Global Healthcare Operational Analytics Market By Component (Software Hardware, and Services), By Application (Financial Analytics, Operational Analytics, Clinical Analytics, and Patient Flow Analytics), By End User (Hospitals, Diagnostic Laboratories, Research Organizations, and Insurance Companies), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151182

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

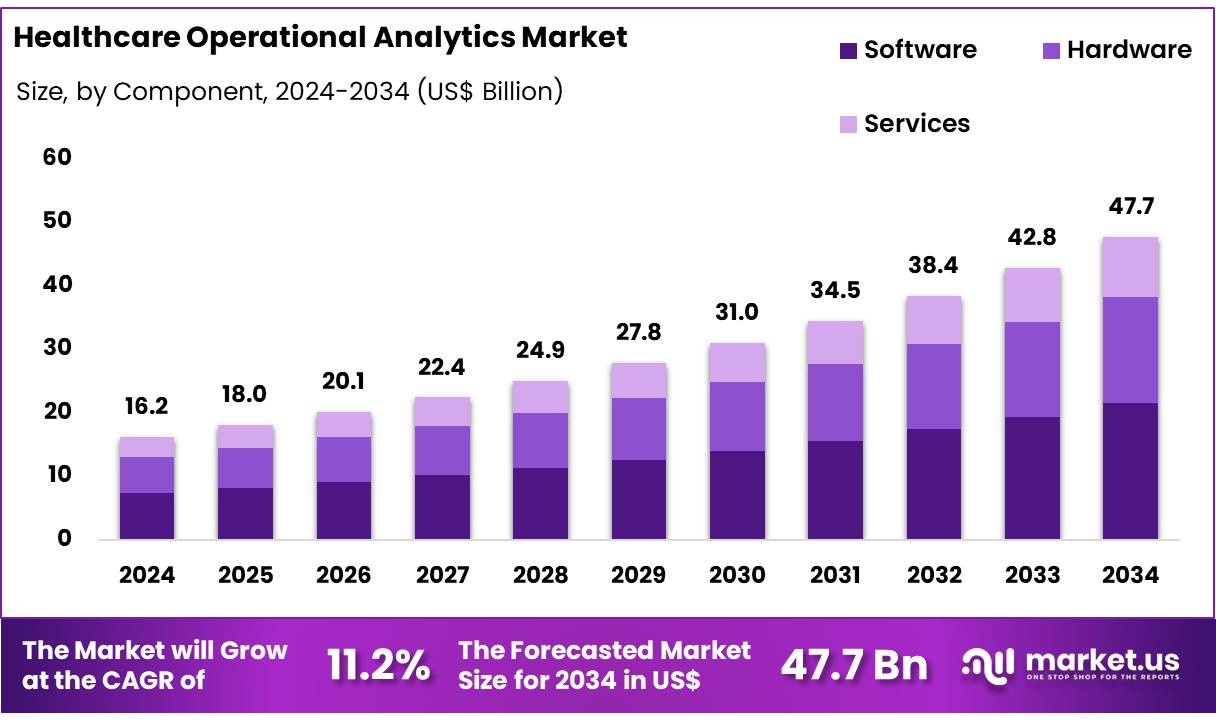

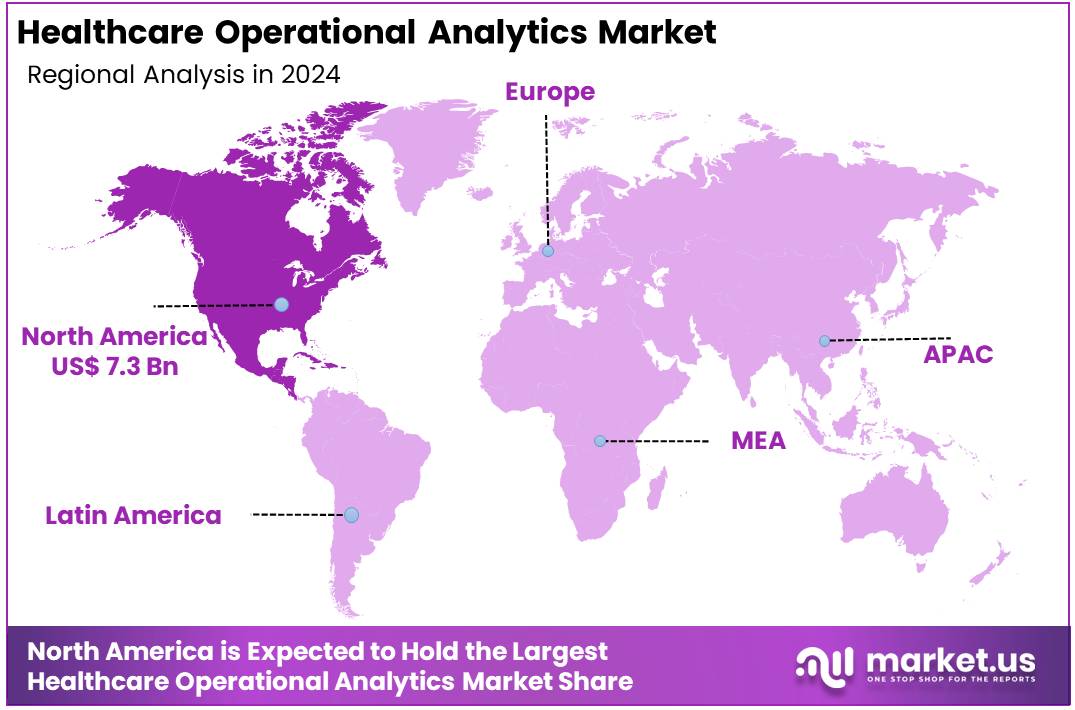

Global Healthcare Operational Analytics Market size is expected to be worth around US$ 47.7 Billion by 2034 from US$ 16.2 Billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 48.4% share with a revenue of US$ 7.3 Billion.

The global healthcare operational analytics market is experiencing significant growth, driven by several key dynamics. The increasing adoption of electronic health records (EHRs) and the growing pressure to reduce healthcare spending while improving patient outcomes are major factors fuelling this expansion.

Healthcare organizations are leveraging advanced analytics tools to optimize operations, enhance decision-making, and improve overall efficiency. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning, are enabling predictive analytics and real-time insights, further accelerating the adoption of operational analytics solutions.

Additionally, the shift towards value-based care models is prompting healthcare providers to focus on performance metrics and outcomes, which are effectively monitored through operational analytics platforms. However, the market faces challenges, including high implementation costs, data privacy concerns, and a shortage of skilled professionals capable of managing and interpreting complex healthcare data.

Interoperability issues between disparate healthcare systems and data sources also pose significant barriers to the seamless integration of analytics solutions. Despite these challenges, the demand for operational analytics in healthcare continues to rise, supported by favourable government initiatives and investments in digital health infrastructure. As healthcare organizations strive for improved efficiency and patient care, the global healthcare operational analytics market is poised for sustained growth in the coming years.

Key Takeaways

- The global healthcare operational analytics market was valued at USD 16.2 billion in 2024 and is anticipated to register substantial growth of USD 47.7 billion by 2034, with 11.4% CAGR.

- In 2024, the software segment took the lead in the global market, securing 46.5% of the total revenue share.

