Global Hotel Central Reservation Systems (CRS) Market Size, Share Analysis Report By Component (Software and Services), By Deployment (On Premise and Cloud-Based), By Application (Reservation Management, Pricing and Revenue Management, Distribution Channel Integration, Property Management and Guest Experience, and Others), By End-User (Luxury Hotels, Resorts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153082

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

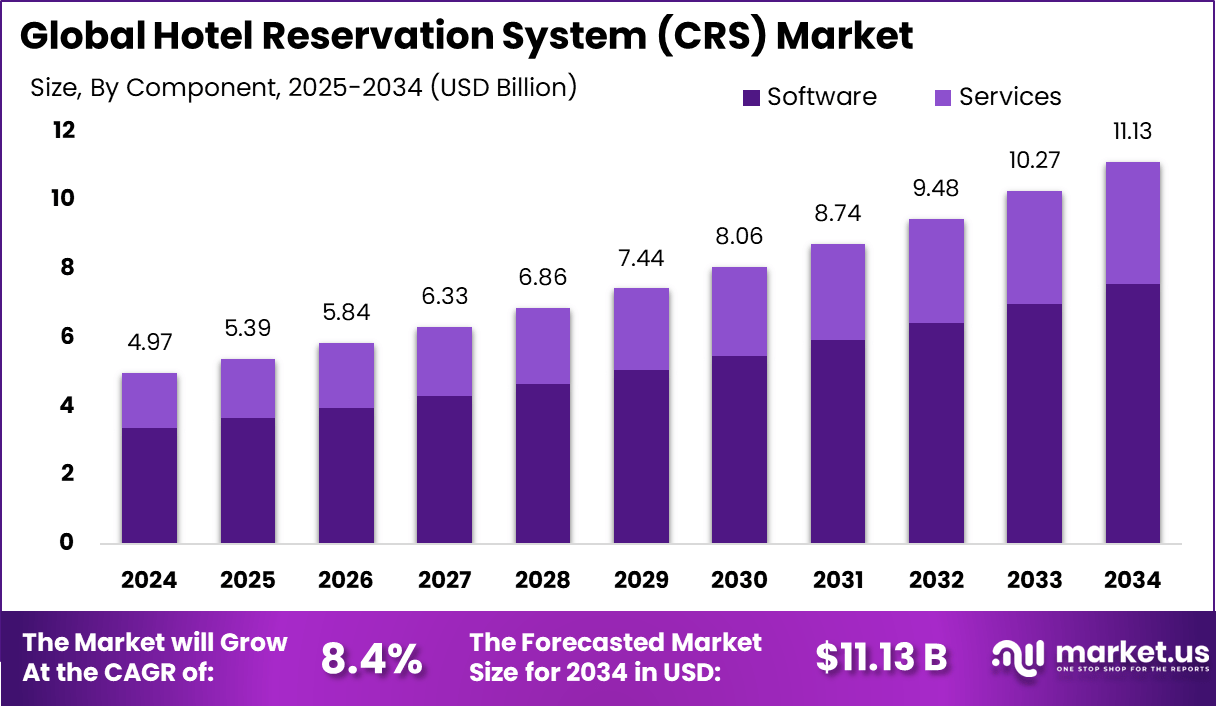

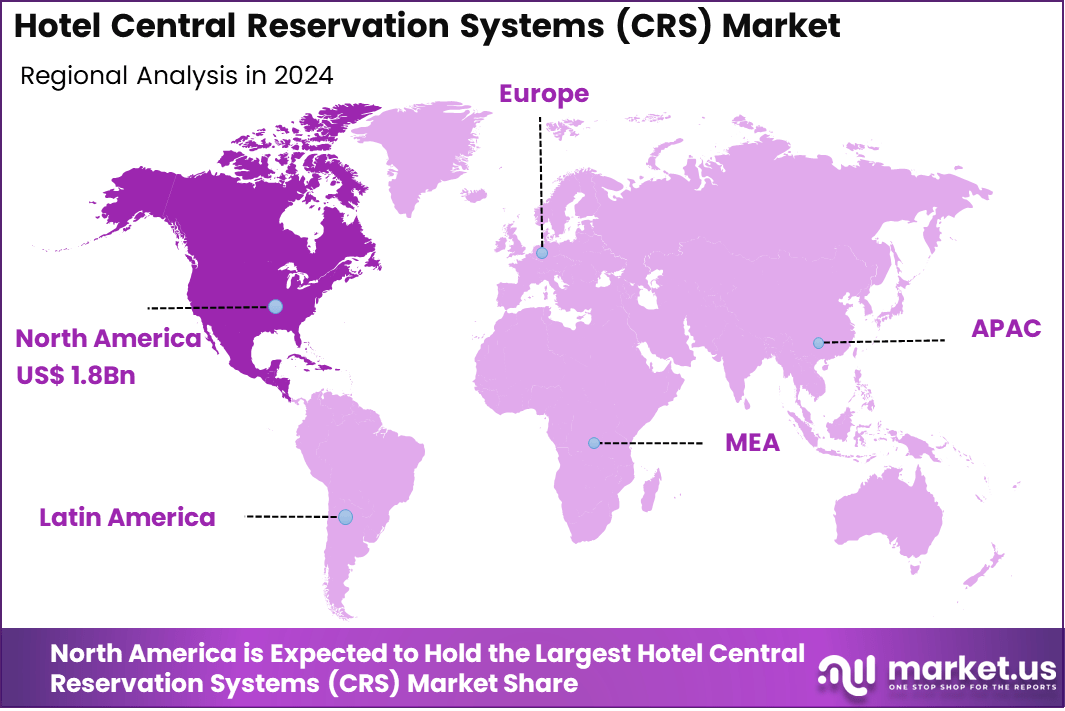

The Global Hotel Central Reservation Systems (CRS) Market size is expected to be worth around USD 11.13 billion by 2034, from USD 4.97 billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.2% share, holding USD 1.8 million in revenue.

The Hotel Central Reservation Systems (CRS) market represents a critical infrastructure in the global hospitality ecosystem. These systems enable hotels to manage room inventory, rates, and bookings centrally across multiple channels, including direct websites, OTAs, and GDS platforms. The shift from traditional booking tools to integrated, real-time CRS platforms is being driven by the demand for operational efficiency and consistent guest experience.

The growth of the CRS market can be attributed to the rising digitalization of hotel operations. As more bookings occur online, hotels need robust systems that provide instant room visibility and pricing updates across all platforms. A key factor includes the increase in multichannel distribution strategies. Hotels now rely on CRS to avoid overbooking, reduce double-booking errors, and align inventory with demand surges.

Scope and Forecast

Report Features Description Market Value (2024) USD 4.97 Bn Forecast Revenue (2034) USD 11.1 Bn CAGR (2025-2034) 8.4% Largest market in 2024 North America [36.2% market share] Key Takeaways

- The global Hotel Central Reservation Systems (CRS) market is projected to grow from USD 4.97 billion in 2024 to USD 11.13 billion by 2034, at a CAGR of 8.4% during the forecast period (2025–2034).

- By component, software dominates with 68% market share, led by standalone CRS and integrated property management modules.

- By Deployment, Cloud-based solutions lead with a 63% share due to their scalability, remote access, and lower upfront costs compared to on-premise models.

