Global Healthcare and Medical System Integrators Market By Type (Horizontal Integration, Vertical Integration) By Application (Government Hospitals, Private Hospitals and Clinics, Healthcare Organizations, Other Applications) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast, 2024–2033

- Published date: Feb 2024

- Report ID: 14324

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

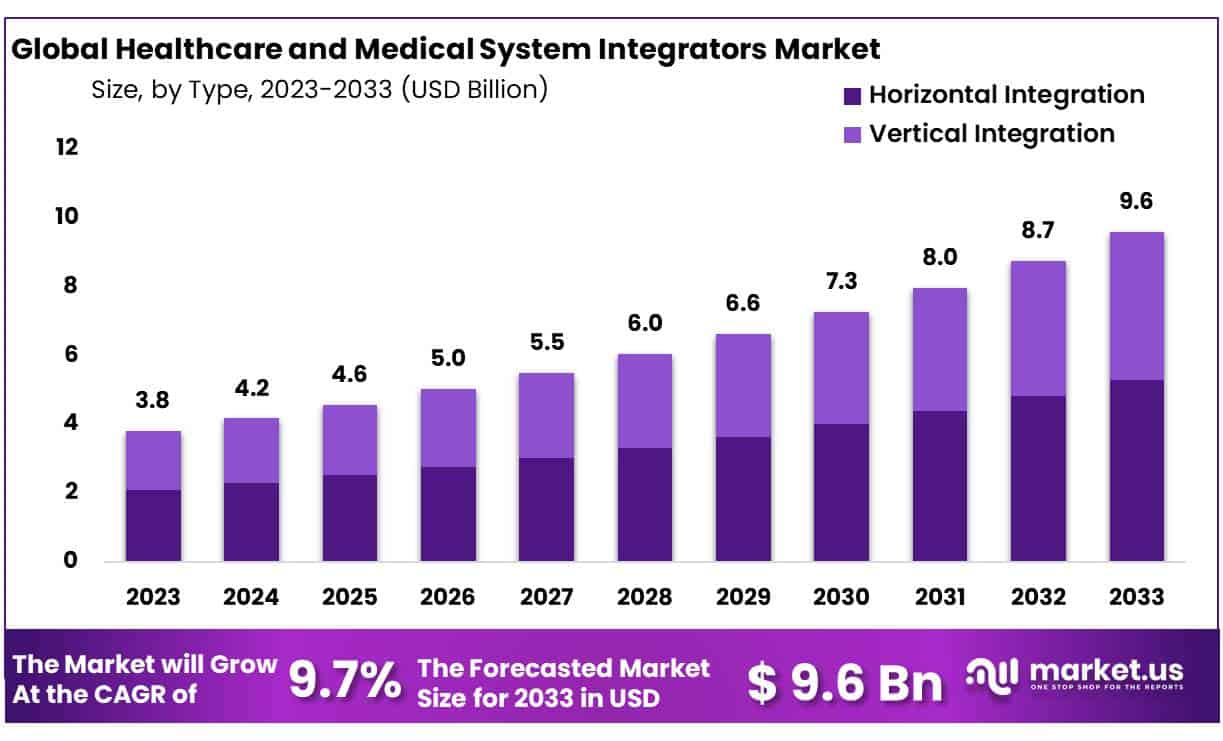

The Global Healthcare and Medical System Integrators Market size is expected to be worth around USD 9.6 Billion by 2033 from USD 3.8 Billion in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

Healthcare and Medical System Integrators play a crucial role in improving healthcare delivery. These integrators facilitate seamless communication among healthcare professionals, improving treatment process. Their user-friendly designs allow easy integration into existing healthcare systems ensuring improved patient outcomes and well-being.

The global healthcare and medical system integrators market is experiencing rapid expansion, fuelled by strong support from IT sector as well as increasing incidences of chronic diseases and psychological disorders attributed to lifestyle and diet changes. Furthermore, surgical errors reduction remains a top priority, fuelling further demand for integrators. Furthermore, market opportunities exist with emerging cutting-edge technological innovations within healthcare fields.

