Global Decorative Lighting Market By Product (Sconce, Chandeliers, Flush Mount, Pendants, Others), By Light Source (LED, Incandescent, Fluorescent, Others), By Application (Commercial, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135964

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

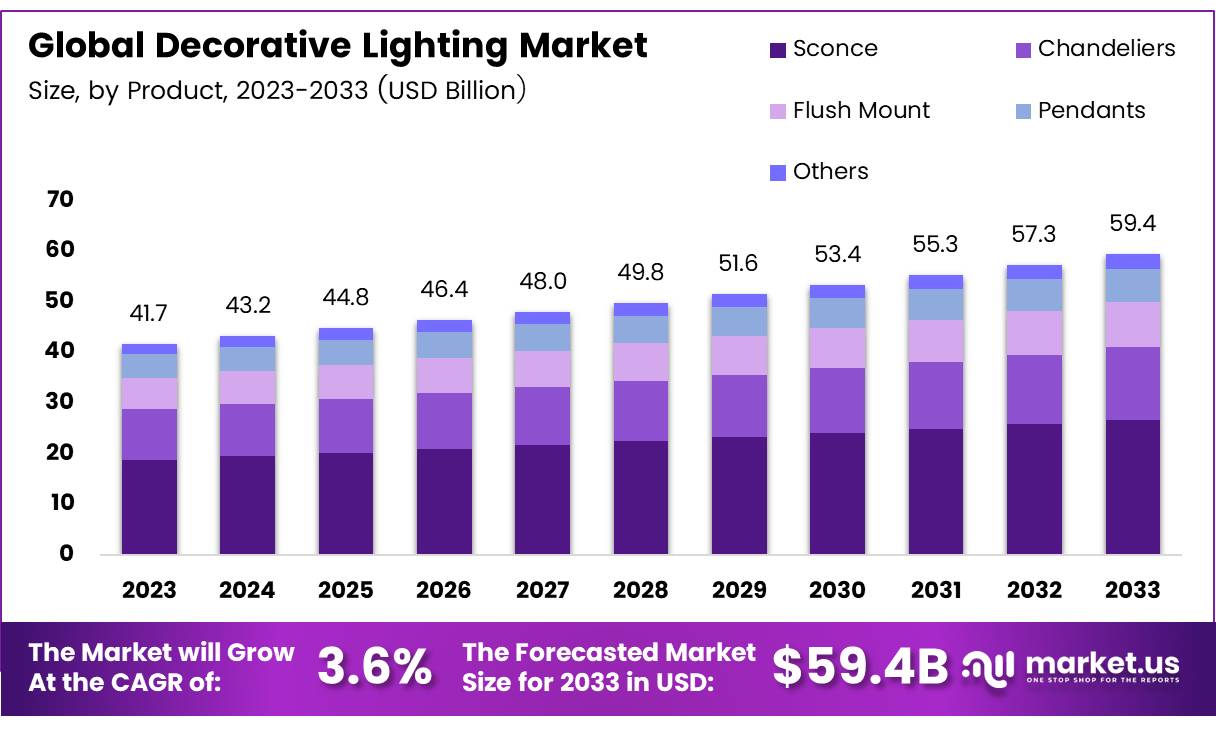

The Global Decorative Lighting Market size is expected to be worth around USD 59.4 Billion by 2033, from USD 41.7 Billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2024 to 2033.

Decorative lighting refers to light fixtures that enhance the aesthetic appeal of a space alongside providing functional illumination. This segment of lighting goes beyond mere functionality to include elements that contribute to the overall design and atmosphere of interior and exterior environments.

Fixtures may range from chandeliers, wall sconces, and table lamps to outdoor lanterns and string lights, each crafted to complement the architectural features and design motifs of their settings.

The decorative lighting market encompasses the production, distribution, and sale of these lighting fixtures to residential, commercial, and industrial customers. It represents a robust sector within the broader lighting industry, characterized by a diverse range of products that cater to varying tastes and budget ranges.