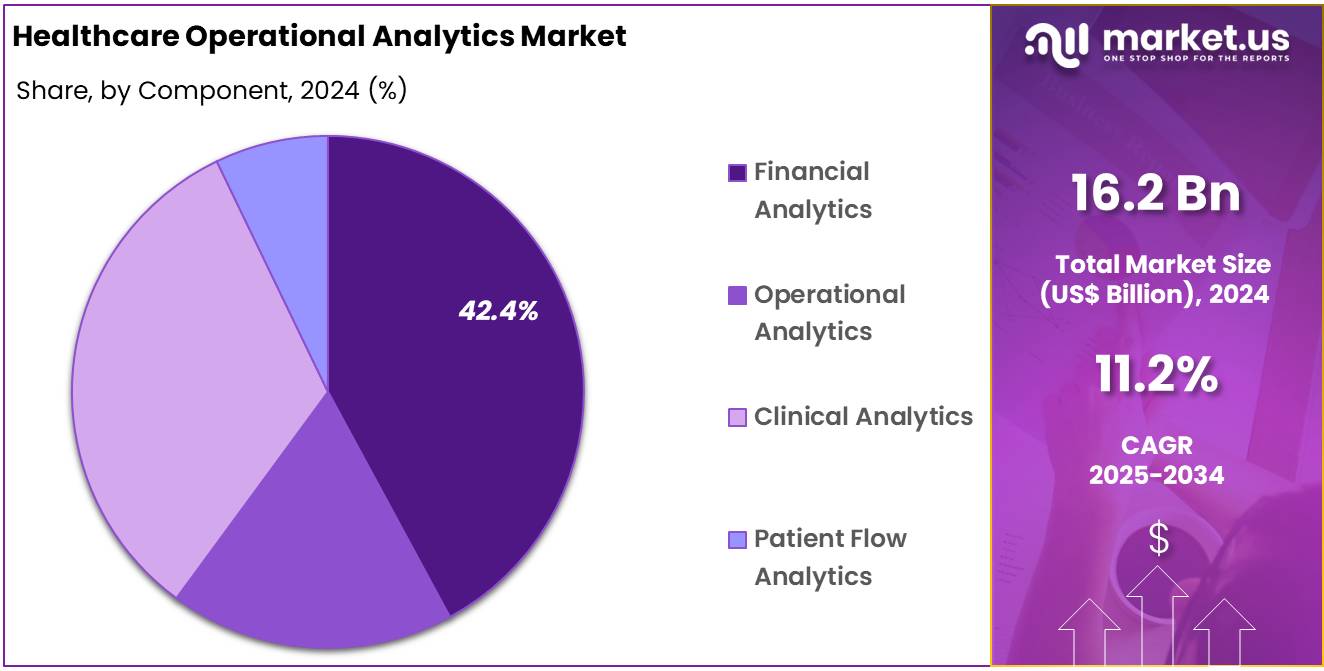

- The financial analytics segment took the lead in the global market, securing 42.4% of the total revenue share.

- The hospitals segment took the lead in the global market, securing 38.5% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 48.4% of the total revenue.

Component Analysis

Based on component the market is fragmented into software, hardware, and services. Amongst these, software segment dominated the global healthcare operational analytics market capturing a significant market share of 46.5% in 2024. The software segment has emerged as the dominant force in the global healthcare operational analytics market. This leadership is primarily driven by the increasing adoption of advanced software solutions that enable healthcare organizations to process and analyze vast amounts of data into actionable insights.

These software tools facilitate various functions such as predictive analytics, resource optimization, and real-time decision-making, which are crucial for enhancing operational efficiency and patient care. Additionally, the shift towards cloud-based platforms has further bolstered the software segment’s growth, offering scalability, cost-effectiveness, and remote accessibility. As healthcare systems worldwide continue to embrace digital transformation, the demand for sophisticated software solutions is expected to rise, solidifying the software segment’s leading position in the market.

Application Analysis

The market is fragmented by application into financial analytics, operational analytics, clinical analytics, and patient flow analytics. Financial analytics dominated the global healthcare operational analytics market capturing a significant market share of 42.4% in 2024. The financial analytics segment captured the largest market share, attributed to the growing number of financial frauds in the healthcare industry and the increasing need for financial analytics solutions in healthcare facilities. This trend is further supported by the rising demand for improved medical claims and revenue cycle management, which are crucial for healthcare organizations to maintain financial health and operational efficiency.

