Global Horticulture Lighting Market Size, Share Analysis Report By Offering (Hardware, Software, Services), By Technology (LED (Light Emitting Diode), High-Intensity Discharge (HID), Fluorescent, Others), By Lighting Type (Toplighting, Interlighting, Supplemental Lighting), By Installation Type (New Installations, Retrofit Installations), By End Use (Greenhouses, Vertical Farms, Indoor Farms, Research and Tissue Culture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159528

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

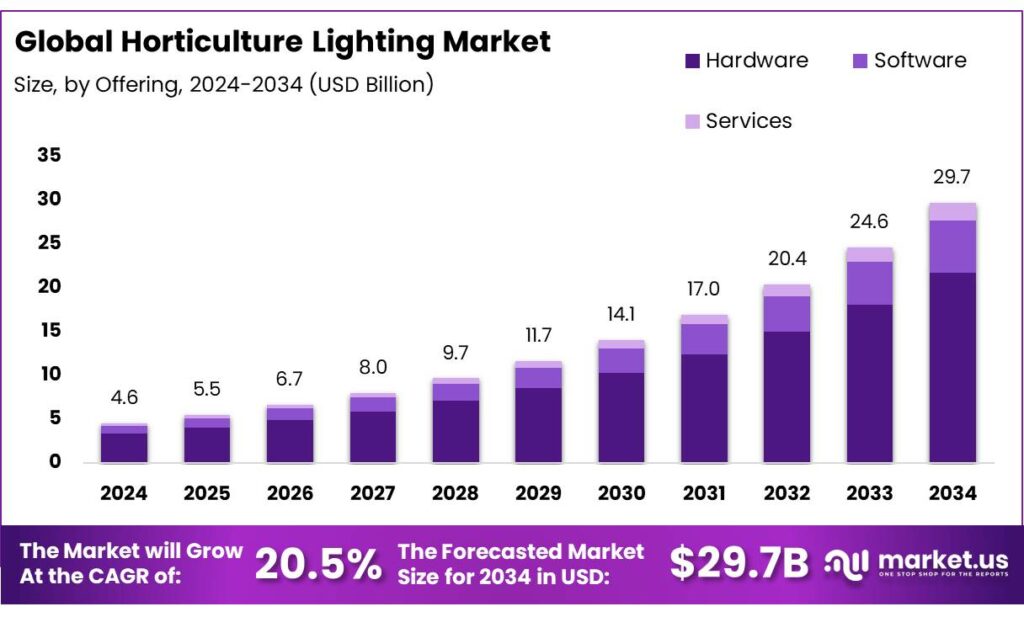

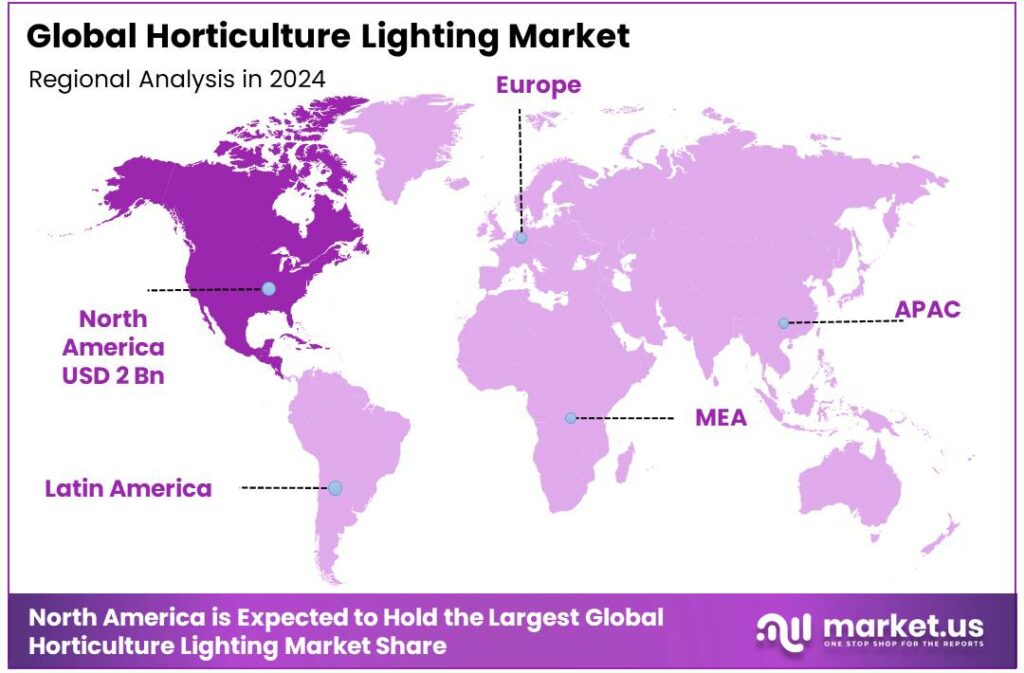

The Global Horticulture Lighting Market size is expected to be worth around USD 29.7 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 20.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.8% share, holding USD 2 Billion in revenue.

The horticulture lighting industry, which focuses on providing artificial light to enhance plant growth, has experienced significant growth over the past decade. The rise in indoor farming, vertical farming, and controlled-environment agriculture (CEA) has propelled the demand for efficient and reliable lighting solutions tailored to horticultural needs. Horticultural lighting is essential for improving crop yield, quality, and consistency, especially in regions where natural sunlight is insufficient for optimal plant growth. This market is driven by advancements in light-emitting diode (LED) technology, energy efficiency, and environmental sustainability.

- In the state of Karnataka, the horticulture department offers a 50% subsidy for solar-powered irrigation pumps to farmers in Mysuru and Chamarajanagar districts. Under this scheme, eligible farmers can receive Rs 1 lakh for a 3 HP pump and Rs 3 lakh for a 5 HP pump, aiming to reduce irrigation costs and promote sustainable farming practices. Such initiatives not only support the adoption of energy-efficient technologies but also contribute to the overall sustainability of agricultural practices.