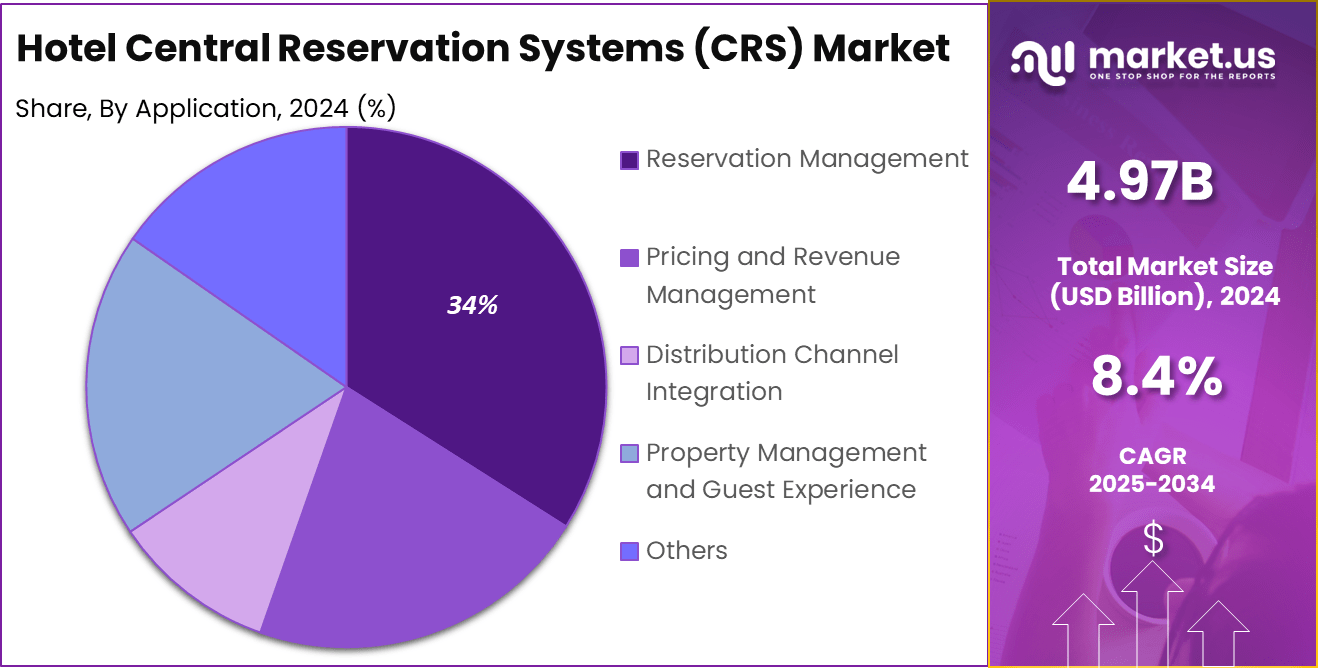

- By Application, Reservation Management is the leading application, accounting for 34% of the market share, driven by the need for real-time booking, rate management, and channel integration.

- By End-User, Luxury Hotels hold the highest market share at 38%, as they invest significantly in advanced systems for better customer experience and operational efficiency.

- North America leads the global market with a 36.2% share, valued at USD 1.8 billion in 2024, driven by strong digital infrastructure and widespread adoption in the U.S.

