Global Ibuprofen API Market By Kit Type (Quantitative and Digital), By Application (Infectious diseases testing, Oncology testing, Human genetic testing, Blood screening, Forensic applications and Others), By End-User (Hospitals and diagnostic centres, Stand-alone diagnostic laboratories, Research laboratories, and Pharmaceutical & biotechnology companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173318

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

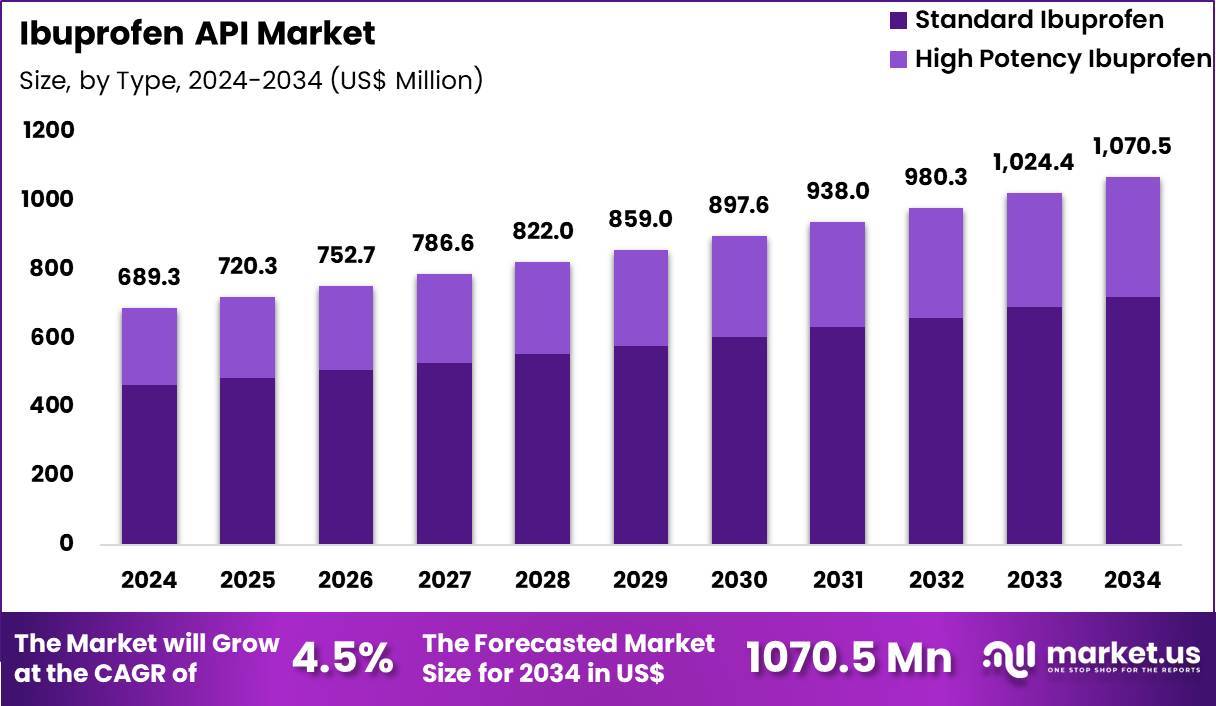

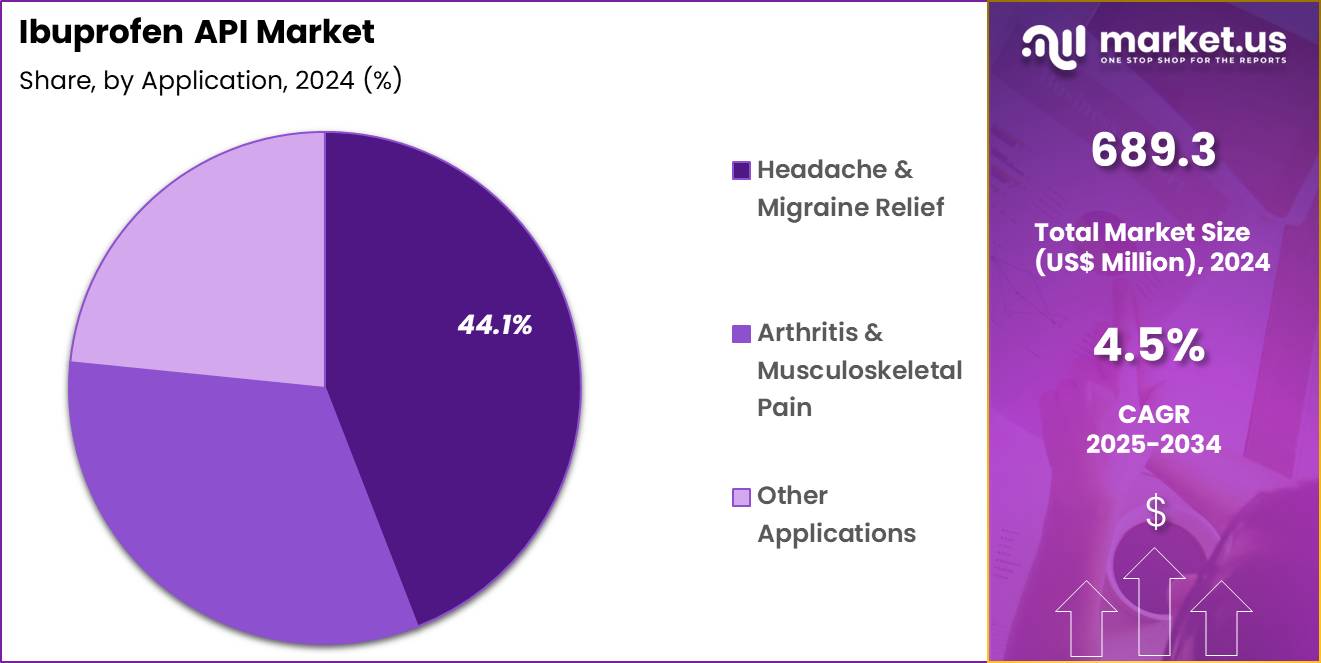

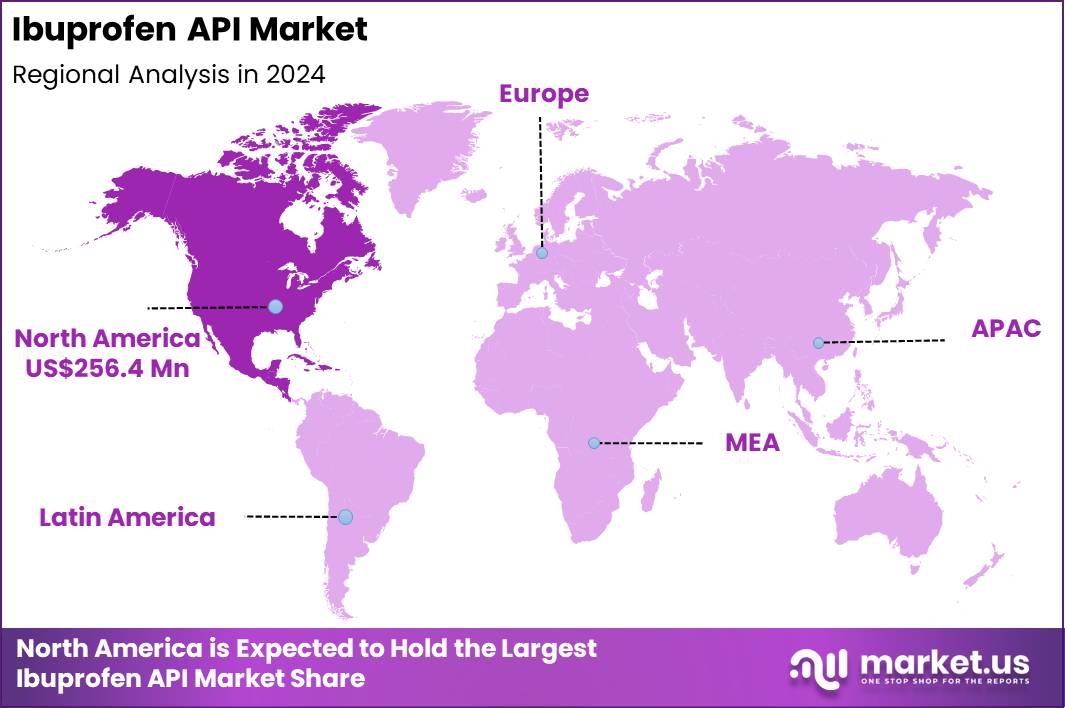

The Global Ibuprofen API Market size is expected to be worth around US$ 1070.5 Million by 2034 from US$ 689.3 Million in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.2% share with a revenue of US$ 256.4 Million.

The Ibuprofen API Market represents a critical segment of the global pharmaceutical supply chain, supporting extensive production of analgesic, anti-inflammatory, and antipyretic formulations across prescription and over-the-counter categories.

Ibuprofen remains one of the most widely consumed NSAIDs globally due to rising prevalence of musculoskeletal disorders, headache disorders, post-operative pain, menstrual pain, dental pain, and fever management needs. Healthcare systems worldwide rely on consistent availability of Ibuprofen API for large-scale formulation manufacturing, driven by increasing retail pharmacy demand, expanding self-medication trends, and the universal use of NSAIDs in primary care.

