Global Healthcare Cloud Computing Market By Component (Hardware, Software, Services), By Service Model (Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)), By Pricing Model (Pay-as-you-go, Subscription-based, Spot Pricing), By Application (Clinical Information Systems (Electronic Medical Records (EMR), Picture Archiving and Communication System (PACS), Radiology Information Systems (RIS), Clinical Decision Support Systems (CDSS), Laboratory Information Systems (LIS), Practice Management s (PMS), Others), Non-Clinical Information Systems (Revenue Cycle Management, Billing and Claims Management, Workforce Management, Hospital Information Systems (HIS), Customer Relationship Management (CRM) Systems, Others)), By Deployment Model (Private Cloud, Public Cloud, Hybrid Cloud) By End-User (Healthcare Providers (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgery Centers), Healthcare Payers (Public Payers, Private Payers)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 13074

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

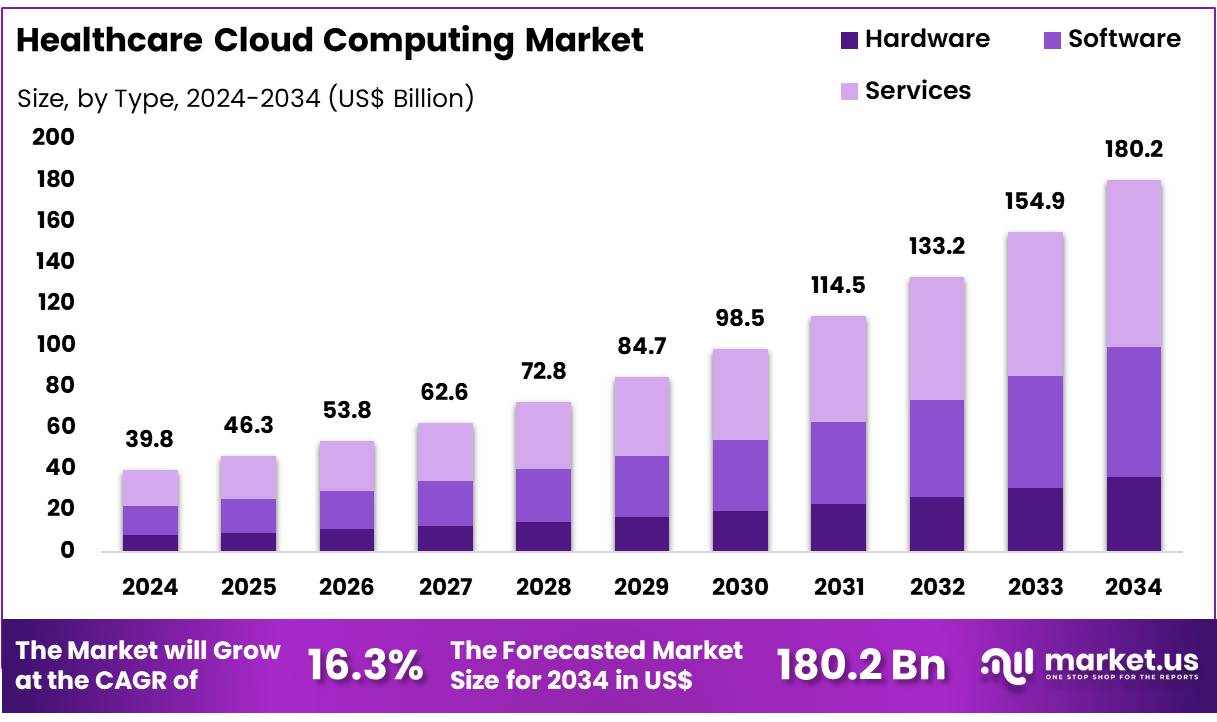

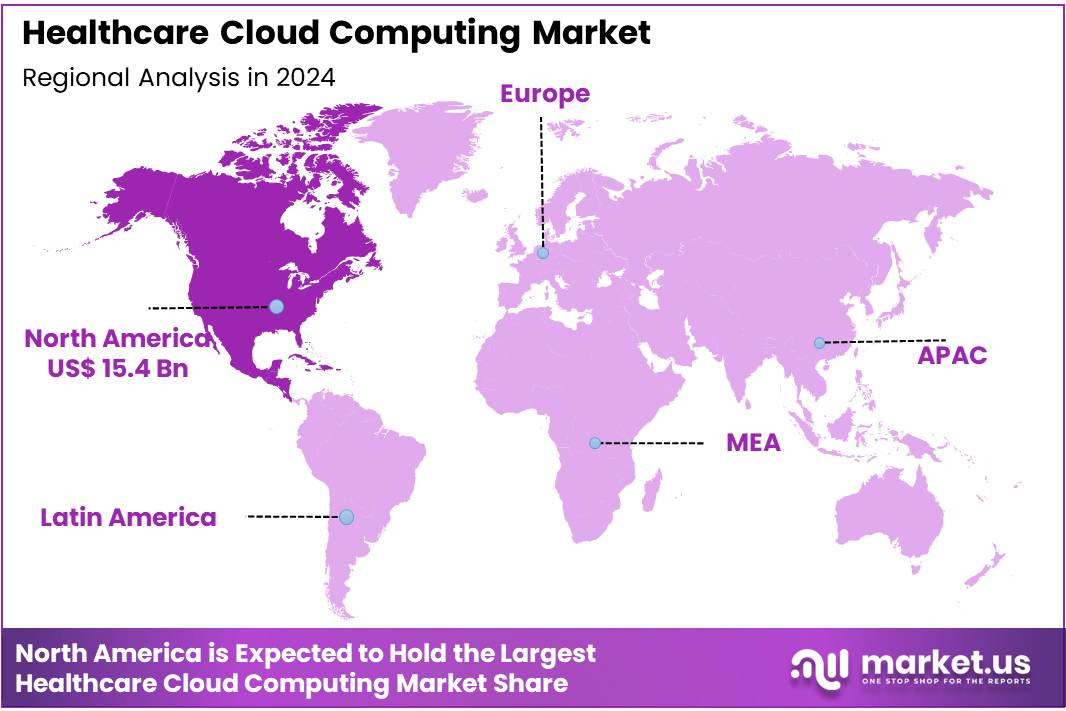

Global Healthcare Cloud Computing Market size is forecasted to be valued at US$ 180.2 Billion by 2034 from US$ 39.8 Billion in 2024, growing at a CAGR of 16.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 15.4 Billion.

The healthcare cloud computing market is experiencing robust growth, driven by the rising use of telehealth and remote patient monitoring, government initiatives and digitalization, and technological advancements in cloud services. Cloud computing allows healthcare organizations to store, manage, and process enormous amounts of data securely and efficiently via remote servers accessible through the internet.

