Global Humate Market Size, Share, And Business Benefits By Type (Potassium Humate, Sodium Humate , Humic Acid Compound, Others), By Form (Powder, Flake, Spherical, Others), By Application (Agriculture, Ecological Bioremediation, Horticulture, Dietary Supplements, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034.

- Published date: August 2025

- Report ID: 156030

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

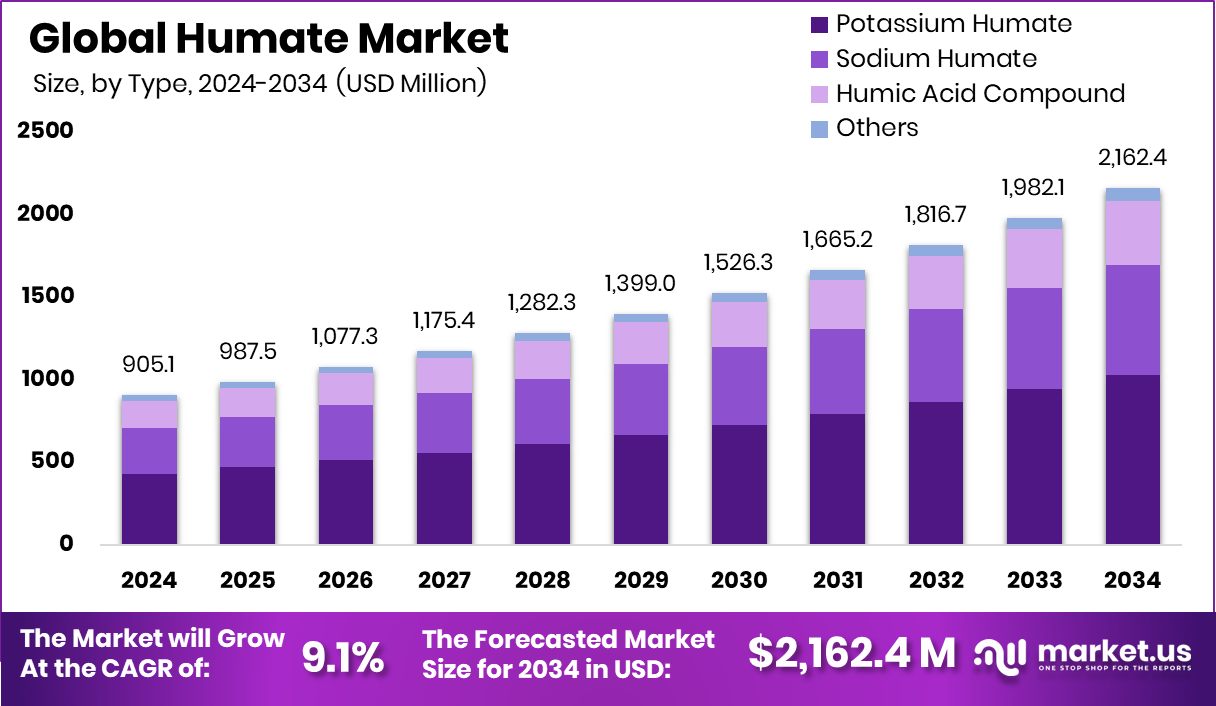

The Global Humate Market is expected to be worth around USD 2,162.4 million by 2034, up from USD 905.1 million in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034. Strong adoption of sustainable farming practices fueled North America’s 45.70% market growth.

Humate is a natural substance formed from the decomposition of organic matter, rich in humic and fulvic acids that improve soil fertility, water retention, and nutrient absorption. It is commonly used in agriculture as a soil conditioner and plant growth enhancer, helping improve crop yield and soil health. Beyond farming, humates are also applied in water treatment, animal feed, and environmental restoration due to their binding and chelating properties.

The humate market refers to the global trade, production, and usage of humate-based products across agriculture, horticulture, landscaping, and other industries. With increasing demand for sustainable farming practices, humates are gaining prominence as eco-friendly soil enhancers that reduce the reliance on chemical fertilizers while supporting higher crop productivity and healthier soils. This trend is supported by rising interest in the broader nutrition and supplement space, where ARTAH Nutrition secured £2.85 million in funding to expand its dietary supplement operations.

