Global Home Appliance Rental Apps Market Size, Share, Statistics Analysis Report By Product Type (Refrigerator, Television, Water Purifier/Water Dispenser, Air Conditioner, Washing Machine, Microwave, Air Purifier, Others), By Rental Duration (Short-Term Rentals, Long-Term Rentals), By End-Use (Residential, Commercial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 143755

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Market Leadership

- Environmental Impact

- Commonly Rented Appliance Types

- Product Type Analysis

- Rental Duration Analysis

- End-Use Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

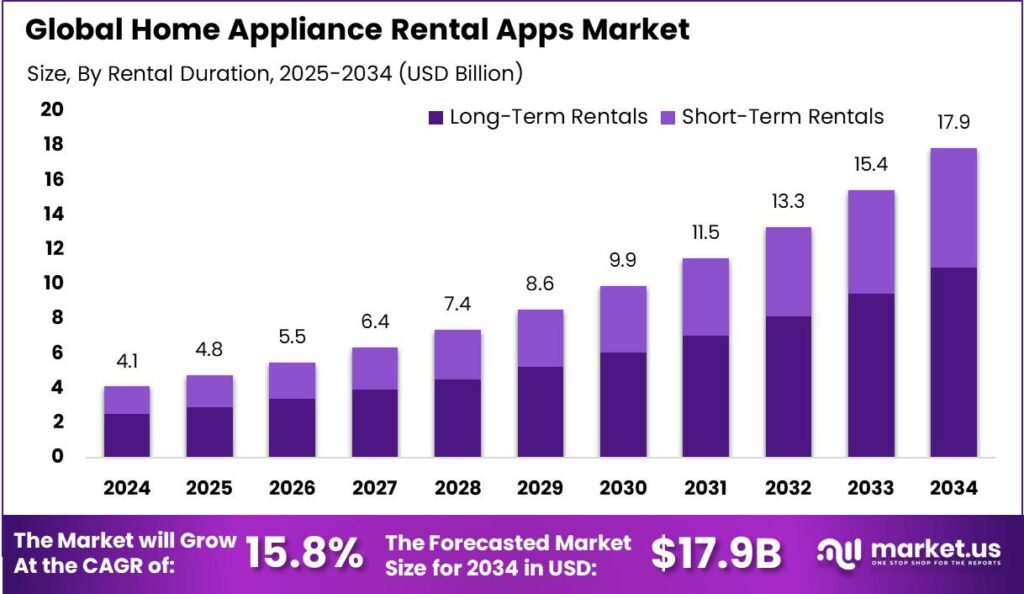

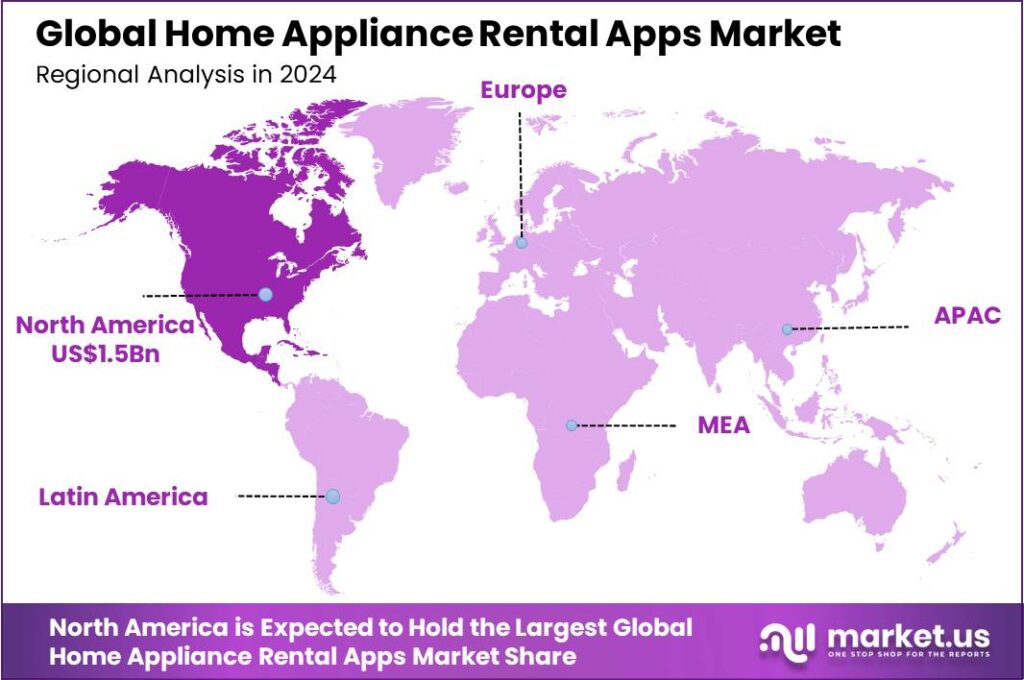

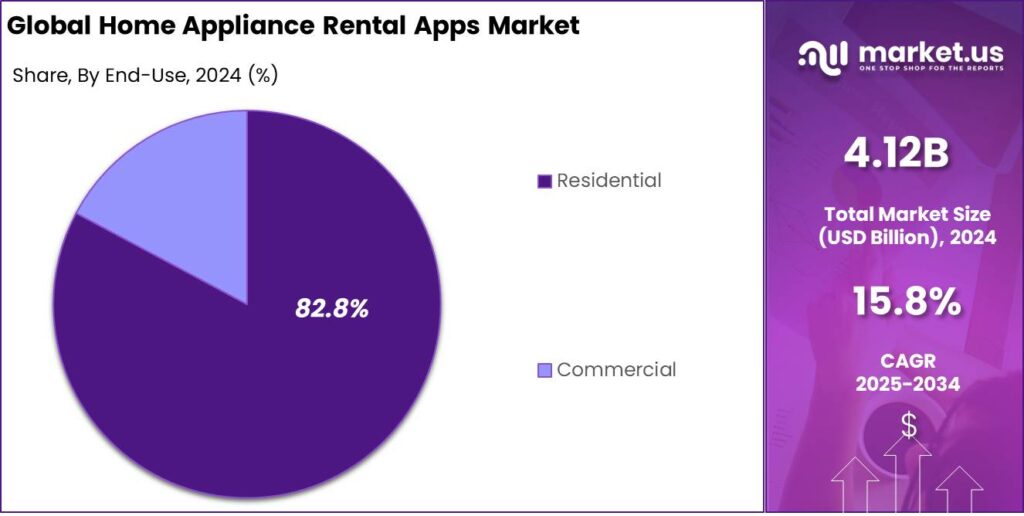

The Global Home Appliance Rental Apps Market size is expected to be worth around USD 17.9 Billion By 2034, from USD 4.12 Billion in 2024, growing at a CAGR of 15.80% during the forecast period from 2025 to 2034. North America held the largest market share in the home appliance rental apps sector in 2024, capturing more than 38.5% of the market.

Home appliance rental apps facilitate the leasing of home appliances to users over specified periods. These platforms provide a cost-effective alternative for consumers who prefer not to purchase or cannot afford to buy home appliances outright. The apps usually feature a range of products from basic kitchen appliances to high-end electronic devices, enabling customers to select items that suit their immediate needs.

The home appliance rental apps market has witnessed significant growth driven by the increasing mobility of the global workforce and a shift towards flexible consumption models. Consumers, especially millennials and urban dwellers, are opting for rental solutions to avoid the high costs and maintenance hassles associated with owning appliances.

The primary driving factors of the home appliance rental apps market include the rising cost of home appliances and a noticeable shift towards more sustainable living practices. Economic factors also play a significant role; as prices for new technologies and premium appliances climb, more consumers are looking for cost-effective solutions.