This technology allows real-time access to patient information, facilitates seamless collaboration among providers, and supports the growth of telehealth and remote patient monitoring services. The COVID-19 pandemic accelerated the shift to cloud-based systems, as healthcare providers sought solutions for remote work, virtual care, and enhanced data sharing.

One of the major drivers of this market is the rising use of telehealth and remote patient monitoring. Telehealth platforms and remote patient monitoring solutions require secure, scalable, and interoperable infrastructure to store, manage, and transmit large volumes of patient data across diverse locations. Cloud technology enables healthcare providers to access patient information in real time, facilitate seamless collaboration among care teams, and deliver care to patients regardless of geographic barriers.

For instance, in October 2024, GE HealthCare announced a new CareIntellect offering: a cloud-first, digital solution designed to help care providers tackle both clinical and operational challenges. CareIntellect for Oncology, the first application within CareIntellect, brings together multi-modal patient data from disparate systems into a single view.

The application uses generative AI to summarize clinical notes and reports, surfacing relevant data to help care teams quickly understand disease progression and flag potential deviations from the treatment plan. This allows clinicians to determine potential next steps and consider proactive interventions. In addition, CareIntellect for Oncology assists in assessing clinical trial eligibility and tracking adherence to treatment protocols in an easy-to-navigate view.

