Global Hybrid Operating Room Market By Component (Intraoperative Imaging Systems (Fixed Angiography/Fluoroscopy Systems, Intraoperative CT, Intraoperative MRI, Robotic C-Arm Imaging Systems and Others), Operating Room Fixtures (Surgical OR Tables, Surgical Lighting Systems, Ceiling-Mounted Surgical Booms, Radiation Shielding Panels & Drapes and Others), OR Integration & Display Systems and Others), By Application (Cardiovascular & Endovascular Surgery, Neurosurgery, Orthopedic & Trauma Surgery, Thoracic Surgery and Other Surgeries), By End-User (Hospitals and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171914

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

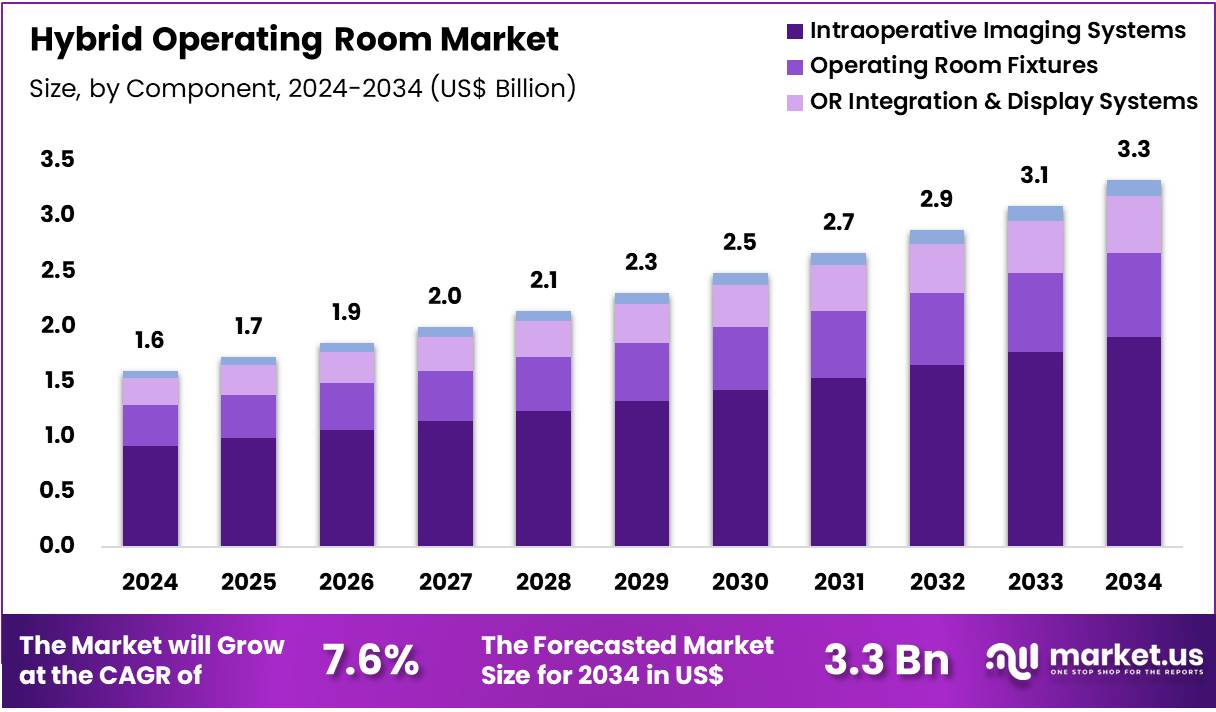

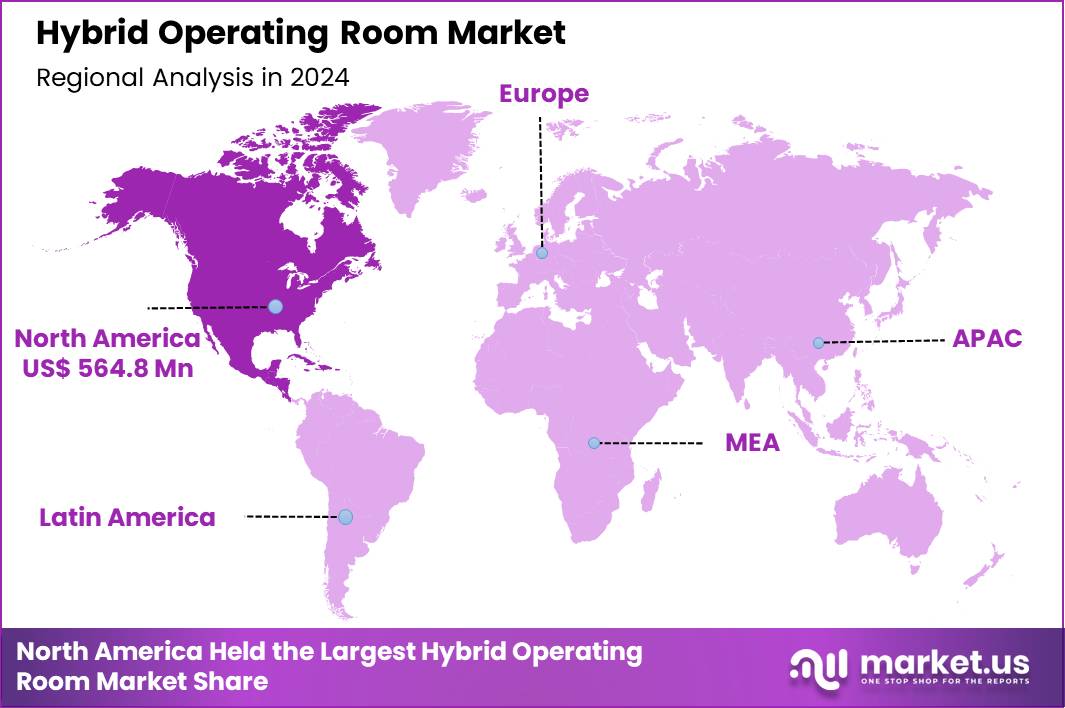

The Global Hybrid Operating Room Market size is expected to be worth around US$ 3.3 Billion by 2034 from US$ 1.6 Billion in 2024, growing at a CAGR of 7.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 35.3% share with a revenue of US$ 564.8 Million.

Growing complexity of surgical interventions drives adoption of hybrid operating rooms that integrate advanced imaging with traditional surgical capabilities for enhanced procedural accuracy and patient safety. Surgeons increasingly utilize these suites for cardiovascular procedures, combining endovascular techniques with open repairs to treat aortic aneurysms and valve disorders efficiently.

These environments support neurosurgical applications by enabling intraoperative MRI guidance during tumor resections and deep brain stimulation placements. Clinicians apply hybrid setups in vascular surgery to facilitate real-time angiography for stent grafting in thoracoabdominal repairs. These rooms accommodate trauma cases, allowing simultaneous diagnostic imaging and emergency interventions without patient transfer.

In June 2024, Getinge introduced the Maquet Corin operating table, marking its entry into fully connected table systems designed specifically for hybrid surgical settings. The table incorporates sensor-based positioning and automated collision-avoidance features that coordinate with fixed imaging equipment such as CT and MRI scanners.

Its radiolucent and modular design allows surgical teams to conduct both minimally invasive and open procedures without repositioning the patient, supporting safer workflows and higher procedural throughput in advanced hybrid operating suites.

Healthcare providers pursue opportunities to incorporate robotic assistance into hybrid operating rooms, expanding precision in thoracic surgeries involving endobronchial valve placements and lung resections. Manufacturers develop modular imaging integrations that broaden applications in orthopedic trauma, supporting fluoroscopy-guided fracture fixations and joint reconstructions. These facilities enable urological interventions by merging cystoscopy with advanced CT navigation for complex stone management and prostate procedures.