The market continues to evolve as manufacturers advance synthesis efficiency, purity levels, stability profiles, and compliance with international regulatory standards. Pharmaceutical companies emphasize streamlined production, impurity control, and continuous-manufacturing technologies to improve batch consistency. Global consumption of NSAIDs increases with aging populations, growth of chronic pain cases, and high outpatient visit frequencies. Ibuprofen formulations remain a standard component in emergency departments, sports medicine, orthopedics, pediatrics, and general practice settings, creating sustained long-term API demand.

Regulatory bodies across regions require strict quality control, GMP adherence, validated process efficiency, and compliance with pharmacopoeial standards such as USP, EP, BP, and JP. Manufacturers continuously upgrade reactor systems, purification stages, and environmental-safety compliance to maintain uninterrupted Ibuprofen API supply for multinational pharmaceutical clients.

In May 2023, Ludhiana-based IOL Chemicals and Pharmaceuticals Limited, a major manufacturer of pharmaceutical APIs and specialty chemicals, obtained a Certificate of Suitability from the European Directorate for the Quality of Medicines & HealthCare (EDQM).

Key Takeaways

- In 2024, the market generated a revenue of US$ 689.3 Million, with a CAGR of 4.5%, and is expected to reach US$ 1070.5 Million by the year 2034.

- The Type segment is classified into Standard Ibuprofen and High Potency Ibuprofen, with Standard Ibuprofen taking the lead in 2024 with a market share of 67.4%

- The Application segment includes Headache & Migraine Relief, Arthritis & Musculoskeletal Pain, and Other Applications, with Headache & Migraine Relief taking the lead in 2024 with a market share of 44.1%

- The End-User segment is divided into Pharmaceutical & Biopharmaceutical Companies, CROs and CMOs, and Others, with pharmaceutical manufacturers taking the lead in 2024 with a market share of 77.5%

- North America remains the leading regional market due to high NSAID consumption rates by securing a market share of 37.2% in 2024.

Type Analysis

Standard Ibuprofen accounts for the dominant share of 67.4% due to its widespread role in manufacturing oral tablets, capsules, syrups, suspensions, and combination analgesic formulations. Global consumption of NSAIDs is substantial, with millions of daily doses administered across outpatient clinics, emergency departments, and home-care settings. Standard Ibuprofen is widely used for mild to moderate pain management and is included in essential medicines lists in many countries.

