HPV Testing and Pap Test Market By Product Type (Consumables, Instruments, and Services), By Technology (Molecular Diagnostics, Immunodiagnostics, and Cytology), By Application (Cervical Cancer Screening, and Vaginal Cancer Screening), By Test Type (Pap Test, and HPV Test), By End-user (Hospitals & Clinics, Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162466

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

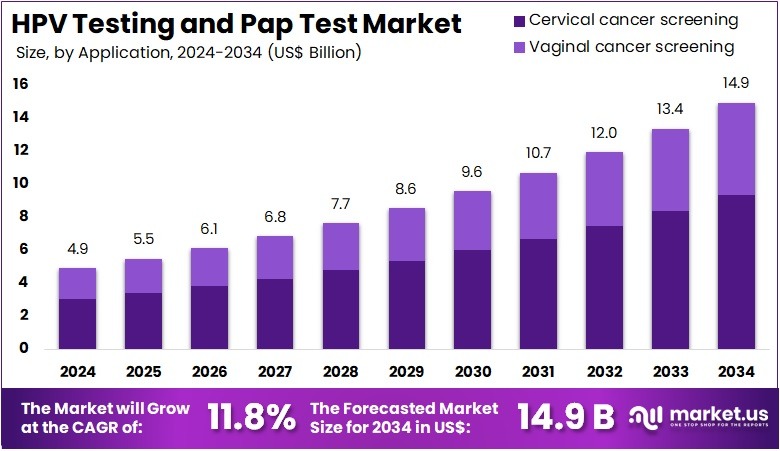

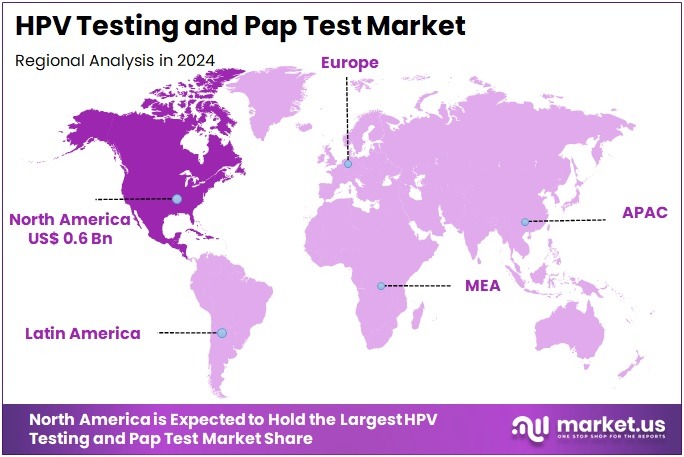

The HPV Testing and Pap Test Market Size is expected to be worth around US$ 14.9 billion by 2034 from US$ 4.9 billion in 2024, growing at a CAGR of 11.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.2% share and holds US$ 0.6 Billion market value for the year.

Increasing global focus on preventive healthcare drives the HPV Testing and Pap Test Market, as stakeholders prioritize early detection of cervical cancer. Clinicians employ HPV testing to identify high-risk viral strains in primary screening, enabling risk stratification in asymptomatic women. Pap tests complement this by detecting abnormal cervical cells, guiding follow-up interventions like colposcopy.

Innovations in molecular diagnostics, such as PCR-based HPV assays, enhance sensitivity and specificity for routine screening. In January 2023, UNICEF launched the Cervical Cancer Toolkit to equip clinics with resources for HPV testing and Pap tests, boosting screening rates in underserved communities. This initiative expands market reach by integrating diagnostics into public health programs, fostering sustained demand.

Growing public awareness of cervical cancer prevention fuels the HPV Testing and Pap Test Market, as advocacy campaigns highlight the importance of regular screening. HPV testing supports triage for abnormal Pap test results, streamlining diagnostic pathways in clinical settings. Pap tests serve as a cornerstone for population-based screening programs, identifying precancerous lesions in diverse patient groups.

Digital cytology advancements accelerate result interpretation, improving efficiency in high-volume labs. In March 2022, the International Papilloma Virus Society hosted a live panel for International HPV Awareness Day, emphasizing HPV vaccination and early detection to drive testing adoption. Such efforts strengthen market demand by encouraging proactive health-seeking behaviors across populations.