Technological advancements, such as the integration of artificial intelligence (AI), machine learning, and big data analytics, have significantly enhanced the capabilities of financial analytics solutions, enabling healthcare providers to analyze vast amounts of financial data efficiently and make informed decisions.

These technologies facilitate predictive modeling, real-time data insights, and improved financial forecasting, which are essential for optimizing financial performance and reducing operational inefficiencies. As healthcare organizations continue to face rising costs and complex regulatory requirements, the demand for robust financial analytics solutions is expected to grow, solidifying its position as a key component in the healthcare operational analytics landscape.

End User Analysis

The market is fragmented by end user into hospitals, diagnostic laboratories, research organizations, and insurance companies. Hospitals dominated the global healthcare operational analytics market capturing a significant market share of 38.5% in 2024. This leadership is primarily driven by the increasing adoption of advanced software solutions that enable healthcare organizations to process and analyze vast amounts of data into actionable insights. These software tools facilitate various functions such as predictive analytics, resource optimization, and real-time decision-making, which are crucial for enhancing operational efficiency and patient care.

Additionally, the shift towards cloud-based platforms has further bolstered the software segment’s growth, offering scalability, cost-effectiveness, and remote accessibility. As healthcare systems worldwide continue to embrace digital transformation, the demand for sophisticated software solutions is expected to rise, solidifying the software segment’s leading position in the market.

Key Segments Analysis

By Component

- Software

- Hardware

- Services

By Application

- Financial Analytics

- Operational Analytics

- Clinical Analytics

- Patient Flow Analytics

By End User

- Hospitals

- Diagnostic Laboratories

- Research Organizations

- Insurance Companies

Market Dynamics

The Increasing Adoption of Electronic Health Records (EHRs)

The increasing adoption of electronic health records (EHRs) across healthcare organizations is driving the growth of market. The integration of EHRs has significantly facilitated data collection, storage, and management within healthcare systems, leading to the generation of vast amounts of health-related data. With this surge in data, healthcare providers are increasingly turning to operational analytics tools to make sense of this information.

These tools enable them to monitor key performance indicators, enhance decision-making, and improve operational efficiency. Moreover, the shift toward value-based care is pushing healthcare organizations to focus more on improving patient outcomes while controlling costs. Operational analytics solutions play a crucial role in tracking these metrics, identifying inefficiencies, and suggesting improvements. The need for cost-effective care delivery and better patient outcomes has made operational analytics indispensable in healthcare management.

With governments offering incentives and funding for digital health infrastructure, the adoption of operational analytics is accelerating, making it one of the most significant drivers in the market. These advancements allow healthcare organizations to optimize their operations, reduce redundancies, enhance resource allocation, and ultimately deliver better care, contributing to the overall growth of the market.

Market Restraints

High Implementation Cost

A major restraint in the global healthcare operational analytics market is the high implementation cost of advanced analytics solutions. While the adoption of these tools offers long-term benefits, the initial investment required for purchasing and deploying sophisticated analytics platforms can be prohibitively expensive for many healthcare organizations, especially smaller practices or those in low-resource settings. Additionally, these systems often require ongoing costs related to maintenance, software updates, and training personnel to manage and interpret complex data sets.

The upfront financial burden of integrating such solutions can deter healthcare providers from adopting them, particularly in regions where budgets for healthcare IT are limited. Furthermore, the integration of operational analytics into existing systems often requires significant changes in infrastructure and workflow, adding another layer of complexity and cost.

As a result, many healthcare organizations delay or forgo the implementation of these analytics tools, hindering the market’s overall growth. Despite the promising potential of operational analytics to improve efficiency and patient outcomes, these financial constraints remain a significant barrier for widespread adoption.

Market Opportunities

Expansion of Predictive Analytics Capabilities

A significant opportunity for the global healthcare operational analytics market lies in the expansion of predictive analytics capabilities. Predictive analytics uses advanced data models, artificial intelligence (AI), and machine learning to forecast future outcomes based on historical data. In healthcare, predictive analytics can be applied to various aspects of operations, such as predicting patient admission rates, identifying potential outbreaks, or anticipating equipment and resource needs.