Its proven safety profile, rapid onset of action, and broad therapeutic use support large-scale API procurement by generic manufacturers. In several regions, self-medication habits significantly contribute to Ibuprofen consumption, especially for fever and common cold symptoms. Manufacturers continuously refine crystallization methods to enhance purity and reduce process impurities such as isobutylbenzene derivatives and residual solvents. High-efficiency catalytic routes and green-chemistry protocols are increasingly adopted to improve yield and minimize environmental impact.

High Potency Ibuprofen holds a smaller but growing segment of the market, primarily used in modified-release formulations, pediatric suspensions requiring enhanced solubility, and specialized combination therapies. Pharmaceutical companies use higher-potency grades when developing formulations for chronic inflammatory conditions or pain episodes requiring sustained relief.

Application Analysis

Headache & Migraine Relief represents the largest application which held 44.1% market share in 2024 category due to the extremely high global incidence of headache disorders. According to international neurological associations, tension-type headaches affect a majority of adults worldwide, while migraine impacts over one billion individuals annually. Ibuprofen remains a frontline therapy because of its rapid onset, cost-effectiveness, and safety across diverse age groups.

Retail pharmacies, e-commerce platforms, and supermarket chains register persistent demand for Ibuprofen-based headache products. Emergency departments also rely on Ibuprofen as part of their symptomatic management protocols for non-severe headache cases. Innovations such as liquid-filled capsules and rapidly dispersing tablets continue to expand application appeal.

In August 2021, Alkem Laboratories Ltd. announced the U.S. launch of its Ibuprofen and Famotidine Tablets (800 mg/26.6 mg) after receiving FDA approval. The product is an AB-rated generic equivalent to Horizon Medicines LLC’s Duexis® Tablets (800 mg/26.6 mg).

Arthritis & Musculoskeletal Pain forms the second-largest application segment, supported by rising prevalence of osteoarthritis, sports injuries, occupational strain injuries, and age-related joint deterioration. Global arthritis cases continue to rise, with millions of individuals experiencing joint pain severe enough to require regular analgesic therapy. Other Applications include menstrual pain management, dental pain, post-operative discomfort, fever reduction, and general inflammatory conditions.

End-User Analysis

Pharmaceutical & Biopharmaceutical Companies represent the largest end-user segment accounting for 77.5% market share in 2024 as they purchase Ibuprofen API to produce oral solids, suspensions, gels, and combination medicines. The global distribution footprint of Ibuprofen formulations is vast, spanning retail pharmacies, hospitals, hypermarkets, and online drugstores.

High-volume manufacturers rely on consistent API quality, tight impurity limits, validated dissolution performance, and stable supply chains. Regulatory standards such as GMP, ICH Q3D, and pharmacopoeial monographs require rigorous quality assurance, prompting manufacturers to maintain advanced process controls. Ibuprofen remains one of the most frequently produced generic drugs globally, requiring uninterrupted API procurement.

CROs and CMOs form the second-largest segment, driven by increasing outsourcing of drug formulation, scale-up, and packaging activities. Mid-sized pharmaceutical companies increasingly contract external facilities for Ibuprofen product development, stability studies, and production of pilot and commercial batches. Others include academic institutions, research laboratories, veterinary medicine producers, and specialty healthcare providers. Research labs utilize Ibuprofen API in pharmacology experiments, toxicology studies, dissolution testing, and comparative bioavailability research.

Key Market Segments

By Type

- Standard Ibuprofen

- High Potency Ibuprofen

By Application

- Headache & Migraine Relief

- Arthritis & Musculoskeletal Pain

- Other Applications

By End-User

- Pharmaceutical & Biopharmaceutical Companies

- CROs and CMOs

- Others

Drivers

Rising global prevalence of pain-related disorders and increasing OTC analgesic consumption

Rising incidence of pain-related disorders continues to drive Ibuprofen API demand across all major pharmaceutical markets. Headache disorders affect more than half of the global adult population annually, according to the World Health Organization, with migraines ranked among the top causes of disability worldwide.