Rising investments in diagnostic infrastructure propel the HPV Testing and Pap Test Market, as governments and private entities enhance access to screening services. HPV testing facilitates point-of-care applications in low-resource settings, broadening reach for underserved populations. Pap tests remain integral for confirming dysplasia in secondary care, ensuring accurate diagnosis before treatment.

Automated screening platforms integrate both tests, optimizing workflows for large-scale programs. In December 2024, Nigeria’s government partnered with Abbott Laboratories, Siemens Healthineers, and Tanit Medical Engineering to expand cervical cancer testing infrastructure, increasing availability of HPV testing and Pap tests. This collaboration drives market growth by improving access and uptake, particularly in resource-constrained environments.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.9 billion, with a CAGR of 11.8%, and is expected to reach US$ 14.9 billion by the year 2034.

- The product type segment is divided into consumables, instruments, and services, with consumables taking the lead in 2023 with a market share of 48.7%.

- Considering technology, the market is divided into molecular diagnostics, immunodiagnostics, and cytology. Among these, molecular diagnostics held a significant share of 41.3%.

- Furthermore, concerning the application segment, the market is segregated into cervical cancer screening and vaginal cancer screening. The cervical cancer screening sector stands out as the dominant player, holding the largest revenue share of 62.5% in the market.

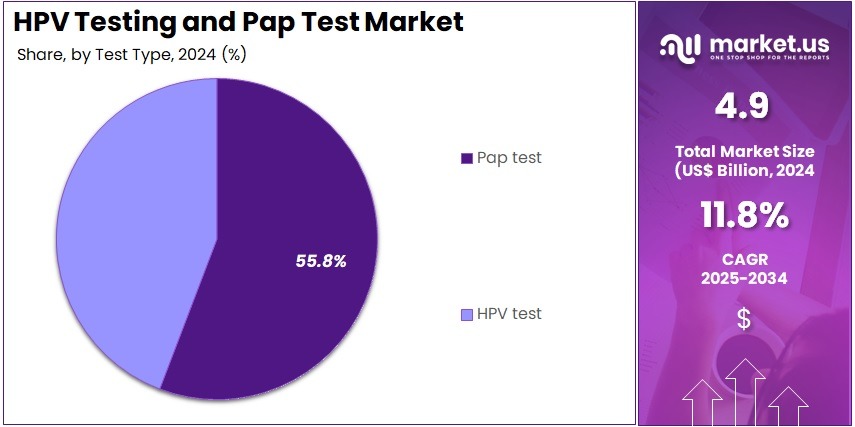

- The test type segment is segregated into pap test and HPV test, with the pap test segment leading the market, holding a revenue share of 55.8%.

- Considering end-user, the market is divided into hospitals & clinics, laboratories, and others. Among these, hospitals & clinics held a significant share of 53.4%.

- North America led the market by securing a market share of 41.2% in 2023.

Product Type Analysis

Consumables account for 48.7% of the HPV Testing and Pap Test market and are expected to maintain strong growth due to their high usage and recurring demand in diagnostic procedures. Consumables include reagents, slides, collection kits, and other essential materials required for performing Pap tests and HPV assays. The rising prevalence of cervical cancer and increased participation in screening programs is likely to drive repeated consumption of these materials.

Hospitals and laboratories increasingly adopt standardized kits and reagents to ensure consistent, accurate results, supporting the dominance of consumables. Technological improvements in reagent stability, sample collection efficiency, and compatibility with automated analyzers are projected to enhance adoption. The expanding number of healthcare facilities and increasing awareness among women regarding routine screening further boosts the need for consumables.

As preventive healthcare initiatives gain traction, consumables are expected to remain the backbone of operational testing. The ease of integration into existing diagnostic workflows ensures ongoing reliance on consumables for efficient testing. Market growth is further strengthened by government-supported cervical cancer screening programs and international health initiatives. Continuous innovation and the rising adoption of multiplex testing kits are likely to sustain demand in this segment. The combination of recurring demand, regulatory endorsement, and improved test reliability positions consumables as a leading product type in the market.

Technology Analysis

Molecular diagnostics hold 41.3% of the technology segment and are anticipated to grow rapidly due to their high accuracy and sensitivity in detecting HPV and other oncogenic markers. Molecular diagnostic platforms, including PCR-based assays, enable early detection of high-risk HPV strains, supporting timely intervention and treatment planning. The increasing prevalence of cervical cancer and the global emphasis on preventive screening programs are expected to drive the adoption of molecular diagnostic solutions.