In India, the government’s support plays a pivotal role in fostering the adoption of horticulture lighting solutions. The Clean Plant Programme (CPP), launched by the Ministry of Agriculture & Farmers Welfare, aims to enhance the quality of horticultural produce by providing disease-free planting material. Under this initiative, the government plans to establish nine Clean Plant Centres across the country, with three located in Maharashtra—Pune (grapes), Nagpur (oranges), and Solapur (pomegranates)—with an investment of ₹300 crore.

Additionally, the Mission for Integrated Development of Horticulture (MIDH), implemented since 2014–15, provides financial and technical support to states and union territories for various horticultural activities, including the adoption of modern technologies like horticulture lighting. These initiatives are complemented by state-level programs, such as the 50% subsidy on solar-powered irrigation pumps offered to farmers in Mysuru and Chamarajanagar districts, promoting sustainable farming practices

Key Takeaways

- Horticulture Lighting Market size is expected to be worth around USD 29.7 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 20.5%.

- Hardware held a dominant market position, capturing more than a 73.4% share of the horticulture lighting market.

- LED (Light Emitting Diode) held a dominant market position, capturing more than a 69.3% share of the horticulture lighting market.

- Toplighting held a dominant market position, capturing more than a 56.9% share of the horticulture lighting market.

- New Installations held a dominant market position, capturing more than a 67.2% share of the horticulture lighting market.

