Healthcare API Market By Service (Wearable Medical Device, Appointments, EHR Access, Remote Patient Monitoring and Payment) By Deployment Model (Cloud-based and On-Premise) By End-use (Healthcare Payers, Providers and Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 83162

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

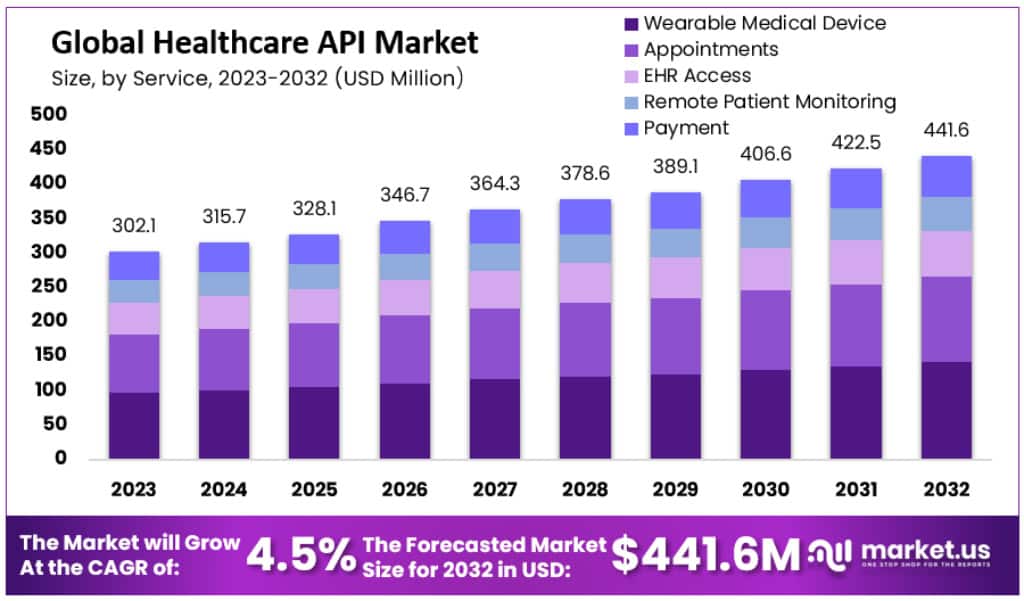

The Global Healthcare API Market size is expected to be worth around USD 441.6 Million by 2032, from USD 302.1 Million in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2033.

Healthcare API is software that is used by hospitals and clinics for electronic data transfer. With the use of the healthcare API, doctors now have an easier time staying up-to-date on their patient’s health as well as serving as a more efficient communicators with other physicians and nurses in the hospital system. Healthcare API solves several problems of old, outdated healthcare-related systems.

APIs are a system of communication typically used by developers to allow access to various services and resources. The growing use of APIs as a way for organizations to share data and information across the internet allows healthcare providers to now provide their users with more information and services, such as booking an appointment or checking lab results, all through one easy-to-use interface.

Healthcare API’s are necessary for the future of healthcare. They offer many benefits for patients, providers, payers, and society in general. Healthcare API’s can lower costs for everyone by decreasing errors in coding, claims processing, and transactions. Patient data is digitally stored which offers faster access to patient records in emergencies. This also means that healthcare staff can make more informed decisions about patient care because they have access to an individual’s medical history.

Healthcare API allows for the payment of a variety of bills for healthcare facilities, including hospital fees, emergency room fees, and physician office visits. The API system is intended to eliminate the need for patients to spend time on the phone waiting for billing updates from their providers. In addition to saving time, APIs can also save money by eliminating the need for manual data entry and retrieval. Another major benefit of this system is that it helps to reduce human error.

Key Takeaways

- The Global Healthcare API Market is projected to reach approximately USD 441.6 Million by 2032, up from USD 302.1 Million in 2023.

- This growth represents a Compound Annual Growth Rate (CAGR) of 4.5% from 2023 to 2033.

- In 2023, Electronic Health Records (EHR) access accounted for over 32% of the healthcare API market share.