As homeowners and designers emphasize personalized spaces that reflect individual style and contemporary trends, the market for decorative lighting has expanded to accommodate an increasingly discerning clientele.

The decorative lighting market is poised for significant growth, fueled by increasing consumer demand for aesthetic and functional lighting solutions. This growth is supported by the rising interest in home and commercial space renovations, where lighting plays a crucial role in defining the ambiance and functionality of a space.

According to a 2023 Lutron/Harris Poll survey, a striking 91% of U.S. homeowners affirm that quality lighting is pivotal to their home design, with 75% considering it one of the most critical design choices. These statistics underscore the growing prioritization of decorative lighting in residential planning and design.

Government investment and regulatory frameworks also play essential roles in shaping the market dynamics. Energy efficiency standards and incentives aimed at reducing energy consumption in lighting significantly influence product development and consumer preferences. The U.S. Energy Information Administration highlights a 58% decrease in annual residential lighting energy consumption from 2015 to 2020, reflecting the impact of these policies.

The dissatisfaction expressed by nearly one in five U.S. homeowners with their current lighting underscores a substantial market opportunity for decorative lighting manufacturers and retailers. Addressing these gaps can lead to increased customer satisfaction and market share.

Moreover, the prioritization of lighting in high-use areas such as kitchens (72% importance), living/family rooms (69%), and bathrooms highlights key target areas for new product development and marketing strategies.

Key Takeaways

- The Global Decorative Lighting Market is projected to grow from USD 41.7 billion in 2023 to USD 59.4 billion by 2033, at a CAGR of 3.6%.

- Sconce dominates the Product Analysis segment with a 34.6% market share, reflecting its significant influence on consumer preferences and design trends.

- LED leads the Light Source Analysis segment, preferred for its energy efficiency and longevity.

- The Commercial Application segment is prominent, driven by increased investment in commercial infrastructure and emphasis on aesthetics.