Opportunities arise in oncology, where hybrid suites facilitate image-guided biopsies and ablations alongside surgical tumor removals in multidisciplinary settings. Companies advance setups for pediatric congenital corrections, combining echocardiography with minimally invasive repairs for septal defects. Firms invest in expandable configurations that support interventional radiology transitions to surgical completions in biliary and renal obstruction treatments.

Industry specialists deploy artificial intelligence-enhanced navigation systems to optimize real-time decision-making during hybrid cardiovascular and neurosurgical operations. Developers refine ceiling-mounted robotic C-arms that deliver low-dose 3D imaging for intricate vascular and spinal fusion procedures.

Market participants introduce integrated workflow platforms that synchronize surgical tools with intraoperative ultrasound in trauma and thoracic applications. Innovators embed augmented reality overlays to guide catheter placements and implant positioning in endovascular aneurysm repairs.

Companies prioritize radiation-reduction protocols alongside high-resolution displays for prolonged neurosurgical and orthopedic interventions. Ongoing enhancements focus on seamless data interoperability, elevating multidisciplinary performance in complex hybrid environments across diverse surgical disciplines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.6 Billion, with a CAGR of 7.6%, and is expected to reach US$ 3.3 Billion by the year 2034.

- The component segment is divided into intraoperative imaging systems, operating room fixtures, OR integration & display systems and others, with intraoperative imaging systems taking the lead in 2024 with a market share of 57.3%.

- Considering application, the market is divided into cardiovascular & endovascular surgery, neurosurgery, orthopedic & trauma surgery, thoracic surgery and other surgeries. Among these, cardiovascular & endovascular surgery held a significant share of 46.1%.

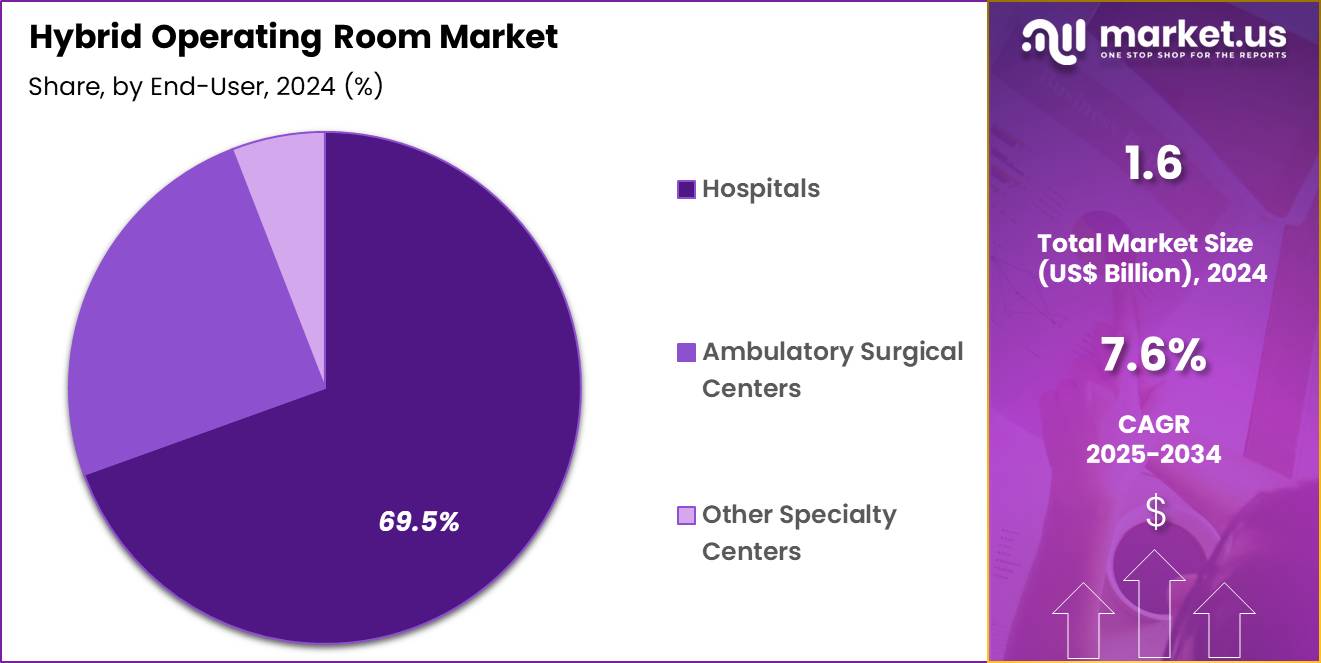

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and ambulatory surgical centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 69.5% in the market.