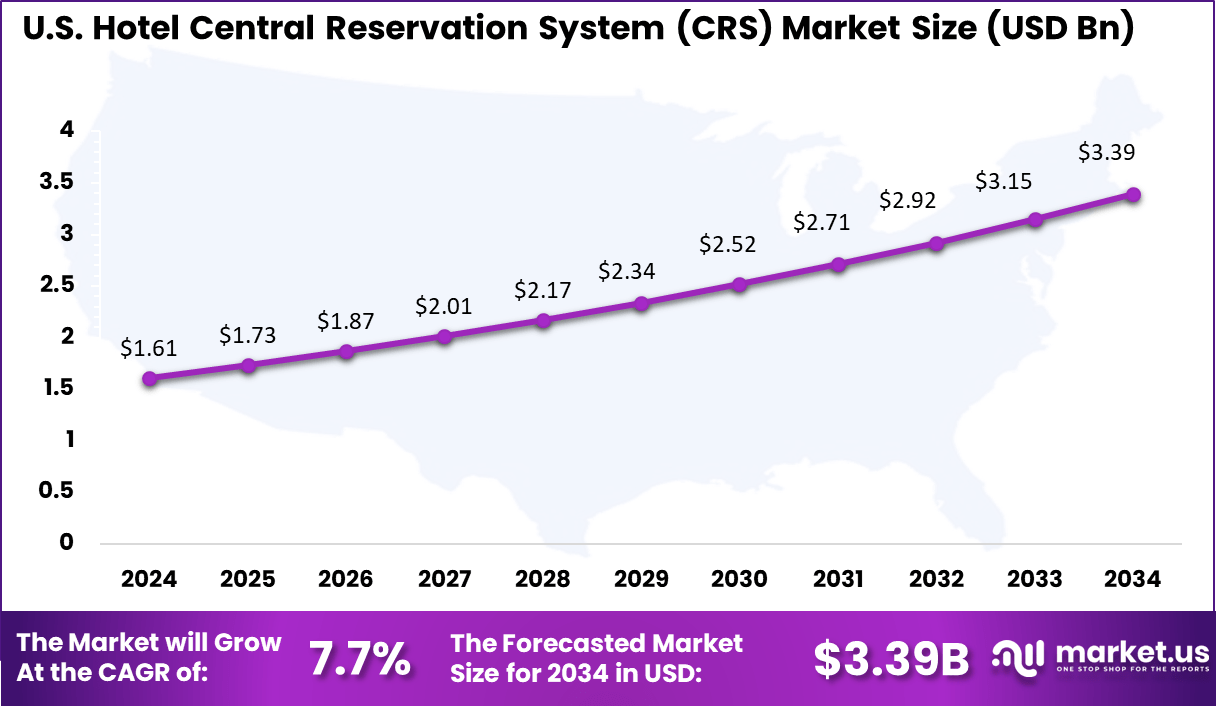

U.S. CRS Market Size

The U.S. Hotel Central Reservation Systems (CRS) Market is experiencing steady growth, valued at approximately USD 1.6 billion in 2024, and projected to reach USD 3.39 billion by 2034, expanding at a CAGR of around 7.73% during the forecast period.

This growth is fueled by increasing demand for centralized, real-time inventory control, advanced booking capabilities, and seamless integration with Property Management Systems (PMS), Global Distribution Systems (GDS), Internet Booking Engines (IBE), and channel managers.

Leading hotel chains across the U.S., particularly in the luxury and upscale segments, are actively adopting modern CRS platforms to enhance operational efficiency and revenue management. For example, Hyatt Hotels recently selected Sabre’s SynXis CRS as its primary platform to streamline global reservation operations, highlighting a broader shift toward centralized systems.

Mobile bookings and direct reservation channels have also gained significant traction. Studies indicate that hotel website bookings generate 60% higher revenue per booking than third-party OTAs, averaging over USD 519 per reservation. This trend underscores the value of mobile-optimized, CRS-integrated direct booking platforms.

Mid-sized and independent hotels are increasingly adopting cloud-based CRS solutions due to their affordability and flexibility. However, challenges remain particularly for smaller properties due to high upfront implementation costs and integration issues with legacy systems. Despite these hurdles, the U.S. CRS market continues to evolve, with digital transformation and guest-centric solutions driving future adoption.

The North America Hotel Central Reservation Systems (CRS) Market is the leading regional market globally, contributing approximately 36.2% of the total market revenue as of 2024. This dominance is attributed to the region’s advanced digital infrastructure, strong presence of global hotel chains, and widespread adoption of cloud-based reservation technologies.

In 2023, over 25,000 hotels globally, many located in North America, migrated to cloud-based CRS platforms, resulting in up to an 18% increase in occupancy rates due to enhanced real-time inventory and rate management, according to Hospitality Investor.

Key industry players such as Amadeus and Sabre Hospitality’s SynXis have a significant footprint in the region. Amadeus supports over 35,000 hotels worldwide, while SynXis manages around 42% of global chain reservations. In 2024, Hyatt Hotels selected Sabre’s SynXis platform to optimize its global reservation operations and implement dynamic pricing strategies.