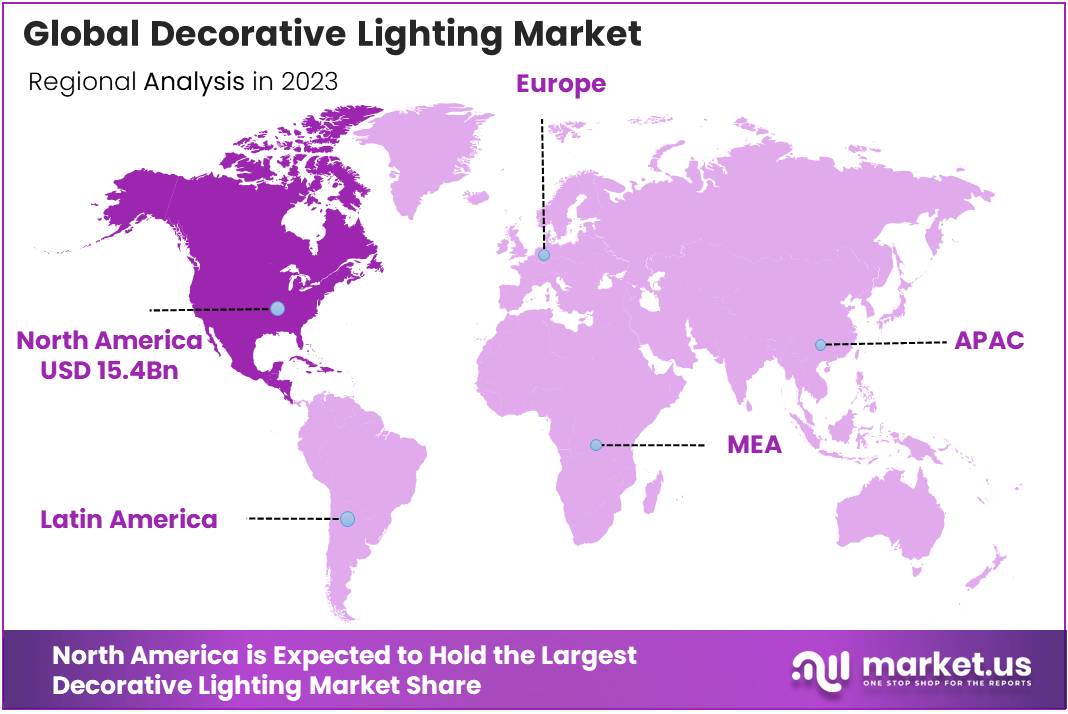

- North America holds a dominant 37.1% market share, valued at USD 15.4 billion, due to high disposable incomes and a mature retail infrastructure.

Product Analysis

Sconce Leads with 34.6% in Decorative Lighting; Diverse Designs Illuminate the Market

In 2023, Sconce held a dominant market position in the By Product Analysis segment of the Decorative Lighting Market, capturing a 34.6% share. This substantial market share underscores Sconce’s pivotal role in shaping consumer preferences and design trends within the industry.

Following closely, Chandeliers contributed significantly, reflecting an appreciation for luxury and traditional aesthetics in residential and commercial spaces.

Flush Mount fixtures, known for their sleek profile and modern appeal, also captured a notable portion of the market, suitable for varied ceiling heights and compact spaces. Pendants continued to see growth, favored for their versatility and ability to complement a wide range of decors.

The Others category, which includes specialized and niche products, although smaller in comparison, plays a crucial role in catering to specific consumer needs and emerging design trends. Together, these segments collectively represent a diverse and vibrant market landscape, driven by evolving consumer tastes and advancements in lighting technology.

Light Source Analysis

In-Depth Segment Analysis of the Decorative Lighting Market by Light Source (2023)

In 2023, LED held a dominant market position in the By Light Source Analysis segment of the Decorative Lighting Market, indicating a strong preference for energy-efficient and long-lasting lighting solutions.

The adoption of LED technology has been driven by its superior energy efficiency and longer lifespan compared to traditional lighting options. This segment’s growth is further supported by the increasing consumer awareness regarding environmental sustainability and energy savings.

Meanwhile, incandescent lights continue to occupy a niche market, favored for their warm light and aesthetic appeal, particularly in settings that value ambiance and design tradition. However, the market share for incandescent lighting is declining due to stringent energy regulations and rising energy costs.

Fluorescent lights, known for their high luminosity and cost-effectiveness, remain relevant in commercial and industrial applications. Their use in decorative lighting, however, is limited by the growing consumer preference for LEDs.

The ‘Others’ category, which includes newer technologies like OLED and fiber optics, is gradually gaining traction. These technologies offer versatile and innovative lighting solutions, particularly in high-end and custom decorative lighting applications, though they currently represent a smaller portion of the market.