Advances in automated molecular testing, faster turnaround times, and integration with laboratory information systems enhance efficiency and throughput. Healthcare providers rely on molecular diagnostics to reduce false negatives and improve patient outcomes, particularly in high-risk populations. The growing trend of combining molecular diagnostics with cytology testing, referred to as co-testing, is anticipated to increase market penetration. Expansion in research applications, including biomarker discovery and epidemiological studies, further supports growth.

Molecular diagnostics also offer advantages in point-of-care and centralized testing models, allowing flexibility across healthcare settings. The continuous development of next-generation sequencing (NGS) and multiplex PCR assays is projected to strengthen this segment. Rising awareness among healthcare professionals and patients regarding early detection benefits is likely to fuel adoption. Regulatory approvals and quality standards enhance confidence in molecular diagnostics, reinforcing their dominant position in the market.

Application Analysis

Cervical cancer screening represents 62.5% of the application segment and is expected to continue growing due to increasing global awareness and routine screening initiatives. Screening programs focus on early detection of precancerous lesions and high-risk HPV infections, significantly improving patient outcomes. Hospitals, clinics, and diagnostic laboratories are expanding their screening capacities to address rising female populations at risk.

The adoption of combined Pap test and HPV testing protocols enhances sensitivity and diagnostic accuracy, driving demand for screening solutions. Preventive healthcare campaigns and government-supported initiatives further accelerate patient participation in screening programs. Technological advancements in automated cytology systems, high-throughput molecular platforms, and digital slide analysis are anticipated to improve efficiency and coverage.

The growing availability of self-collection kits and minimally invasive methods is expected to increase participation rates in screening programs. Integration of patient data with electronic health records enhances follow-up care and monitoring. Increasing prevalence of cervical cancer in both developed and developing regions underscores the need for widespread screening, fueling demand.

The focus on reducing cervical cancer mortality through early detection ensures sustained growth in this application segment. Hospitals and clinics remain central to screening implementation, reinforcing adoption. Ongoing research and validation of novel biomarkers support the expansion of screening programs, maintaining its dominance in the market.

Test Type Analysis

Pap tests hold 55.8% of the test type segment and are projected to maintain strong growth due to their proven effectiveness in detecting abnormal cervical cells and precancerous conditions. Healthcare providers continue to rely on Pap cytology as a standard screening method in combination with HPV testing. The high demand for routine preventive screenings and early detection of cervical abnormalities supports the consistent use of Pap tests.

Technological innovations, including liquid-based cytology and automated slide reading, enhance accuracy, throughput, and reproducibility. Hospitals and clinics benefit from standardized Pap testing protocols, which improve patient outcomes and operational efficiency. Increasing patient awareness and government-driven cervical cancer prevention programs contribute to growing adoption. The combination of molecular diagnostics with Pap cytology improves sensitivity, enabling healthcare providers to offer co-testing strategies.

Research initiatives exploring novel cytological markers are expected to expand clinical applications. The ease of integration into laboratory workflows and point-of-care environments ensures ongoing utilization. As screening programs expand globally, the demand for Pap test consumables and instruments is projected to rise, securing its leadership within the market.

End-User Analysis

Hospitals and clinics represent 53.4% of the end-user segment and are expected to remain the largest consumers of HPV and Pap testing due to their central role in patient care and preventive health services. These facilities conduct routine screenings, early diagnostic evaluations, and follow-up testing for cervical and vaginal cancers. Rising awareness among women about the importance of early detection and preventive care drives testing volumes in hospitals and clinics.

The integration of automated cytology and molecular diagnostic systems enhances workflow efficiency, test accuracy, and patient throughput. Hospitals increasingly adopt co-testing approaches, combining HPV testing with Pap cytology, to improve diagnostic confidence and reduce false negatives. Government programs supporting cervical cancer screening further reinforce hospital adoption. Training and availability of specialized personnel contribute to the effective implementation of testing protocols.

Hospitals also serve as referral centers for high-risk and complex cases, ensuring continued demand for diagnostic solutions. The growing emphasis on quality healthcare standards and accreditation requirements motivates hospitals to adopt the latest testing technologies. Expanding hospital infrastructure and capacity to support screening programs sustains the segment’s growth. Partnerships with diagnostic companies and public health initiatives further strengthen hospital dominance in this market.