The report on Healthcare and Medical System Integrators Market offers in-depth analysis on market trends, drivers, restraints, opportunities etc. Along with qualitative information, this report include the quantitative analysis of various segments in terms of market share, growth, opportunity analysis, market value, etc. for the forecast years. The global healthcare and medical system integrators market is segmented on the basis of type, application forecast years.

Key Takeaways

- Market Size: Healthcare and Medical System Integrators Market size is expected to be worth around USD 9.6 Billion by 2033 from USD 3.8 Billion in 2023.

- Market Growth: The market growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

- Type Analysis: Horizontal Integration dominates the Healthcare and Medical System Integrators Market with 56% market share.

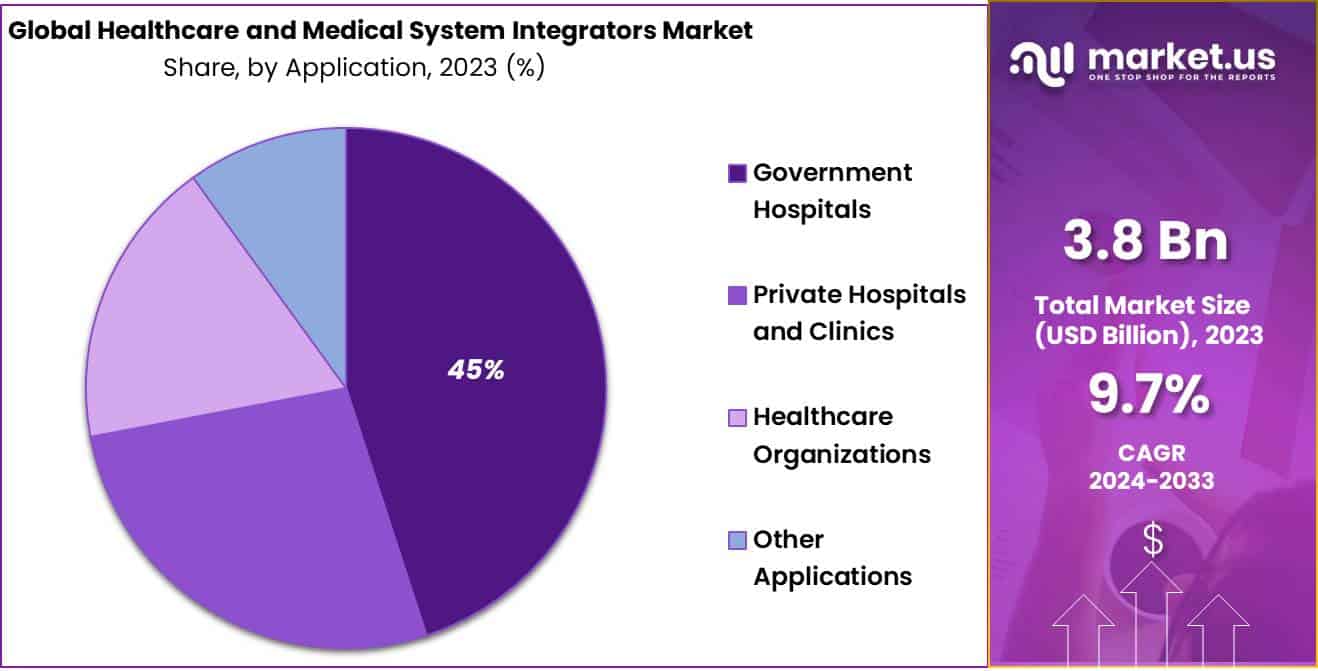

- Application Analysis: Government Hospitals dominate the Healthcare and Medical System Integrators Market with an impressive 45% market share.

