Global Heavy Aromatic Naphtha Solvent Market Size, Share, And Business Benefits By Product Type (High Flash Point, Low Flash Point), By Application (Paints and Coatings, Industrial Cleaning, Agrochemicals, Automotive, Others), By Distribution Channel (Direct Sales, Indirect Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166917

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

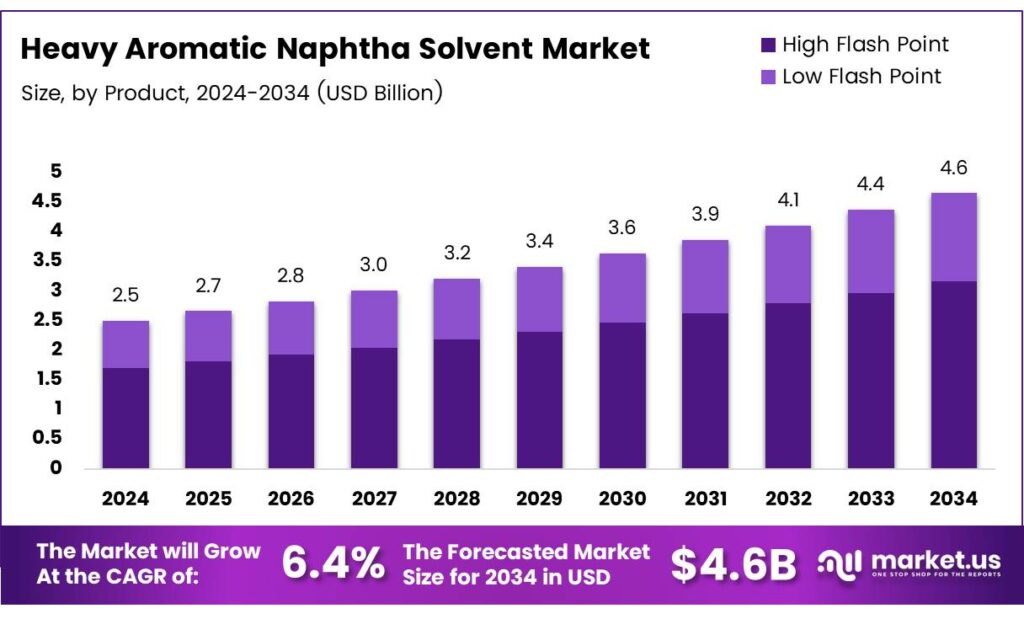

The Global Heavy Aromatic Naphtha Solvent Market size is expected to be worth around USD 4.6 billion by 2034, from USD 2.5 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Heavy Aromatic Naphtha Solvent, often known as Aromatic 150, plays a crucial role across coatings, agrochemicals, industrial cleaning, and oilfield chemicals. It is valued for strong solvency power and high aromatic content, helping industries achieve consistent formulations in high-performance applications. Its versatility supports stable long-term market expansion.

The market steadily grows as end-users seek solvents with excellent evaporation profiles, strong solvency, and better compatibility with resins. Increasing industrial activity across Asia and the Middle East drives stronger demand for heavy aromatic grades with controlled naphthalene levels. This shift allows manufacturers to meet strict quality requirements and improve product safety standards.

- Toward the technical side, the product’s boiling range between 181–205°C enhances usability in various solvent-based coatings. Aromatic Solvent 150 contains predominantly C9–C11 hydrocarbons, offering high aromatic strength. As noted in toxicological guidelines, heavy solvent naphtha containing ≥1% naphthalene is labeled H351, while <1% grades avoid carcinogenic classification.

Furthermore, industry data states that aromatic fluids typically hold 99% aromatic content, supporting stronger solvency performance. Producers now provide naphthalene-depleted (<1 wt%) and ultra-low naphthalene (0.1 wt%) variants to reduce labeling requirements and meet global regulatory standards. Naphtha product enhancements strengthen long-term demand and reinforce market competitiveness.