Small and mid-sized enterprises (SMEs) and boutique hotels in North America are increasingly adopting cloud-first CRS platforms that support mobile bookings, AI chatbots, and upselling modules. Emerging trends include voice-activated bookings and sustainability-integrated features, with 22% of luxury hotels integrating voice assistants by 2023.

However, barriers remain, especially for smaller properties, as 31% cite high implementation costs and integration challenges as key obstacles. Despite these issues, North America’s CRS market is poised for sustained growth, driven by continuous digital transformation and an increasing focus on guest-centric solutions.

By Component Analysis

The software segment accounted for approximately 68% of the hotel CRS market. This dominance can be attributed to the increasing reliance on sophisticated reservation platforms that enable real-time room availability, dynamic pricing, and seamless integration with property management and distribution systems.

Hotels are increasingly adopting dedicated CRS software to reduce operational errors and improve guest booking experience. Such software helps automate reservations, optimize inventory, and support multi-channel distribution, making it a preferred choice over manual or hybrid systems.

Moreover, the adoption of advanced analytics and AI-driven modules within CRS software has enhanced its value proposition. Hotels are leveraging these features to forecast demand, personalize guest interactions, and manage revenue more effectively. The rising competition in the hospitality sector and the need to maintain occupancy rates are expected to further sustain the demand for software-driven CRS solutions in the coming years.

By Deployment Analysis

The cloud-based deployment segment represented about 63% of the market, reflecting a clear shift from on-premise solutions. Cloud deployment is favored due to its scalability, lower upfront cost, and ease of access across multiple locations. Hotels, particularly chains with geographically dispersed properties, benefit significantly from centralized cloud-based systems as they facilitate real-time data synchronization and unified management of room inventory.

Additionally, the cloud model enables faster updates, robust data security, and disaster recovery capabilities, which have become essential in the increasingly digital hospitality landscape. The ongoing emphasis on operational efficiency and remote accessibility, especially post-pandemic, has reinforced the preference for cloud-based CRS among both luxury and mid-scale hotels.

By Application Analysis

The reservation management application held a share of nearly 34%, underscoring its critical role in CRS adoption. Reservation management remains the core function of a CRS, enabling hotels to efficiently manage bookings from direct and indirect channels.

This function reduces overbooking risks, improves turnaround times, and ensures a better customer experience through prompt confirmation and communication. Hotels are increasingly using CRS for optimizing reservation workflows, offering real-time room status visibility, and integrating with loyalty programs.

With growing guest expectations for seamless booking experiences across mobile, web, and travel agents, reservation management applications have seen sustained demand and are being continually enhanced with AI chatbots and personalized recommendation engines.

By End-User Analysis

The luxury hotel segment accounted for approximately 38% of the CRS market share. Luxury properties are early adopters of advanced CRS solutions as they aim to offer superior, highly personalized guest services.

The higher budget allocation for technology investments allows luxury hotels to implement fully integrated CRS that caters to complex demands such as multi-property bookings, special package deals, and bespoke guest preferences. The rising competition within the luxury segment has further driven adoption, as these establishments seek to differentiate their service levels through technology.

Additionally, luxury hotels benefit from CRS systems that enable better inventory control, dynamic pricing strategies, and integration with global distribution systems, which are crucial for attracting international clientele and maintaining occupancy rates.

Summary Table: Hotel CRS Market Segmentation

Segment Leading Share Market Driver Component Software: 68% Need for automation, scalability, and integration Deployment Cloud-based: 63% Flexibility, scalability, lower total cost of ownership Application Reservation Mgmt: 34% Focus on booking accuracy and inventory control End-User Luxury Hotels: 38% Complex operations, demand for premier guest experience Key Market Segments

By Component

- Software

- Standalone CRS

- Integrated hotel property management system

- Services

- Consulting

- Implementation

- Support

By Deployment

- On Premise

- Cloud-Based

By Application

- Reservation Management

- Pricing and Revenue Management

- Distribution Channel Integration

- Property Management and Guest Experience

- Others

By End-User

- Luxury Hotels

- Resorts

- Others

Driving Factor

Growing preference for contactless booking and digital check-in/check-out.

