path to leveraging in-silico data to support or optimize traditional clinical trials becomes more defined, increasing industry confidence and adoption. The FDA, for example, published its final guidance on “Assessing the Credibility of Computational Modeling and Simulation in Medical Device Submissions” in November 2023, offering a risk-informed framework for demonstrating model credibility to the agency.

Restraints

Lack of comprehensive validation standards is restraining the market

A significant restraint on the market is the lack of comprehensive and universally adopted validation standards for in-silico models intended for widespread regulatory use in clinical trials. While progress is being made and guidance documents are emerging, the diverse nature of biological systems, disease processes, and therapeutic interventions makes developing one-size-fits-all validation protocols challenging.

Ensuring that computational models are robust, reliable, and predictive across different patient populations and clinical scenarios requires rigorous validation against empirical data, which can be complex and data-intensive. Regulatory bodies and the industry are actively working towards establishing clearer benchmarks, but the absence of established, detailed standards for all applications creates uncertainty for developers.

An EMA review of Physiologically Based Pharmacokinetic (PBPK) modeling in Marketing Authorization Applications in 2022 and 2023 found that although approximately one out of four approved “full” applications contained PBPK modeling, only 28% of these models were considered qualified as per EMA guidelines, indicating the ongoing challenges in meeting regulatory expectations for model validation.

Opportunities

The potential for significant cost and time savings is creating growth opportunities

The potential for significant cost and time savings is creating substantial growth opportunities in the in-silico clinical trials market. Traditional clinical trials are notoriously expensive and time-consuming, often representing the largest portion of drug and device development costs and timelines.

In-silico methods offer the promise of reducing the number of required physical experiments or patient recruits, optimizing trial design, and potentially predicting outcomes more efficiently. This can lead to faster development cycles and reduced overall expenditure, presenting a compelling value proposition for pharmaceutical and medical device companies.

While specific, independently verifiable statistics on average cost and time savings from in-silico trials across the entire industry are not routinely published by government bodies, the drive for greater efficiency in the costly clinical development process, which sees billions invested annually in R&D, underscores the significant opportunity presented by these cost-saving technologies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors exert influence on the in-silico clinical trials market by shaping the broader investment climate for the life sciences industry. Periods of economic expansion generally correlate with increased funding for research and development from both public and private sources, facilitating investment in advanced technologies like computational modeling and simulation platforms.

Conversely, economic downturns can lead to tighter R&D budgets, potentially slowing the adoption of these technologies despite their long-term cost-saving potential. Geopolitical stability plays a role by ensuring reliable international collaboration in research and access to the global supply chain for the high-performance computing infrastructure essential for running complex simulations.

Economic pressures can paradoxically also highlight the efficiency benefits of in-silico methods, as companies look for ways to reduce the significant costs and risks associated with traditional clinical development, ultimately driving interest in computational approaches.

Current US tariff policies affect the in-silico clinical trials market by increasing the cost of essential high-performance computing hardware. Running complex computational models for virtual clinical trials demands significant computing power, relying heavily on specialized servers and data center equipment. Tariffs imposed on imported technology components and finished hardware directly raise the acquisition cost of this critical infrastructure for US-based companies and research institutions.

A March 2023 report by the US International Trade Commission (USITC) showed that Section 301 duties led to a 5% drop in computer equipment imports. The tariffs also caused a 0.8% increase in U.S. hardware prices. These higher costs raise capital expenditure for companies investing in computing systems for in-silico trials. As a result, some firms may delay or reduce infrastructure upgrades. This financial strain highlights a key barrier to adopting advanced simulation-based technologies in drug and medical device development.

Despite the impact of tariffs, in-silico methods continue to attract investment. These methods offer long-term savings by reducing the need for physical trials. This makes them appealing even when initial hardware costs rise. In the long run, tariffs may drive local production of computing parts. This shift could strengthen supply chain security and support future growth. The market is expected to adapt as stakeholders seek cost-effective and resilient technology solutions.

Latest Trends

Increased integration of artificial intelligence and machine learning is a recent trend

The integration of artificial intelligence (AI) and machine learning (ML) is reshaping in-silico trial development. Researchers and developers are adopting these tools to improve predictive accuracy. AI and ML are used to analyze large datasets from sources like electronic health records, genomic data, and past clinical trials. These technologies help create virtual patient groups that are more realistic. They also identify patterns in data and support better parameter selection. As a result, simulation models become more precise, enhancing the efficiency of digital clinical testing.