The demand for home appliance rental apps is growing, driven by increased mobility, urban migration, and a shift toward temporary accommodations. Additionally, environmental concerns and the increasing awareness of sustainable living practices encourage consumers to opt for rental services, which often promote recycling and reusing appliances, reducing overall consumer waste.

The Home appliance rental market offers several opportunities, including expanding into regions where the concept is still emerging. There is potential to expand the product range with high-end appliances, making them accessible to more consumers. Improving app features and customer service can further enhance user experience, attracting more customers and expanding market reach.

For businesses, entering the home appliance rental market offers numerous advantages. These include a consistent revenue stream through recurring rental fees and the potential to tap into a broader customer base that might not be reached through traditional retail models. Rental platforms can also benefit from partnerships with appliance manufacturers for direct supply deals, which can reduce costs and improve supply chain efficiency.

Key Takeaways

- The Global Home Appliance Rental Apps Market is projected to reach a value of approximately USD 17.9 Billion by 2034, growing from USD 4.12 Billion in 2024, with a CAGR of 15.80% during the forecast period from 2025 to 2034.

- In 2024, the Refrigerator segment dominated the home appliance rental apps market, holding more than a 31.7% share.

- The Long-Term Rentals segment led the home appliance rental apps market in 2024, accounting for over 61.4% of the market share.

- The Residential segment maintained a dominant position in the market in 2024, representing over 82.8% of the share.

- North America held the largest market share in the home appliance rental apps sector in 2024, capturing more than 38.5% of the market.

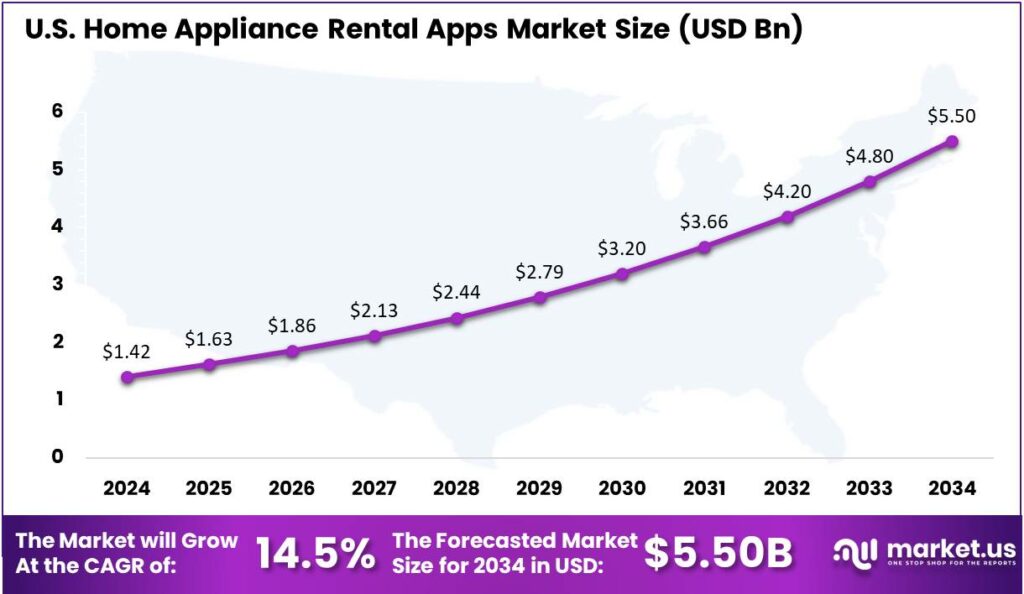

- In the U.S., the market for home appliance rental apps was valued at $1.42 billion in 2024, and it is expected to grow at a robust CAGR of 14.5%.

Analysts’ Viewpoint

From an investment perspective, the home appliance rental apps market presents substantial opportunities due to its rapid growth and the ongoing shift towards digital and shared economies. Analysts emphasize the importance of monitoring technological advancements and regulatory environments to stay competitive.

The top impacting factors include consumer behavior trends towards sustainability and convenience, while the regulatory environment continues to evolve to keep pace with technological changes. Investments in this sector are seen as increasingly attractive due to the scalability of the business model and the potential for high returns on investment.