Additionally, Government Initiatives and Digitalization has played a major role in driving the growth of global healthcare cloud computing market. For instance, according to data published by Government of India on January 20 2025, India’s healthcare landscape is undergoing a digital transformation, driven by government initiatives, policy reforms, and technological advancements.

With a rapidly growing population and increasing demand for quality healthcare, digital health solutions are playing a crucial role in enhancing accessibility, affordability, and efficiency. Digital healthcare infrastructure in India is evolving to bridge the gap between urban and rural healthcare services, leveraging telemedicine, electronic health records (EHRs), and artificial intelligence (AI)-driven diagnostics.

Government of India has undertaken initiatives such as the Ayushman Bharat Digital Mission (ABDM) and the Digital Health Incentive Scheme (DHIS), to change traditional healthcare structure to digitalization.

Despite the growth prospects, the healthcare cloud computing market faces several challenges. Data security and privacy concerns and shortage of skilled IT professionals are hampering the growth of global healthcare cloud computing market over the forecast period. Healthcare organizations manage highly confidential patient information, including medical histories, insurance details, and personal identifiers, making them prime targets for cyberattacks such as ransomware, phishing, and insider threats.

The quick alteration to cloud-based systems, while improving efficiency and accessibility, has introduced new exposure misconfigurations of cloud storage, insufficient access controls, and lack of visibility into cloud environments have led to several high-profile data breaches. For example, in 2025, a major U.S. health insurance provider exposed 4.7 million patient records due to a misconfigured cloud storage bucket.

Furthermore, shortage of skilled IT professionals is expected to slow down the growth of global healthcare cloud computing market over the forecast period. As healthcare organizations step-up their adoption of cloud technologies to manage vast and rapidly growth of patient data, the demand for expertise in cloud architecture, cybersecurity, DevOps, and data analytics has surged.

However, the supply of qualified professionals has not kept pace. Recent industry surveys indicate that about 45.6% of healthcare organizations identify talent shortages as a major barrier to faster cloud implementation, with recruitment and retention of cloud specialists posing ongoing challenge.

Key Takeaways

- In 2024, the market for healthcare cloud computing generated a revenue of US$ 39.8 billion, with a CAGR of 16.3%, and is expected to reach US$ 180.2 billion by the year 2034.

- By component, Services segment dominated the market with 37.8% share in 2024.

- Based on the service model segment, Software as a Service (SaaS) held the largest revenue share of 47.4% in 2024.

- Based on the pricing model segment, Pay-as-you-go held the largest revenue share of 58.2% in 2024.

- Based on the application segment, Non-Clinical Information Systems held the largest revenue share of 57.5% in 2024.

- Based on the deployment model segment, Private Cloud held the largest revenue share of 39.7% in 2024.

