Global Healthcare Analytics Market By Product Type (Descriptive, Predictive, and Prescriptive), By Technology (Web Hosted, Cloud-based, and On-premises), By Application (Clinical, Financial, and Operational & Administrative), By Component (Software, Services, and Hardware), By End-user (Life Science Companies, Healthcare Payers, and Healthcare Providers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 103401

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

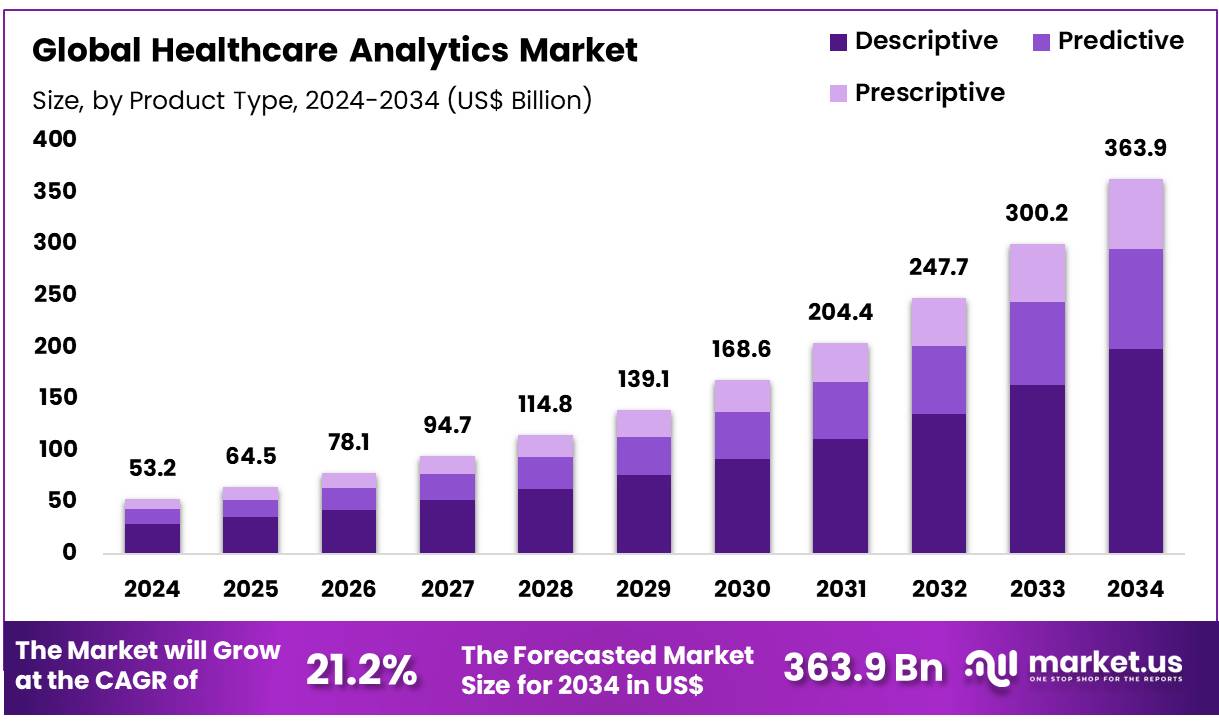

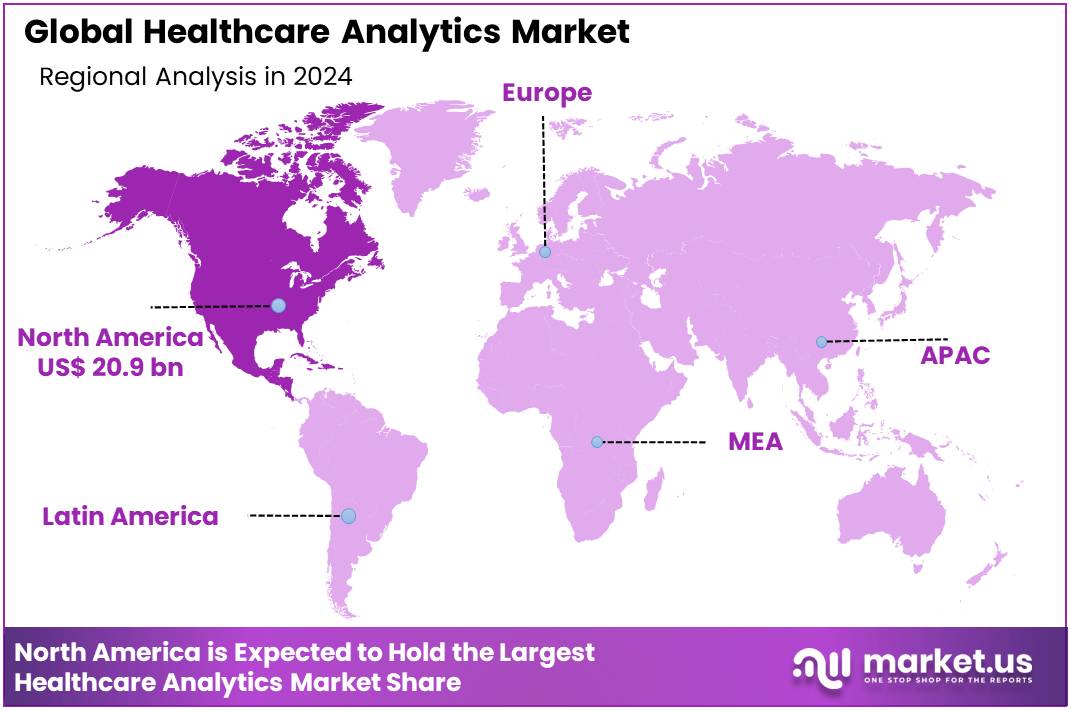

Global Healthcare Analytics Market size is expected to be worth around US$ 363.9 Billion by 2034 from US$ 53.2 Billion in 2024, growing at a CAGR of 21.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 20.9 Billion.

Increasing demand for data-driven insights and the growing need for operational efficiency are fueling the expansion of the healthcare analytics market. Healthcare providers are increasingly leveraging advanced analytics to improve patient outcomes, reduce costs, and optimize operations. Analytics applications in healthcare span across clinical decision support, predictive modeling, patient monitoring, and operational performance management.

Predictive analytics, for instance, helps identify at-risk patients, reduce hospital readmissions, and improve treatment plans by analyzing historical and real-time data. The market is also benefiting from the rising adoption of electronic health records (EHRs) and wearable health devices, which generate large volumes of data that can be analyzed for actionable insights.

In March 2022, Microsoft introduced Microsoft Cloud for Healthcare, a platform designed to foster collaboration between patients and healthcare providers. This platform delivers improved insights into patient care, enabling better decision-making and enhancing overall healthcare delivery. By integrating data from various sources, healthcare providers can gain a more comprehensive view of patient health, leading to more personalized treatment plans and better management of chronic conditions.

Moreover, healthcare analytics is becoming essential for improving the efficiency of administrative tasks, such as billing, scheduling, and resource allocation. As AI and machine learning algorithms continue to evolve, healthcare analytics is set to provide even more accurate predictions and optimized care pathways.

The ongoing shift toward value-based care and the need for real-time data analysis present significant opportunities for the growth of healthcare analytics, driving innovation in both clinical and operational applications.

Key Takeaways

- In 2024, the market for healthcare analytics generated a revenue of US$ 53.2 Billion, with a CAGR of 21.2%, and is expected to reach US$ 363.9 Billion by the year 2034.

- The product type segment is divided into descriptive, predictive, and prescriptive, with descriptive taking the lead in 2024 with a market share of 54.6%.