U.S. Market Leadership

In 2024, the U.S. market for home appliance rental apps was estimated at a value of $1.42 billion. This sector is experiencing robust growth, with a compound annual growth rate (CAGR) of 14.5%.

The burgeoning expansion of the home appliance rental apps market is driven by a variety of factors. Consumers are increasingly seeking flexible and cost-effective solutions for home appliance usage, particularly in urban areas where transient lifestyles and smaller living spaces are common. This trend is complemented by the rising popularity of the sharing economy, which has shifted consumer preferences from owning to renting.

Looking ahead, the market is expected to continue its growth trajectory, fueled by the ongoing innovation in app functionalities and the broadening acceptance of rental services as a mainstream consumer option. Companies in this space are expected to focus on improving user experience and broadening their product range, which will help attract more customers, encourage repeat business, and sustain market growth.

In 2024, North America held a dominant market position in the home appliance rental apps sector, capturing more than a 38.5% share. This translates to revenue of approximately USD 1.5 billion, underscoring the region’s substantial impact on the global market.

The technology-driven culture in North America greatly accelerates the growth of home appliance rental apps. With robust digital infrastructure, seamless app functionalities, and widespread smartphone and internet access, these apps offer smooth user experiences and easy accessibility, driving broad adoption.

Economic factors significantly impact the growth of home appliance rental apps in North America. High living costs make renting appliances a more attractive option for cost-conscious consumers. Additionally, the region’s focus on sustainability drives eco-conscious behaviors, encouraging people to choose rental and sharing models to reduce waste and environmental impact.

The presence of major players in North America’s home appliance rental market drives competition and innovation. Companies invest in marketing and technology to enhance services, expand their reach, and attract new users with the convenience and flexibility of rental solutions, while solidifying their current customer base.

Environmental Impact

- Reduction of E-Waste: Renting appliances promotes a circular economy, where products are used, maintained, and returned instead of being discarded. This model reduces appliance production, lowering resource demand and minimizing electronic waste.

- Resource Conservation: Renting encourages efficient use of materials such as metals and plastics involved in manufacturing. By opting for rentals, consumers help lower the demand for new products, which conserves valuable resources and reduces environmental degradation associated with extraction and production processes.

- Extended Appliance Lifespan: Rental services often maintain and refurbish appliances, which extends their usable life. This practice maximizes resources and also minimizes the need for new appliance production, further contributing to sustainability efforts.

- Energy Efficiency: Rental companies provide access to high-quality, energy-efficient appliances that may be financially out of reach for many consumers. Modern appliances use less energy and water, lowering utility bills and reducing carbon emissions.

- Encouragement of Sustainable Practices: By choosing to rent rather than buy, consumers support businesses that prioritize eco-friendly practices. This choice fosters a market that values sustainability and encourages manufacturers to adopt greener production methods.

Commonly Rented Appliance Types

- Refrigerators: Essential for any household, refrigerators are among the most commonly rented appliances, available in various styles like side-by-side and French door models.

- Washers and Dryers: These laundry essentials are frequently rented due to their importance in daily life. Options include both top-loading and front-loading models.

- Dishwashers: Often rented to save time and effort, dishwashers are popular in both residential and rental properties.

- Ovens and Ranges: Available in various configurations, these cooking appliances are crucial for renters who enjoy home-cooked meals.

- Air Conditioners: Especially sought after in warmer climates or during summer months, portable or window air conditioning units are commonly rented.

Product Type Analysis

In 2024, the Refrigerator segment held a dominant position within the Home Appliance Rental Apps market, capturing more than a 31.7% share. This segment’s leadership is largely due to the essential nature of refrigerators in households.

The continued dominance of the refrigerator segment is due to its broad utility across various demographics. Families, single-person households, and shared accommodations all require refrigerators, ensuring steady demand. This universal need diversifies the customer base and stabilizes rental frequency, unlike niche segments like air purifiers or microwaves, which may not be essential for all users.

