Global Hypersonic Aircraft Market Size, Share, Statistics Analysis Report By Type (Military Jet, Commercial Plane), By Component (Propulsion (Scramjet Engine, Ramjet Engine, Rocket Engine, Hybrid Engine), Aerostructure (Airframe Structure, Wing and control surface, Nose cone and leading edge), Avionics (Flight control system, Navigation System, Communication system, Others), By End Use (Space Agencies, Military & Defense, Commercial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141398

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

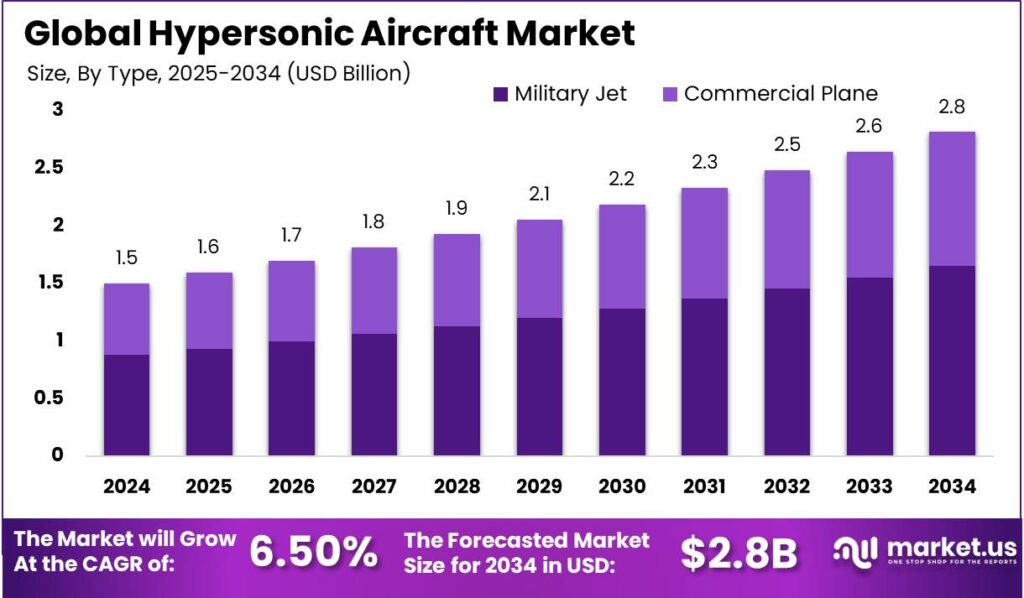

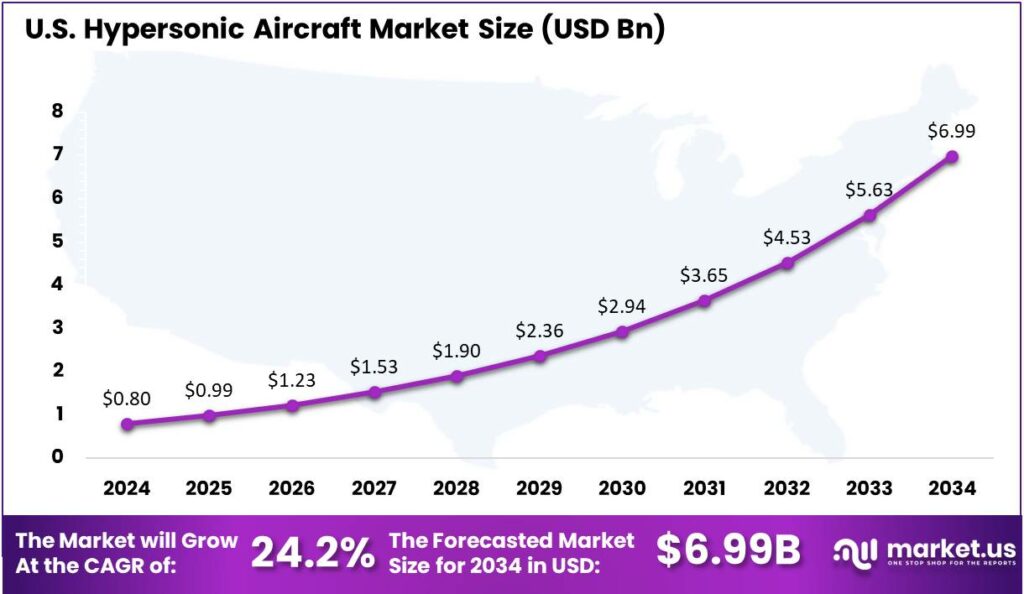

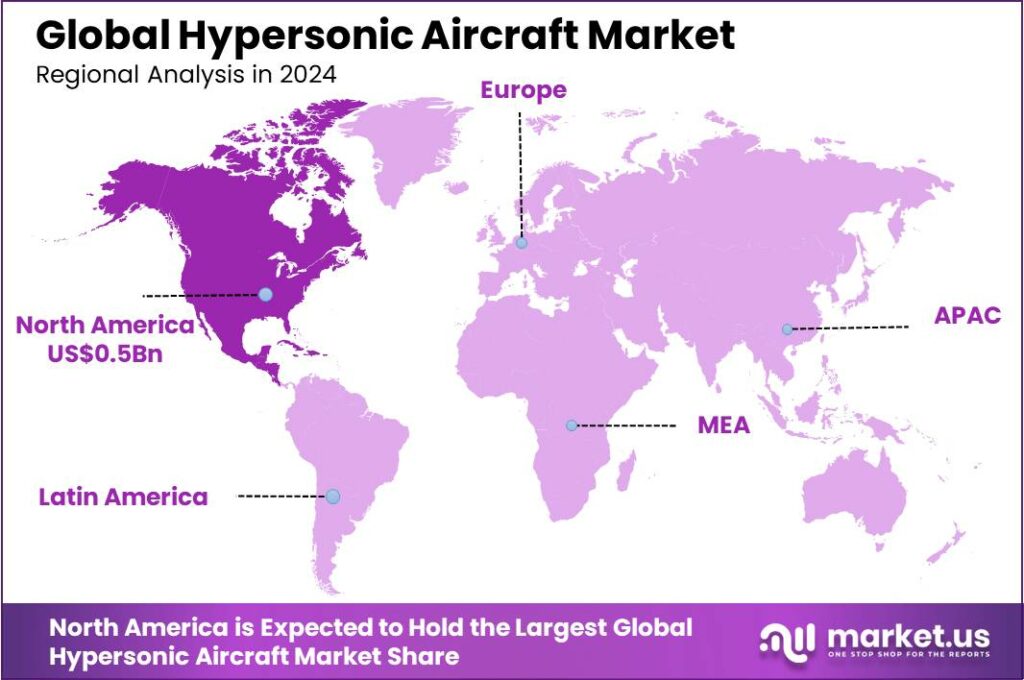

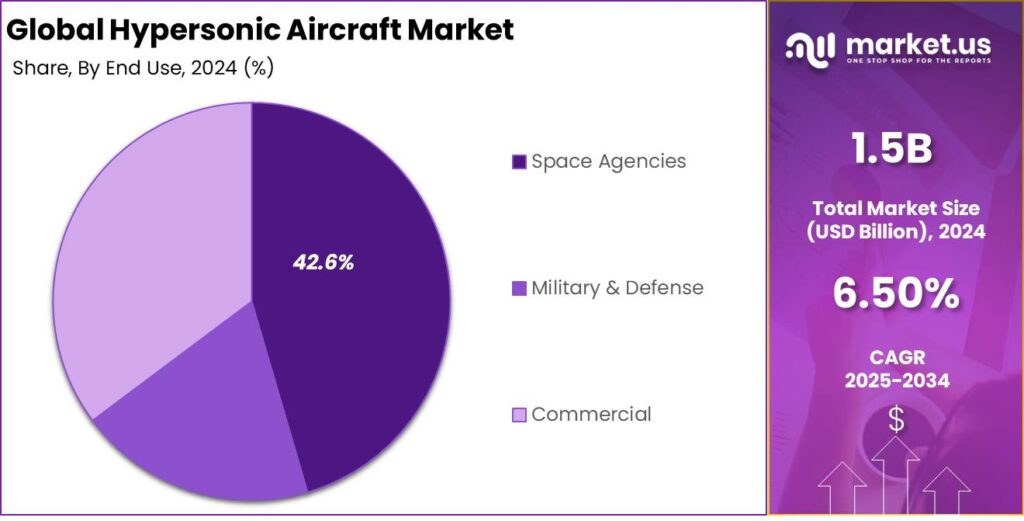

The Hypersonic Aircraft Market size is expected to be worth around USD 2.8 Bn By 2034, from USD 1.5 Bn in 2024, growing at a CAGR of 6.50% during the forecast period from 2025 to 2034. In 2024, North America held over 37.4% of the global hypersonic aircraft market, with an estimated revenue of USD 0.5 bn. The U.S. hypersonic aircraft market was valued at USD 0.80 bn and is expected to grow at a CAGR of 24.2% during the forecast period.

Hypersonic aircraft travel at speeds greater than Mach 5 (3,836 mph or 6,174 km/h), enabling ultra-fast long-distance flights. This technology offers significant advancements for both civilian and military applications, including fast passenger flights, rapid cargo transport, and advanced defense systems.