AI and ML also play a vital role in optimizing simulations. They fine-tune model settings and help interpret complex outputs. These improvements speed up the design of clinical trials and reduce reliance on traditional methods. The healthcare and life sciences sectors are embracing these changes quickly. Institutions such as the National Institutes of Health (NIH) are funding projects in computational biomedicine. This trend highlights the expanding role of AI-driven analytics in advancing in-silico trial methods and supporting regulatory research.

Regional Analysis

North America is leading the In-Silico Clinical Trials Market

North America dominated the market with the highest revenue share of 44.7% owing to increased regulatory acceptance and technological advancements. The FDA, a key regulatory body, is actively promoting the use of modeling and simulation. For instance, the FDA’s Center for Drug Evaluation and Research (CDER) has been involved in initiatives to advance the use of computational modeling and simulation, with workshops and guidance documents published between 2022 and 2024. This proactive stance encourages the adoption of in-silico methods by pharmaceutical companies.

Furthermore, the National Institutes of Health (NIH) has funded research projects that develop and validate computational models; in fiscal year 2023, the NIH supported research programs focused on developing new computational tools and methods for biomedical research. This funding supports the scientific basis for in-silico trials and expands their applicability. The combination of regulatory support and research investment has facilitated the growth of in-silico clinical trials in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing focus on advanced drug development technologies and the rising number of pharmaceutical companies in the region. Regulatory agencies in countries like Japan and China are exploring the use of computational modeling in drug evaluation. For example, the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan has been involved in initiatives to incorporate computational approaches into regulatory science, and has increased its focus on these technologies in recent years.

Additionally, government investments in scientific computing infrastructure across the Asia Pacific region are projected to provide the necessary technological foundation for the wider adoption of in-silico methodologies. China’s investment in R&D, which reached 2.54% of GDP in 2022, according to the National Bureau of Statistics of China, also indicates a growing capacity for advanced computational research.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the global in-silico clinical trials market drive growth through strategic partnerships, technological innovation, and expanding therapeutic applications. They collaborate with regulatory bodies and pharmaceutical companies to develop standardized frameworks for virtual trials, enhancing industry acceptance. Investments in artificial intelligence, machine learning, and high-fidelity simulation models enable more accurate predictions of drug efficacy and safety, reducing reliance on traditional clinical trials.

Companies also focus on diversifying their service offerings to include various therapeutic areas, such as oncology, neurology, and immunology, to meet the growing demand for personalized medicine. Additionally, expanding into emerging markets allows these companies to tap into new opportunities and broaden their customer base.

Insilico Medicine is a prominent player in the in-silico clinical trials sector, specializing in the application of artificial intelligence to drug discovery and development. The company utilizes its proprietary AI platform, Pharma.AI, to design novel therapeutic candidates, predict clinical trial outcomes, and optimize drug development processes.

Insilico Medicine has established collaborations with various pharmaceutical companies and research institutions to advance its AI-driven approaches, aiming to accelerate the delivery of effective treatments to patients. With a strong focus on innovation and efficiency, Insilico Medicine continues to be a key contributor to the evolution of in-silico clinical trials.

Top Key Players in the In-Silico Clinical Trials Market

- The AnyLogic Company

- InSilicoTrials

- Immunetrics Inc

- GNS Healthcare Inc

- Exscientia plc

- Dassault Systemes SE

- Abzena Ltd

Recent Developments

- In July 2024, Exscientia plc extended its collaboration with Amazon Web Services to integrate the cloud provider’s AI and machine learning capabilities into its drug discovery and automation platform, enhancing the efficiency of the process.

- In June 2023, Insilico Medicine announced the completion of the first dose administration in Phase II trials for INS018_055. This marks the development of the first-ever anti-fibrotic small molecule inhibitor discovered using artificial intelligence, now progressing through Phase II trials for clinical evaluation.

Report Scope

Report Features Description Market Value (2024) US$ 3.7 billion Forecast Revenue (2034) US$ 7.7 billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Industry (Medical Devices and Pharmaceutical), By Therapeutic Area (Oncology, Infectious Disease, Cardiology, and Others), By Phase (Phase IV, Phase III, Phase II, and Phase I) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The AnyLogic Company, InSilicoTrials, Immunetrics Inc, GNS Healthcare Inc, Exscientia plc, Dassault Systemes SE, Abzena Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In-Silico Clinical Trials MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

In-Silico Clinical Trials MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The AnyLogic Company

- InSilicoTrials

- Immunetrics Inc

- GNS Healthcare Inc

- Exscientia plc

- Dassault Systemes SE

- Abzena Ltd