- North America led the market by securing a market share of 35.3% in 2024.

Component Analysis

Intraoperative imaging systems, holding 57.3%, are expected to dominate because hybrid operating rooms increasingly rely on real time, high resolution imaging to support complex surgical and interventional procedures. Surgeons require immediate visualization during minimally invasive and image guided interventions to improve precision and reduce procedural risks.

The rising adoption of advanced angiography, CT, and MRI integrated imaging strengthens demand for these systems. Hospitals invest in imaging upgrades to handle higher case complexity and improve procedural outcomes. Integration with navigation and robotic systems further enhances clinical efficiency.

Growing preference for single room diagnosis and treatment workflows accelerates imaging system adoption. Technological improvements that reduce radiation exposure and improve image clarity increase clinician acceptance. These factors keep intraoperative imaging systems anticipated to remain the leading component segment.

Application Analysis

Cardiovascular and endovascular surgery, holding 46.1%, is projected to dominate due to the high global burden of cardiovascular diseases and the growing shift toward minimally invasive interventions. Hybrid operating rooms support complex procedures such as transcatheter valve replacements and endovascular aneurysm repairs that require both surgical and imaging capabilities.

Aging populations and rising prevalence of lifestyle related cardiac conditions expand procedure volumes. Surgeons favor hybrid settings to manage complications without transferring patients between rooms. Improved patient outcomes and shorter recovery times strengthen procedural adoption.

Hospitals prioritize cardiovascular programs because they generate high clinical value and revenue. Continuous innovation in endovascular devices increases procedural complexity, reinforcing hybrid OR usage. These drivers keep cardiovascular and endovascular surgery expected to lead application demand.

End-User Analysis

Hospitals, holding 69.5%, are expected to dominate because they manage the highest volume of complex surgeries requiring multidisciplinary collaboration. Large hospitals possess the capital budgets and infrastructure necessary to install and maintain hybrid operating rooms. Tertiary and quaternary care centers use hybrid ORs to support advanced cardiac, neurovascular, and trauma procedures.

Demand for integrated surgical care models aligns with hospital strategies to improve efficiency and patient throughput. Regulatory emphasis on safety and outcome optimization encourages adoption of advanced surgical environments. Teaching hospitals and referral centers further drive utilization through specialized programs. Long term return on investment from high acuity procedures supports continued expansion. These factors keep hospitals anticipated to remain the primary end users.

Key Market Segments

By Component

- Intraoperative Imaging Systems

- Fixed Angiography/Fluoroscopy Systems

- Intraoperative CT

- Intraoperative MRI

- Robotic C-Arm Imaging Systems

- Others

- Operating Room Fixtures

- Surgical OR Tables

- Surgical Lighting Systems

- Ceiling-Mounted Surgical Booms

- Radiation Shielding Panels & Drapes

- Others

- OR Integration & Display Systems

- Others

By Application

- Cardiovascular & Endovascular Surgery

- Neurosurgery

- Orthopedic & Trauma Surgery

- Thoracic Surgery

- Other Surgeries

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Other Specialty Centers

Drivers

Increasing adoption of minimally invasive surgeries is driving the market

The hybrid operating room market is prominently driven by the increasing adoption of minimally invasive surgeries, which leverage integrated imaging and surgical capabilities to enhance procedural precision and patient outcomes. These environments combine advanced angiography systems with traditional operating room infrastructure, facilitating real-time guidance during complex interventions. Surgeons benefit from seamless transitions between diagnostic imaging and therapeutic actions, reducing the need for multiple procedures.