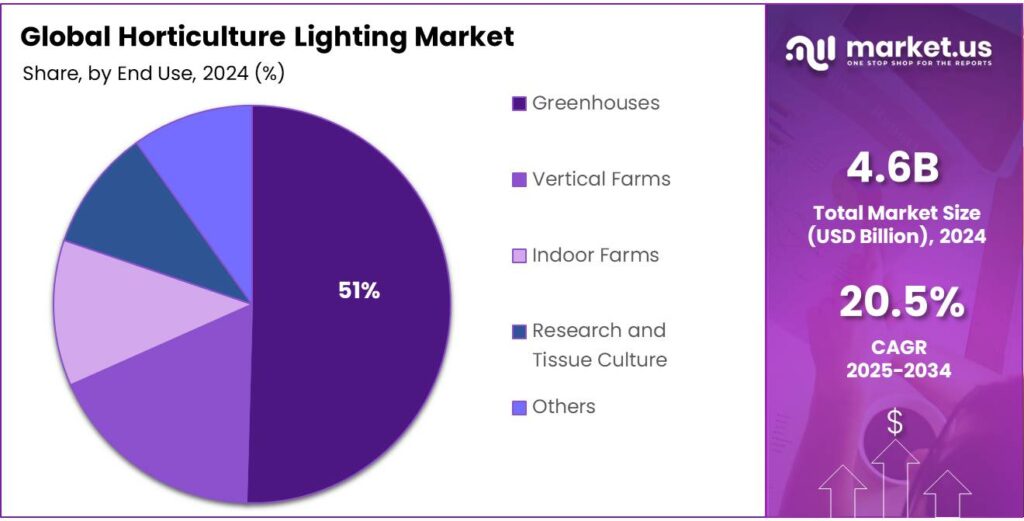

- Greenhouses held a dominant market position, capturing more than a 51.7% share of the horticulture lighting market.

- North America held a dominant position in the horticulture lighting market, capturing more than 43.8% of the total market share, valued at approximately USD 2 billion.

By Offering Analysis

Hardware Dominates Horticulture Lighting Market with 73.4% in 2024 Due to Its Essential Role

In 2024, Hardware held a dominant market position, capturing more than a 73.4% share of the horticulture lighting market. This substantial market share can be attributed to the essential role hardware plays in horticultural lighting systems, including components such as light fixtures, LED chips, reflectors, and cooling systems. These hardware components are critical to the operation and efficiency of lighting systems used in various agricultural applications, such as indoor and vertical farming.

As of 2024, hardware-based solutions are the most widely adopted in the market due to their proven reliability and performance. The increasing adoption of LED technology, known for its energy efficiency and longer lifespan, further propels the demand for hardware components. The hardware segment is expected to continue to lead the market in the coming years, with the share remaining relatively stable, though growth is anticipated due to ongoing technological advancements in horticultural lighting solutions.

By Technology Analysis

LED Dominates Horticulture Lighting Market with 69.3% in 2024 Due to Efficiency and Longevity

In 2024, LED (Light Emitting Diode) held a dominant market position, capturing more than a 69.3% share of the horticulture lighting market. The primary reason for this dominance is the inherent advantages of LED technology, which offers energy efficiency, long lifespan, and a customizable light spectrum that is ideal for plant growth. These benefits make LED the preferred choice for horticultural applications, including vertical farming and controlled environment agriculture (CEA), where optimizing light conditions is crucial for maximizing yield and quality.

LED technology’s energy savings are particularly significant, as it consumes less electricity compared to traditional lighting systems like fluorescent or high-intensity discharge (HID) lamps. The global shift towards sustainability in agriculture has further increased the demand for energy-efficient solutions, further solidifying LEDs’ market leadership. In 2025, LEDs are projected to maintain their dominant position in the market, with slight growth in their share as more advanced LED systems with better light spectrum control and integration with smart farming technologies emerge.

By Lighting Type Analysis

Toplighting Dominates Horticulture Lighting Market with 56.9% in 2024 Due to Its Broad Application

In 2024, Toplighting held a dominant market position, capturing more than a 56.9% share of the horticulture lighting market. Toplighting systems are widely used in large-scale commercial agriculture due to their ability to provide uniform light distribution across large crop areas. These systems are typically installed above plant canopies, making them suitable for applications in greenhouses and high-tech vertical farms. The effectiveness of toplighting in promoting healthy plant growth while maintaining energy efficiency has been a key factor behind its market dominance.