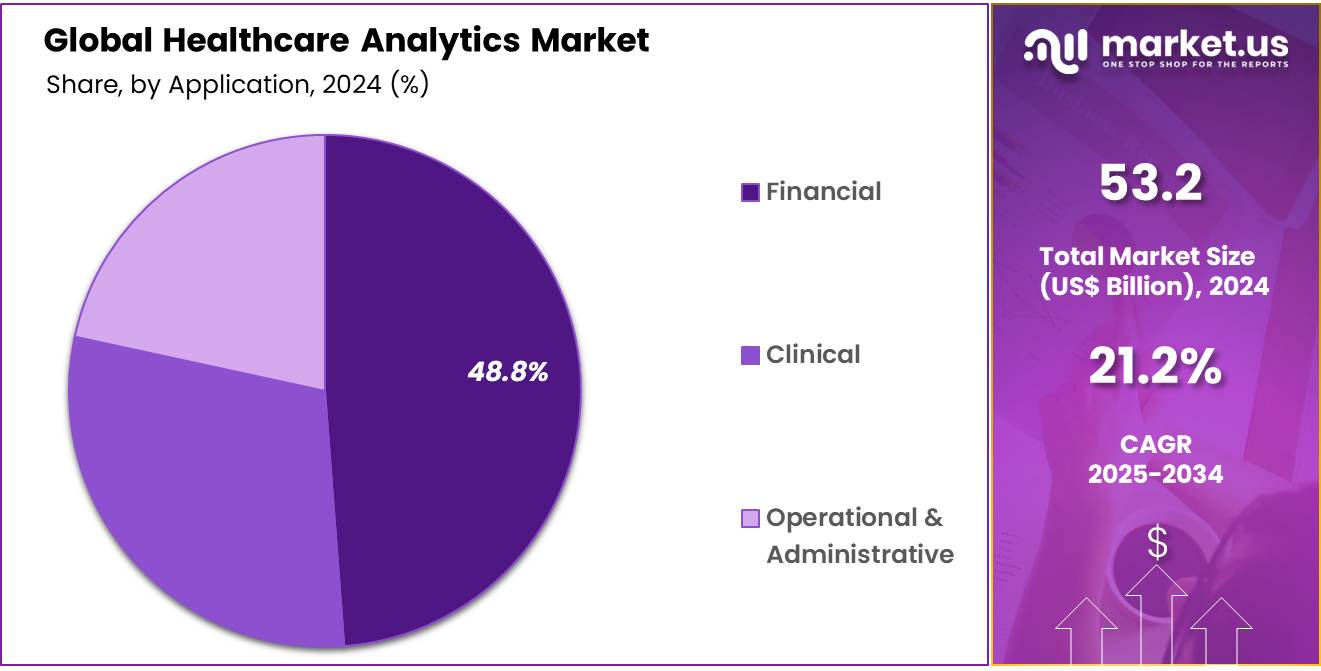

- Considering technology, the market is divided into web hosted, cloud-based, and on-premises. Among these, on-premises held a significant share of 48.8%.

- Furthermore, concerning the application segment, the market is segregated into clinical, financial, and operational & administrative. The financial sector stands out as the dominant player, holding the largest revenue share of 40.7% in the healthcare analytics market.

- The component segment is segregated into software, services, and hardware, with the services segment leading the market, holding a revenue share of 42.5%.

- Considering end-user, the market is divided into life science companies, healthcare payers, and healthcare providers. Among these, life science companies held a significant share of 43.9%.

- North America led the market by securing a market share of 39.3% in 2024.

Product Type Analysis

Descriptive analytics is expected to capture 54.6% of the healthcare analytics market, driven by its ability to analyze historical data to identify patterns and trends. This segment is essential for improving operational efficiency and patient outcomes by leveraging past data to inform current practices. With the rapid adoption of Electronic Health Records (EHR) and other data management systems, healthcare organizations can more effectively track past patient behaviors, clinical outcomes, and operational performance.

Descriptive analytics helps healthcare providers optimize workflows, enhance decision-making, and identify inefficiencies, leading to cost reductions and improved patient care. The growing demand for actionable insights from historical data is expected to propel the continued growth of this segment.

Technology Analysis

On-premises solutions are expected to dominate the technology segment, capturing 48.8% of the market share. These systems offer healthcare organizations control over their sensitive data, ensuring strict security and compliance with privacy regulations, such as HIPAA. Given the healthcare industry’s focus on safeguarding patient information, on-premises solutions are preferred as they provide full oversight and reduce the risks associated with cloud-based solutions.

Additionally, on-premises systems can be tailored to meet the unique needs of healthcare providers, allowing for highly customized IT infrastructure. The ongoing demand for secure, compliant, and customizable data management solutions is expected to sustain the dominance of on-premises technologies in the healthcare analytics market.

Application Analysis

The financial application segment is projected to hold 40.7% of the healthcare analytics market. With the healthcare industry facing increasing financial pressures and the shift toward value-based care models, financial analytics solutions are critical for managing revenue cycles, improving billing accuracy, and optimizing financial performance.

Healthcare providers are utilizing these tools to forecast and manage reimbursement issues, insurance claims, and payment delays, all of which contribute to financial sustainability. Furthermore, financial analytics solutions help healthcare organizations identify cost-saving opportunities, reduce fraud, and enhance operational efficiency. The growing need for real-time financial insights and predictive models is expected to drive further growth in this segment.