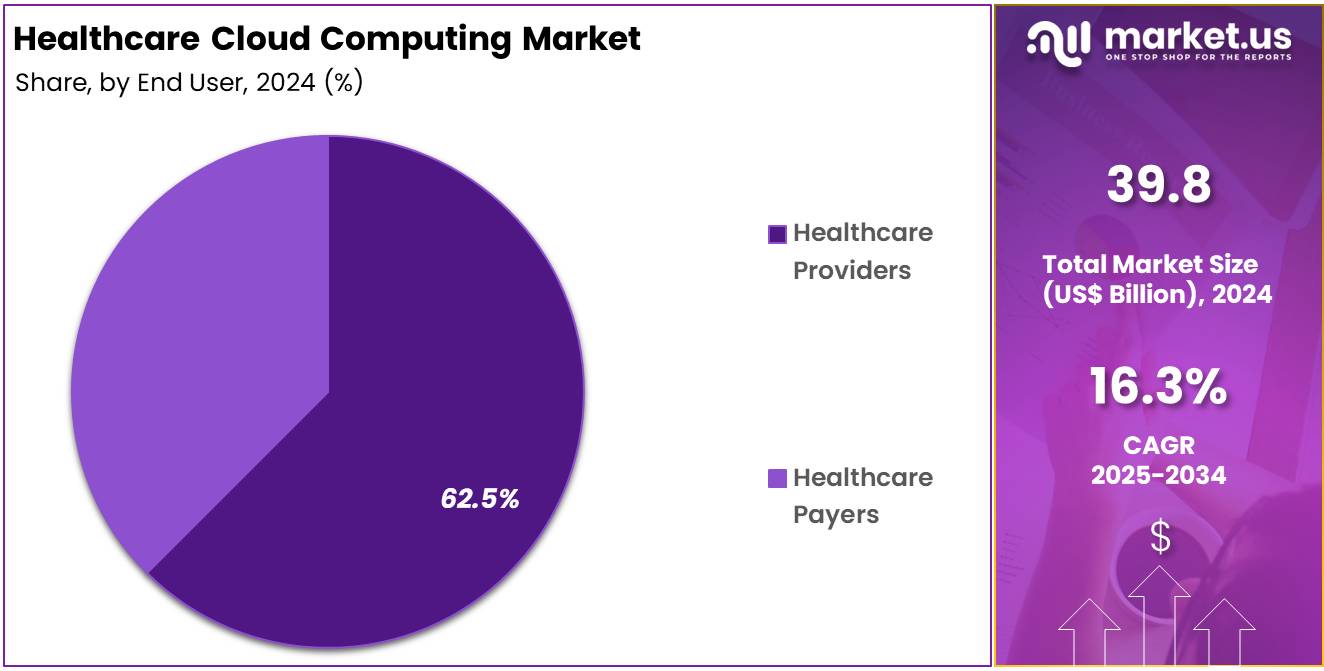

- By end-user, Healthcare Providers accounted for the largest market share of 62.5% in 2024.

- North America held the largest share of 38.8% in 2024 in the global market.

Component Analysis

The services segment emerged as the largest component in the healthcare cloud computing market, accounting for 37.8% share in 2024. This dominance is attributed to the increasing complexity of healthcare IT infrastructures and the rising dependence on specialized support for cloud integration and management.Healthcare providers are leveraging a wide range of services including consulting, implementation, integration, maintenance, and managed services to ensure smooth transitions from legacy systems, compliance with regulatory mandates, and optimal performance of cloud-based applications. The demand is further driven by the necessity for continuous support, software upgrades, and cybersecurity surveillance amid the integration of advanced technologies like telehealth, EHRs, and AI-driven analytics.Additionally, the introduction of innovative cloud software is expected to reinforce this segment’s growth. For example, GE HealthCare introduced its Genesis SaaS platform on March 4, 2025, offering four key features edge, storage, vendor-neutral archive, and data migration. These tools are intended to improve workflow efficiency, capital utilization, and IT resource management in healthcare organizations.Service Model Analysis

Software as a Service (SaaS) led the service model segment with a market share of 47.4% in 2024, driven by its widespread use across providers and payers. SaaS platforms support applications such as Electronic Health Records (EHRs), telehealth platforms, and revenue cycle management systems, allowing healthcare organizations to focus on core clinical operations while outsourcing software maintenance.The growing preference for SaaS is linked to its scalability, flexibility, and cost-efficiency over traditional on-premise solutions. Moreover, SaaS models enable healthcare professionals to access mission-critical applications remotely, facilitating real-time patient care and administrative efficiency.Pricing Model Analysis

The Pay-as-you-go (PAYG) pricing model held the largest share at 58.2% in 2024. Its dominance can be attributed to the ability to avoid high initial capital expenditures. PAYG allows healthcare organizations to pay only for the computing resources consumed, optimizing operational budgets and improving cash flow management.This model also enhances agility and resource efficiency, critical in a dynamically evolving healthcare landscape.Furthermore, the PAYG approach aligns with the adoption of AI, machine learning, and IoT, all of which demand scalable and flexible infrastructure. Industry reports confirm that leading cloud vendors promote PAYG for broadening access to digital health innovations across all healthcare settings.Application Analysis