Transitioning to safer formulations also creates opportunities for innovation. Industries that require regulated storage conditions benefit from improved safety protocols. Heavy Aromatic Naphtha Solvent, being flammable, demands careful handling in cool, ventilated facilities, prompting stricter compliance. These operational standards strengthen supply reliability and ensure safer distribution networks worldwide.

Key Takeaways

- The Global Heavy Aromatic Naphtha Solvent Market is expected to reach USD 4.6 billion by 2034, rising from USD 2.5 billion in 2024, at a CAGR of 6.4% from 2025–2034.

- High Flash Point solvents dominated by Product Type with a notable 62.8% share in 2024.

- Paints and Coatings led the By Application segment with a substantial 38.9% share in 2024.

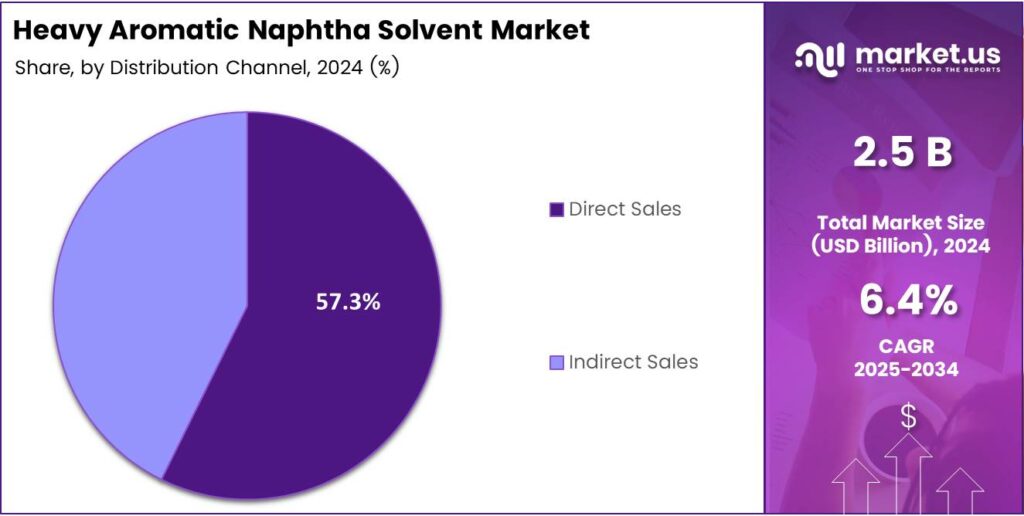

- Direct Sales remained the preferred distribution channel, capturing 57.3% market share in 2024.