As healthcare organizations strive to improve efficiency and patient care, predictive analytics offers an opportunity to optimize workflows, reduce operational costs, and prevent adverse outcomes by enabling timely interventions. The demand for such predictive capabilities is rising as healthcare providers seek to transition from reactive to proactive care models.

Moreover, with the increasing availability of big data in healthcare, the ability to leverage predictive analytics to optimize hospital management, clinical decision-making, and financial planning is expected to create a vast growth opportunity in the market. Companies investing in AI-driven predictive analytics solutions are well-positioned to capitalize on this trend, making predictive analytics a key growth driver for the healthcare operational analytics market in the coming years.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the global healthcare operational analytics market by affecting financial sustainability, investment priorities, and data accessibility. Rising inflation and economic uncertainty, such as the 4.6% healthcare inflation rate in the U.S. in 2023, have increased cost pressures on healthcare providers, prompting them to adopt analytics tools to optimize spending and improve financial resilience.

For instance, 70% of healthcare executives planned to invest in real-time analytics solutions by 2024 to make informed financial decisions, such as adjusting staffing levels or identifying revenue leakage. Geopolitical events, like the COVID-19 pandemic, have disrupted supply chains and increased demand for specific medical devices, leading to sudden spikes in demand. AI-enhanced demand forecasting has been utilized to predict shifts in demand with greater accuracy, allowing for real-time adjustments to production schedules and minimizing waste.

Additionally, geopolitical factors can impact healthcare infrastructure and access to care. For example, geopolitical determinants of health, such as government policies and international relations, can influence the availability and quality of healthcare services, affecting health outcomes and disparities. These macroeconomic and geopolitical influences underscore the need for healthcare organizations to leverage operational analytics to navigate financial challenges, anticipate demand fluctuations, and adapt to evolving policy landscapes, ensuring resilience and improved patient outcomes.

Latest Trends

The healthcare operational analytics market is experiencing rapid growth. This expansion is fuelled by the increasing adoption of AI and machine learning technologies, which enhance decision-making, streamline workflows, and improve patient outcomes. Hospitals and clinics are leveraging these tools for predictive analytics, resource optimization, and real-time monitoring, thereby reducing costs and enhancing efficiency. Additionally, the integration of cloud computing and Internet of Things (IoT) devices facilitates seamless data sharing and remote patient monitoring, further driving the demand for operational analytics solutions.

North America remains the largest market, benefiting from advanced healthcare infrastructure and a strong focus on value-based care initiatives. However, the Asia-Pacific region is emerging as the fastest-growing market, with countries like China and India investing heavily in healthcare IT infrastructure and digital health solutions.

Despite the promising growth, challenges such as data privacy concerns, high implementation costs, and a shortage of skilled professionals may impact market expansion. Nonetheless, the continuous advancements in AI and data analytics are expected to overcome these hurdles, propelling the healthcare operational analytics market toward a transformative future.

Regional Analysis

North America held a dominant position in the global healthcare operational analytics market, driven by its advanced healthcare infrastructure, widespread adoption of electronic health records (EHRs), and a strong presence of analytics solution providers. The United States, in particular, leads the market, accounting for a significant share due to its complex healthcare system that generates vast amounts of data from EHRs, insurance claims, pharmacy records, and mobile health applications.

Government incentives, such as the Centers for Medicare & Medicaid Services (CMS) quality programs and the Medicare Access and CHIP Reauthorization Act (MACRA), have further spurred the adoption of analytics among providers. Private insurers, hospital networks, and research institutions extensively utilize analytics for value-based contracting, clinical trial matching, and chronic care management. The integration of artificial intelligence (AI) and machine learning technologies has enhanced decision-making, streamlined workflows, and improved patient outcomes.