Economic factors play a crucial role in reinforcing the Refrigerator segment’s market leadership. In the context of rising living costs and the upfront expense associated with purchasing new, energy-efficient models, rental options present a cost-effective alternative.

The rise of transient lifestyles, especially in urban areas, has greatly boosted the growth of the refrigerator rental segment. As people move more frequently due to job changes or personal preferences, renting appliances becomes a more convenient and cost-effective option. This trend is likely to continue as mobility increasingly shapes modern life.

Rental Duration Analysis

In 2024, the Long-Term Rentals segment held a dominant position in the home appliance rental apps market, capturing more than a 61.4% share. This segment’s leadership can be attributed to several compelling factors that resonate with both consumers and rental service providers.

Long-term rentals appeal to consumers seeking stability and convenience without the high upfront costs of purchasing appliances. This model is particularly attractive to individuals and families residing in a location for extended periods but not permanently, such as expatriates or professionals on long-term work assignments.

From the business perspective, long-term rentals provide a steady and predictable revenue stream. This reliability helps companies optimize inventory and operations, improving cost management and profit margins. Longer rental periods also allow customer acquisition costs to be spread over time, boosting profitability per customer.

The long-term rental model also strengthens customer relationships. By engaging with customers over time, companies can provide personalized services, better maintenance, and upgrades, boosting satisfaction and loyalty. This leads to higher retention rates, essential for sustainable growth in a competitive market.

End-Use Analysis

In 2024, the Residential segment held a dominant market position in the home appliance rental apps market, capturing more than an 82.8% share. This substantial market share underscores the segment’s pivotal role in driving the overall market dynamics.

The dominance of the Residential segment is driven by shifting housing trends and lifestyle changes, particularly in urban areas with smaller living spaces. This shift encourages renting appliances, offering flexibility and reducing upfront costs, especially among millennials and Gen Z, who favor transient living arrangements.

Additionally, the rise of the gig economy and remote working trends has altered how consumers view home management, pushing convenience to the forefront. Home appliance rental apps cater to this need by offering services that are not only convenient but also scalable, allowing customers to select solutions that best fit their changing needs without the permanence of purchase.

Economic factors also contribute significantly to the prominence of the residential segment. In an era of economic fluctuation, consumers are more cautious about their spending habits. The option to rent appliances allows households to manage their budgets better, avoiding the depreciation and maintenance costs associated with appliance ownership.

Key Market Segments

By Product Type

- Refrigerator

- Television

- Water Purifier/Water Dispenser

- Air Conditioner

- Washing Machine

- Microwave

- Air Purifier

- Others

By Rental Duration

- Short-Term Rentals

- Long-Term Rentals

By End-Use

- Residential

- Commercial

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Urbanization and Mobility

The rapid pace of urbanization has significantly influenced consumer behavior, particularly in the context of home appliance rentals. As more individuals migrate to urban centers for employment and education, the demand for flexible living arrangements has surged.

This demographic shift has led to a preference for renting over purchasing, not only in housing but also in essential household items. Renting appliances offers a cost-effective solution for urban dwellers who may relocate frequently or have limited space, eliminating the burden of transporting bulky items.

Moreover, the rise of the sharing economy has normalized the concept of temporary ownership, making appliance rental services more appealing. This trend is particularly pronounced among millennials and Gen Z consumers, who prioritize experiences and flexibility over long-term commitments.

Restraint

Availability of Financing Options

Financial institutions provide consumers with accessible loans and credit facilities, enabling the outright purchase of appliances. This accessibility diminishes the appeal of rental services, as ownership becomes more attainable. Consumers may perceive purchasing as a more economical long-term investment, especially when interest rates are favorable.

Additionally, ownership eliminates recurring rental payments and potential contractual obligations, offering a sense of permanence and control over the asset. The perception that owning appliances adds to one’s assets and can be more cost-effective over time further discourages the rental model. Cultural factors, where ownership is linked to status and stability, challenge the growth of the appliance rental market as consumers weigh ownership benefits against the flexibility of renting.