Cardiovascular and neurosurgical applications particularly capitalize on this synergy for endovascular repairs and tumor resections. Patient preferences shift toward techniques offering smaller incisions, shorter hospital stays, and lower complication rates. Healthcare providers invest in hybrid setups to accommodate growing procedural volumes in these modalities. Multidisciplinary teams collaborate more effectively in unified spaces equipped for both open and image-guided approaches.

Technological compatibility with robotic assistance further amplifies procedural efficiency. Global training programs familiarize clinicians with hybrid workflows, promoting broader implementation. Institutional policies prioritize infrastructure upgrades to support evidence-based minimally invasive protocols. Regulatory endorsements for combined modalities reinforce clinical confidence.

Economic models demonstrate cost savings through reduced readmissions and operative times. Ongoing clinical trials validate expanded indications, sustaining momentum. This driver aligns market evolution with advancements in surgical paradigms focused on safety and efficacy.

Restraints

High initial capital investment and installation costs are restraining the market

The hybrid operating room market encounters substantial restraints from the high initial capital investment and installation costs required to equip facilities with integrated imaging systems, surgical tables, and radiation shielding. Comprehensive setups demand significant financial outlays for fixed C-arm angiographers, intraoperative MRI or CT scanners, and compatible operating room fixtures.

Retrofitting existing spaces often involves structural modifications, electrical upgrades, and specialized flooring to accommodate heavy equipment. Procurement of ancillary components like boom-mounted monitors and data integration software adds to expenditures. Smaller hospitals and ambulatory centers face disproportionate barriers due to limited budgets. Financing challenges persist amid competing priorities for healthcare capital allocation. Extended planning phases for architectural compliance delay project initiation.

Vendor contracts include premium pricing for customized configurations and validation services. Maintenance agreements and periodic upgrades impose ongoing financial commitments. Geographic disparities exacerbate access in under-resourced regions. Risk-averse administrators defer investments absent clear volume projections.

Reimbursement models may not fully offset incremental costs for hybrid procedures. These factors collectively moderate adoption rates and constrain market penetration in cost-sensitive environments. Strategic leasing options emerge as partial mitigations, yet fundamental economic hurdles remain influential.

Opportunities

Rising demand for robot-assisted procedures in hybrid settings is creating growth opportunities

The hybrid operating room market presents compelling growth opportunities through the rising demand for robot-assisted procedures, which integrate seamlessly with advanced imaging for enhanced dexterity and visualization. Robotic platforms enable precise manipulations in confined anatomical spaces, complemented by intraoperative fluoroscopy or 3D mapping. Surgeons achieve superior ergonomics and tremor filtration while operating within hybrid environments optimized for multidisciplinary use.

Expansion into orthopedic, urologic, and thoracic applications broadens procedural portfolios. Manufacturers develop compatible interfaces between robotic consoles and ceiling-mounted imaging systems. Clinical evidence supports reduced blood loss and faster recovery in robot-assisted hybrid cases. Training centers incorporate simulation modules tailored to hybrid workflows. Partnerships between robotic developers and imaging providers accelerate system interoperability.

Emerging indications for spinal fusion and prostatectomy drive infrastructure investments. Global reimbursement expansions for robotic techniques incentivize facility upgrades. Academic institutions pioneer hybrid protocols combining robotics with endovascular tools. Intellectual property advancements protect novel integration features. These opportunities foster ecosystem collaboration and position hybrid rooms as platforms for next-generation precision surgery. Sustained innovation cycles promise differentiated capabilities in competitive healthcare landscapes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics bolster the hybrid operating room market as escalating healthcare budgets and surging demand for minimally invasive surgeries compel hospitals to equip advanced suites with integrated imaging and robotic systems for enhanced precision in cardiovascular and neurosurgical procedures. Leading manufacturers strategically expand offerings with AI-driven platforms and modular designs, seizing opportunities from aging demographics and telemedicine integrations to drive adoption across global healthcare networks.