The market is set for growth, driven by aerospace innovations and increasing demand from defense and commercial sectors, transforming air travel and defense capabilities. The rapid growth of the hypersonic aircraft market is driven by the demand for faster, more efficient transportation in both military and commercial sectors. Hypersonic aircraft can drastically reduce flight times, attracting interest from airlines and governments.

Advancements in materials science and propulsion systems, like scramjets and heat-resistant materials, have made hypersonic vehicles more feasible. Geopolitical tensions and the need for stronger defense capabilities are driving investments in hypersonic weapon systems, particularly by the U.S., Russia, and China.

Meanwhile, the development of commercial hypersonic flights offers new revenue opportunities for the aerospace industry, with companies like SpaceX and Boeing exploring faster passenger travel. A key trend in the hypersonic aircraft market is the development of hybrid propulsion systems, combining air-breathing engines and rocket-based systems for greater efficiency.

According to Market.us, The aircraft market is on an upward trajectory, with projections showing it will swell from USD 414.8 billion in 2023 to USD 596.5 billion by 2033. This growth, averaging a steady 3.7% annually, reflects continuous innovation and expanding global travel demands. North America leads the charge, holding a robust 43.2% market share. In 2023 alone, the region generated a significant USD 179.19 billion, underscoring its pivotal role in the global market landscape.

Shifting focus to the refueling aircraft sector, it too is experiencing significant growth. From a value of USD 13.1 billion in 2023, it’s expected to climb to USD 20.2 billion by 2033, marking a 4.40% annual growth rate. North America remains a key player here, commanding over 41% of the market share and bringing in about USD 5.4 billion in revenue last year. This segment benefits from the increasing demand for efficient and rapid refueling services, essential for military and commercial operations alike.

Meanwhile, the hydrogen aircraft market is making groundbreaking strides. With a base of USD 425.4 million in 2023, it’s forecasted to skyrocket to USD 6,380.1 million by 2033, thanks to an impressive 31.1% compound annual growth rate. This surge reflects the industry’s push towards sustainable aviation solutions. In 2023, North America already carved out over 40% of this market, translating to revenues of USD 170.2 million.

The hypersonic aircraft market is expanding due to military and commercial applications. Military investments in hypersonic weapons are driving growth, especially for defense contractors. On the commercial side, advancements in technology enable the development of ultra-fast passenger aircraft, potentially disrupting global travel by reducing flight times and boosting market growth.

