Global Hemp-Based Food Market Size, Share, And Industry Analysis Report By Product (Hemp Seed Oil, Hemp Protein Powder, Whole Hemp Seed, Hulled Hemp Seed, Others), By Distribution Channel (Supermarket Stores, Convenience Stores, Hypermarket Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169039

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

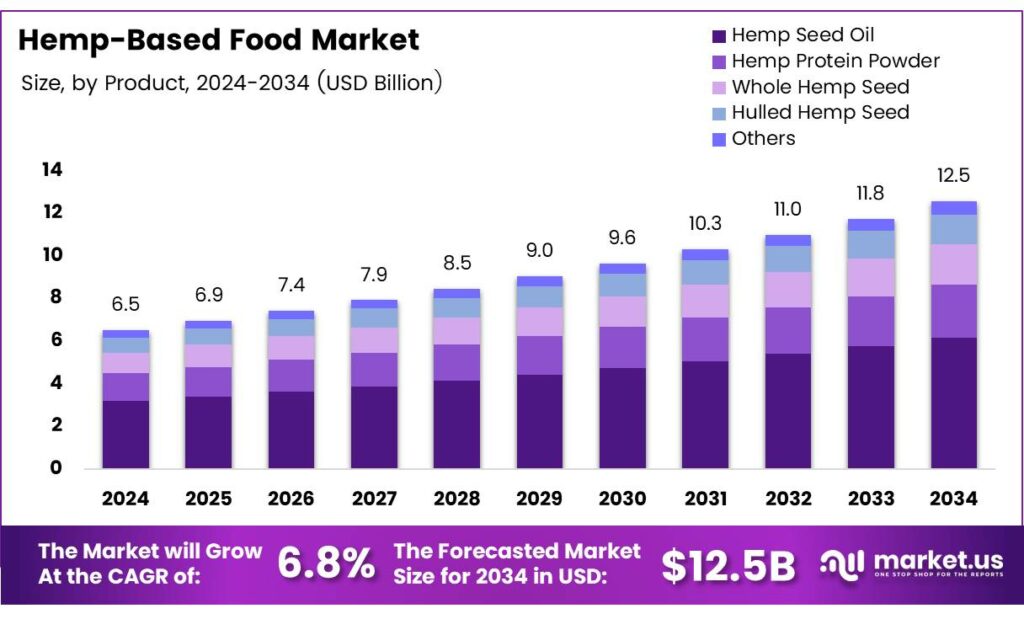

The Global Hemp-Based Food Market size is expected to be worth around USD 12.5 billion by 2034, from USD 6.5 billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The hemp-based food market refers to commercial foods and ingredients derived from industrial hemp seeds, oil, and flour. These products are legally produced from low-THC hemp varieties and used in protein powders, bakery items, dairy alternatives, and functional nutrition. The market aligns closely with plant-based foods, clean-label diets, and sustainable agriculture trends.

Hemp-based food stands out because it combines nutritional density with versatile food applications. Moreover, manufacturers increasingly prefer hemp due to allergen-free proteins, neutral taste profiles, and compatibility with vegan formulations. Consequently, food brands position hemp ingredients as premium, functional, and wellness-oriented offerings across retail and foodservice channels.

- Government policies further support market development through regulated hemp cultivation frameworks and agri-food investments. Countries in Europe, North America, and the Asia-Pacific permit industrial hemp below 0.2–0.3% THC thresholds.Public funding promotes sustainable crops, carbon-efficient farming, and farmer income diversification, indirectly strengthening hemp food supply chains.

Hemp seed contains approximately 30–40% fiber, 25–30% protein, 25–30% oil, and 6–7% moisture. The same source reports protein-85 hemp products reaching 93.01 ± 0.18% protein, highlighting exceptional functional nutrition potential. Hemp seed derivatives contain nearly 80% polyunsaturated fatty acids, with omega-6 to omega-3 ratios near 4:1, considered optimal for human nutrition. Linoleic acid levels ranging from 53.80 ± 2.02% to 69.53 ± 0.45%, reinforcing hemp-based food market credibility.