Opportunity

Technological Advancements and Smart Appliances

The integration of technology into household appliances presents a substantial opportunity for the rental market. Smart appliances equipped with Internet of Things (IoT) capabilities offer enhanced functionalities, such as remote operation, energy efficiency, and integration with smart home systems.

Rental services can bridge this gap by providing access to the latest technology without the significant financial commitment of purchasing. This model allows consumers to experience the benefits of smart appliances, such as improved convenience and energy savings, on a flexible basis.

As technology advances, rental services allow seamless upgrades to newer models, preventing outdated equipment. This aligns with the growing demand for sustainability by reducing electronic waste and promoting resource efficiency. Rental companies can attract tech-savvy consumers seeking flexibility and functionality.

Challenge

Maintenance and Quality Assurance

Ensuring the maintenance and quality of rented appliances presents a significant challenge in the rental market. Consumers expect appliances to function reliably, and any malfunction can lead to dissatisfaction and loss of trust in the rental service. Regular maintenance is essential but adds costs. Rental companies must balance these with competitive pricing through efficient logistics and skilled staff.

Moreover, the wear and tear from multiple users can accelerate the depreciation of appliances, necessitating more frequent replacements. Implementing robust quality assurance protocols is crucial to identify and address potential issues before appliances reach consumers.

Coordinating maintenance and managing inventory can be complex, especially at scale. Poor management of these aspects can lead to negative customer experiences, damaging the rental service’s reputation and growth.

Emerging Trends

A prominent trend is the integration of smart technology into rental appliances.Consumers are increasingly seeking appliances that seamlessly connect with smart devices, offering features like remote monitoring, voice control, and automated scheduling. This integration boosts convenience and supports the broader trend towards automation and smart living.

Another emerging trend is the rise of subscription-based rental models. Unlike traditional rentals with long-term commitments, subscription models offer flexible monthly or short-term appliance rentals. This appeals to younger, mobile consumers and urban dwellers who value minimalism. Benefits like regular maintenance, easy upgrades, and appliance swaps cater to the fast-paced, evolving lifestyles of modern users.

Flexible rental agreements are gaining traction as consumers seek solutions that adapt to their changing needs. Flexible rental terms allow users to choose durations that suit their needs, appealing to students, transient workers, and those in shared housing. This reflects the growing shift toward access over ownership.

Business Benefits

- Convenience and Time Savings: These apps streamline the process of acquiring high-quality appliances by providing services like delivery, installation, and maintenance. This eliminates the logistical challenges and time associated with purchasing and setting up new appliances, allowing businesses to focus on their core operations without disruption.

- Access to Latest Technology: Rental apps enable businesses to access the latest appliance models and technologies without committing to full purchases. This is crucial for staying competitive, as it ensures that one can leverage the most efficient and modern equipment.

- Scalability: Home appliance rental apps make it easier to scale operations up or down based on the current business volume. This flexibility helps businesses during peak periods or promotions without the need for long-term appliance purchases.

- Risk Reduction: Renting appliances reduces the risks associated with obsolescence and depreciation. Businesses can return or upgrade their equipment as newer models become available, ensuring that they are not stuck with outdated or depreciating assets.

- Enhanced Cash Flow Management: By renting appliances, businesses can better manage their cash flow since rental costs are predictable and spread over time. This aids in more effective budgeting and financial planning, as opposed to the significant upfront costs of purchasing.

Key Player Analysis

Several players in Home Appliance Rental Apps Market have emerged, offering unique services to cater to the diverse needs of consumers

Rentomojo has established itself as a leading player in the home appliance rental industry by offering a wide range of products, from refrigerators and washing machines to furniture and electronics. What sets Rentomojo apart is its subscription-based model, allowing customers to rent products for various durations with the option to upgrade, return or buy the items.