Technological innovation is key to the hypersonic aircraft market, with advancements in propulsion, materials, and avionics. Scramjet engines enable sustained hypersonic speeds, while improved thermal protection systems safeguard aircraft from intense heat. Additionally, innovations in flight control systems enhance navigation and stability, ensuring safe, reliable operations at high speeds.

Key Takeaways

- The Global Hypersonic Aircraft Market is expected to reach USD 2.8 Billion by 2034, growing from USD 1.5 Billion in 2024, at a CAGR of 6.50% during the forecast period from 2025 to 2034.

- In 2024, the Military Jet segment held a dominant market share in the hypersonic aircraft market, capturing more than 58.7% of the total market share.

- The Propulsion segment also held a leading position in 2024, commanding over 36.7% of the hypersonic aircraft market.

- The Space Agencies segment dominated the hypersonic aircraft market in 2024, with a share of more than 42.6%.

- North America captured a leading position in the hypersonic aircraft sector in 2024, holding more than 37.4% of the global market share, amounting to an estimated revenue of USD 0.5 billion.

- The U.S. hypersonic aircraft market was valued at USD 0.80 billion in 2024 and is projected to grow at a robust CAGR of 24.2% during the forecast period.

U.S. Hypersonic Aircraft Market

The U.S. hypersonic aircraft market was valued at USD 0.80 billion in 2024 and is expected to witness a robust compound annual growth rate (CAGR) of 24.2% during the forecast period. This growth is driven by rising demand for advanced defense technologies and significant U.S. government investments in hypersonic R&D.

The U.S. Department of Defense (DoD) is prioritizing the development of hypersonic flight systems, focusing on hypersonic weapons and air-breathing propulsion systems. This strategic emphasis has accelerated research and development, fostering new advancements and applications in defense technology.

The strong market growth is driven by factors like the U.S.’s technological leadership in aerospace and defense. Major defense contractors, including Lockheed Martin, Boeing, and Raytheon Technologies, are deeply involved in hypersonic aircraft programs, utilizing advanced manufacturing and cutting-edge technologies to bring these systems to market.

In 2024, North America held a dominant market position in the hypersonic aircraft sector, capturing more than 37.4% of the global market share, with an estimated revenue of USD 0.5 billion. This leadership is due to significant investments by the U.S. government and private defense contractors in advanced aerospace technologies.

The United States, in particular, has been at the forefront of hypersonic weaponry and aircraft development, primarily driven by defense and national security needs. The Department of Defense’s increasing focus on maintaining technological superiority has propelled R&D activities and collaborations between military agencies and aerospace manufacturers.

The region’s market growth is further bolstered by the presence of key players such as Lockheed Martin, Raytheon Technologies, and Boeing, all of which are actively pursuing hypersonic flight projects. These companies benefit from strong government funding and a favorable regulatory environment that promotes innovation in defense technologies.

The ongoing development of hypersonic cruise missiles and air-breathing propulsion systems further reinforces North America’s position as a market leader, providing a strong foundation for future growth. Additionally, the U.S. government’s push toward modernizing its military infrastructure continues to drive demand for next-generation aerospace systems.

Type Analysis

In 2024, the Military Jet segment held a dominant market position in the hypersonic aircraft market, capturing more than a 58.7% share. This dominance can be attributed to the strategic importance of hypersonic technologies in modern defense systems.

Hypersonic military jets offer unparalleled speed, making them ideal for tactical missions, such as rapid strikes, reconnaissance, and defense penetration. Their ability to travel at Mach 5 and beyond allows them to evade current missile defense systems, making them an attractive asset for military forces worldwide.

The increasing geopolitical tensions, particularly among major powers like the United States, Russia, and China, have escalated the demand for advanced hypersonic weapon systems. As nations focus on strengthening their defense capabilities, military investments in hypersonic technology have surged, further contributing to the segment’s growth.

Another key driver for the dominance of the Military Jet segment is the ongoing advancements in aerospace engineering. Significant investments in propulsion systems like scramjets, alongside innovations in heat-resistant materials, have made the development of hypersonic jets more feasible and cost-effective for military applications.