Key Market Segments

By Product Type

- Consumables

- Instruments

- Services

By Technology

- Molecular Diagnostics

- Immunodiagnostics

- Cytology

By Application

- Cervical Cancer Screening

- Vaginal Cancer Screening

By Test Type

- Pap Test

- HPV Test

By End-user

- Hospitals & Clinics

- Laboratories

- Others

Drivers

Increasing Incidence of Cervical Cancer is Driving the Market

The persistent elevation in cervical cancer diagnoses has intensified the imperative for robust HPV testing and Pap test utilization, as these modalities serve as foundational tools for early detection and intervention. Human papillomavirus, the principal etiologic agent, necessitates vigilant screening to identify high-risk strains before oncogenic transformation occurs. This driver manifests through heightened clinical guidelines advocating routine assessments, particularly in underserved demographics where late-stage presentations predominate.

Public health infrastructures are reallocating resources to fortify diagnostic capacities, recognizing the potential for substantial morbidity reduction via timely cytological and molecular evaluations. The integration of co-testing regimens further amplifies efficacy, enabling comprehensive risk stratification in primary care venues. Epidemiological surveillance underscores the urgency, as incidence patterns reveal disparities influenced by socioeconomic determinants and vaccination gaps.

The Centers for Disease Control and Prevention documented 12,960 new cervical cancer cases in the United States in 2022, reflecting the ongoing burden that sustains demand for accessible screening infrastructures. This figure, derived from national registries, illustrates the clinical imperative for scalable assays amid stable incidence trends.

Innovations in liquid-based cytology have enhanced sample adequacy, mitigating interpretive ambiguities in high-volume laboratories. Economically, proactive deployment averts escalation to advanced therapies, justifying fiscal commitments to test procurement. International alignments with elimination strategies further catalyze domestic expansions, embedding diagnostics within broader oncology frameworks. This oncogenic prevalence not only propels throughput but also fosters interdisciplinary synergies in preventive oncology.

Restraints

Low HPV Vaccination Coverage Rates is Restraining the Market

Suboptimal uptake of the human papillomavirus vaccine continues to curtail the prophylactic impact on screening necessities, perpetuating reliance on diagnostic evaluations amid preventable viral exposures. Recommended for adolescents to forestall oncogenic sequelae, vaccination hesitancy stems from misinformation and access inequities, sustaining infection reservoirs that necessitate vigilant Pap and HPV assessments. This restraint exacerbates resource strains in healthcare systems, as unvaccinated cohorts demand recurrent testing to monitor persistent or emergent threats.

Payer models reflect this, with heightened utilization offsetting prevention investments, yet coverage shortfalls undermine long-term efficacy. Clinicians confront persistent caseloads, diverting focus from high-risk triages to routine surveillances in vaccinated populations. The Centers for Disease Control and Prevention reported that 61.4 percent of adolescents aged 13 to 17 years were up to date with the human papillomavirus vaccine series in 2023, indicating persistent gaps that prolong screening dependencies.

Such metrics highlight immunization shortfalls, correlating with elevated testing volumes in transitional age groups. Logistical barriers, including provider shortages, compound hesitancy, fragmenting program coherence. Efforts to integrate school-based initiatives yield variable adherence, with urban-rural divides amplifying variances. These vaccination deficits not only inflate operational overheads but also challenge equity in diagnostic distribution.

Opportunities

Expansion of National Cervical Cancer Elimination Strategies is Creating Growth Opportunities

The institutionalization of comprehensive cervical cancer elimination frameworks has engendered expansive prospects for HPV testing and Pap test integration, aligning diagnostics with ambitious public health targets. These strategies prioritize universal access, leveraging subsidized screenings to encompass previously marginalized segments through community outreach and digital enhancements.

Opportunities emerge in assay diversification, as programs endorse primary HPV modalities for extended intervals, optimizing cost-utilities in resource-variable contexts. Collaborations between governmental entities and diagnostic innovators facilitate bulk acquisitions, embedding advanced platforms within ambulatory networks. Patient-centric adaptations, such as multilingual resources, elevate participation, mitigating historical non-adherence.