The continued preference for toplighting in the horticulture industry is supported by its versatility and efficiency. With technological advancements, modern toplighting systems now integrate LEDs, providing higher energy savings and more precise control over the light spectrum. In 2025, toplighting is expected to maintain its leading market position, although growth may slightly decelerate as alternative lighting types, such as interlighting and hybrid systems, gain traction in more specialized applications.

By Installation Type Analysis

New Installations Dominate Horticulture Lighting Market with 67.2% in 2024 Due to Growing Demand for Advanced Solutions

In 2024, New Installations held a dominant market position, capturing more than a 67.2% share of the horticulture lighting market. The increase in new installations can be attributed to the expansion of indoor farming and vertical farming systems, which require efficient and advanced lighting solutions. New agricultural operations and greenhouses are increasingly adopting modern horticultural lighting systems to optimize plant growth and improve yield, particularly in regions with limited access to natural sunlight.

The rising trend toward controlled-environment agriculture (CEA) and the growing demand for high-quality, locally grown produce are key drivers for the growth of new installations. In 2025, this segment is expected to maintain its dominant position, with new installations continuing to account for a significant portion of the market. As farmers and growers seek to modernize and expand their operations, the need for state-of-the-art lighting systems, particularly LED-based solutions, will continue to rise.

By End Use Analysis

Greenhouses Dominate Horticulture Lighting Market with 51.7% in 2024 Due to Their Widespread Adoption

In 2024, Greenhouses held a dominant market position, capturing more than a 51.7% share of the horticulture lighting market. The preference for greenhouses in the agricultural sector is primarily due to their ability to provide a controlled environment that optimizes plant growth, making them ideal for a wide range of crops, from vegetables to flowers. Greenhouses benefit from enhanced light conditions, which are critical for maintaining crop yields, particularly in regions with insufficient natural light.

Greenhouses are increasingly adopting advanced lighting technologies, such as LED systems, which offer energy savings, longer lifespan, and customizable light spectrums suited for various stages of plant growth. In 2025, greenhouses are expected to maintain their leadership in the market, with continued adoption of efficient lighting solutions. This growth is driven by the increasing demand for locally grown food, coupled with the global push for sustainable agricultural practices that can be supported by controlled-environment systems like greenhouses.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Technology

- LED (Light Emitting Diode)

- High-Intensity Discharge (HID)

- Fluorescent

- Others

By Lighting Type

- Toplighting

- Interlighting

- Supplemental Lighting

By Installation Type

- New Installations

- Retrofit Installations

By End Use

- Greenhouses

- Vertical Farms

- Indoor Farms

- Research and Tissue Culture

- Others

Emerging Trends

Government Support for Horticulture Lighting in India

The Indian government is actively promoting the adoption of horticulture lighting technologies to enhance agricultural productivity and sustainability. A significant initiative in this regard is the Clean Plant Programme (CPP), launched in August 2024. This program aims to provide farmers with access to high-quality, virus-free planting material, thereby improving crop yields and quality. The National Horticulture Board (NHB) is the implementing agency, collaborating with the Indian Council of Agricultural Research (ICAR) to oversee technical progress and facilitate capacity building.

Under the CPP, the government has approved the establishment of horticulture facilities in various states, including Maharashtra. In June 2025, Union Agriculture Minister Shivraj Singh Chouhan announced an investment of ₹300 crore to set up three horticulture facilities in Pune, Nagpur, and Solapur. These centers will focus on grape, orange, and pomegranate cultivation, providing farmers with healthy, disease-free saplings.