Nonclinical information systems dominated the application segment, accounting for a 57.5% market share in 2024. This is primarily due to their widespread implementation in functions such as fraud detection, financial management, and health information exchange (HIE).Market players continue to drive growth through strategic partnerships aimed at enhancing administrative efficiencies. For instance, in January 2025, Life Flight Network partnered with MP Cloud Technologies to deploy AdvanceClaim, an advanced cloud-based claims and billing platform. The platform automates workflows, improves billing accuracy, and accelerates reimbursements solidifying nonclinical systems’ lead in this segment.Deployment Model Analysis

The private cloud model led the deployment landscape, with a 39.7% market share in 2024. Private clouds provide enhanced data security, control, and customization, making them particularly suited for the healthcare sector where compliance with data protection laws like HIPAA and GDPR is critical.The model ensures that healthcare institutions can design tailored infrastructure solutions, supporting secure digital transformation within hybrid or multi-cloud strategies. Private cloud environments continue to be favored for their ability to safeguard sensitive patient data and meet complex organizational needs.End-User Analysis

Healthcare providers, especially hospitals, represented the leading end-user category with a 62.5% market share in 2024. This segment benefits from growing digital transformation initiatives aimed at enhancing operational efficiency and clinical outcomes. Strategic collaborations are playing a pivotal role in driving this trend.In August 2023, HCA Healthcare, Inc. partnered with Google Cloud to deploy generative AI technologies for clinical documentation automation. This initiative is expected to reduce the administrative burden on physicians and nurses while ensuring data privacy. Additionally, HCA’s ongoing rollout of the MEDITECH Expanse platform further exemplifies providers’ increasing reliance on cloud solutions to streamline care delivery and administration.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Service Model

- Infrastructure as a Service (IaaS)

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

By Pricing Model

- Pay-as-you-go

- Subscription-based

- Spot Pricing

By Application

- Clinical Information Systems

- Electronic Medical Records (EMR)

- Picture Archiving and Communication System (PACS)

- Radiology Information Systems (RIS)

- Clinical Decision Support Systems (CDSS)

- Laboratory Information Systems (LIS)

- Practice Management Systems (PMS)

- Others

- Non-Clinical Information Systems

- Revenue Cycle Management

- Billing and Claims Management

- Workforce Management

- Hospital Information Systems (HIS)

- Customer Relationship Management (CRM) Systems

- Others

By Deployment Model

- Private Cloud

- Public Cloud

- Hybrid Cloud

By End-User

- Healthcare Providers

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgery Centers

- Healthcare Payers

- Public Payers

- Private Payers

Drivers

Rising Use of Telehealth and Remote Patient Monitoring

The global healthcare industry is undergoing a transformative shift, with telehealth and remote patient monitoring (RPM) emerging as pivotal forces driving the growth of the healthcare cloud computing market. These technologies are revolutionizing patient care by enabling remote consultations, continuous health monitoring, and data-driven decision-making, all of which rely heavily on scalable, secure, and efficient cloud computing infrastructure.

Data from industry reports, company websites, government organizations, and white papers underscore the critical role of cloud computing in supporting the rapid adoption of telehealth and RPM, fuelling market expansion. Telehealth, which facilitates virtual consultations between healthcare providers and patients, and RPM, which allows continuous monitoring of patients’ health metrics through connected devices, have seen unprecedented growth.

These services require secure, scalable, and interoperable platforms to store, process, and share vast volumes of patient data in real time. Cloud computing provides the backbone for telehealth consultations, remote diagnostics, and the integration of data from wearable devices and mobile health apps, enabling seamless communication and collaboration between patients and providers regardless of location. Market players are focused on launching new products in the market, to expand their presence and increase market share in the market.

For instance, in September 2024, Talkdesk, Inc., a global provider of artificial intelligence (AI)-powered customer experience (CX) technology that serves enterprises of all sizes, announced the launch of the Talkdesk Healthcare Experience Cloud for Payers, the company’s latest industry-specific contact center offering built entirely around the CX needs of healthcare insurance organizations. The Talkdesk Healthcare Experience Cloud for Payers solution combines contact center technology with healthcare payer-specific AI capabilities and dedicated agent views and tools.