The World Health Organization’s global strategy, endorsed in 2020 and advanced through 2024, aims for 70 percent screening coverage among women aged 35 to 45 by 2030, catalyzing investments in scalable infrastructures. This benchmark galvanizes national adaptations, with projections indicating amplified reagent demands. Technological infusions, including point-of-care validations, broaden deployment in remote locales. As metrics track progress, data analytics refine targeting, diversifying revenue via performance-linked contracts. These initiatives not only amplify volumes but also position diagnostics as pivotal in attaining eradication thresholds.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and tight budgets are causing developers in the cervical screening diagnostics market to pause improvements on self-collection kits, instead focusing resources on maintaining core cytology slide production amid uncertain reimbursement rates. Trade restrictions between the U.S. and China, along with Panama Canal delays, are disrupting shipments of monoclonal antibodies from Latin American suppliers, slowing shelf-life testing and increasing certification costs for international partnerships.

To manage these challenges, some developers are partnering with antibody producers in Wisconsin, using blockchain traceability to speed up CMS approvals and attract grant funding. Growing global cervical cancer awareness is driving funding from organizations like GAVI into co-testing algorithms, boosting adoption in low-resource clinics. At the same time, U.S. tariffs on imported pharmaceuticals and medical devices are increasing costs for Asian-sourced fixatives and viral probes, squeezing margins for ambulatory panels and causing temporary pauses in multinational assay collaborations.

Latest Trends

FDA Approval of Roche’s HPV Self-Collection Solution is a Recent Trend

The regulatory advancement of self-sampling technologies has delineated a transformative trajectory in HPV testing and Pap test paradigms during 2024, prioritizing patient autonomy in specimen acquisition. Roche’s solution empowers individuals to perform vaginal collections in clinical environments, circumventing procedural discomforts associated with clinician-led methods. This innovation preserves analytical integrity while accelerating throughput, aligning with demands for decentralized evaluations in overburdened facilities.

The trend embodies a shift toward inclusive protocols, accommodating those deterred by traditional invasiveness, thereby elevating overall adherence rates. Integration with automated platforms streamlines post-collection workflows, minimizing errors in transit-sensitive samples. Patient education modules accompany implementations, fostering confidence in self-obtained specimens.

The Food and Drug Administration authorized Roche’s human papillomavirus self-collection solution on May 15, 2024, marking one of the inaugural endorsements for enhanced accessibility in cervical cancer screening. This clearance validates equivalence to conventional approaches, influencing guideline evolutions. Subsequent validations affirm robustness across demographics, mitigating equity variances. The progression anticipates at-home extensions, pending further evidentiary accruals. This patient-empowering modality not only refines precision but also harmonizes with ambulatory imperatives in oncology prevention.

Regional Analysis

North America is leading the HPV Testing and Pap Test Market

In 2024, North America held a 41.2% share of the global HPV testing and Pap test market, bolstered by comprehensive cervical cancer screening guidelines that advocate co-testing for women aged 30-65, enhancing detection rates through combined cytological and molecular approaches in routine gynecological examinations.

Healthcare providers increasingly prioritized high-risk HPV genotyping to triage abnormal Pap results, reducing unnecessary colposcopies by up to 30% while focusing interventions on persistent oncogenic strains, amid stable incidence rates in vaccinated populations. The shift toward self-collection kits, supported by telehealth expansions, facilitated access in underserved areas, aligning with federal equity initiatives to address disparities among low-income and minority groups.

Laboratory advancements in liquid-based cytology improved sample adequacy, enabling faster processing in high-volume centers, which correlated with elevated compliance during annual wellness visits. Demographic factors, such as sustained immigration from high-prevalence regions, sustained demand for targeted screening in diverse communities, underscoring the need for culturally sensitive outreach. These evolutions reflected the region’s commitment to proactive, layered diagnostic frameworks.

The Centers for Disease Control and Prevention reported that approximately 79 million Americans were infected with HPV in 2022, with about 14 million acquiring new infections annually, emphasizing the ongoing imperative for vigilant screening.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health ministries in Asia Pacific anticipate the HPV testing and Pap test sector to proliferate during the forecast period, as population-scale vaccination drives and national mandates amplify screening uptake in high-burden nations. Regulators in China and India channel investments into subsidized co-testing programs, equipping community health workers with self-sampling devices to detect oncogenic strains among rural women facing logistical barriers.