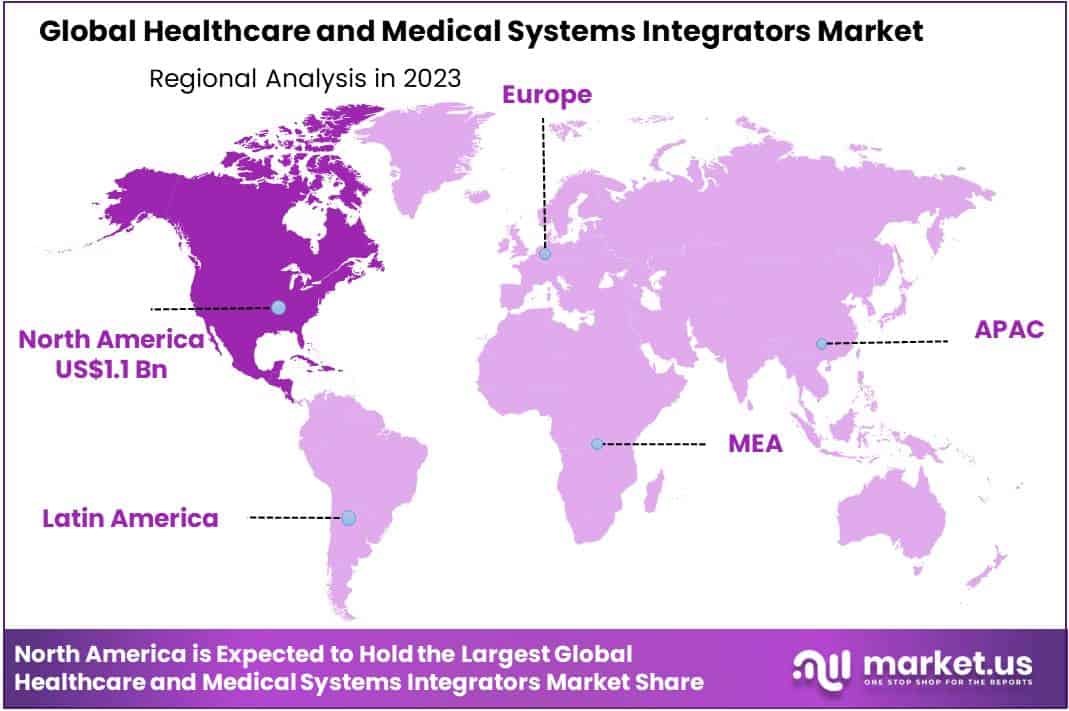

- Regional Analysis: North America currently leads the healthcare and medical system integrators market with 32% market share, equivalent to USD 1.1 billion in revenue.

Type Analysis

Horizontal Integration dominates the Healthcare and Medical System Integrators Market with 56% market share. This strategy involves merging companies operating within one sector into an enlarged unit to optimize synergies, optimize operational efficiencies, expand market penetration, pool resources, expertise and technologies effectively providing comprehensive healthcare solutions that serve multiple needs efficiently.

This trend reflects an increasing shift toward collaborative partnerships and mergers or acquisitions to strengthen competitive advantage and expand service offerings. By capitalizing on economies of scale and shared infrastructure, companies engaged in Horizontal Integration can take advantage of market opportunities while streamlining processes to create added customer value.

Vertical Integration, defined as controlling various stages of the production or distribution chain, remains an effective strategy in certain niche segments of the healthcare industry. Although Horizontal Integration dominates, Vertical Integration offers more specialized expertise and tailored solutions, especially in areas requiring precise control of quality and supply chain management.

Application Analysis

Government Hospitals dominate the Healthcare and Medical System Integrators Market with an impressive 45% market share. Serving as primary care providers to large segments of society, these hospitals play a pivotal role in providing essential medical services while implementing system integration solutions to enhance operational efficiencies and patient care.

Private Hospitals, Clinics, and Healthcare Organizations collectively comprise the remaining market share. Private healthcare entities bring a dynamic energy to the industry that is marked by flexibility, innovation, and customer-centric focus, as well as their adoption of system integration solutions to provide high-quality care while optimizing processes to meet patient and stakeholder demands.

Healthcare Organizations such as integrated delivery networks, physician practices, and ambulatory care centers also play a vital role in driving market expansion. Their aim is to enhance care coordination, patient engagement, and overall healthcare delivery; to achieve this they often use system integration technology to streamline operations, enhance interoperability, and facilitate data-driven decision-making.

Key Market Segments

Type

- Horizontal Integration

- Vertical Integration

Application

- Government Hospitals

- Private Hospitals and Clinics

- Healthcare Organizations

- Other Applications

Driver

Technological Advances

Technological advancements have become one of the primary forces driving medical system integrator growth. Integrating various healthcare systems such as electronic health records (EHR), picture archiving and communication systems (PACS), and laboratory information management systems (LIMS) is essential to streamlining operations and providing enhanced patient care, and their seamless integration is driving market expansion.