Integrations with critical systems of record, such as claims, customer relationship management (CRM), and electronic health record (EHR) software, enable greater personalization and accuracy of interactions while out-of-the-box workflows aid the fast resolution of common member, caregiver, and provider network issues.

Similarly, in June 2022, GoMeyra, a cloud software company dedicated to providing innovative, real-time software for the health care industry, launched a new telehealth platform – GoVirtual Clinic. This single-interface cloud-based solution allows labs, physicians or nurses to administer medical tests and consult with patients over a secure remote platform.

GoVirtual Clinic is a next-generation platform that includes a suite of solutions for medical professionals to conduct virtual patient appointments while comprehensively managing patient care and related electronic health records. Just released, the first phase of the platform features ways to seamlessly schedule and manage virtual testing appointments, order test kits, monitor online waiting rooms, conduct virtual appointments, and share test results with patients in real-time.

Restraints

Data Security and Privacy Concerns

While it has the ability to change healthcare delivery as well as improve internal operations, impediments to the growth of the global healthcare cloud market are related to data security and privacy. Health organizations around the world are increasingly using cloud-based solutions to deliver better patient care, enhance operations, and cut infrastructure spending.

As healthcare organizations globally embrace the solutions offered by the cloud, the inherent characteristics of patient data such as electronic health records (EHRs), insurance records, and personally identifiable information (PII), increase the value of the healthcare sector as a target for cyberattacks. According to a 2024 report from the HIPAA Journal, 82% of the U.S. population had their medical records exposed, stolen or disclosed to an unauthorized party. Indicating just how large the problem is.

Opportunities

Integration of AI & Big Data Analytics

The integration of artificial intelligence (AI) and big data analytics represents a transformative opportunity for the global healthcare cloud computing market. As healthcare organizations generate and collect vast amounts of data from electronic health records (EHRs), medical imaging, wearable devices, and telemedicine platforms, the need for advanced analytics and AI-driven insights has become paramount.

Cloud computing provides the scalable infrastructure and processing power required to store, manage, and analyze these massive datasets efficiently, enabling real-time access to actionable information for clinicians and administrators. AI technologies, including machine learning and natural language processing, are revolutionizing healthcare by enhancing diagnostic accuracy, predicting patient outcomes, and enabling personalized treatment plans.

For example, generative AI tools can analyze diverse data stored in the cloud to identify patterns and anomalies, leading to earlier detection of diseases and more precise interventions. According to a 2024 Microsoft-IDC study, 79% of healthcare organizations are already utilizing AI, with a reported return on investment of $3.20 for every $1 spent, and most seeing ROI within 14 months. These capabilities are especially critical as the healthcare sector faces a growing shortage of clinical staff, making AI-powered automation and decision support tools essential for maintaining quality care.

Increasing product launches by market players is expected to boost the growth of Big data in healthcare cloud computing market over the forecast period. For instance, in October 2024, Google Cloud, announced Vertex AI Search for Healthcare and several new features for Healthcare Data Engine are available to global allowlist customers.

Vertex AI Search for Healthcare helps developers build better assistive technology for healthcare workers to alleviate administrative burdens, and Healthcare Data Engine helps organizations build an interoperable data platform, the foundation of generative AI (gen AI). When used together, these products can accelerate digital transformation in healthcare, improving systems and enhancing patient care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic challenges such as inflation, rising interest rates, and market volatility have established complexities. While cloud computing offers cost-effective solutions, some healthcare organizations face budget constraints that may delay large-scale technology upgrades. Additionally, concerns about data security and the high initial costs of cloud adoption, including migration and training expenses, can deter investment, particularly among smaller healthcare providers.

Geopolitical factors have increasingly directed the growth of the global healthcare cloud computing market, influencing everything from data sovereignty to supply chain resilience. Rising geopolitical tensions such as trade disputes, regional conflicts, and shifting alliances have led to stricter data localization laws and heightened scrutiny over cross-border data transfers.