One of the major growth factors is the rising push for organic and sustainable farming practices. Farmers are increasingly looking for natural inputs that enrich soil quality without harming the environment, and humates fit perfectly into this trend. Their ability to improve nutrient efficiency and soil structure makes them essential for long-term agricultural sustainability. In parallel, health and nutrition startups are also attracting strong investment, as seen when HealthKart raised USD 153 million in a fresh funding round and Unilever Ventures led a $6 million Series A investment in vitamin brand Perelel Health, reflecting investor confidence in sustainable wellness products.

Demand is further supported by the growing global food requirement. With limited arable land and increasing population pressure, farmers are adopting humates to maximize crop output. Their cost-effectiveness and compatibility with both organic and conventional farming practices strengthen demand across developed and emerging markets.

This wider move toward health and wellness is mirrored in the supplement sector, where Nutrabay obtained $5 million from RPSG Capital and others to boost its supplement business, and GetSupp, a food startup, raised Rs 9.5 crore in funding led by General Catalyst and Better Capital, both indicating expanding opportunities aligned with natural and sustainable products like humates.

Key Takeaways

- The Global Humate Market is expected to be worth around USD 2,162.4 million by 2034, up from USD 905.1 million in 2024, and is projected to grow at a CAGR of 9.1% from 2025 to 2034.

- In 2024, potassium humate dominated the Humate Market, capturing 47.5% due to its strong soil-enhancing properties.

- Powder form held the largest share of 53.7% in the Humate Market, favored for easy application.

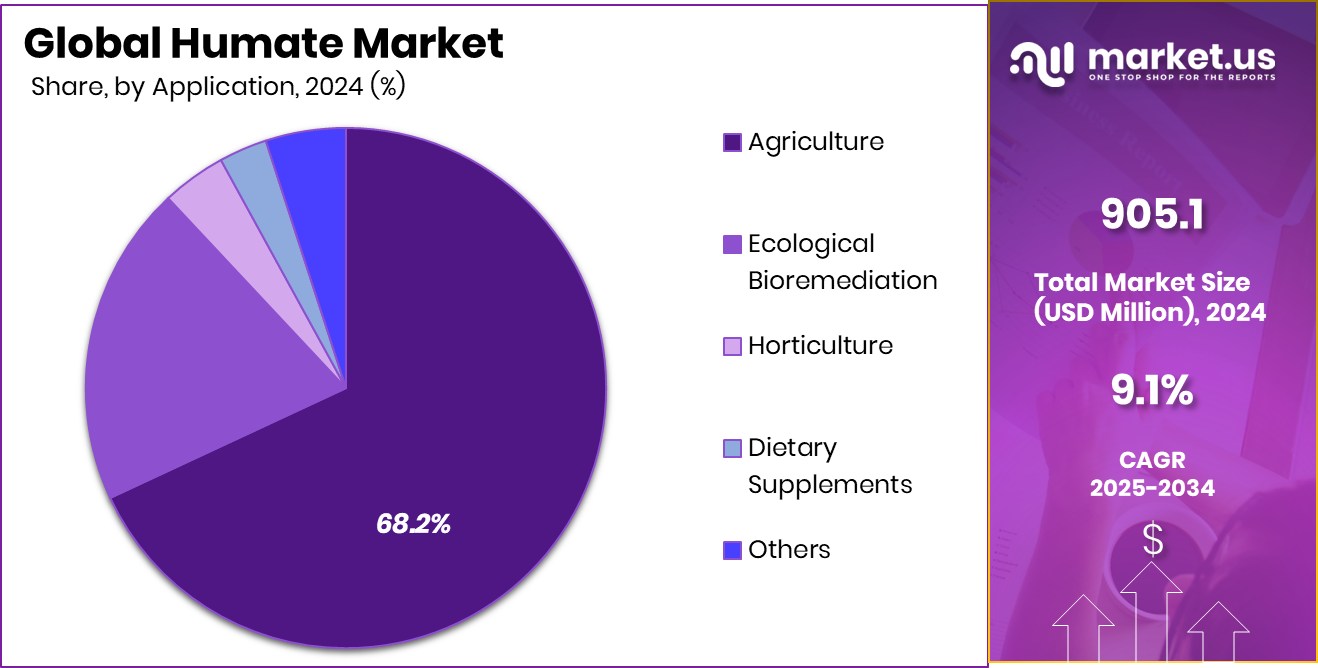

- Agriculture remained the leading application segment in the Humate Market, accounting for 68.2% with rising farming adoption.