In the post-pandemic era, both guests and hotel operators have prioritized safety, hygiene, and convenience, leading to the rapid adoption of contactless technologies. Hotel CRS platforms have evolved to support digital guest journeys by enabling mobile-based reservations, automated check-ins, room selection, and even digital key access without requiring physical interaction with front desk staff.

According to Oracle’s Hospitality Industry survey, 71% of travelers prefer hotels that offer self-service technology, and over 60% want contactless check-in/check-out options. Major hotel chains like Marriott International and Hilton have invested heavily in mobile applications integrated with their CRS and PMS systems to allow guests to manage their stay entirely through smartphones.

For example, Hilton’s Digital Key service, available in over 80% of its hotels globally, allows users to skip the front desk and access rooms using their mobile phones. CRS platforms are increasingly incorporating these capabilities to enhance the guest experience and streamline operations.

Restraining Factor

High initial implementation and training costs, especially for small and independent hotels.

While CRS platforms offer long-term efficiency and improved guest experience, the upfront investment in software licensing, customization, integration with existing property management systems (PMS), and employee training can be substantial. These costs pose a barrier to entry for smaller properties operating on limited budgets.

For instance, setting up a full-featured CRS with cloud integration, channel management, and mobile support can cost anywhere from $1,500 per year to upwards of $10,000+ per year, depending on the vendor, the number of properties and rooms, and the specific features included.

In addition to licensing fees, hoteliers must invest in IT infrastructure upgrades and ongoing staff training to ensure optimal usage of the system. A survey by Software Advice found that 35% of independent hotels cited affordability as the primary reason for not adopting advanced hotel management technologies.

Many small hoteliers also struggle with the complexity of integrating CRS with legacy systems or lack the in-house expertise to manage digital platforms, making them reliant on third-party consultants or service providers, adding to the cost. As a result, these hotels often delay or forego CRS implementation, limiting the overall market penetration of these solutions in the budget and mid-tier segments.

Growth Opportunity

Opportunities to offer mobile-optimized CRS platforms for smartphone-based guest bookings.

With mobile becoming the dominant channel for travel planning and hotel reservations, CRS vendors that offer mobile-friendly interfaces and native app integration are well-positioned to gain market share. According to latest research, over 60% of hotel bookings in 2023 were made via mobile devices, and this trend is expected to rise as digital-native travelers prioritize convenience and instant access.

Mobile-optimized CRS platforms enable guests to search for rooms, view real-time availability, compare prices, and complete bookings directly from their smartphones, often in a matter of seconds. This capability not only enhances the user experience but also improves direct booking rates, reducing a hotel’s dependency on commission-based third-party booking channels.

For example, Marriott Bonvoy and Hilton Honors apps, both integrated with CRS systems, allow guests to make reservations, check in/check out, and manage loyalty points seamlessly via mobile. Smaller hotels and boutique properties also benefit from mobile CRS platforms that support quick integration with payment gateways, push notifications, and multilingual support.

As mobile penetration deepens in emerging markets like India, Southeast Asia, and Latin America, vendors that prioritize smartphone-first CRS solutions will unlock significant growth and customer loyalty opportunities.

Latest Trends

Rising use of AI chatbots and virtual assistants for guest communication and booking

Hotels are increasingly integrating AI-powered tools within their CRS platforms to automate and personalize interactions across the guest journey from booking inquiries and confirmations to in-stay support and post-checkout feedback. These tools enhance operational efficiency while providing guests with 24/7 instant assistance.