Component Analysis

The services segment is expected to be the largest component in the healthcare analytics market, accounting for 42.5% of the market share. Healthcare organizations are increasingly seeking third-party service providers for analytics consulting, system implementation, and ongoing support. These services are crucial for healthcare providers that require specialized expertise to implement and manage complex analytics platforms.

The need for data integration, training, and system optimization is driving the demand for services in this sector. As healthcare organizations continue to adopt more advanced analytics solutions, the role of service providers in supporting their data-driven initiatives will become even more critical, ensuring the long-term success and adoption of healthcare analytics technologies.

End-User Analysis

Life science companies are expected to dominate the end-user segment, with an anticipated 43.9% share of the healthcare analytics market. Pharmaceutical, biotechnology, and medical device companies are increasingly relying on analytics to streamline drug development, improve clinical trial efficiency, and accelerate the pace of research.

The rise of personalized medicine, coupled with the explosion of genomic and clinical data, is pushing life science companies to adopt advanced analytics solutions to improve research and drug discovery processes. These solutions enable life science companies to make data-driven decisions in drug development, identify promising therapeutic targets, and enhance clinical trial outcomes. As the pressure to innovate and reduce R&D costs grows, life science companies will continue to be the primary drivers of growth in the healthcare analytics market.

Key Market Segments

By Product Type

- Descriptive

- Predictive

- Prescriptive

By Technology

- Web Hosted

- Cloud-based

- On-premises

By Application

- Clinical

- Financial

- Operational & Administrative

By Component

- Software

- Services

- Hardware

By End-user

- Life Science Companies

- Healthcare Payers

- Healthcare Providers

Drivers

The Rising Adoption of Value-Based Care is Driving the Market

The increasing adoption of value-based care (VBC) models is a primary driver for the healthcare analytics market. In contrast to the traditional fee-for-service model, VBC programs reward healthcare providers for improving patient outcomes and reducing costs, not just for the volume of services they provide. This fundamental shift in payment models creates an urgent need for robust analytics tools to measure performance, identify at-risk patient populations, and track outcomes.

Healthcare organizations must analyze vast amounts of clinical, financial, and operational data to succeed under VBC agreements. They use these analytics to identify care gaps, predict patient readmissions, and manage chronic diseases more effectively.

According to a 2024 report from the Centers for Medicare & Medicaid Services (CMS), the number of Medicare beneficiaries in Accountable Care Organizations (ACOs) reached 13.7 million in 2024, up from 11 million in 2022. This represents a significant portion of the Medicare population now covered by VBC arrangements, demonstrating the growing demand for the analytical capabilities needed to succeed in these models.

Restraints

Data Security and Privacy Concerns are Restraining the Market

Significant data security and privacy concerns are a key restraint on the healthcare analytics market. The industry handles a massive volume of highly sensitive protected health information (PHI), making it a prime target for cyberattacks. The risk of data breaches, ransomware attacks, and unauthorized access erodes patient trust and imposes severe financial and reputational penalties on healthcare organizations.

According to the US Department of Health and Human Services (HHS) Office for Civil Rights (OCR) breach portal, there were 720 reported data breaches of 500 or more records in 2022, and that number grew to 725 breaches in 2023, with over 133 million records exposed or impermissibly disclosed in 2023 alone.

In 2024, a single major breach affecting a business associate resulted in the exposure of an estimated 190 million records, according to AHA News. These figures highlight the pervasive threat to healthcare data. The continuous threat of cyberattacks necessitates substantial investments in cybersecurity infrastructure and compliance with strict regulations like HIPAA in the US and GDPR in Europe.

These security requirements and the risk of a breach increase the cost and complexity of implementing and maintaining analytics platforms, slowing adoption, especially for smaller providers with limited resources.

Opportunities

The Use of Predictive Analytics for Population Health Management Creates Growth Opportunities

The application of predictive analytics to population health management creates a significant growth opportunity within the market. Predictive models analyze historical patient data to forecast future health outcomes, identify individuals at high risk for developing chronic diseases, or predict those likely to be readmitted to a hospital. This proactive approach allows healthcare providers to intervene early, allocate resources more efficiently, and prevent adverse health events, shifting the focus from reactive care to preventive care.