For instance, countries like China, Russia, and India have implemented or proposed regulations requiring sensitive health data to be stored within national borders, compelling cloud providers to invest in localized infrastructure or risk losing market access. Despite these challenges, geopolitical changes have also created opportunities. Governments in North America and Europe are investing heavily in digital health infrastructure as part of national security and pandemic preparedness strategies, further accelerating cloud adoption in healthcare.

Latest Trends

Expansion of Mobile Health (mHealth) and Wearable Devices

The rapid expansion of mobile health (mHealth) and wearable devices is notably shaping the growth of the global healthcare cloud computing market. As healthcare systems worldwide pivot toward digital transformation, the integration of mHealth technologies such as mobile apps, connected wearables, and remote monitoring tools has become a cornerstone of modern care delivery. This upsurge is largely driven by the increasing demand for remote patient monitoring, chronic disease management, and personalized care all of which rely heavily on cloud infrastructure for data storage, analytics, and interoperability.

Wearable devices, including fitness trackers, smartwatches, and biosensors, continuously generate vast volumes of health data. This data must be securely stored, processed, and accessed in real time, which has accelerated the drive the utilization of cloud-based platforms. Cloud computing enables seamless integration of these devices with electronic health records (EHRs), telemedicine platforms, and AI-powered diagnostic tools. For instance, companies like Apple and Fitbit have developed ecosystems that sync user health data to cloud servers, allowing healthcare providers to monitor patient vitals remotely and intervene proactively.

Government initiatives are also fuelling this trend. The U.S. Department of Health and Human Services (HHS) and the European Commission have both emphasized the importance of digital health and cloud-based interoperability frameworks to improve care coordination and patient outcomes. Moreover, the World Health Organization (WHO) has recognized mHealth as a critical component of universal health coverage, particularly in low-resource settings where cloud-enabled mobile solutions can bridge gaps in access.

Regional Analysis

North America is leading the Healthcare Cloud Computing Market

In 2024, North America accounted for approximately 38.8% of the global healthcare cloud computing market share, driven by factors such as robust healthcare infrastructure, stringent regulatory frameworks, and high adoption rates of digital health solutions. The region’s adoption of EHR, telemedicine, and other digital health solutions has significantly driven the demand for healthcare cloud computing.

For instance, on May 22 2025, Innovaccer Inc., a leading healthcare AI company, announced the launch of ‘Innovaccer Gravity’, its Healthcare Intelligence Platform, designed to help organizations unlock the full value of their data and accelerate AI-driven transformation.

Innovaccer Gravity seamlessly integrates healthcare enterprise data, enables cross-domain intelligence, and delivers faster return on investment (ROI), all while reducing total cost of ownership (TCO). Moreover, the presence of major healthcare technology companies and the integration of AI, cloud computing, and data analytics within healthcare operations further strengthen the region’s dominance in the market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is emerging as the fastest-growing region in the healthcare cloud computing market. This rapid growth is primarily driven by the increasing healthcare expenditure, government initiatives to modernize healthcare systems, and rising investments in healthcare IT infrastructure. Countries such as China and India are leading the way in embracing digital health technologies to address challenges like overcrowding in hospitals, limited access to healthcare in rural areas, and the growing burden of chronic diseases.

According to data published by Government of China on January 18 2025, The Greater Bay Area has taken a significant step towards advancing its digital health ecosystem with the establishment of its first cross-border medical data space. This initiative aims to meet international standards for data security, interoperability, and innovation.

The project is a collaborative effort led by institutions including the Chinese University of Hong Kong (CUHK) Entrepreneurship Research Center, the United International Data Space Association (IDSA), the Hong Kong Science Park Company, the Next Generation Internet National Engineering Center, and other key stakeholders.

The cross-border medical data space is designed to ensure the secure and credible handling of medical data across its lifecycle, from generation and extraction to storage, processing, distribution, and eventual destruction or archiving. This aligns with the objectives set forth in China’s Trusted Data Space Development Action Plan (2024–2028), which outlines the establishment of over 100 “Trusted Data Space” demonstration pilots by 2028. These initiatives are intended to bolster the global data economy by encouraging cross-industry cooperation, promoting external data utilization, and driving innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major market players in the healthcare cloud computing market include Amazon Web services, Microsoft, Google Inc., athenahealth and others. These companies are thriving their market revenue by launching new products, collaborations and adopting various other strategies.