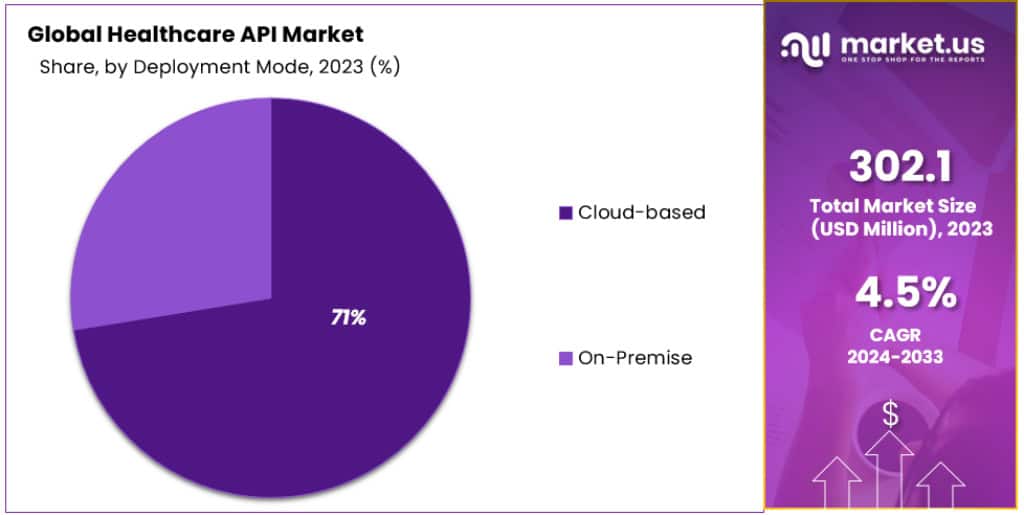

- Cloud-based deployment models dominated the market, holding over 71% market share in 2023.

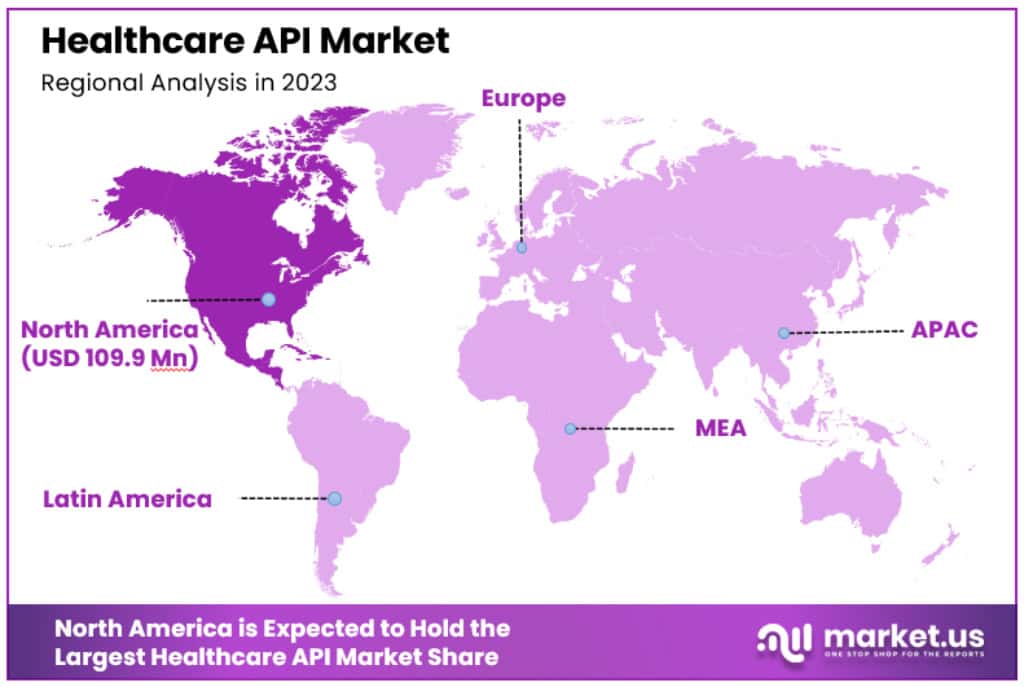

- North America is dominating Healthcare API Market with 36.4% share, with USD 109.9 Million in 2023

- In 2023, healthcare providers led the healthcare API segment with over 47% market share.

Service Analysis

In 2023, the healthcare API market observed significant segmentation, with Electronic Health Records (EHR) access commanding a dominant market position. This segment captured more than a 32% share, indicative of the growing reliance on digital health records in healthcare management. The EHR access segment benefits from increased emphasis on seamless data accessibility and interoperability in healthcare systems. This trend reflects the growing demand for efficient and real-time patient data management.