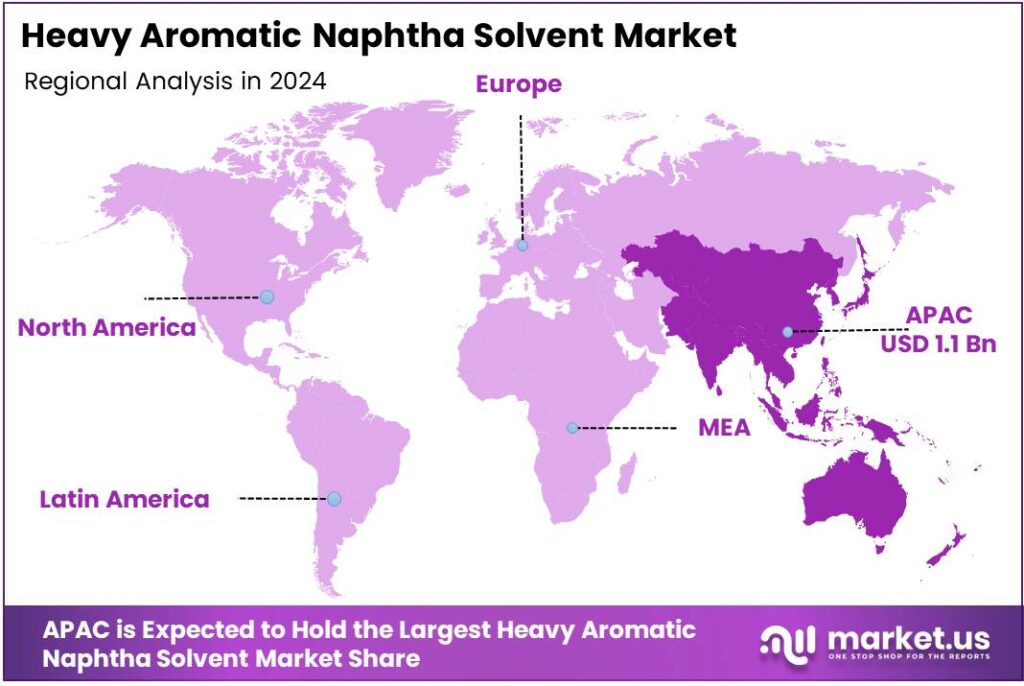

- Asia Pacific dominated the global market with a significant 47.2% share valued at USD 1.1 billion in 2024.

By Product Type Analysis

High Flash Point dominates with 62.8% because of its safer handling and broad industrial acceptance.

In 2024, High Flash Point held a dominant market position in the By Product Type Analysis segment of the Heavy Aromatic Naphtha Solvent Market, with a 62.8% share. This grade improved safety, reduced volatility, and supported large-scale chemical processing. It also enhanced regulatory compliance across solvent-using industries globally.

Low Flash Point products continued to gain traction due to their strong solvency and fast evaporation properties. These characteristics benefited applications requiring quick drying and deep penetration. As industries shifted toward high-performance formulations, this segment found new relevance, especially in coatings and degreasing operations where efficient material removal remained a key operational priority.

By Application Analysis

Paints and Coatings lead the segment with a strong 38.9% share due to widespread industrial use.

In 2024, Paints and Coatings held a dominant market position in the By Application Analysis segment of the Heavy Aromatic Naphtha Solvent Market, with a 38.9% share. Its demand grew as industries expanded architectural, automotive, and protective coating uses. High solvency and viscosity control supported consistent performance across large-volume manufacturing lines.

Industrial Cleaning applications expanded steadily, driven by the need for strong degreasing power. Heavy aromatic naphtha offered reliable contaminant removal, which strengthened adoption in metal finishing, machinery maintenance, and equipment restoration. As industries modernized operations, efficient solvent-based cleaning systems ensured productivity while maintaining cost-effectiveness and reducing downtime.

Automotive applications benefited from strong cleaning and surface-treatment capabilities. Heavy aromatic naphtha supported component degreasing, coating preparation, and lubricant formulation. This segment progressed as automotive manufacturing focused on consistent solvent performance. Others encompassed diverse uses across adhesives, inks, and specialty chemicals, where high solvency and stable evaporation profiles improved operational efficiency.

By Distribution Channel Analysis

Direct Sales dominates with a significant 57.3% share supported by long-term industrial contracts.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel Analysis segment of the Heavy Aromatic Naphtha Solvent Market, with a 57.3% share. Large buyers preferred direct procurement for consistent supply, stable pricing, and technical support. This model enhanced trust, ensured timely delivery, and strengthened relationships between suppliers and customers.

Indirect Sales grew steadily as distributors enabled flexible order quantities and local availability. Smaller and mid-sized manufacturers relied on indirect channels to optimize procurement and reduce inventory burdens. With broader reach and faster turnaround, indirect distribution supported diversified industrial needs while offering competitive service options across multiple end-use markets.

Key Market Segments

By Product Type

- High Flash Point

- Low Flash Point

By Application

- Paints and Coatings

- Industrial Cleaning

- Agrochemicals

- Automotive

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Emerging Trends

Growing Use in Paints and Coatings Boosts Market Demand

The Heavy Aromatic Naphtha Solvent market is witnessing strong momentum as industries increasingly require effective solvents for high-performance paints and coatings. Companies prefer this solvent because it provides good dissolving power, helping manufacturers create smooth, durable finishes across industrial and automotive applications.