Component Analysis

In 2024, the Propulsion segment held a dominant market position, capturing more than a 36.7% share of the hypersonic aircraft market. The propulsion systems in hypersonic aircraft are critical for achieving and sustaining the speeds necessary for hypersonic flight, making this segment the most crucial in the overall development of the technology.

A key reason for this dominance is the ongoing focus on advancing propulsion systems such as scramjet engines, ramjet engines, rocket engines, and hybrid engines. These advanced systems are pivotal in overcoming the substantial challenges associated with hypersonic travel, including high-speed air compression, heat management, and propulsion efficiency.

The scramjet engine is one of the primary drivers of this segment’s growth. These engines allow for continuous combustion at hypersonic speeds, enabling aircraft to travel at Mach 5 or higher. Their ability to operate at such high speeds makes them ideal for both military and potential commercial hypersonic applications.

Another contributing factor to the propulsion segment’s dominance is the increasing interest in hybrid propulsion systems, which combine the benefits of both air-breathing engines and rocket-based propulsion. These hybrid systems offer greater fuel efficiency and performance flexibility over a wider range of speeds, making them particularly appealing for long-range hypersonic missions.

End Use Analysis

In 2024, the Space Agencies segment held a dominant position in the hypersonic aircraft market, capturing more than 42.6% of the total market share. This dominance can be attributed to the increasing demand for hypersonic technologies in space exploration and satellite deployment.

Space agencies like NASA, along with other governmental and private organizations, are heavily investing in hypersonic vehicles to reduce travel time and improve space launch efficiency. Hypersonic aircraft could revolutionize space transportation by enabling faster access to space and enhancing re-entry technologies for spacecraft.

Additionally, space agencies are leveraging hypersonic technologies to improve research and development capabilities in both atmospheric and space environments. The ability to travel at hypersonic speeds, coupled with the development of advanced propulsion systems, allows for more efficient testing of space-related technologies.

The segment’s market leadership is fueled by international collaboration toward next-generation space exploration goals. Public-private partnerships and cross-border efforts in the hypersonic space program have sped up innovation, ensuring that hypersonic technologies evolve to meet the pressing needs of space exploration and commercialization.

Key Market Segments

By Type

- Military Jet

- Commercial Plane

By Component

- Propulsion

- Scramjet Engine

- Ramjet Engine

- Rocket Engine

- Hybrid Engine

- Aerostructure

- Airframe Structure

- Wing and control surface

- Nose cone and leading edge

- Avionics

- Flight control system

- Navigation System

- Communication system

- Others

By End Use

- Space Agencies

- Military & Defense

- Commercial

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increased Investment in Defense and Military Sectors

The hypersonic aircraft market is driven by substantial investments in defense and military applications. Governments worldwide are focusing on advancing defense technologies, with hypersonic flight being a key area of interest. Hypersonic aircraft offer a significant advantage in terms of speed and maneuverability, which makes them valuable for military missions, such as rapid response and strike capabilities.

As nations prioritize military modernization and technological superiority, funding for hypersonic research and development is expected to increase. Additionally, the rise in geopolitical tensions and security concerns is prompting countries to invest heavily in hypersonic technologies to ensure defense preparedness in the future. These investments are propelling the development of hypersonic aircraft, thereby fostering market growth.

Restraint

Technological and Engineering Challenges

The development of hypersonic aircraft faces several technological and engineering challenges, which pose substantial restraints to the industry. The extreme speeds involved in hypersonic flight create significant technical hurdles, especially in terms of maintaining aircraft stability and safety.

At speeds beyond Mach 5, the aerodynamic and thermodynamic properties of materials change dramatically, creating issues with heat management and structural integrity. For instance, ensuring that the aircraft remains operational at such high velocities requires advancements in propulsion systems, such as scramjet engines.

These engines are still under development and may take years to perfect, meaning that the full realization of hypersonic aircraft technology is still distant. Additionally, the integration of advanced navigation, communication, and control systems capable of functioning at hypersonic speeds remains an unsolved challenge.

