Global Herbicide Safeners Market Size, Share Analysis Report By Product Type (Benoxacor, Furilazole, Dichlormid, Isoxadifen, Others), By Selectivity (Selective Herbicides, Non-Selective Herbicides), By Crop Type (Wheat, Soybean, Sorghum, Maize, Rice, Barley, Others), By Application (Post-emergence, Pre-emergence) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155352

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

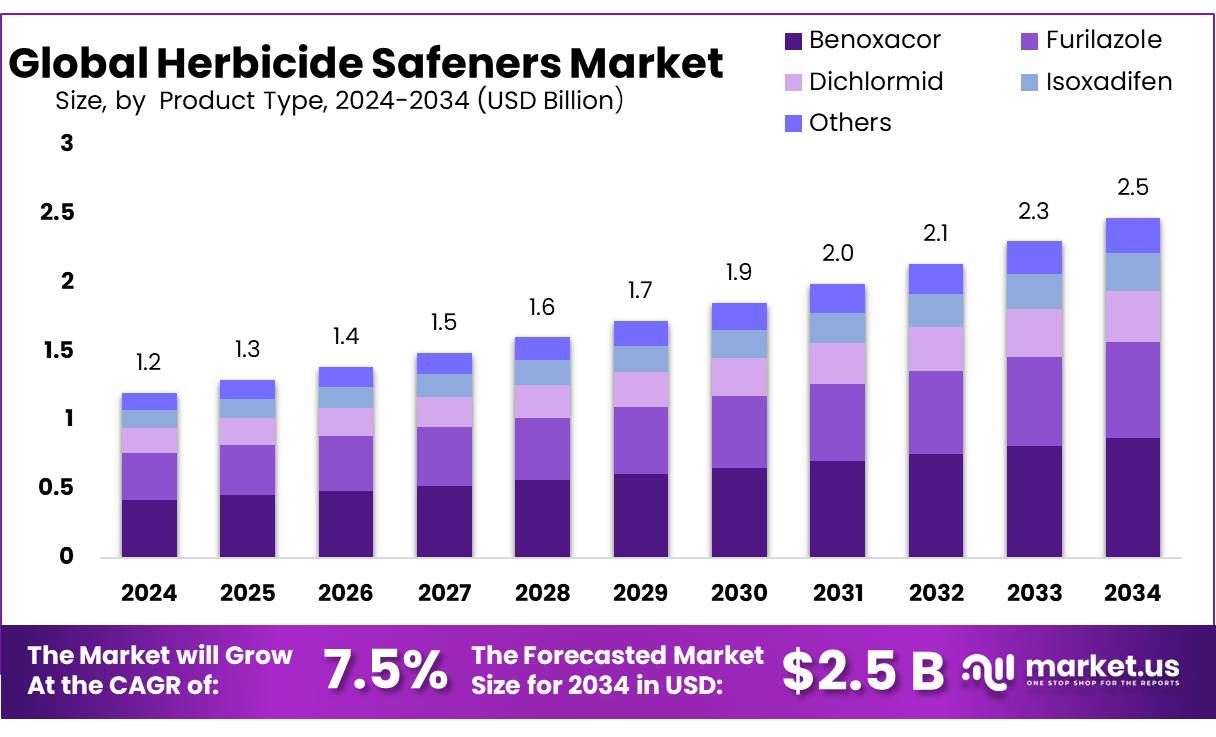

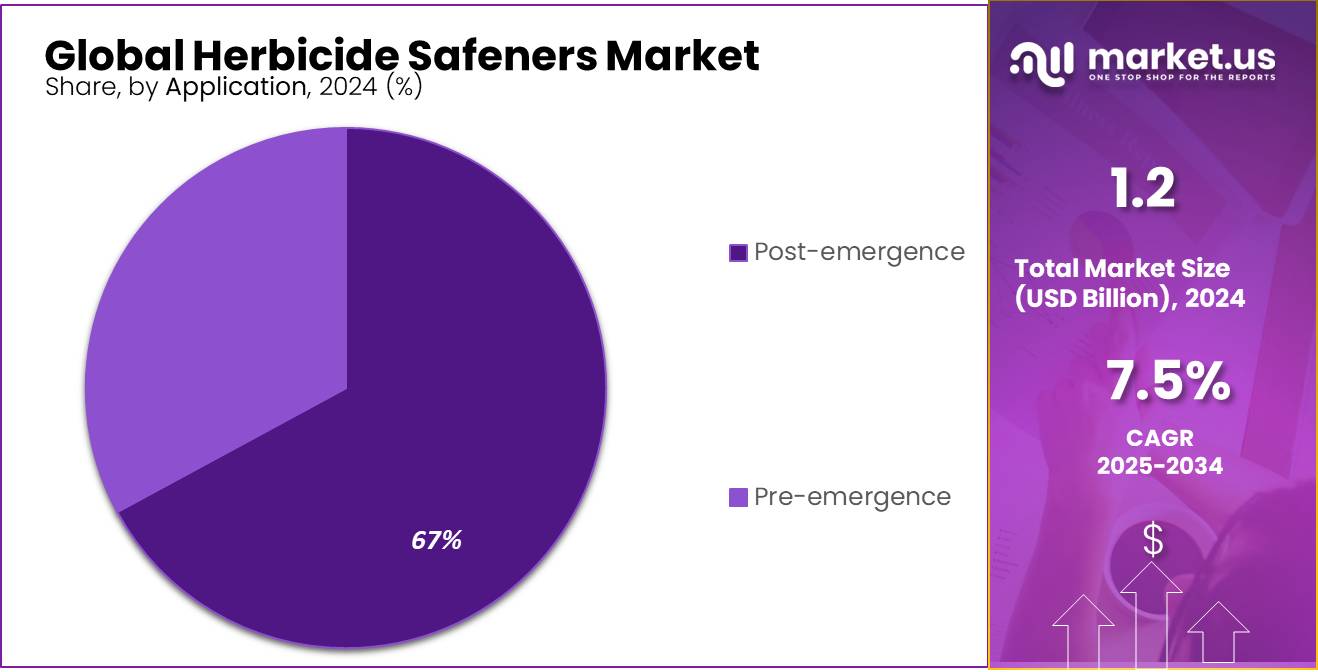

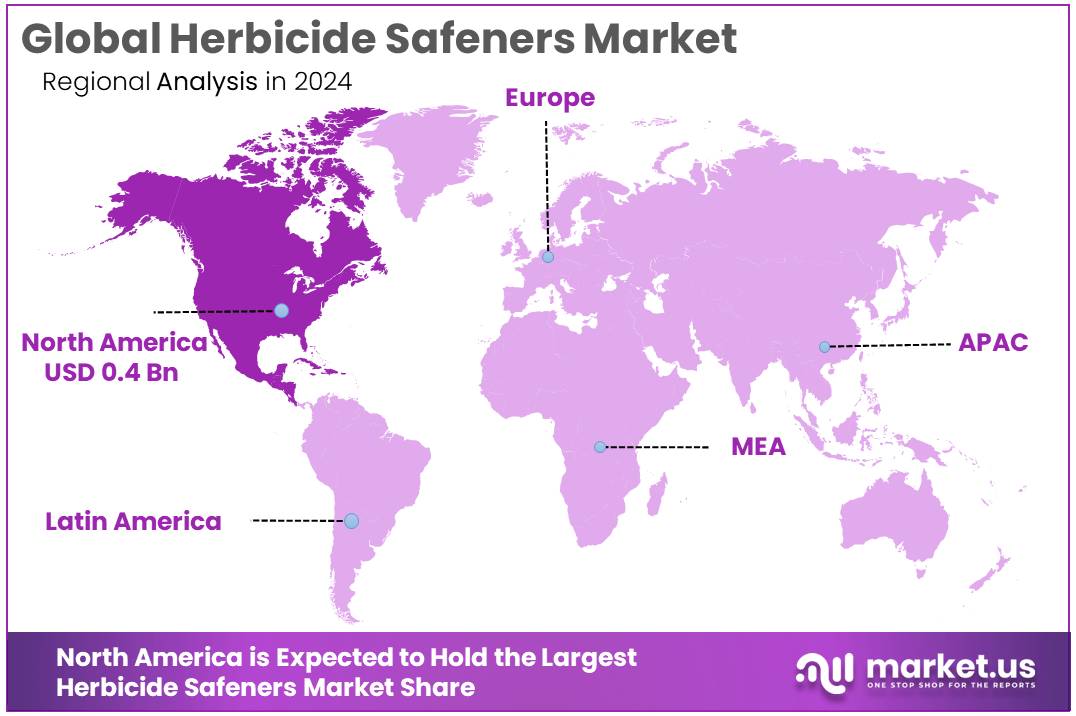

The Global Herbicide Safeners Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 0.4 Billion revenue.