Another major trend comes from the rising construction and infrastructure activity in developing economies. As builders demand more protective coatings and adhesives, the need for Heavy Aromatic Naphtha Solvent continues to increase. Its ability to support fast-drying formulations makes it a preferred option for large-scale projects.

- A clear trend in heavy aromatic naphtha solvents (Aromatic 150) is the move from standard grades to low- or ultra-low-naphthalene versions. Traditional Aromatic 150 can contain about 5–10 wt% naphthalene, a substance that has caused cancer in laboratory animals.

A shift toward specialized chemicals is also shaping the market. Manufacturers are expanding production of customized solvent blends to meet different viscosity and evaporation rate needs. This personalization trend is attracting sectors like automotive refinishing, industrial repair, and marine coatings.

Drivers

Growing Use of Solvents in Coatings and Industrial Cleaning Boosts Market Expansion

Demand for heavy aromatic naphtha solvent is rising because industries such as paints, coatings, and adhesives rely on strong and stable solvents for smooth production. These solvents help improve viscosity, drying time, and overall product performance. As manufacturing activities expand and companies look for consistent formulations, demand grows steadily.

The market is also supported by the increasing use of heavy aromatic naphtha solvent in industrial cleaning and degreasing applications. Its strong solvency power makes it suitable for removing oil, grease, and heavy residues in factories and maintenance facilities. This trend strengthens the market as industries prioritize efficiency and high-quality cleaning solutions.

Growth in automotive refinishing and metalworking further supports the market. Heavy aromatic naphtha solvent helps create smooth finishes, durable coatings, and better surface preparation. As automotive production and aftermarket repair activities grow, the need for reliable solvents also increases.

Additionally, rising construction and infrastructure development across emerging economies drives higher consumption of coatings and protective paints. These industries rely heavily on aromatic solvents for formulation and performance. As new building projects expand globally, demand for heavy aromatic naphtha solvent continues to gain momentum.

Restraints

Strict Environmental Regulations Limit Market Expansion

Tight environmental rules are a major restraint for the Heavy Aromatic Naphtha Solvent Market. Many countries are enforcing stricter VOC and hazardous chemical norms to reduce air pollution. These policies make it harder for industries to use heavy aromatic solvents freely, affecting overall demand.

- The European Solvents Industry Group (ESIG) estimates solvent VOC emissions in the EU-27 plus UK at around 1,741 kilotonnes of NMVOCs, with a 4% drop versus and an 8% fall in emissions from ESIG-covered solvents alone. Industries such as coatings, adhesives, and metalworking are gradually shifting toward water-based or bio-based solvents.

Supply chain volatility also puts pressure on the market. Heavy aromatic naphtha is tied to crude oil prices, which fluctuate due to geopolitical tensions, refinery disruptions, and global energy transitions. These price swings make planning difficult for end-use industries that rely on stable cost structures.

Growth Factors

Rising Use in Coatings and Industrial Formulations Unlocks New Market Opportunities

Growing investment in the coatings and resins industry is creating strong opportunities for heavy aromatic naphtha solvents. Many manufacturers are expanding production of high-performance paints, adhesives, and sealants, increasing the need for reliable solvents. This rising industrial demand helps suppliers offer customized grades for better drying, viscosity control, and formulation stability.

In addition, the growth of construction and automotive activities in developing countries opens new application areas. As infrastructure projects expand, industries require more protective coatings, metal cleaners, and chemical intermediates. Heavy aromatic naphtha solvents benefit because they provide strong solvency power suited for high-demand industrial environments.

Opportunities also arise from the expansion of specialty chemical manufacturing. Many chemical plants use heavy aromatic naphtha solvents as raw materials or process solvents, supporting growth in pharmaceutical intermediates, agrochemicals, and polymer additives. As global specialty chemical investments grow, the market for heavy aromatic naphtha solvents continues to gain long-term potential.