Tens of millions of outpatient visits in North America and Europe each year are associated with back pain, musculoskeletal injuries, and inflammatory conditions, placing Ibuprofen among the most commonly recommended first-line NSAIDs. Emergency departments routinely administer Ibuprofen for acute headache, sports injuries, and trauma-related pain, contributing to high consumption volumes.

Self-medication trends have accelerated significantly, supported by expanding e-commerce platforms and retail pharmacy penetration. Surveys show that more than 70% of adults use over-the-counter pain relievers for headache or body pain at least once a month, with Ibuprofen ranking among the top preferred choices. Sports participation statistics further reinforce NSAID demand: global sports injuries reach tens of millions annually, with sprains and strains accounting for the majority of cases that benefit from Ibuprofen therapy.

Pediatric populations also contribute heavily, as Ibuprofen remains a standard recommendation for managing fever and mild inflammation in children. Aging populations are another major driver—global estimates indicate that more than one billion people will be aged 65 or older within the next decade, substantially increasing needs for arthritis and chronic pain management therapies that frequently include Ibuprofen formulations.

Restraints

Growing concerns over NSAID-related side effects and rising regulatory scrutiny

Concerns over NSAID-induced gastrointestinal, renal, and cardiovascular complications continue to challenge Ibuprofen market expansion. Medical literature reports that long-term or high-dose NSAID use can contribute to significant gastrointestinal irritation, with millions of ulcer-related cases reported globally each year.

Renal societies estimate that NSAIDs contribute to a notable proportion of acute kidney injury cases, especially among elderly individuals or those already experiencing dehydration or impaired renal function. Cardiovascular risk warnings issued by regulatory bodies have further intensified scrutiny, advising stricter dosing limits and shorter treatment durations.

Regulators such as the FDA, EMA, and Australia’s TGA have implemented increasingly stringent impurity standards under evolving pharmacopoeial monographs, requiring Ibuprofen API manufacturers to maintain ultra-low thresholds for residual solvents, genotoxic impurities, and catalyst-derived contaminants. Compliance with ICH Q3D guidelines places additional pressure on producers to monitor elemental impurities using advanced analytical instrumentation.

Furthermore, volatility in raw-material supply for key intermediates such as isobutylbenzene results from shutdowns at chemical plants, stricter environmental controls, and petrochemical sector fluctuations. Studies indicate that over 40 percent of global chemical plants producing aromatic intermediates report operational disruptions annually due to environmental and regulatory audits. These factors collectively increase quality compliance costs, reduce operating margins, and complicate production scalability for Ibuprofen API suppliers.

Opportunities

Development of advanced delivery systems and growth of combination therapies

Emerging innovation in drug-delivery science provides major opportunities for Ibuprofen API advancement. Rapid-dissolve tablets, effervescent formats, and liquid-filled soft gels continue to gain consumer preference due to faster symptom relief and improved swallowability. Clinical studies demonstrate that liquid-filled capsules can achieve significantly faster absorption rates than traditional tablets, enhancing early-phase analgesic effects.

Pediatric medicine also offers strong opportunities as global birth rates in Asia and Africa remain high, generating long-term demand for flavored suspensions, mini-tablets, chewable formats, and calibrated-dose droppers. Combination therapies represent one of the fastest-growing opportunities. Ibuprofen combined with acetaminophen has shown superior pain relief compared to monotherapy in multiple randomized studies, especially for dental and post-surgical pain.

Combinations with antihistamines support upper respiratory infection symptom management, while formulations with caffeine enhance migraine relief. Regions experiencing high seasonal flu activity and increasing rates of viral infections contribute substantially to dual-ingredient analgesic demand.

Digital health adoption amplifies this opportunity. Telemedicine consultations surged dramatically worldwide, leading to increased online prescriptions for common analgesics. E-pharmacy penetration now exceeds 60 percent in several Asian metropolitan regions, accelerating sales of Ibuprofen formulations.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic shifts, trade policy changes, and geopolitical disruptions significantly influence the Ibuprofen API supply chain. Many key intermediates and starting materials are concentrated in specific Asian manufacturing hubs, making supply continuity sensitive to export regulations, currency fluctuations, and political instability. Environmental compliance requirements for chemical synthesis facilities, including restrictions on solvent emissions and waste disposal, can slow production and increase costs.