Athenahealth is the provider of cloud-based services and mobile applications for medical groups and health systems. The company delivers cloud solutions for revenue cycle management, medical billing, patient engagement, electronic health records (EHRs), care coordination, population health management, and clinical intelligence/decision support. The company’s various products and services include AthenaOne – athenaClinicals, athenaCollector, and athenaCommunicator.

AWS provides an extensive suite of cloud services for healthcare organizations, including computing, storage, database, analytics, machine learning, and security services.

Top Key Players

- Amazon Web Services Inc.

- Microsoft

- Google Inc.

- Siemens Healthineers AG

- CareCloud Inc.

- Athenahealth Inc.

- ClearDATA

- Oracle Corporation

- OSP

- Experion Technologies.

- Binariks Inc.

- Epic Systems Corporation.

- Medical Information Technology, Inc.

- ScienceSoft USA Corporation.

- Innowise

Recent Developments

- On May 08 2025, Mastek, a trusted digital engineering and cloud transformation partner, announced its strategic collaboration with Zulekha Healthcare Group. Mastek will deploy an extensive Oracle Fusion Cloud suite which closely integrates with Oracle Health (Cerner) system. This transformation aligns with Zulekha’s vision of delivering “Patient First” healthcare while enhancing clinical workflows, operational efficiency, and fiscal agility.

- On February 03 2025, Press Ganey, the leading provider of experience measurement, data analytics, and insights for health systems and health plans, announced a strategic collaboration with Microsoft. This collaboration will enable the development of a suite of generative AI-powered solutions that redefine actionable insights, driving transformational improvements in the safety, quality, and experience of care delivery.

- On January 09 2025, Innovaccer Inc., a leading healthcare AI company, announced a US$ 275M Series F funding round. The round was a combination of primary and secondary funding, and includes participation from B Capital Group, Banner Health, Danaher Ventures LLC, Generation Investment Management, Kaiser Permanente, and M12. This investment will fuel Innovaccer’s efforts to expand its collaboration with existing customers, introduce new AI and cloud capabilities, and scale a developer ecosystem on the platform. The company plans to add multiple copilots and agents to its offerings, including utilization management, prior authorization, clinical decision support, clinical documentation, care management, and contact center.

Report Scope

Report Features Description Market Value (2024) US$ 39.8 Billion Forecast Revenue (2034) US$ 180.2 Billion CAGR (2025-2034) 16.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Service Model (Infrastructure as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)), By Pricing Model (Pay-as-you-go, Subscription-based, Spot Pricing), By Application (Clinical Information Systems (Electronic Medical Records (EMR), Picture Archiving and Communication System (PACS), Radiology Information Systems (RIS), Clinical Decision Support Systems (CDSS), Laboratory Information Systems (LIS), Practice Management Systems (PMS), Others), Non-Clinical Information Systems (Revenue Cycle Management, Billing and Claims Management, Workforce Management, Hospital Information Systems (HIS), Customer Relationship Management (CRM) Systems, Others)), By Deployment Model (Private Cloud, Public Cloud, Hybrid Cloud) By End-User (Healthcare Providers (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgery Centers), Healthcare Payers (Public Payers, Private Payers)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services Inc., Microsoft, Google Inc., Siemens Healthineers AG, CareCloud Inc., Athenahealth Inc., ClearDATA, Oracle Corporation, OSP, Experion Technologies, Binariks Inc., Epic Systems Corporation., Medical Information Technology, Inc., ScienceSoft USA Corporation and Innowise. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Cloud Computing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Cloud Computing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services Inc.

- Microsoft

- Google Inc.

- Siemens Healthineers AG

- CareCloud Inc.

- Athenahealth Inc.

- ClearDATA

- Oracle Corporation

- OSP

- Experion Technologies.

- Binariks Inc.

- Epic Systems Corporation.

- Medical Information Technology, Inc.

- ScienceSoft USA Corporation.

- Innowise