Opportunity

Civilian and Commercial Applications

While the primary focus of hypersonic aircraft has been on military and defense applications, a significant opportunity exists in exploring civilian and commercial uses. The ability of hypersonic aircraft to dramatically reduce travel times opens up the potential for faster air travel, particularly for long-haul flights.

Hypersonic aircraft could cut continent travel times from hours to minutes, benefiting both business and leisure. With increasing interest in sustainability, these aircraft also present an opportunity for eco-friendly, low-impact transportation.

As research progresses, hypersonic aircraft could be deployed for commercial airliners, leading to new revenue streams in the aviation sector and enhancing global connectivity. This expanding market potential is likely to accelerate investment in the development of both military and civilian hypersonic technologies.

Challenge

Regulatory and Safety Concerns

The rapid development of hypersonic aircraft presents a significant challenge related to regulatory and safety concerns. Governments and international regulatory bodies will face difficulties in setting standards for the safe operation of hypersonic aircraft due to their extreme speeds, high temperatures, and complex technologies.

The challenge lies not only in creating technical safety standards but also in ensuring that hypersonic aircraft can be integrated into existing airspace infrastructure. Given the high velocity and unpredictability of hypersonic travel, maintaining passenger and cargo safety during both regular operations and emergencies could prove to be an immense hurdle.

Additionally, there are concerns about the environmental impact of hypersonic aircraft, particularly the potential for noise pollution and atmospheric disruptions due to the high-altitude speeds.

Emerging Trends

Recent developments in hypersonic technology have been driven by advances in materials science, propulsion systems, and aerodynamics. Additionally, air-breathing engines, which do not require an oxidizer like traditional rockets, are becoming more viable for sustained hypersonic flight.

One of the most notable trends is the increasing investment from governments and private enterprises in hypersonic technologies. Governments, particularly in the U.S., China, and Russia, are heavily funding research to develop military hypersonic weapons and aircraft capable of rapid global reach.

For the commercial sector, the interest in hypersonic travel lies in drastically reducing flight times. Companies are exploring how to apply hypersonic technology to passenger aircraft, aiming to cut long-haul flight times by several hours. This could transform the way global business and tourism operate, offering unparalleled speed and convenience.

Business Benefits

One of the most obvious advantages is the potential reduction in travel time. A hypersonic aircraft could drastically reduce international flight times, enabling businesses to expand their global reach. Companies involved in international trade would benefit from faster cargo transport, reducing supply chain bottlenecks and improving inventory management.

The ability to conduct rapid long-distance travel would also offer a substantial advantage for corporate leaders and executives who require frequent, long-haul travel. Hypersonic speeds would allow business professionals to attend global meetings in a day, simplifying international operations and negotiations without the current flight time constraints.

Additionally, there are significant economic implications for defense contractors. Hypersonic technology could create new revenue streams for aerospace and defense companies, while driving innovation in propulsion, materials, and engineering, fostering growth in high-tech sectors.

Key Player Analysis

The hypersonic aircraft market is an exciting and rapidly growing segment in the aerospace industry, with several key players working on cutting-edge technologies.

Aerojet Rocketdyne Holdings, Inc. is a prominent player in the hypersonic aircraft market, specializing in propulsion systems. The company is known for its work in rocket engines and propulsion technology, which plays a vital role in hypersonic flight.

AeroVironment, Inc. is another key player in the hypersonic aircraft market, focusing on advanced unmanned aerial vehicles (UAVs) and cutting-edge aerospace technologies. Known for its expertise in drone systems, AeroVironment has been actively involved in hypersonic vehicle development, particularly in the military space.

Airbus, one of the largest aerospace manufacturers globally, is also deeply involved in the development of hypersonic aircraft. Known for its work in both commercial and military aviation, Airbus is exploring hypersonic technologies to enhance future air travel. The company is focusing on creating aircraft that can travel at ultra-high speeds while maintaining safety and efficiency.

Top Key Players in the Market

- Aerojet Rocketdyne Holdings, Inc.