Application Analysis

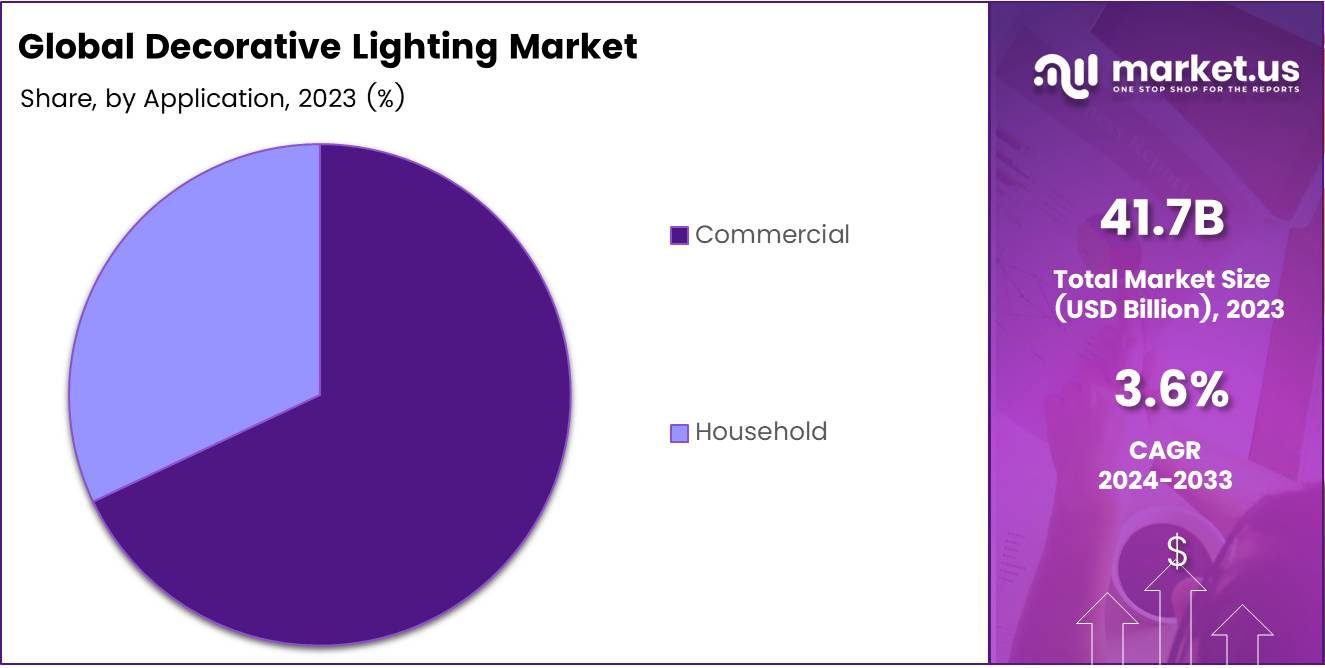

Commercial Leads 2023 Decorative Lighting with Robust Growth, Household Segment Brightens with Tech Integration

In 2023, Commercial held a dominant market position in the By Application Analysis segment of the Decorative Lighting Market. This segment’s strength can be attributed to increased investments in commercial infrastructure and a rising emphasis on aesthetic enhancement in spaces such as offices, malls, and hospitality establishments.

Enhanced lighting solutions not only elevate the visual appeal of these venues but also contribute to energy efficiency, driving the commercial sector’s growth.

On the other hand, the Household segment also showed notable expansion, driven by consumer interest in home decor and the availability of innovative lighting solutions that blend functionality with design. The shift towards smart homes has further propelled this segment, as residential consumers increasingly adopt smart lighting systems that offer both decorative and energy management features.

The commercial segment’s predominance is underpinned by substantial business investments in aesthetic and practical lighting solutions, whereas the household segment benefits from the ongoing trends toward personalization and technology integration in home lighting.

Key Market Segments

By Product

- Sconce

- Chandeliers

- Flush Mount

- Pendants

- Others

By Light Source

- LED

- Incandescent

- Fluorescent

- Others

By Application

- Commercial

- Household

Drivers

Rising Disposable Income Boosts Decorative Lighting Market

As disposable income levels rise in emerging economies, there is a marked increase in demand for decorative lighting products that combine aesthetic appeal with high quality. This trend is driven by consumers’ greater spending power, enabling them to invest in premium lighting solutions that enhance the ambiance of their living spaces.

Concurrently, rapid urbanization is fueling extensive development across commercial, residential, and hospitality sectors, thereby escalating the need for diverse decorative lighting options that can cater to various architectural styles and design preferences.

Moreover, the growing interior design industry continues to push the boundaries of innovation in decorative lighting, with consumers seeking unique and stylish products that reflect the latest home decor trends.

Further bolstering the market is the advancement in technology, including the proliferation of energy-efficient LED lights and smart lighting systems, which are not only cost-effective but also offer enhanced functionality and ease of use. This convergence of economic, social, and technological factors is significantly shaping the decorative lighting market, presenting numerous opportunities for industry stakeholders.