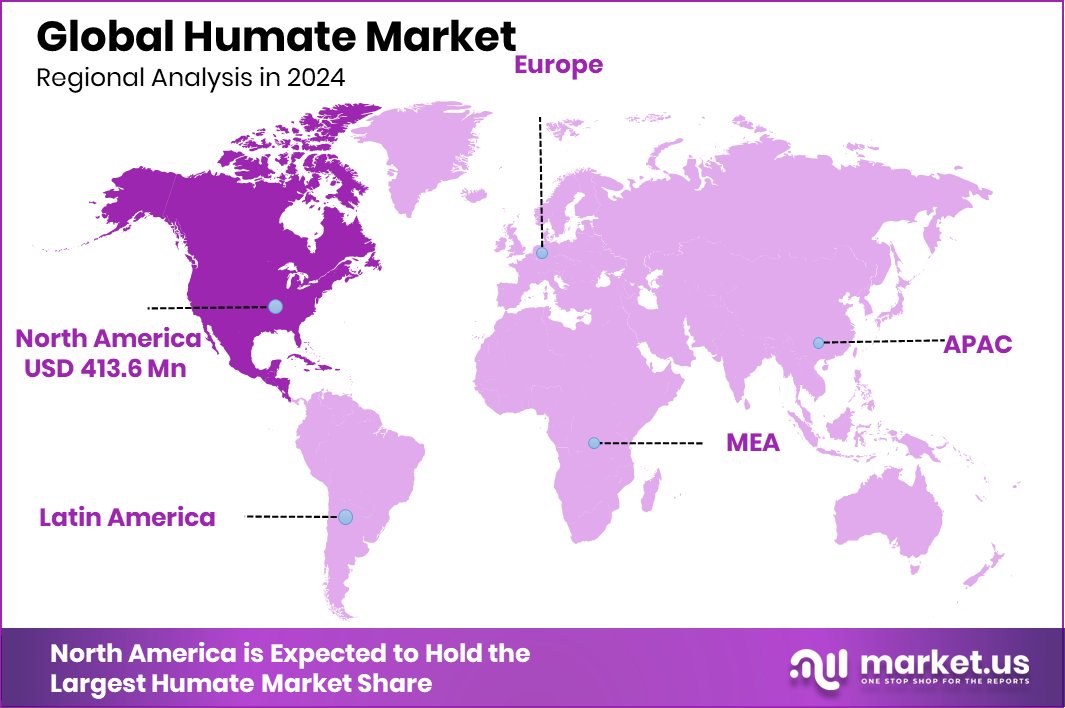

- The North American market was valued at USD 413.6 million in 2024.

By Type Analysis

Potassium Humate leads the Humate Market, holding 47.5% of the global share.

In 2024, Potassium Humate held a dominant market position in the By Type segment of the Humate Market, with a 47.5% share. This strong presence is driven by its widespread application in agriculture as a soil conditioner and plant growth stimulant. Potassium Humate is highly valued for its ability to enhance nutrient uptake, improve soil fertility, and increase crop resilience against stress conditions such as drought and salinity.

The demand for Potassium Humate is also supported by its solubility, which ensures ease of application through irrigation systems and foliar sprays. Farmers increasingly use it to boost root development, stimulate microbial activity in the soil, and improve the overall quality of produce. Rising awareness of soil health management has further pushed adoption, especially in areas facing soil degradation and declining fertility.

Additionally, Potassium Humate aligns with global initiatives promoting eco-friendly inputs to reduce dependence on chemical fertilizers. Its cost-effectiveness, coupled with its proven benefits for yield enhancement, has positioned it as a leading product in the humate market. This trend is expected to remain strong as agriculture continues shifting toward sustainable solutions.

By Form Analysis

Powder form dominates humate market applications, accounting for 53.7% of total usage.

In 2024, Powder held a dominant market position in the By Form segment of the Humate Market, with a 53.7% share. This leading position is largely due to the convenience, stability, and versatility that powdered humates offer for agricultural and industrial applications. Farmers prefer powder form because it is easy to store, transport, and blend with other fertilizers or soil conditioners, ensuring consistent performance in the field. Its long shelf life and reduced risk of degradation during storage make it a reliable input across varied climatic conditions, giving it a clear edge over other forms.