Geopolitical trade tensions may cause tariff fluctuations or cross-border transport delays, affecting international pharmaceutical companies that depend on uninterrupted API shipments. Global health emergencies can dramatically increase demand for fever-relief medications, creating temporary supply shortages. Workforce disruptions in manufacturing clusters, port congestion, and rising freight costs all impact API availability. Additionally, inflationary pressure on raw materials such as catalysts, solvents, and petroleum-derived intermediates influences overall production economics for Ibuprofen manufacturers.

Latest Trends

Shift toward high-purity APIs, sustainable manufacturing, and advanced synthesis technologies

A strong trend influencing the Ibuprofen API market is the shift toward high-purity grades that meet progressively stricter international standards. Pharmacopoeial updates continue to redefine allowable impurity limits, prompting manufacturers to adopt advanced catalytic processes, continuous-flow reactors, and multi-stage purification systems. Continuous-flow technologies have demonstrated the ability to reduce impurity formation by more than 50 percent in certain reaction pathways while increasing batch consistency and lowering energy consumption.

Sustainability has also become a major trend. Chemical manufacturers are increasingly adopting solvent-recovery systems capable of capturing up to 90% of organic solvents used in Ibuprofen synthesis. Green-chemistry initiatives emphasize catalyst recycling, lower-waste reaction routes, and biodegradable processing aids. Several large pharmaceutical ecosystems in Europe and Japan have already begun implementing environmental-impact scoring for API procurement, incentivizing greener Ibuprofen production.

Micronization technologies are another prominent trend. Particle size reduction improves dissolution performance, supporting fast-acting formulations and enhanced bioavailability products. Market demand is rising for micronized Ibuprofen API due to its suitability for advanced delivery systems including orally disintegrating tablets, thin films, and high-absorption soft gels.

Regional Analysis

North America is leading the Ibuprofen API Market

North America remains the leading region accounting for 37.2% market share in 2024 due to high NSAID consumption rates, widespread use of OTC pain medications, and strong pharmaceutical manufacturing capacity. The region sees substantial outpatient visits annually for headache, back pain, and musculoskeletal disorders, all contributing to Ibuprofen demand.

Large pharmacy networks and e-commerce platforms increase availability of Ibuprofen formulations, while robust regulatory frameworks ensure strict compliance with API quality standards. The region’s aging population contributes to greater prevalence of arthritis and chronic pain conditions.

Advanced R&D facilities, established drug-manufacturing clusters, and increasing investment in continuous-manufacturing technologies further support API consumption. Clinical guidelines frequently recommend NSAIDs as part of first-line therapy for various acute and chronic pain conditions, reinforcing reliance on Ibuprofen-based medicines.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region, supported by expanding pharmaceutical manufacturing capacity, rising NSAID usage, and growing burden of musculoskeletal disorders. Countries such as China and India are major global producers of Ibuprofen API and intermediates, supplying pharmaceutical companies worldwide. Increasing diagnostic activity, growing incidence of fever-related conditions, and large populations contribute to substantial consumption of OTC analgesics.

Economic development is improving access to healthcare and expanding hospital and pharmacy networks. Government initiatives to support domestic drug manufacturing strengthen the API production landscape. Additionally, high volumes of online pharmaceutical sales and rapid adoption of self-medication practices contribute to regional growth. The region’s strong raw-material base, large workforce, and developing chemical-synthesis infrastructure position it as a long-term growth center for Ibuprofen API production and consumption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include BASF, IOL Chemicals and Pharmaceuticals, Solara Active Pharma Sciences, Shasun Pharmaceuticals, SI Group, Xinhua Pharmaceutical, Granules India, Perrigo, Teva API, Tianjin Pharmaceutical, Zhejiang Huahai Pharmaceutical, Hubei Biocause Pharmaceutical, Enantiotech, Bioford Remedies, and Other key players.