Restraints

Limited Awareness Restricts Decorative Lighting Market Growth in Emerging Markets

In emerging markets, the decorative lighting industry faces a significant challenge due to the limited awareness among consumers about the diverse benefits and options available in decorative lighting. This lack of understanding can restrict market penetration and growth, as potential customers may not fully appreciate the value or functionality of advanced lighting solutions.

Additionally, the decorative lighting market is susceptible to the fluctuations in raw material prices, which can lead to instability in manufacturing costs. Such volatility affects the profitability of manufacturers and can result in inconsistent product pricing, making it difficult for companies to maintain competitive pricing strategies and for consumers to afford these products.

These economic and informational restraints are critical barriers that need addressing to unlock the full potential of the decorative lighting market, especially in developing regions where market expansion opportunities are substantial yet underexploited.

Growth Factors

Expansion in Emerging Markets Offers Bright Prospects for Decorative Lighting

The decorative lighting market is poised for significant growth, particularly in emerging markets such as Asia-Pacific and Latin America, where rising disposable incomes and urbanization are expanding consumer bases eager for aesthetic and functional lighting solutions.

This growth is further augmented by the increasing trend towards smart homes, presenting lucrative opportunities for the integration of smart lighting into home automation systems.

These smart solutions offer consumers convenience and enhanced control, aligning with the global shift towards technology-driven homes.

Additionally, there is a mounting demand for sustainable lighting solutions, driven by growing environmental awareness and the push for energy efficiency. Manufacturers who innovate in eco-friendly decorative lighting options are likely to capture a substantial market share, benefiting from consumer preferences shifting towards sustainability.

Furthermore, the expansion of the commercial sector, including offices, restaurants, and hotels, continues to drive demand for both aesthetic and functional lighting solutions.

These sectors require unique lighting to enhance ambiance and customer experience, creating vast opportunities for decorative lighting companies to innovate and expand their product offerings in these dynamic markets.

Emerging Trends

Smart Lighting Gains Ground in Decorative Lighting Trends

The decorative lighting market is currently shaped by several dynamic trends, with the most notable being the increasing demand for smart, connected lighting solutions.

These innovations, which include app-controlled and voice-activated features, are being driven by advancements in the Internet of Things (IoT) technologies. This trend reflects a growing consumer preference for convenience and customization in home and commercial environments.

Additionally, LED technology remains a cornerstone of the industry due to its superior energy efficiency, durability, and adaptable design capabilities. There is also a notable shift towards minimalist and modern aesthetics in decorative lighting, which emphasizes clean lines and simple forms.

Conversely, there is a resurgence in the appeal of vintage and retro designs, particularly in residential and hospitality settings, where there is a desire for nostalgic and warm atmospheres. These trends collectively highlight the market’s movement towards more personalized and technologically integrated lighting solutions, while balancing modern efficiency with classic styles.

Regional Analysis

North America dominates the Decorative Lighting Market with 37.1% Share and USD 15.4 Billion in Revenue

The decorative lighting market exhibits varied growth dynamics across different regions, reflecting distinct consumer preferences, economic conditions, and levels of urbanization.

In North America, the market is highly developed, holding a dominant share of 37.1% with a valuation of USD 15.4 billion. This can be attributed to the robust demand for aesthetic enhancement in residential and commercial spaces, supported by high disposable incomes and advanced retail infrastructure.

Regional Mentions:

Europe, the region shows a strong inclination towards energy-efficient and sustainable lighting solutions, driven by stringent regulations and a high awareness of environmental issues. The market here benefits from the rich cultural heritage that influences diverse aesthetic preferences, encouraging the adoption of innovative and designer lighting fixtures.