Lingering inflation and economic slowdowns, however, inflate costs for high-tech components and construction, prompting facilities to postpone installations and constrain expansions in financially strained regions. Geopolitical frictions, especially U.S.-China trade disputes and regional conflicts, routinely disrupt supplies of critical electronics and sterilization tools, generating production delays and sourcing uncertainties for internationally reliant producers.

Current U.S. tariffs impose elevated duties on imported medical devices and equipment, particularly from Asian suppliers, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic channels. These tariffs also provoke counter-tariffs from trading partners that curtail U.S. exports of innovative hybrid technologies and impede multinational R&D alliances. Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Enhanced integration of artificial intelligence and robotic systems is a recent trend

In 2025, the hybrid operating room market has manifested a significant trend toward enhanced integration of artificial intelligence and robotic systems to optimize intraoperative decision-making and automation. These advancements incorporate machine learning algorithms for real-time image enhancement, anomaly detection, and predictive analytics during procedures. AI augments robotic arms with adaptive path planning and haptic feedback refined by procedural data.

Hybrid configurations increasingly feature voice-activated controls and augmented reality overlays for surgical navigation. Developers prioritize seamless connectivity between AI platforms and fixed imaging equipment. Clinical implementations demonstrate reduced operative times through automated workflow orchestration. Multidisciplinary teams leverage AI-driven insights for vascular and neurosurgical interventions.

Regulatory frameworks evolve to accommodate validated AI modules in hybrid environments. Pilot programs in leading institutions validate precision gains in complex cases. Cybersecurity protocols strengthen to protect interconnected systems. Training curricula update to include AI literacy alongside robotic proficiency. Vendor ecosystems expand offerings with modular AI upgrades for existing hybrid installations. Ethical guidelines address algorithmic transparency in critical care settings. This trend elevates hybrid operating rooms to intelligent ecosystems promoting consistent, data-informed surgical excellence.

Regional Analysis

North America is leading the Hybrid Operating Room Market

In 2024, North America accounted for 35.3% of the global hybrid operating room market, advanced by escalating requirements for integrated surgical environments that facilitate complex interventional procedures. Surgeons increasingly rely on fixed imaging systems combined with operative capabilities to perform transcatheter aortic valve replacements and endovascular aneurysm repairs, reducing patient transfer risks and procedural durations.

Academic medical centers upgrade facilities with ceiling-mounted angiographic units, supporting multidisciplinary teams in managing structural heart diseases amid rising procedural complexities. Reimbursement frameworks from Centers for Medicare & Medicaid Services encourage investments in robotic-assisted integrations, enhancing precision in thoracic and neurosurgical applications.

Demographic trends toward chronic vascular conditions compel community hospitals to retrofit suites with modular radiation shielding, accommodating volume surges in peripheral interventions. Vendor partnerships streamline installations of 3D rotational angiography, optimizing workflow efficiencies in high-acuity trauma responses.

Professional guidelines endorse intraoperative computed tomography for orthopedic reconstructions, broadening utility beyond cardiovascular domains. These advancements reflect a strategic emphasis on outcome optimization and resource consolidation. The American Heart Association reports that coronary heart disease accounted for substantial cardiovascular mortality in the United States in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Authorities project considerable expansion in hybrid operating room adoption across Asia Pacific during the forecast period, driven by intensifying investments in advanced interventional infrastructure. Cardiology centers in China and India procure multifunctional suites equipped with biplane fluoroscopy, enabling intricate congenital heart defect corrections in pediatric populations.

Health ministries prioritize endovascular suites for stroke thrombectomy programs, addressing rapid urbanization-linked hypertension escalations. Medtech firms localize production of articulated surgical booms, tailoring configurations to space-constrained public hospitals in Southeast Asia. Regional consortia standardize training on fusion imaging overlays, empowering interventionalists to execute hybrid aortic arch repairs with minimized contrast loads.