Furlenco focuses on providing an elegant and stylish range of home appliances and furniture for rent, targeting customers who want premium, high-quality products without the upfront costs. Known for its well-curated designs and user-friendly platform, Furlenco offers rental packages that come with free maintenance, making it a hassle-free option for individuals who prioritize convenience.

Rent-A-Center, a well-established brand, serves as a dominant force in the home appliance rental market in North America. With a wide selection of appliances, electronics, and furniture, Rent-A-Center offers flexible lease-to-own options, catering to individuals who may not have access to traditional financing methods.

Top Key Players in the Market

- Rentomojo

- Furlenco

- Rent A Center

- CityFurnish

- Housejoy

- Rentickle

- Appliancesonrent.com

- Fabrento

- Livpure Smart Homes Private Limited

- DrinkPrime

- Other Major Players

Top Opportunities Awaiting for Players

The Home appliance rental apps market is driven by several transformative trends that cater to evolving consumer preferences and technological advancements.

- Integration of Smart Technology: As smart home integration becomes increasingly prevalent, there is a substantial opportunity for rental companies to offer appliances that boast advanced connectivity and automation features. Smart appliances, like recipe-suggesting refrigerators and remote-controlled washers, boost convenience and meet growing consumer demand for efficient home management.

- Flexible Rental Agreements: The market is shifting towards more adaptable rental terms to accommodate the fluctuating economic conditions and lifestyles of consumers. Flexible rental agreements, offering customizable durations, attract a wide range of people, from transient workers and students to families, by allowing them to adjust appliance needs without long-term commitments.

- Subscription-Based Models: The rise of subscription-based models in the appliance rental market indicates a shift towards more flexible, service-oriented consumer engagements. These models allow customers to access the latest appliances without upfront costs and offer flexibility to upgrade as needs evolve, fostering satisfaction and long-term engagement while aligning with minimalism and convenience.

- Eco-Friendly and Sustainable Practices: Appliance rental apps have the opportunity to attract environmentally conscious customers by offering the latest in energy-efficient and eco-friendly appliances. This trend meets customer expectations and supports environmental sustainability by promoting energy-efficient appliances and circular economy practices like refurbishing and recycling, boosting brand reputation and customer loyalty.

- Enhanced User Experience with Technological Innovations: The appliance rental sector can differentiate itself by adding features like automated maintenance reminders, real-time troubleshooting with smart diagnostics, and personalized usage insights via app integrations. These enhancements not only boost appliance functionality but also make managing home appliances more seamless and interactive, enriching the user experience.

Recent Developments

- In February 2025, Herc Holdings announced a definitive agreement to acquire H&E Equipment Services. This strategic merger aims to strengthen Herc’s position as the third-largest equipment rental company in North America.

- In January 2025, LG Taiwan introduced a home appliance rental and care service, becoming the first major brand to offer such a service in Taiwan. This initiative allows consumers to access premium appliances without significant upfront costs.

- In November 2024, LG Electronics is expanding its subscription service into new markets like India to boost growth in its leasing business. The company has broadened its product offerings, now including premium home ventilation systems, CLOi robots, TVs, laptops, refrigerators, and washing machines.

Report Scope

Report Features Description Market Value (2024) USD 4.12 Bn Forecast Revenue (2034) USD 17.9 Bn CAGR (2025-2034) 15.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Refrigerator, Television, Water Purifier/Water Dispenser, Air Conditioner, Washing Machine, Microwave, Air Purifier, Others), By Rental Duration (Short-Term Rentals, Long-Term Rentals), By End-Use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rentomojo, Furlenco, Rent A Center, CityFurnish, Housejoy, Rentickle, Appliancesonrent.com, Fabrento, Livpure Smart Homes Private Limited, DrinkPrime, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Appliance Rental Apps MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Home Appliance Rental Apps MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rentomojo

- Furlenco

- Rent A Center

- CityFurnish

- Housejoy

- Rentickle

- Appliancesonrent.com

- Fabrento

- Livpure Smart Homes Private Limited

- DrinkPrime

- Other Major Players