Powder humates are widely used in soil application as they improve nutrient absorption, enhance microbial activity, and support better soil structure. Their fine consistency allows uniform mixing with soil and water, ensuring effective penetration and utilization by plants. This has made powdered humates a critical input for crops grown in nutrient-deficient soils or regions struggling with declining soil fertility.

The market growth of powder form is also supported by its cost-effectiveness, as smaller quantities are sufficient to deliver noticeable improvements in crop yield and quality. With growing emphasis on sustainable farming and natural soil enhancers, the powdered form continues to be the most adopted format, reinforcing its leadership in the global humate market.

By Application Analysis

The agriculture sector drives Humate Market growth, capturing 68.2% of the market share worldwide.

In 2024, agriculture held a dominant market position in the by-application segment of the Humate Market, with a 68.2% share. This dominance is primarily driven by the extensive use of humates as soil conditioners and plant growth stimulants in farming. Farmers across the globe are adopting humate-based products to enhance soil fertility, improve nutrient uptake, and promote healthier crop development. The increasing shift toward sustainable and organic farming practices has further boosted demand, as humates provide a natural alternative to synthetic inputs while maintaining soil health over the long term.

The agricultural sector benefits from humates due to their ability to improve water retention, stimulate microbial activity, and reduce the adverse effects of chemical fertilizers. This is particularly important in regions facing soil degradation and water scarcity, where humates help restore productivity and optimize resource use. Their role in strengthening plant resistance against drought, salinity, and disease also adds to their value in modern farming systems.

Furthermore, rising global food demand has intensified the need for higher yields on limited arable land. Humates, by improving crop efficiency and quality, have become a critical input for meeting these challenges. With their proven effectiveness, agriculture continues to remain the largest consumer of humates worldwide.

Key Market Segments

By Type

- Potassium Humate

- Sodium Humate

- Humic Acid Compound

- Others

By Form

- Powder

- Flake

- Spherical

- Others

By Application

- Agriculture

- Ecological Bioremediation

- Horticulture

- Dietary Supplements

- Others

Driving Factors

Rising Shift Toward Sustainable and Organic Farming

One of the strongest driving factors for the humate market is the growing shift toward sustainable and organic farming practices. Farmers and agricultural industries are under pressure to reduce the use of chemical fertilizers and pesticides that degrade soil health and harm the environment.

Humates, being natural soil conditioners rich in humic and fulvic acids, provide an eco-friendly solution that improves nutrient absorption, enhances soil fertility, and boosts crop yields without harmful side effects.

With rising consumer demand for organic food and government initiatives encouraging sustainable agriculture, humates have gained wide acceptance. Their ability to restore degraded soils, improve water retention, and promote microbial activity makes them a crucial input for modern, environmentally responsible farming systems.

Restraining Factors

Limited Awareness and Knowledge Among Small Farmers

A key restraining factor for the humate market is the limited awareness and knowledge among small and medium-scale farmers about its long-term benefits. While large agricultural producers are increasingly adopting humates to improve soil health and crop yields, many smaller farmers remain dependent on conventional fertilizers due to a lack of information, limited training, or misconceptions about cost and effectiveness.

In several regions, farmers are not fully aware of how humates work to improve soil fertility or how to apply them correctly, which slows down adoption. Additionally, the absence of strong extension services or demonstration programs makes it difficult to showcase the real benefits of humates. This knowledge gap continues to act as a barrier to wider market growth.

Growth Opportunity

Expanding Use of Humates in Precision Agriculture

A major growth opportunity for the humate market lies in its expanding use within precision agriculture. As farming increasingly adopts advanced technologies such as soil sensors, controlled irrigation, and data-driven nutrient management, humates are being integrated to maximize efficiency and crop health.

Their ability to improve nutrient uptake and soil structure makes them highly compatible with precision practices that focus on applying the right input at the right time. Farmers can use humates in combination with modern systems to enhance yields while reducing chemical fertilizer dependency.

This integration not only supports sustainable farming goals but also opens new demand in technologically advanced agricultural regions, positioning humates as a key input in the future of smart farming.