Economic corridors accelerate technology diffusion, outfitting secondary facilities with portable C-arms for emergent biliary stenting. Policy incentives promote public-private partnerships, scaling deployments for minimally invasive spinal fusions in aging societies. These measures leverage epidemiological imperatives, establishing versatile platforms to confront proliferative cardiothoracic demands. The World Health Organization estimates that cardiovascular diseases caused over 10 million deaths in the South-East Asia and Western Pacific regions combined in recent assessments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the hybrid operating room market drive growth by delivering fully integrated surgical environments that combine advanced imaging, surgical navigation, and minimally invasive capabilities to support complex cardiovascular and neurosurgical procedures. Companies expand adoption through close collaboration with hospitals and surgeons to customize room layouts, workflow design, and technology stacks that improve procedural efficiency and patient outcomes.

Commercial strategies focus on long-term capital equipment contracts, bundled service agreements, and upgrade pathways that protect hospital investments over time. Innovation efforts emphasize interoperability, real-time data integration, and AI-assisted visualization to enhance clinical decision-making during surgery.

Geographic expansion targets tertiary care centers in emerging markets where investment in advanced surgical infrastructure continues to rise. Siemens Healthineers exemplifies leadership through its comprehensive imaging and surgical solutions portfolio, global installation expertise, and strong hospital partnerships that position the company as a preferred provider of hybrid operating room systems worldwide.

Top Key Players

- Siemens Healthineers

- GE Healthcare

- Getinge AB

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Stryker Corporation

- STERIS PLC

- Baxter

- Skytron LLC

- Medical Illumination International, Inc.

- ALVO Medical

- Drägerwerk AG & Co. KGaA

- Cook Medical, Inc.

- Karl Storz SE & Co. KG

- Mizuho Corporation

Recent Developments

- In September 2024, Medtronic plc and Siemens Healthineers disclosed a collaboration aimed at advancing Hybrid Operating Room capabilities. The partnership centers on linking Medtronic’s robotic surgery platforms, including its spine-focused robotic systems, with Siemens’ real-time imaging solutions such as advanced C-arm technologies. By combining robotic guidance with live intraoperative imaging, the approach supports greater procedural accuracy and reduces reliance on follow-up imaging, improving workflow efficiency for complex surgical interventions across hospitals in the US and other regions.

- On November 13, 2024, Philips Healthcare launched an upgraded version of its Azurion interventional system, positioning it as a core technology within next-generation Hybrid Operating Rooms. The platform introduces improved mechanical flexibility of the imaging arm to support rapid switching between two-dimensional and three-dimensional visualization during demanding neurovascular and cardiac procedures. The inclusion of an AI-enabled Service Hub allows continuous system monitoring and predictive maintenance, helping ensure uptime and reliability in environments where uninterrupted imaging performance is critical.

Report Scope

Report Features Description Market Value (2024) US$ 1.6 Billion Forecast Revenue (2034) US$ 3.3 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Intraoperative Imaging Systems (Fixed Angiography/Fluoroscopy Systems, Intraoperative CT, Intraoperative MRI, Robotic C-Arm Imaging Systems and Others), Operating Room Fixtures (Surgical OR Tables, Surgical Lighting Systems, Ceiling-Mounted Surgical Booms, Radiation Shielding Panels & Drapes and Others), OR Integration & Display Systems and Others), By Application (Cardiovascular & Endovascular Surgery, Neurosurgery, Orthopedic & Trauma Surgery, Thoracic Surgery and Other Surgeries), By End-User (Hospitals and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, GE Healthcare, Getinge AB, Koninklijke Philips N.V., Canon Medical Systems Corporation, Stryker Corporation, STERIS PLC, Baxter, Skytron LLC, Medical Illumination International, Inc., ALVO Medical, Drägerwerk AG & Co. KGaA, Cook Medical, Inc., Karl Storz SE & Co. KG, Mizuho Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hybrid Operating Room MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Hybrid Operating Room MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers

- GE Healthcare

- Getinge AB

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Stryker Corporation

- STERIS PLC

- Baxter

- Skytron LLC

- Medical Illumination International, Inc.

- ALVO Medical

- Drägerwerk AG & Co. KGaA

- Cook Medical, Inc.

- Karl Storz SE & Co. KG

- Mizuho Corporation