Additionally, the Mission for Integrated Development of Horticulture (MIDH), implemented since 2014–15, supports the holistic growth of the horticulture sector across all states and Union Territories. The mission includes initiatives such as the establishment of Centres of Excellence in Horticulture, which serve as hubs for demonstration and training on the latest technologies in the field.

Drivers

Government Support for Horticulture Lighting in India

The Indian government has been instrumental in promoting the adoption of horticulture lighting technologies, recognizing their potential to enhance agricultural productivity and sustainability. Through various schemes and subsidies, the government aims to make these technologies accessible to farmers across the country.

One of the significant initiatives is the National Horticulture Board’s (NHB) Development of Commercial Horticulture scheme, which offers a 50% subsidy on the total project cost for greenhouse construction, up to a maximum of ₹112 lakh per beneficiary. This subsidy has enabled farmers to invest in controlled environment agriculture, where horticulture lighting plays a crucial role in optimizing plant growth.

Additionally, the government has introduced the Cluster Development Programme (CDP), supported by the CDP-SURAKSHA digital platform, to streamline the disbursement of subsidies to horticulture farmers. This initiative ensures that farmers receive timely financial assistance, facilitating the adoption of modern agricultural practices, including the use of advanced lighting systems.

Restraints

High Initial Investment Costs

One of the primary challenges hindering the widespread adoption of horticulture lighting in India is the substantial initial investment required. While technologies like LED grow lights offer long-term energy savings and enhanced crop yields, their upfront costs remain a significant barrier, especially for small-scale farmers. High-quality horticulture lighting systems, tailored to the specific needs of different plant species and growth stages, often come with a hefty price tag.

- For instance, advanced LED systems designed for commercial indoor growing can cost upwards of $500 per unit, making them unaffordable for many farmers without financial assistance.

Recognizing this challenge, the Indian government has introduced several initiatives to support the adoption of modern agricultural technologies. The Mission for Integrated Development of Horticulture (MIDH), for example, provides financial assistance to farmers for various horticultural activities, including the adoption of advanced technologies like horticulture lighting.

- Additionally, the Agriculture Infrastructure Fund (AIF) Scheme, launched in July 2020 with a corpus of ₹1,00,000 crore, offers financial support to agri-entrepreneurs, start-ups, and farmer groups for infrastructure and logistics facilities, which can include investments in horticulture lighting systems.

Opportunity

Government Initiatives Fueling Growth in Horticulture Lighting

The horticulture lighting sector in India is experiencing significant growth, driven by a combination of technological advancements and supportive government policies. As the country seeks to enhance agricultural productivity and sustainability, initiatives like the National Horticulture Mission (NHM) and the PM Formalization of Micro Food Processing Enterprises (PMFME) scheme are playing pivotal roles.

Launched in 2005, the NHM aims to promote holistic growth in the horticulture sector through area-based and regionally differentiated strategies. The mission focuses on enhancing horticulture production, improving nutritional security, and providing income support to farm households. By establishing convergence among multiple ongoing and planned programs, NHM facilitates the dissemination of technologies and creates employment opportunities, especially for the youth.

The PMFME scheme, introduced to formalize the food processing sector, is another significant initiative. In Uttar Pradesh, for instance, the state government plans to invest ₹11,000 crore to develop mega food processing units and enhance infrastructure under this scheme. This investment includes promoting efficient irrigation methods like drip and sprinkler systems, aiming to increase coverage from 2.64% to 9% (approximately 10 lakh hectares) by 2027.

These government initiatives are creating a conducive environment for the adoption of advanced horticulture lighting solutions. The NHM’s focus on enhancing horticulture production and the PMFME scheme’s emphasis on modernizing food processing align with the objectives of controlled environment agriculture (CEA). CEA practices, which often rely on specialized lighting systems, are becoming more prevalent as farmers seek to optimize crop yields and quality.