Commercial opportunities continue to emerge as brands innovate with hemp milk, hemp protein isolates, spreads, and nut alternatives. Furthermore, hemp’s long shelf stability and compatibility with organic certifications improve export potential. Processors increasingly invest in cold-pressed oil extraction, protein concentration, and seed-based ingredient standardization.

Key Takeaways

- The Global Hemp-Based Food Market is projected to grow from USD 6.5 billion in 2024 to USD 12.5 billion by 2034, registering a 6.8% CAGR during 2025–2034.

- Hemp Seed Oil leads the product landscape with a dominant share of 37.4%, driven by its wide culinary use and strong nutritional profile.

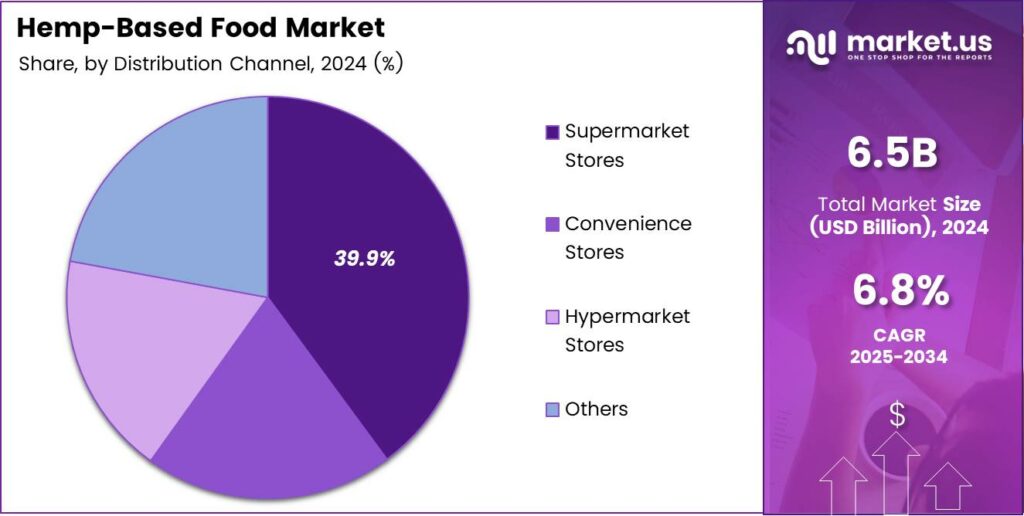

- Supermarket Stores dominate distribution channels, accounting for a leading 39.9% share due to high footfall and consumer trust.

- North America remains the largest regional market, holding a 46.3% share and valued at USD 3.0 billion in 2024.

By Product Analysis

Hemp Seed Oil dominates the By Product segment with 37.4% share due to its broad culinary use and nutritional profile.

In 2024, Hemp Seed Oil held a dominant market position in the By Product Analysis segment of the Hemp-Based Food Market, with a 37.4% share. Moreover, its balanced fatty acid profile drives strong acceptance among health-focused consumers. Therefore, food manufacturers increasingly use hemp seed oil in dressings, supplements, and functional foods.

Hemp Protein Powder continues to gain attention as an alternative plant protein source. Additionally, its easy blending characteristics support usage in smoothies and nutrition bars. As a result, fitness-conscious consumers and vegan product developers are gradually expanding their presence within specialty food and wellness retail channels.

Whole Hemp Seed maintains a steady demand due to its natural form and minimal processing. Furthermore, consumers prefer whole seeds for baking, breakfast cereals, and direct consumption. Consequently, ingredient transparency and clean-label preferences support consistent adoption across home cooking and artisanal food applications.

Hulled Hemp Seed benefits from improved taste and texture compared to whole seeds. Also, removal of the outer shell enhances digestibility and versatility. Therefore, food brands commonly use hulled seeds in snacks, yogurts, and ready-to-eat meals targeting premium nutrition segments.