Growing Demand for Interoperability

Healthcare organizations have come to realize the significance of interoperability as they look for seamless transfer of patient information across systems and platforms, system integrators play a pivotal role in closing this interoperability gap by connecting disparate systems together and facilitating exchange among healthcare providers, payers and patients – this fuels increased demand for medical system integrators who ensure optimal care coordination, reduce medical errors and enhance outcomes among their patient base.

Trend

Adoption of Cloud-Based Solutions

The healthcare industry has seen an upward shift toward cloud solutions due to their scalability, flexibility and cost-effectiveness. System integrators have increasingly turned towards this form of integration for interoperability purposes and secure patient data accessibility anytime anywhere – providing healthcare organizations the ability to adapt quickly to market dynamics while scaling infrastructure as necessary, prompting increased adoption of medical system integration services.

Emphasis on Data Security and Compliance

Due to an unprecedented volume of sensitive patient information being exchanged across healthcare systems, data security and compliance have become top priorities for healthcare organizations. System integrators have responded by adopting robust security measures while adhering to regulations like HIPAA (Health Insurance Portability and Accountability Act) to protect patient records against unauthorized access or breaches; increasing demand for healthcare/medical system integrators who offer comprehensive security solutions while adhering to regulatory requirements.

Restraints

Budget Constraints

Healthcare organizations often struggle with limited funds and budget restrictions that limit their ability to invest in system integration projects. With high upfront costs associated with integrated healthcare systems – like software licenses, hardware purchases and consulting fees – becoming an issue, organizations with limited financial resources often end up postponing or cancelling system integration projects altogether, negatively affecting growth within the medical system integrator market.

Resistance to Change in Healthcare Organizations

Health care organizations’ resistance to adopt new technologies or workflows is often an impediment to medical system integrators’ market growth. Healthcare staff may resist adopting changes due to concerns over disruption, training requirements or perceived inefficiencies that they might create – this makes overcoming resistance an essential aspect of successful integration healthcare solutions implementation for system integrators.

Opportunity

Emerging Markets

The healthcare and medical system integrators market offers immense growth potential in emerging markets due to expanding healthcare infrastructure and growing investments in IT solutions for healthcare delivery. Countries throughout Asia-Pacific, Latin America and the Middle East are witnessing rapid urbanization with rising healthcare spending as governments take steps to modernize systems – creating an ideal setting for adopting integrated healthcare solutions such as system integrators providing tailored solutions designed specifically to address their individual needs and challenges of these regions.

Focusing on Value-Based Care

As healthcare systems transition towards value-based models that emphasize quality of care, patient outcomes and cost efficiency, medical system integrators have an opportunity to align healthcare systems with value-based principles. Integration solutions enabling data-driven decision-making, care coordination and population health management are essential in meeting value-based care objectives; system integrators may become valuable partners by offering innovative integration solutions focused on improving patient outcomes while cutting costs.

Regional Analysis

North America currently leads the healthcare and medical system integrators market with 32% market share, equivalent to USD 1.1 billion in revenue. This dominance can be attributed to stringent legislative and accreditation requirements governing healthcare, while Asia-Pacific looks set for substantial growth over 2024-2033 due to an increase in chronic diseases among both elderly and pediatric populations.

The Healthcare and Medical System Integrators Market Report’s country-specific section addresses influencers and regulatory changes influencing domestic market trends presently and into the future. Forecasting market scenarios for individual countries requires gathering multiple pieces of data – consumption volumes, production sites and capacities, import/export analysis, price trends, raw material costs and upstream/downstream value chain analyses among them. Factors such as the presence and accessibility of global brands, challenges caused by competition between local and domestic brands, tariffs, trade routes and trade route restrictions must all be carefully taken into account when conducting forecast analyses of country-specific data.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Player Analysis

The Healthcare and Medical System Integrators Market in its competitive landscape and company profiles sections. These key players undergo intensive evaluation based on criteria such as their product and service offerings, financial performance, notable advancements, strategic initiatives, market positioning, geographical reach, and any other significant attributes. Additionally, this chapter offers insights into the strengths, weaknesses, opportunities, and threats (SWOT analysis), essential imperatives for success, ongoing strategies, and competitive threats facing three to five players in the market. Furthermore, clients can customize this market analysis according to their own specific requirements.