Additionally, the region’s emphasis on value-based care and the need for cost control and improved outcomes have made analytics a cornerstone in healthcare delivery. Despite challenges such as data fragmentation and privacy concerns, North America’s commitment to digital health transformation and the presence of leading market players continue to drive the growth of healthcare operational analytics in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Players Analysis

The global healthcare operational analytics market is characterized by a dynamic and competitive landscape, with a diverse array of players ranging from established tech giants to specialized startups. Dominant entities such as GE Healthcare, IBM, Roche, and Oracle lead the market by offering comprehensive solutions encompassing predictive analytics, real-time monitoring, and resource optimization. These companies leverage advanced technologies such as artificial intelligence (AI) and machine learning to enhance decision-making processes and improve operational efficiency across healthcare organizations.

In addition to these industry leaders, emerging players such as Innovaccer are gaining traction by providing innovative cloud-based platforms that facilitate data integration and analytics, enabling healthcare providers to make data-driven decisions. Furthermore, traditional healthcare providers such as Epic Systems and Cerner are expanding their portfolios to include operational analytics capabilities, integrating them with electronic health record (EHR) systems to offer seamless solutions to their clients.

The competitive dynamics are further influenced by the increasing adoption of cloud-based solutions, which offer scalability and cost-effectiveness, making them attractive to healthcare organizations of varying sizes. This competitive environment is also shaped by strategic partnerships, mergers, and acquisitions, as companies seek to enhance their technological capabilities and expand their market reach.

Top Key Players

- Philips Healthcare

- GE Healthcare

- Anthem

- IBM

- Roche

- Cerner

- Oracle

- Cigna

- Change Healthcare

- Optum

- McKesson

- UnitedHealth Group

- Siemens Healthineers

- Allscripts

Recent Developments

- In May 2025, Carestream Health introduced its advanced analytics dashboard, Carestream 360º, in the U.S. market. This tool is designed to assist radiology departments in monitoring key performance metrics, analyzing imaging trends, and enhancing operational efficiency.

- In August 2024, Innovaccer Inc., a leading healthcare AI company and Certified Data Partner for the National Committee for Quality Assurance (NCQA) Data Aggregator Validation program, unveiled the Government Health AI Data and Analytics Platform (GHAAP). This award-winning platform is one of the first end-to-end integration, interoperability, analytics, and AI platforms created specifically for the public sector, with an initial focus on Medicaid and Public Health Modernization.

- In October 2024, Konica Minolta Healthcare Americas Inc. partnered with Quinsite to integrate Quinsite’s Comprehensive Healthcare Analytics Platform™ into the Exa® Platform. This integration will allow Exa Platform users to apply advanced analytics to clinical, financial, and operational data, offering real-time insights into important metrics such as physician productivity, patient flow, and billing accuracy.

- In June 2024, Cognizant, as part of an expanded partnership announced in August, launched its first set of healthcare large language model (LLM) solutions on Google Cloud’s generative AI (genAI) technology, including the Vertex AI platform and Gemini models, aimed at transforming healthcare administrative processes and enhancing user experiences.

Report Scope

Report Features Description Market Value (2024) US$ 16.2 Billion Forecast Revenue (2034) US$ 47.7 Billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software Hardware, and Services), By Application (Financial Analytics, Operational Analytics, Clinical Analytics, and Patient Flow Analytics), By End User (Hospitals, Diagnostic Laboratories, Research Organizations, and Insurance Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Philips Healthcare, GE Healthcare, Anthem, IBM, Roche, Cerner, Oracle, Cigna, Change Healthcare, Optum, McKesson, UnitedHealth Group, Siemens Healthineers, and Allscripts Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Operational Analytics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Operational Analytics MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Philips Healthcare

- GE Healthcare

- Anthem

- IBM

- Roche

- Cerner

- Oracle

- Cigna

- Change Healthcare

- Optum

- McKesson

- UnitedHealth Group

- Siemens Healthineers

- Allscripts