By Distribution Channel Analysis

Supermarket Stores lead the By Distribution Channel segment with a 39.9% share, supported by high consumer footfall.

In 2024, Supermarket Stores held a dominant market position in the By Distribution Channel Analysis segment of the Hemp-Based Food Market, with a 39.9% share. Moreover, wide shelf space and consumer trust enable supermarkets to promote hemp-based foods alongside mainstream health products effectively.

Convenience Stores serve impulse-driven and urban consumers seeking quick nutritional options. Additionally, smaller pack sizes improve accessibility for first-time buyers. Consequently, hemp-based snacks and beverages perform steadily in locations where speed, availability, and portability strongly influence purchasing decisions.

Hypermarket Stores support bulk purchasing and brand comparison under one roof. Furthermore, large-format retail allows educational labeling and sampling initiatives. Consumers exploring hemp-based foods in family-sized or value-oriented formats increasingly rely on hypermarkets for variety and pricing clarity.

Other distribution channels include online platforms and specialty health stores. Meanwhile, digital access supports informed purchasing decisions. Therefore, targeted marketing and subscription models help brands reach loyal consumers seeking convenient, repeat access to hemp-based food products.

Key Market Segments

By Product

- Hemp Seed Oil

- Hemp Protein Powder

- Whole Hemp Seed

- Hulled Hemp Seed

- Others

By Distribution Channel

- Supermarket Stores

- Convenience Stores

- Hypermarket Stores

- Others

Emerging Trends

Clean-Label Positioning and Sustainable Sourcing Shape Market Trends

A key trend in the hemp-based food market is strong demand for clean-label products. Consumers prefer simple ingredient lists and transparent sourcing. Hemp foods match this trend well because they are minimally processed and naturally nutritious.

- Sustainability is another important trend shaping the market. Hemp cultivation requires less water and fewer chemicals compared to many traditional crops. Hemp seeds are regarded as complete protein — meaning they supply all nine essential amino acids — and a 30-gram serving (about three tablespoons) gives roughly 9.5 grams of protein.

Food brands are highlighting these environmental benefits to appeal to eco-conscious consumers. Branding and education are becoming central strategies. Companies are investing more in explaining nutritional benefits and clarifying misconceptions. This focus on awareness is helping hemp-based foods move from niche health stores into wider retail channels.

Drivers

Rising Consumer Demand for Plant-Based and Nutritious Foods Drives Market Growth

The hemp-based food market is strongly driven by growing consumer interest in plant-based diets. Many consumers are moving away from animal-based proteins and looking for clean, natural, and nutrient-rich food options. Hemp foods fit well into this shift because they offer protein, fiber, and healthy fats in a natural form.

Another key driver is rising health awareness. Consumers are actively reading labels and choosing foods with fewer additives and more functional benefits. Hemp seeds, hemp protein powder, and hemp oil are seen as natural sources of essential nutrients, making them attractive for daily consumption.

Additionally, expanding the legalization of industrial hemp cultivation in many countries is supporting better raw material availability. This improves supply chains, encourages new product launches, and reduces production barriers, further driving steady market expansion.

Restraints

Regulatory Complexity and Consumer Misunderstanding Limit Market Expansion

One major restraint in the hemp-based food market is regulatory uncertainty. Food regulations related to hemp vary widely across countries and regions. These differences create compliance challenges for manufacturers, especially those operating in multiple markets. Product approvals and market entry can be slow.

- Consumer confusion remains another limiting factor. Many buyers still associate hemp with cannabis drugs, despite food-grade hemp containing no psychoactive effects. A recent nutrition review mentions that a 30-gram serving of hemp seeds provides roughly 10 grams of protein, 14 grams of healthy fat, and 1 gram of carbohydrates, making it an efficient source of macronutrients.