Regional Analysis

Asia Pacific Dominates the Heavy Aromatic Naphtha Solvent Market with a Market Share of 47.2%, Valued at USD 1.1 Billion

In the Heavy Aromatic Naphtha Solvent Market, Asia Pacific leads with a strong foothold driven by expanding petrochemical production, rising consumption in coatings, and rapidly growing industrial manufacturing. The region’s dominance at 47.2%, valued at USD 1.1 billion, reflects its large-scale solvent demand supported by China, India, and Southeast Asia’s expanding industrial base. Increasing investments in downstream chemical processing and infrastructure projects continue to strengthen regional consumption patterns.

North America shows steady growth supported by advanced refining capabilities and rising demand from automotive coatings, adhesives, and industrial cleaning applications. Strong environmental standards encourage the development of higher-quality aromatic solvents, while the U.S. benefits from shale-based feedstock availability. The region also experiences consistent consumption from specialty chemical manufacturers.

Europe maintains a mature but stable position, driven by strong industrial coatings, automotive refinishing, and chemical processing sectors. Sustainability-focused regulations influence producers to enhance refining efficiency and solvent purity. Demand remains stable across Germany, France, and the UK, where manufacturing activities support moderate consumption.

The U.S. remains one of the most important individual markets, supported by strong petrochemical capacity, advanced manufacturing operations, and consistent demand from coatings and specialty chemicals. Expansion in construction and automotive refinishing sectors further drives solvent usage, while rising technological upgrades enhance product performance and efficiency.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Heavy Aromatic Naphtha Solvent market in 2024 reflects stable demand from coatings, industrial cleaning, and petrochemical downstream segments, with leading energy and chemical companies strengthening supply security and refining efficiency.

ExxonMobil Corporation maintains a strong foothold through its integrated refining network and steady production of high-aromatic streams. The company’s extensive logistics infrastructure supports consistent global supply, helping customers in coatings and chemicals secure reliable solvent-grade feedstocks.

Royal Dutch Shell plc continues to leverage advanced refining technologies and diversified product lines to support growth in specialty solvents. Its ability to optimize aromatic recovery and maintain stable quality specifications positions Shell as a preferred supplier across industrial applications.

Chevron Phillips Chemical Company benefits from its strong petrochemical integration and strategic presence in North America. The company’s focus on efficiency, aromatics optimization, and customer-oriented formulations supports greater adoption of heavy aromatic solvents in industrial and coatings markets.

Total S.A. plays an important role with its broad refining operations and global distribution strengths. The company’s ability to balance upstream and downstream operations ensures steady production of heavy aromatic naphtha suited for high-performance solvent applications.

Top Key Players in the Market

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Chevron Phillips Chemical Company

- Total S.A.

- China National Petroleum Corporation (CNPC)

- Sinopec Limited

- Reliance Industries Limited

- LyondellBasell Industries N.V.

- BASF SE

- Huntsman Corporation

- Others

Recent Developments

- In 2025, ExxonMobil continues to emphasize its SolVesso line of heavy aromatic solvents, which offer high solvency and controlled evaporation rates suitable for industrial and agricultural applications. These products are highlighted in ongoing product stewardship efforts.

- In 2025, Shell maintains a robust portfolio of aromatic solvents under the ShellSol brand, including heavy grades derived from naphtha processing, used in coatings, inks, and adhesives. The company announced a final investment decision for the expansion of its CSPC joint venture petrochemical complex.

Report Scope

Report Features Description Market Value (2024) USD 2.5 billion Forecast Revenue (2034) USD 4.6 billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (High Flash Point, Low Flash Point), By Application (Paints and Coatings, Industrial Cleaning, Agrochemicals, Automotive, Others), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ExxonMobil Corporation, Royal Dutch Shell plc, Chevron Phillips Chemical Company, Total S.A., China National Petroleum Corporation (CNPC), Sinopec Limited, Reliance Industries Limited, LyondellBasell Industries N.V., BASF SE, Huntsman Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Heavy Aromatic Naphtha Solvent MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Heavy Aromatic Naphtha Solvent MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Chevron Phillips Chemical Company

- Total S.A.

- China National Petroleum Corporation (CNPC)

- Sinopec Limited

- Reliance Industries Limited

- LyondellBasell Industries N.V.

- BASF SE

- Huntsman Corporation

- Others