The wearable medical device segment also showcased notable growth. This segment leverages the widespread adoption of wearable technology for health monitoring. The integration of APIs in these devices facilitates real-time health tracking and data synchronization, enhancing patient engagement and preventive healthcare measures.

Appointment scheduling services, another key segment, offer significant convenience and efficiency. The integration of APIs in this domain streamlines the appointment booking process, reducing administrative burdens and improving patient access to healthcare services. This segment is driven by the rising demand for digital solutions in patient management and healthcare accessibility.

Remote patient monitoring (RPM) represents a vital segment in the healthcare API market. RPM APIs enable healthcare providers to monitor patients’ health remotely, especially crucial for chronic disease management and elderly care. This segment benefits from the increasing emphasis on telehealth and remote care models, accelerated by the global health crisis and technological advancements.

Lastly, the payment segment in the healthcare API market underscores the shift towards streamlined and secure digital payment solutions in healthcare. APIs in this segment facilitate efficient billing and payment processing, enhancing the financial operations of healthcare providers and simplifying patient transactions. The growth in this segment reflects the broader trend of digital transformation in healthcare financial management.

Deployment Model Analysis

In 2023, the cloud-based segment of the healthcare API market held a dominant position, capturing more than a 71% share. This substantial market share is attributed to the cloud’s flexibility, scalability, and cost-effectiveness. Cloud-based APIs enable healthcare organizations to manage large volumes of data efficiently while ensuring accessibility and interoperability. The increasing adoption of cloud technologies in healthcare for data storage and management has been a key driver for this segment’s growth.

On-premise deployment, while smaller in market share compared to cloud-based solutions, remains significant. This segment appeals to healthcare organizations seeking greater control over their data and infrastructure. On-premise APIs are preferred in scenarios where data security and regulatory compliance are of utmost importance. Although growth in this segment is more moderate, it continues to play a critical role in healthcare settings that prioritize data sovereignty and localized control over their IT environments.

Overall, the deployment model of healthcare APIs reflects the evolving needs of the healthcare industry. The dominant cloud-based segment showcases the sector’s shift towards more agile and scalable solutions, while the steady presence of on-premise deployments highlights ongoing requirements for security and control in certain healthcare applications. Both deployment models contribute to the overarching aim of enhancing healthcare services through technological advancements.

End-use Analysis

In 2023, healthcare providers held a dominant market position in the healthcare API segment, capturing more than a 47% share. This prominence is largely due to the increasing adoption of APIs by hospitals, clinics, and other healthcare facilities. These APIs enhance patient care through improved data management and accessibility, facilitating better health outcomes. The integration of APIs allows healthcare providers to streamline their operations, offering efficient services such as appointment scheduling, patient record management, and telehealth consultations.

Healthcare payers, including insurance companies, also constitute a significant segment. They utilize APIs for efficient data exchange, claims processing, and policy management. The adoption of APIs by healthcare payers is driven by the need for streamlined workflows and enhanced customer experiences. This segment benefits from the digital transformation in the healthcare insurance sector, emphasizing operational efficiency and patient-centric care.

The ‘others’ segment, encompassing various stakeholders in the healthcare ecosystem such as pharmaceutical companies, research organizations, and health tech startups, also plays a crucial role. This segment uses APIs for diverse purposes like research data collection, drug development, and digital health innovations. The growth in this segment is fueled by the increasing collaboration between technology and healthcare sectors, focusing on innovation and improved healthcare delivery.

Overall, the end-use segmentation in the healthcare API market highlights the diverse applications and benefits of APIs across the healthcare spectrum. The dominant position of providers underlines the central role of APIs in enhancing patient care and healthcare operations, while the significance of payers and other stakeholders reflects the broadening scope of digital integration in healthcare.

Key Market Segments

Service

- Wearable Medical Device

- Appointments

- EHR Access

- Remote Patient Monitoring

- Payment

Deployment Model

- Cloud-based

- On-Premise

End-use

- Healthcare Payers

- Providers

- Others

Driver

The healthcare API market is driven by a surge in demand for simplified healthcare access. Frequent updates and technological advancements, along with a growing focus on healthcare integration, are key factors. Additionally, the escalating activities of EHR vendors and healthcare IT startups contribute significantly. For instance, Apple Health’s launch of a healthcare API in June 2018, enabling access to EHR data from over 500 U.S. hospitals, exemplifies this trend.