According to a report by Oracle Hospitality, 77% of hotel executives believe AI chatbots improve customer service, and nearly 50% of travelers are comfortable interacting with bots for basic queries and bookings. AI assistants like “Connie” by Hilton, powered by IBM Watson, and Edwardian Hotels’ “Edward”, offer real-time responses to guest requests, FAQs, and even reservation modifications.

Smaller hotels are also adopting third-party chatbot solutions that integrate directly with CRS and PMS systems, enabling seamless room availability checks, upselling services, and secure payment processing through messaging apps like WhatsApp, Facebook Messenger, and hotel websites.

Key Player Analysis

The Hotel Central Reservation Systems (CRS) Market is moderately consolidated, with a few major players accounting for a significant share of the overall market. Leading companies such as Sabre Hospitality, Oracle Hospitality (OPERA PMS), Amadeus, and Hotelogix collectively hold over 50% of the global market share.

Among them, Sabre’s SynXis CRS is one of the most widely adopted platforms, especially among large hotel chains, managing approximately 42% of global chain hotel reservations. Amadeus, another key player, powers CRS solutions for over 35,000 hotels worldwide, offering robust integrations with GDS, booking engines, and loyalty systems.

Oracle’s OPERA is renowned for its enterprise-level CRS-PMS integration, particularly in luxury and resort segments. Hotelogix, eZee FrontDesk, and roomMaster dominate the small-to-medium hotel segment by offering cost-effective cloud-based CRS solutions.

Other significant players include MSI CloudPM, Rezlynx PMS, Vertical Booking, SHR, GuestCentric, D-EDGE, and The Access Group, all of which focus on providing tailored, scalable solutions for varying hotel sizes and types.

Top Key Players

- Hospitality Solutions (Sabre Hospitality)

- OPERA Property Management System (Oracle)

- eZee Front desk

- roommaster

- Hotelogix PMS

- MSI CloudPM

- Rezlynx PMS

- CenDyn

- Vertical booking

- Amadeus

- eRevMax

- SHR

- GuestCentric

- D-EDGE

- The Access Group

- Other Key Players

Recent Developments

- In June 2025, Omni Hotels & Resorts adopted OPERA Cloud Central, with plans to integrate OPERA PMS and Simphony POS across its 50+ North American properties to unify reservations, CRM, and distribution.

- In April 2025, Sabre Hospitality, a division of Sabre Corporation, has announced the renewal of its strategic agreement with Kerzner International. Under this renewed partnership, Kerzner will enhance its distribution strategy by leveraging Sabre’s SynXis platform, including the SynXis Booking Engine, to offer ancillaries alongside room reservations.

- In February 2025, Absolute Hotel Services began rolling out OPERA Cloud and Simphony POS across 23 properties (~3,600 rooms), aiming for full global deployment by early 2026.

- In June 2024, Red Sea Global (Saudi Arabia) deployed OPERA Cloud Central across its luxury resorts to support distribution, loyalty, and guest engagement with unified operations.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software and Services), By Deployment (On Premise and Cloud-Based), By Application (Reservation Management, Pricing and Revenue Management, Distribution Channel Integration, Property Management and Guest Experience, and Others), By End-User (Luxury Hotels, Resorts, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hospitality Solutions (Sabre Hospitality), OPERA Property Management System (Oracle), eZee Front desk, roommaster, Hotelogix PMS, MSI CloudPM, Rezlynx PMS, CenDyn, Vertical booking, Amadeus, eRevMax

SHR, GuestCentric, D-EDGE, The Access Group, and Other Key PlayersCustomization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hotel Central Reservation Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Hotel Central Reservation Systems MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hospitality Solutions (Sabre Hospitality)

- OPERA Property Management System (Oracle)

- eZee Front desk

- roommaster

- Hotelogix PMS

- MSI CloudPM

- Rezlynx PMS

- CenDyn

- Vertical booking

- Amadeus

- eRevMax

- SHR

- GuestCentric

- D-EDGE

- The Access Group

- Other Key Players