A 2024 publication in the National Library of Medicine highlighted how predictive analytics helps pave the way for personalized medicine by analyzing genetic, environmental, and lifestyle data to tailor treatments to each patient. By predicting which individuals are most likely to benefit from certain interventions, healthcare organizations can optimize care pathways and reduce unnecessary costs.

The ability to forecast patient needs with a high degree of accuracy allows providers to manage population health more effectively, which aligns with the goals of value-based care and enhances clinical outcomes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the healthcare analytics market through their direct impact on healthcare spending, digital infrastructure investment, and government funding for public health programs. During periods of robust economic stability and growth, countries allocate more resources to healthcare, which drives investment in sophisticated analytics platforms to improve efficiency and manage costs.

Conversely, economic downturns or high inflation can lead to tightened healthcare budgets, potentially delaying technology upgrades and limiting spending on new analytics solutions, especially for smaller hospitals and clinics. The International Monetary Fund (IMF) indicated in its April 2025 “World Economic Outlook” that while global economic growth is stable, persistent geopolitical fragmentation and higher interest rates pose risks, which could indirectly impact healthcare spending and technological innovation.

Geopolitical factors also play a crucial role, influencing global supply chains for the hardware and cloud infrastructure required to run powerful analytics platforms, and the stability of global distribution channels. Political instability or trade disputes can disrupt supply chains, increase costs for companies, and create uncertainty for global distribution, impacting the availability and pricing of essential technology.

However, the pressing need to control healthcare costs and improve patient outcomes ensures sustained political and financial commitment to data-driven healthcare, allowing the market to navigate and overcome these challenges.

Current US tariff policies can indirectly impact the healthcare analytics market by influencing the cost of imported hardware and cloud computing infrastructure essential for running complex analytics platforms. These platforms rely on high-performance servers, data storage devices, and networking equipment, much of which is manufactured and imported from abroad.

In April 2025, the US introduced broad new import tariffs, including a 10% baseline tariff on all imports, with higher rates on goods from specific trading partners. While certain medical devices were initially exempt, these tariffs can directly affect the technology components used in data centers and cloud services.

For instance, some reports from May 2025 indicated that certain server components and IT hardware products are now subject to duties up to 25% or more, depending on the country of origin. These tariffs incrementally increase the cost of building and maintaining analytics infrastructure for healthcare providers and technology developers in the US. This might translate to higher prices for analytics solutions or potentially slow down the pace of innovation as companies absorb increased costs.

Conversely, these tariff policies can act as a powerful incentive for domestic production of essential IT hardware, fostering a more resilient and secure national supply chain. This strategic shift towards localized manufacturing aims to reduce dependence on potentially volatile international sources and enhance national technological security, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Increased Focus on Interoperability and Data Exchange is a Recent Trend

A prominent recent trend in the healthcare analytics market is the increased focus on interoperability and seamless data exchange between disparate health information systems. Traditionally, patient data has been siloed across electronic health records (EHRs), lab systems, and pharmacy databases, making it difficult to gain a comprehensive view of a patient’s health journey.

Recent initiatives and regulations, such as the 21st Century Cures Act in the US, are mandating that healthcare organizations adopt technologies that enable health information to be securely shared across different platforms and providers. The Office of the National Coordinator for Health Information Technology (ONC) has been actively promoting these standards, with a focus on data accessibility.

As per an ONC report from December 2023, the percentage of hospitals that electronically send, receive, find, and integrate patient data from outside their organization increased to 75% in 2022. This progress in interoperability provides a richer, more complete dataset for analytics platforms to leverage. By breaking down data silos, healthcare organizations can use analytics to create a holistic view of a patient, leading to more informed clinical decisions, improved care coordination, and more accurate population health insights.

Regional Analysis

North America is leading the Healthcare Analytics Market

North America dominated the market with the highest revenue share of 39.3% owing to the increasing volume of digital health data, a strong emphasis on value-based care models, and significant government initiatives promoting data interoperability. The United States, a key driver in this market, saw a projected 8.2% growth in national health expenditures in 2024, reflecting a continued rebound in the use of healthcare services and goods, which generates vast amounts of data ripe for analysis. This growth is further fueled by the widespread adoption of electronic health records (EHRs) and other health information technology.

The Office of the National Coordinator for Health Information Technology (ONC) has actively promoted data exchange, with the Trusted Exchange Framework and Common Agreement (TEFCA) going live in December 2023, establishing a framework for nationwide interoperable data sharing. Additionally, the ONC finalized the Health Data, Technology, and Interoperability (HTI-1) rule in December 2023, which includes groundbreaking transparency requirements for artificial intelligence and predictive algorithms in certified health IT, fostering responsible data use.