Restraint

Data security concerns, particularly regarding sensitive patient information, pose a major challenge. The lack of skilled professionals, inadequate IT infrastructure, and poor network connectivity further impede market growth. The reliance on internet services, especially in rural areas with less connectivity, also restricts market expansion.

Opportunity

The market is buoyed by the rising prevalence of chronic diseases and an aging population. For example, chronic diseases account for 43% of all diseases globally, and by 2050, the elderly population is expected to reach 1.5 billion. This demographic shift and health trend necessitate efficient healthcare management, which APIs facilitate.

Challenge

A significant challenge is maintaining comprehensive records across various disease categories. With chronic diseases being the leading cause of death worldwide, and the number of diabetes patients projected to reach 783 million by 2045, the task of updating and categorizing patient records through APIs becomes increasingly complex.

Trends

The healthcare API market trends towards more efficient healthcare sector operations, with APIs playing a crucial role in managing the vast amounts of individual health data. This efficiency is expected to contribute to market growth during the forecast period. However, concerns about data security and the lack of skilled professionals continue to challenge the market’s potential growth.

Regional Analysis

North America is dominating Healthcare API Market with 36.4% share, with USD 109.9 Million in 2023, attributed to high digital literacy and established healthcare infrastructure with integrated patient EHRs. Europe, with its robust healthcare infrastructure and stringent data protection regulations like GDPR, is expected to witness the highest CAGR during the forecast period. The adoption of healthcare APIs in these regions is further bolstered by favorable policies and the presence of large healthcare organizations (HCOs).

Germany’s Market Outlook

Germany is expected to hold a near ~7.0% share of the global healthcare API market in 2023. The market’s growth is propelled by the increasing adoption of electronic health records (EHRs) integrated with APIs, enabling easier data access. The German market is also benefiting from continued enhancements and initiatives by EHR vendors and healthcare IT companies.

Market Growth in China

China’s healthcare API market is forecasted to grow at a CAGR of ~3.2%. Key drivers include enhanced patient satisfaction and treatment quality, with services like wearable medical devices and remote patient monitoring gaining traction. Healthcare APIs are increasingly used for accessing detailed information about healthcare professionals’ qualifications and availability.

Key Market Players

- Apple, Inc.

- Greenway Health, LLC

- Microsoft Corporation

- Cerner Corporation

- General Electric Company

- Athenahealth

- Practo Technologies Pvt. Ltd.

- MuleSoft, Inc.

- Epic Systems Corporation

- Practice Fusion, Inc.

- Other Key Players

Recent Developments

- In November 2024: Practo Technologies expanded its teleconsultation services significantly, reporting a tenfold increase over six months, primarily driven by the pandemic. The platform now supports over 25,000 verified doctors providing online consultations, indicating a rapid adoption rate. The company also aimed to expand its reach from 16,000 to 25,000 pin codes, targeting increased access in Tier 2 cities and beyond.

- In September 2024: Introduction of New Generative AI Products, Microsoft unveiled new generative AI products for health systems designed to streamline healthcare delivery and enhance clinical documentation. This development includes the Dragon Ambient eXperience (DAX™) Express, which integrates advanced conversational and ambient AI capabilities with OpenAI’s GPT-4, significantly reducing the administrative burden and improving the efficiency of clinical workflows.

- In June 2023: Apple introduced new features in iOS 17, iPadOS 17, and watchOS 10, focusing on mental and vision health. These features aim to provide innovative health management tools while ensuring privacy and security. The launch included the Health app on iPad, offering comprehensive health and fitness data integration from various devices.

Report Scope

Report Features Description Market Value (2023) SD 302.1 Million Forecast Revenue (2032) USD 441.6 Million CAGR (2023-2032) 4.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Wearable Medical Device, Appointments, EHR Access, Remote Patient Monitoring and Payment) By Deployment Model (Cloud-based and On-Premise) By End-use (Healthcare Payers, Providers and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Apple, Inc, Greenway Health LLC, Microsoft Corporation, Cerner Corporation, General Electric Company, Athenahealth, Practo Technologies Pvt. Ltd., MuleSoft, Inc., Epic Systems Corporation, Practice Fusion, Inc. And Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple, Inc.

- Greenway Health, LLC

- Microsoft Corporation

- Cerner Corporation

- General Electric Company

- Athenahealth

- Practo Technologies Pvt. Ltd.

- MuleSoft, Inc.

- Epic Systems Corporation

- Practice Fusion, Inc.

- Other Key Players