Regional Insights

North America Dominates Horticulture Lighting Market with 43.8% Share in 2024

In 2024, North America held a dominant position in the horticulture lighting market, capturing more than 43.8% of the total market share, valued at approximately USD 2 billion. The growth of horticulture lighting in this region can be attributed to the increasing adoption of controlled-environment agriculture (CEA), urban farming, and vertical farming, where efficient lighting solutions are critical to enhancing crop yield and quality. North America’s robust agricultural infrastructure, combined with a strong focus on sustainability and technological advancements, has fueled the widespread use of advanced horticultural lighting systems, particularly LEDs.

The demand for horticulture lighting in North America is also driven by government support for energy-efficient farming practices, as well as investments in research and development of new lighting technologies. Various state-level initiatives, such as those in California and New York, focus on promoting energy-efficient farming and indoor agriculture, further boosting market growth. Additionally, the increasing consumer preference for locally grown, organic produce has led to the expansion of greenhouse farming and indoor farming operations, which heavily rely on advanced lighting technologies.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Signify, formerly Philips Lighting, is a global leader in lighting solutions, including horticultural lighting. The company offers a range of LED grow lights under the Philips brand, designed to enhance plant growth and energy efficiency. Signify’s GrowWise Control System allows for dynamic light recipes, optimizing light conditions for various plant species and growth stages. Their solutions are used in greenhouses and vertical farms worldwide, supporting sustainable agriculture practices.

Heliospectra, based in Sweden, specializes in intelligent LED lighting systems for controlled environment agriculture. Their MITRA X series offers multi-channel spectrum control, enabling growers to tailor light conditions to specific plant needs. The helioCORE™ control system provides real-time data and automation, improving energy efficiency and crop yields. Heliospectra’s solutions are utilized in various horticultural applications, including research institutions and commercial growers.

Hortilux Schréder, a collaboration between Hortilux and Schréder, focuses on providing advanced grow light solutions for greenhouse horticulture. They offer LED, HPS, and hybrid lighting systems tailored to the specific needs of different crops and growing conditions. Their products aim to enhance plant development, improve yield quality, and reduce energy consumption. Hortilux Schréder’s expertise supports growers in achieving optimal cultivation results.

Top Key Players Outlook

- Signify Holding B.V.

- Heliospectra AB

- Gavita International B.V.

- Hortilux Schreder B.V.

- Valoya Oy

- OSRAM GmbH

- California LightWorks, Inc.

- Kroptek Ltd.

- SANANBIO Co., Ltd.

- Agnetix, Inc.

Recent Industry Developments

In 2024 Heliospectra AB, reported a revenue of SEK 33.48 million, marking a 12.76% decrease from SEK 38.38 million in 2023. Despite this decline, Heliospectra continues to innovate and expand its product offerings.

In 2024, ams OSRAM reported total revenues of €3.4 billion, with the horticulture segment contributing significantly to their portfolio. A notable development in 2024 was the collaboration with Inventronics to launch the OSCONIQ P 3737 horticulture LED module.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Bn Forecast Revenue (2034) USD 29.7 Bn CAGR (2025-2034) 20.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Services), By Technology (LED (Light Emitting Diode), High-Intensity Discharge (HID), Fluorescent, Others), By Lighting Type (Toplighting, Interlighting, Supplemental Lighting), By Installation Type (New Installations, Retrofit Installations), By End Use (Greenhouses, Vertical Farms, Indoor Farms, Research and Tissue Culture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Signify Holding B.V., Heliospectra AB, Gavita International B.V., Hortilux Schreder B.V., Valoya Oy, OSRAM GmbH, California LightWorks, Inc., Kroptek Ltd., SANANBIO Co., Ltd., Agnetix, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Horticulture Lighting MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Horticulture Lighting MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Signify Holding B.V.

- Heliospectra AB

- Gavita International B.V.

- Hortilux Schreder B.V.

- Valoya Oy

- OSRAM GmbH

- California LightWorks, Inc.

- Kroptek Ltd.

- SANANBIO Co., Ltd.

- Agnetix, Inc.