BASF is widely recognized as one of the most advanced producers of Ibuprofen API, leveraging decades of expertise in chemical synthesis and process optimization. The company’s integrated production facilities are designed to deliver high-purity Ibuprofen through advanced catalytic routes and rigorous purification processes.

BASF’s focus on quality management systems and compliance with major pharmacopoeias has enabled it to maintain strong relationships with multinational pharmaceutical corporations that rely on consistent API performance for both generic and branded products. IOL Chemicals and Pharmaceuticals has established itself as a major global supplier of Ibuprofen API and related intermediates, with a vertically integrated approach that enhances reliability and cost efficiency. Its production model encompasses upstream raw-material management, controlled synthesis, and post-synthesis purification to meet exacting regulatory standards.

Solara Active Pharma Sciences positions itself as a specialized API manufacturer with distinct strengths in high-purity production and stringent process controls. The company’s focus on advanced crystallization techniques, solvent management, and impurity reduction aligns closely with evolving pharmacopoeial standards adopted by regulatory authorities globally.

Top Key Players

- BASF

- IOL Chemicals and Pharmaceuticals

- Solara Active Pharma Sciences

- Shasun Pharmaceuticals

- SI Group

- Xinhua Pharmaceutical

- Granules India

- Perrigo

- Teva API

- Tianjin Pharmaceutical

- Zhejiang Huahai Pharmaceutical

- Hubei Biocause Pharmaceutical

- Enantiotech

- Bioford Remedies

- Other key players

Recent Developments

- In October 2025, Cumberland Pharmaceuticals Inc., a specialty pharmaceutical company, announced that its ibuprofen injection has received regulatory approval in Mexico. The approval is aligned with the company’s partnership with PiSA Farmacéutica, which holds exclusive rights to supply and distribute the product in the country. Under the collaboration, Cumberland provides regulatory and manufacturing support, while PiSA managed the approval process and will oversee the product’s launch in the Mexican market.

- In May 2025, IOL Chemicals and Pharmaceuticals Limited (IOL), a producer of APIs and specialty chemicals, received regulatory approval from China’s Center for Drug Evaluation (CDE) under the National Medical Products Administration (NMPA) for its Ibuprofen API. This authorization enables IOL to export Ibuprofen to China, representing a significant step in its global expansion strategy.

- In November 2022, Solara Active Pharma Sciences Limited (Solara), a major pure-play API manufacturer, announced that its new multipurpose API plant in Visakhapatnam, Andhra Pradesh, received a Certificate of Suitability (CEP) from the European Directorate for the Quality of Medicines (EDQM) for Ibuprofen API production. This marks the facility’s first international regulatory approval.

Report Scope

Report Features Description Market Value (2024) US$ 689.3 Million Forecast Revenue (2034) US$ 1070.5 Million CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Standard Ibuprofen and High Potency Ibuprofen), By Application (Headache & Migraine Relief, Arthritis & Musculoskeletal Pain and Other Applications), By End-User (Pharmaceutical & Biopharmaceutical Companies, CROs and CMOs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF, IOL Chemicals and Pharmaceuticals, Solara Active Pharma Sciences, Shasun Pharmaceuticals, SI Group, Xinhua Pharmaceutical, Granules India, Perrigo, Teva API, Tianjin Pharmaceutical, Zhejiang Huahai Pharmaceutical, Hubei Biocause Pharmaceutical, Enantiotech, Bioford Remedies, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF

- IOL Chemicals and Pharmaceuticals

- Solara Active Pharma Sciences

- Shasun Pharmaceuticals

- SI Group

- Xinhua Pharmaceutical

- Granules India

- Perrigo

- Teva API

- Tianjin Pharmaceutical

- Zhejiang Huahai Pharmaceutical

- Hubei Biocause Pharmaceutical

- Enantiotech

- Bioford Remedies

- Other key players