Pricing pressure also acts as a barrier. Hemp-based foods are often priced higher than traditional grains, seeds, or protein sources. Cost-sensitive consumers may hesitate to switch, especially in developing markets where affordability strongly influences food choices.

Growth Factors

Product Innovation and Functional Food Demand Create New Growth Opportunities

The hemp-based food market offers strong growth opportunities through product innovation. Manufacturers are increasingly developing hemp-based snacks, beverages, dairy alternatives, and bakery products. These formats make hemp easier to consume in everyday diets and attract mainstream consumers.

Functional food demand presents another major opportunity. Hemp’s protein, omega fatty acids, and fiber content position it well for fortified foods targeting heart health, digestion, and energy. Brands can link hemp ingredients with wellness-focused claims to expand their appeal.

Growth in vegan and allergen-free food categories also supports future expansion. Hemp foods are naturally gluten-free and dairy-free, making them suitable for people with dietary restrictions. This opens access to niche but fast-growing consumer segments.

Regional Analysis

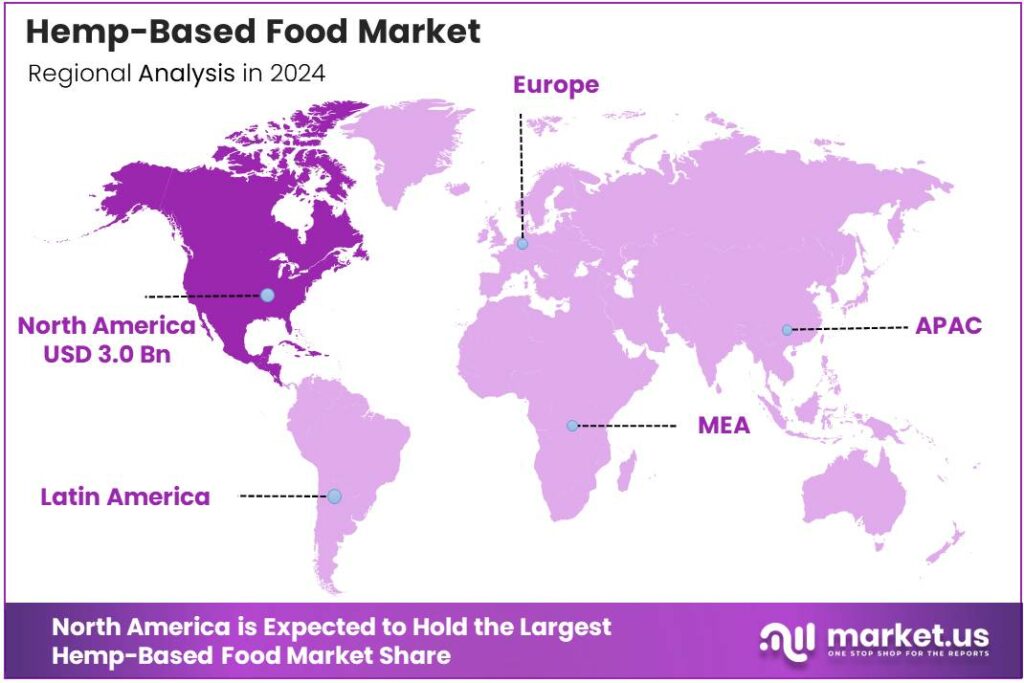

North America Dominates the Hemp-Based Food Market with a Market Share of 46.3%, Valued at USD 3.0 Billion

North America remains the leading region in the hemp-based food market, driven by strong consumer awareness of plant-based nutrition and protein-rich diets. In this region, the market holds a dominant share of 46.3%, reaching a value of USD 3.0 billion, supported by early legalization frameworks and wide retail penetration.

Europe shows stable growth in the hemp-based food market due to increasing focus on sustainable food systems and plant-based eating habits. Consumers across the region are actively shifting toward protein alternatives and functional foods with natural ingredients. Regulatory clarity around industrial hemp use in food is also improving, encouraging wider product availability. Health-conscious consumers and sustainability-driven policies remain key contributors to regional expansion.