The Competitive Landscape segment of this report offers comprehensive details regarding the top five companies, recent developments, collaborative ventures, mergers and acquisitions, as well as introduction of new products in the Healthcare and Medical System Integrators Market. This section gives stakeholders an overall picture of its dynamics that assists them in making informed decisions and gaining a competitive advantage within this market.

Key Market Players

- iNTERFACEWARE Inc

- IBM

- InterSystems Corporation

- Orchestrate Healthcare

- Siemens Healthcare Private Limited

- Cerner Corporation

- Burwood Group, Inc

- Boston Software Systems

- AVI SYSTEMS

- Epic Systems Corporation

Recent Developments

- iNTERFACEWARE Inc.: Partnered with MEDITECH to offer pre-built integrations for MEDITECH Expanse EHR and various third-party applications.

- IBM: Announced a collaboration with CVS Health to develop and implement a cloud-based platform for managing healthcare data and analytics.

- InterSystems Corporation: Released InterSystems IRIS Interoperability Engine, a new solution for connecting healthcare systems and applications.

- Orchestrate Healthcare: Launched Orchestrate Marketplace, a platform for healthcare providers to discover and deploy integration solutions.

- Siemens Healthineers: Acquired Varian, a leading provider of radiation oncology solutions, expanding its offerings in cancer care.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 9.6 Billion CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Horizontal Integration, Vertical Integration) By Application, Government Hospitals, Private Hospitals and Clinics, Healthcare Organizations, Other Applications) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape iNTERFACEWARE Inc, IBM, InterSystems Corporation, Orchestrate Healthcare, Siemens Healthcare Private Limited, Cerner Corporation, Burwood Group, Inc, Boston Software Systems, AVI SYSTEMS, Epic Systems Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Healthcare and Medical System Integrators?Healthcare and Medical System Integrators are specialized solutions designed to facilitate seamless communication and integration of various healthcare systems and devices, ultimately enhancing the efficiency and quality of patient care delivery.

How big is the Healthcare and Medical System Integrators Market?The global Healthcare and Medical System Integrators Market size was estimated at USD 3.8 Billion in 2023 and is expected to reach USD 9.6 Billion in 2033.

What is the Healthcare and Medical System Integrators Market growth?The global Healthcare and Medical System Integrators Market is expected to grow at a compound annual growth rate of 9.7%. From 2024 To 2033

Who are the key companies/players in the Healthcare and Medical System Integrators Market?Some of the key players in the Healthcare and Medical System Integrators Markets are iNTERFACEWARE Inc, IBM, InterSystems Corporation, Orchestrate Healthcare, Siemens Healthcare Private Limited, Cerner Corporation, Burwood Group, Inc, Boston Software Systems, AVI SYSTEMS, Epic Systems Corporation.

How do Healthcare and Medical System Integrators benefit healthcare professionals?These integrators streamline communication among healthcare professionals, allowing for better coordination of care, access to comprehensive patient data, and improved decision-making processes.

What makes Healthcare and Medical System Integrators user-friendly?Healthcare and Medical System Integrators are engineered to be user-friendly and easy to operate, ensuring smooth integration into existing healthcare infrastructures without extensive training requirements.

What factors are driving the growth of the Healthcare and Medical System Integrators Market?Factors driving market growth include increasing support from the IT sector, rising prevalence of chronic diseases and psychological disorders due to lifestyle changes, and the growing emphasis on minimizing errors in surgical procedures.

What are the growth opportunities in the Healthcare and Medical System Integrators Market?Growth opportunities in the market stem from advancements in medical technology, which continue to improve the efficiency and effectiveness of healthcare delivery systems, as well as the increasing demand for integrated solutions to optimize patient care processes.

Healthcare and Medical System Integrators MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Healthcare and Medical System Integrators MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- iNTERFACEWARE Inc

- IBM

- InterSystems Corporation

- Orchestrate Healthcare

- Siemens Healthcare Private Limited

- Cerner Corporation

- Burwood Group, Inc

- Boston Software Systems

- AVI SYSTEMS

- Epic Systems Corporation