In Canada, total healthcare spending is expected to reach US$372 billion in 2024, an increase of 5.7% from 2023, indicating a growing data landscape. Canada Health Infoway, a key organization, continues to work with governments and healthcare organizations to make healthcare more digital, facilitating seamless and secure information sharing.

Major players like Oracle Health (formerly Cerner) and Optum are continually enhancing their analytics capabilities, with Optum, for instance, strengthening its data analytics solutions through partnerships, underscoring the market’s robust expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s increasing healthcare expenditures, accelerating digital transformation efforts within healthcare systems, and a growing recognition of data’s role in improving patient outcomes and operational efficiency. Countries across Asia are actively investing in digital health infrastructure. For example, China’s digital healthcare market reached 195.4 billion CNY in 2022, showcasing a robust foundation for further data-driven solutions.

Governments are implementing policies to encourage the use of health data; Japan’s Ministry of Health, Labour and Welfare consistently emphasizes health data utilization to enhance public health and medical services. India’s National Health Authority is spearheading digital health initiatives, including the Ayushman Bharat Digital Mission, which aims to create a national digital health ecosystem, generating extensive data for analysis.

Singapore, a leader in digital health, continues to advance its national electronic health record system, which provides a rich data source for advanced analytical applications. Companies like Tencent Health and Alibaba Health are actively developing and deploying digital health solutions, including those with analytical capabilities, to serve the region’s vast and diverse populations. This collective push towards digital health, coupled with increasing investments and supportive regulatory environments, ensures that the market for analyzing health data will expand considerably across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the healthcare analytics market implement several strategies to fuel growth. They prioritize expanding their product portfolios by developing advanced analytics platforms that integrate data from diverse healthcare sources to improve decision-making. Companies invest heavily in artificial intelligence and machine learning to enhance predictive analytics capabilities, offering more personalized and efficient solutions.

Collaborations with healthcare providers, pharmaceutical companies, and research institutions help accelerate product development and innovation. Furthermore, strategic acquisitions and partnerships allow companies to expand their technological capabilities and extend their market presence globally. Players also focus on offering scalable solutions to meet the diverse needs of both small and large healthcare organizations.

Cerner Corporation is a leading player in the healthcare analytics market. Based in North Kansas City, Missouri, Cerner specializes in health information technology, including electronic health records (EHR) and population health management solutions. The company integrates its analytics solutions with healthcare systems to help organizations manage patient data more effectively and make data-driven decisions.

Cerner’s cloud-based platform enables healthcare providers to improve clinical and operational outcomes while enhancing patient care. Through continuous innovation and strategic partnerships, Cerner plays a crucial role in shaping the future of data-driven healthcare solutions.

Top Key Players

- Syntellis

- Oracle

- Optum, Inc

- McKesson Corporation

- IQVIA

- IBM

- Elsevier

- Allscripts Healthcare Solutions, Inc

Recent Developments

- In August 2022, Syntellis Performance Solutions acquired Stratasan, a leading healthcare market intelligence and data analytics firm. This acquisition allows Syntellis to enhance its software offerings, providing healthcare organizations with data-driven solutions to support financial, strategic, and operational planning.

- In June 2022, Oracle completed the acquisition of Cerner Corporation, merging Cerner’s clinical expertise with Oracle’s strengths in analytics, automation, and enterprise solutions. This combination aims to create more comprehensive healthcare technologies, improving patient care and operational efficiency.

Report Scope

Report Features Description Market Value (2024) US$ 53.2 Billion Forecast Revenue (2034) US$ 363.9 Billion CAGR (2025-2034) 21.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Descriptive, Predictive, and Prescriptive), By Technology (Web Hosted, Cloud-based, and On-premises), By Application (Clinical, Financial, and Operational & Administrative), By Component (Software, Services, and Hardware), By End-user (Life Science Companies, Healthcare Payers, and Healthcare Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Syntellis, Oracle, Optum, Inc, McKesson Corporation, IQVIA, IBM, Elsevier, Allscripts Healthcare Solutions, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Analytics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Analytics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Syntellis

- Oracle

- Optum, Inc

- McKesson Corporation

- IQVIA

- IBM

- Elsevier

- Allscripts Healthcare Solutions, Inc