Asia Pacific is emerging as a fast-developing region for hemp-based foods, supported by changing dietary preferences and rising interest in functional nutrition. Urban consumers are adopting protein-rich and fiber-based foods to support wellness lifestyles. Expanding middle-class populations and increased awareness of plant-based diets are widening the consumer base. Local innovation and gradual regulatory acceptance are further opening growth opportunities.

The Middle East and Africa region shows gradual adoption of hemp-based food products, mainly driven by health-focused niche consumers. Demand is primarily supported by imported products and growing awareness of plant-based nutrition benefits. While regulatory structures are still developing, interest in alternative protein sources is improving. Over time, lifestyle shifts and wellness trends are expected to support market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agropro positions itself as a reliable upstream supplier in the hemp-based food value chain, focusing on high-quality hemp seeds and ingredients for food manufacturers and private-label brands. The company benefits from rising demand for clean-label, plant-based proteins and oils, and its emphasis on traceability and sustainable farming practices makes it an attractive partner for European and North American buyers seeking secure, compliant sourcing.

Nutiva plays a visible consumer-facing role with a broad portfolio of branded hemp-based foods, including oils, protein powders, and snacks. Its strong positioning around organic, non-GMO and wellness-centric messaging helps the company tap into health-conscious retail channels and e-commerce. Nutiva’s continuous product innovation and marketing around lifestyle and nutrition trends strengthen its influence on category awareness and premium pricing.

Hempco operates as an integrated hemp foods and ingredients supplier, leveraging expertise in processing hemp seeds into value-added formats for global customers. The company’s ability to provide bulk ingredients, branded products, and private-label solutions allows it to serve both industrial and retail segments. Hempco’s strategic focus on quality certifications and export markets supports its role in scaling hemp-based foods beyond niche health stores into mainstream distribution.

Manitoba Harvest remains one of the most recognizable names in hemp-based foods, particularly in North American grocery and health food channels. The brand’s diversified product range—covering seeds, oils, and protein formats—helps it address multiple consumer use cases, from baking to sports nutrition. With strong retail relationships and consumer education efforts, Manitoba Harvest contributes significantly to category growth and helps normalize hemp-based products in everyday diets.

Top Key Players in the Market

- Agropro

- Nutiva

- Hempco

- Manitoba Harvest

- Canada Hemp Foods

- Elixinol

- Braham and Murray

- Healthy Brands Collective

- The Cool Hemp Company

- Hemp Foods Australia

Recent Developments

- In 2024, Agropro benefited from ongoing U.S. Department of Agriculture (USDA) approvals for hemp cultivation under the 2018 Farm Bill, facilitating expanded sourcing for hemp-based proteins and oils. This supports integration into gluten-free and vegan food lines, with no new product launches announced on official updates.

- In 2024, Nutiva, a pioneer in organic hemp foods, reported steady advancements in product transparency and sustainability, with a focus on cold-processed hemp seeds, oils, and proteins. Hempco (now Hempco Food and Fiber), a Canadian vertically integrated hemp producer, focused on technological innovations for food-grade hemp.

Report Scope

Report Features Description Market Value (2024) USD 6.5 billion Forecast Revenue (2034) USD 12.5 billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hemp Seed Oil, Hemp Protein Powder, Whole Hemp Seed, Hulled Hemp Seed, Others), By Distribution Channel (Supermarket Stores, Convenience Stores, Hypermarket Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Agropro, Nutiva, Hempco, Manitoba Harvest, Canada Hemp Foods, Elixinol, Braham and Murray, Healthy Brands Collective, The Cool Hemp Company, Hemp Foods Australia Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Hemp-Based Food MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Hemp-Based Food MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agropro

- Nutiva

- Hempco

- Manitoba Harvest

- Canada Hemp Foods

- Elixinol

- Braham and Murray

- Healthy Brands Collective

- The Cool Hemp Company

- Hemp Foods Australia