Herbicide safeners are chemical compounds designed to protect crops from the phytotoxic effects of herbicides, thereby enhancing the selectivity and efficacy of weed control. These safeners are particularly crucial in modern agriculture, where the use of herbicides is prevalent to manage weed populations effectively.

The Indian agrochemical industry is experiencing robust expansion, with herbicides being a crucial component of crop protection strategies. In 2024, the herbicide segment generated a revenue of ₹8,200 crore, reflecting a growth rate exceeding 10% annually. This surge is attributed to the increasing adoption of herbicides to enhance crop yields and manage weed resistance. Herbicide safeners play a pivotal role in this context by enabling the safe application of herbicides, thereby safeguarding crops and improving the efficacy of weed control measures.

Policy is a central industrial shaper. The EU’s Farm-to-Fork strategy targets a 50% reduction in the overall use and risk of chemical pesticides and a 50% cut in the use of more hazardous pesticides by 2030, incentivizing safer, more selective programs in which safeners help maintain efficacy at optimized rates. Regulatory attention to co-formulants has also increased; recent EU data-requirement updates set out consistent approval frameworks for safeners and synergists, signaling clearer pathways for innovation and compliance.

Driving factors for the growth of herbicide safeners in India include the intensification of agriculture, limited arable land, and the need for increased crop yields to meet the demands of a growing population. Additionally, the rising awareness among farmers about the benefits of herbicide safeners in reducing crop damage and improving herbicide efficacy contributes to their adoption. The development of new safener formulations that are more effective and environmentally friendly further supports market growth.

Key Takeaways

- Herbicide Safeners Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 7.5%.

- Benoxacor held a dominant market position, capturing more than a 34.2% share.

- Selective Herbicides held a dominant market position, capturing more than a 72.8% share.

- Maize held a dominant market position, capturing more than a 26.4% share.

- Post-emergence held a dominant market position, capturing more than a 67.3% share.

- North America held a dominant position in the global herbicide safeners market, capturing 38.5% of total revenue, valued at USD 0.4 billion.

By Product Type Analysis

Benoxacor leads with 34.2% market share in 2024

In 2024, Benoxacor held a dominant market position, capturing more than a 34.2% share, driven by its proven effectiveness as a herbicide safener in corn and other cereal crops. Widely used in combination with chloroacetanilide herbicides such as S-metolachlor, Benoxacor helps protect crop seedlings by enhancing the plant’s natural detoxification processes, allowing effective weed control without compromising crop safety.

Its role has been reinforced in major agricultural economies like the United States, where large corn acreages—over 91 million acres planted in 2024—create a substantial market for safener-based herbicide formulations. The compound’s regulatory acceptance in multiple regions, including the U.S. Environmental Protection Agency’s established tolerance levels, supports its consistent use in pre-emergent and early post-emergent applications.

By Selectivity Analysis

Selective Herbicides dominate with 72.8% market share in 2024

In 2024, Selective Herbicides held a dominant market position, capturing more than a 72.8% share, supported by their ability to target specific weed species without harming the intended crop. These herbicides, when paired with safeners, offer high precision in crop protection programs, especially in staple crops like corn, wheat, and rice where maintaining crop safety is critical to yield performance.

Safeners enhance the crop’s natural tolerance, allowing for effective weed control even at optimized herbicide application rates, which is increasingly important under tightening environmental regulations. The strong adoption of selective herbicides in regions such as North America—where over 91 million acres of corn were planted in 2024—and Europe—where integrated pest management is widely practiced—has reinforced this segment’s market dominance.

By Crop Type Analysis

Maize leads with 26.4% market share in 2024

In 2024, Maize held a dominant market position, capturing more than a 26.4% share, driven by its extensive global cultivation and high reliance on safener-supported herbicide programs. As a crop highly sensitive to certain pre-emergent and post-emergent herbicides, maize benefits significantly from safeners like Benoxacor, Cyprosulfamide, and Isoxadifen-ethyl, which protect seedlings from potential chemical injury while enabling broad-spectrum weed control.

Large maize-growing regions, such as the United States—with over 91 million acres planted in 2024—and parts of Latin America, Europe, and Sub-Saharan Africa, form the backbone of demand for safener-integrated herbicide solutions. These programs help farmers manage yield-limiting weeds effectively while adhering to strict application guidelines and environmental regulations.