Diagnostic innovators partner with regional labs to refine affordable genotyping assays, projecting reductions in late-stage diagnoses for squamous intraepithelial lesions in densely populated urban fringes. Oversight agencies in Indonesia and the Philippines pioneer mobile cytology units, positioning primary facilities to perform on-site Pap evaluations without urban referrals. Authorities estimate embedding molecular triage into digital registries, streamlining follow-up for adenocarcinoma precursors in migrant labor forces.

Local experts advance hybrid protocols, coordinating with surveillance grids to monitor vaccine efficacy against nonavalent strains. These advancements construct a scalable bulwark against oncogenic persistence. The World Health Organization recorded 661,044 new cervical cancer cases globally in 2022, with Asia Pacific bearing the majority, signaling persistent regional imperatives for enhanced diagnostic penetration.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

FDA-cleared Genius system, improving detection rates in busy laboratories. They form co-promotion agreements with women’s health networks to integrate self-sampling kits into routine wellness programs, increasing access in underserved communities. Developers are investing in multiplex assays that detect high-risk HPV strains alongside precancerous markers, improving triage accuracy for follow-up care.

Companies are also acquiring assay developers to combine molecular and liquid-based technologies, strengthening end-to-end screening capabilities. Efforts are focused on Latin America and sub-Saharan Africa, aligning products with WHO-backed elimination campaigns to utilize grant-funded rollouts. Additionally, they are implementing bundled reimbursement advocacy programs with payers, using outcome data to support premium access and build long-term institutional partnerships.

Hologic, Inc., founded in 1985 and headquartered in Marlborough, Massachusetts, is a leading innovator in women’s health diagnostics, focusing on technologies that improve breast and cervical cancer detection worldwide. Its Cervex Brush and ThinPrep Pap Test ensure superior sample preservation, while Aptima HPV assays accurately identify oncogenic genotypes.

Hologic invests heavily in digital pathology and AI tools to reduce interpretive variability and streamline workflows. CEO Stephen MacMillan oversees operations in over 70 countries, promoting equity through partnerships with NGOs to bring screening to low-resource areas. The company also works with clinical societies to shape screening guidelines, ensuring evidence-based practices. By combining precise diagnostics with broad accessibility, Hologic strengthens its leadership and helps reduce disease incidence globally.

Top Key Players in the HPV Testing and Pap Test Market

- Seegene Inc.

- Quest Diagnostics Incorporated

- QIAGEN

- NURX Inc.

- Hologic, Inc.

- Femasys Inc.

- Hoffmann-La Roche Ltd

- BD

- Arbor Vita Corporation

- Abbott

Recent Developments

- In October 2024: Becton, Dickinson and Company (BD) received Health Canada approval for its BD Onclarity HPV Assay for self-collected vaginal samples. By enabling at-home testing, this approval improves screening accessibility, supporting growth of the HPV Testing and Pap Test Market in Canada.

- In June 2024: the WHO prequalified Roche’s cobas HPV test for use with automated systems and self-collected samples. This recognition promotes wider adoption of reliable HPV testing solutions, expanding the market for both HPV tests and Pap tests globally.

- In February 2024: BD collaborated with Camtech Health in Singapore to provide women the option of at-home cervical sample collection. Combined with the BD Onclarity HPV Assay, this program enhances screening participation and contributes to the overall growth of the HPV Testing and Pap Test Market by making testing more accessible and user-friendly.

- In June 2022: F. Hoffmann-La Roche Ltd rolled out HPV self-sampling solutions designed to increase participation in cervical cancer screening. By allowing women to collect samples themselves, these innovations expand access and convenience, driving growth in the global HPV Testing and Pap Test Market.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 billion Forecast Revenue (2034) US$ 14.9 billion CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables, Instruments, and Services), By Technology (Molecular Diagnostics, Immunodiagnostics, and Cytology), By Application (Cervical Cancer Screening, and Vaginal Cancer Screening), By Test Type (Pap Test, and HPV Test), By End-user (Hospitals & Clinics, Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Seegene Inc., Quest Diagnostics Incorporated, QIAGEN, NURX Inc., Hologic, Inc., Femasys Inc., F. Hoffmann-La Roche Ltd, BD, Arbor Vita Corporation, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  HPV Testing and Pap Test MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

HPV Testing and Pap Test MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Seegene Inc.

- Quest Diagnostics Incorporated

- QIAGEN

- NURX Inc.

- Hologic, Inc.

- Femasys Inc.

- Hoffmann-La Roche Ltd

- BD

- Arbor Vita Corporation

- Abbott