In the Asia Pacific, rapid urbanization and increasing living standards fuel the demand for decorative lighting. The region is poised for significant growth, supported by expanding real estate sectors and increasing consumer expenditure on home décor. Emerging economies such as China and India are pivotal markets, with local manufacturers playing a crucial role in supplying affordable decorative lighting solutions.

The Middle East & Africa region is witnessing gradual growth in the decorative lighting market, with the Gulf countries leading the way. The market growth in this region is bolstered by luxurious construction projects and an increasing number of hotels and commercial establishments seeking opulent interior aesthetics.

Lastly, Latin America shows a promising increase in demand for decorative lighting, spurred by improving economic conditions and a surge in urban development. Countries like Brazil and Mexico are seeing a rise in consumer spending on decoration, which is progressively driving the market forward.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global decorative lighting market showcases a diverse competitive landscape dominated by key companies such as Acuity Brands, Inc., Lowe’s, GE Lighting, LSI Industries, Hubbell, Generation Brands, Juno, Philips Lighting (Signify Holding), Home Depot, and OSRAM GmbH. Each player holds a strategic position in the market, driven by distinctive competitive advantages and comprehensive product portfolios.

Acuity Brands, Inc. continues to be a prominent leader in the market, renowned for its innovative lighting solutions and strong distribution network. The company has consistently demonstrated its ability to integrate advanced technologies, such as IoT and energy-efficient designs, into its product offerings, thus appealing to a broad customer base seeking both aesthetic and functional value.

Lowe’s and Home Depot, primarily known for their vast retail presence, have effectively capitalized on the growing consumer trend towards DIY home improvement projects. Both companies offer an extensive range of decorative lighting products that cater to diverse consumer preferences and budget ranges, enhancing their market reach and consumer loyalty.

Philips Lighting (Signify Holding) and OSRAM GmbH are pivotal in driving technological innovation within the market. Their focus on sustainability and energy efficiency aligns well with global environmental trends, positioning them favorably among eco-conscious consumers.

GE Lighting and Hubbell have maintained their market presence by focusing on quality and durability, key factors that resonate with both residential and commercial users. LSI Industries and Generation Brands, on the other hand, differentiate themselves through customized solutions and unique design offerings, catering to niche markets within the decorative lighting sector.

Juno, known for its specialized offerings in track and recessed lighting, continues to cater to specific segments of the market, emphasizing precision and quality.

Collectively, these companies form a robust competitive framework within the global decorative lighting market, each leveraging their unique strengths to adapt to dynamic market demands and consumer preferences.

Top Key Players in the Market

- ACUITY BRANDS, INC.

- Lowe’s

- GE Lighting

- LSI Industries

- Hubbell

- Generation Brands

- Juno

- Philips Lighting (Signify Holding)

- Home Depot

- OSRAM GmbH

Recent Developments

- In June 2024, Schréder completed the acquisition of Ligman Lighting USA, aiming to enhance its position in the North American lighting market.

- In February 2023, LMPG Inc. acquired Architectural Lighting Works (ALW), expanding its portfolio and presence in the architectural lighting sector.

- In March 2023, Asian Paints Ltd announced its plan to acquire stakes in White Teak and Weatherseal Fenestration effective April 1st, to bolster its foothold in the burgeoning home improvement and decor segment.

Report Scope

Report Features Description Market Value (2023) USD 41.7 Billion Forecast Revenue (2033) USD 59.4 Billion CAGR (2024-2033) 3.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sconce, Chandeliers, Flush Mount, Pendants, Others), By Light Source (LED, Incandescent, Fluorescent, Others), By Application (Commercial, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ACUITY BRANDS, INC., Lowe’s, GE Lighting, LSI Industries, Hubbell, Generation Brands, Juno, Philips Lighting (Signify Holding), Home Depot, OSRAM GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ACUITY BRANDS, INC.

- Lowe’s

- GE Lighting

- LSI Industries

- Hubbell

- Generation Brands

- Juno

- Philips Lighting (Signify Holding)

- Home Depot

- OSRAM GmbH