By Application Analysis

Post-emergence dominates with 67.3% market share in 2024

In 2024, Post-emergence held a dominant market position, capturing more than a 67.3% share, driven by its effectiveness in targeting actively growing weeds while minimizing crop injury through the use of safeners. This application method allows farmers to assess weed pressure after crop emergence and apply herbicides selectively, reducing unnecessary chemical use and improving cost efficiency.

Safeners play a critical role in post-emergence programs for crops such as maize, wheat, and rice, ensuring that herbicide activity is focused on weeds without harming young plants. In regions like North America and Europe, where precision agriculture and integrated pest management (IPM) practices are widely adopted, post-emergence treatments are preferred for their flexibility and alignment with environmental stewardship goals.

Key Market Segments

By Product Type

- Benoxacor

- Furilazole

- Dichlormid

- Isoxadifen

- Others

By Selectivity

- Selective Herbicides

- Non-Selective Herbicides

By Crop Type

- Wheat

- Soybean

- Sorghum

- Maize

- Rice

- Barley

- Others

By Application

- Post-emergence

- Pre-emergence

Emerging Trends

Rise of Seed-Applied Herbicide Safeners in Precision Agriculture

This trend is driven by the increasing adoption of genetically modified (GM) crops and the need for precise weed management. Seed-applied safeners offer a proactive approach, protecting crops from herbicide-induced stress right from germination. For instance, in 2024, the benoxacor segment garnered USD 442.1 million in revenue, highlighting its effectiveness in enhancing crop tolerance to herbicides like metolachlor.

Governments and regulatory bodies are also supporting this shift. In March 2024, the U.S. Environmental Protection Agency (EPA) amended regulations to broaden the use of the safener cloquintocet-mexyl, permitting its inclusion in any herbicide formulation applied to specified commodities such as maize and sorghum. This regulatory change facilitates safer herbicide applications, promoting sustainable agricultural practices.

The move towards seed-applied herbicide safeners not only enhances crop protection but also aligns with the global push for sustainable agriculture. By integrating these safeners, farmers can achieve effective weed control while minimizing environmental impact, ensuring food security for future generations.

Drivers

Enhanced Crop Protection and Yield Optimization

One of the primary driving factors for the adoption of herbicide safeners in India is the need to protect crops from herbicide-induced damage while effectively controlling weeds. Herbicide safeners are chemical agents that, when applied alongside herbicides, mitigate the phytotoxic effects on crops, allowing for more selective and efficient weed management. This is particularly crucial in India, where agriculture is heavily reliant on herbicides for weed control.

Government initiatives have also played a significant role in promoting the use of herbicide safeners. The National Mission on Sustainable Agriculture (NMSA) aims to enhance agricultural productivity, especially in rainfed areas, focusing on integrated farming, water use efficiency, soil health management, and synergizing resource use . Such initiatives encourage the adoption of technologies that improve crop protection and sustainability, including the use of herbicide safeners.

Furthermore, the expansion of genetically modified (GM) crops in India has created a need for specialized herbicide formulations. GM crops are engineered to be resistant to specific herbicides, and the use of safeners ensures that these herbicides can be applied without harming the crops. This synergy between GM crops and herbicide safeners contributes to increased agricultural productivity and efficiency.

Restraints

High Cost of Herbicide Safeners

One significant challenge hindering the widespread adoption of herbicide safeners in India is their relatively high cost compared to traditional herbicides. This financial barrier is particularly impactful for smallholder farmers, who constitute a substantial portion of India’s agricultural community. These farmers often operate on limited budgets and may prioritize immediate cost savings over long-term benefits, making them hesitant to invest in additional inputs like safeners. As a result, despite the advantages that safeners offer in protecting crops and enhancing herbicide efficacy, their adoption remains limited among this demographic.

Furthermore, the complexity involved in the formulation and application of herbicide safeners adds to their cost. Developing effective safeners requires specialized knowledge and technology, which can lead to higher production costs. Additionally, the need for precise application methods to ensure their effectiveness and minimize environmental impact necessitates additional training and equipment, further increasing the financial burden on farmers.

While government initiatives such as the National Mission on Sustainable Agriculture (NMSA) aim to promote sustainable farming practices, including the use of herbicide safeners, the financial constraints faced by farmers pose a significant hurdle. Without adequate subsidies or financial support, the high cost of safeners remains a substantial barrier to their adoption.

Opportunity

Safener-Enhanced Herbicide Solutions for Sustainable Agriculture

Herbicide safeners are chemical compounds used in conjunction with herbicides to protect crops from potential damage while effectively controlling weeds. They work by enhancing the plant’s ability to detoxify herbicides, thereby reducing phytotoxicity and improving crop safety . This is particularly important as farmers face challenges such as herbicide-resistant weeds and the need to increase crop yields sustainably.