- AeroVironment, Inc.

- Airbus

- BAE Systems

- Blue Origin

- Boeing

- Dynetics, Inc.

- General Dynamics Corporation

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies

- Lockheed Martin Corporation

- MBDA

- Mitsubishi Heavy Industries

- Northrop Grumman Corporation

- Orbital ATK

- Raytheon Technologies Corporation

- Reaction Engines Limited

- Saab AB

- SpaceX

- Thales Group

- Others

Top Opportunities Awaiting for Players

- Military Applications and Defense Contracts: The defense sector is one of the largest drivers of hypersonic aircraft development. Governments worldwide are investing heavily in hypersonic technologies for national security, leading to lucrative defense contracts for companies that can deliver advanced solutions. The U.S., China, and Russia are leading the race in military hypersonics, with high demand for both missile and aircraft platforms.

- Commercial Air Travel Efficiency: With the increasing demand for faster air travel, hypersonic aircraft have the potential to revolutionize the commercial aviation industry. Companies focused on developing hypersonic passenger planes could tap into a niche market that offers unparalleled speed, cutting flight times significantly.

- Technological Innovations in Propulsion Systems: The development of advanced propulsion technologies, such as scramjet engines, is key to enabling practical hypersonic flight. Companies that specialize in propulsion system innovations stand to benefit greatly from the increased focus on hypersonic capabilities. These innovations could also impact broader aerospace sectors, including satellite launches and space exploration.

- Strategic Partnerships for Research and Development: Collaboration between private firms and government entities will be essential to overcoming the technological and financial challenges in hypersonic aircraft development. Forming strategic partnerships can provide access to funding, infrastructure, and expertise, accelerating the development timeline and market penetration.

- Global Supply Chain for Hypersonic Components: As the hypersonic industry grows, there will be increased demand for specialized materials and components, such as heat-resistant alloys, advanced composites, and high-performance avionics. Companies in these sectors that can supply components for hypersonic aircraft will find significant growth potential in providing critical parts and systems to aircraft manufacturers.

Recent Developments

- In December 2024, China’s hypersonic jumbo aircraft, in a groundbreaking test in the Gobi desert, hit an astonishing Mach 6, paving the way for a revolutionary flight that could travel from Beijing to New York in just two hours.

- In February 2025, Embry-Riddle researchers, backed by a $1.4 million contract from the U.S. Department of Defense, are developing a device to simulate the intense stress and heat of hypersonic flight, enabling more efficient and cost-effective material testing for hypersonic vehicles.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 2.8 Bn CAGR (2025-2034) 6.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Military Jet, Commercial Plane), By Component (Propulsion (Scramjet Engine, Ramjet Engine, Rocket Engine, Hybrid Engine), Aerostructure (Airframe Structure, Wing and control surface, Nose cone and leading edge), Avionics (Flight control system, Navigation System, Communication system, Others), By End Use (Space Agencies, Military & Defense, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aerojet Rocketdyne Holdings, Inc., AeroVironment, Inc., Airbus, BAE Systems, Blue Origin, Boeing, Dynetics, Inc., General Dynamics Corporation, Kratos Defense & Security Solutions, Inc., L3Harris Technologies, Lockheed Martin Corporation, MBDA, Mitsubishi Heavy Industries, Northrop Grumman Corporation, Orbital ATK, Raytheon Technologies Corporation, Reaction Engines Limited, Saab AB, SpaceX, Thales Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hypersonic Aircraft MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Hypersonic Aircraft MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aerojet Rocketdyne Holdings, Inc.

- AeroVironment, Inc.

- Airbus

- BAE Systems

- Blue Origin

- Boeing

- Dynetics, Inc.

- General Dynamics Corporation

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies

- Lockheed Martin Corporation

- MBDA

- Mitsubishi Heavy Industries

- Northrop Grumman Corporation

- Orbital ATK

- Raytheon Technologies Corporation

- Reaction Engines Limited

- Saab AB

- SpaceX

- Thales Group

- Others