Latest Trends

Rising Popularity of Water-Soluble Humate Products

One of the latest trends in the humate market is the rising popularity of water-soluble humate products. Farmers and agricultural businesses are increasingly preferring liquid or water-dissolved humates because they are easier to apply through modern irrigation systems, foliar sprays, and drip methods.

This trend is driven by the need for quick absorption, efficient nutrient delivery, and compatibility with advanced farming techniques. Water-soluble humates not only save time but also reduce wastage, ensuring that plants receive nutrients more effectively.

With agriculture moving toward high-efficiency solutions, the demand for soluble forms of humates is growing steadily. This trend reflects a shift toward convenience, precision, and sustainability, further supporting the long-term expansion of the humate market worldwide.

Regional Analysis

In 2024, North America dominated the Humate Market with a 45.70% share.

The humate market shows a varied regional performance, with North America emerging as the leading region in 2024, holding a dominant 45.70% share valued at USD 413.6 million. This leadership is strongly supported by the region’s high adoption of sustainable agricultural practices, growing organic farming acreage, and government-backed initiatives encouraging eco-friendly soil enhancers.

Farmers in the U.S. and Canada are increasingly integrating humates into crop management to improve soil fertility, water retention, and overall crop yield, particularly in areas facing soil degradation. Europe follows closely, supported by strict regulations promoting organic farming and environmental sustainability, which drive demand for humate-based products across major agricultural economies like Germany, France, and Spain.

Asia Pacific is witnessing rapid growth fueled by the need to improve productivity on limited arable land and rising awareness of soil health among farmers in India and China. Meanwhile, the Middle East & Africa region is gradually adopting humates to address soil salinity and water scarcity challenges, while Latin America, led by Brazil and Mexico, benefits from strong agricultural exports and rising use of bio-based inputs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ACTAGRO, known for its focus on soil and plant health solutions, continues to strengthen its presence through humate-based formulations that enhance nutrient efficiency and improve soil fertility. The company’s emphasis on developing products tailored for sustainable farming makes it a key contributor to meeting the rising demand for eco-friendly agricultural inputs. Its expertise in soil health management positions it strongly in markets where crop productivity and resource efficiency are top priorities.

Bayer AG, a global leader in agricultural sciences, has been strategically integrating humates into its crop solutions portfolio to align with its broader sustainability commitments. By combining humate-based inputs with advanced agronomic practices, Bayer supports farmers in improving yield while reducing dependency on synthetic fertilizers. The company’s global reach and strong investment in research give it an edge in scaling humate applications across diverse regions.

Bioline Corp, with its specialization in biological and organic farming solutions, complements the market by offering humate products that directly support organic certification requirements. Its focus on environmentally safe and sustainable inputs caters to the growing organic farming sector. By aligning with the increasing consumer shift toward chemical-free food production, Bioline Corp strengthens its market relevance.

Top Key Players in the Market

- ACTAGRO

- Bayer AG

- Biolchim SpA

- Bioline Corp

- Borregaard ASA

- Humintech GmbH

- Sikko Industries Ltd

- TAGROW CO. Ltd

Recent Developments

- In June 2024, ACTAGRO’s Humic Acid 10% product gained official approval from California’s CDFA, confirming it as an organic input for certified organic agriculture, strengthening its plant-friendly humate portfolio.

- In March 2024, the EU enacted Commission Implementing Regulation (EU) 2024/749 in March 2024, approving lignosulfonate—used by Borregaard—as a technological additive (binder) in feed for all animal species, complete with content and sugar limitations tied to their fermentation process.

Report Scope

Report Features Description Market Value (2024) USD 905.1 Million Forecast Revenue (2034) USD 2,162.4 Million CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Potassium Humate, Sodium Humate , Humic Acid Compound, Others), By Form (Powder, Flake, Spherical, Others), By Application (Agriculture, Ecological Bioremediation, Horticulture, Dietary Supplements, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ACTAGRO, Bayer AG, Biolchim SpA, Bioline Corp, Borregaard ASA, Humintech GmbH, Sikko Industries Ltd, TAGROW CO. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACTAGRO

- Bayer AG

- Biolchim SpA

- Bioline Corp

- Borregaard ASA

- Humintech GmbH

- Sikko Industries Ltd

- TAGROW CO. Ltd