A notable example of this growth is the increased adoption of herbicide safeners in the cultivation of genetically modified (GM) crops. In the United States, for instance, 91% of corn, 95% of soybeans, and b of cotton produced were from GM strains tolerant to multiple herbicides, including glyphosate . These crops benefit from safener-enhanced herbicide applications, which protect them from herbicide-induced stress and improve weed control efficacy.

Government initiatives play a crucial role in promoting the adoption of herbicide safeners. In the European Union, for example, regulations are being developed to ensure the safe use of safeners and synergists, aiming to minimize potential risks and promote environmental sustainability . Such regulatory frameworks encourage the development and adoption of safer agricultural practices.

Regional Insights

North America leads with 38.5% share, valued at USD 0.4 billion

In 2024, North America held a dominant position in the global herbicide safeners market, capturing 38.5% of total revenue, valued at USD 0.4 billion. The region’s leadership is anchored by its extensive maize and cereal production base, where safener-integrated herbicide formulations are standard in crop protection programs. The United States alone planted over 91 million acres of corn in 2024, making it one of the largest markets for safeners such as Benoxacor, Cyprosulfamide, and Isoxadifen-ethyl, which protect crops from herbicide injury while enabling the use of potent weed-control chemistries.

Safeners are particularly important in North America’s high-intensity farming systems, where multiple herbicide modes of action are deployed to combat resistant weeds like waterhemp and Palmer amaranth, both of which have documented resistance to several herbicide classes.

The regional market benefits from strong regulatory frameworks, with the U.S. Environmental Protection Agency and Canada’s PMRA providing clear guidelines for safener use, ensuring both crop safety and environmental compliance. Adoption is further supported by precision agriculture technologies, which allow for optimized application timing and integration of post-emergence and pre-emergence safener programs. In Canada, safener-enhanced herbicides are also widely used in corn and small grains, helping manage weed competition in shorter growing seasons.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADAMA is a notable participant in the herbicide safeners market, delivering solutions that integrate safeners into both pre- and post-emergence herbicide products. In 2024, the company focused on strengthening its maize and cereal protection portfolio with safener-based innovations. ADAMA’s global reach, coupled with a strong presence in emerging agricultural economies, has helped increase adoption rates. The company also invests in localized product development to match specific climatic and soil conditions, ensuring safener performance and farmer profitability in diverse regions worldwide.

Nufarm plays a significant role in the herbicide safeners sector, particularly in selective herbicide programs for cereals and maize. In 2024, the company emphasized developing safener-enhanced formulations tailored to regional agronomic needs, especially in Australia, North America, and Latin America. Nufarm’s strategy includes collaborations with technology partners to improve formulation efficiency and expand product portfolios. Its safeners support farmers in managing resistant weeds while maintaining crop safety, aligning with sustainable farming practices and regulatory requirements across its global markets.

BASF remains a leading player in the herbicide safeners market, offering products like Isoxadifen-ethyl for maize and cereal applications. In 2024, its safeners were integrated into multiple selective herbicide formulations, enhancing crop safety and yield potential. The company invests heavily in R&D to create new safener-active combinations that meet evolving regulatory standards and resistance challenges. BASF’s strong distribution network in North America, Europe, and Asia-Pacific ensures wide accessibility, while its sustainability-driven approach positions it to capture future market growth opportunities.

Top Key Players Outlook

- DuPont

- BASF

- Bayer AG

- Nufarm

- ADAMA

- Drexel Chemical Company

Recent Industry Developments

In 2024, DuPont reported net sales of $3.1 billion, marking a 7% increase year-over-year, driven by strong demand within its electronics and industrial segments.

In 2024, BASF’s Agricultural Solutions segment reported sales of €9.8 billion, accounting for 15% of the company’s total sales, with herbicides generating €2.97 billion in revenue.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 2.5 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Benoxacor, Furilazole, Dichlormid, Isoxadifen, Others), By Selectivity (Selective Herbicides, Non-Selective Herbicides), By Crop Type (Wheat, Soybean, Sorghum, Maize, Rice, Barley, Others), By Application (Post-emergence, Pre-emergence) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DuPont, BASF, Bayer AG, Nufarm, ADAMA, Drexel Chemical Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DuPont

- BASF

- Bayer AG

- Nufarm

- ADAMA

- Drexel Chemical Company